Professional Documents

Culture Documents

ACFrOgAuks-FLUGTRVAbwbanKl352rAnl OVgwUKeboMzikY2OFuTpxZhpaxi4eT Hah6cknePQVmYPx CqnVY4D-4K8XOXkv3bCfDL4XlMzaxGdhtjGAes4RKisznk

Uploaded by

ganapathy rOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACFrOgAuks-FLUGTRVAbwbanKl352rAnl OVgwUKeboMzikY2OFuTpxZhpaxi4eT Hah6cknePQVmYPx CqnVY4D-4K8XOXkv3bCfDL4XlMzaxGdhtjGAes4RKisznk

Uploaded by

ganapathy rCopyright:

Available Formats

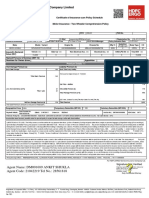

Two Wheeler-Comprehensive Insurance

CERTIFICATE OF INSURANCE CUM SCHEDULE

Name of the Policy Holder : Syed Shabaz Policy No : SJ635461

Communication Address : kanaka nagar 29.16th cross BNG -560032 Policy Type : Two Wheeler-Comprehensive Insurance

Bengaluru, Karnataka - 560032 Policy

Contact No : 9845988541 Total Premium : 929

Period Of Insurance : 30/06/2021 00:00 to midnight of 29/06/2022

Email ID : Ganapathy541@gmail.com

Agent No : 2C000407

Agent Name : POLICYBAZAAR INSURANCE BROKERS PRIVATE

LIMTED

Your Vehicle Details

Vehicle Reg.no.: KA03JM1927 Year of Manufacture:2017 Make / Model:HONDA MOTORS/DIO Fuel Type:Petrol

Insured Declared Value of the Seating Capacity(Including Driver):2 Chassis / Cubic Capacity:110

Vehicle(IDV):20344 EngineNo:ME4JF39DGH7035550/

JF39E72047967

Your Premium Details(in Rs)

Own Damage Premium(A)

Vehicle 347 Additional Cover

Electrical Accessories Sum Insured (IMT 24) (0) 0.00 Deprecition Cover(100%) 0

Non-Electrical Accessories Sum Insured (0)

CNG/LPG (IMT 25) (0) 0.00

Basic Own Damage Premium 347

Voluntary Deductible 0.00

No Claim Bonus (0%) NA

AntiTheft 0.00

Load / Discount -312

Total Own Damage Premium 35

Liability Premium (B)

Basic TP Premium (Including TPPD) 752

PA to Owner Driver 0

Unnamed PA Cover to Passengers (IMT 16) 0.00

Legal Liability to Paid Driver (IMT 28) 0.00

TPPD 0

Bi-Fuel Kit 0.00

Total Liability Premium 752

Net Premium (A+B) 787

GST @18% 142

Total Premium(In Rs) 929

Limitations as to use: The Policy covers use of the vehicle for any purpose other than: (a) Hire or Reward (b) Carriage of goods (other than samples of personal luggage)(c) Organized Racing (d) Pace

Making (e) Speed Testing (f) Reliability Trial (g) Any purpose in connection with Motor Trade. Driver's Clause: Persons or Classes of person entitled to drive: Any person including the insured, provided

that a person driving holds an effective driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding an effective

Learner's License may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Limits of Liability: Under Section II-1 (i) of the policy

(Death of or bodily injury): Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. Under Section II-1 (ii) of the policy (Damage to Third Party Property) Rs. 7.5 lakhs.

Under Section III: P.A cover to owner driver (CSI): Rs.0.00. PA cover to unnamed passenger Rs. 0. Deductible under Section-I: Compulsory Deductible IMT 22: Rs. 100 . Voluntary Deductible IMT 22 (A):

Rs. 0 Subject to Indian Motor Tariff Endorsement (nos.) IMT22-IMT5-IMT6-IMT7-

Under HP / HYP / Lease with:Bengaluru

I/We hereby certify that the Policy to which this Certificate relates as well as this Certificate of Insurance are issued in accordance with the provisions of Chapter X and XI of Motor Vehicles Act, 1988. In

witness of this Policy has been signed at Bengaluru

This policy is booked via IP at 28/6/2021 17:32:38

For Bharti AXA General Insurance Co. Ltd

Receipt no. : PG34685967 Service Tax Registration no.:AADCB2008DST001

Authorized Signatory

Authorized Signatory

Stamp duty paid to the account of The District Registrar of Stamps (Acc Head 0030-02-103-0-01), Bangalore Karnataka.

Important Notice: The insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this schedule. Any payment made by the company by reason of wider terms appearing

in the certificate in order to comply with the Motor Vehicle's Act, 1988 is recoverable from the insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY".The

Schedule, the attached Policy and Endorsements mentioned herein above shall read together and word or expression to which a specific meaning has been attached in any part of this Policy or of the

Schedule shall bear the same meaning wherever it may appear. Any amendments/modifications/alterations made on this system generated policy document is not valid and Company shall not be

liable for any liability whatsoever arising from such changes. Any changes required to be made in the policy once issued, would be valid and effective, only after written request is made to the company

and Company accepts the requested amendments/ modifications/alterations and records the same through separate endorsement to be issued by the Company.Insurance is the subject matter of

solicitation. For redressal of your grievance, if any, you may approach any one of the offices- 1.Policy issuing office 2.Corporate Office. In case, you are not satisfied with our own grievance redressal

mechanism; you may also approach Insurance Ombudsman. Details of Insurance Ombudsman offices are available at IRDA website: www.irda.gov.in , or on the website of General Insurance Council:

www.gicouncil.in or on the company website www.bharti-axagi.co.in

Bharti AXA General Insurance Company Limited, 1902, 19th Floor Parinee Creseenzo "G" Block, Bandra Kurla Complex BKC Road, Bandra East, Mumbai, Bandra Suburban, Maharashtra, India,

400051.

Tax Invoice will be followed after the Policy Certificate

You might also like

- Bike Insurance PDFDocument1 pageBike Insurance PDFVaishnavi HallikarNo ratings yet

- Insurance ActivaDocument1 pageInsurance ActivaSidVermaNo ratings yet

- Bike InsuranceDocument1 pageBike InsuranceTapan BadhaneNo ratings yet

- Bharti Axa Bike Insurance OriginalDocument1 pageBharti Axa Bike Insurance OriginalAyaz SayedNo ratings yet

- Agent Name & No Airtel Payments Bank LTD (11006207) Agent Contact No 8800688006Document2 pagesAgent Name & No Airtel Payments Bank LTD (11006207) Agent Contact No 8800688006Toufeeq AbrarNo ratings yet

- PolicySoftCopy 132677665Document1 pagePolicySoftCopy 132677665Akash SahuNo ratings yet

- Insurrance PageDocument1 pageInsurrance PageSuresh GounderNo ratings yet

- Passion Insurance PDFDocument1 pagePassion Insurance PDFHungamaSurat SuratNo ratings yet

- Two Wheeler-Comprehensive Insurance: Certificate of Insurance Cum ScheduleDocument1 pageTwo Wheeler-Comprehensive Insurance: Certificate of Insurance Cum ScheduleTBM TechnologiesNo ratings yet

- Two Wheeler-Comprehensive Insurance: Certificate of Insurance Cum ScheduleDocument1 pageTwo Wheeler-Comprehensive Insurance: Certificate of Insurance Cum SchedulePrabu ArNo ratings yet

- Smart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleDocument1 pageSmart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleAnonymous KITquh5No ratings yet

- PolicySoftCopy 104667249Document1 pagePolicySoftCopy 104667249Masum PatthakNo ratings yet

- Smart Drive Two Wheeler Insurance PolicyDocument2 pagesSmart Drive Two Wheeler Insurance Policyravisaitejas2014No ratings yet

- PolicySofyCopy 87175987Document1 pagePolicySofyCopy 87175987Grace Touch Interior and DesignsNo ratings yet

- Policy ScheduleDocument2 pagesPolicy Schedulepou pouNo ratings yet

- 5cada937537a7b09bf1a2b81 File PDFDocument1 page5cada937537a7b09bf1a2b81 File PDFWinkedpic PhotographyNo ratings yet

- Smart Drive Two Wheeler Insurance PolicyDocument2 pagesSmart Drive Two Wheeler Insurance PolicyUma Mahesh100% (1)

- Two Wheelar Policy PDFDocument1 pageTwo Wheelar Policy PDFanshumanshrivastavaNo ratings yet

- SJ413983TN14B7536Document1 pageSJ413983TN14B7536Adm RajaNo ratings yet

- PolicySchedule SR039719 134623191Document1 pagePolicySchedule SR039719 134623191Sridhar RamanNo ratings yet

- Agent Name & No Landmark Insurance Brokers PVT (2C000048) Agent Contact No 9833399772Document2 pagesAgent Name & No Landmark Insurance Brokers PVT (2C000048) Agent Contact No 9833399772Naveen VNo ratings yet

- Smart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleDocument2 pagesSmart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleSHILADITYA DEYNo ratings yet

- Smart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum ScheduleDocument2 pagesSmart Drive Two Wheeler Insurance Policy: Certificate of Insurance Cum SchedulePavanNo ratings yet

- Bike Insurance 1021741038964946Document2 pagesBike Insurance 1021741038964946Süñîl Åñîl PäťïlNo ratings yet

- BHARTIAXA FW Comprehensive MGD026S5DO9 1622728783326Document2 pagesBHARTIAXA FW Comprehensive MGD026S5DO9 1622728783326Akhand SinghNo ratings yet

- Smart Drive Private Car Insurance Policy: Certificate of Insurance Cum ScheduleDocument2 pagesSmart Drive Private Car Insurance Policy: Certificate of Insurance Cum Schedulevishal sharmaNo ratings yet

- Policy Schedule Cum Certificate of InsuranceDocument2 pagesPolicy Schedule Cum Certificate of Insurance058 PAUL MICHAEL SNo ratings yet

- KotakbillDocument1 pageKotakbillamanNo ratings yet

- Untitled 1Document2 pagesUntitled 1Shankar KumarNo ratings yet

- Broker - Policy DetailsDocument1 pageBroker - Policy DetailsBrijesh EnterprisesNo ratings yet

- Broker - Policy DetailsDocument1 pageBroker - Policy DetailsRupendra sainiNo ratings yet

- MR SasiDocument3 pagesMR Sasisaneesh369000No ratings yet

- Magma HDI General Insurance Company Limited: Magma House, 24 P S, K - 700016 Website: Http://magma-Hdi - Co.inDocument1 pageMagma HDI General Insurance Company Limited: Magma House, 24 P S, K - 700016 Website: Http://magma-Hdi - Co.inpratik ranaNo ratings yet

- BRR 2 PDFDocument1 pageBRR 2 PDFsureshNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Prathamesh KannaNo ratings yet

- PDFDocument4 pagesPDFJwalant J AntaniNo ratings yet

- Bike Insurance PDFDocument3 pagesBike Insurance PDFSenthil KumarNo ratings yet

- Bike Insurance PDFDocument3 pagesBike Insurance PDFSenthil KumarNo ratings yet

- N Sure PolicyDocument2 pagesN Sure Policymadhav100% (2)

- Insurance PDFDocument4 pagesInsurance PDFBala SubramaniyamNo ratings yet

- Your Smartdrive Motor Insurance Policy: Own Damage (A) Third Party (B)Document2 pagesYour Smartdrive Motor Insurance Policy: Own Damage (A) Third Party (B)Hardik N. SarangNo ratings yet

- Broker - Policy DetailsDocument2 pagesBroker - Policy DetailsheroelectricbnlNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222123123112783 Proposal/Covernote No: R20122100976Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222123123112783 Proposal/Covernote No: R20122100976manojk172No ratings yet

- Registration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDDocument2 pagesRegistration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDObaid Shafi67% (3)

- PolicySchedule P0022000100/4102/721320Document3 pagesPolicySchedule P0022000100/4102/721320Jegan JegaNo ratings yet

- PolicySchedule PDFDocument2 pagesPolicySchedule PDFVarun VarunNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument3 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy ScheduleBharti ThakkerNo ratings yet

- Motor Insurance - Two Wheeler Comprehensi PDFDocument2 pagesMotor Insurance - Two Wheeler Comprehensi PDFVijay MaskarNo ratings yet

- UP37T6186Document2 pagesUP37T6186Aakash ShishodiaNo ratings yet

- Bike Insurance 1021741038964946Document1 pageBike Insurance 1021741038964946Süñîl Åñîl PäťïlNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 240322223120007234 Proposal/Covernote No: R19092232360Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 240322223120007234 Proposal/Covernote No: R19092232360santosh kumarNo ratings yet

- Quotepdf20240220 113706Document1 pageQuotepdf20240220 113706aravinth609No ratings yet

- Ergo InsuranceDocument2 pagesErgo InsuranceFaizargarNo ratings yet

- HIBIPL - Policy DetailsDocument1 pageHIBIPL - Policy DetailsBrijesh EnterprisesNo ratings yet

- Pulsar 150 InsuranceDocument2 pagesPulsar 150 Insurancesunny rocky100% (1)

- Digitally Signed by Reliance General Insurance Company Limited Date: 2023.03.25Document7 pagesDigitally Signed by Reliance General Insurance Company Limited Date: 2023.03.25Bharati PatilNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!sujeethsNo ratings yet

- 05ADDocument2 pages05ADINSURANCE POINTNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- SAP PST Keys ReferenceDocument8 pagesSAP PST Keys ReferenceMilliana0% (1)

- Maple Ridge Pitt Meadows News - December 31, 2010 Online EditionDocument24 pagesMaple Ridge Pitt Meadows News - December 31, 2010 Online EditionmapleridgenewsNo ratings yet

- SDA Accounting Manual - Jan 2011Document616 pagesSDA Accounting Manual - Jan 2011haroldpsb100% (2)

- HSN Table 12 10 22 Advisory NewDocument2 pagesHSN Table 12 10 22 Advisory NewAmanNo ratings yet

- Music Scrap BookDocument38 pagesMusic Scrap BookKaanthi PendemNo ratings yet

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- Chapter 1Document25 pagesChapter 1Annie Basing-at AngiwotNo ratings yet

- Admixtures For Concrete, Mortar and Grout ÐDocument12 pagesAdmixtures For Concrete, Mortar and Grout Ðhz135874No ratings yet

- Final Report On The Audit of Peace Corps Panama IG-18-01-ADocument32 pagesFinal Report On The Audit of Peace Corps Panama IG-18-01-AAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Annual Report 17-18Document96 pagesAnnual Report 17-18Sajib Chandra RoyNo ratings yet

- Business Myth's About Ethics in BusinessDocument4 pagesBusiness Myth's About Ethics in BusinessDoc Wad Negrete Divinaflor100% (1)

- On Rural America - Understanding Isn't The ProblemDocument8 pagesOn Rural America - Understanding Isn't The ProblemReaperXIXNo ratings yet

- Η Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνDocument25 pagesΗ Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνKonstantinos MantasNo ratings yet

- 12-Chemical Hazard CommunicationDocument9 pages12-Chemical Hazard CommunicationHalime HalimeNo ratings yet

- Exclusion Clause AnswerDocument4 pagesExclusion Clause AnswerGROWNo ratings yet

- Henry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Document7 pagesHenry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Scribd Government DocsNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- Solved Acme Realty A Real Estate Development Company Is A Limited PDFDocument1 pageSolved Acme Realty A Real Estate Development Company Is A Limited PDFAnbu jaromiaNo ratings yet

- Assembly ScriptDocument3 pagesAssembly ScriptMary Ellen100% (1)

- Radio CodesDocument1 pageRadio CodeshelpmeguruNo ratings yet

- Appendix 1. Helicopter Data: 1. INTRODUCTION. This Appendix Contains 2. VERIFICATION. The Published InformationDocument20 pagesAppendix 1. Helicopter Data: 1. INTRODUCTION. This Appendix Contains 2. VERIFICATION. The Published Informationsamirsamira928No ratings yet

- Student Profile Guide G TuDocument5 pagesStudent Profile Guide G TuumeshNo ratings yet

- Yayen, Michael - MEM601Document85 pagesYayen, Michael - MEM601MICHAEL YAYENNo ratings yet

- Employment Termination and Settlement AgreementDocument6 pagesEmployment Termination and Settlement AgreementParul KhannaNo ratings yet

- Cambodia vs. RwandaDocument2 pagesCambodia vs. RwandaSoksan HingNo ratings yet

- Valuation of Fixed Assets in Special CasesDocument7 pagesValuation of Fixed Assets in Special CasesPinky MehtaNo ratings yet

- (NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeDocument2 pages(NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeAngelica Joy Toronon SeradaNo ratings yet

- List of Officers Who Attended Courses at NCRB-2019Document189 pagesList of Officers Who Attended Courses at NCRB-2019Manish Bhardwaj100% (1)

- Performance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorDocument6 pagesPerformance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorRHTi BDNo ratings yet

- Solicitor General LetterDocument6 pagesSolicitor General LetterFallon FischerNo ratings yet