Professional Documents

Culture Documents

2022 PC REVIEW DAY 3 - INCOTERMS (Computations) Handout

2022 PC REVIEW DAY 3 - INCOTERMS (Computations) Handout

Uploaded by

Nasudi AspricOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 PC REVIEW DAY 3 - INCOTERMS (Computations) Handout

2022 PC REVIEW DAY 3 - INCOTERMS (Computations) Handout

Uploaded by

Nasudi AspricCopyright:

Available Formats

CLAP CUSTOMS REVIEW AND CENTER FOR PROFESSIONAL

DEVELOPMENT

Room 204, 2nd Floor, Manuel F. Tiaoqui Bldg., Plaza Sta. Cruz, Manila / Contacts - Globe: 09063811016 / 09068172757

Email: pedrezasem@gmail.com FB: www.facebook.com/clap.stacruz/

2022 CBLE REVIEW ON PRACTICAL COMPUTATIONS – DAY 3

ICC INCOTERMS 2020 (SEC. 415, CMTA) - COMPUTATIONS

By: ENGR. RUBEN C. PEDREZA

CEO / Review Director

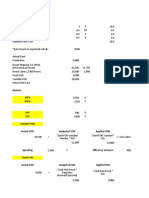

TRANSPOSITION : INCOTERMS FORMULAS TRANSPOSITION : INCOTERMS FORMULAS

ILLUSTRATION No.1 ILLUSTRATION No.2

GIVEN: FOB = EXW + O/C GIVEN: CIF = FOB + INS + FRT

b) O/C FIND: a) FOB b) INS c) FRT

FIND: a) EXW

SOLUTION:

SOLUTION:

a) FOB = CIF - (INS + FRT)

a) EXW = FOB - O/C

b) INS = CIF - (FOB + FRT)

b) O/C = FOB - EXW c) FRT = CIF - (FOB + INS)

12

11

TRANSPOSITION : ADDITION / SUBTRACTION TRANSPOSITION : ADDITION / SUBTRACTION

ILLUSTRATION No.3 SOLUTION : ILLUSTRATION No.3

GIVEN: EQ. : CFR = FOB + FRT

Substitute given values

CFR / INV - $ 5,500.00 $ 5,500.00 = FOB + $ 500.00

FRT / BL - $ 500.00 Solving for FOB by TRANSPOSITION

FIND: FOB = $ 5,500.00 - $ 500.00

TOTAL FOB VALUE TOTAL FOB = $ 5,000.00

13 14

Solution :

SUBSTITUTION – Mathematical tool used to CFR = FOB + FRT

substitute a given value for a term in an equation By Substitution :

to reduce 2 unknowns to only 1 unknown. $ 10,500.00 = FOB + 0.05 FOB

Example: $ 10,500.00 = 1.05 FOB

Given : By Transposition, solve for “FOB” :

CFR – $ 10,500.00 $ 10,500.00

FOB =

FRT – 5% of FOB 1.05

Find : FOB = $ 10,000.00

FOB & FRT using the formula : x 0.05

CFR = FOB + FRT FRT - $ 500.00

23

ILLUSTRATION No. 4 ILLUSTRATION No. 5

GIVEN: FOB - $ 10,300.00 FIND: EXW GIVEN:

O/C – 3% of EXW Using the formula:

T otal CIP - $16,800.00

FOB = EXW + O/C

SOLUTION:

by substitution: 3% of EXW T otal FRT - 8% of T OT AL FCA

FOB = EXW + 0.03 EXW T otal INS - 4% of T OT AL FCA

= 1.03 EXW

by transposition: FIND:

$ 10,300.00

EXW = Total Customs Value based on the Formula

1.03

= $10,000.00 CIF = FOB + INS + FRT

Prof. RUBEN C. PEDREZA, CB, EE, MCA

Page 1 of 5

CLAP CUSTOMS REVIEW AND CENTER FOR PROFESSIONAL

DEVELOPMENT

Room 204, 2nd Floor, Manuel F. Tiaoqui Bldg., Plaza Sta. Cruz, Manila / Contacts - Globe: 09063811016 / 09068172757

Email: pedrezasem@gmail.com FB: www.facebook.com/clap.stacruz/

Solution: ILLUSTRATION No. 5

Solution: ILLUSTRATION No. 5

1st Solution :

Formula : CIP = FCA + INS + FRT $ 16,800.00 = FCA + 0.04FCA + 0.08FCA

1) based on the given data, equate “INS” & “FRT” in terms of “FOB”

$ 16,800.00 = 1.12 FCA

a) INS = 0.04 FCA (Gen. cargo ins. rate)

b) FRT = 0.08 FCA (given) By TRANSPOSITION, solve for “FCA”

2) Substitute value of “INS” & “FRT” in terms of FOB in the

CIF formula $ 16,800.00

FCA =

1.12

$ 16,800.00 = FCA + 0.04 FCA + 0.08 FCA

Total FCA = $ 15,000.00

CIF INS FRT

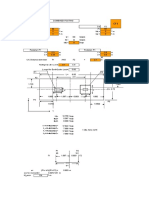

Alternative Solution: ILLUS. No. 5 INCOTERMS 2020

CIP - FRT EXWORKS (EXW)

2nd Solution : FCA =

1.04 COUNTRY OF ORIGIN Carrying Aircraft

Substitute value of “FRT” in terms of “FCA” Carrying Vessel

FRT EXW Sea Frt

Air Freight

(Pre-paid/collect)

(Prepaid or collect)

CIP - 0.08 FOB CUSTOMS

FCA =

1.04

1.04 FCA = CIP - 0.08 FOB

Seller’s warehouse,

1.04 FCA + 0.08 FCA = CIP Port of Shipment at origin

Factory, plant or EXW = COST OF GOODS (Seaport/Airport)

premises

1.12 FCA = $ 16,800.00

DELIVERY : Seller delivers goods at his warehouse, factory, plant and may or may

By transposition, solve for “FCA” not be his premises (not loaded to collecting vehicle provided by buyers)

$ 16,800.00

FCA = N O T E : Importer pays for ocean/air freight charges prior to departure at origin or

1.12 upon arrival of goods at destination. Port to port insurance not included

FCA = $ 15,000.00 in seller’s invoice price. 32

(CV)

INCOTERMS 2020 INCOTERMS 2020

FREE CARRIER (FCA)

COUNTRY OF ORIGIN CARRIAGE PAID TO (CPT)

1 2

Customs COUNTRY OF ORIGIN

FCA FCA 1 2

OR

Customs

CPT CPT

OR

Seller’s warehouse, Carrier Port of Shipment

Factory or plant (airlines/shipping lines/NVOCC) at origin (Seaport/Airport

- Frt collect) Port of Shipment

Seller’s warehouse, Carrier

FCA = EXW + OC (airlines/shipping lines/NVOCC)

at origin (Seaport/Airport

Factory or plant - Frt pre-paid)

DELIVERY : Seller delivers the goods at any of 2 places at origin:

CPT = FCA + O/C

a) seller’s premises loaded to the collecting vehicle provided by the buyer,

or DELIVERY : Seller delivers the goods by handing them over to the custody of the

b) Another named place where goods were handed over to the carrier or carrier or his agent (seller fulfills his obligation to deliver when goods

another person (forwarder) nominated by the buyer ready for unloading are handed over to the carrier and not when the goods reaches the port

from vehicle provided by the seller of destination)

N O T E : Importer pays for ocean/air freight charges upon arrival of goods at destination.

Port to port insurance not included in seller’s invoice price.

N O T E : Seller pays for ocean/air charges prior to departure at origin. Port to port

34

insurance not included in seller’s invoice price. 36

INCOTERMS 2020 INCOT R S 2 2

CARRIAGE & INSURANCE PAID TO (CIP)

COUNTRY OF ORIGIN

Seller port anu acturer,

CO NTR OF ORI IN

1 onsignor a S b S

2 ustoms

Customs

CIP CIP

OR

Port of Shipment

Seller’s warehouse, Carrier Seller s warehouse, actory,

at origin (Seaport/Airport Pier

Factory or plant (airlines/shipping lines/NVOCC) plant or premises

- Frt pre-paid) S rt ollect

CIP = CPT + INS

DELIVERY : Seller delivers the goods by handing them over to the custody of the Seller delivers goods at any o points at seaport o shipment

carrier or his agent (seller fulfills his obligation to deliver when a. at the port side o carrying vessel on board arriving delivery vehicle, not

goods are handed over to the carrier and not when the goods unloaded

reaches the port of destination) b. at the starboard side o carrying vessel or on board a barge lighter, ready or

loading on board the vessel

N O T E : Seller pays for ocean/air freight charges prior to departure at origin. Port mporter pays or ocean reight charges upon arrival o goods at destination. Port

to port insurance included in seller’s invoice price. 38 to port insurance not included in seller s invoice price.

Prof. RUBEN C. PEDREZA, CB, EE, MCA

Page 2 of 5

CLAP CUSTOMS REVIEW AND CENTER FOR PROFESSIONAL

DEVELOPMENT

Room 204, 2nd Floor, Manuel F. Tiaoqui Bldg., Plaza Sta. Cruz, Manila / Contacts - Globe: 09063811016 / 09068172757

Email: pedrezasem@gmail.com FB: www.facebook.com/clap.stacruz/

INCOT R S 2 2 INCOTERMS 2020

COST & FREIGHT (CFR)

CO NTR OF ORI IN COUNTRY OF ORIGIN

B CFR

(Frt. Pre-Paid)

rt. ollect

S S CUSTOMS

Seller s warehouse, Seller’s warehouse, Seaport at origin

Port o Shipment at origin Seaport at origin Factory, plant or premises

Port of Shipment at origin

actory, plant or premises

CFR = FOB + FRT

B DELIVERY : Seller delivers goods on board carrying vessel at port of shipment

(seller fulfills his obligation to deliver when goods are loaded on

Seller delivers goods on board carrying vessel at seaport o shipment

board the vessel and not when the goods reaches the port of

destination)

mporter pays or ocean reight charges upon arrival o goods at

destination. Port to port insurance not included in seller s invoice price. N O T E : Seller pays for ocean freight charges prior to departure at origin. Port to port

53

insurance not included in seller’s invoice price.

INCOTERMS 2020

INCOTERMS 2020

COST, INSURANCE & FREIGHT (CIF) DELIVERED AT PLACE (DAP)

Co unt ry o f De st inat io n

COUNTRY OF ORIGIN Arriving aircraft

CIF

(Frt. Pre-Paid) Customs

CUSTOMS DAP

Buyer’s warehouse

Seller’s warehouse, Arriving vessel Port of Destination1 / Designated place

Port of Shipment at origin Seaport at origin

Factory, plant or premises DAP = FOB/FCA + FRT + Dest. O/C

CIF = FOB + INS + FRT

DELIVERY : elivers goods at buyer’s warehouse or designated place ready or unloading rom arriving

DELIVERY : Seller delivers goods on board carrying vessel at port of shipment vehicle provided by him

(seller fulfills his obligation to deliver when goods are loaded on board N O T E : Seller pays for ocean/air freight charges prior to departure at origin. Port to port insurance

the vessel and not when the goods reaches the port of destination) not included in seller’s invoice price.

Seller pays destination inland reight charges up to buyer’s warehouse.

N O T E : Seller pays for ocean freight charges prior to departure at origin. Port to Buyer pays import duties/taxes, import clearing expenses including expenses for

44

port insurance included in seller’s invoice price. 55 unloading of goods from arriving delivery vehicle.

INCOTERMS 2020 INCOTERMS 2020

DELIVERED AT PLACE UNLOADED (DPU) DELIVERED DUTY PAID (DDP)

Country of Destination Country of Destination

Arriving aircraft (Frt. Pre-paid)

Arriving aircraft DPU Customs

(Frt. Pre-paid) Customs DDP

Buyer’s warehouse

Buyer’s warehouse Arriving Vessel (Frt. Pre-paid) Port of Destination Designated place

Arriving Vessel (Frt. Pre-paid) Port of Destination Designated place

DDP = FOB/FCA + FRT + Dest. O/C

DPU = FOB/FCA + FRT + Dest. O/C DELIVERY : Seller delivers goods at buyer’s warehouse or designated place ready or unloading rom

DELIVERY : Seller delivers goods at buyer’s warehouse or designated place. vehicle provided by him.

N O T E : Seller pays for ocean/air freight charges prior to departure at origin. Port to port insurance

N O T E : Seller pays for ocean/air freight charges prior to departure at origin. Port to port insurance not included in seller’s invoice price.

not included in seller’s invoice price.

Seller pays destination inland reight charges up to buyer’s warehouse e cluding

Seller pays destination inland reight charges up to buyer’s warehouse including expenses for unloading of goods from arriving delivery vehicle.

expenses for unloading of goods from arriving delivery vehicle. Seller pays import duties/taxes and import clearing expenses.

48

Buyer pays import duties/taxes and import clearing expenses. 46

SUMMARY OF INCOTERMS FORMULAS INCOTERMS FORMULAS

(Originally conceptualized &derived by Engr. R. Pedreza) 8) FCA = EXW + O/C

1) EXW = FOB/FCA - O/C 9) FCA = CPT - FRT

2) EXW = CFR/CPT - (O/C + FRT) 10) FCA = CIP - (INS + FRT)

3) EXW = CIF/CIP - (O/C + INS + FRT)

4) FAS = EXW + O/C 11) CFR = FOB + FRT

5) FOB = EXW + O/C 12) CFR = EXW + O/C + FRT

6) FOB = CFR - FRT

13) CFR = CIF - INS

7) FOB = CIF - (INS + FRT)

Prof. RUBEN C. PEDREZA, CB, EE, MCA

Page 3 of 5

CLAP CUSTOMS REVIEW AND CENTER FOR PROFESSIONAL

DEVELOPMENT

Room 204, 2nd Floor, Manuel F. Tiaoqui Bldg., Plaza Sta. Cruz, Manila / Contacts - Globe: 09063811016 / 09068172757

Email: pedrezasem@gmail.com FB: www.facebook.com/clap.stacruz/

INCOTERMS FORMULAS INCOTERMS FORMULAS

14) CPT = FCA + FRT

15) CPT = EXW + O/C + FRT

20) CIP = FCA + INS + FRT

16) CPT = CIP - INS

21) CIP = EXW + O/C + INS + FRT

17) CIF = FOB + INS + FRT

22) CIP = CPT + INS

18) CIF = EXW + O/C + INS + FRT

19) CIF = CFR + INS

INCOTERMS FORMULAS Determination of Customs Value

24) DAP/DPU/DDP = EXW + Origin O/C + FRT + Dest. O/C

23) DAP/DPU/DDP = FOB/FCA + FRT + Dest. O/C

To determine the CUSTOMS VALUE

of imported goods for assessment

25) DAP/DPU/DDP = CFR/CPT + Dest. O/C

purposes it is equal to the FOB

Note: value or Cost of Goods as

1) Shipments by AIR/SEA – use EXW, FCA and CPT contemplated in CMO 20-2004.

2) Shipments by SEA ONLY – use EXW, FOB and CFR

DETERMINATION OF OTHER CHARGES (O/C)

Under the provisions of CMO 43-93, whenever the

other dutiable charges are not indicated as a separate

value in the invoice, the said charges are already

deemed included in the FOB value. (FOB = EXW + O/C)

On the other hand, whenever the other charges are

indicated in the invoice price as a separate value, the

Exw value is adopted as the customs value while the

other charges shall be indicated as a separate

component of the dutiable value.

(DV = EXW + O/C + FRT + INS) 38

Prof. RUBEN C. PEDREZA, CB, EE, MCA

Page 4 of 5

CLAP CUSTOMS REVIEW AND CENTER FOR PROFESSIONAL

DEVELOPMENT

Room 204, 2nd Floor, Manuel F. Tiaoqui Bldg., Plaza Sta. Cruz, Manila / Contacts - Globe: 09063811016 / 09068172757

Email: pedrezasem@gmail.com FB: www.facebook.com/clap.stacruz/

Prof. RUBEN C. PEDREZA, CB, EE, MCA

Page 5 of 5

You might also like

- Breakeven AnalysisDocument5 pagesBreakeven AnalysisBloom BoxNo ratings yet

- Draft Survey Manual CalculationDocument8 pagesDraft Survey Manual Calculationfragkyc100% (14)

- Equation For Incoterms 2020Document1 pageEquation For Incoterms 2020Nasudi Aspric50% (2)

- Equity Chapter4Document46 pagesEquity Chapter4Arun RaiNo ratings yet

- Chapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Document37 pagesChapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Ehsan Umer Farooqi100% (1)

- Eccentric FootingDocument8 pagesEccentric Footingpriodeep chowdhuryNo ratings yet

- Sourcing: CIPS Procurement TopicDocument6 pagesSourcing: CIPS Procurement Topichuman and rightNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueJemimah MalicsiNo ratings yet

- FCF ValuationDocument46 pagesFCF ValuationDhirajNo ratings yet

- Inventories and Cost of Good SoldDocument20 pagesInventories and Cost of Good Solda4306470No ratings yet

- Free Cash Flow Valuation: Presenter Venue DateDocument46 pagesFree Cash Flow Valuation: Presenter Venue DateMohsin JuttNo ratings yet

- Free Cash Flow ValuationDocument46 pagesFree Cash Flow ValuationLayNo ratings yet

- 423 Special DutiesDocument35 pages423 Special DutiesJoyce Ann Ramos BaquiNo ratings yet

- Exercises1 BFNDC002 Time Value of Money - Simon, JusthineDocument13 pagesExercises1 BFNDC002 Time Value of Money - Simon, JusthineJohn Dexter SimonNo ratings yet

- Clase 5 Estática - Método de Los Nudos - 14-04-22Document5 pagesClase 5 Estática - Método de Los Nudos - 14-04-22Agustin VargasNo ratings yet

- Drawings StatusDocument2 pagesDrawings StatusSaurabh TiwariNo ratings yet

- Free Cash Flow Valuation: Presenter Venue DateDocument69 pagesFree Cash Flow Valuation: Presenter Venue DateAyoub BzdNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueAlyssa RiveraNo ratings yet

- 2511 Final Effects of Changes in FC Exchange RatesDocument57 pages2511 Final Effects of Changes in FC Exchange RatesmerrygoroooundNo ratings yet

- Report On Costing and Expenses For Initial CIFDocument2 pagesReport On Costing and Expenses For Initial CIFAnony MousNo ratings yet

- Guiding Cfs Lecture PracticeDocument25 pagesGuiding Cfs Lecture PracticeThanh UyênNo ratings yet

- Classification of CostDocument4 pagesClassification of CostSha Heradura AngadNo ratings yet

- Los Multilane Hcm2010: DR - MahDocument4 pagesLos Multilane Hcm2010: DR - MahAhmed Non MeemNo ratings yet

- Direct Method - Ocf:: To Find Cash Payment For Purchasing Inventory Through AP and COGSDocument19 pagesDirect Method - Ocf:: To Find Cash Payment For Purchasing Inventory Through AP and COGSUyên Nguyễn Hoàng ThanhNo ratings yet

- TB Dens 018Document2 pagesTB Dens 018ManoloNo ratings yet

- Diseño de Zapatas - ExcentricaDocument7 pagesDiseño de Zapatas - Excentricaedyn vega coralNo ratings yet

- Cfs Direct Method - IaDocument35 pagesCfs Direct Method - IaCanny TrầnNo ratings yet

- Eccentric Footing Design Based On ACI 318-14: Input Data Design SummaryDocument8 pagesEccentric Footing Design Based On ACI 318-14: Input Data Design SummaryphanikrishnabNo ratings yet

- DCF PV of FCFF in Growth Years + PV FCFF in Perpetuity PV of FCFF in Growth Years + PV TVDocument3 pagesDCF PV of FCFF in Growth Years + PV FCFF in Perpetuity PV of FCFF in Growth Years + PV TVTanya JunejaNo ratings yet

- Formulas For TariffDocument8 pagesFormulas For TariffforfloodphNo ratings yet

- Clip PlatformDocument24 pagesClip Platformwisnu_bayusaktiNo ratings yet

- IRR and NPV Conflict - IllustartionDocument27 pagesIRR and NPV Conflict - IllustartionVaidyanathan RavichandranNo ratings yet

- Draft Survey Manual CalculationDocument14 pagesDraft Survey Manual CalculationKuco NotNo ratings yet

- TestDocument8 pagesTestGeorge Cristian100% (1)

- EccentricFooting PDFDocument3 pagesEccentricFooting PDFFernando LopezNo ratings yet

- Web Tapered Frame Design Based On AISC-ASD 9th, Appendix F Input Data & Design SummaryDocument5 pagesWeb Tapered Frame Design Based On AISC-ASD 9th, Appendix F Input Data & Design Summaryஅம்ரு சாந்திவேலுNo ratings yet

- Cif Fob + F + (Cif X R) (Fob + Freight) / (1-Insurance Rate)Document1 pageCif Fob + F + (Cif X R) (Fob + Freight) / (1-Insurance Rate)Nguyễn Ngọc Phương LinhNo ratings yet

- CH 6 Slides 1kua58iDocument29 pagesCH 6 Slides 1kua58iTaa AngieNo ratings yet

- Eccentric FootingDocument8 pagesEccentric FootingJinshad UppukodenNo ratings yet

- Steel Design LatestDocument52 pagesSteel Design LatestAhsan HabibNo ratings yet

- Vessel FormulaDocument13 pagesVessel Formulaismansaleh27No ratings yet

- Report - 2024-03-18T084952.758Document1 pageReport - 2024-03-18T084952.758agabafidelis5No ratings yet

- Export problemsShilpaADocument3 pagesExport problemsShilpaASheikh YajidulNo ratings yet

- PETE 411 Well Drilling: Lesson 10 Drilling Hydraulics (Cont'd)Document39 pagesPETE 411 Well Drilling: Lesson 10 Drilling Hydraulics (Cont'd)mirzasdNo ratings yet

- Eccentric Footing Design Based On ACI 318-05: Input Data Design SummaryDocument8 pagesEccentric Footing Design Based On ACI 318-05: Input Data Design SummaryWintun73No ratings yet

- Bep LeverageDocument13 pagesBep LeverageEmerald LinfuNo ratings yet

- Break - Even Analysis: Presented by "Group "Document18 pagesBreak - Even Analysis: Presented by "Group "Sarasij SarkarNo ratings yet

- Absorption Costing vs. Variable Costing GDocument11 pagesAbsorption Costing vs. Variable Costing GYamaapNo ratings yet

- Report - 2024-03-18T095616.959Document1 pageReport - 2024-03-18T095616.959agabafidelis5No ratings yet

- Kelompok 8 (Raw)Document5 pagesKelompok 8 (Raw)RezaNo ratings yet

- Mohamed Abbas Assement Finance ManagmentDocument2 pagesMohamed Abbas Assement Finance ManagmentMohamed AbbasNo ratings yet

- Kalkulator EksporDocument6 pagesKalkulator EksporAdi NugrohoNo ratings yet

- Production Cost: FOB PriceDocument9 pagesProduction Cost: FOB PriceAhmad Erwin SaputraNo ratings yet

- Combined Footing DesignDocument12 pagesCombined Footing DesignPAWANNo ratings yet

- SS 4 Mindmaps EconomicsDocument25 pagesSS 4 Mindmaps Economicshaoyuting426No ratings yet

- Exmaen Final CostosDocument10 pagesExmaen Final CostosFátima Heras RiveraNo ratings yet

- Access Engineering: Combined Footing Design Based On ACI 318-99Document7 pagesAccess Engineering: Combined Footing Design Based On ACI 318-99আসিফ মাহমুদNo ratings yet

- Retaining Wall Stability Computation Sheet 2.05Document3 pagesRetaining Wall Stability Computation Sheet 2.05Gustavo PaganiniNo ratings yet

- 2x4 Hem-Fir #2 - Wall Cap TableDocument1 page2x4 Hem-Fir #2 - Wall Cap Tableodiseo_basquasaNo ratings yet

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- PMI Colleges Tariff 7: Departmental Examination Aspric Nasudi IDocument4 pagesPMI Colleges Tariff 7: Departmental Examination Aspric Nasudi INasudi AspricNo ratings yet

- SYLLABIDocument5 pagesSYLLABINasudi AspricNo ratings yet

- 2022 CL Review Day 1 - HandoutDocument4 pages2022 CL Review Day 1 - HandoutNasudi AspricNo ratings yet

- Implementation of The Ata System in The Philippines: Clap Customs Review and Center For Professional DevelopmentDocument3 pagesImplementation of The Ata System in The Philippines: Clap Customs Review and Center For Professional DevelopmentNasudi AspricNo ratings yet

- SAP WM Interview Questions and AnswersDocument21 pagesSAP WM Interview Questions and AnswersBipul KumarNo ratings yet

- Significant of Supply Chain Management in Hospitality IndustryDocument20 pagesSignificant of Supply Chain Management in Hospitality IndustryPerla PascuaNo ratings yet

- Supply Chain Management - Mba Lecture Notes PresentationDocument64 pagesSupply Chain Management - Mba Lecture Notes PresentationAlper Orhun KilicNo ratings yet

- Iteb G621 275 C 2007 1Document2 pagesIteb G621 275 C 2007 1saket reddyNo ratings yet

- Activity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)Document8 pagesActivity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)kakimog738No ratings yet

- HP Boeblingen Supply Chain Management: Presented byDocument15 pagesHP Boeblingen Supply Chain Management: Presented byrathod30No ratings yet

- Single Sourcing Vs Sole Sourcing 5m PROF - NEWDocument6 pagesSingle Sourcing Vs Sole Sourcing 5m PROF - NEWZakarya Al AzriNo ratings yet

- Role of E-Commerce in Supply Chain Management: Group No. - 7Document24 pagesRole of E-Commerce in Supply Chain Management: Group No. - 7azharscribdNo ratings yet

- Global Supply Chain ManagementDocument10 pagesGlobal Supply Chain Managementlehachi810No ratings yet

- 2-3 Example Office Chair-AnntdDocument11 pages2-3 Example Office Chair-AnntdAhmedNo ratings yet

- The Supply Chain Management ProcessesDocument25 pagesThe Supply Chain Management ProcessesvlknbrkkrmnNo ratings yet

- CPIM Module 3 - Plan SupplyDocument80 pagesCPIM Module 3 - Plan SupplyTristan TippittNo ratings yet

- BL TerminadoDocument2 pagesBL TerminadoAntonío IvailovNo ratings yet

- Total Quality Management TQMDocument1 pageTotal Quality Management TQMsreenathNo ratings yet

- Identifikasi Kendala Dengan Kolaborasi Theory of Constraints Dan Supply Chain ManagementDocument16 pagesIdentifikasi Kendala Dengan Kolaborasi Theory of Constraints Dan Supply Chain ManagementAzzah Ninda SyathrakinantiNo ratings yet

- Enterprise Resource Planning (ERP) SystemsDocument33 pagesEnterprise Resource Planning (ERP) SystemsSpamsong onwTwiceNo ratings yet

- References - SERVQUALDocument3 pagesReferences - SERVQUALApparna BalajiNo ratings yet

- 2.fixation of Material Levels - PPTDocument15 pages2.fixation of Material Levels - PPTHasim SaiyedNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Accounting For Raw MaterialsDocument5 pagesAnsay, Allyson Charissa T. - BSA 2 - Accounting For Raw Materialsカイ みゆきNo ratings yet

- Introduction Logistics SCMDocument25 pagesIntroduction Logistics SCMlunettaNo ratings yet

- Incoterms 2020: EXW FCA CPT CIP DAP DPU DDP FASDocument1 pageIncoterms 2020: EXW FCA CPT CIP DAP DPU DDP FASmetal sourcingNo ratings yet

- Inventory Management - Written ReportDocument4 pagesInventory Management - Written ReportTracy Miranda BognotNo ratings yet

- CITLP 2020 Material Pages 253-334 2Document82 pagesCITLP 2020 Material Pages 253-334 2A KNo ratings yet

- Chapter 4 Value ChainDocument24 pagesChapter 4 Value ChainashlyNo ratings yet

- Tugas Pengauditan II Audit Persediaan Dan PergudanganDocument3 pagesTugas Pengauditan II Audit Persediaan Dan PergudanganPutri RahmawatiNo ratings yet

- Global Available-to-Promise With SAP - CH2Document27 pagesGlobal Available-to-Promise With SAP - CH2shipra177No ratings yet

- Lean Manufacturing For StudentsDocument4 pagesLean Manufacturing For StudentsCristian Camilo Toro DavilaNo ratings yet

- Assignment That Arranged As One Condition To Get Bachelor Degree at Industrial Engineering MajorDocument158 pagesAssignment That Arranged As One Condition To Get Bachelor Degree at Industrial Engineering MajorRosnani Ginting TBANo ratings yet

- Chapter 12Document46 pagesChapter 12Diandra OlivianiNo ratings yet