Professional Documents

Culture Documents

Nickelodeon's Impact On Viacom Shareholders

Uploaded by

Kate TaylorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nickelodeon's Impact On Viacom Shareholders

Uploaded by

Kate TaylorCopyright:

Available Formats

Article

Tuesday, April 24, 2012 3:58 PM ET

Nickelodeon's impact on Viacom shareholders

By Steve Birenberg

Opinions expressed in this piece are solely those of the author and do not represent the views of SNL Kagan.

Recently, SNL Kagan published an article discussing the sharp drop in ratings for Viacom Inc.'s flagship Nickelodeon channel.

Since last fall, Nick's ratings have been consistently down 20% to 30% on a year-over-year basis. There is no question that this

is of great concern to investors, and Viacom shares have severely lagged the market and peer cable network companies since the

ratings decline first came to light.

Viacom management firmly state that they believe Nielsen's ratings data are flawed. They point to data from Rentrak Corp. that

shows just a small decline in ratings, consistent with a pattern seen across many cable networks for the past six months. Yet

investors and analysts are not buying management's explanation. Instead, they are focused on Viacom's overall advertising growth,

which is barely positive against gains of mid-single digits to midteens for other national cable network companies. In addition,

despite complaining about Nielsen, management has effectively accepted the ratings by dramatically increasing its investment in

new programming for Nickelodeon.

Most of the speculation on what went wrong at Nickelodeon has focused on Netflix Inc. Nickelodeon programming is available on

Netflix, and many observers believe children are watching what they want on the over-the-top service rather than accepting Nick's

linear programming schedule.

SNL Kagan's Adam Swanson took another view. Adam noted that programming on two newer Viacom networks, Nick Jr. and

Nicktoons Network, used to appear on Nickelodeon. For example, Nick Jr. was once a successful programming block on

Nickelodeon — so successful it was spun off to create Nick Jr. Perhaps viewers of Nick Jr. and Nicktoons used to watch

Nickelodeon?

I am not sure we will ever fully understand what has happened to Nickelodeon's ratings. However, I think one way to look at it for

Viacom investors is to compare the economics of the three networks. The economics of cable networks are quite good given the

dual revenue stream of advertising and affiliate fees. It is totally understandable that Viacom management would want to launch the

new networks given how a fully distributed cable network with modest ratings can create hundreds of millions or billions of asset

value for shareholders. This was especially the case several years ago before the recession, Netflix, cord cutting, cord shaving and

over the top became significant concerns.

SNL Kagan projects that Nickelodeon will have 100.6 million subscribers in 2012, producing operating cash flow of $1.361 billion.

Viacom and other cable network stocks trade at about 8x operating cash flow, so arguably Nickelodeon is worth more than $10.9

billion, or about 33% of Viacom's total enterprise value of $32.8 billion. Viacom shares are valued 1.0 to 1.5 multiple points below

peers due to the Nickelodeon concerns. Thus, you could say that the ratings issues at Nickelodeon are costing Viacom

shareholders $1.4 billion to $2.1 billion in value.

Meanwhile, according to SNL Kagan, Nick Jr. is in 85 million homes and will generate operating cash flow of about $106 million in

2012; while Nicktoons is in 68 million homes and will generate roughly $50 million in operating cash flow. Both networks are

growing, with SNL Kagan forecasting 2015 operating cash flow to be 28% above 2012 for Nick Jr. and 53% higher for Nicktoons.

Nickelodeon also is growing, but more slowly, with 2015 operating cash flow expected to be 19% higher than 2012. Of course, due

to Nickelodeon's much larger size, the incremental operating cash flow of $250 million in 2015 is more than the combined projected

operating cash flow that year for Nick Jr. and Nicktoons.

Given that they are growing faster, let's give Nick Jr. and Nicktoons a slightly higher multiple. At 10x operating cash flow, the

networks are worth $1.57 billion today. This is at the low end of the $1.4 billion to $2.1 billion value destruction we calculated at

Nickelodeon. A neutral trade at best if the new networks are cannibalizing Nickelodeon ratings.

Looking ahead to 2015, let's say a mature Nickelodeon is worth 7x operating cash flow, or more than $11 billion. Valuing Nick Jr.

and Nicktoons' $210 million in projected operating cash flow at 9x creates asset value of $1.9 billion. The newer networks have

increased in value by $500 million, a meaningful amount for sure, but relative to the $11 billion value of Nickelodeon, the

incremental value creation is marginal.

To repeat, we may never know exactly what is happening with Nickelodeon's ratings, specifically whether the development of Nick

Source: S&P Global Market Intelligence | Page 1 of 2

Article

Jr. and Nicktoons is partially or mostly to fault for the ratings slide. However, I think it is fair to say that fixing Nickelodeon is

priority one for Viacom investors. Success at smaller networks built off of Nickelodeon programming and branding is not enough to

drive value for Viacom as a whole.

To their credit, Viacom management is taking the ratings challenge at Nickelodeon head on with dramatic increases in

programming investment. I chose to take a wait and see attitude and sold my Viacom shares at the end of February. My thesis

remains that the industry-wide ad recovery has matured and entered a normal phase. Ratings winners will be rewarded on Wall

Street. Until Nickelodeon turns around, Viacom will not be a winner even with success at its smaller networks.

Steve Birenberg has no positions in Viacom for himself or clients of Northlake Capital Management LLC or the Entermedia Funds.

Birenberg is sole proprietor of Northlake, a registered investment adviser. He also is co-portfolio manager of Entermedia, owns a

stake in Entermedia's investment management company, and has personal monies invested in the funds.

Source: S&P Global Market Intelligence | Page 2 of 2

You might also like

- FT Article - The Quality of Quantity at NetflixDocument10 pagesFT Article - The Quality of Quantity at NetflixNiyati TiwariNo ratings yet

- Disney, Netflix, Apple - Is Anyone Winning The Streaming Wars - The EconomistDocument9 pagesDisney, Netflix, Apple - Is Anyone Winning The Streaming Wars - The EconomistLương Nguyễn Khánh BảoNo ratings yet

- Netflix Part ADocument23 pagesNetflix Part Aganashreep2003No ratings yet

- NFLX EarningsMiss NoSurpise2015!10!20Document5 pagesNFLX EarningsMiss NoSurpise2015!10!20kunalwarwickNo ratings yet

- On Demand Quarterly - June 2008Document16 pagesOn Demand Quarterly - June 2008kwlowNo ratings yet

- MGT539 IA NetflixDocument15 pagesMGT539 IA Netflixmohd_uzair_14No ratings yet

- Netflix Case StudyDocument22 pagesNetflix Case StudyIvette Estefanía Ramírez YumblaNo ratings yet

- Individual Company Analysis - ComcastDocument6 pagesIndividual Company Analysis - ComcastAkshay RamNo ratings yet

- (MM5002) Dina Rizkia Rachmah - 29120431 - UTSDocument12 pages(MM5002) Dina Rizkia Rachmah - 29120431 - UTSDina Rizkia RachmahNo ratings yet

- Netflix Case StudyDocument25 pagesNetflix Case StudyIvette Estefanía Ramírez Yumbla100% (1)

- Dreamworks Animation SKG, Inc.: Secondary Data AnalysisDocument13 pagesDreamworks Animation SKG, Inc.: Secondary Data AnalysislaurabarrowNo ratings yet

- Netflix Revenue History, SWOT Analysis & OTT PlatformDocument3 pagesNetflix Revenue History, SWOT Analysis & OTT Platformpankhuri dhimanNo ratings yet

- MGNM 578Document15 pagesMGNM 578Rashika guptaNo ratings yet

- NIO Final REPORTDocument29 pagesNIO Final REPORTRating AaNo ratings yet

- Qual CommDocument7 pagesQual CommAlvaroNo ratings yet

- Netflix Case AnalysisDocument13 pagesNetflix Case AnalysisTrishaIntrîgüeAarons100% (2)

- How To Boost AXP by 50 BillionDocument33 pagesHow To Boost AXP by 50 BillionnpapadokostasNo ratings yet

- Analysis of The Walt Disney CompanyDocument15 pagesAnalysis of The Walt Disney CompanygimbrinelNo ratings yet

- Commercial-Ratings White PaperDocument12 pagesCommercial-Ratings White PaperCarlos DebiasiNo ratings yet

- Qual CommDocument8 pagesQual CommAlvaroNo ratings yet

- New Markets Tax Credit Connection: Spring 2010 IssueDocument8 pagesNew Markets Tax Credit Connection: Spring 2010 IssueReznick Group NMTC PracticeNo ratings yet

- Netflix subscriber cash flow modelDocument7 pagesNetflix subscriber cash flow modelAnant Naidu100% (3)

- ISI - Cable & Satellite Initiations - Oct 2011Document139 pagesISI - Cable & Satellite Initiations - Oct 2011brettpevenNo ratings yet

- Netflix Case-1Document6 pagesNetflix Case-1Eliza Sankar-GortonNo ratings yet

- Netflix Inc. StratDocument8 pagesNetflix Inc. StratKenneth Llorera AbayonNo ratings yet

- Walt Disney Strategic CaseDocument28 pagesWalt Disney Strategic CaseArleneCastroNo ratings yet

- Case Study On Nikola SPACDocument22 pagesCase Study On Nikola SPACburhan100% (1)

- IJCRT2102208Document16 pagesIJCRT2102208Diya LalwaniNo ratings yet

- Global Video Index Reveals Rising Tide of Online Content in Q4 2017Document24 pagesGlobal Video Index Reveals Rising Tide of Online Content in Q4 2017Vinh LươngNo ratings yet

- Ism PPT NetflixDocument14 pagesIsm PPT NetflixAnushree SrivastavaNo ratings yet

- Content Deep Dive and Recent Media and Ad TrendsDocument101 pagesContent Deep Dive and Recent Media and Ad TrendsDerek HsuNo ratings yet

- Project Report On Netflix: By, R P Preethi Iii BbaDocument12 pagesProject Report On Netflix: By, R P Preethi Iii BbaPreethi RaviNo ratings yet

- Barro Week9ReportDocument3 pagesBarro Week9ReportFiona Ashford S. BarroNo ratings yet

- Zillow's Uphill Battle To Attach Mortgages - Mike DelPrete - InmanDocument7 pagesZillow's Uphill Battle To Attach Mortgages - Mike DelPrete - InmanMax de FreitasNo ratings yet

- CB Insights Electric Vehicles WebinarDocument72 pagesCB Insights Electric Vehicles WebinarFred Lamert100% (3)

- Digital Media and Internet Sector Update - Spring 2012 FinalDocument52 pagesDigital Media and Internet Sector Update - Spring 2012 Finalstupac7864No ratings yet

- Virgin Media Inc.: NeutralDocument7 pagesVirgin Media Inc.: NeutralSumayyah ArslanNo ratings yet

- Netflix Summative 2Document15 pagesNetflix Summative 2akhil paulNo ratings yet

- Capital Budgeting SlidesDocument57 pagesCapital Budgeting SlidesCatherine SelladoNo ratings yet

- Netflix 1Document22 pagesNetflix 1shikhayadav1911No ratings yet

- 2009-01-06 - Broadcast & Outdoor 2009 Outlook (WACH)Document12 pages2009-01-06 - Broadcast & Outdoor 2009 Outlook (WACH)Jonathan ShawNo ratings yet

- In A Challenge To TiVo, DirecTV Promotes Its Own Box - The New York TimesDocument2 pagesIn A Challenge To TiVo, DirecTV Promotes Its Own Box - The New York TimesDan EnzmingerNo ratings yet

- Assignment 2 ReportDocument18 pagesAssignment 2 Reportsushant singhNo ratings yet

- Netflix's New Low-Cost Ad Plan With MicrosoftDocument5 pagesNetflix's New Low-Cost Ad Plan With MicrosoftRegina RamirezNo ratings yet

- netflix equity analysis reportDocument15 pagesnetflix equity analysis reportapi-739767325No ratings yet

- Market Analysis Report NetflixDocument10 pagesMarket Analysis Report NetflixsantamargaritaNo ratings yet

- Soalan FinanceDocument27 pagesSoalan FinanceNur Ain SyazwaniNo ratings yet

- 09 Task Performance 1 Netflix Inc. Strategic ManagementDocument13 pages09 Task Performance 1 Netflix Inc. Strategic ManagementAnn AcobaNo ratings yet

- Venture Capital 101 PDFDocument38 pagesVenture Capital 101 PDFPhuong Chi Nguyen100% (2)

- FINAL Q1 22 Shareholder Letter (Netflix)Document12 pagesFINAL Q1 22 Shareholder Letter (Netflix)Melissa EckNo ratings yet

- Sustainable Industries NewsletterDocument4 pagesSustainable Industries Newsletteramitjain310No ratings yet

- Netflix ThesisDocument7 pagesNetflix Thesisdnr8hw9w100% (2)

- Viacom Stahl ReportDocument19 pagesViacom Stahl ReportmattdoughNo ratings yet

- Edited Transcript: Refinitiv StreeteventsDocument19 pagesEdited Transcript: Refinitiv StreeteventsalexisNo ratings yet

- 1 Case Blaine KitchenwareDocument11 pages1 Case Blaine Kitchenware鄭小麗100% (1)

- NetflixDocument4 pagesNetflixdsioridzeNo ratings yet

- Value Investing Congress Presentation-Tilson-10!1!12Document93 pagesValue Investing Congress Presentation-Tilson-10!1!12VALUEWALK LLCNo ratings yet

- Zeke Ashton Apples To ApplesDocument30 pagesZeke Ashton Apples To ApplesValueWalk100% (1)

- Home Capital Group Initiating Coverage (HCG-T)Document68 pagesHome Capital Group Initiating Coverage (HCG-T)Zee MaqsoodNo ratings yet

- Solow V SolowDocument1 pageSolow V SolowKate TaylorNo ratings yet

- Solow V JenkinsDocument4 pagesSolow V JenkinsKate TaylorNo ratings yet

- Stefan Soloviev Et Al V Jane Doe SUMMONS COMPLAINT 1Document11 pagesStefan Soloviev Et Al V Jane Doe SUMMONS COMPLAINT 1Kate TaylorNo ratings yet

- Pizza Hut Filing Sept 20Document35 pagesPizza Hut Filing Sept 20Kate TaylorNo ratings yet

- Chick Fil A Disabilities Drive ThruDocument19 pagesChick Fil A Disabilities Drive ThruKate TaylorNo ratings yet

- Maria Resendiz CalOSHA ComplaintDocument4 pagesMaria Resendiz CalOSHA ComplaintKate TaylorNo ratings yet

- Beauford Texas V Chick Fil ADocument18 pagesBeauford Texas V Chick Fil AKate TaylorNo ratings yet

- Stefan Soloviev Et Al V Ross School Et AlDocument1 pageStefan Soloviev Et Al V Ross School Et AlKate TaylorNo ratings yet

- ComplaintDocument2 pagesComplaintKate TaylorNo ratings yet

- NPC Filing Sept 22Document24 pagesNPC Filing Sept 22Kate TaylorNo ratings yet

- Kim K Vs Missguided PDFDocument89 pagesKim K Vs Missguided PDFKate TaylorNo ratings yet

- Rent ComplaintDocument5 pagesRent ComplaintKate TaylorNo ratings yet

- Global Baristas LawsuitsDocument3 pagesGlobal Baristas LawsuitsKate TaylorNo ratings yet

- Maria Resendiz CalOSHA ComplaintDocument4 pagesMaria Resendiz CalOSHA ComplaintKate TaylorNo ratings yet

- JAB Keurig ComplaintDocument13 pagesJAB Keurig ComplaintKate TaylorNo ratings yet

- Avenatti BankruptcyDocument1 pageAvenatti BankruptcyKate Taylor100% (1)

- May PlanDocument1 pageMay PlanKate TaylorNo ratings yet

- WarrantDocument2 pagesWarrantKate TaylorNo ratings yet

- Yogurt ComplaintDocument4 pagesYogurt ComplaintKate TaylorNo ratings yet

- Counter Case KeurigDocument22 pagesCounter Case KeurigKate TaylorNo ratings yet

- 2018 Global Baristas Annual ReportDocument2 pages2018 Global Baristas Annual ReportKate TaylorNo ratings yet

- Filed Against Global BaristasDocument1 pageFiled Against Global BaristasKate TaylorNo ratings yet

- ComplaintDocument6 pagesComplaintKate TaylorNo ratings yet

- Mcqs On ForexDocument62 pagesMcqs On ForexRaushan Ratnesh70% (20)

- Chapter 8: The Mathematics of Finance: Learner'S Module: Mathematics in The Modern WorldDocument6 pagesChapter 8: The Mathematics of Finance: Learner'S Module: Mathematics in The Modern Worldchibbs1324100% (2)

- LIBOR Transition A Practical Guide August 2020 EditionDocument31 pagesLIBOR Transition A Practical Guide August 2020 EditionmartaNo ratings yet

- Unit 1 Acf 255 ADocument32 pagesUnit 1 Acf 255 AAugustine Kwadjo GyeningNo ratings yet

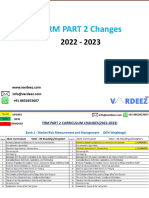

- Macro Curriculum Changes 2023 Part 2Document6 pagesMacro Curriculum Changes 2023 Part 2Al VelNo ratings yet

- Ey Pe Capital Briefing SeptDocument22 pagesEy Pe Capital Briefing SeptgreenpostitNo ratings yet

- Hadian 2020Document20 pagesHadian 2020valentina raniNo ratings yet

- Philippine Government Accounting StandardsDocument9 pagesPhilippine Government Accounting StandardsShien AgucayNo ratings yet

- Issues and Redemption LiabilitiesDocument75 pagesIssues and Redemption LiabilitiesOckouri BarnesNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- F6mys Jun 2011 QuDocument10 pagesF6mys Jun 2011 Qutoushiga100% (1)

- Hedge Funds, Credit Risk and Financial StabilityDocument199 pagesHedge Funds, Credit Risk and Financial Stabilitybenhadhram100% (2)

- Chapter 1 - Overview of FinanceDocument70 pagesChapter 1 - Overview of FinancePhuonganh LeNo ratings yet

- Customizing For Hedge Management: Hedging ClassificationDocument13 pagesCustomizing For Hedge Management: Hedging ClassificationDillip Kumar mallickNo ratings yet

- A Study On Multi-Variate Financial Statement Analysis of Amazon and EbayDocument14 pagesA Study On Multi-Variate Financial Statement Analysis of Amazon and EbayNisrine HafidNo ratings yet

- Purchases and Sales Exercises (Accounting)Document27 pagesPurchases and Sales Exercises (Accounting)ScribdTranslationsNo ratings yet

- Laporan Penjualan Crusher dan Keuangan CV Maju JayaDocument8 pagesLaporan Penjualan Crusher dan Keuangan CV Maju JayaHaikal KhanNo ratings yet

- Scotia Sensitivities DeckDocument22 pagesScotia Sensitivities DeckForexliveNo ratings yet

- Final Ojt ReportDocument57 pagesFinal Ojt ReportLove GumberNo ratings yet

- Corporate Governance Presentation on Fortis HospitalDocument9 pagesCorporate Governance Presentation on Fortis HospitalRahul kumarNo ratings yet

- ShopriteDocument1 pageShopriteAlrexie pgNo ratings yet

- Top visa interview questions for UK studyDocument2 pagesTop visa interview questions for UK studyBijita Dhungana100% (2)

- Preliminary Due Diligence ChecklistDocument7 pagesPreliminary Due Diligence Checklistekatamadze1972No ratings yet

- MBC - 307 - Session 1Document15 pagesMBC - 307 - Session 1Devina DevNo ratings yet

- Full download book Managerial Economics Pdf pdfDocument21 pagesFull download book Managerial Economics Pdf pdfmelinda.wilson841100% (15)

- Final Assesment: I. Problem SolvingDocument12 pagesFinal Assesment: I. Problem SolvingKaren Nicole Borreo MaddelaNo ratings yet

- DisclaimerDocument13 pagesDisclaimerAK CREATIONSNo ratings yet

- Financial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Document4 pagesFinancial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Diamante GomezNo ratings yet

- Fred Forum 2018Document16 pagesFred Forum 2018Dexie Cabañelez ManahanNo ratings yet

- Introduction to the Strategic Plan for a Merchandising StoreDocument24 pagesIntroduction to the Strategic Plan for a Merchandising StoreVictoria Quebral Carumba100% (1)