Professional Documents

Culture Documents

Real Property Valuation Theories, Practices & Ethics

Uploaded by

Solomon Nega100%(1)100% found this document useful (1 vote)

173 views43 pagesOriginal Title

RPV-6021 Week 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

173 views43 pagesReal Property Valuation Theories, Practices & Ethics

Uploaded by

Solomon NegaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 43

Ethiopian Civil Service University

College of Urban Development & Engineering

Department of Housing & Real Estate Property

Management (Weekend Program)

Real Property Valuation theories,

Practices & Ethics (RPV-6021)

Yeshitla Agonafir (PhD Candidate)

CUDE ESCU,

Addis Ababa, Ethiopia

October, 2021

10/24/2021 Yeshitla A. RPV-6021 1

1. Module Introduction

• Module title: RPV Theories, Practices & Ethics

• Module No: RPV-6021,

• Module Type: Core Module

• Credit hours: 7 ECTS

10/24/2021 Yeshitla A. RPV-6021 2

1.1 Module Outcomes:

Upon the completion of the course, students will be able to:

• Become familiar with various concepts of property,

• Comprehend the various valuation concepts and theories

• Identify the determinants of property value

• Understand the various methods of property valuation

• Know and realize the ethics in property valuation,

• Evaluate the real practice of property valuation in Ethiopia.

• Design real property valuation manual for various purposes

• Apply valuation methods in real property valuations.

10/24/2021 Yeshitla A. RPV-6021 3

1.2 Module Contents:

1. Introduction to Basics of Land

• The nature & Unique features of land

• Concepts of Land, Real estate, real & personal property

2. Introductions to the concept of Valuation

• Defining Valuation, appraisal

• Basic terms in valuation i.e. Worth, Price, Cost and Value

• Defining market value

3. Bases and Purposes of Valuation

• Bases of valuation: Market vs. non market valuation

• Purposes of property valuation

• The valuation process

• The valuation report

• Economic Principles of value

10/24/2021 Yeshitla A. RPV-6021 4

Contents cont’d…

4. Determinants of property values;

• Socio-economic, physical & political factors.

• Demand factors

• Supply factors

• Property related factors

5. the Valuation approaches/Methods;

• Sale comparative approach

• Cost approach

• Income approach (Residual & investment),

10/24/2021 Yeshitla A. RPV-6021 5

contents Cont’d…

6. Fundamental Ethical Principles in Valuation

• Integrity

• Objectivity

• confidentiality

• professional competence and due care

• professional behavior

• Valuer’s Obligation to his Client

• Valuer’s Primary Duty and Responsibility

• Valuer’s Obligation to other Valuers

• Unethical & Unprofessional Valuation Practices

10/24/2021 Yeshitla A. RPV-6021 6

Content Cont’d…

7. Threats and Safeguards

7.1 Threats

• Self-interest threat

• Self-review threat

• Client conflict threat

• Advocacy threat

• Familiarity threat

• Intimidation threat

7.2 Safeguards

• Safeguards by profession, legislation or regulation

• Safeguards in the work environment

• Safeguards enhancing citizenship and attitudinal changes

8. the valuation practices of Ethiopia & other counties experiences in

Property Valuation

10/24/2021 Yeshitla A. RPV-6021 7

1.3 Didactic Methods:

• Interactive lecture,

• Group work and presentation

• Article Review

• Reading Assignments

10/24/2021 Yeshitla A. RPV-6021 8

Cont’d

1.4 Mode of Assessment:

• Test (20%)

• Individual Assignment (20%)

• Group Assignment (20%)

• Final Exam (40%)

1.5 Grading: As per the university Legislation

10/24/2021 Yeshitla A. RPV-6021 9

1.6 Punctuality

• Attendance is mandatory (90% is a must)

• Expectation for Classroom Behavior

• Contribute in class discussion

• Meet assignment deadlines

• Courtesy and respect

• Discipline

• Cell phones must be silent

• Late submission is not acceptable

• Plagiarism

• May disqualify your assignments,

• Missing Exam and Tests (medical case & emergency only)

• Need to be supplemented by relevant documents

10/24/2021 Yeshitla A. RPV-6021 10

1.7 References

• Introducing Property Valuation by Michael Blackledge 2nd edition

• Alan Millington (2000) An Introduction to Property Valuation 5th edition

• Peter Wyatt (2013) Property Valuation 2nd edition

• Peter Wyatt (2007) Property Valuation: In an Economic Context

• Sayce.S, Smith.J.,Cooper.R., and Venmor-Rowland.P. (2006) Real

estate Appraisal: From Value to Worth. Black Well publishing Ltd. ISBN:

978-1-4051-0001-4

• Wang.K. and Wolverton.L.M. (Eds.). (2002) Real estate Valuation

Theory. Research Issue in Real Estate, Volume 8. Appraisal

Department and America

10/24/2021 Yeshitla A. RPV-6021 11

Week 1:

Introduction to Real Property Valuation

1. Contents:

• Definition of terms:

• the nature of land & real property

• Real estate, Real property & personal property

• Nature & characteristics of the property Market

• Defining valuation, Appraisal, Price, Value, Cost etc.

• Definition of Market Value

10/24/2021 Yeshitla A. RPV-6021 12

Learning Outcomes:

At the end of this session, students will be able to;

• Understand the nature of land & real property

• Understand the nature & features of land/property market

• Understand the concept of valuation

• Differentiate among price, cost &value

• Comprehend the determinants of Market value

10/24/2021 Yeshitla A. RPV-6021 13

the Nature of Land

• The term “land” is used to describe an area of ground used

for agriculture to grow food, for construction to create shelter

and for resource extraction.

• Land is unique as a resource as it is immovable, yet

extremely versatile in terms of its nature, quality and use.

• It forms the basis of all development and is the primary

source of a plethora of other resources crucial for human

survival and growth.

• In the context of the built environment, land represents both

the beginning and the end of the development life cycle.

10/24/2021 Yeshitla A. RPV-6021 14

the Nature of Land

• Its the ultimate resource i.e. without it life on earth

cannot sustain.

• Is the free gifts of nature w/ch yield an income

(Classical economist)

• Includes all the surface, subjacent & super-jacent

things of a physical nature like buildings, trees,

minerals etc. (Lawyer’s defn).

• Is a primary source of wealth, social status, & power.

• Is the basis for shelter, food, and economic activities.

10/24/2021 Yeshitla A. RPV-6021 15

Basic features of Land

Unlike other factors of production, land has many unique features such as;

• Heterogenity:

• Each parcel of land is unique

• Renders information assymetry

• Incurs immmense transaction cost

• Immobility:

• a real property with its fixtures like buildings & factories is in exchangeable

• No national/central market

• Source of negative/positive externalities

• Longevity/durability:

• Undepreciability of land unlike other factors of production

• Serve as inflation proof/protection.

• Serves as a basis for savings/ as a collateral.

10/24/2021 Yeshitla A. RPV-6021 16

Basic features of Land Cont’d

• Relative Fixity of it’s supply:

• Supply of land is perfectly inelastic thus, one use can be

increased at the expense of the other

• Land is the least flexible factor of production

• Cause a tendency of monopoly by lessors, vendors etc

• Costyness:

• requires bulk finance to acquire & develop

• Incurs immmense transaction cost.

• No cost of creation:

• It is a free gift of nature not a commodity

• Thus, its more than just an asset:

• Its linked to individuals & community identity, history and

culture, as well as being a source of livelihoods and,

• the only form of social security for many poor.

10/24/2021 Yeshitla A. RPV-6021 17

Basic features of Land Cont’d

• Subject to the Law of Diminishing returns:

• It states that, MOT, AOT & TOT of land eventually

diminishes after successive application of labor &

capital to a given area of land.

• Absence of market for ‘Land’:

• unlike other factors of production transaction is not in

land itself, but in interests/rights in, on, under & over

land.

10/24/2021 Yeshitla A. RPV-6021 18

Real estate, Real Property & Personal Property

Real Estate:

Physical Land and Appurtenances affixed to the land

(e.g. Land, structures)

Real Property:

all interests, benefits and rights inherent in the

ownership of real estate,

Whole/Portions of the bundle of rights,

Personal Property:

Moveable items not permanently affixed to, or part of,

the real estate such as;

Manufactured Housing, Plants

Fixtures; movable property that is attached

permanently to the land like machines.

10/24/2021 Yeshitla A. RPV-6021 19

Characteristics of Real Property

• Economic Characteristics

• Scarcity

• Improvements

• Permanence of investment

• Location

• Physical Characteristics

• Immobility

• Indestructibility

• Uniqueness

10/24/2021 Yeshitla A. RPV-6021 20

The nature & characteristics of the property Market

• Market is an organized action b/n buyers (demand) and sellers

(supply) that permits trade.

• Its the interaction of individuals who exchange real property rights

for other assets like money.

• Real property Market is thus, an arrangement by which buyers &

sellers of virgin land, agricultural estates, industrial buildings,

offices, shops & houses are meet together to determine the

price of exchanged.

• Real property markets may be classified in several ways:

• by geographic area;

• by property type or

• by the scope of prospective market participants.

• Real property transactions are not on the land it self, but on

interests/rights over the land,

10/24/2021 Yeshitla A. RPV-6021 21

Items in the Property Market

• Are resources affixed with land

• Are neither physically movable.

• They differ from labor, capital & other goods in general.

• Too heterogeneous:

• Imperfect Information/assymetry among participants

• Low transaction frequency: participants buy/sell infrequently)

• No central market: mainly in informal markets

• Relatively small no of buyers and sellers

• Property Market is either formal or informal.

10/24/2021 Yeshitla A. RPV-6021 22

Cont’d

• Transactions may be formally recognized (Auction advertised) or

• Exchanges may also be informal (introduced by estate

agents, dealings b/n principals, brokers etc.).

• Its impossible to distinguish the means by which people are

informed from but, much is advertised through news papers

or personally which in turn is part of the market.

• So, land market is subject to the law of supply & demand w/ch

determine the price & value of land.

10/24/2021 Yeshitla A. RPV-6021 23

Cont’d

• Unlike Labor & Capital, land/property market is the least

efficient b/c of;

• Imperfect knowledge of buyers & sellers ( need experts

like surveyors, lawyers, valuers),

• Heterogeneity & immovability of land,

• Imperfect competition (monopoly interests),

• Relatively high cost of dealing.

10/24/2021 Yeshitla A. RPV-6021 24

Cont’d

• Prices are not determined by the market, rather by

other factors which differ in each transaction (e.g.

Crisis, location etc.). So, no clearing fixed price.

• High transaction cost: high purchase & sale costs

• Therefore, property markets are imperfect & not 100%

efficient.

• If rights are clearly defined and costs of negotiation are

minimized, then the market will work efficiently.

10/24/2021 Yeshitla A. RPV-6021 25

Defining Valuation

• Valuation is the provision of a written opinion as to

capital price or value, or rental price or value, on

any given basis in respect of an interest in

property.

• However, it does not include a forecast of value.

• Is the art and/or science of estimating the

monetary value of an asset at a particular point in

time for a specific purpose.

• It could be the value to an individual or in the open

market.

• In the case of real property, it is interests/rights in

property and not property by itself that are valued

i.e. either freehold or leasehold interests.

10/24/2021 Yeshitla A. RPV-6021 26

Definitions (Appraisal)

• Appraisal means the written provision of a valuation,

combined with professional opinion, advice and/or analysis

relating to the suitability or profitability, of the subject

property for defined purposes, as judged by the valuer

following relevant investigations.

• It may include a calculation of worth.

• Worth: is a specific investor’s perception of the capital

sum which he would be prepared to pay or accept for a

property,

10/24/2021 Yeshitla A. RPV-6021 27

The Relation among Price, Cost and Value

• Valuers should carefully distinguish b/n value, cost and

price during valuation.

a) Price

• Is related to exchange of property rights/interests.

• Is the actual observable exchange price in an open

market.

• Is “The amount asked, offered, or paid for a property.”

• Price is a fact, whether publicly disclosed or retained in

private.

• Because of the financial capabilities, motivations or

special interests of a given buyer or seller, the price paid

for a property may or may not have any relation to the

value that might be ascribed to that property by others.”

10/24/2021 Yeshitla A. RPV-6021 28

b) Cost

• is “The amount required to create, produce, or obtain a

property.”

• Cost is either a fact or an estimate of fact.

• Is a production-related concept, not related from

exchange,

• Is the amount of money required to develop a property,

service,

• Is a historic fact after development.

• May be in different forms direct/indirect.

10/24/2021 Yeshitla A. RPV-6021 29

c) Value

• Is the estimate of the price that would be paid if the

property were to be sold in the market.

• Determined by market or non-market bases,

• Value is “the monetary r/ship b/n properties and those

who buy, sell, or use those properties.”

• Value is never a fact, but always an opinion of the worth

of a property at a given time in accordance with a

specific opinion of value.

• Value must always be defined like, market value,

liquidation value, book value, insurance value,

investment value.”

Price ≠ Cost ≠ Value

10/24/2021 Yeshitla A. RPV-6021 30

Bases of Value

three principal bases of Value (IVSC,2019);

• “Market value” is an estimated amount for which an asset

or liability should exchange on the valuation date b/n a

willing buyer and a willing seller in an arm’s length

transaction, after proper marketing and where the parties

had each acted knowledgeably, prudently and without

compulsion.

• “Investment Value” is the value of the asset to the owner or

a prospective owner for individual investment or operational

objectives.

• “Fair Value” is the estimated price for the transfer of an

asset or liability b/n identified knowledgeable and willing

parties that reflects the respective interests of those parties.

10/24/2021 Yeshitla A. RPV-6021 31

Defining Market Value

• Is an estimated amount for which an asset should

exchange;

• on the date of valuation,

• b/n a willing buyer and a willing seller,

• in an arm's length transaction,

• after proper marketing wherein the parties had each

acted;

• knowledgeably,

• prudently and

• without compulsion.

10/24/2021 Yeshitla A. RPV-6021 32

Definition of Market Value Cont’d

• Market Value assumes a price negotiated in an open &

competitive market,

• Market for one property may be an international or local,

• the market may consist of numerous buyers and sellers or

a limited number of participants.

• the property must be exposed for sale in a non restricted

or constricted market.

• A market with out any barrier for entry and exit,

10/24/2021 Yeshitla A. RPV-6021 33

Definition of Market Value Cont’d

• Does market value mean the best price that is likely to be

obtained in the market at the time? or

• Is it an average price in current market conditions?

• ‘the estimated amount’…refers to a price expressed in

terms of money, payable for the property in an arm’s

length transaction.

• MV is measured as the most probable price reasonably

obtainable in the market on the date of valuation,

• therefore MV is not typically an average.

10/24/2021 Yeshitla A. RPV-6021 34

Definition of Market Value Cont’d

• Property is relatively illiquid and a reasonable marketing

period is needed to achieve the best price.

• Do you assume that this marketing period has already

taken place before the date of valuation or that it has still to

take place?

• The choice of time perspective could make a big difference

to the end figure in a market where prices are moving

rapidly up or down.

10/24/2021 Yeshitla A. RPV-6021 35

Definition of Market Value Cont’d

• after ‘proper marketing’ means;

• the property would be exposed to the market in the most

appropriate manner to effect its disposal at the best

price,

• the length of exposure time may vary with market

conditions,

• But, the time must be sufficient to allow the property to

be brought to the attention of many of potential buyers.

• exposure period occurs prior to the valuation date.

• the seller should not be under any time pressure to sell;

• Example; liquidation case may affect the price.

10/24/2021 Yeshitla A. RPV-6021 36

Definition of Market Value Cont’d

• ‘A willing seller:

• Is neither an over-eager nor a forced seller, who

prepared to sell at any price,

• nor one who prepared to hold out for a price not

considered reasonable in the current market.

• Should be motivated to sell the property at market terms

for the best price attainable in the (open) market after

proper marketing, whatever that price may be.

• ‘willing seller’ is a hypothetical owner not factual.

10/24/2021 Yeshitla A. RPV-6021 37

Definition of Market Value Cont’d

• ‘A willing buyer:

• one who is motivated, but not compelled to buy.

• neither over-eager nor determined to buy at any price

• one who purchases in accordance with the realities of

the current market and

• with current market expectations, rather than an

imaginary or hypothetical market that cannot be

demonstrated or anticipated to exist.

• Should not pay a higher price than the market requires.

• A Valuer should make realistic assumptions about

market conditions or assume a level of market value

equal with the real condition.

10/24/2021 Yeshitla A. RPV-6021 38

Definition of Market Value Cont’d

• Valuation must determine the highest & best use of a

property,

• HABU is ‘the most probable use of a property which is;

• Physically possible,

• appropriately justified,

• legally permissible,

• financially feasible, and

• which results in the highest value of the property.

10/24/2021 Yeshitla A. RPV-6021 39

Definition of Market Value Cont’d

• MV should be based on an ‘arm’s length transaction.

• Arms length transaction means;

• A transaction b/n parties who do not have a particular

special r/ship (for example, parent and subsidiary

companies or landlord and tenant) that may make the

price level uncharacteristic of the market.

• A transaction presumed to be b/n unrelated parties,

each acting independently.

10/24/2021 Yeshitla A. RPV-6021 40

Definition of Market Value Cont’d

• MV should be based on transaction b/n parties who

act ‘ knowledgeably and prudently’. This means;

• both the willing buyer and seller are reasonably

informed about;

• the nature and characteristics of the property,

• its actual and potential uses of the property, &

• the state of the market as of the date of

valuation.

10/24/2021 Yeshitla A. RPV-6021 41

Definition of Market Value Cont’d

• Both parties act for self-interest with that knowledge

and prudently seek the best price for their

respective positions in the transaction.

• Prudence is assessed by referring to the state of

the market at the date of valuation, not at some

later date.

• Prudent buyer/seller will act in accordance with the

best market information available at the time.

10/24/2021 Yeshitla A. RPV-6021 42

Market Value Cont’d

• MV should be based on a transaction made without

compulsion on both parties. Which implies that;

• Each party should be motivated to undertake the

transaction by themselves,

• But, neither of them should be forced or unduly

coerced to undertake the transaction.

End of session!!!

Question or Comment?

10/24/2021 Yeshitla A. RPV-6021 43

You might also like

- Performance CH 3 Part 2Document33 pagesPerformance CH 3 Part 2Yasichalew sefinehNo ratings yet

- Study On Project Schedule and Cost OverrDocument162 pagesStudy On Project Schedule and Cost OverrWilliam Chipofya100% (1)

- Massif Capital Pitch DeckDocument18 pagesMassif Capital Pitch DecksidjhaNo ratings yet

- Business Plan The Wine Store Business PlanDocument18 pagesBusiness Plan The Wine Store Business Plandan6780% (1)

- Unit Rates Build UpDocument6 pagesUnit Rates Build UpBernard KagumeNo ratings yet

- Lecture 4-Procurement and Contract ManagementDocument54 pagesLecture 4-Procurement and Contract ManagementAdane BelayNo ratings yet

- A Critical Review of The Causes of Cost Overrun in Construction Industries in Developing CountriesDocument41 pagesA Critical Review of The Causes of Cost Overrun in Construction Industries in Developing CountriesO. ONo ratings yet

- BoQ - IOM Benin CBR Fish Farm ProjectDocument3 pagesBoQ - IOM Benin CBR Fish Farm ProjectHarrison Daka LukwesaNo ratings yet

- Economic and Financial Analysis of Water Supply and Sanitation ProjectDocument7 pagesEconomic and Financial Analysis of Water Supply and Sanitation ProjectwaheedanjumNo ratings yet

- Price Water House Coopers (PWC) ProfileDocument13 pagesPrice Water House Coopers (PWC) ProfilebharatNo ratings yet

- Guidelines for Economic Analysis of ProjectsDocument215 pagesGuidelines for Economic Analysis of ProjectskszymanskiNo ratings yet

- Seven Step Business Continuity ModelDocument1 pageSeven Step Business Continuity Modelgear123nNo ratings yet

- Final Report EtabsDocument32 pagesFinal Report EtabsSisay chaneNo ratings yet

- Thomas Alves ThesisDocument375 pagesThomas Alves ThesisLabinotMMorinaNo ratings yet

- Water Specs English-FinalDocument266 pagesWater Specs English-FinalMohammed HanafiNo ratings yet

- Quantity Surveying 2. What Is Quantity Surveying?: 5. Works To Be EstimatedDocument27 pagesQuantity Surveying 2. What Is Quantity Surveying?: 5. Works To Be Estimatedshumet tadeleNo ratings yet

- 07 Building Up Rates For The BoQ UIPE ApprovedDocument24 pages07 Building Up Rates For The BoQ UIPE Approvedjoz lapNo ratings yet

- Ebay Order Baterias 9V - Edenorte-FusionadoDocument4 pagesEbay Order Baterias 9V - Edenorte-FusionadoYamilka MedranoNo ratings yet

- Bridge Design Project, BiTDocument71 pagesBridge Design Project, BiTአምባቸው ገብሬ100% (1)

- DRAINAGE DRAWING CHECKLIST PROJECT REVIEWDocument2 pagesDRAINAGE DRAWING CHECKLIST PROJECT REVIEWzeroicesnowNo ratings yet

- 10) Assessment On Performance and Challenges of EthiopianDocument11 pages10) Assessment On Performance and Challenges of EthiopianyaregalNo ratings yet

- Bidire Water Supply Project DesignDocument129 pagesBidire Water Supply Project DesignNaafNo ratings yet

- CED Design Alternatives-1Document38 pagesCED Design Alternatives-1Liban HalakeNo ratings yet

- Bus Lane Pattern Live LoadingDocument19 pagesBus Lane Pattern Live Loadingamangirma100% (1)

- Estimating Overhead ContingenciesDocument15 pagesEstimating Overhead Contingenciesasd123456789asdcomNo ratings yet

- CH 1 Quantity of Water M.M.PPT 2008Document63 pagesCH 1 Quantity of Water M.M.PPT 2008Fetene Nigussie100% (2)

- Civil Engineering Services BriefDocument10 pagesCivil Engineering Services BriefTrevor T ParazivaNo ratings yet

- Senior Project - B+G+7 - GeotecDocument162 pagesSenior Project - B+G+7 - Geotecyeshi janexoNo ratings yet

- Report AlemayheuDocument108 pagesReport AlemayheuEyerusNo ratings yet

- 1.0 Design Criterea 1 1 Assumptions 1.1 Assumptions: 8M Clear Span Solid Slab Bridge DesignDocument10 pages1.0 Design Criterea 1 1 Assumptions 1.1 Assumptions: 8M Clear Span Solid Slab Bridge DesignAddisu Gizaw Addis Ye AbereyeNo ratings yet

- Estimation and Evaluation of G+3 Residential BuildingDocument4 pagesEstimation and Evaluation of G+3 Residential BuildingVIVA-TECH IJRINo ratings yet

- Design of Lawrence Hargrave Drive BridgesDocument11 pagesDesign of Lawrence Hargrave Drive BridgesKhandaker Khairul AlamNo ratings yet

- FinalDocument36 pagesFinalTinsae SolomonNo ratings yet

- Ethiopia Procurement of Goods AgreementDocument18 pagesEthiopia Procurement of Goods AgreementMaulidNo ratings yet

- PROGRESS REPORT JULY 2020 FinalDocument14 pagesPROGRESS REPORT JULY 2020 FinalOKELLO OKOT PATRICKNo ratings yet

- Cause and Effect of Price Escalation of Construction Material in Dire Dawa TownDocument10 pagesCause and Effect of Price Escalation of Construction Material in Dire Dawa TownAbnet BeleteNo ratings yet

- ETABS Software TOR - IrrigationDocument8 pagesETABS Software TOR - IrrigationMustefa Mohammed Adem100% (2)

- Analysis and design of multi-story building using STAAD ProDocument6 pagesAnalysis and design of multi-story building using STAAD ProarjunNo ratings yet

- Background: Section 7. Terms of Reference Detail Study and Design of Jijiga Town Water Supply ProjectDocument18 pagesBackground: Section 7. Terms of Reference Detail Study and Design of Jijiga Town Water Supply Projectmohammed ahmedNo ratings yet

- Colombo Port City Causing Unimaginable Environmental HarmDocument6 pagesColombo Port City Causing Unimaginable Environmental HarmThavam RatnaNo ratings yet

- Reservoir Storage Zone and Uses of ReservoirDocument2 pagesReservoir Storage Zone and Uses of Reservoirsuresh100% (2)

- Conduits, Pipes, and Culverts Associated With Dams and Levee SystemsDocument404 pagesConduits, Pipes, and Culverts Associated With Dams and Levee SystemsRaveeNo ratings yet

- Peak Flow Calculation-LunugalaDocument3 pagesPeak Flow Calculation-LunugalakanishkaNo ratings yet

- Concrete Bridge Maintenance GuideDocument99 pagesConcrete Bridge Maintenance GuideNigusNo ratings yet

- EBCS en 1991 1.6 2014 - VersionFinal - Actions During Executio - SECUREDDocument29 pagesEBCS en 1991 1.6 2014 - VersionFinal - Actions During Executio - SECUREDSitotaw AlemuNo ratings yet

- MSC CPM (HRE) Individual Assignment - Shepherd Nhanga Rev 00Document11 pagesMSC CPM (HRE) Individual Assignment - Shepherd Nhanga Rev 00Shepherd NhangaNo ratings yet

- Final Thesis SubmittedDocument59 pagesFinal Thesis SubmittedAbelNo ratings yet

- Letters With Forms PDFDocument130 pagesLetters With Forms PDFsagar9129No ratings yet

- 160 MM Dia (A) Labour For Lowering / Sub Surface Transport HDPE 160mm Outer Dia Mat-07383 JointingDocument9 pages160 MM Dia (A) Labour For Lowering / Sub Surface Transport HDPE 160mm Outer Dia Mat-07383 Jointingk v rajeshNo ratings yet

- Ethiopian Roads Authority bid document for Shire-Adigoshu road projectDocument43 pagesEthiopian Roads Authority bid document for Shire-Adigoshu road projectTewodros TadesseNo ratings yet

- Hydraulics flow typesDocument3 pagesHydraulics flow typesMayank ShrivastavaNo ratings yet

- Mohammad Taha CVDocument1 pageMohammad Taha CVmd taha100% (2)

- CM1Document61 pagesCM1somapala88No ratings yet

- Dire Dawa University: Institute of Technology Construction Technology and Management ChairDocument30 pagesDire Dawa University: Institute of Technology Construction Technology and Management ChairSemNo ratings yet

- Draft Concept Design Report For Lot 1 PDFDocument320 pagesDraft Concept Design Report For Lot 1 PDFEndalk BekeleNo ratings yet

- 44 CA Final Costing TheoryDocument38 pages44 CA Final Costing TheoryJoydeep AdakNo ratings yet

- Philippines Infrastructure FacilityDocument3 pagesPhilippines Infrastructure FacilityFrangelin Dianne SarabiaNo ratings yet

- Dormitory - t1 Final PDF Report Sep 22,2021Document123 pagesDormitory - t1 Final PDF Report Sep 22,2021Freedom Love NabalNo ratings yet

- Write A Literature Review With Citation On Construction Equipment in Ethiopia ContextDocument2 pagesWrite A Literature Review With Citation On Construction Equipment in Ethiopia ContextChina AlemayehouNo ratings yet

- EBCS EN 1991 1.7 2014 - Final - Accidental ActionsDocument64 pagesEBCS EN 1991 1.7 2014 - Final - Accidental ActionsGirum Menassie100% (1)

- BSc Thesis Compares Local vs. Int'l Construction ContractsDocument99 pagesBSc Thesis Compares Local vs. Int'l Construction ContractsyibeltalNo ratings yet

- Ecohydrology: Vegetation Function, Water and Resource ManagementFrom EverandEcohydrology: Vegetation Function, Water and Resource ManagementNo ratings yet

- RPV-6021 Week 2 & 3Document40 pagesRPV-6021 Week 2 & 3Solomon NegaNo ratings yet

- RPV 4Document136 pagesRPV 4Melkamu AmusheNo ratings yet

- Chapter One 1.0 Background of The StudyDocument35 pagesChapter One 1.0 Background of The StudyAjegbomogun SundayNo ratings yet

- Epropriation, Valuation and Payment of Compensation The Law and Practices in Addis Ababa City, EthiopiaDocument24 pagesEpropriation, Valuation and Payment of Compensation The Law and Practices in Addis Ababa City, EthiopiaSolomon Nega100% (1)

- RPV-6021 Week 2 & 3Document40 pagesRPV-6021 Week 2 & 3Solomon NegaNo ratings yet

- Building Materials 2007Document34 pagesBuilding Materials 2007Solomon NegaNo ratings yet

- Daniel Weldegenriel AmbayeDocument38 pagesDaniel Weldegenriel AmbayeSolomon NegaNo ratings yet

- IPMS - Office BuildingsDocument26 pagesIPMS - Office BuildingsSolomon NegaNo ratings yet

- Habtamu Bishaw AsresDocument12 pagesHabtamu Bishaw AsresSolomon NegaNo ratings yet

- Thesis Writing GuideDocument18 pagesThesis Writing GuideSolomon NegaNo ratings yet

- Guideline For Research Proposal WritingDocument12 pagesGuideline For Research Proposal WritingSolomon NegaNo ratings yet

- Elizabeth ShewayeDocument53 pagesElizabeth ShewayeSolomon NegaNo ratings yet

- Research ProposalDocument22 pagesResearch ProposalSolomon NegaNo ratings yet

- Kumkang FormworkDocument5 pagesKumkang FormworkSolomon Nega100% (1)

- Financial Accounting and Accounting StandardsDocument31 pagesFinancial Accounting and Accounting StandardsAlbert Adi NugrohoNo ratings yet

- BOOOOMDocument221 pagesBOOOOMScrappy WellNo ratings yet

- Econ Micro Canadian 1st Edition Mceachern Solutions ManualDocument13 pagesEcon Micro Canadian 1st Edition Mceachern Solutions ManualMrsJenniferCarsonjrcy100% (57)

- Module For Chapter 2 - Strategic Human Resource Management - MGT101-HRMDocument5 pagesModule For Chapter 2 - Strategic Human Resource Management - MGT101-HRMTricia Claire BarraquioNo ratings yet

- Sustainability at Wipro Case AnalysisDocument31 pagesSustainability at Wipro Case AnalysisSaurabh AudichyaNo ratings yet

- TRAVCRM India's Best Travel Management Software by DeBox GlobalDocument7 pagesTRAVCRM India's Best Travel Management Software by DeBox GlobalKm DeepaNo ratings yet

- Integrating The Business Model Puzzle: A Systematic Literature ReviewDocument46 pagesIntegrating The Business Model Puzzle: A Systematic Literature ReviewAI Coordinator - CSC JournalsNo ratings yet

- Kajal 1Document60 pagesKajal 1Prabhat SharmaNo ratings yet

- VRIN Framework, AmazonDocument11 pagesVRIN Framework, AmazonManoj Kumar SinghNo ratings yet

- Philippine Overseas Employment Administration: Chief, HRD DivisionDocument2 pagesPhilippine Overseas Employment Administration: Chief, HRD DivisionKim Josashiwa BergulaNo ratings yet

- Hascol Internship Report To Be SubmittedDocument5 pagesHascol Internship Report To Be SubmittedNazir AnsariNo ratings yet

- Next Step Change in Safety: Organisational MitigationDocument6 pagesNext Step Change in Safety: Organisational MitigationasdasdNo ratings yet

- Burshane Petroleum Income Statement AnalysisDocument25 pagesBurshane Petroleum Income Statement AnalysisCorolla GrandeNo ratings yet

- Bab03 Memanage Dalam Lingkungan GlobalDocument38 pagesBab03 Memanage Dalam Lingkungan GlobalPerbasi SidoarjoNo ratings yet

- HRM Case Study GodrejDocument8 pagesHRM Case Study GodrejRashi RamolaNo ratings yet

- Marco Polo Shipping Company Pte LTD V Fairmacs Shipping & Transport Services Pte LTDDocument9 pagesMarco Polo Shipping Company Pte LTD V Fairmacs Shipping & Transport Services Pte LTDEH ChngNo ratings yet

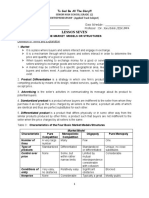

- SHS LESSON 7 Market Models or StructuresDocument12 pagesSHS LESSON 7 Market Models or StructuresPaul AnteNo ratings yet

- Unit 3: Supply Chain, Purchase and Stores Management: Prepared by Dr. R. ArivazhaganDocument58 pagesUnit 3: Supply Chain, Purchase and Stores Management: Prepared by Dr. R. ArivazhaganSusrii SangitaNo ratings yet

- Managerial Accounting and Cost Concept Continuation Lesson Proper: The Analysis of Mixed CostsDocument5 pagesManagerial Accounting and Cost Concept Continuation Lesson Proper: The Analysis of Mixed CostsGladymae MaggayNo ratings yet

- Learnings from the Satyam ScandalDocument35 pagesLearnings from the Satyam Scandalmanishkms100% (2)

- Group C ActivityDocument3 pagesGroup C ActivityGerard Andrei B. DeinlaNo ratings yet

- Yogesh Project Sem6Document28 pagesYogesh Project Sem6Sushrut chauhanNo ratings yet

- Digital Consumers, Emerging Markets, and The $4 Trillion FutureDocument23 pagesDigital Consumers, Emerging Markets, and The $4 Trillion FutureAnuragNo ratings yet

- Jenil Desai ResumeDocument1 pageJenil Desai ResumeSujay TorviNo ratings yet

- Tally Prime full course in Hindi - Practice sample assessment and credit limit interest calculationDocument2 pagesTally Prime full course in Hindi - Practice sample assessment and credit limit interest calculationPrasanjitNo ratings yet