Professional Documents

Culture Documents

VAT: A Transparent Tax on Value Added

Uploaded by

Argel CosmeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT: A Transparent Tax on Value Added

Uploaded by

Argel CosmeCopyright:

Available Formats

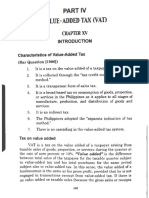

VALUE ADDED TAX manufacturers.

Subsequently, if manufacturers

add tax to price, after the goods were further

processed, and afterward sold at higher prices to

Value-added Tax (VAT) the buyers, then, burden of tax is thus shifted to

It is a tax on consumption levied on the sale, barter, the buyers.

exchange or lease of goods or properties or services

in the Philippines and on importation of goods into The shifting of the VAT to the buyer does not make

the Philippines (RR No. 16-2005, Sec.4.105-2). the person directly liable and therefore, it cannot

invoke its tax exemption privilege under Section 109

Characteristics of Philippine VAT: [1][R] of the Tax Code of 1997, as amended, to

1. It is an indirect tax. The amount of tax maybe avoid the passing on or shifting of the VAT (BIR

shifted or passed on by the seller to the buyer, Ruling No. 170-2013, May 6, 2013).

transferee or lessee of goods, properties or

services (NIRC, Sec. 105[b]). Note: Once the VAT is shifted to the buyer/customer

as an addition to the cost of goods or services sold,

Impact of Taxation – on the seller upon whom it is no longer a tax but an additional cost which the

the tax has been imposed in first instance buyer/customer has to pay in order to obtain the

goods or services. The buyer cannot be held directly

Except in the case of tax-free importation of goods liable to pay tax or invoke exemption privilege to

into the Philippines by persons, entities or avoid paying the output tax passed on to them by

agencies exempt from tax where such goods are the vendor, in the form of higher selling price

subsequently sold, transferred or exchanged in

the Philippines to non-exempt persons or entities, 2. It is a tax on value added of the taxpayer.

the purchasers, transferees or recipients shall be

considered the importers thereof, who shall be Value added – is the value added to the raw

liable for any internal revenue tax on such materials or to the purchases, other than the labor

importation. (NIRC, Sec. 107[B]). component of the goods or service, by the

producer, before its sale.

Incidence of Taxation – on the final consumer

who finally bears burden of tax Total Sales Pxx.xx

Less: Total Purchases (xx.xx)

What is transferred in such instances is not the = Value Added Pxx.xx

liability for the tax, but the tax burden. Stated

differently, a seller who is directly and legally liable *Assuming both sales and purchases are

for payment of an indirect tax, such as the VAT on subject to VAT in the same taxable quarter.

goods or services is not necessarily the person

who ultimately bears the burden of the same tax. It 3. It is a transparent form of sales tax.

is the final purchaser or consumer of such goods

or services who, although not directly and legally VAT is a tax on the taxable sale, barter or

liable for the payment thereof, ultimately bears the exchange of goods, properties or services. A

burden of the tax (Contex v. CIR, G.R. No. barter or exchange has the same tax

151135, July 2, 2004). consequence as a sale. A sale may be an actual

sale or a deemed sale, or an export sale or a local

Illustration: Tax will be paid to BIR in first sale (MAMALATEO, supra at 316).

instance by manufacturers of consumer goods.

Impact or liability to pay tax is, therefore, on the

EXECUTIVE COMMITTEE SUBJECT COMMITTEE MEMBERS

SYLVESTER AUSTRIA over-all chairperson, MA. EVANOR BONAOBRA subject chair, Jez Charlemagne Arago, Noreen

REYNOLD ORSUA chairperson for academics, MABEL BUTED assistant subject chair, IAN Joyce Aquino, Jeana Lyn

JOE VINCENT AGUILA chairperson for hotel CALMARES edp, CLAIRE BULIYAT general Caceres, Paul Vincent Casilla,

operations, LYNDON RUTOR vice-chairperson principles, CAROLINE CLAIRE BARIC, Bai Pangandongan Dilangalen,

for operations, RODEL JAMES PULMA vice- ROBERT JAY LIM and NIKKI NAKHISHA Clarissa Heromina Esguerra,

chairperson for secretariat, DENISE DIANNE MACALINO income tax, PATRICIA ANNE Lara Carmela Fernando, Aemie

MAGBUHOS vice-chairperson for finance, IAN SAYO transfer tax, MA. PATRICIA PAULA Mana Jordan, Raynald Lopez,

DANIEL GALANG vice-chairperson for GAUNA, value added tax, FLORIAN Ali Loraine Manrique,

electronic data processing, JOMARC PHILIP SALCEDO nirc remedies, MONIQUE CHU Maygenica Mateo, Jona

DIMAPILIS vice-chairperson for logistics, tax administration and enforcement, Christinelli Mendoza, Henson

ALBERTO RECALDE JR. vice-chairperson for JONATHAN VINARAO real property tax and Macayanan Montalvo, Derek

membership local taxation, RICHMOND MONTEVIRGEN Odosis, Krizia Marie Redondo,

tariff and customs law, IAN DULDULAO Ma. Katrina Roxas, Michelle

court of tax appeals Salcedo, Sarah Lou Sulit, Doris

Moriel Tampis, Fenna Marie

Tilos, Wesley Young

Transparent – the law requires that the tax be Freeport Zones and Economic Zones are

shown as a separate item in the VAT invoice or considered as separate customs territories. Sales

receipt. by entities registered with these zones are either

treated as sales outside the country (if the

4. It is a broad-based tax on consumption of goods, purchaser is also a locator, or if the goods are for

properties or service in the Philippines. export to a country other than the Philippines) or

domestic sales. If considered as domestic sales,

Broad based – there is VAT on every stage of the these sales are importations in the hands of the

taxable sales of goods, properties or services purchaser and are thus subject to the

corresponding customs duties and other taxes on

5. It is collected through the tax credit method imported products (RR No. 2-2012, February 17,

(sometimes called as the invoice method). 2012).

Tax Credit Method – the input tax shifted by the In Toshiba Information Equipment (Phils.) Inc., v.

seller to the buyer is credited against the buyer’s CIR, PEZA-registered enterprises, such as

output taxes when he in turn sells the taxable Toshiba, are VAT-exempt and no VAT can be

goods, properties or services passed on to them. PEZA-registered enterprise,

which would necessarily be located within

6. It does not cascade (tax on tax), hence, there is Ecozones, are VAT-exempt entities, not because

no tax pyramiding. of Sec. 24 of R.A. 7916, as amended, which

imposes the 5% preferential tax rate on gross

Cascading – Tax passed on by the previous income of PEZA-registered enterprises, in lieu of

seller, which is now a component of gross selling all taxes; but, rather, because of Sec. 8 of the

price/receipts of the seller, is again subjected to same statute which establishes the fiction that

tax. Ecozones are foreign territory. Consistently, under

the Cross Border Doctrine, actual export of

Reason: Because VAT allows a seller to credit his goods and services from the Philippines to a

input tax (which is equivalent to the output tax of foreign country must be free of VAT albeit zero

previous seller) from his output tax. Hence, no tax rated; while, those destined for use or

on tax. consumption within the Philippines shall be

imposed with 12% VAT (G.R. No. 157594, March

7. It adopts the “tax-inclusive method”. 9, 2010).

Unless otherwise stated, any price charged by a Advantages of VAT:

VAT registered person shall be deemed to include 1. VAT has a built-in advantage in self-policing

the VAT charged. feature and available audit trail.

8. It follows the Destination Principle/Cross Border The VAT is, in principle, described as “self-

Doctrine. policing.” The description stems from the nature

of the invoice-based credit VAT: a taxable

Destination Principle or Cross Border Doctrine business can claim for the refund of the input VAT

Goods and services are taxed only in the country only if the claim is supported by purchase

where these are consumed, and in connection invoices—the mechanism provides strong

with the said principle, the Cross Border Doctrine incentives for firms to keep invoices of their

mandates that no VAT shall be imposed to form transactions and is an efficient means for tax

part of the cost of the goods destined for authorities to check and cross-check for

consumption outside the territorial border of the enforcement enhancement.

taxing authority (Atlas Consolidated Mining and

Development Corporation v. Commissioner of 2. VAT covers more transactions in a wider tax base.

Internal Revenue G.R. Nos. 141104 & 148763.

June 8, 2007). VAT is generally more broad-based (it is extended

to cover both goods and services). Every sale of

Exports are zero-rated because these shall be goods, properties or services at the levels of

consumed outside the Philippines, while generally, manufacturers or producers and distributors is

imports are subject to regular VAT rate because subject to VAT (MAMALATEO, supra at 317).

they are for consumption in the Philippines.

134 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

3. VAT makes sales tax more equitable. are also subject to VAT (Kepco Ilijan Corporation v.

CIR, CTA Case No. 8091, October 23, 2012).

Exemptions of certain transactions involving

specific categories of goods and services from Therefore, the sale of a motor vehicle forming part of

VAT (See NIRC, Sec. 109 for exempt the taxpayer’s property and equipment, which is an

transactions) were made in an attempt to make incidental transaction made in the course of the

the sales tax more equitable. taxpayer’s business, is subject to tax (Mindanao II

Geothermal Partnership v. Commissioner of Internal

By exempting certain kind of food and other Revenue, G.R. No. 193301, March 11, 2013).

necessities from the sales tax, e.g., food items

which are being purchased mostly by workers like, Exceptions to the Rule of Regularity:

sardines, canned fish, milk and cooking oil (VAT 1. Importation is subject to VAT regardless of

Ruling No. 009-07, June 21, 2007), it is argued, whether or not it is in the course of trade or

lower-income families are relieved from part of business (NIRC, Sec. 107[A]).

their tax burden.

Note: The Code provides that there shall be

4. VAT is neutral in making business decisions. levied, assessed and collected on every

importation of goods.

The cost in a business is ultimately neutral

because if a business receives more output tax 2. Services rendered in the Philippines by non-

from sales than it pays in input tax on purchases, resident foreign persons shall be considered as

the excess output will be paid to the BIR. If more being in the course of trade or business even if the

input tax has been paid than output tax charged, a performance of services is not regular (NIRC, Sec.

refund may be made for the difference. What it 105 [d]).

does mean is that a taxpayer can re-claim some 3. Any business where the gross sales or receipt do

or all of the VAT it paid on goods or services it not exceed P100,000 during any 12-month period

used for the business. shall be considered principally for subsistence or

livelihood and not in the course of trade or

business (RMC No.4-98, January 21, 1998).

PERSONS LIABLE FOR V AT

VAT Person

Refers to any person liable for the payment of VAT,

1. Any person who in the course of trade or whether registered or registrable:

business: 1. Any person who engages in transactions subject

a. Sells, barters, or exchanges goods or properties to VAT.

(seller or transferor), leases goods or properties 2. Importers of goods, whether or not made in the

(lessor); course of his trade or business (Secs. 106-108,

b. Renders services (service provider) NIRC),

2. Imports goods (importer) – the person who brings

goods into the Philippines, whether or not made in Illustration:

the course of trade or business (RR No. 16-2005, D’2 Luck Trading is not registered as a VAT

Sec. 4.105-1). business. During the month, it made an

importation equivalent to P200,000.00. The

In the Course of Trade or Business (Rule of importation is intended for the personal use of

Regularity) Didi, the owner.

Regular conduct or pursuit of a commercial or an

economic activity, including transactions incidental In the above case, although the importation is

thereto, by any person regardless of whether or not made by a non-VAT business and even not

the person engaged therein is a non-stock, non- intended for use in business and does not meet

profit private organization (irrespective of the the required threshold, the transaction is subject to

disposition of its net income and whether or not it VAT.

sells exclusively to members or their guests), or (also in relation to the Destination Principle)

government entity (NIRC, Sec. 105; RR No. 16-

2005, Sec. 4.105-3). 3. Persons whose annual sales exceed P1,919,500

(previously P1,500,000) (RR No. 16-2011,

Likewise, transactions incidental to the pursuit of a effective January 1, 2012).

commercial or economic activity are considered as

entered into in the course of trade or business and

SAN BEDA COLLEGE OF LAW 135

2014 CENTRALIZED BAR OPERATIONS

Illustration: The following persons are VAT-exempt:

V-Go Trading is not registered as VAT business. 1. Persons not engaged in undertaking VAT-taxable

During the year, it has a total sales of goods transactions including:

entered in the normal course of business a. Those whose sales or receipts are exempt

amounting to P2,000,000.00. under Sec. 109[v] of the NIRC;

b. Those whose annual gross sales or receipt do

In this case, V-GO Trading is liable for VAT due to not exceed P1,919,500; and

the fact that its sales exceeded the VAT c. Non-stock/ nonprofit organizations.

registration threshold of P1,919,500, These are organized primarily for the purpose of

notwithstanding the fact that it is not a VAT- engaging in nontaxable transactions.

registered business.

If at the same time these entities undertake

VAT-Registered Person taxable transactions but the value of such

VAT person who: transactions does not exceed P1,919,500 per

1. Registered in accordance with the law; or year, they remain exempt from VAT. They will be

2. Opted to be registered as a VAT person. taxed under percentage tax unless they registered

as VAT business.

Such status shall continue until registration is

cancelled or until the three (3) consecutive years Illustration:

moratorium had lapsed for a person who opted to MC Lakad is a nonprofit entity founded to train and

register as a VAT person and thereafter decides to prepare wheel-chaired persons for skills that will

revert to exempt status (NIRC, Sec 236[H][2]). make them self-supporting. In the course of

training, the products of these beneficiaries are

VAT-Registrable Person being sold to public. For the year, the total cash

Persons required to register for Value-Added Tax: sales amounted P300,000 which was used to

1. Any person, who in the course of trade or finance the foundation.

business, sells, barters or exchanges goods or

properties, or engages in the sale or exchange of In the above case, the sale of the foundation is

services, shall be liable to register for VAT if: exempt from VAT. The sale will be subject to

a. His gross sales or receipts for the past twelve percentage tax except when specifically exempted

(12) months, other than those that are exempt by the Tax Code or special laws from VAT.

under Section 109[A] to [U] have exceeded

P1,919,500; or 2. Subsistence Livelihood Income

b. There are reasonable grounds to believer that Subsistence livelihood activities are exempt from

his gross sales or receipts for the next 12 VAT or percentage tax and and/or payment of

months, other than those that are exempt under P500 registration fee.

Section 109[A] to [U], will exceed P1,919,500;

(NIRC, Sec 236 [G][1]) Any business or businesses pursued by an

individual where the aggregate gross sales or

2. Any person who is required to register but failed to receipts do not exceed P100,000 during the 12-

do so. As a form of penalty, he shall not be month period shall be considered principally for

entitled to claim any input tax credit, although he is subsistence or livelihood and not in the course of

liable to output tax in his taxable sales. (NIRC, business (RMC No.4-98 dated January 21, 1998).

Sec 236 [G][2])

Illustration:

VAT-Exempt Person Tina Pay is engaged in the selling of homemade

Not liable for the imposition of Output VAT on its cakes. Her gross sales for the year 2013 from this

sales, either because his transactions are not activity amounted to P70,000. How much is the

taxable transactions or he is specifically exempt VAT to be remitted by Tina for her sales?

from VAT by specific provision of the Code or by

special laws. There is no VAT to be remitted by Tina. Her gross

sales are considered as receipts from livelihood

VAT-exempt person may be exempted from levying activity and therefore not subject to VAT.

of Output VAT; however he may still be required by

his VAT-registered supplier to pay VAT component 3. Persons exempt from VAT under Special Laws:

on his purchases. a. CDA-registered cooperatives (R.A. 6938, R.A.

8424);

136 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

b. Enterprise registered with Special Economic Aggregation Rule

Zones or Free Ports in the Philippines; A spouse who derives revenue not only from the

c. Regional or Area Headquarters established in practice of his profession but also from other lines

the Philippines by multinational corporations of trades or businesses, which are likewise subject

(BIR Ruling 176-88); and to VAT, shall be aggregated for purposes of

d. Inventors (RR No. 19-93). determining whether the threshold amount has

been exceeded (RR No. 16-2005, Sec. 4.109-1).

4. VAT-Exempt under Treaty

Under the Vienna Convention on Diplomatic 2. Joint Venture

Relations of 1961, diplomatic agents are exempt An unincorporated joint venture undertaking

from all dues, taxes, personal or real, national, construction or energy-related contractual

regional or municipal. activities with the government, although exempt

from income tax, shall be liable to VAT

They are, nevertheless, subject to the indirect (MAMALATEO, Value Added Tax, 2007, p.45)

taxes of a kind which are normally incorporated in [hereinafter MAMALATEO, VAT].

the price of goods or services (BIR Ruling No.

065-96, June 18,1996). 3. General Professional Partnership (GPP)

A professional may practice profession either

through:

INPUT TAX AND OUTPUT TAX a. His personal capacity; or

b. A GPP.

Input Tax Rules:

The VAT due from or paid by a VAT registered a. An individual who practice profession in his

person in the course of his trade or business on individual capacity shall pay VAT if his annual

importation of goods or local purchase of goods, or gross receipts exceed P1,919,500; otherwise,

services, including lease or use of property, from a he shall be liable to the three percent (3%)

VAT-registered person (NIRC, Sec. 110[A]). percentage tax (RR No. 16-2011).

b. An individual who practice through a GPP shall

Sources of Input Tax: no longer be liable for VAT on his share of the

1. Passed-on VAT (12%) – VAT paid on: partnership profits from the GPP. GPPs whose

a. Purchase or importation of goods; gross annual receipts exceed P1,919,500 shall

b. Purchase of real properties; and be liable for VAT (RR No. 16-2011).

c. Purchase of services;

2. Transactions Deemed Sale (12%); Please see discussion on Updates on VAT.

3. Presumptive Input Tax (4%);

4. Transitional Input Tax (2% or actual VAT paid); 4. Government

5. Standard Input Tax (7%); a. Performance of essential governmental

6. Withholding Input Tax; and functions exempt from VAT

7. Excess Input Tax b. Performance of their proprietary functions –

liable to pay VAT

Output Tax

The VAT due on the sale or lease of taxable goods 5. Non-Stock, Non-Profit Association

or properties or services by any person registered or a. Receipts which come purely from association

required to register under VAT (NIRC, Sec. dues or special assessments from members –

110[A][3][b]). exempt from VAT

b. Once it engages in any taxable sale of goods or

Sources of Output Tax: services (i.e., operating a restaurant) – liable to

1. Actual Sales pay VAT

2. Zero-rated Sales

3. Deemed Sales 6. Real Estate Dealer, Developer or Lessor

Sale of real property held primarily for sale or for

Transactions of Special VAT Persons lease is subject to VAT only if:

1. Husband and Wife a. Made by a real estate dealer; and

Husband and wife shall be separate taxpayers for b. The gross selling price exceeds the threshold

purposes of the P1,919,500 threshold. However, prescribed by law (RR No. 16-2011).

the aggregation rule for each taxpayer shall apply

(RR No. 16-2011).

SAN BEDA COLLEGE OF LAW 137

2014 CENTRALIZED BAR OPERATIONS

Real Estate Dealer – includes any person 4. The sale is not exempt from VAT under Sec. 109

engaged in the business of buying, developing, of the NIRC, special law, or international

selling, exchanging real properties as principal agreement binding upon the government of the

and holding himself out as a full or part-time Philippines (RR No. 16-2005, Sec. 4.106-1).

dealer in real estate (RR No. 16-2005, Sec. 4.106-

3). Absence of any of the above requisites exempts the

transaction from VAT. However, percentage taxes

Exception: Sale of real property that are may apply.

expressly exempted from VAT (See VAT Exempt

Transactions) Tax Base and Tax Rate: Twelve percent (12%) of

the gross selling price or gross value in money of

the goods or properties sold, bartered or exchanged.

Please see Sale of Real Property for the threshold

Such tax is to be paid by the seller or transferor.

amounts.

Gross Selling Price for Goods or Properties

7. Importer Other than Real Property – the total amount of

Generally, it is the seller who shall pay the output money or its equivalent which the purchaser pays or

tax on his taxable sales. However, in case of is obligated to pay to the seller in consideration of

importation, it shall be the importer who shall pay the sale, barter or exchange of the goods or

VAT upon release of the goods from the customs properties, excluding VAT. The excise tax, if any, on

territory. This is an exception to the general rule such goods or properties shall form part of the gross

requiring a sale before VAT shall be incurred selling price (NIRC, Sec. 106[A]).

(MAMALATEO, VAT, supra at 44).

If the VAT is not billed separately, the selling price

stated in the sales document shall be deemed to be

V AT ON SALE OF GOODS OR inclusive of VAT (NIRC, Sec. 106; RR No. 16-2005).

PROPERTIES Allowable Deductions from Gross Selling Price:

1. Sales discounts determined and granted at the

time of the sale as expressly indicated in the

Goods or Properties invoice. Discounts conditioned upon the

Means all tangible and intangible objects which are subsequent happening of an event or fulfillment of

capable of pecuniary estimation and shall include, certain conditions shall not be allowed as

among others: (TEMPR) deductions;

1. Radio, television, satellite Transmission and cable 2. Sales returns and allowances granted where

transmission time; proper credit or refund was made during the

2. The right or privilege to use in the Philippines of month or quarter to the buyer for sales previously

any industrial, commercial, or scientific recorded as taxable sales (RR No. 16-2005).

Equipment;

3. The right or privilege to use Motion pictures films,

tapes, and discs; V AT ON SALE OF REAL

4. The right or privilege to use Patent, copyright,

design or model, plan, secret formula or process, PROPERTIES

goodwill, trademark, trade brand, or other like

property or right; and Requisites for Taxability of Sale or Exchange or

5. Real properties held primarily for sale to Real Property:

customers or held for lease in the ordinary course 1. The seller executes a deed of sale, including

of trade or business (NIRC, Sec. 106). dacion en pago, barter or exchange, assignment,

transfer, or conveyance, or merely contract to sell

Requisites for Taxability of Sale of Goods and involving real property;

Personal Properties: 2. The real property is located within the Philippines;

1. There is an actual or deemed sale, barter or 3. The seller or transferor is a real estate dealer;

exchange of goods or personal properties for a 4. The real property is an ordinary asset – held

valuable consideration; primarily for sale or for lease in the ordinary

2. The sale is in the course of trade or business or course of business;

exercise of profession in the Philippines; 5. The sale is not exempt from VAT under the Sec.

3. The goods or properties are located in the 109 of the NIRC, special law or international

Philippines and are for use or consumption

therein; and

138 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

agreement binding upon the government of the being a residential lot, house & lot or a residential

Philippines; and dwelling, thus, should be subject to VAT

6. The threshold amount set by the law should be regardless of amount of selling price (RR No. 13-

met (RR No. 16-2005, Sec. 4.106-1). 2012 dated October 12, 2012).

Absence of any of the above requisites exempts the Note: Whether the instrument is nominated as a

transaction from VAT. However, percentage taxes deed of absolute sale, deed of conditional sale or

may apply. otherwise.

Tax Base and Tax Rate: Twelve percent (12%) of Modes of Sale of Real Property by a Real Estate

the gross selling price or gross value in money of Dealer

the goods or properties sold, bartered or exchanged. 1. On Installment Plan – A sale which has initial

Such tax is to be paid by the seller or transferor. payments not exceeding twenty-five percent

(25%) of the gross selling price.

Gross Selling Price in Case of Real Property:

a. The consideration stated in the sales document; or The real estate dealer shall pay VAT on

b. The fair market value (whichever is higher of the installment payments, including interest and

zonal value as determined by the BIR or the value penalties, actually and/or constructively received

shown in the schedule of values of the Provincial by the seller (RR No. 16-2005, Sec. 4.106-3).

and City Assessors [value declared in the latest

real property tax declaration]), whichever is higher. Initial payments – Payment or payments which

the seller receives before or upon execution of the

Please see discussion on the allowable deductions instrument of sale and payments which he expects

from gross selling price. or is scheduled to receive other than the

purchaser’s evidence of indebtedness, during the

Sale of Real Property Covered by VAT calendar year where the real property was sold.

Sale by a real estate dealer of a:

1. Residential lot with gross selling price exceeding It covers any down payment made and includes all

P1,919,500; payments actually or constructively received

2. Residential house and lot or other residential during the year of sale, the aggregate of which

dwellings with gross selling price exceeding determines the limit set by law, i.e., P1,919,500.00

P3,199,200 (RR No. 16-2011); or P3,199,200.00.

3. Sale, transfer or disposal within a 12-month period

of two or more adjacent: 2. On a Deferred Payment Basis – A sale which

a. residential lots; has initial payments exceeding twenty-five percent

b. house and lots; or (25%) of the gross selling price.

c. other residential dwellings in favor of one buyer

from the same seller, for the purpose of utilizing The transaction shall be treated as cash sale

the lots, house and lots or other residential which makes the entire selling price taxable in the

dwellings as one residential area wherein the month of the sale.

aggregate value of the adjacent properties

exceeds P1,919,500 for residential lots, and Distinctions between Sale on Installment Plan

P3,199,200 for residential house and lots or and Sale on a Deferred Payment Basis

other residential dwellings (RR No. 13-2012 Installment Plan Deferred Plan

dated October 12, 2012). Initial payments do not Initial payments exceed

exceed 25% of the 25% of the gross selling

Adjacent residential lots, houses and lots or other gross selling price price

residential dwellings, although covered by

separate titles and/or separate tax declarations, Seller shall be subject

when sold or disposed to one and the same buyer, to output VAT on the

Transaction shall be

whether covered by one or separate Deed/s of installment payments

treated as cash sale

Conveyance, shall be presumed as a sale of one received, including the

which makes the entire

residential lot, house and lot or residential interests and penalties

selling price taxable in

dwelling. for late payment,

the month of sale

actually and/or

The sale of parking lots in a condominium is a constructively received

separate and distinct transaction and is not

covered by the rules on threshold amount not

SAN BEDA COLLEGE OF LAW 139

2014 CENTRALIZED BAR OPERATIONS

Output tax shall be residential lots with the improvements thereon to B

The buyer of the

recognized by the seller Co., a non-stock non-profit organization

property can claim the

and input tax shall established for charitable purposes and registered

input tax in the same

accrue to the buyer at with the Philippine Council for NGO Certification

period as the seller

the time of the (PCNC).

recognized the output

execution of the

tax

instrument of sale The donation by a VAT-registered person of its

Payments that are Payments that are ordinary assets is subject to VAT pursuant to

subsequent to “initial subsequent to “initial Section 4.106-7 of RR No. 16-05, as amended,

payments” shall be payments” shall no the same being considered a transaction deemed

subject to output longer be subject to sale.

VAT output VAT

2. Distribution or transfer to:

Summary of the Increased VAT Threshold (RR a. Shareholders or investors share in the profits of

No. 16-2011, effective January 1, 2012) VAT-registered person; or

Current Adjusted b. Creditors in payment of debt or obligation;

NIRC provision exemption threshold

levels amounts Illustration:

Sec. 109[P] – Some of the importations of JGU Corporation are

P1,500,000 P1,919,500

residential lot 100 cars which are intended to be sold locally.

Sec. 109[P] – The cars are currently being sold in the local

residential P2,500,000 P3,199,200 market at P500,000 per unit. Twenty units of these

house and lot cars were declared as property dividends and

Sec. 109 [Q] –rental distributed to its stockholders.

P10,000 P12,800

of residential unit

Sec. 109[V] – sales The distribution of 20 units are deemed sale and

of goods and subject to 12% VAT on the taxable base of

services not P1,500,000 P1,919,500 P500,000 per unit.

exceeding the VAT-

exemption threshold 3. Consignments of goods if actual sale is not made

within sixty (60) days following the date such

goods were consigned.

TRANSACTIONS DEEMED

SALE Exception: Consigned goods physically returned

by the consignee within the 60-day period are not

deemed sold;

The following are transactions deemed sales

(NIRC, Sec. 106 [B]): (TDCR) 4. Retirement from or cessation of business with

1. Transfer, use, consumption not in the course of respect to all goods on hand, whether capital

business of goods or properties originally intended goods, stock-in-trade, supplies or materials as of

for sale or for use in the course of business (i.e., the date of such retirement or cessation.

when a VAT-registered person withdraws goods a. Change of ownership of a business when:

from his business for his personal use); i. Single proprietorship incorporates;

ii. Proprietor of single proprietorship sells his

Illustration: business.

Jude, the sole proprietor of JV Trading, a VAT- b. Dissolution of a partnership and creation of a

registered business, consumed for personal use new partnership which takes over the business

P100,000 of the total purchase for the quarter. (NIRC, Sec. 106[B]; RR No. 16-2005, Sec.

4.106-[b]).

The P100,000 used for personal purpose is

deemed sale. Illustration:

Hook and Eye, partners in HE partnership, a

Donations by a VAT-registered person of ordinary VAT-registered merchandising business,

assets are subject to VAT, the same being decided to dissolve their partnership. The

considered a transaction deemed sale. dissolution and liquidation resulted in the

distribution of P200,000 merchandise inventory

Illustration: to each of the partner.

A Co., a domestic real estate dealer, donated 23

140 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

In the above case, the transfer of P400,000 (or by a person who voluntarily registered despite

the value determined by the BIR) of being exempt under Sec. 109[2] of the NIRC;

merchandise inventories to Hook and Eye will c. Failure to meet the specific threshold

be treated as if sold to partners. Thus, (P1,919,500) by one who commenced business

transaction deemed sale. with the expectation of reaching the required

gross sales or receipts during the first 12

Before considering whether the transaction is months of operation (RR No. 16-2005, Sec.

“deemed sale”, it must first be determined whether 4.106-8).

the sale was in the ordinary course of trade or

business. Even if the transaction was “deemed sale” Not Subject to 12% Output VAT

if it was not done in the ordinary course of trade or The 12% VAT shall not apply to goods or properties

business, still the transaction is not subject to VAT which are originally intended for sale or for use in

(CIR v. Magsaysay Lines Inc., GR No. 146984, July the course of business existing as of the occurrence

28, 2006). of the following, as they are mere changes in form

and not in substance:

Tax Base and Tax Rate: Twelve percent (12%) of 1. Change of control of a corporation by the

the market value of the goods deemed sold as of the acquisition of the controlling interest of such

time of the occurrence of the transactions corporation by another stockholder (individual or

enumerated in (1), (2), and (3) above. However, in corporate) or group of stockholders.

retirement or cessation of business, tax base shall

be the acquisition cost or the current market price of The goods or properties used in the business

the goods or properties, whichever is lower. (including those held for lease) or those

comprising the stock in trade of the corporation

In the case of a sale where the gross selling price is having a change in corporate control will not be

unreasonably lower than the fair market value, the considered sold, bartered, or exchanged despite

actual market value shall be the tax base. the change in the ownership interest in the said

corporation since the same corporation still owns

Reason: To recapture the input tax that was them.

claimed by the buyer in the month of the purchase.

Exceptions:

Note: Deemed sales apply only to sale of goods and a. Exchange of property by corporation acquiring

properties and not to sale and exchange of services. control for the shares of stocks of the target

There is no actual sale but there shall be deemed corporation.

sale by operation of law. b. From the point of view of the person who joins

the corporation, who exchanges his properties

held for sale or for lease for shares of stocks,

CHANGE OR CESSATION OF whether resulting to corporate control or not.

S T A T U S A S V AT- Illustration: SBC Corp., engaged in furniture

REGISTERED PERSON business, has finished goods amounting to P10M.

1D Corp, a manufacturer of industrial equipment,

exchanged its heavy equipment for the shares of

Subject to 12% Output VAT: stock of SBC Corp. acquiring corporate control

The 12% VAT shall apply to goods or properties thereof. The inventory of SBC Corp. of P10M is

existing as of the occurrence of the following: not subject to output tax despite change in

1. Change of business activity from VAT taxable corporate control because the same corporation

status to VAT-exempt status (e.g., A VAT- still owns them. This is in recognition of the

registered person engaged in a taxable activity separate and distinct personality of the corporation

like wholesaler or retailer who decides to from its stockholders. However, the exchange of

discontinue such activity and engages instead in heavy equipment held for sale or lease and which

life insurance business or in any other business are not used in the ordinary course of its business

not subject to VAT); for shares of stock, whether it would result to

2. Approval of a request for cancellation of VAT corporate control or not, is subject to VAT.

registration due to:

a. Reversion to exempt status; 2. Change in trade name or corporate names of the

b. Desire to revert to exempt status after lapse of 3 business; or

consecutive years from the time of registration 3. Merger or consolidation of corporations.

SAN BEDA COLLEGE OF LAW 141

2014 CENTRALIZED BAR OPERATIONS

The unused input tax of the dissolved corporation, Importer

as of the date of merger or consolidation, shall be Refers to any person who brings goods into the

absorbed by the surviving corporation (RR No. 10- Philippines, whether or not made in the course of

2011). trade or business. It includes non-exempt persons

or entities who acquire tax-free imported goods from

exempt persons, entities or agencies (RR No. 16-

V AT ON IMPORTATION OF 2005, Sec. 4.107-1)

GOODS

V AT ON THE SALE OF

VAT on Importation of Goods

The importation of goods herein contemplated refers SERVICE AND USE OR LEASE

to importation by any person, who may or may not OF PROPERTIES

be engaged in trade or business in the Philippines

(RR No. 15-2005).

Sale or Exchange of Services

Tax Base and Tax Rate: Twelve percent (12%) Means the performance of all kinds of services in

based on: the Philippines for others for a fee, remuneration or

1. Total value used by the BOC in determining tariff consideration whether in kind or in cash (NIRC, Sec.

and customs duties, plus customs duties, excise 108).

taxes, if any, and other charges prior to the

release of goods from the customs; Requisites for Taxability:

2. Landed cost in case the valuation used by the 1. There is a sale or exchange of service or lease or

BOC is based on volume and quantity. Landed use of property enumerated in the law or other

cost consists of the invoice amount, customs similar services;

duties, freight, insurance and other charges and 2. The service is performed or to be performed in the

also excise tax, if any (NIRC, Sec. 107). Philippines, and in case of lease, property leased

or used must be located in the Philippines (place

The same rule applies to technical importation of where the contract of lease or the licensing

goods sold by a person located in a Special agreement was executed is irrelevant);

Economic Zone to a customer located in a customs 3. The service is in the course of the taxpayer’s trade

territory (RR No. 16-2005). or business or profession;

4. The service is for a valuable consideration actually

Technical Importation or constructively received; and

In the case of tax-free importation of goods into the 5. The service is not exempt under the NIRC,

Philippines by persons, entities or agencies exempt special law or international agreement (NIRC,

from tax where such goods are subsequently sold, Sec. 108[A]).

transferred or exchanged in the Philippines to non-

exempt persons or entities, the purchasers, Absence of any of these requisites renders the

transferees or recipients shall be considered the transaction exempt from VAT but maybe subject to

importers thereof, who shall be liable for any internal other percentage tax under the NIRC.

revenue tax on such importation. The tax due on

such importation shall constitute a lien on the goods Tax Base and Tax Rate: Twelve percent (12%) of

superior to all charges or liens on the goods, the gross receipts derived from the sale or exchange

irrespective of the possessor thereof (NIRC, Sec. of services, including the use or lease of properties

107[B]). (NIRC, Sec. 108).

Illustration: MD is a tax-exempt entity that imported Gross Receipts

goods, and then subsequently sold it to E, a VAT Total amount of money or its equivalent

person. E has to pay for the VAT. E can claim the representing the contract price, compensation,

VAT paid as creditable input taxes. service fee, rental or royalty, including the amount

charged for materials supplied with the services and

Please refer to discussions on sales made in a deposit applied as payments for services rendered

customs territory. and advance payments actually or constructively

received during the taxable period for the services

When and by whom paid: The VAT on importation performed or to be performed for another person,

shall be paid by the importer prior to the release of excluding VAT, except those amounts earmarked for

such goods from customs custody. payment to unrelated third party or received as

142 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

reimbursement for advanced payment on behalf of c. A security deposit to insure the faithful

another which do not redound to the benefit of the performance of certain obligations of the lessee

payor (RR No. 16-2005, Sec. 4.108-4). to the lessor; or

d. Pre-paid rental.

Actual Receipt

Receipt constitutes a transfer of property from one If the advance payment is either of (a), (b) or (c)

party to another at the taxpayer’s direction, or for the above, such advance payment is not subject to

benefit of the taxpayer; need not be in the form of VAT. Because (a), (b) or (c) is not yet considered

cash, can be in the form of property or cash as actual or constructive receipt liable for VAT.

equivalent.

However, security deposits in lease contracts are

Constructive Receipt subject to VAT when applied to rental at the time

Occurs when the money consideration or its of its application. If the advance payment

equivalent is placed at the control of the person who constitutes a prepaid rental, then such payment is

rendered the service without restrictions by the taxable to the lessor in the month when received,

payor (e.g., deposit in banks made available to irrespective of the accounting method employed

seller of services or set-off of seller of services’ debt by the lessor (RR No. 16-2005, Sec. 4.108-3).

with the consent of the latter as payment for

services rendered to the former) (RR No. 16-2005, 4. Warehousing services;

Sec. 4.108-4). 5. Lessors or distributors of cinematographic films;

6. Persons engaged in milling, processing,

Amounts are constructively received when: manufacturing or repacking goods for others;

1. Credited to the taxpayer’s account; 7. Proprietors, operators, or keepers of hotels,

2. Set apart for the taxpayer; or motels, resthouses, pension houses, inns, resorts,

3. Otherwise made available so that the taxpayer theaters and movie houses;

may draw upon it at any time, or draw upon it 8. Proprietors or operators of restaurants,

when notice of intention to withdraw has been refreshment parlors, cafes and other eating

given (RR No. 16-2005, Sec. 4.108-4). places, including clubs and caterers;

Actual or constructive receipt of the contract price, The gross receipts of recreational clubs including

compensation, remuneration or fee makes the seller but not limited to membership fees, assessment

of service liable to VAT, even if no service has yet dues, rental income, and service fees are subject

been performed by him (MAMALATEO, supra at to VAT.

336).

9. Dealers in securities;

Sale or exchange of services includes services 10. Lending investors;

performed or rendered by: Lending investor includes all persons other than

1. Construction and service contractors; banks, non-bank financial intermediaries, finance

2. Stock, real estate, commercial, customs and companies and other financial intermediaries not

immigration brokers; performing quasi-banking functions who make a

3. Lessors of property, whether personal or real; practice of lending money for themselves or others

at interest.

Lease of property shall be subject to VAT

regardless of the place where the contract of lease Interest income derived by a taxpayer not

or licensing agreement was executed if the engaged in the business of lending money from

property leased or used is located in the loans or advances granted to affiliates is not

Philippines (Destination Principle). subject to VAT (Waterfront Philippines, Inc. v. CIR,

CTA Case No. 8024, November 13, 2012).

The licensee shall be responsible for the payment

of VAT on such rentals and/or royalties in behalf of 11. Transportation contractors on their transport of

the non-resident foreign corporation or owner goods or cargoes, including persons who

transport goods or cargoes for hire and other

In a lease contract, the advance payment by the domestic common carriers by land relative to

lessee may be: their transport of goods or cargoes;

a. A loan to the lessor from the lessee; or 12. Common carriers by air and sea relative to their

b. An option money for the property; or transport of passengers, goods or cargoes from

one place in the Philippines to another place in

the Philippines;

SAN BEDA COLLEGE OF LAW 143

2014 CENTRALIZED BAR OPERATIONS

13. Sales of electricity by generation, transmission income payor is a PEZA-registered entity to whom

and/or distribution companies; VAT may not be passed on, the royalties shall be

exempt from VAT (BIR Ruling No. ITAD 365-12,

Exception: Sale of power or fuel generated October 24, 2012).

through renewable sources of energy such as,

but not limited to, biomass, solar, wind, 2. The lease or the use of, or the right to use any

hydropower, geothermal, ocean energy, and industrial, commercial, or scientific equipment;

other emerging energy sources using 3. The supply of scientific, technical industrial or

technologies such as fuel cells and hydrogen commercial knowledge or information;

fuels shall be subject to zero percent (0%) VAT 4. The supply of any assistance that is ancillary and

(RR No. 16-2005, Sec. 4.108-3). subsidiary to and is furnished as a means of

enabling the application or enjoyment of any such

14. Franchise grantees of electric utilities, telephone property, or right as is mentioned in subparagraph

and telegraph, radio and/or television (2) or any such knowledge or information as is

broadcasting and all other franchise grantees mentioned in subparagraph (3);

except those under Sec. 119 of the NIRC; 5. The supply of services by a non-resident person

or his employee in connection with the use of

Note: Franchise grantees of radio and/or property or rights belonging to, or the installation

television broadcasting whose annual gross or operation of any brand, machinery or other

receipts of the preceding year do not exceed P10 apparatus purchased from such nonresident

million, and franchise grantees of gas and water person;

utilities are not subject to VAT. 6. The supply of technical advice, assistance or

services rendered in connection with technical

15. Non-life insurance companies (except their crop management or administration of any scientific,

insurances) including surety, fidelity, indemnity industrial or commercial undertaking, venture,

and bonding companies; project or scheme;

7. The lease of motion picture films, films, tapes, and

The gross receipts on non-life insurance discs; and

companies shall mean total premiums collected, 8. The lease or the use of, or the right to use, radio,

whether paid in money, notes, credits or any television, satellite transmission and cable

substitute for money. television time (RR No. 16-2005).

Non-life reinsurance premiums are not subject to Cinema/theater operators may not refuse to

VAT. Insurance and reinsurance commissions, shoulder the VAT component from their lease of

whether life or non-life, are subject to VAT (RR cinematographic films. The exemption from VAT

No. 04-07). of cinema/theater operators or proprietors, which

was upheld by Supreme Court (Commissioner of

16. Similar services regardless of whether or not the Internal Revenue v. SM Prime Holdings, G.R. No.

performance thereof calls for the exercise or use 183505, February 26, 2010), is only limited on the

of the physical or mental faculties (R.R. No. 16- gross receipts derived by cinema/theater

05). operators or proprietors from admission tickets

and does not extend to the purchase or lease of

The phrase “sale or exchange of services” shall cinematographic films. Hence, owners, producers,

likewise include: and lessors of cinematographic films may pass on

1. The lease or the use of or the right or privilege to the VAT component to cinema/theater operators

use any copyright, patent, design or model, plan, or proprietors on the sale or lease of

secret formula or process, goodwill, trademark, cinematographic films (BIR Ruling No. 047-2013,

trade brand or other like property or right; January 24, 2013).

Royalty payments to non-residents are subject to Condominium Corporations Subject to VAT and

twelve percent (12%) withholding value-added tax Income Tax

(WVAT). The resident payor is required to The association dues, membership fees, and other

withhold twelve percent (12%) VAT before paying assessments/charges collected by condominium

the royalties to the non-resident payee (BIR Ruling corporations constitute income payment or

No. ITAD 002-12, January 10, 2012). compensation for beneficial services that the

condominium corporations provide to their members

Royalties paid for the use of trademarks are and tenants. Thus, the gross receipts of

generally subject to VAT. However, when the condominium corporations including association

144 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

Z E R O -R A T E D S A L E S OF V AT

R E G I S T E R E D P E R S O N S

dues, membership fees and other assessments and Illustration:

charges are subject to VAT and income tax. Income X is a VAT-registered business, engaged in export

payments made to condominium corporations are of locally made products. During the taxable year, its

subject to applicable withholding taxes under total export sales all denominated in foreign

existing regulations (RMC No. 65-2012, October 31, currency has equivalent value of P500,000. Its total

2012). input payments for purchases and utilized services

all in connection with the conduct of business

Homeowners’ Association of Subdivisions and amounted to P36,000.

Villages If X has no other transactions which will give rise to

Contributions to associations in exchange for goods, business tax liability, its tax credit/refund would be

services and use of properties constitute as other as follows:

assessments/charges from activity in exchange for

the performance of a service, use of properties or Export Sale-Output tax(P500,000 x 0%) P 0

delivery of an object. As such, these fees are Less: Creditable Input Tax 36,000

income on the part of the associations that are Net VAT Refundable P 36,000

subject to income tax under Section 27 of the Tax

Code, as amended. Note: The seller must be a VAT-registered person

to make his export sales zero-rated. Any Input VAT

Further, considering that these fees are received in attributable to the purchase of capital goods or to

the conduct or pursuit of commercial or economic zero rated sales by a VAT-registered person may at

activity, these fees are also subject to value added his option be refunded or credited against other

tax (VAT) imposed in Sections 106 and 108 of the internal revenue taxes, subject to the provisions of

same Code (RMC NO. 53-2013, August 16, 2013). the NIRC, Sec. 112.

If he is a not VAT-registered person (i.e., he

VAT on Professionals

registered as VAT-exempt), then his export sales

Are lawyers liable for VAT for legal services

rendered? shall be merely VAT-exempt under Sec. 109[1][O] of

Yes. R.A. 9337 clearly provided that sale of legal the NIRC, disallowing him to claim his unused

creditable input taxes attributable to export sales in

services by a lawyer or a law firm shall be subject to

the form of refund or tax credit.

VAT effective November 1, 2005. There was an

elimination of the exemption from VAT of legal

Input tax attributable to zero-rated sales, at the

services, deleting the old Sec. 109[BB] of R.A. 9238.

option of the taxpayer, may be:

1. Refunded; or

A lawyer practicing his profession is subject to

2. Credited against other internal revenue taxes,

VAT if:

subject to the provisions of Section 112 (RMC 57-

1. There is no employer-employee relationship

between him and the person to whom he provides 2013, August 23, 2013).

the legal service; and

2. His gross receipts for the next twelve (12) months Kinds of Zero-Rated Sales:

exceed P1,919,500 (RR No. 16-2011). I. As to object of the sale:

A. Zero-Rated Sales of Goods or Properties

Otherwise, he is exempt from VAT. (NIRC, Sec. 106[A][2]): (EFI)

1. Export Sales (ANEGEI)

a. The sale and Actual shipment of goods from

the Philippines to a foreign country (actual

export sale) which must be paid for in

acceptable foreign currency and accounted for

in accordance with the rules and regulations

Sales which are zero-rated shall result to zero (0) of BSP;

output tax since the tax rate applied to the tax base b. The sale of raw materials or packaging

is zero percent (0%). Since the output tax is zero, materials to Non-resident buyer for delivery to

the seller shall pay no VAT. resident local export-oriented enterprise to be

used in manufacturing, processing, packing,

However, as an advantage, the seller shall be or repacking in the Philippines of the said

entitled to an input tax which he may credit against buyer’s goods, which must be paid for in

his zero output tax giving rise to an excess input tax. acceptable foreign currency and accounted for

in accordance with the rules and regulations

of BSP;

SAN BEDA COLLEGE OF LAW 145

2014 CENTRALIZED BAR OPERATIONS

c. Sale of raw materials or packaging materials 2. Foreign Currency Denominated Sales

to an Export-oriented enterprise. a. Sale to non-resident (refers to balikbayans)

b. Of goods assembled or manufactured in the

Export-Oriented Enterprise - An enterprise Philippines except automobiles (NIRC, Sec.

whose export sales exceed seventy percent 149) and non-essential goods (NIRC, Sec.

(70%) of total annual production (RR No. 16- 150);

2005, Sec. 4.106-5) c. For delivery to a resident in the Philippines;

and

d. Paid for in acceptable foreign currency and

d. Sale of Gold to the BSP;

accounted for in accordance with the rules

Except for sale of gold to the BSP, sale of

and regulations of the BSP (NIRC, Sec.

metallic minerals to persons and entities is

106[A][2][b]).

subject to 12% VAT if the value exceeds the

threshold set by the NIRC and existing

3. Sales to persons or entities deemed tax-

issuances. Sale of gold to BSP is subject to

exempt under Special Law or International

VAT at 0% if the seller is a VAT-registered

taxpayer (RR No. 6-2012 dated April 2, 2012). Agreement

e. Those “considered Export sales under E.O. Such as the Asian Development Bank (ADB)

and International Rice Research Institute (IRRI)

226” (Omnibus Investment Code of 1987) and

which shall be effectively subject to zero-rate.

other special laws;

Note: Nos. 1 and 2 are considered as

Considered Export Sales (under E.O. 226)

automatically zero-rated sales while No. 3 is

shall mean the Philippine Free On Board

an effectively zero-rated sale.

(FOB) value determined from invoices, bills of

lading, and other commercial documents of

B. Zero-Rated Sales of Services (NIRC, Sec.

export products exported directly by registered

108[B]): (POSIST-R)

export producers, or the net selling price of

export products sold by a registered export 1. Processing, manufacturing or repacking of

producer to another export producer, or to an goods for other persons doing business outside

the Philippines, which goods are subsequently

export trader that subsequently exports the

exported and paid for in acceptable foreign

same.

currency and accounted for in accordance with

the rules and regulations of the BSP;

“Considered export sales under E.O. 226” is

2. Services other than those mentioned in the

expanded to make sales of goods and

preceding paragraph rendered to a person

services by a VAT-registered in the customs

engaged in business conducted Outside the

territory to Ecozone and free port enterprises

Philippines or to a non-resident person not

automatically zero-rated (RR No. 4-2007, Sec.

engaged in business who is outside the

4.106-5).

Philippines when the services are performed

f. Sale of goods, supplies, equipment and fuel to and paid for in acceptable foreign currency and

persons engaged exclusively in International accounted for in accordance with the rules and

regulations of the BSP;

shipping or international air transport

3. Services rendered to persons or entities whose

operations.

exemption under Special laws or international

agreements to which the Philippines is a

Goods subject to zero-rating are limited to

signatory effectively subjects the supply of such

goods and passengers transported from a port

services to zero percent (0%) rate;

in the Philippines directly to a foreign port, or

4. Services rendered to persons engaged in

vice versa, without docking or stopping at any

International shipping or air transport

other port in the Philippines.

operations, including leases of property for use

“Without docking or stopping at any other thereof;

port in the Philippines” – an international

Note: Crewing services rendered by a VAT-

airline that makes a stopover in a Philippine

registered company to a foreign ocean-going

port to unload passengers and/or cargoes

vessel that is paid for in foreign currency is

from a foreign destination or to pick up

subject to VAT at zero percent (0%). However,

passenger and/or cargoes for foreign

the entitlement to zero percent (0%) VAT does

destination is deemed not to have docked or

not extend to services rendered to common

stopped at any other port in the Philippines

carriers by sea with respect to transport of

(RR No. 4-2007, Sec. 4, 106-5).

146 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

passengers, goods, or cargoes from one place Application for Effective Zero Rating

in the Philippines to another place in the Sec. 6 of RR No. 4-07, which amended Sec. 4.106-6

Philippines, the same being subject to twelve of RR No. 16-05 dispensed with the requirement for

percent (12%) VAT in accordance with Sec. prior BIR approval for effectively zero-rated sales of

4.108-5[b][4] of RR No. 16-2005, as amended goods and properties. However, the VAT zero-rated

(BIR Ruling No. 295-2012 dated May 3, 2012). sellers have to submit the supporting documents as

required by the existing rules and regulations to

5. Services performed by Subcontractors and/or qualify for VAT zero-rating to the concerned BIR

contractors in processing, converting, or Offices for post-audit and for validation of the zero-

manufacturing goods for an enterprise whose rated transactions (BIR Ruling DA No. [VAT-003]

export sales exceed 70% of the total annual 010-2009, January 14, 2009).

production;

6. Transport of passengers and cargo by domestic Other than the general registration of a taxpayer the

air or sea carriers from the Philippines to a VAT status of which is aptly determined, no

foreign country; and provision under our VAT law requires an additional

application to be made for such taxpayer’s

Note: Gross receipts of international air and sea transactions to be considered effectively zero-rated.

carriers doing business in the Philippines shall An effectively zero-rated transaction does not and

still be subject to three percent (3%) Percentage cannot become exempt simply because an

Tax (NIRC, Sec. 118). application therefor was not made or, if made, was

denied. A VAT-registered status, as well as

7. Sale of power or fuel generated through compliance with the invoicing requirements, is

Renewable sources of energy such as, but not sufficient for the effective zero rating of the

limited to, biomass, solar, wind, hydropower, transactions of a taxpayer (CIR v. Seagate

geothermal and steam, ocean energy, and other Technology (Philippines), G.R. No. 153866,

emerging sources using technologies such as February 11, 2005).

fuel cells and hydrogen fuels.

Doctrine on Effectively Zero-Rated Sales

The sale of power or fuel is the one being The provision subjecting the Philippine Amusement

subject to zero percent (0%) and not the sale of and Gaming Corporation (PAGCOR) to Value

services related to the maintenance or operation Added Tax (VAT) is invalid for being contrary to R.A.

of the plants generating said power (Sec.4.108- 9337 (PAGCOR v. BIR, G.R. No. 172087, March 15,

5, RR No. 16-2005). 2011).

II. As to how the transaction shall be subject to Hence, PAGCOR being an entity granted indirect

zero-rating: tax exemption, its lessor is subject to effective zero

A. Automatically Zero-Rated Sales – refers to a percent (0%) VAT on its rental income and sales to

sale of goods, properties and services by a VAT- the former (CIR v. Acesite Hotel Corp., G.R. No.

registered seller/supplier that is regarded as either 147295, February 16, 2007).

an export sale or a foreign currency denominated

sale under Sec. 106 of the NIRC (RMC No. 50-07 Sales Made to Foreign Embassies

dated July 30, 2007). Examples are sales to For taxation purposes, embassies are considered

registered ecozones and freeport zones (RR No. extensions of their respective countries’ territory. As

4-07, February 7,2007). such, any sale within a foreign embassy is

considered foreign sale or transaction outside the

B. Effectively Zero-Rated Sales – refers to the Philippine territory. The sale of goods or properties

local sale of goods, properties and services by a by local suppliers to a non-resident foreign

VAT-registered person to an entity that was corporation providing required security measure of

granted indirect tax exemption under special laws the embassy is considered a transaction outside the

or international agreements. Since the buyer is Philippine territory that qualifies for VAT zero-rating.

exempt from indirect tax, the seller cannot pass on However, said sale is an effectively zero-rated sale

the VAT and therefore, the exemption enjoyed by which shall require the said local suppliers to secure

the buyer shall extend to the seller, making the prior approval from the BIR for effective zero-rating

sale effectively zero-rated (RMC No. 50-07 dated on their sale of goods or properties to non-resident

July 30, 2007). foreign corporation (BIR Ruling No. 536-04, October

29, 2004).

SAN BEDA COLLEGE OF LAW 147

2014 CENTRALIZED BAR OPERATIONS

V AT- E X E M P T

TRANSACTIONS

Sale, Barter or Exchange of Goods, Propeties or the seller is not allowed any tax credit of VAT (input

Services in Ecozones tax) on purchases (RR No. 6-2005, Sec. 4.109-1).

Customs Territory The person making the exempt sale of goods,

Means the national territory of the Philippines properties or services shall not bill any output tax to

outside of the proclaimed boundaries of the his customers because the said transaction is not

Ecozones except those areas specifically declared subject to VAT (RR No. 16-2005, Sec. 4.109-1).

by other laws and/or presidential proclamations to

have the status of special economic zones and/or

Features of VAT-Exempt Transactions:

free ports (PEZA Rules and Regulations, Sec. 1[g];

1. VAT-exempt transactions shall not be included in

CIR v. Seagate Technology Philippines, Inc., G.R.

determining the general threshold prescribed by

No. 153866, February 11, 2005; CIR v. Toshiba

law (P1,919,500) (RR No. 16-2011).

Information Systems Philippines, G.R. No.150154,

2. VAT-exempt transactions shall not be liable for

August 9, 2005).

VAT or the three percent (3%) percentage tax

under Sec. 116 of the NIRC.

Ecozone or Special Economic Zone 3. The person making the exempt sale of goods,

Selected areas with highly developed or which have properties, or services shall not bill any output tax

the potential to be developed into agro-industrial,

to his customers because the said transaction is

industrial, tourist, recreational, commercial, banking,

not subject to VAT (RR No. 16-2005).

investment and financial centers whose metes and

bounds are fixed or delimited by Presidential

Distinction between Zero-Rated Sales and VAT-

Proclamations. Ecozones, by fiction of law, are

Exempt Sales

considered foreign territories.

Zero-rated sales Vat-exempt sales

The transaction is

While an ecozone is geographically within the

completely free of VAT

Philippines, it is deemed a separate customs

because the tax rate Exemption only as it

territory and is regarded in laws as foreign soil.

applied on the tax base removes the VAT at the

Sales by supplies outside the borders of the

is zero, hence, the exempt stage.

ecozone to this separate customs territory are

seller charges no

deemed exports and treated as export sales (CIR v.

output tax

Seksui Jushi Phils, Inc., G.R. No. 149671, July 21,

VAT payer cannot claim

2006).

VAT payer can claim a credit or refund for

and enjoy a credit or the input tax (which

Proof of VAT Zero-Rated Sales

refund for the input tax. could result to

The documents that should be presented by the

The benefit is 100% of increased prices of

taxpayer to prove that there is direct export sales

the tax (total relief). goods or services

are:

(partial relief).

1. Sales invoice as proof of sale of goods;

2. Export declaration and bill of lading or airway bill Not considered as

as proof of actual shipment of goods from the taxable sales. A person

Still considered as

Philippines to a foreign country; and who makes only

“taxable sales” for the

3. The bank credit advice, certificate of bank exempt sales is not a

purpose of measuring

remittance or any other document proving taxable person for VAT

turnover sales.

payment for the goods in acceptable foreign purposes and may not

VAT registration is

currency or its equivalent in goods and services register for VAT.

required.

(Philippine Gold Processing & Refining Corp. v. VAT registration is

CIR, CTA Case No. 8270, June 11, 2013). optional.

Transactions Exempt from VAT:

A. Sale or Importation: (AFAB)

1. Sale or importation of Agricultural and marine

food products in their original state, livestock

and poultry of a kind generally used as, or

yielding or producing foods for human

“VAT-exempt transactions” refer to the sale of goods consumption; and breeding stock and genetic

or properties and/or services and the use or lease of materials therefore:

properties that is not subject to VAT (output tax) and a. Non-food products are not included under this

category. Livestock or poultry does not include

fighting cocks, race horses, zoo animals, and

148 SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

other animals generally considered as pets and poultry feeds, including ingredients, whether

(RR 16-2005, Sec. 4-109-1); locally produced or imported, used in the

b. Original State – product classified as such manufacture of finished feeds;

shall remain such even if they have

undergone the simple process of preparation Exception: Specially made feeds for Race

or preservation for the market such as horses, Fighting cocks, Aquarium fish, Zoo

freezing, drying, salting, broiling, roasting, animals and Other animals generally considered

smoking or stripping. Advanced technological as pets (ZOFAR).

means of packaging such as shrink wrapping

in plastics, vacuum packing, tetra-pack, in 3. Sale, importation or lease of passenger or cargo

itself does not make the same liable to VAT vessels and Aircraft, including engine,

(RR No. 16-2005, Sec. 4-109-1). equipment and spare parts thereof for domestic

or international transport operations weighing

Examples of products in its original state: 150 tons and above and which complies with

frozen boneless briskets, frozen boneless the age limit provided by law; and

buffalo meat, deboned fish. 4. Sale, importation, printing or publication of

Books and any newspaper, magazine, review,

Polished and/or husked rice, corn grits, raw or bulletin.

cane sugar and molasses, ordinary salt and

copra shall be considered in their original Requisites to be VAT-Exempt:

state (RR 16-2005, Sec. 4.109-1). The newspaper, magazine, review or bulletin

must:

a. be printed or published at regular intervals;

Examples of products not in original state:

b. be available for subscription and sold at fixed

solar salt, iodized salt; chilli powder; onion

prices; and

powder and garlic powder since anti-oxidants

c. not be principally devoted to the publication of

have already been incorporated.

paid advertisements.

c. Not a “simple process” if it is a physical or

Note: The terms “book”, “newspaper”,

chemical process which would alter the

“magazine”, “review”, and “bulletin” as used in

exterior or inner substance of a product in

Sec. 109[1][R] of the NIRC shall refer to printed

such a manner as to prepare it for special use

materials in hard copies, and do not include

to which it could not have been put in its

those in digital or electronic format or

original form or condition.

computerized versions, including but not limited

Bagasse is not included in the VAT

to the following: e-books, e-journals, electronic

exemption.

copies, online library sources, CDs and software

(RMC No. 75-2012 dated November 22, 2012).

Centrifugal process of producing sugar is not

in itself a simple process. Therefore any type

of sugar produced therefrom is not exempt General Rule: All imported books, whether for

from VAT (RR No. 13-08). commercial or personal use are exempt from

VAT and customs duties.

Notes:

Exception: Books published by or for a private

a. Sale of Andok’s roasted chicken is exempt

commercial enterprise essentially for advertising

from VAT. However, should Andok’s maintain

purposes as stated in Annex A of the Florence

a facility by which the roasted chicken will be

Agreement (Agreement on the Importation of

offered as a menu to customers who would

Educational, Scientific and Cultural Materials)

dine-in, then it will be subject to the VAT on

(DOF Order No. 57-2011 dated December 9,

sale of service which is similarly imposed on

2011).

restaurants and other eateries (VAT Ruling

No. 009-07, June 21, 2007). 2

b. Not all sales of marine or agricultural food B. Sale: (REC )

1. Sale of Real properties;

products in processed form are subject to

VAT. Exempt are those sold by agricultural

Requisites to be VAT-Exempt:

cooperatives registered under CDA (Please

a. Not primarily held for sale to customers or

refer to discussions below).

held for lease in the ordinary course of trade

or business;

2. Sale or importation of Fertilizers; seeds,

b. Utilized for low-cost housing;

seedlings, and fingerlings; fish, prawn, livestock

SAN BEDA COLLEGE OF LAW 149

2014 CENTRALIZED BAR OPERATIONS

c. Utilized for socialized housing; 4. Sales by non-agricultural, non-electrical and

d. Residential lot valued at P1,919,500 and non-credit Cooperatives duly registered and in

below; good standing with the CDA. Provided that:

e. House and lot and other residential dwellings a. Share capital contribution of each member

valued at P3,199,200 and below; or does not exceed P15,000; and

f. Two or more adjacent residential lots where b. Regardless of the aggregate capital and net

the aggregate value does not exceed P1, surplus ratably distributed among the

919,500. members.

Even if the real property is not primarily held for Importation by these cooperatives of

sale to customers or held for lease in the machineries and equipment, including spare

ordinary course of trade or business but the parts thereof, to be used by them are subject to

same is used in the trade or business of the VAT (Compare with no.3 above).

seller, the sale thereof shall be subject to VAT

being a transaction incidental to the taxpayer’s C. Importation: (PP-FLC)

main business (RR No. 04-2007, Sec. 14). 1. Importation of Personal and household effects

belonging to residents of the Philippines

Example: VAT-registered person engaged in returning from abroad and non-resident citizen

manufacturing sells his warehouse, which was coming to resettle in the Philippines: provided,

used in his business, the sale shall be subject to that such goods are exempt from customs duty

VAT being an incidental to his business. under the Tariff and Customs Code of the

Philippines;

2. Export sales by persons who are not VAT

registered; 2. Importation of Professional instruments and

Reason: To encourage exporters of goods to implements, wearing apparel, domestic animals,

register as a VAT person with the BIR to be able and personal household effects;

to claim unused input tax in the form of refund or

tax credit. Requisites to be VAT-Exempt:

a. Belonging to persons coming to settle in the

If he is a VAT-registered, his export sales are Philippines;

zero-rated under Sec. 106[A][2] of the NIRC. b. For their own use and not for sale, barter or

exchange;