Professional Documents

Culture Documents

Appendix 34 - Instructions - RCD

Appendix 34 - Instructions - RCD

Uploaded by

Joann Saballero HamiliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix 34 - Instructions - RCD

Appendix 34 - Instructions - RCD

Uploaded by

Joann Saballero HamiliCopyright:

Available Formats

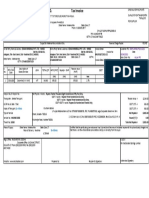

Appendix 34

REPORT OF COLLECTIONS AND DEPOSITS

(RCD)

INSTRUCTIONS

A. The Collecting Officers/Liquidating Officers/Treasurer/Cashier shall prepare this report to

record his/her collections and deposits to an AGDB as of specific date and shall be

maintained by fund cluster.

B. It shall be accomplished as follows:

1. LGU – name of the local government unit

2. Fund – fund name in which the collections and deposits are attributable to

3. Name of Accountable Officer – name of the accountable officer

4. Report No. – shall be numbered one series for each year as follows:

00-00-000

Serial number (one series per year)

Month

Year

5. Sheet No. – page number of the report which shall be series for each month

6. Date – date covered by the report

7. COLLECTIONS –

For Collectors

a. Type (Form No.) - type of official receipts used

b. Official Receipt/Serial No. (From ___ To ___ ) – serial number of the Official

Receipts issued by the Treasurer/Accountable Officer including the cancelled

ones in chronological and numerical sequence

c. Amount – amount of collections received

For Liquidating Officers/Treasurers

a. Name of Accountable Officer – the name of collector/accountable officer

remitting the collections

b. Report No. – the reference number of the Report of Collections and Deposits of

the Collector, bearing the collector no. and the series

c. Amount – amount of collections received from collectors/liquidating officers,

taxpayers and other sources

8. REMITTANCES/DEPOSITS –

a. Bank –the name of the depository bank

b. Reference – reference documents used as basis in the remittance/deposit of the

collections like the RCD number/deposit slip.

c. Amount – amount of remittances/deposits

9. ACCOUNTABILITY FOR ACCOUNTABLE FORMS

a. Name of Forms & No. - the name(s) of the form(s) (checks/official

receipts/etc.) for which this report is being made shall be written in the boxes

provided

b. Qty. and Serial no. – the quantity and the corresponding serial numbers of the

forms on hand at the start of the period; those received, and those issued or

Appendix 34

transferred during the period covered; and the balance at the end of the period

shall be entered in these columns.

10. SUMMARY OF COLLECTIONS AND REMITTANCES/DEPOSITS - A summary

shall be prepared as shown in the report.

11. Certification – shall be signed by the Accountable Officer preparing the report.

12. Verification and Acknowledgement – shall be signed by the Treasurer/Liquidating

Officer receiving the RCD and corresponding remittances. In case of RCD of the

Local Treasurer, this portion shall no longer be filled up. However, the validated

deposit slip/remittance advice from the bank shall be attached to the report.

13. Accounting Entries:

i. Particulars – describes the transaction and the account titles of the accounts used.

ii. Account – account code

iii. Debit – the amount debited

iv. Credit – the amount credited

The preparer of the accounting entries and the certifying officer as to the correctness of

the accounting entries shall sign the appropriate space provided.

C. Collections should be deposited intact daily. The balance of collections not deposited during

the day due to cut-off should be deposited on the first banking hour of the next working day.

D. This report shall be prepared in four (4) copies to be distributed as follows:

Original – Cash Treasury/Unit, together with the duplicate copy of the ORs and

validated DSs

Copy 2 – COA Auditor thru the Accounting Division/Unit of Central/Regional/

Division Office concerned,

Copy 3 – Accounting Division/Unit of Central/Regional/Division Office

concerned to be attached to the copy of the JV

Copy 4 – Collecting Officer's/Teller’s file

You might also like

- Audit ProgramsDocument492 pagesAudit ProgramsNa-na Bucu100% (7)

- Appendix 40 - Instructions - RSMIDocument2 pagesAppendix 40 - Instructions - RSMIhehehedontmind me100% (2)

- Appendix 40 - Instructions - RSMIDocument2 pagesAppendix 40 - Instructions - RSMIhehehedontmind me100% (2)

- Prodcure ManualDocument23 pagesProdcure ManualpateljayaminNo ratings yet

- Policies ManualDocument23 pagesPolicies Manualpateljayamin100% (1)

- Appendix 35 - Instructions - RCIDocument2 pagesAppendix 35 - Instructions - RCITesa GD100% (1)

- Disbursements by CashDocument6 pagesDisbursements by CashAG R OhcnaNo ratings yet

- Appendix 12 - Instructions - NORSADocument2 pagesAppendix 12 - Instructions - NORSATesa GD100% (2)

- San Roque v. CIR, GR 180345Document6 pagesSan Roque v. CIR, GR 180345amareia yapNo ratings yet

- International Business Environments and Operations Fifteenth Edition Chapter 3Document2 pagesInternational Business Environments and Operations Fifteenth Edition Chapter 3Moiz Anwar88% (8)

- Appendix 31 - DVDocument2 pagesAppendix 31 - DVhehehedontmind me100% (1)

- Sample Audit Program - Cash Disbursing OfficersDocument3 pagesSample Audit Program - Cash Disbursing OfficersYnnejesor Aruges100% (1)

- Appendix 27 - Instructions - CRRegDocument2 pagesAppendix 27 - Instructions - CRRegTesa GDNo ratings yet

- Accounting For Government and Not-For-Profit Organizations: ACCO 30033Document24 pagesAccounting For Government and Not-For-Profit Organizations: ACCO 30033hehehedontmind me100% (1)

- Articles of Incorporation-OPCDocument4 pagesArticles of Incorporation-OPCTLC LawFirm100% (1)

- NCR Cup 6 - Afar: Lina Mina NinaDocument2 pagesNCR Cup 6 - Afar: Lina Mina Ninahehehedontmind meNo ratings yet

- Appointment Letter Dilip6122018Document2 pagesAppointment Letter Dilip6122018kiranNo ratings yet

- NLRC CasesDocument123 pagesNLRC CasesKimberly Ramos100% (1)

- Instructions: Report of Collections and Deposits (RCD)Document1 pageInstructions: Report of Collections and Deposits (RCD)Joseph PamaongNo ratings yet

- Appendix 26 - Instructions - RCDDocument2 pagesAppendix 26 - Instructions - RCDthessa_starNo ratings yet

- Appendix 42 - Instructions - SUCDocument1 pageAppendix 42 - Instructions - SUCJohn Jade JaymeNo ratings yet

- Journal Entry Voucher (Jev) : Liquidation Report (LR)Document4 pagesJournal Entry Voucher (Jev) : Liquidation Report (LR)Mariechi BinuyaNo ratings yet

- Report of Collections and RemittancesDocument2 pagesReport of Collections and Remittancesbarangaysecretary18No ratings yet

- Appendix 44 - Instructions - LRDocument1 pageAppendix 44 - Instructions - LRpdmu regionix100% (1)

- Appendix 38 - Instructions - RCIDocument2 pagesAppendix 38 - Instructions - RCIhehehedontmind meNo ratings yet

- Appendix 39 - Instructions - RCDisbDocument1 pageAppendix 39 - Instructions - RCDisbhehehedontmind meNo ratings yet

- Appendix 37 - Instructions - RADAIDocument2 pagesAppendix 37 - Instructions - RADAIhehehedontmind meNo ratings yet

- Appendix 13 - Instructions - RADAIDocument1 pageAppendix 13 - Instructions - RADAIthessa_starNo ratings yet

- A-36 CKDRDocument1 pageA-36 CKDRErica DascoNo ratings yet

- Appendix 41 - Instructions - RCDisbDocument1 pageAppendix 41 - Instructions - RCDisbTesa GD100% (2)

- Appendix 37 - Instructions - CBRegDocument1 pageAppendix 37 - Instructions - CBRegabbey89No ratings yet

- Appendix 12 - Instructions - NORSADocument1 pageAppendix 12 - Instructions - NORSApdmu regionixNo ratings yet

- Cash Receipts Record (Crrec) : InstructionsDocument1 pageCash Receipts Record (Crrec) : InstructionsdinvNo ratings yet

- Appendix 28 - Instructions - OPDocument1 pageAppendix 28 - Instructions - OPthessa_starNo ratings yet

- Appendix 67 - Instructions - RAAFDocument1 pageAppendix 67 - Instructions - RAAFRichelle PascorNo ratings yet

- Cash Disbursements Register (Cdreg) : InstructionsDocument1 pageCash Disbursements Register (Cdreg) : InstructionsLyka Mae Palarca IrangNo ratings yet

- Accounting Reports PreparationDocument23 pagesAccounting Reports Preparationcao.lilydawnfNo ratings yet

- C2003 006 InstructionsDocument5 pagesC2003 006 InstructionsJekBrionesNo ratings yet

- Instructions - GLDocument1 pageInstructions - GLTirailleurNo ratings yet

- A-57 PCRRDocument1 pageA-57 PCRRErica DascoNo ratings yet

- Accounting Reports PreparationDocument23 pagesAccounting Reports Preparationcao.lilydawnfNo ratings yet

- Appendix 54 - Instructions - SAPDocument1 pageAppendix 54 - Instructions - SAPpdmu regionixNo ratings yet

- Appendix 39 - Instructions - ACICDocument2 pagesAppendix 39 - Instructions - ACICTesa GDNo ratings yet

- Appendix 2 - Instructions - CRJDocument1 pageAppendix 2 - Instructions - CRJPayie PerezNo ratings yet

- Appendix 49 - Instructions - RPPCVDocument1 pageAppendix 49 - Instructions - RPPCVCENTRAL OFFICE ACCOUNTINGNo ratings yet

- Financial MNGT Sir BACAYDocument35 pagesFinancial MNGT Sir BACAYBfp Car TublayNo ratings yet

- A-59 RsmiDocument2 pagesA-59 RsmiJessa Mae LaynesaNo ratings yet

- Appendix 30 - Instructions - RANCADocument1 pageAppendix 30 - Instructions - RANCApdmu regionixNo ratings yet

- Check Disbursements Journal (CKDJ) : InstructionsDocument1 pageCheck Disbursements Journal (CKDJ) : Instructionsabbey89No ratings yet

- Advice To Debit Account Disbursements Journal (Adadj) : InstructionsDocument2 pagesAdvice To Debit Account Disbursements Journal (Adadj) : Instructionsabbey89No ratings yet

- Appendix 5 - Instructions - GLDocument1 pageAppendix 5 - Instructions - GLPayie PerezNo ratings yet

- Compilation of BFM FormsDocument118 pagesCompilation of BFM FormsMaricris BiscarraNo ratings yet

- Process Responsible Unit/Person Disbursements by ChecksDocument9 pagesProcess Responsible Unit/Person Disbursements by ChecksGie Bernal CamachoNo ratings yet

- A-22 AlobsDocument2 pagesA-22 Alobsjohnnygold2013No ratings yet

- 08 AnnexesDocument109 pages08 AnnexesCassieNo ratings yet

- A 21 Cashbook AdvancesDocument1 pageA 21 Cashbook AdvancesKatherine PacenoNo ratings yet

- Appendix 40 - Instructions - CDRecDocument1 pageAppendix 40 - Instructions - CDRecTesa GDNo ratings yet

- Appendix 77 - Instructions - CIPLCDocument1 pageAppendix 77 - Instructions - CIPLCdinvNo ratings yet

- Disbursements MommyDocument61 pagesDisbursements MommyLyn CarlosNo ratings yet

- Appendix 31 - Instructions - RANTADocument1 pageAppendix 31 - Instructions - RANTApdmu regionixNo ratings yet

- Rocedures: These Policies and Procedures May Be Revised, Subject To Board ApprovalDocument23 pagesRocedures: These Policies and Procedures May Be Revised, Subject To Board ApprovalpateljayaminNo ratings yet

- Cash Book (Cash in Treasury)Document1 pageCash Book (Cash in Treasury)Katherine PacenoNo ratings yet

- Index of Payments (Ip) : Gross Amount - DeductionsDocument1 pageIndex of Payments (Ip) : Gross Amount - DeductionsErica DascoNo ratings yet

- Appendix 42 - Instructions - LDDAP-ADADocument2 pagesAppendix 42 - Instructions - LDDAP-ADATesa GD67% (3)

- Fund - Fund Name/code: Cash Disbursements Journal (CDJ)Document1 pageFund - Fund Name/code: Cash Disbursements Journal (CDJ)KristineMarzanNo ratings yet

- 6 - Notes On Government AccountingDocument6 pages6 - Notes On Government AccountingLabLab ChattoNo ratings yet

- Appendix 15 - Instructions - NBURSADocument1 pageAppendix 15 - Instructions - NBURSALian Blakely CousinNo ratings yet

- Appendix 39 - Instructions - RCDisbDocument1 pageAppendix 39 - Instructions - RCDisbhehehedontmind meNo ratings yet

- Appendix 38 - Instructions - RCIDocument2 pagesAppendix 38 - Instructions - RCIhehehedontmind meNo ratings yet

- Appendix 32 - Instructions - PayrollDocument2 pagesAppendix 32 - Instructions - Payrollhehehedontmind meNo ratings yet

- Cash Journal: Month - Agency - Fund - Sheet No.Document7 pagesCash Journal: Month - Agency - Fund - Sheet No.hehehedontmind meNo ratings yet

- Appendix 36 Authority To Debit AccountDocument1 pageAppendix 36 Authority To Debit Accounthehehedontmind meNo ratings yet

- Appendix 32 - PayrollDocument2 pagesAppendix 32 - Payrollhehehedontmind meNo ratings yet

- Appendix 37 - Instructions - RADAIDocument2 pagesAppendix 37 - Instructions - RADAIhehehedontmind meNo ratings yet

- Petty Cash Voucher: Appendix 33Document2 pagesPetty Cash Voucher: Appendix 33hehehedontmind meNo ratings yet

- Report of Collections and Deposits: AppendixDocument3 pagesReport of Collections and Deposits: Appendixhehehedontmind me100% (1)

- Certification On Appropriations, Funds and Obligation of AllotmentDocument1 pageCertification On Appropriations, Funds and Obligation of Allotmenthehehedontmind meNo ratings yet

- Appendix 28 - Instructions - CAFOADocument1 pageAppendix 28 - Instructions - CAFOAhehehedontmind me100% (1)

- Issolution of A Artnership Firm: 1995 A1 HC 1863 (Bom) AIR 1989 Cal 254Document4 pagesIssolution of A Artnership Firm: 1995 A1 HC 1863 (Bom) AIR 1989 Cal 254Rakesh SahuNo ratings yet

- GP Fund Form CDocument2 pagesGP Fund Form CIrfan ArifNo ratings yet

- Booking SlipDocument10 pagesBooking Slipmuhammad jamshedNo ratings yet

- CPGET - 2020: Osmania University - HyderabadDocument3 pagesCPGET - 2020: Osmania University - HyderabadMarumamula Santosh KumarNo ratings yet

- Individual Attendance History Unit JAL-Knitting-1: This Is Kormee™ Generated ReportDocument1 pageIndividual Attendance History Unit JAL-Knitting-1: This Is Kormee™ Generated Reportshaikh md.kamruzzamanNo ratings yet

- Mashumi Sankhe - MBA 5010 CSRDocument6 pagesMashumi Sankhe - MBA 5010 CSRMashumi SankheNo ratings yet

- Theme 10-Colonialism QBDocument2 pagesTheme 10-Colonialism QBShad ChoudharyNo ratings yet

- Internship Project (Repaired)Document47 pagesInternship Project (Repaired)Nahim MalikNo ratings yet

- Dynamics 365 Service ComplianceDocument3 pagesDynamics 365 Service Compliancevivekrajan3No ratings yet

- Saudi Aramco Test Report: Radiography Interpretation (To Be Filled in by The Responsible RTFI)Document2 pagesSaudi Aramco Test Report: Radiography Interpretation (To Be Filled in by The Responsible RTFI)mmmNo ratings yet

- Company Profile: Surya Roshni Limited (Formerly Prakash Surya Roshni Limited) IsDocument11 pagesCompany Profile: Surya Roshni Limited (Formerly Prakash Surya Roshni Limited) IsMahesh KumarNo ratings yet

- Regulations and Guidelines For Redevelopment of Exisping Planned Industrial Area1Document4 pagesRegulations and Guidelines For Redevelopment of Exisping Planned Industrial Area1naveenarora298040No ratings yet

- Reorientasi Usaha Pegadaian Swasta Sebagai Upaya Keseimbangan Hubungan Hukum para Pihak Di IndonesiaDocument15 pagesReorientasi Usaha Pegadaian Swasta Sebagai Upaya Keseimbangan Hubungan Hukum para Pihak Di IndonesiaGhanestyaNo ratings yet

- Judge Marc Van Der Woude IBC PresentationDocument18 pagesJudge Marc Van Der Woude IBC PresentationTrevor SoamesNo ratings yet

- Company Profile Merged MergedDocument71 pagesCompany Profile Merged MergedLaavanyah ManimaranNo ratings yet

- 20 Poush 2079 BlastDocument4 pages20 Poush 2079 BlastMishal LimbuNo ratings yet

- Kmu Cat23 FormDocument1 pageKmu Cat23 FormUbaid UllahNo ratings yet

- Regulations Regarding Grant of Certificates of Competency To Wireman andDocument10 pagesRegulations Regarding Grant of Certificates of Competency To Wireman andsalmanNo ratings yet

- Electrosteel Castings Limited. Tax InvoiceDocument1 pageElectrosteel Castings Limited. Tax InvoiceArvind SrivastavaNo ratings yet

- Eixo Interm MontagemDocument22 pagesEixo Interm MontagemGomes PereiraNo ratings yet

- Final RFP - Headhunting NITB EDDocument37 pagesFinal RFP - Headhunting NITB EDEurocodesign Civil Structural EngineersNo ratings yet

- CC-308 Industrial Law 2022Document2 pagesCC-308 Industrial Law 2022Prem BhojwaniNo ratings yet

- Corruption in India - WikipediaDocument8 pagesCorruption in India - Wikipediaindhu mathiNo ratings yet

- Incentives and Benefits Available To Ssi Entrepreneurs 1Document8 pagesIncentives and Benefits Available To Ssi Entrepreneurs 1veenagadennavarNo ratings yet

- GST-CHALLAN (13) KPDocument2 pagesGST-CHALLAN (13) KPacpandey.lawfirmNo ratings yet