Professional Documents

Culture Documents

MB Online - MSOA Statement

Uploaded by

Dana SibalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MB Online - MSOA Statement

Uploaded by

Dana SibalCopyright:

Available Formats

April 3, 2022

*

ONMEX-000404

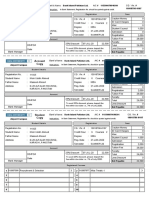

MARY ROSS PAMELA PIAMONTE

UNIT D 4 PASADENA ST

PASADENA PLACE TOWN HOMES 1

BRGY PASADENA

1500 SAN JUAN CITY

CREDIT CARD ACCOUNT

5345 0700 4850 4449

Account Number 1000 0000 2685 5112

Regular

ON Internet Credit Limit

10,000.00

*

ONMEX-000404

MARY ROSS PAMELA PIAMONTE

UNIT D 4 PASADENA ST

Statement Date Payment Due Date

PASADENA PLACE TOWN HOMES 1 1 April 2022 22 April 2022

BRGY PASADENA

Total Amount Due Minimum Amount Due

1500 SAN JUAN CITY

PHP 1,206.29 PHP 850.00

Previous Balance Plus Purchase/Debits Less Payments/Credits Total Amount Due

7,502.15 704.14 7,000.00 1,206.29

Page 2 of 2

REMINDERS TRANSACTION DETAILS

Payment Due Date. All payments shall be in the billing currency

of the issued card. Your Payment Due Date is at least 16 days

after your statement cut-off date. If it falls on a holiday or non-

Post Tran Description Amount

banking day, the payment due date shall be automatically moved

to the next business day. If it is already a week before your usual

Date Date

Payment Due Date and you still have not received your SOA, Previous Balance 7,502.15

please contact our 24-hour Customer Service at (632) 88-700-700.

Minimum Amount Due (MAD). Is the amount that must be PESO ACCOUNT DETAILS

paid on or before your Payment Due Date to avoid late payment

fee or penalty; and is computed as the sum of (A) outstanding MAR* **** ****** PIA***** - 1000 0000 2685 5112

balance (which is equal to Total Amount due less overlimit amount

less past due amounts) multiplied by 5% plus, (B) any amount in 04/01 04/01 FINANCE CHARGES 99.04

excess of the approved credit limit plus, (C) all past due amounts,

if any, or (D) a required minimum amount imposed by Metrobank,

whichever is higher. Any payment amount less than the Total

MRP * PIA***** - 53** **** **** 4449

Amount Due or any cash advance transactions, will incur finance

charge at the prevailing interest rate indicated in our relevant

03/08 03/06 SHOPEE PHILIPPINES INC, TAGUIG CITY, PHL 90.00

notices and on our website is applied. 03/21 03/21 CASH PAYMENT - THANK YOU - MB 7,000.00 C

Computation of Finance Charge. If you opt to pay the 03/23 03/22 GOOGLE *GAMEHOUSE, 650-253-0000, GBR 515.10

Minimum Amount Due (MAD) or any amount less than the Total

Amount Due, you agree to pay the finance charge and other

charges, as provided by Metrobank, plus any applicable taxes and

charges required by the government on such charges. The finance

TOTAL AMOUNT DUE 1,206.29

charge, at Metrobank's prevailing rate, will be computed based on

the unpaid balance as of the given cut-off date and shall continue ****END OF STATEMENT****

to be imposed until the outstanding balance and applicable interest

are fully paid. Interest will be computed as follows: (A) your PAYMENT MADE EASIER: Pay your Metrobank Credit Card bills through ATM (Metrobank or

previous outstanding balance as reflected in the current SOA

computed from a day after the cut-off of the previous SOA to a day

before the payment transaction date, plus (B) your previous

Bancnet) or through online payment via Metrobankdirect at www.metrobankdirect.com.

outstanding balance less payment/s made, and (C) any credit

adjustments computed from the payment transaction date to the

beginning of the next statement cut-off. Interest on Cash Advances

are computed from the transaction date to the next statement date. Important Reminders:

Check Payments. Please make the check payable to

Metropolitan Bank & Trust Company and write the following

information at the back of the check: (A) cardholder's complete 1. Paying less than the total amount due will increase the amount of interest and other

name, (B) 16-digit credit card number, and (C) contact

number/s. Make sure that the check you issued has no erasures charges you pay and the time it takes to repay your balance.

and corrections. Otherwise, it will not be accepted for payment, or

will be rejected for clearing.

Payment Recognition.Payments made through any authorized

payment channels, including check payments, shall be considered

2. Lost or Stolen Card. For lost or stolen cards, please contact our 24-hour Customer

as payment on the same date subject to the cut-off schedules of

the accredited payment center.

Service at (632) 88-700-700 or 1-800-1888-5775 (domestic toll-free) immediately upon

Credit Limit Replenishment. Your credit limit will be knowledge of the loss so we can block your card. Your liability for all purchases

replenished only after payments have been posted to your credit

card. For check payments, credit limit will only be replenished after and/or cash advances made through the use of your lost or stolen card will cease only

the funds have been cleared. upon your written/verbal notification to and actual receipt or recording thereof by

Delinquent Account. If the Minimum Amount Due (MAD) is not

paid on or before the Payment Due Date, your account shall be Metrobank. The replacement card will have a new credit card number.

considered delinquent and in default. You shall be liable to pay the

Late Payment Fee, finance charge and other charges as

applicable. Metrobank reserves the right to demand full payment in

case of default. 3. Card Security. Never give your credit card or disclose any information pertaining

Late Payment Fee. If you fail to pay at least the Minimum

Amount Due (MAD) on or before the Payment Due Date, a late

thereto to any person even if he/she claims to be an employee or representative of

payment fee will be imposed and will be reflected in the next

cycle's SOA.

Metrobank. Surrender or return of the credit card plastic to Metrobank or any

Credit Limit. Your credit card has one credit limit for both local representative of Metrobank is not required for card account cancellation, expiration/

and international purchases. The cash advance and installment

facilities form part of your total credit limit. Moreover, the credit termination, or replacement. Credit card plastics contain personal information so

limit assigned to the principal card member is shared with all

supplementary card members. The total credit limit is subject to make sure you dispose of your cancelled cards properly.

security and credit limit management conditions that Metrobank

may impose for your benefit. Metrobank reserves the right to

decline or approve any transaction and/or suspend the credit card

privileges of the principal card member and his/her supplementary 4. Change in Name, Address and Telephone Numbers. Please notify us of any change in

card members without prior notice if the credit limit will be or has your name, billing (residence and business) address or telephone number by calling

been exceeded. Metrobank may demand immediate payment of

the amount over the credit limit or the total amount outstanding. An our 24-hour Customer Service at (632) 88-700-700 or 1-800-1888-5775 (domestic toll

over credit limit fee of PHP750 or such other amount as Metrobank

may set is charged for every overlimit occurrence. free). Otherwise, it is presumed that all information are still valid and that you have

Foreign Exchange Transactions. All charges, advances, or

amounts in currencies other than Philippine Peso (PHP) shall be received all communications and billings sent by Metrobank.

converted to PHP. Transactions in US Dollar, Hong Kong Dollar,

Japanese Yen, Euro, Singapore Dollar, Australian Dollar, British

Pound, Canadian Dollar, Chinese Yuan, Swiss Francs and Danish

Kroner shall be converted using the foreign exchange selling rate

of Metropolitan Bank and Trust Company on transaction posting

date. Transactions denominated in currencies other than the

aforementioned will be converted using the foreign exchange

buying/selling rate of Mastercard and Visa on transaction posting

date. The billing currency amount represents the amount due to

Metrobank for its purchase and payment on the Card Member's

behalf of the foreign currency necessary to discharge the

amount(s) due to Mastercard/Visa or the acquiring bank and/or

foreign merchant affiliates. The said transactions may also be

subject to additional fees to cover assessment fee that may be

charged by Mastercard/Visa and service or processing fees.

These additional fees shall likewise apply to transactions involving

foreign currencies converted to Philippine Peso at point of sale

whether executed in the Philippines or abroad or online.

Gaming Transactions. A 5% service fee will be levied on

gaming transactions charged to your credit card. Gaming

transactions include those that involve the placement of a wager,

purchase of lottery tickets, in-flight commerce gaming, and the

purchase of chips or other values in conjunction with gaming

activities provided by establishments such as casinos, race tracks,

airlines, and the like.

Statement Printing Fee. A printing fee of PHP100 will be

charged per request for reprinting and delivery of your monthly

statement.

Bank Certification Fee. A bank certification fee of P100 will be

charged per copy and delivery of the bank certificate.

Returned Check Fee. A fee of PHP1,500 will be charged for

check payments which were returned due to reasons such as, but

not limited to, insufficient funds, unsecured deposit, stop payment

order or closed account.

Overpayments. Overpayments shall not earn interest and

shall be applied to succeeding credit card usages and charges. In

case of overpayments on closed accounts, a monthly account

maintenance fee, or amount equivalent to the credit balance,

whichever is lower will be charged to accounts with credit balance

that are closed or with no activity for the past 12 months.

Errors in Your Statement of Account. Please notify us within

thirty (30) days from statement date of any erroneous billing.

Otherwise, the SOA will be considered correct. Likewise, any

payment shall be taken as conclusive proof of your concurrence.

Visit https://metrobankcard.com/cards/compare-all to see the

complete Table of Fees & Charges.

REWARDS POINTS SUMMARY

Previous Pts. Balance ADD LESS This Month's Pts. Balance

Pts. Earned/Adjustment Pts. Redeemed/Adjustment

1,626 29 0 1,655

#

*Keep your credit card in active standing to avoid your Rewards Points from being forfeited. Settle at least your Minimum

Amount Due on or before the Payment Due Date.

Payment Validation Slip

MAR* **** ****** PIA***** Account Number: 1000 0000 2685 5112

Total Amount Due: PHP1,206.29 Credit Card Account Number: 53** **** **** 4449

Payment Due Date: 22 April 2022 Minimum Amount Due: PHP850.00

Metropolitan Bank & Trust Company

The MCC Center, 6778 Ayala Avenue, Makati City, Philippines

Customer Service: 88-700-707

Domestic Toll Free: 1-800-10-8700-707

International Toll Free: 800-8-700-0707

Email Address: customerservice@metrobankcard.com

You might also like

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDocument4 pages03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNo ratings yet

- BillingStatement - REY PJ S. BENDANA PDFDocument2 pagesBillingStatement - REY PJ S. BENDANA PDFLea BacalaoloyoNo ratings yet

- Metrobank Vs Asb HoldingsDocument7 pagesMetrobank Vs Asb HoldingsAlex Viray LucinarioNo ratings yet

- Landbank Iaccess Retail Internet Banking PDFDocument1 pageLandbank Iaccess Retail Internet Banking PDFMiriam DatinggalingNo ratings yet

- Converge SOA SummaryDocument1 pageConverge SOA SummaryJayson IbardalozaNo ratings yet

- Smart Broadband Bill and Payment DetailsDocument2 pagesSmart Broadband Bill and Payment DetailsLorelie LimNo ratings yet

- Thi Yen Quynh Nguyen 180 Melbourne Drive Bradford West Gwillimbury, ON L3Z 2W2Document4 pagesThi Yen Quynh Nguyen 180 Melbourne Drive Bradford West Gwillimbury, ON L3Z 2W2Quynh NguyenNo ratings yet

- 2GO Travel - Itinerary ReceiptDocument2 pages2GO Travel - Itinerary ReceiptGeoseff Entrata100% (1)

- Angeline Martinez credit card statement summaryDocument5 pagesAngeline Martinez credit card statement summaryAngelineNo ratings yet

- Professional Regulation CommissionDocument1 pageProfessional Regulation CommissionXiantelle MagbanuaNo ratings yet

- Edited HSS Decal Form 2022.DocxDec1.Docx FinalDocument10 pagesEdited HSS Decal Form 2022.DocxDec1.Docx FinalRichard Sta rosaNo ratings yet

- Khentedezabatican: Page1of4 Poblacion3 1 0 8 9 - 5 7 5 0 - 3 2 Siatonnegrosoriental 6 2 1 9Document4 pagesKhentedezabatican: Page1of4 Poblacion3 1 0 8 9 - 5 7 5 0 - 3 2 Siatonnegrosoriental 6 2 1 9KierstenNo ratings yet

- PTC 1Document2 pagesPTC 1Shierly Arciaga ProtacioNo ratings yet

- Fees IU PDFDocument1 pageFees IU PDFMOIN UDDIN AHMEDNo ratings yet

- Dalisaydepisioco : 2039bautistasubdsamala Marquezstbrgysamalamarquez 4104binakayankawitDocument6 pagesDalisaydepisioco : 2039bautistasubdsamala Marquezstbrgysamalamarquez 4104binakayankawitDalisay EpisiocoNo ratings yet

- Normabmascara : Inandayanmalabang Lanaodelsur 9300lanaodelsurDocument6 pagesNormabmascara : Inandayanmalabang Lanaodelsur 9300lanaodelsurNorma MáscaraNo ratings yet

- Direct Loan Disclosure DetailsDocument3 pagesDirect Loan Disclosure DetailsNathan BurrisNo ratings yet

- DPC Directory StatementDocument1 pageDPC Directory StatementRobert FergustoNo ratings yet

- SKY Cable Statement DetailsDocument3 pagesSKY Cable Statement DetailsLeonidas SpartacusNo ratings yet

- Statement of Account 2 16 Apr 19 To 15 May 19 880757036: Total Amount Due: P1,684.16Document2 pagesStatement of Account 2 16 Apr 19 To 15 May 19 880757036: Total Amount Due: P1,684.16Dat Doria PalerNo ratings yet

- AEON Credit Service-JocelynDocument1 pageAEON Credit Service-JocelynJoey Albarracin Sardañas100% (1)

- BillingStatement 315028328217Document2 pagesBillingStatement 315028328217Renier Palma CruzNo ratings yet

- 9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListDocument4 pages9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListAllan Ramirez RadilloNo ratings yet

- Ang v. ChinatrustDocument10 pagesAng v. ChinatrustRhiz BantilloNo ratings yet

- Statementmay21xxxxxxxx910611pdf OriginalDocument5 pagesStatementmay21xxxxxxxx910611pdf OriginalSwaroop MNo ratings yet

- Housing Loan Billing StatementDocument2 pagesHousing Loan Billing StatementOiro Kram YakNo ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- Adorutuazon: Page1of3 194malmedast 3 9 8 9 - 0 5 0 2 - 6 4 PaterosmlaDocument4 pagesAdorutuazon: Page1of3 194malmedast 3 9 8 9 - 0 5 0 2 - 6 4 Paterosmlatuazonadoryahoo.comNo ratings yet

- DCB 30Document4 pagesDCB 30skyline.7777gtrNo ratings yet

- INF1DDocument4 pagesINF1DgabrielleparryNo ratings yet

- Ebron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesDocument3 pagesEbron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesJan Karlyle Stefan EbronNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- LANDBANK Credit Card ApplicationDocument3 pagesLANDBANK Credit Card Applicationmeninist27 ianNo ratings yet

- Lealyn S. Clemente: Statement of AccountDocument1 pageLealyn S. Clemente: Statement of Accountbktsuna0201No ratings yet

- Statement 1002 Apr20 2022Document3 pagesStatement 1002 Apr20 2022AYDE KAROL CABRERA CALLANNo ratings yet

- Invoice 26100221899 20230528Document6 pagesInvoice 26100221899 20230528Paula VargasNo ratings yet

- BillingStatement - LOLITA P. AREVALO - 2Document2 pagesBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulNo ratings yet

- Kinly Account Statement Summary for Myrtle OttDocument1 pageKinly Account Statement Summary for Myrtle OttjohanNo ratings yet

- 2GO Travel - Itinerary ReceiptDocument4 pages2GO Travel - Itinerary ReceiptClement Preston IIINo ratings yet

- SKY Cable Statement DetailsDocument2 pagesSKY Cable Statement DetailsIvy PantalunanNo ratings yet

- Gsis Computer Loan Application Form: To Be Filled Up by The ApplicantDocument2 pagesGsis Computer Loan Application Form: To Be Filled Up by The ApplicantMr. Bates100% (1)

- Moving Notification FormDocument1 pageMoving Notification FormdavidNo ratings yet

- Please Take This To Your Local Bank: CIBC International Student PayDocument6 pagesPlease Take This To Your Local Bank: CIBC International Student PaypanikNo ratings yet

- Citibanamex Trust Account ApplicationDocument2 pagesCitibanamex Trust Account Applicationchistopher freundNo ratings yet

- Annual Income Tax Return: BrianDocument4 pagesAnnual Income Tax Return: BrianChristine ViernesNo ratings yet

- Globe Postpaid Oct 2020 PDFDocument3 pagesGlobe Postpaid Oct 2020 PDFJasper GicaNo ratings yet

- Questions: Send Correspondence To: Mail Payments ToDocument4 pagesQuestions: Send Correspondence To: Mail Payments Tofinape6897No ratings yet

- Í+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobeDocument5 pagesÍ+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobenoelitoNo ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- BillingStatement - NICEO SIANEMAR C. MORENODocument2 pagesBillingStatement - NICEO SIANEMAR C. MORENOTroy MorenoNo ratings yet

- DBS Bank LTD Ground Floor Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-6638 8888 DBSS0IN0811 400641002Document6 pagesDBS Bank LTD Ground Floor Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-6638 8888 DBSS0IN0811 400641002Sham AinapuNo ratings yet

- PayslipDocument1 pagePayslipsandovalelaine292No ratings yet

- NBR Tin Certificate 868740934640 PDFDocument1 pageNBR Tin Certificate 868740934640 PDFডাঃ রাজিব রোহানNo ratings yet

- Í Jrszè Deâlaâpena Johnâpaulâ P Çlâ&-3Jî Mr. John Paul Perez de La PenaDocument3 pagesÍ Jrszè Deâlaâpena Johnâpaulâ P Çlâ&-3Jî Mr. John Paul Perez de La PenaJP De La PeñaNo ratings yet

- Fifth Third Bank 2014-2016 CRA Performance EvaluationDocument788 pagesFifth Third Bank 2014-2016 CRA Performance EvaluationWCNC DigitalNo ratings yet

- Statement of AccountDocument2 pagesStatement of Accountmdyakubhnk85No ratings yet

- Í /4mè Supan Jayâanthonyââââ B Ç+) (-5xî Mr. Jay Anthony Bayog SupanDocument4 pagesÍ /4mè Supan Jayâanthonyââââ B Ç+) (-5xî Mr. Jay Anthony Bayog SupanCholo SupanNo ratings yet

- Proof of Adimin Fee Payment To VutDocument1 pageProof of Adimin Fee Payment To Vutbossy mokheleNo ratings yet

- Manage credit card account onlineDocument2 pagesManage credit card account onlineOliver TabagNo ratings yet

- INTERESTS AND INSTITUTIONSDocument32 pagesINTERESTS AND INSTITUTIONSEdward KarimNo ratings yet

- Fin358 Chap 4 BondDocument5 pagesFin358 Chap 4 Bondsyaiera aqilahNo ratings yet

- GST Book Bank AnswersDocument10 pagesGST Book Bank AnswersAditya DasNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- BUSINESS PAPER 1 KCSE PAST PAPERSDocument46 pagesBUSINESS PAPER 1 KCSE PAST PAPERSrnyaboke90No ratings yet

- Important Questions For CBSE Class 11 Business Studies Chapter 11Document23 pagesImportant Questions For CBSE Class 11 Business Studies Chapter 11Aishwarya100% (1)

- Session 7 Case StudyDocument4 pagesSession 7 Case StudyDiajal HooblalNo ratings yet

- Caso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalDocument18 pagesCaso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalArmando GarzaNo ratings yet

- International Business: by Charles W.L. HillDocument32 pagesInternational Business: by Charles W.L. Hilllamisha tasnimNo ratings yet

- David Strategic Management 17e Accessible PowerPoint 03Document51 pagesDavid Strategic Management 17e Accessible PowerPoint 03ishrat0621No ratings yet

- Production & Ops MGNT 05092019Document68 pagesProduction & Ops MGNT 05092019Goli HereNo ratings yet

- Knaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringDocument429 pagesKnaster, R., & Leffingwell, D. (2017) - SAFe 4.0 Distilled. Applying The Scaled Agile Framework For Lean Software and Systems EngineeringMarco Antonio Jimenez Cervantes100% (1)

- SEC Objection To Binance VoyagerDocument7 pagesSEC Objection To Binance VoyagerGMG EditorialNo ratings yet

- Chapter 1Document45 pagesChapter 1Genanew AbebeNo ratings yet

- 08tax Forum BusecoDocument51 pages08tax Forum BusecoAemie JordanNo ratings yet

- Mayank Ahuja 19021321063 IbfsDocument4 pagesMayank Ahuja 19021321063 IbfsMayank AhujaNo ratings yet

- Service Request For Quotation: M/S: - PO. Box: - Postal CodeDocument6 pagesService Request For Quotation: M/S: - PO. Box: - Postal CodeMirsoNo ratings yet

- ACC reports 74% rise in Q1 profit, Ambuja Cement to benefitDocument7 pagesACC reports 74% rise in Q1 profit, Ambuja Cement to benefitShivansh RawatNo ratings yet

- CBFS-MODULE NO. 3-Globe-Intl TradeDocument4 pagesCBFS-MODULE NO. 3-Globe-Intl TradeDA YenNo ratings yet

- Merchandise ManagementDocument32 pagesMerchandise ManagementMonika Sharma100% (1)

- 5 - Spa To Transfer TitleDocument2 pages5 - Spa To Transfer TitleAntonio AlfelorNo ratings yet

- Loan AgreementDocument2 pagesLoan Agreementgidraphgathuku2022No ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Group Assignment MGCR 382 Fall 2023, Oct. 4Document9 pagesGroup Assignment MGCR 382 Fall 2023, Oct. 4darkninjaNo ratings yet

- Section 3 (Other Definition)Document26 pagesSection 3 (Other Definition)jinNo ratings yet

- The Eight Components of Supply Chain ManagementDocument4 pagesThe Eight Components of Supply Chain ManagementEmma AlexandersNo ratings yet

- Explained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%Document3 pagesExplained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%saurabhNo ratings yet

- Marc - International Corporate Governance (2012, Pearson)Document337 pagesMarc - International Corporate Governance (2012, Pearson)Irsa AritaniaNo ratings yet

- LSRDocument20 pagesLSRTanuNo ratings yet

- Sl. No. Grade Cement Ggbfs Micro Filler CA FA Admixture Name of Lab Date Status RemarksDocument1 pageSl. No. Grade Cement Ggbfs Micro Filler CA FA Admixture Name of Lab Date Status Remarksmahesh naikNo ratings yet