Professional Documents

Culture Documents

Payback Period of Project A 4 Years

Uploaded by

Carlo B Cagampang0 ratings0% found this document useful (0 votes)

7 views2 pagesPayback period

Original Title

Which investment project

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPayback period

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesPayback Period of Project A 4 Years

Uploaded by

Carlo B CagampangPayback period

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

46.

Which investment project(s) does the company invest in?

Project A

Discount rate= 10%

Project A Present value factor Discounted cash flow Cumulative cash flow

Year Cash Flow

0 ($100,000) 1 (100,000) (100,000)

1 40,000 0.909091 36,364 (63,636)

2 40,000 0.826446 33,058 (30,578)

3 40,000 0.751315 30,053 (525)

4 30,000 0.683013 20,490 19,965 Payback period= 4

(In this year the discounted cash flow becomes positive)

Payback period of Project A = 4 years

Project B

Discount rate= 10%

Project B Present value factor Discounted cash flow Cumulative cash flow

Year Cash Flow

0 ($80,000) 1 (80,000) (80,000)

1 50,000 0.909091 45,455 (34,545)

2 20,000 0.826446 16,529 (18,016)

3 30,000 0.751315 22,539 4,523 Payback period= 3

4 0 0.683013 0 4,523 (In this year the discounted cash flow becomes positive)

Payback period of Project B = 3 years

Only the Project B meets the investment criteria of recovering all the costs within 3

years

Hence the company invests in B

C

The discounted payback period method discounts the estimated cash flows by the

project's cost of capital and then calculates the time needed to recover the investment.

Year CF Discounted CF Cumulative Discounted CF

0 −$200,000 −$200,000.00 −$200,000.00

1 60,000 53,571.43 −146,428.57

2 80,000 63,775.51 −82,653.06

3 70,000 49,824.62 −32,828.44

4 60,000 38,131.08 5,302.64

5 50,000 28,371.30 33,673.98

discounted payback period =number of years until the year before full recovery +

uncovered cost at beginning of the year/discounted CF during the year

=3+32,828.44/38,131.08=3.86

You might also like

- Week 1 Requirement Introduction To Financial ManagementDocument12 pagesWeek 1 Requirement Introduction To Financial ManagementCarlo B CagampangNo ratings yet

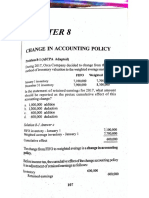

- Change in PolicyDocument5 pagesChange in PolicyCarlo B CagampangNo ratings yet

- Week 2 RequirementsDocument18 pagesWeek 2 RequirementsCarlo B CagampangNo ratings yet

- Q-2.14.-No AnswerDocument16 pagesQ-2.14.-No AnswerCarlo B CagampangNo ratings yet

- I Used To Be Black Now I'm WhiteDocument4 pagesI Used To Be Black Now I'm WhiteCarlo B CagampangNo ratings yet

- Make Space For God To FillDocument2 pagesMake Space For God To FillCarlo B CagampangNo ratings yet

- FC 8 043 Pa Drills and CeremoniesDocument140 pagesFC 8 043 Pa Drills and CeremoniesCarlo B Cagampang100% (1)

- PAS 41 AgricultureDocument4 pagesPAS 41 AgricultureCarlo B Cagampang100% (1)

- Application LetterDocument1 pageApplication LetterCarlo B CagampangNo ratings yet

- Linear Programming - MINIMIZATIONDocument3 pagesLinear Programming - MINIMIZATIONCarlo B CagampangNo ratings yet

- Catholic Social TeachingsDocument21 pagesCatholic Social TeachingsCarlo B CagampangNo ratings yet

- PDF Answers Cost of Capital Exercisesdocdoc - CompressDocument8 pagesPDF Answers Cost of Capital Exercisesdocdoc - CompressCarlo B CagampangNo ratings yet

- How To Write A Reflection PaperDocument2 pagesHow To Write A Reflection PaperCarlo B Cagampang100% (2)

- 2 Landscape of Financial SystemDocument18 pages2 Landscape of Financial SystemCarlo B CagampangNo ratings yet

- Saint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleDocument1 pageSaint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleCarlo B CagampangNo ratings yet

- WALKING IN UNITY (Ephesians 4:1-6)Document3 pagesWALKING IN UNITY (Ephesians 4:1-6)Carlo B CagampangNo ratings yet

- 3 COST Lesson 3Document4 pages3 COST Lesson 3Carlo B Cagampang100% (1)

- The Power of UnityDocument9 pagesThe Power of UnityCarlo B CagampangNo ratings yet

- Financial Accounting Management AccountingDocument4 pagesFinancial Accounting Management AccountingCarlo B CagampangNo ratings yet

- Costs - Concepts and ClassificationsDocument5 pagesCosts - Concepts and ClassificationsCarlo B CagampangNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)