Professional Documents

Culture Documents

Accounting Subject

Accounting Subject

Uploaded by

Cezanne Pi-ay EckmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Subject

Accounting Subject

Uploaded by

Cezanne Pi-ay EckmanCopyright:

Available Formats

College of Accountancy

PARTNERSHIP OPERATION

Contents:

3.1. Rules for the Distribution of Profits and Losses

3.2. Basis for Distribution of Profits and Losses

3.3. Correction of Errors

3.4. Partnership’s Income Statement

Lesson 3.1 Rules for the Distribution of Profits and losses

1. Profits

a. The profits will be divided according to partners’ agreement.

b. If there is no agreement:

As to capitalist partners, the profits shall be divided according to their capital

contributions (according to the ratio of original investments or in its absence, the ratio

of capital balances at the beginning of the year).

As to industrial partners (if any), such share as may be just and equitable under the

circumstances, provided, that the industrial partner shall receive such share before the

capitalist partners shall divide the profits.

2. Losses

a. The losses will be divided according to the partners’ agreement.

b. If there is no agreement as to the distribution of losses but there is an agreement as to

profits, the losses shall be divided according to the profit sharing ratio.

c. In the absence of any agreement:

As to capitalist partners, the losses shall be divided according to their capital

contributions (according to the ratio of original capital investments or in its absence,

the ratio of capital balances at the beginning of the year).

As to purely industrial partners (if there’s any), shall not be liable for any losses.

The industrial partner is not liable for losses because he cannot withdraw the work or labor

already done by him, unlike the capitalist partners who can withdraw their capital. In addition, if

the partnership failed to realize any profits, then he has labored in vain and in real sense, he has

already contributed his share in the loss.

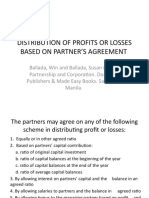

Lesson 3.2 Basis for Distribution of Profit and Losses

The partners may agree on any of the following scheme in distributing profits and losses:

1. Equally or in other agreed ratio

2. Based on partners’ capital contributions:

a. Ratio of original capital investments

b. Ratio of capital balances at the beginning of the year

c. Ratio of capital balances at the end of the year

d. Ratio of average capital balances

3. By allowing interest on partners’ capital and balance in an agreed ratio.

4. By allowing salaries to partner’s capital and the balance in an agreed ratio

5. By allowing bonus to the managing partner based on profit and the balance in an

agreed ratio

6. By allowing salaries, interest on partners’ capital, bonus to the managing partner and

the balance in an agreed ratio.

Salaries (S) – normally, an industrial partner receives salary in addition to his share in

the partnership’s profits as compensation for his services to the partnership.

Instructor: Orlando L. Ananey Page 1 of 7

College of Accountancy

Bonuses (B) – the managing partner may be entitled to a bonus for excellent management

performance. Unlike for salaries, a partner is entitled to a bonus only if the partnership

earns profit. The partner is not entitled to any bonus if the partnership incurs loss.

Bonus can be computed in various ways such as:

Based on net income (NI)

Formula: B = B% x NI

This is based on net income before deducting salaries, interest and bonus.

Based on net income after salaries, interest and bonus

Formula: B = B% x (NI – S – I – B)

Based on net income after salaries and interest

Formula: B = B% x (NI – S – I)

Based on net income after salaries and bonus

Formula: B = B% x (NI – S – B)

Based on net income after interest and bonus

Formula: B = B% x (NI – I – B)

Based on net income after salaries

Formula: B = B% x (NI – S)

Based on net income after interest

Formula: B = B% x (NI – I)

Based on net income after bonus

Formula: B = B% x (NI – B)

Interest on capital contributions (I) – the partnership agreement may stipulate that

capitalist partners are entitled to an annual interest on their capital contributions.

Note: Salaries, Interest and Bonuses are only tools in dividing the profits and should

never be treated as a company expense.

Illustration:

The following data are given in the books of Hobbs and Shaw Partnership for the year 20x1.

Hobbs, Capital Hobbs, Drawing

Jan. 1 400,000 Jan. – Dec.

April 1 100,000 60,000

Shaw, Capital Shaw, Drawing

July 1 Jan. 1 800,000 Jan. – Dec.

50,000 60,000

Income Summary

Dec. 31

300,000

The partnership contract provided that each partner may withdraw P5,000 on the last day of

each month; both partners did so during the year. The drawings are recorded by debits to the

partners’ drawing accounts and shall not be considered in the division of profit or loss.

Instructor: Orlando L. Ananey Page 2 of 7

College of Accountancy

Case 1: Equally or in Agreed Ratio

a. Equally

Income Summary 300,000

Hobbs, Capital 150,000

Shaw, Capital 150,000

To record the division of

profits

b. Assume instead that the partnership had a loss of 100,000

Hobbs, Capital 50,000

Shaw, Capital 50,000

Income Summary 100,000

To record the division of losses

c. Agreed Ratio (60:40)

Income Summary 300,000 Computation:

Hobbs, Capital 180,000 Hobbs: 60% x P300,000 = P180,000

Shaw, Capital 120,000 Shaw: 40% x P300,000 = P120,000

To record the division

of profits

Case 2: Based on Partner’s Capital Contributions

a. Ratio of Original Capital

Income Summary 300,000 Computation:

Hobbs, Capital 100,000 Hobbs: 400,000/1,200,000 x P300,000 =

Shaw, Capital 200,000 P100,000

To record the division Shaw: 800,000/1,200,000 x P300,000 =

of profits P200,000

b. Ratio of Capital at the Beginning of the Year

Income Summary 300,000 Computation:

Hobbs, Capital 100,000 Hobbs: 400,000/1,200,000 x P300,000 =

Shaw, Capital 200,000 P100,000

To record the division Shaw: 800,000/1,200,000 x P300,000 =

of profits P200,000

c. Ratio of Capital Balances at the End of the Year

Income Summary 300,000 Computation:

Hobbs, Capital 100,000 Hobbs: 500,000/1,250,000 x P300,000 =

Shaw, Capital 200,000 P120,000

To record the division Shaw: 750,000/1,250,000 x P300,000 =

of profits P180,000

d. Ratio of Average Capital Balances

Income Summary 300,000 Computation:

Hobbs, Capital 114,000 Hobbs: 475,000/1,250,000 x P300,000 =

Shaw, Capital 186,000 P114,000

To record the division Shaw: 775,000/1,250,000 x P300,000 =

of profits P186,000

Computation of Average Capital Balances

For the Year Ended Dec. 31, 20x1

Hobbs, Capital

Date Capital Portion of the Year Average Capital

Account Unchanged Balances

Balances

Jan. 1 P400,000 x 3/12 = P100,000

April 1 500,000 x 9/12 = 375,000

Instructor: Orlando L. Ananey Page 3 of 7

College of Accountancy

Average Capital P475,000

Shaw, Capital

Jan. 1 P800,000 x 6/12 = P400,00

July 1 750,000 x 6/12 = 375,000

Average Capital P775,000

Total Average P1,250,000

Capital

The agreement should state the amount of drawings each partner may make. These drawings

are considered temporary and are recorded as debits to the partner’s drawing account. Drawings

within the allowable amount will not affect the computation of the average capital balances. On

the contrary, drawings in excess of the allowable amount are considered permanent reductions in

capital; hence, the excess withdrawals affect the computation of the average capital balances.

Case 3: By Allowing Salaries, Interest on Capital, and Bonus to the Managing Partner and

the Balance in an Agreed Ratio

Assume that the profit for the year is P400,000 and the partnership agreement for the Hobbs and

Shaw Partnership provided the following:

1. Bonus to Hobbs of 25% of profit after salaries and interest but before bonus;

2. Annual salaries of P100,000 to Hobbs and P60,000 to Shaw;

3. 15% Interest on average capital account balances;

4. Balances to be divided in a ratio of 40:60.

Hobbs Shaw Total

Salary Allowances P100,000 P60,000 P160,000

15% Interest on Average Capital:

Hobbs: P475,000 x 15% 71,250

Shaw: P775,000 x 15% 116,250

Subtotal 187,500

Bonus [25% (P400,000 – P160,000 – 13,125 13,125

P187,500)]

Balance to be divided in the Ratio of 40:60

(P400,000 - P160,000 - P187,500 – P13,125

=P39,375): 15,750

Hobbs: P39,375 x 40% 23,625

Shaw: P39,375 x 60% 39,375

Share in the Partners in Profits P200,125 P199,875 P400,000

The journal entry to close the income summary ledger account on December 31, 2019 follows:

Income Summary 400,000

Hobbs, Capital 200,125

Shaw, Capital 199,875

To record the division

of profits

Lesson 3.3 Correction of Errors

Errors are omissions from and other misstatements of the entity’s financial statements.

Errors may occur as a result of mathematical mistakes, mistakes in applying accounting policies,

misinterpretation of facts or oversights.

a. Current Period Errors

Instructor: Orlando L. Ananey Page 4 of 7

College of Accountancy

Errors in the current period discovered in the current period before closing the books.

Accounting Treatment:

Should be reported by adjusting the income summary and affected assets and liabilities

before closing to partners’ capital.

b. Prior Period Errors

Prior period errors are omissions from and other misstatements of the entity’s financial

statements for one or more prior periods that are discovered in the current period.

Accounting Treatment:

Should be reported by adjusting the opening balances of partners’ capital and affected

assets and liabilities.

The correction of prior period error is excluded from profit or loss for the period in

which the error is discovered.

If an error resulted in an understatement of profit in previous period, a correcting

entry would be needed to increase Partners’ capital accounts.

If an error overstated profit in prior periods, then Partners’ capital accounts would

have to be decreased.

The effect of the error correction will be divided based on the applicable profit or loss

ratio during the year the error is related.

Illustration:

Andrew and Boy created a partnership to own and operate a health-food store. The

partnership agreement provided that Andrew receive a salary of P10,000 and Boy a salary of

P5,000 to recognize their relative time spent in operating the store. Remaining profits and losses

were divided 60:40 to Andrew and Boy. Income for 20x1, the first year of operations, of P13,000

was allocated P8,800 to Andrew and P4,200 to Boy.

On January 1, 20x2, the partnership agreement was changed to reflect the fact that Boy

could no longer devote time to the store’s operations. The new agreement allows Andrew a

salary of P18,000, and the remaining profits and losses are divided equally. In 20x2 an error was

discovered such that the 20x1 reported income was understated by P4,000. The partnership

income of P25,000 for 20x2 included the P4,000 related to year 20x1.

Analysis:

The distributed income in 20x1 is understated by P4,000. The partners received lesser

that what they should have received.

The income related to 20x2 is P21,000 (P25,000 – P4,000)

20x1 profit distribution is: 60:40 after providing P10,000 and P5,000 salary to Andrew

and Boy respectively.

20x2 profit distribution is: 50:50 after providing P18,000 salary to Andrew.

Instructor: Orlando L. Ananey Page 5 of 7

College of Accountancy

20x1 Division of Profits

Andrew Boy Total

Salary P10,000 P5,000 P15,000

Balance (60:40) (1,200) (800) (2,000)

Allocation of NI P8,000 P4,200 P13,000

Should be 20x1 Division of Profits

Andrew Boy Total

Salary P10,000 P5,000 P15,000

Balance (60:40) 1,200 800 2,000

Should be Allocation of NI P11,200 P5,800 P17,000 (13k + 4k)

Allocated NI (8,000) (4,200)

Additional Distribution to P2,400 P1,600

partners

Or simply divide using the ratio 60:40 = Andrew P2,400 (P4,000 x 60%); Boy P1,600

(P4,000 x 40%)

Note: The division basis used for the effect of prior period errors is the division basis

applicable to the year when the error is related.

20x2 Division of Profits

Andrew Boy Total

Salary P18,000 P-0- P18,000

Balance (60:40) 1,500 1,500 3,000

Allocation of NI P19,500 P1,500 P21,000

Total allocation of the P25,000

Andrew Boy Total

Allocation of NI P19,500 P1,500 P21,000

Allocated NI 2,400 1,600 4,000

P21,900 P3,100 P25,000

Journal Entries:

Various asset/liability accounts 4,000

Income Summary 21,000

Andrew, Capital 21,900

Boy, Capital 3,100

To record the division of profits

for 20x2 and the adjustment for

prior period errors.

Instructor: Orlando L. Ananey Page 6 of 7

College of Accountancy

Lesson 3.4 Partnership’s Income Statement

The form and content of the income statement of the partnership resemble those of the

sole proprietorship with the exception of the presentation of the division of profits or losses at the

lower portion of the statement.

Illustration:

ABC PARTNERSHIP

Income Statement

For the Period Ended December 31, 20x1

Revenue P100,000

Less: Expenses 50,000

Net Profit P50,000

Division of Profit (40:30:30)

Partner A P20,000

Partner B 15,000

Partner C 15,000

Total P50,000

Instructor: Orlando L. Ananey Page 7 of 7

You might also like

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 OperationsDocument5 pages01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Operationsjohn francisNo ratings yet

- Module Chapter12 FinalDocument19 pagesModule Chapter12 Finaljeremy bucayuNo ratings yet

- Acctg122 Chapter 2 ExercisesDocument5 pagesAcctg122 Chapter 2 ExercisesIce James Pachano100% (1)

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- Fundamentals of PartnershipsDocument6 pagesFundamentals of PartnershipsJobelle Candace Flores AbreraNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationKyla DizonNo ratings yet

- Chapter 4 Accounting For Partnership OperationsDocument35 pagesChapter 4 Accounting For Partnership OperationsJhazz Do100% (2)

- Module 3Document6 pagesModule 3trixie maeNo ratings yet

- Partnership OperationsDocument14 pagesPartnership OperationsShoyo HinataNo ratings yet

- 1.2. Partnership Operations and Distributions of Profits or LossesDocument4 pages1.2. Partnership Operations and Distributions of Profits or LossesKPoPNyx EditsNo ratings yet

- Partnership OperationsDocument4 pagesPartnership OperationsJEYA SHENNELLE ALLYSSANDREA CORTEZNo ratings yet

- Partnerships OperationsDocument44 pagesPartnerships Operationsmay villzNo ratings yet

- Chapter 3Document9 pagesChapter 3graceNo ratings yet

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- Partnership OperationsDocument5 pagesPartnership OperationsCrystal GaliciaNo ratings yet

- Partnership NotesDocument31 pagesPartnership NotesAimee100% (1)

- Pacoac LecturesDocument9 pagesPacoac LecturesKrystel Charizze VerzosaNo ratings yet

- Parcor 002Document17 pagesParcor 002Vincent Larrie MoldezNo ratings yet

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- OperationDocument6 pagesOperationKenncy50% (2)

- Partnership OperationsDocument27 pagesPartnership OperationsAbc xyzNo ratings yet

- FABM2 Week5Document14 pagesFABM2 Week5Hazel TolentinoNo ratings yet

- Chapter 5 PartnershipDocument10 pagesChapter 5 PartnershipMelkamu Dessie TamiruNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- Lecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017Document10 pagesLecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017sunflowerNo ratings yet

- 02 Partnership OperationDocument4 pages02 Partnership OperationRoland jamesNo ratings yet

- AST Discussion 2 - PARTNERSHIP OPERATIONDocument3 pagesAST Discussion 2 - PARTNERSHIP OPERATIONYvone Claire Fernandez SalmorinNo ratings yet

- 12th Partnership Revision SolutionDocument42 pages12th Partnership Revision Solutiongarima312006No ratings yet

- Partnership: TCC TacDocument5 pagesPartnership: TCC TacErika Faith HalladorNo ratings yet

- Distribution of Profits or Losses Based On Partner'sDocument20 pagesDistribution of Profits or Losses Based On Partner'sJOANNA ROSE MANALONo ratings yet

- Lesson 10 - Partnership OperationsDocument7 pagesLesson 10 - Partnership OperationsKatrina MarzanNo ratings yet

- Partnership OperationDocument20 pagesPartnership OperationNicole Gole CruzNo ratings yet

- Partnership Operation Quiz 1 Combined OnlineDocument7 pagesPartnership Operation Quiz 1 Combined OnlineZyka SinoyNo ratings yet

- No Solutions, No PointsDocument5 pagesNo Solutions, No PointsLois Yanzeigh Habbiling BalachaweNo ratings yet

- Partnership OperationsDocument13 pagesPartnership OperationsMaria Nicole OroNo ratings yet

- Chapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership InterestsDocument53 pagesChapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership Interestsgracerich20No ratings yet

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- AFAR 1 Exams 2020Document7 pagesAFAR 1 Exams 2020RJ Kristine DaqueNo ratings yet

- Accounting For ST - Activity 2Document8 pagesAccounting For ST - Activity 2Aretha Joi Domingo PrezaNo ratings yet

- Session 2 On Partnership: OPERATIONS Prepared By: Rañer S. Arañez, CPA Problem 1Document3 pagesSession 2 On Partnership: OPERATIONS Prepared By: Rañer S. Arañez, CPA Problem 1Cyra JimenezNo ratings yet

- Partnership Operations and Financial ReportingDocument45 pagesPartnership Operations and Financial ReportingChristine Joyce EnriquezNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- PARTNERSHIP OPERATIONS Lecture NotesDocument12 pagesPARTNERSHIP OPERATIONS Lecture NotesJean Pierre IsipNo ratings yet

- Accounting For Partnership Operations1Document30 pagesAccounting For Partnership Operations1Christine Mae MataNo ratings yet

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- Partnership OPERATIONS Handout PDFDocument3 pagesPartnership OPERATIONS Handout PDFRayne Andreana YuNo ratings yet

- Acst Examination Summary UnfinishedDocument23 pagesAcst Examination Summary Unfinishedchristianlatorre199No ratings yet

- Partnership Operations - 2021 Online ClassDocument38 pagesPartnership Operations - 2021 Online ClassAnne AlagNo ratings yet

- Module 2 - Partnership Operations and Financial ReportingDocument85 pagesModule 2 - Partnership Operations and Financial ReportingxxxNo ratings yet

- Integ02 A QuestionsDocument20 pagesInteg02 A QuestionsRonald CorunoNo ratings yet

- ACT115 - Topic 6Document6 pagesACT115 - Topic 6Le MinouNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- 02 Lesson 2 - Partnership Operations and Financial ReportingDocument12 pages02 Lesson 2 - Partnership Operations and Financial ReportingZAIL JEFF ALDEA DALENo ratings yet

- Financial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreDocument17 pagesFinancial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreMaryjoy NemenoNo ratings yet

- Partnership OperationsDocument3 pagesPartnership OperationsAra AlcantaraNo ratings yet

- Biboso&Racines WILEYDocument20 pagesBiboso&Racines WILEYLouise BattungNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Lesson 16 Job Order CostingDocument3 pagesLesson 16 Job Order CostingMark TaysonNo ratings yet

- Lesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsDocument8 pagesLesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsMark TaysonNo ratings yet

- Lesson 14 Audit SamplingDocument9 pagesLesson 14 Audit SamplingMark TaysonNo ratings yet

- Lesson 16 Considering Work of Other PractitionersDocument7 pagesLesson 16 Considering Work of Other PractitionersMark TaysonNo ratings yet

- Lesson 2 Auditing OverviewDocument2 pagesLesson 2 Auditing OverviewMark TaysonNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- Lesson 8 Identifying and Assessing The ROMMDocument5 pagesLesson 8 Identifying and Assessing The ROMMMark TaysonNo ratings yet

- Lesson 1 Assurance EngagementsDocument7 pagesLesson 1 Assurance EngagementsMark TaysonNo ratings yet

- Lesson 6 Pre-Engagement ActivitiesDocument5 pagesLesson 6 Pre-Engagement ActivitiesMark TaysonNo ratings yet

- Lesson 3 Financial Statements AuditDocument5 pagesLesson 3 Financial Statements AuditMark TaysonNo ratings yet

- Lesson 4 Professional StandardsDocument8 pagesLesson 4 Professional StandardsMark TaysonNo ratings yet

- Lesson 10 Understanding The Entity and Its EnvironmentDocument8 pagesLesson 10 Understanding The Entity and Its EnvironmentMark TaysonNo ratings yet

- 5 Long-Term Construction ContractDocument12 pages5 Long-Term Construction ContractMark TaysonNo ratings yet

- 4 Revenue From Contracts With Customers (PFRS 15)Document11 pages4 Revenue From Contracts With Customers (PFRS 15)Mark TaysonNo ratings yet

- Chapter 4 Review KEYDocument4 pagesChapter 4 Review KEYMark TaysonNo ratings yet

- 1d Partnership LiquidationDocument8 pages1d Partnership LiquidationMark TaysonNo ratings yet

- 2 Corporate LiquidationDocument12 pages2 Corporate LiquidationMark Tayson100% (1)

- 1c Partnership DissolutionDocument9 pages1c Partnership DissolutionMark TaysonNo ratings yet

- Case Study 2 HRMDocument3 pagesCase Study 2 HRMrienahsanari99No ratings yet

- Ejercicio de Scary StoryDocument4 pagesEjercicio de Scary StoryRamhiroCarphioNo ratings yet

- Bad Sex: Lessons For LifeDocument3 pagesBad Sex: Lessons For Lifestefanaserafina9421No ratings yet

- Eight-Step Strategic Plan - FJVDocument17 pagesEight-Step Strategic Plan - FJVapi-487889494No ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Shop Drawing Check List (HVAC)Document1 pageShop Drawing Check List (HVAC)Satya N.GNo ratings yet

- Players LotteryDocument14 pagesPlayers LotteryUtpal Kumar TalukderNo ratings yet

- Stuti Black Book Final PrintingDocument72 pagesStuti Black Book Final PrintingSiddhant PatilNo ratings yet

- Pakistan Nursing Council Pakistan Nursing Council Pakistan Nursing CouncilDocument2 pagesPakistan Nursing Council Pakistan Nursing Council Pakistan Nursing CouncilHameed Khan100% (2)

- Statement 20230629130645Document8 pagesStatement 20230629130645Bura MahendraNo ratings yet

- Notes On OrthodoxyDocument48 pagesNotes On OrthodoxyTrevor PetersonNo ratings yet

- Bloomberg 2Document10 pagesBloomberg 2RG ViewerNo ratings yet

- Mistake: English Law: To Their Original Positions As If The Contract Has Been PerformedDocument38 pagesMistake: English Law: To Their Original Positions As If The Contract Has Been Performed承艳100% (1)

- I. Map of GhanaDocument18 pagesI. Map of GhanaAngel GrospeNo ratings yet

- Basic Democracies 1959: Historical BackgroundDocument3 pagesBasic Democracies 1959: Historical BackgroundEishaAnwarCheema100% (3)

- Macroeconomics 9th Edition Mankiw Test Bank DownloadDocument40 pagesMacroeconomics 9th Edition Mankiw Test Bank DownloadEric Gaitor100% (29)

- Final Assignment: Introduction To Sociology Soc101.10Document5 pagesFinal Assignment: Introduction To Sociology Soc101.10Navila FarhanaNo ratings yet

- Nicanor Perlas - Platform For GovernanceDocument31 pagesNicanor Perlas - Platform For GovernanceYouthVotePhilippines0% (1)

- American English Vowel SoundsDocument3 pagesAmerican English Vowel SoundsiammiguelsalacNo ratings yet

- Facts:: 47 Phil 464Document1 pageFacts:: 47 Phil 464Athens TumanganNo ratings yet

- Generalized System of References Certificate of Origin (Combined Declaration and Certificate)Document1 pageGeneralized System of References Certificate of Origin (Combined Declaration and Certificate)Ade GuruhNo ratings yet

- CREST Industrial Control Systems Technical Security Assurance Position PaperDocument15 pagesCREST Industrial Control Systems Technical Security Assurance Position PaperwaleedNo ratings yet

- Classification, Formation & Incorporation: 4LM1 Castillo, Angelica Elaine Montemayor, Anna Carmela Yacob, Judith ElisciaDocument29 pagesClassification, Formation & Incorporation: 4LM1 Castillo, Angelica Elaine Montemayor, Anna Carmela Yacob, Judith ElisciaMikkboy RosetNo ratings yet

- LOTUS POND 2022b MENUDocument2 pagesLOTUS POND 2022b MENUBrookNo ratings yet

- Assessment Task 1 - BSBSUS511 V1.1Document11 pagesAssessment Task 1 - BSBSUS511 V1.1ZomakSoluion100% (1)

- Filipino Patients Bill of RightsDocument2 pagesFilipino Patients Bill of Rights@ngeloNo ratings yet

- Amanda GordonDocument2 pagesAmanda GordonRoberto SavocaNo ratings yet

- ACFrOgBfaPHUTGTFzw4pkKEtzAS8qCvRQlFv8YcUhmWv8tSnJM-2OpBZr-M sKPCz8BR1znu2SUQqjSOtDF EQXL6EIVm3i6mkm3OchoCHFgfQJ2Xlc9I3zn3wdZrjo PDFDocument7 pagesACFrOgBfaPHUTGTFzw4pkKEtzAS8qCvRQlFv8YcUhmWv8tSnJM-2OpBZr-M sKPCz8BR1znu2SUQqjSOtDF EQXL6EIVm3i6mkm3OchoCHFgfQJ2Xlc9I3zn3wdZrjo PDFArun SharmaNo ratings yet

- The Truth About The Greek Old Calendarists (1993)Document5 pagesThe Truth About The Greek Old Calendarists (1993)HibernoSlavNo ratings yet

- Significance of Qualifying Examination in The Retention Program of Bsa Students in Saint Vincent College of CabuyaoDocument18 pagesSignificance of Qualifying Examination in The Retention Program of Bsa Students in Saint Vincent College of CabuyaoGenRev SamaniegoNo ratings yet