Professional Documents

Culture Documents

(Kotak) Economy, May 08, 2020

Uploaded by

abhinavsingh4uOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Kotak) Economy, May 08, 2020

Uploaded by

abhinavsingh4uCopyright:

Available Formats

INDIA

Economy

Public Finance MAY 08, 2020

UPDATE

BSE-30: 31,643

Government borrowing catches up with Covid reality. The government has,

expectedly, revised up its FY2021 dated borrowing plan to Rs12 tn. Factoring in states’

additional supply, we expect an overall gross borrowing of Rs20 tn. We restate that,

given this supply, RBI will need to support the markets with large OMO purchases (with

a calendar) and, as a last resort, partial direct monetization. In the absence of any RBI

response, we expect the 10-year yield to move towards 6.15-6.35% range in 1QFY21.

Covid-19 shock prompts the government to revise its borrowing calendar

The central government has revised its FY2021 dated borrowing program as the pandemic is QUICK NUMBERS

likely to lead to a sharp fall in tax collections and has accentuated the need for relief and

stimulus measures. The central government now plans to borrow Rs12 tn in dated securities FY2021 gross

(budgeted at Rs7.8 tn), in line with our estimates. Net market borrowing for FY2021 would borrowing at Rs12

therefore be Rs9.6 tn (budgeted at Rs5.4 tn). The government has stepped up its 1HFY21 tn; 1HFY20 gross

government dated borrowing by Rs2.1 tn to Rs6.98 tn (Rs4.88 tn as per the initial plan), borrowing at Rs6.98

accounting for around 58% of the FY2021 total issuance. The net issuance for 1HFY21 is now tn

around Rs5.6 tn (Rs3.4 tn in 1HFY20). The weekly bond auction size for the rest of 1HFY21 is

Rs300 bn (range Rs190-210 bn earlier). Absence of redemptions in July, August and September Average weekly

would imply heavy net supply (Exhibit 1). We note that the RBI has already revised higher the auction size of

central government’s WMA limit to Rs2 tn. The government had also increased its 1QFY21 Rs300 bn for the

gross T-Bill borrowing by Rs2 tn to Rs5 tn (net borrowing of Rs2.6 tn) (Exhibit 2). rest of 1HFY21

Supply concentrated in the belly of the curve India 10-year

As per the revised calendar, the long-end of the curve (30-year and 40-year) now accounts for benchmark yield to

21.3% of the total supply. The short-end (2-year and 5-year) has total issuance of 25.4%, while move in range of

the belly of the curve (10-year and 14-year) has 47% of the total supply (35.9% earlier). FRB 6.15-6.35% in

reliance has been increased to 6.3% (from 4.9%) and may provide some relief to the belly and 1QFY21

far-end of the curve. The securities that have been opened to unrestricted foreign investment

(5-year, 10-year and 30-year tenor) account for 61.5% of the overall issuance (Exhibit 3).

Government has provided a credible borrowing plan

In our GFD/GDP estimate of 6.7% (0.2% further slippage from our earlier estimate as we revise

our FY2021 real GDP growth to (-)2%), we were already factoring in G-Sec borrowing of Rs11-

13 tn to bridge the deficit (see Covid-19: Financing the stimulus, April 18 for details). We had

factored in a sharp shortfall in receipts (tax, non-tax and divestment) along with relief/stimulus

measures of 2.1% of GDP, which is offset by some capital expenditure cuts (Exhibits 4 and 5).

While we pencil in the Rs12 tn of G-Sec borrowing, we also factor in Rs1.8 tn of T-bill Suvodeep Rakshit

borrowing (budgeted at Rs250 bn) as well as lower financing through small savings. suvodeep.rakshit@kotak.com

Mumbai: +91-22-4336-0898

With states’ GDF/GDP expected at 4%, consolidated GFD/GDP is likely at 10.7%. This would

Upasna Bhardwaj

imply a consolidated government borrowing of Rs20 tn in FY2021E, which will push up yields upasna.bhardwaj@kotak.com

(Exhibit 6). We reiterate that unless RBI supports the market through OMO purchases (possibly Mumbai: +91-22-6166-0531

accompanied by a 2-3 month calendar) for G-Sec/SDLs, it will be difficult to absorb this amount

Avijit Puri

of supply. If OMO purchases fail to have the desired effect, RBI may have to explore the option avijit.puri@kotak.com

of direct monetization of part of the overall borrowing (Exhibit 7). Bond markets may also get Mumbai: +91-22-6166 1547

some respite from additional monetary easing. We retain our call of additional 50-75 bps of

repo rate cuts along with focus on unconventional measures to support liquidity and bond

markets. In the absence of any RBI intervention, we expect the benchmark 10-year G-Sec yield

to move towards 6.15-6.35% in the rest of 1QFY21.

Kotak Economic Research

kotak.research@kotak.com

Mumbai: +91-22-4336-0000

For Private Circulation Only.

India Economy

Exhibit 1: Net supply is expected to surge in 2QFY21

Monthly gross and net borrowings (Rs bn)

FY2020 FY2021

FY2020 FY2021 1,600 1,500

1,600 1,500

1,400

1,400

1,200 1,200 1,200 1,200 1,200

1,200 1,200

1,090

1,000 1,000

790

800 800

671

590

600 600

434

400 400

200 200

0 0

Sep

May

Aug

Apr

Jun

Jul

Sep

May

Aug

Apr

Jun

Jul

Source: RBI, Kotak Economics Research

Exhibit 2: Net short-term borrowing for 1QFY21 is higher at Rs2.6 tn

Gross and net issuances of T-Bill across tenors, March fiscal year-ends (Rs bn)

Gross issuance Net issuance Redemption

1QFY20 1QFY21 1QFY20 1QFY21 1QFY20 1QFY21

91-day 1,170 1,700 650 1,110 520 590

182-day 910 1,760 390 1,240 520 520

364-day 520 1,540 0 1,020 520 520

CMB 0 0 0 (800) 0 800

Total 2,600 5,000 1,040 2,570 1,560 2,430

Source: RBI, Kotak Economics Research

Exhibit 3: Overall issuances in the 5-year, 10-year and 30-year tenor is at 61.5%

Borrowing calendar for different tenors for 1HFY21 (Rs bn)

Borrowing 2 years 5 years 10 years 14 years 30 years 40 years FRB

April 790 60 180 190 90 120 110 40

May 1,090 60 240 280 220 140 110 40

June 1,200 60 240 360 220 140 100 80

July 1,500 90 240 540 220 140 150 120

August 1,200 60 240 360 220 140 100 80

September 1,200 60 240 360 220 140 100 80

Total 6,980 390 1,380 2,090 1,190 820 670 440

% of total 5.6 19.8 29.9 17.0 11.7 9.6 6.3

Source: RBI, Kotak Economics Research

2 KOTAK ECONOMIC RESEARCH

Economy India

Exhibit 4: Measures announced and probable measures by central government

Fiscal

Central govt impact

Relief measures announced Benefits fiscal impact (% of GDP) Beneficiaries Remarks

Hospitals and testing Rs77.7 bn to spend immediately and remaining over 1-4 years

Health infrastructure 150 78 0.0

facilities to build health infrastructure for fighting Covid-19

5kgs of rice/wheat and 1 kg of pulses over and above the

Food security 450 800 mn individuals

existing food security rules

PM-KISAN 160 87 mn farmers Rs2000 transferred to all farmers in April (front loaded)

NREGA 56 56 0.0 136 mn families Rs20 increase in base wages

Senior

30 30 0.0 30 mn individuals Rs500 each in two tranches over next three months

citizens/widows/handicapped

Women Jan Dhan accounts 310 310 0.2 204 mn individuals Rs500 each per month for next three months

Ujwala scheme 130 130 0.1 80 mn BPL families Free cylinders for next three months

24% contribution due for PF for next 3 months to be borne by

8 mn workers/ 0.4 mn

Organized sector - I 50 50 0.0 government; all firms with up to 100 employees and

firms

empoloyees whose salary is <Rs15000/month

PF scheme regulation will be amended to allow non-refundable

Organized sector - II 48 mn workers advance of 70% of outstanding or three months of wages,

whichever is lower

Building and construction workers 310 35 mn workers Through building and other construction worker welfare fund

Women SHG group 68.5 mn households Rs2 mn collateral free loan compared to Rs1 mn earlier

States to use this fund for medical testing/screening/prevention

District Mineral Funds 255 All states

of Covid-19

Total resources from government 1,900 653 0.3

Probable relief measures (during lockdown)

Hospitals and testing Expansion of testing facilities, Covid-19 gears, and

Health infrastructure 150 150 0.1

facilities isolation/quarantine facilities

Rs2000 to all registered farmers in addition to the scheduled

PM-KISAN 200 200 0.1 100 mn farmers

Rs6000 annually

Rs500 each per month for next three months to remaining Jan

Jan Dhan accounts 273 273 0.1 180 mn individuals

Dhan accounts

Credit guarantee for Covid-19 loan of Rs100,000 for all GST

MSME sector 300 100 0.0 Around 3 mn SMEs

registered SMEs

Loans and grants 500 200 0.1 High-risk sectors Fund to support high-risk sectors

Total resources from government 1,423 923 0.4

Probable stimulus measures (post lockdown)

NREGA 100 100 0.0 100 mn families Higher NREGA projects for rural population

Jan Dhan accounts 570 570 0.3 380 mn individuals Rs1500 lumpsum payout to all Jan Dhan accounts

GST rate cut 500 500 0.2 All consumers Reduction in CGST across goods

Construction/Daily wage

Rural and urban infrastructure 500 500 0.2 Higher spending on rural roads, highways, urban infrastructure

labor

Transfer to states/local bodies for last mile spending,

Support to states 1,000 1,000 0.5 States/Local bodies

urban/rural infrastructure

Total resources from government 2,670 2,670 1.3

Source: PIB, Kotak Economics Research estimates

KOTAK ECONOMIC RESEARCH 3

India Economy

Exhibit 5: We expect FY2021E GFD/GDP at 6.7%

Major central government budgetary items, March fiscal year-ends, 2016-21E (Rs bn)

Change (%)

2019/ 2020RE/ 2020E/ 2021BE/ 2021E/

2016 2017 2018 2019 2020RE 2020E 2021BE 2021E 2018 2019 2019 2020E 2020E

Receipts

1. Revenue receipts (2d + 3) 11,950 13,742 14,352 15,529 18,501 16,805 20,209 17,571 8 19 8 20 5

2. Gross tax revenues (a + b ) 14,556 17,158 19,190 20,805 21,634 19,864 24,230 20,721 8 4 (5) 22 4

2.a. Direct taxes 7,458 8,539 10,068 11,431 11,769 10,487 13,265 10,493 14 3 (8) 26 0

2.a.1. Corporation tax 4,532 4,849 5,712 6,636 6,105 5,640 6,810 5,640 16 (8) (15) 21 0

2.a.2. Income tax 2,876 3,646 4,308 4,730 5,595 4,777 6,380 4,777 10 18 1 34 0

2.a.3. Other taxes 50 43 48 66 69 69 75 75 37 5 5 9 9

2.b. Indirect taxes 7,098 8,620 9,122 9,373 9,865 9,377 10,965 10,229 3 5 0 17 9

2.b.1. Goods and Services Tax — — 4,426 5,816 6,123 5,855 6,905 4,840 31 5 1 18 (17)

2.b.1.1. CGST — — 2,033 4,575 5,140 4,920 5,800 3,940 125 12 8 18 (20)

2.b.1.2. IGST — — 1,767 289 — — — — (84)

2.b.1.3. Compensation cess — — 626 951 983 935 1,105 900 52 3 (2) 18 (4)

2.b.2. Customs duty 2,103 2,254 1,290 1,178 1,250 1,150 1,380 994 (9) 6 (2) 20 (14)

2.b.2.1. Basic duties 572 646 808 1,048 1,104 1,004 1,240 854 30 5 (4) 23 (15)

2.b.2.2. Others 1,532 1,608 483 130 146 146 140 140 (73) 12 12 (4) (4)

2.b.3. Excise duty 2,881 3,821 2,594 2,310 2,480 2,360 2,670 4,395 (11) 7 2 13 86

2.b.4. Service tax 2,114 2,545 812 69 12 12 10 — (92) (83) (83) (15)

2.c Transfers to states, UTs, etc. 5,119 6,145 6,765 7,633 6,588 6,058 7,871 6,079 13 (14) (21) 30 0

2.d Net tax revenues 9,438 11,014 12,425 13,172 15,046 13,805 16,359 14,643 6 14 5 18 6

3. Non-tax revenues 2,513 2,728 1,927 2,357 3,455 3,000 3,850 2,928 22 47 27 28 (2)

3.a. RBI's transfer of surplus 659 659 407 680 1,476 1,476 600 750 67 117 117 (59) (49)

3.a. Telecommunications 565 702 321 408 590 590 1,330 887 27 45 45 126 50

4. Non-debt capital receipts (a + b) 630 654 1,157 1,128 816 666 2,250 850 (3) (28) (41) 238 28

4.a Recovery of loans 208 176 156 181 166 166 150 150 15 (8) (8) (10) (10)

4.b Other receipts (disinvestments) 421 477 1,000 947 650 500 2,100 700 (5) (31) (47) 320 40

5. Total receipts (1 + 4) 12,580 14,396 15,509 16,657 19,317 17,471 22,459 18,420 7 16 5 29 5

Expenditure

6. Revenue expenditure 15,378 16,906 18,788 20,074 23,496 22,705 26,301 29,083 7 17 13 16 28

6.a. Interest payments 4,417 4,807 5,290 5,826 6,251 6,251 7,082 7,082 10 7 7 13 13

6.b. Subsidies 2,418 2,040 1,912 1,968 2,273 2,273 2,278 1,869 3 15 15 0 (18)

6.b.1. Food 1,394 1,102 1,003 1,013 1,087 1,087 1,156 1,156 1 7 7 6 6

6.b.2. Fertilizer 724 663 664 706 800 800 713 713 6 13 13 (11) (11)

6.b.3. Oil 300 275 245 248 386 386 409 0 2 55 55 6 (100)

6.c. Pay, allowances and pensions 3,301 3,996 4,464 4,957 5,447 4,997 5,877 5,627 11 10 1 18 13

6.c.1.a. Pay and allowances 2,334 2,682 3,007 3,291 3,606 3,306 3,770 3,520 9 10 0 14 6

6.c.1.b. Pensions 967 1,314 1,457 1,666 1,841 1,691 2,107 2,107 14 11 2 25 25

6.d. Agriculture and farmers' welfare 153 369 374 461 1,019 1,019 1,343 1,496 23 121 121 32 47

6.e. Education 672 720 800 781 927 835 972 972 (2) 19 7 16 16

6.f. Health and family welfare 322 364 483 506 608 608 639 869 5 20 20 5 43

6.g. Rural development 774 951 1,086 1,118 1,226 1,226 1,200 1,700 3 10 10 (2) 39

6.h. Others 3,321 3,658 4,381 4,457 5,746 5,497 6,909 9,467 2 29 23 26 72

7. Capital expenditure 2,530 2,846 2,631 3,077 3,489 3,125 4,121 3,101 17 13 2 32 (1)

7. a. Defence 836 915 954 998 1,154 1,038 1,186 786 5 16 4 14 (24)

7. b. Railways 350 452 434 528 678 509 700 350 22 28 (4) 38 (31)

7. c. Roads and Highways 275 412 508 676 722 722 820 920 33 7 7 14 27

7. d. Housing and urban affairs 106 165 153 158 192 163 211 311 3 22 3 30 91

7. e. Others 963 902 582 717 743 693 1,204 734 23 4 (3) 74 6

8. Total expenditure (6 + 7) 17,908 19,752 21,420 23,151 26,986 25,831 30,422 32,184 8 17 12 18 25

Deficit

Primary deficit (PD) 911 549 621 668 1,417 2,108 881 6,681 7 112 216 (58) 217

Revenue deficit (RD) 3,427 3,164 4,436 4,545 4,995 5,900 6,092 11,512 2 10 30 3 95

Gross fiscal deficit (GFD) 5,328 5,356 5,911 6,494 7,668 8,359 7,963 13,763 10 18 29 (5) 65

Gross borrowings (dated securities) 5,850 5,842 5,891 5,715 7,100 7,100 7,800 12,028 (3) 24 24 10 69

Net market borrowing 4,416 4,093 4,518 4,233 4,740 4,740 5,449 9,677 (6) 12 12 15 104

Net market borrowing (adjusted for buyback) 4,041 3,497 4,103 4,233 4,740 4,740 5,149 9,677 3 12 12 9 104

Short-term borrowing (T-bills) 507 55 449 69 250 1,560 250 1,800

Nominal GDP at market prices 137,719 153,917 170,983 189,712 204,422 203,372 224,894 205,405 11.0 7.8 7.2 10.6 1.0

PD/GDP (%) 0.7 0.4 0.4 0.4 0.7 1.0 0.4 3.3

RD/GDP (%) 2.5 2.1 2.6 2.4 2.4 2.9 2.7 5.6

GFD/GDP (%) 3.9 3.5 3.5 3.4 3.8 4.1 3.5 6.7

Notes:

(a) 'Gross tax revenues' means revenues post refunds and 'net tax revenues' means gross tax revenues minus devolution to states.

(b) RBI's transfer of surplus for FY2020BE and FY2020E are our estimate.

(c) Pay and allowances include pay and allowances from Ministry of Railways.

Source: Ministry of Finance, Kotak Economics Research estimates

4 KOTAK ECONOMIC RESEARCH

Economy India

Exhibit 6: Overall dated borrowing set to move substantially higher in FY2021E

Trend in borrowings of the center and state governments (Rs bn)

2021E-

2020BE 2020RE 2020E 2021BE 2021E 2020E

Central GFD/GDP (%) 3.3 3.8 4.1 3.5 6.7 2.6

Center's gross borrowing 7,100 7,100 7,100 7,800 12,000 4,900

G-Sec redemption 2,369 2,360 2,360 2,351 2,351 (9)

Center's net borrowing 4,731 4,740 4,740 5,449 9,649 4,909

Net T-bill issuance 250 250 1,560 250 1,800 240

State GFD/GDP (%) 2.6 2.9 2.9 2.4 4.0 1.1

States' gross borrowing 5,764 6,345 6,345 5,666 7,987 1,642

States' redemption 1,375 1,375 1,375 1,348 1,348 (27)

States' net borrowing 4,389 4,970 4,970 4,318 6,639 1,668

Total gross dated supply 12,864 13,445 13,445 13,466 19,987 6,542

Total net dated supply 9,120 9,710 9,710 9,767 16,287 6,577

Source: States and union budget documents, RBI, Kotak Economics Research estimates

KOTAK ECONOMIC RESEARCH 5

India Economy

Exhibit 7: Measures announced and probable measures by RBI

Measures announced by RBI

Policy repo rate Cut the repo rate by 75 bps to 4.40%

Reverse Repo rate Cut the reverse repo rate by 115 bps to 3.75% to disinventize banks from parkking the surplus liquidity with the RBI

LTROs Conduct Long Term Repo Operations (LTROs) for up to a total amount of Rs2 tn at the policy repo rate

1) Introduction of Targeted LTRO (TLTRO) auctions of up to three-year tenor for a total amount of Rs1 tn at a floating rate

linked to the repo rate, with the liquidity availed under this to be deployed in CPs, investment-grade corporate bonds and NCDs

2) Banks shall be required to acquire up to 50% of their incremental holdings from primary market issuances and remaining

TLTRO 1.0 50% from secondary market, including from MFs and NBFCs

3) Investments made by banks under this facility will be classified as held to maturity (HTM) even in excess of 25% of total

investment permitted to be included in HTM

4) Exposures under this facility will also not be reckoned under the large exposure framework

1) Conduct targeted long-term repo operations (TLTRO 2.0) for an aggregate amount of Rs500 bn, to begin with, in tranches

of appropriate sizes. The funds availed by banks under TLTRO 2.0 should be invested in investment grade bonds, commercial

paper, and non-convertible debentures of NBFCs, with aleast 50% of the total amount availed going to small and mid-sized

NBFCs and MFIs in the following proportion, a) 10% in securities/instruments issued by Micro Finance Institutions (MFIs), b) 15%

in securities/instruments issued by NBFCs with asset size of Rs5 bn and below; c) 25% in securities/instruments issued by NBFCs

TLTRO 2.0

with assets size between Rs5 bn and Rs50 bn

2) These investments have to be made within one month of the availment of liquidity from the RBI

3) Investments made by banks under this facility will be classified as held to maturity (HTM) even in excess of 25% of total

investment permitted to be included in the HTM portfolio

4) Exposures under this facility will also not be reckoned under the large exposure framework

1) Provide special refinance facilities for a total amount of Rs500 bn to NABARD, SIDBI and NHB to enable them to meet sectoral

credit needs. This will comprise Rs250 bn to NABARD for refinancing regional rural banks (RRBs), cooperative banks and micro

Refinancing Facilities for All India

finance institutions (MFIs); Rs150 bn to SIDBI for on-lending/refinancing; and Rs100 bn to NHB for supporting housing finance

Financial Institutions (AIFIs)

companies (HFCs)

2) Advances under this facility will be charged at the RBI’s policy repo rate at the time of availment

1) Reduce the cash reserve ratio (CRR) of all banks by 100 bps to 3% of net demand and time liabilities (NDTL) for a year

CRR 2) Reduction to release liquidity worth Rs1.37 tn

3) Reduce the requirement of minimum daily CRR balance maintenance from 90% to 80% (available up to June 26, 2020)

1) In order to ease the liquidity position at the level of individual institutions, the RBI decided to bring down the LCR requirement

Liquidity Coverage Ratio for Scheduled Commercial Banks from 100% to 80% with immediate effect

2) The requirement shall be gradually restored back in two phases – 90% by October 1, 2020 and 100% by April 1, 2021

1) Raising MSF to 3% of SLR from 2% in view of the exceptionally high volatility in domestic financial markets which can bring in

MSF phases of liquidity stress. This will remain applicable until June 30, 2020.

2) Allows banks to avail an additional Rs1.37 tn of liquidity under the LAF window in times of stress at the MSF rate

OMO purchases Conducted OMO purchases worth Rs400 bn

The RBI has opened a special 90-day liquidity facility for mutual funds to ease the liquidity strains which have intensified in the

wake of redemption pressures related to closure of some debt MFs and potential contagious effects. Banks meeting the liquidity

Special Liquidity facility for mutual

requirements of MFs by (1) extending loans, and (2) undertaking outright purchase of and/or repos against the collateral of

funds

investment grade corporate bonds, CPs, debentures and CDs held by MFs will be eligible to claim all the regulatory benefits

available under SLF-MF scheme without the need to avail back to back funding from the Reserve Bank under the SLF-MF.

Decided as an interim measure to extend the window timings of Fixed Rate Reverse Repo and MSF operations to provide eligible

Extends fixed rate reverse repo

market participants with greater flexibility in their liquidity management. Changes will come into effect from March 31, 2020 and

and MSF window

will be applicable till April 30, 2020

USD-INR sell-buy swap Providing dollar liquidity by having conducted US$4bn worth of USD-INR sell buy swap

Permitting all lending institutions to allow a moratorium of three months on payment of installments for term loans outstanding

Term loans as on March 1, 2020 without asset classification downgrade. The RBI also decided to exclude the moratorium period from the

90-day period for NPA classification, implying that an account can remain in default for 180 days before it is classified as an NPA

Permitting lending institutions to allow deferment of three months on payment of interest with respect to working capital

Working capital facilities

facilities without asset classification downgrade

Permitting lending institutions to recalculate drawing power by reducing margins and/or by reassessing the working capital cycle

Working capital financing for the borrowers In respect of working capital facilities sanctioned in the form of cash credit/overdraft without asset

classification downgrade

WMA limit for the central

Increased the limits for Ways and Means Advances (WMA) for 1HFY21 to Rs2 tn

government

WMA limit for the state

Increased the limits for Ways and Means Advances (WMA) for states 1HFY21 by 60%

governments

Probable measures by RBI

Policy rates/corridor Cut the repo rate by 50-75 bps; further widen policy corridor by reducing reverse repo rate by more 50-75 bps to 3-3.25%

Announce OMO calendar for the next three months. Conduct OMO purchases of around Rs6-7 tn including SDLs. Current RBI

OMO purchases

ownership of SDLs is 0% while SCBs, insurance companies, and pension funds own 89% of SDLs

Support corporate bond purchases by buying through banks without appropriate haircuts. LCR norms allow corporate bonds as

Corporate bond purchases

part of HQLA

NBFCs Open a collateralized refinancing window at repo rate

Direct monetization of deficit If required, monetize part of central government fiscal deficit (0.5-1% of GDP)

Source: RBI, PIB, media articles, Kotak Economics Research estimates

6 KOTAK ECONOMIC RESEARCH

Disclosures

"Each of the analysts named below hereby certifies that, with respect to each subject company and its securities for which

the analyst is responsible in this report, (1) all of the views expressed in this report accurately reflect his or her personal views

about the subject companies and securities, and (2) no part of his or her compensation was, is, or will be, directly or

indirectly, related to the specific recommendations or views expressed in this report: Suvodeep Rakshit, Upasna Bhardwaj

and Avijit Puri."

Kotak Institutional Equities Research coverage universe

Distribution of ratings/investment banking relationships

Percentage of companies covered by Kotak Institutional

70%

Equities, within the specified category.

60%

Percentage of companies within each category for which Kotak

Institutional Equities and or its affiliates has provided

50% 47.1%

investment banking services within the previous 12 months.

40% * The above categories are defined as follows: Buy = We

expect this stock to deliver more than 15% returns over the next

12 months; Add = We expect this stock to deliver 5-15% returns

30%

over the next 12 months; Reduce = We expect this stock to

23.0%

deliver -5-+5% returns over the next 12 months; Sell = We

20% 17.2% expect this stock to deliver less than -5% returns over the next

12.7% 12 months. Our target prices are also on a 12-month horizon

basis. These ratings are used illustratively to comply with

10%

3.9% applicable regulations. As of 31/03/2020 Kotak Institutional

2.0% 1.5%

0.0% Equities Investment Research had investment ratings on 204

0% equity securities.

BUY ADD REDUCE SELL

Source: Kotak Institutional Equities As of March 31, 2020

Ratings and other definitions/identifiers

Definitions of ratings

BUY. We expect this stock to deliver more than 15% returns over the next 12 months.

ADD. We expect this stock to deliver 5-15% returns over the next 12 months.

REDUCE. We expect this stock to deliver -5-+5% returns over the next 12 months.

SELL. We expect this stock to deliver <-5% returns over the next 12 months.

Our Fair Value estimates are also on a 12-month horizon basis.

Our Ratings System does not take into account short-term volatility in stock prices related to movements in the market. Hence, a particular Rating may not

strictly be in accordance with the Rating System at all times.

Other definitions

Coverage view. The coverage view represents each analyst’s overall fundamental outlook on the Sector. The coverage view will consist of one of the following

designations: Attractive, Neutral, Cautious.

Other ratings/identifiers

NR = Not Rated. The investment rating and fair value, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s)

and/or Kotak Securities policies in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction

involving this company and in certain other circumstances.

CS = Coverage Suspended. Kotak Securities has suspended coverage of this company.

NC = Not Covered. Kotak Securities does not cover this company.

RS = Rating Suspended. Kotak Securities Research has suspended the investment rating and fair value, if any, for this stock, because there is not a sufficient

fundamental basis for determining an investment rating or fair value. The previous investment rating and fair value, if any, are no longer in effect for this stock

and should not be relied upon.

NA = Not Available or Not Applicable. The information is not available for display or is not applicable.

NM = Not Meaningful. The information is not meaningful and is therefore excluded.

KOTAK ECONOMIC RESEARCH 7

Corporate Office Overseas Affiliates

Kotak Securities Ltd. Kotak Mahindra (UK) Ltd Kotak Mahindra Inc

27 BKC, Plot No. C-27, “G Block” 8th Floor, Portsoken House 369 Lexington Avenue

Bandra Kurla Complex, Bandra (E) 155-157 Minories 28th Floor, New York

Mumbai 400 051, India London EC3N 1LS NY 10017, USA

Tel: +91-22-43360000 Tel: +44-20-7977-6900 Tel:+1 212 600 8856

Copyright 2020 Kotak Institutional Equities (Kotak Securities Limited). All rights reserved.

1. Note that the research analysts contributing to this report may not be registered/qualified as research analysts with FINRA; and

2. Such research analysts may not be associated persons of Kotak Mahindra Inc and therefore, may not be subject to NASD Rule 2711 restrictions on communications with a subject

company, public appearances and trading securities held by a research analyst account.

3. Any U.S. recipients of the research who wish to effect transactions in any security covered by the report should do so with or through Kotak Mahindra Inc and (ii) any transactions in

the securities covered by the research by U.S. recipients must be effected only through Kotak Mahindra Inc at vinay.goenka@kotak.com.

This report is distributed in Singapore by Kotak Mahindra (UK) Limited (Singapore Branch) to institutional investors, accredited investors or expert investors only as defined under the

Securities and Futures Act. Recipients of this analysis / report are to contact Kotak Mahindra (UK) Limited (Singapore Branch) (16 Raffles Quay, #35-02/03, Hong Leong Building, Singapore

048581) in respect of any matters arising from, or in connection with, this analysis / report. Kotak Mahindra (UK) Limited (Singapore Branch) is regulated by the Monetary Authority of

Singapore.

Kotak Securities Limited and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We along with our affiliates are

leading underwriter of securities and participants in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationships with a

significant percentage of the companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other

business selection processes. Investors should assume that Kotak Securities Limited and/or its affiliates are seeking or will seek investment banking or other business from the company or

companies that are the subject of this material and that the research professionals who were involved in preparing this material may participate in the solicitation of such business. Our

research professionals are paid in part based on the profitability of Kotak Securities Limited, which include earnings from investment banking and other business. Kotak Securities Limited

generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that

the analysts cover. Additionally, Kotak Securities Limited generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of

any companies that the analysts cover. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect

opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the

recommendations expressed herein.

In reviewing these materials, you should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. Additionally, other important

information regarding our relationships with the company or companies that are the subject of this material is provided herein.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be ille gal. We are not

soliciting any action based on this material. It is for the general information of clients of Kotak Securities Limited. It does not constitute a personal recommendation or take into account the

particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, clients should consider whether it is

suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go

down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original

capital may occur. Kotak Securities Limited does not provide tax advise to its clients, and all investors are strongly advised to consult with their tax advisers regarding any potential investment.

Certain transactions -including those involving futures, options, and other derivatives as well as non-investment-grade securities - give rise to substantial risk and are not suitable for all

investors. The material is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions

expressed are our current opinions as of the date appearing on this material only. We endeavor to update on a reasonable basis the information discussed in this material, but regulatory,

compliance, or other reasons may prevent us from doing so. We and our affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this

material, may from time to time have "long" or "short" positions in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. Kotak

Securities Limited and its non US affiliates may, to the extent permissible under applicable laws, have acted on or used this research to the extent that it relates to non US issuers, prior to

or immediately following its publication. Foreign currency denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of or

income derived from the investment. In addition, investors in securities such as ADRs, the value of which are influenced by f oreign currencies affectively assume currency risk. In addition

options involve risks and are not suitable for all investors. Please ensure that you have read and understood the current derivatives risk disclosure document befor e entering into any

derivative transactions.

Kotak Securities Limited established in 1994, is a subsidiary of Kotak Mahindra Bank Limited. Kotak Securities is one of India's largest brokerage and distribution house.

Kotak Securities Limited is a corporate trading and clearing member of Bombay Stock Exchange Limited (BSE), National Stock Ex change of India Limited (NSE), Metropolitan Stock

Exchange of India Limited (MSE), National Commodity and Derivatives Exchange (NCDEX) and Multi Commodity Exchange(MCX). Our businesses include stock broking, services rendered

in connection with distribution of primary market issues and financial products like mutual funds and fixed deposits, depository services and Portfolio Management.

Kotak Securities Limited is also a depository participant with National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). Kotak Securities Limited

is also registered with Insurance Regulatory and Development Authority as Corporate Agent for Kotak Mahindra Old Mutual Life Insurance Limited and is also a Mutual Fund Advisor

registered with Association of Mutual Funds in India (AMFI). Kotak Securities Limited is registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014.

We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered in last five years. However SEBI,

Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on KSL for certain operational

deviations. We have not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has our certificate of registration been cancelled by SEBI at any point

of time.

We offer our research services to primarily institutional investors and their employees, directors, fund managers, advisors who are registered with us

Details of Associates are available on website i.e. www.kotak.com

Research Analyst has served as an officer, director or employee of subject company(ies): No

We or our associates may have received compensation from the subject company(ies) in the past 12 months.

We or our associates have managed or co-managed public offering of securities for the subject company(ies) in the past 12 months. YES. Visit our website for more details

We or our associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our

associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company(ies) in the

past 12 months. We or our associates may have received compensation or other benefits from the subject company(ies) or third party in connection with the research report.

Our associates may have financial interest in the subject company(ies).

Research Analyst or his/her relative's financial interest in the subject company(ies): No

Kotak Securities Limited has financial interest in the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: YES

Nature of Financial interest: Holding equity shares or derivatives of the subject company.

Our associates may have actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of

Research Report.

Research Analyst or his/her relatives has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of

publication of Research Report: No

Kotak Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of

Research Report: No

Subject company(ies) may have been client during twelve months preceding the date of distribution of the research report.

A graph of daily closing prices of securities is available at https://www.moneycontrol.com/india/stockpricequote/ and http://economictimes.indiatimes.com/markets/stocks/stock-quotes.

(Choose a company from the list on the browser and select the"three years" icon in the price chart).

Kotak Securities Limited. Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051. CIN: U99999MH1994PLC134051, Telephone No.: +22

43360000, Fax No.: +22 67132430. Website: www.kotak.com / www.kotaksecurities.com. Correspondence Address: Infinity IT Park, Bldg. No 21, Opp. Film City Road, A K Vaidya Marg,

Malad (East), Mumbai 400097. Telephone No: 42856825. SEBI Registration No. INZ000200137(Member of NSE, BSE, MSE, MCX & NCDEX). Member Id: NSE-08081; BSE-673; MSE-1024;

MCX-56285; NCDEX-1262. AMFI ARN 0164, PMS INP000000258 and Research Analyst INH000000586. NSDL/CDSL: IN-DP-NSDL-23-97. Compliance Officer Details: Mr. Manoj Agarwal.

Call: 022 - 4285 8484, or Email: ks.compliance@kotak.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing.

In case you require any clarification or have any concern, kindly write to us at below email ids:

Level 1: For Trading related queries, contact our customer service at ‘service.securities@kotak.com’ and for demat account related queries contact us at ks.demat@kotak.com or call us on:

Toll free numbers 18002099191 / 1860 266 9191

Level 2: If you do not receive a satisfactory response at Level 1 within 3 working days, you may write to us at ks.escalation @kotak.com or call us on 022-42858445 and if you feel you are

still unheard, write to our customer service HOD at ks.servicehead@kotak.com or call us on 022-42858208.

Level 3: If you still have not received a satisfactory response at Level 2 within 3 working days, you may contact our Complia nce Officer (Name: Mr. Manoj Agarwal) at

ks.compliance@kotak.com or call on 91- (022) 4285 8484.

Level 4 : If you have not received a satisfactory response at Level 3 within 7 working days, you may also approach Managing Director / CEO (Mr. Jaideep Hansraj) at ceo.ks@kotak.com or

call on 91-(022) 4285 8301.

First Cut notes published on this site are for information purposes only. They represent early notations and responses by analysts to recent events. Data in the notes may not have been

verified by us and investors should not act upon any data or views in these notes. Most First Cut notes, but not necessarily all, will be followed by final research reports on the subject.

There could be variance between the First cut note and the final research note on any subject, in which case the contents of the final research note would prevail. We accept no liability

for the contents of the First Cut Notes.

You might also like

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Union Budget FY19 Note FinalDocument17 pagesUnion Budget FY19 Note FinalRajeshNo ratings yet

- Practice Set (Questions) - IFRIC 14Document3 pagesPractice Set (Questions) - IFRIC 14kashan.ahmed1985No ratings yet

- AUSmall FinancebanklimitedDocument39 pagesAUSmall FinancebanklimitedDIPAN BISWASNo ratings yet

- Banking PDF Dec 2018Document15 pagesBanking PDF Dec 2018SonamNo ratings yet

- ICRA - Mutual Fund Screener - June 2021Document29 pagesICRA - Mutual Fund Screener - June 2021Dhanush KodiNo ratings yet

- Know Boi @exam&interview2020Document60 pagesKnow Boi @exam&interview2020Avinash ChandraNo ratings yet

- IFRIC 14 - Class Practice (Questions)Document3 pagesIFRIC 14 - Class Practice (Questions)Muhammed NaqiNo ratings yet

- Banking and Financial Services: BackgroundDocument5 pagesBanking and Financial Services: Backgroundvishwanath180689No ratings yet

- Fiscal Policy India ES 2022Document42 pagesFiscal Policy India ES 2022Snehal NivsarkarNo ratings yet

- Banking A ND Fina Ncia L Awareness April 2020: Week IiiDocument2 pagesBanking A ND Fina Ncia L Awareness April 2020: Week IiiAyush AyushNo ratings yet

- Lic Mutual FundDocument40 pagesLic Mutual FundMohammad MushtaqNo ratings yet

- Finance and AccountsDocument4 pagesFinance and AccountsNavneet AgrawalNo ratings yet

- Man Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedDocument5 pagesMan Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedshahavNo ratings yet

- FY 10 Monetary ReviewDocument4 pagesFY 10 Monetary ReviewVivek SarinNo ratings yet

- Iiww 290908Document4 pagesIiww 290908anon-472533No ratings yet

- AP Moderate Portfolio 040219Document20 pagesAP Moderate Portfolio 040219sujeet panditNo ratings yet

- GK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDocument154 pagesGK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDeepaNo ratings yet

- Chap 3Document19 pagesChap 3Nagina MemonNo ratings yet

- Ashok Leyland - Q1FY20 - Result Update - 07082019 - 09-08-2019 - 11Document6 pagesAshok Leyland - Q1FY20 - Result Update - 07082019 - 09-08-2019 - 11Vin PatelNo ratings yet

- Budget Note 2023-24Document3 pagesBudget Note 2023-24JINU JAMESNo ratings yet

- The State of Pakistan Economy 2021-22Document147 pagesThe State of Pakistan Economy 2021-22Director ResearchNo ratings yet

- FRB 6 Revised Sep 2020 Acctg For Jss GrantDocument16 pagesFRB 6 Revised Sep 2020 Acctg For Jss GrantKellenJaneHernandezNo ratings yet

- INDIA BUDGET 2010-11: What Is A Budget ?Document25 pagesINDIA BUDGET 2010-11: What Is A Budget ?adipjksNo ratings yet

- UNION BUDGET 2012-2013 Banking and InvestmentDocument6 pagesUNION BUDGET 2012-2013 Banking and InvestmentRamya NatarajanNo ratings yet

- Performance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquidityDocument2 pagesPerformance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquiditynasirNo ratings yet

- Budget Presentation: Budget For The Year 2018Document15 pagesBudget Presentation: Budget For The Year 2018Arif IslamNo ratings yet

- City Union Bank - GeojitDocument4 pagesCity Union Bank - GeojitSenthil KamarajNo ratings yet

- EconomicletterDocument2 pagesEconomicletterMalik S Muneeb HNo ratings yet

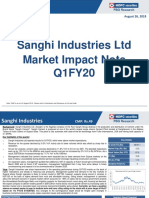

- Sanghi Industries - Q1FY20 - Market Impact-201908291229582531348 PDFDocument3 pagesSanghi Industries - Q1FY20 - Market Impact-201908291229582531348 PDFSabyasachi BangalNo ratings yet

- Economy So Far 18th March 2021 1616070846 PDFDocument4 pagesEconomy So Far 18th March 2021 1616070846 PDFassmexellenceNo ratings yet

- 29.11.22 - Morning Financial News UpdatesDocument5 pages29.11.22 - Morning Financial News UpdatesraviNo ratings yet

- AAAG AGRlDocument158 pagesAAAG AGRl786myemailsNo ratings yet

- Chapter 5Document10 pagesChapter 5Ali KazmiNo ratings yet

- Banking and Financial Awareness Digest June 2021Document9 pagesBanking and Financial Awareness Digest June 2021Sakshi GuptaNo ratings yet

- AxisCap - India Pre-Budget 2021Document19 pagesAxisCap - India Pre-Budget 2021Patel Vishal M.No ratings yet

- EXCLUSIVE FEBRUARY 2020 GA Refresher: Banking & EconomyDocument45 pagesEXCLUSIVE FEBRUARY 2020 GA Refresher: Banking & Economychethan mahadevNo ratings yet

- TATA AIA Annual Report March 2020Document22 pagesTATA AIA Annual Report March 2020SantoshNo ratings yet

- UnionBudgetPreview-Jan14 21Document13 pagesUnionBudgetPreview-Jan14 21Chirag prajapatiNo ratings yet

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepNo ratings yet

- Monetary Management REPORTDocument12 pagesMonetary Management REPORTRajat MishraNo ratings yet

- Mirae Macro Update 23 Feb 2024 FY23 BOP, Positive Support From FinancialDocument7 pagesMirae Macro Update 23 Feb 2024 FY23 BOP, Positive Support From FinancialindonesiamillenNo ratings yet

- Vallum India Fund - Investor Presentation 2017Document42 pagesVallum India Fund - Investor Presentation 2017Rakesh PandeyNo ratings yet

- GDP Sri LankaDocument4 pagesGDP Sri LankaNalaka JayanthaNo ratings yet

- Government Domestic Borrowing: Monthly Report OnDocument8 pagesGovernment Domestic Borrowing: Monthly Report Onrashedul islamNo ratings yet

- Annual Federal Budget 2021-22: Moving From Stabilization To GrowthDocument21 pagesAnnual Federal Budget 2021-22: Moving From Stabilization To GrowthKarim JumaniNo ratings yet

- Press Note FAE 2022-23 - M1673006953862Document7 pagesPress Note FAE 2022-23 - M1673006953862Indu TiwariNo ratings yet

- India Budget Statement 2011: Mgb&coDocument39 pagesIndia Budget Statement 2011: Mgb&coAnsal HaneefaNo ratings yet

- Financials Result ReviewDocument21 pagesFinancials Result ReviewAngel BrokingNo ratings yet

- Larsen & Toubro: Expect Near-Term Uncertainties To Iron Out Retain BuyDocument5 pagesLarsen & Toubro: Expect Near-Term Uncertainties To Iron Out Retain BuydarshanmadeNo ratings yet

- RAK Ceramics PJSC CFS Q2 2020 EnglishDocument34 pagesRAK Ceramics PJSC CFS Q2 2020 Englishahme farNo ratings yet

- Status Paper Final 28.3.18 PDFDocument160 pagesStatus Paper Final 28.3.18 PDFSunil KumarNo ratings yet

- Banking Sector: Presented By:-Nidhi Rachita Shweta Shubhi Priyanka SapnaDocument25 pagesBanking Sector: Presented By:-Nidhi Rachita Shweta Shubhi Priyanka Sapnamoti009No ratings yet

- Decoding The BudgetDocument8 pagesDecoding The BudgetRanjan SharmaNo ratings yet

- 6 Banking and Financial ServicesDocument5 pages6 Banking and Financial ServicesSatish MehtaNo ratings yet

- Icici Bank LTD: Operating Performance On TrackDocument6 pagesIcici Bank LTD: Operating Performance On TrackADNo ratings yet

- 2020 Banking & Finance by AffairsCloud PDFDocument40 pages2020 Banking & Finance by AffairsCloud PDFTarun GargNo ratings yet

- FY22 Budget CommentaryDocument18 pagesFY22 Budget CommentaryKarim JumaniNo ratings yet

- PP 0902Document9 pagesPP 0902jnymjnymjnymNo ratings yet

- CAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020Document15 pagesCAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020SATISHNo ratings yet

- The Great Reset: Macroeconomic Outlook and Issues For India in A Covid-19 WorldDocument6 pagesThe Great Reset: Macroeconomic Outlook and Issues For India in A Covid-19 Worldabhinavsingh4uNo ratings yet

- Kotak India - Daily 20200326Document70 pagesKotak India - Daily 20200326abhinavsingh4uNo ratings yet

- India Financials: Covid-19: Tough Times AheadDocument10 pagesIndia Financials: Covid-19: Tough Times Aheadabhinavsingh4uNo ratings yet

- Identifying Phoenix:: Stocks Set For ComebackDocument19 pagesIdentifying Phoenix:: Stocks Set For Comebackabhinavsingh4uNo ratings yet

- Goldilocks For Gold April 14, 2020 PDFDocument15 pagesGoldilocks For Gold April 14, 2020 PDFabhinavsingh4uNo ratings yet

- Equirus-IC-Cement SectorDocument134 pagesEquirus-IC-Cement Sectorabhinavsingh4uNo ratings yet

- Financials Preview - InvestecDocument19 pagesFinancials Preview - Investecabhinavsingh4uNo ratings yet

- Sinking Deeper: Lockdowns and Restrictions Have Hit Harder Than ExpectedDocument6 pagesSinking Deeper: Lockdowns and Restrictions Have Hit Harder Than Expectedabhinavsingh4uNo ratings yet

- Crisil Fund Insights Banking and Psu Funds A Low Risk Investment Avenue in Turbulent TimesDocument4 pagesCrisil Fund Insights Banking and Psu Funds A Low Risk Investment Avenue in Turbulent Timesabhinavsingh4uNo ratings yet

- Covid 19 Impact On Economy Corporate Revenue and ProfitabilityDocument71 pagesCovid 19 Impact On Economy Corporate Revenue and Profitabilityabhinavsingh4uNo ratings yet

- 17 Quality ManagementDocument19 pages17 Quality Managementأبو الحسن المطريNo ratings yet

- Chapter 2-Part 3Document19 pagesChapter 2-Part 3Puji dyukeNo ratings yet

- DSC Payment DetailsDocument11 pagesDSC Payment DetailsAbhishek SinghNo ratings yet

- ACFrOgAXHgtW7HNg2vN RLE MVyhRh8psIHSYSfj5ztdXGpXG1fbRpt0-yZy5OBA0Lyq0fWmOZGFVpFa5o3ujw3px-HcE7tN5iI vIi8kw8azO6R9j6n00Vdwq9zJffWPQlFwLkdDJp4bkXg7lqDocument14 pagesACFrOgAXHgtW7HNg2vN RLE MVyhRh8psIHSYSfj5ztdXGpXG1fbRpt0-yZy5OBA0Lyq0fWmOZGFVpFa5o3ujw3px-HcE7tN5iI vIi8kw8azO6R9j6n00Vdwq9zJffWPQlFwLkdDJp4bkXg7lqleah r. polancosNo ratings yet

- Unit 8 Money ManagementDocument6 pagesUnit 8 Money ManagementJasmine Mae BalageoNo ratings yet

- Presentation Slides On Borrowers and Lenders Act 2020 (Act 1052)Document62 pagesPresentation Slides On Borrowers and Lenders Act 2020 (Act 1052)Nana Oware100% (1)

- Oblicon Samplex AnswersDocument11 pagesOblicon Samplex AnswersEnvy Lace75% (4)

- Monopoly vs. Monopolistic CompetitionDocument2 pagesMonopoly vs. Monopolistic CompetitionJenniferNo ratings yet

- Indian Capital Markets 2020 and Outlook 2021Document21 pagesIndian Capital Markets 2020 and Outlook 2021Sasidhar ThamilNo ratings yet

- BA PAPER 1 答案Document2 pagesBA PAPER 1 答案Chun Kit LauNo ratings yet

- Yash Raj Films Private LimitedDocument1 pageYash Raj Films Private LimitedKshitij TrivediNo ratings yet

- Case Studies - Production and Operations: Make Versus Buy CaseDocument4 pagesCase Studies - Production and Operations: Make Versus Buy CaseGani SheikhNo ratings yet

- Contract CostingDocument12 pagesContract Costingvivek rajakNo ratings yet

- Polyester DTY-FDY Suppliers List - Through EmailDocument16 pagesPolyester DTY-FDY Suppliers List - Through EmailMonicatrading bdNo ratings yet

- Retail ManagementDocument80 pagesRetail Managementsheemankhan75% (4)

- Austria Import EXPORTDocument3 pagesAustria Import EXPORTTushar SharmaNo ratings yet

- Concept Map ActivityDocument2 pagesConcept Map ActivityVea Ann CantollasNo ratings yet

- Wordvice Proofreading Sample (Farabi Nawar)Document5 pagesWordvice Proofreading Sample (Farabi Nawar)farabi nawarNo ratings yet

- Decline of Reliance Communications LTDDocument25 pagesDecline of Reliance Communications LTDrifatbudhwaniNo ratings yet

- Somaliland Revenue Act 2016 English v2Document129 pagesSomaliland Revenue Act 2016 English v2Mohamed DaudNo ratings yet

- Portfolio Management - AnswersDocument3 pagesPortfolio Management - AnswersCharu KokraNo ratings yet

- Chapter 4 Governmental AccountingDocument5 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Tutorial 5 - MacroDocument2 pagesTutorial 5 - MacroXperiment BeatzNo ratings yet

- Invoice For Missed Toll: Third NoticeDocument2 pagesInvoice For Missed Toll: Third NoticeIvanNo ratings yet

- Moodle Solutions - Ch09Document26 pagesMoodle Solutions - Ch09singhworks.yegNo ratings yet

- Industrial and Commercial Tenancy Agreement-1Document5 pagesIndustrial and Commercial Tenancy Agreement-1刘伊婧No ratings yet

- Anne Richelle Salles CV - AccountantDocument3 pagesAnne Richelle Salles CV - AccountantEniger CaspeNo ratings yet

- Reconciling of AccountDocument72 pagesReconciling of AccountCarlo CariasoNo ratings yet

- P&G PowerpointDocument10 pagesP&G PowerpointVictor KipchirchirNo ratings yet

- The Impact of International Financial ReportingDocument16 pagesThe Impact of International Financial ReportingGadaa TDhNo ratings yet

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- CAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitFrom EverandCAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitRating: 4 out of 5 stars4/5 (6)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (91)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasFrom EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasRating: 4 out of 5 stars4/5 (2)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationFrom EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationRating: 4.5 out of 5 stars4.5/5 (5)

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouRating: 4 out of 5 stars4/5 (2)

- Debt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverFrom EverandDebt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverRating: 3 out of 5 stars3/5 (2)

- 30-Day Kickass Single Mom Money Makeover: Get Your Financial Act Together, Finally and Forever!From Everand30-Day Kickass Single Mom Money Makeover: Get Your Financial Act Together, Finally and Forever!No ratings yet

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Financial Rescue: The Total Money Makeover: Money ManifestationFrom EverandFinancial Rescue: The Total Money Makeover: Money ManifestationRating: 5 out of 5 stars5/5 (1)