Professional Documents

Culture Documents

Alternative Compliance - Reserves On DL - 6.3.2020

Uploaded by

Jan Paolo CruzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alternative Compliance - Reserves On DL - 6.3.2020

Uploaded by

Jan Paolo CruzCopyright:

Available Formats

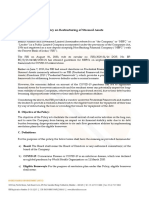

BSP Circular No.

1087

Alternative Compliance with the Reserve Requirements on Banks

Allowable modes of alternative compliance:

BSP Provisions Execution

Peso-denominated loans only Foreign Regular (Trade) & FCDU loans not

qualified

Amount valued at amortized costs (O/S, net

of UID)

MSME Granted, renewed or restructured after Loan releases to new clients automatically

March 15, 2020 qualifies as reserves cover

Loan releases within the existing lines not

qualified as cover based on initial discussion,

(can we consider if line is not fully availed)

Under the new guidelines, releases within

existing lines will qualify.

Loan releases due to additional lines qualifies

as reserves cover

An MSME Loan that was granted on or before Loans renewed and restructured eligible as

March 15 but has been renewed or cover if MSME portfolio demonstrates an

restructured after March 15, 2020: Provided, increase versus last month

that the bank demonstrates an increase in its Outstanding balance daily versus last month

MSME loan portfolio during the month portfolio

preceding the reserve day Suggest a separate tracking for restructured

loans as some might include capitalized

interest so any increase attributed to cap.

Int. will not qualify

Large Enterprise Granted, renewed or Loan releases to new clients eligible as

restructured after March 15, 2020 reserves cover if meets the ffg criteria:

1) business critically –impacted by covid19

i.e. transport industry, tourism industry

and export-import industry

2) Liabilities has become more than its

assets

3) Or it has experienced at least 50% decline

in gross receipts for at least one calendar

quarter; and in either instance, is

generally unable to pay or perform its

obligations as they fall due in the

ordinary course of business, as a result if

the Covid-19 outbreak, or as determined

by the appropriate regulatory agency

4) Conglomerate structure excluded

We can use the covid questionnaire/CARE

assessment forms which bucketed accounts

based on severity of impact as basis. Let’s

discuss with Bennett. The challenge is getting the

latest financial statements. Question: do we just

use audited or can we use reconstructed FS?

A loan to a large enterprise that was granted on If meets the criteria, the Large portfolio

or before March 15 but has been renewed or should demonstrates an increase versus last

restructured after March 15, 2020: Provided, month before it qualifies as reserves cover

that the bank demonstrates an increase in its Outstanding balance daily versus last

MSME loan portfolio during the month month’s portfolio

preceding the reserve day

Not encumbered in any way, or rediscounted Loans used as reserves cover not to be

with the BSP or earmarked for any other rediscounted with the BSP

purpose

The use of MSME loans as allowable alternative

compliance with the reserve requirement shall

be available to banks from April 24, 2020 to

December 30, 2021.

The use of large enterprise as allowable

alternative compliance with the reserve

requirement shall be available to banks from

May 29, 2020 to December 30, 2021

Proposed processes

Activities Responsible Person Deadlines

Process FRP Loans & Trade hand-off files using Regulatory Reporting Dept Daily – 10:00 a.m.

the regulatory system to identify MSME & Large (RRD)

Enterprise based on asset size

Extract outstanding balance, net of UID of RBU

Peso loans granted after March 15

Extract daily loan releases from Finacle Credit & Loans Services Daily – 10:00 a.m.

Tag new loan releases to new clients Dept

Email to RRD

CBG to provide accounts under a conglomerate Corporate Banking Group

structure

Create a Conglomerate library to be used in Management Accounting

identifying accounts under a conglomerate Dept

structure

Group new loan releases as to MSME and Large RRD Daily – 2:00 p.m.

Enterprise

Tagged new loan releases to identify eligible

accounts as to:

1) New loan release to new customer

2) Renewals and restructured

3) Provide list of eligible accounts to CBG &

SME BG for validation

CBG & SME BG to review and confirm eligible CBG / SME BG Daily 3:30 p.m.

accounts as reserves cover

Provide confirmation to RRD of accounts

eligible as cover

Email total amount of loans eligible as cover to: RRD Daily 4:00 p.m.

1) Treasury Liquidity

2) FS Department in charge of the calculation

of Reserves on Deposit Liabilities

3) CLSD to ensure that accounts used as

reserves cover will not be included in the

list of accounts for rediscounting to the BSP

You might also like

- Frequently Asked QuestionsDocument5 pagesFrequently Asked QuestionskgvnktshNo ratings yet

- MSME Relief PackageDocument9 pagesMSME Relief Packageajay khandelwalNo ratings yet

- Objective:: Plant & Machinery EquipmentDocument36 pagesObjective:: Plant & Machinery EquipmentSagar WelekarNo ratings yet

- Future of Indian Banking The Road Ahead 17 23Document7 pagesFuture of Indian Banking The Road Ahead 17 23kamaiiiNo ratings yet

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TNo ratings yet

- Resolution Framework For COVID 19 Related StressDocument10 pagesResolution Framework For COVID 19 Related StressAcquisory Consulting LLPNo ratings yet

- Publication - CARO2020Document9 pagesPublication - CARO2020BSJollyNo ratings yet

- Summary On Additional Refinance Fund For COVID-19 - CMSMEDocument2 pagesSummary On Additional Refinance Fund For COVID-19 - CMSMESuman kunduNo ratings yet

- RBI Circulars On COVIDDocument10 pagesRBI Circulars On COVIDASHWINNo ratings yet

- Management of Credit Portfolio COVID Emergency Line of Credit SchemeDocument12 pagesManagement of Credit Portfolio COVID Emergency Line of Credit SchemeshaantnuNo ratings yet

- Faqs On SBP & Pba'S Relief Package For Household and Businesses To Cope With Impact of Covid-19 PandemicDocument6 pagesFaqs On SBP & Pba'S Relief Package For Household and Businesses To Cope With Impact of Covid-19 PandemicAli LakhanyNo ratings yet

- ECLGS - Operational GuidelinesDocument9 pagesECLGS - Operational GuidelinesdawnerNo ratings yet

- FAR.2852 - Medium Sized Entities PDFDocument16 pagesFAR.2852 - Medium Sized Entities PDFPhoeza Espinosa VillanuevaNo ratings yet

- Small and Medium-Sized Entities (Smes) : Page 1 of 6Document6 pagesSmall and Medium-Sized Entities (Smes) : Page 1 of 6globeth berbanoNo ratings yet

- Emergency Line of Credit - 02076-2020 PDFDocument18 pagesEmergency Line of Credit - 02076-2020 PDFPanigrahi PvsNo ratings yet

- Income Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive BanksDocument10 pagesIncome Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive Banksramsundar_99No ratings yet

- Banking Sector MeasuresDocument3 pagesBanking Sector MeasuresSubbareddyNo ratings yet

- BRPD Circular No. 04 Large Loan Restructuring - 29.01.15Document5 pagesBRPD Circular No. 04 Large Loan Restructuring - 29.01.15M Tariqul Islam MishuNo ratings yet

- Impact of Bank'S Npa On Economic Health of IndiaDocument7 pagesImpact of Bank'S Npa On Economic Health of IndiaShrutiNo ratings yet

- Alternative Funding InstrumentsDocument7 pagesAlternative Funding InstrumentsManasvi GuptaNo ratings yet

- Annexure I AgriDocument5 pagesAnnexure I Agrimanish DodkeyNo ratings yet

- CDR ArticleDocument2 pagesCDR ArticleStuti NayakNo ratings yet

- 01 Handout 1 PDFDocument7 pages01 Handout 1 PDFJeffer Jay GubalaneNo ratings yet

- SFP SciDocument28 pagesSFP SciAcads PurpsNo ratings yet

- M.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan LossesDocument10 pagesM.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan Lossesasdfjkl asddfNo ratings yet

- Loans and AdvancesDocument9 pagesLoans and AdvanceshasithapaletiNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- Advanced Auditing and Professional Ethics 1688653213Document28 pagesAdvanced Auditing and Professional Ethics 1688653213mdasifraza3196No ratings yet

- IDirect Banking SectorReport Jun19Document20 pagesIDirect Banking SectorReport Jun19RajeshNo ratings yet

- 515 Bluebird Senior Syndication Term Sheet PDFDocument23 pages515 Bluebird Senior Syndication Term Sheet PDFzoure samyrNo ratings yet

- Lendingkart - Policy On EMI MoratoriumDocument4 pagesLendingkart - Policy On EMI MoratoriumShelly CouhanNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- PPG 284 15 PDFDocument14 pagesPPG 284 15 PDFKecelyn Costillas AlejandriaNo ratings yet

- Chamber's Journal January 06 PDFDocument6 pagesChamber's Journal January 06 PDFManisha SinghNo ratings yet

- SBR June 2023 ANSWERS To Revision 4Document14 pagesSBR June 2023 ANSWERS To Revision 4Maria AgathocleousNo ratings yet

- Debt RestructuringDocument5 pagesDebt RestructuringVinay TripathiNo ratings yet

- Policy On Restructuring of Stressed AssetsDocument3 pagesPolicy On Restructuring of Stressed AssetsShantanuNo ratings yet

- Irac Norms: Bank Branch AuditDocument45 pagesIrac Norms: Bank Branch AuditjamilsbmmNo ratings yet

- Recovery Policy - 2012Document23 pagesRecovery Policy - 2012Dhawan SandeepNo ratings yet

- Rbi NPA ASSETS PurchaseDocument48 pagesRbi NPA ASSETS PurchasesunilharlalkaNo ratings yet

- Ias 1 AmendmentDocument34 pagesIas 1 AmendmentOnwuchekwa Chidi CalebNo ratings yet

- FAR.2853 - Small Entities PDFDocument10 pagesFAR.2853 - Small Entities PDFstephen poncianoNo ratings yet

- Rehabilitation of Sick UnitsDocument4 pagesRehabilitation of Sick UnitsMurali RamachandranNo ratings yet

- Alert GC RBI COVID 19 Regulatory Package Note April 2020Document3 pagesAlert GC RBI COVID 19 Regulatory Package Note April 2020sathish15779No ratings yet

- Rating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21Document5 pagesRating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21vulture212No ratings yet

- AnnexureIIIDocument4 pagesAnnexureIIIKenedy KhumukchamNo ratings yet

- COVID-19 Impact by Accounting Standard: Reporting UpdateDocument17 pagesCOVID-19 Impact by Accounting Standard: Reporting UpdateFuad Al KhatibNo ratings yet

- Resolution Framework MsmeDocument81 pagesResolution Framework Msmesonyraj99No ratings yet

- HFC Restructuring Policy 2.0Document5 pagesHFC Restructuring Policy 2.0deepNo ratings yet

- Rbi 1Document27 pagesRbi 1Nishant ShahNo ratings yet

- Rediscounting/Erediscounting System December 2020Document23 pagesRediscounting/Erediscounting System December 2020MedyNo ratings yet

- Scheme For Sustainable Structuring of Stressed AssetsDocument9 pagesScheme For Sustainable Structuring of Stressed Assetssumit pamechaNo ratings yet

- What Is The Impact of COVID-19 On Your Going Concern Assessment?Document7 pagesWhat Is The Impact of COVID-19 On Your Going Concern Assessment?Nasrullah DjamilNo ratings yet

- Faqs On Financing Rescheduling Package (FRP) For Covid-19 Affected CustomersDocument4 pagesFaqs On Financing Rescheduling Package (FRP) For Covid-19 Affected Customersjhb13No ratings yet

- Cir 01 Annexure IIDocument3 pagesCir 01 Annexure IIabidkilyaniNo ratings yet

- Final ReportDocument39 pagesFinal ReportBhupendra KushwahaNo ratings yet

- 6 CA Febraury Economy 2020Document10 pages6 CA Febraury Economy 2020AshNo ratings yet

- Chapter1: Introduction: Nonperforming Asset in BankDocument35 pagesChapter1: Introduction: Nonperforming Asset in BankMaridasrajanNo ratings yet

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

- Attachment 4 - Beneficial Owner Information SheetDocument1 pageAttachment 4 - Beneficial Owner Information SheetJan Paolo CruzNo ratings yet

- Subiect: of WithDocument3 pagesSubiect: of WithCarlos JesenaNo ratings yet

- Attachment 8b - Validation Procedures - Valid IDsDocument2 pagesAttachment 8b - Validation Procedures - Valid IDsJan Paolo CruzNo ratings yet

- Attachment 7 - Risk Calculator - Authorized SignatoryDocument1 pageAttachment 7 - Risk Calculator - Authorized SignatoryJan Paolo CruzNo ratings yet

- SME BPR For Fulfillment - Central Admin - UpdatedDocument76 pagesSME BPR For Fulfillment - Central Admin - UpdatedJan Paolo CruzNo ratings yet

- Okta How To Change PasswordDocument2 pagesOkta How To Change PasswordJan Paolo CruzNo ratings yet

- Client On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsDocument39 pagesClient On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsJan Paolo CruzNo ratings yet

- ANNEX A - DOCUMENT REQUIREMENTS v4Document5 pagesANNEX A - DOCUMENT REQUIREMENTS v4Jan Paolo CruzNo ratings yet

- DORO Training - 072121Document90 pagesDORO Training - 072121Jan Paolo CruzNo ratings yet

- Annex H - CLSD Implementing Guidelines - Safekeeping of Loan Documents - FNDocument3 pagesAnnex H - CLSD Implementing Guidelines - Safekeeping of Loan Documents - FNJan Paolo CruzNo ratings yet

- Latest Industry Developments 030822Document5 pagesLatest Industry Developments 030822Jan Paolo CruzNo ratings yet

- Time TemplateDocument1 pageTime TemplateJan Paolo CruzNo ratings yet

- Industry News Brief 031422Document4 pagesIndustry News Brief 031422Jan Paolo CruzNo ratings yet

- Automotive Industry 030422Document2 pagesAutomotive Industry 030422Jan Paolo CruzNo ratings yet

- Authority To Conduct BI - v6.5.2018Document1 pageAuthority To Conduct BI - v6.5.2018Jan Paolo CruzNo ratings yet

- Real Estate Industry - Office Market 011422Document2 pagesReal Estate Industry - Office Market 011422Jan Paolo CruzNo ratings yet

- PMRF 012020 PDFDocument2 pagesPMRF 012020 PDFJenilyn Gonzales Narrido100% (2)

- Data Privacy Notice and Consent V2 (19 Jul 2018)Document2 pagesData Privacy Notice and Consent V2 (19 Jul 2018)Jan Paolo Cruz100% (1)

- BIR Form 2316 UndertakingDocument1 pageBIR Form 2316 UndertakingJan Paolo CruzNo ratings yet

- RCBC 2019 Annual and Sustainability Report V2Document110 pagesRCBC 2019 Annual and Sustainability Report V2Jan Paolo CruzNo ratings yet

- Pre Employment Req For Candidates - v02.16.21Document5 pagesPre Employment Req For Candidates - v02.16.21Jan Paolo CruzNo ratings yet

- JD - COR Officer 102021Document3 pagesJD - COR Officer 102021Jan Paolo CruzNo ratings yet

- Cdd161304-Manual Craftsman LT 1500Document40 pagesCdd161304-Manual Craftsman LT 1500franklin antonio RodriguezNo ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- 15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingDocument2 pages15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingRaima DollNo ratings yet

- Oral PresentationDocument4 pagesOral PresentationYaddie32No ratings yet

- CHAPTER 5 - STATES OF MATTER (S) Edit20152016Document12 pagesCHAPTER 5 - STATES OF MATTER (S) Edit20152016PAKK20622P Syarifah Nor Izzah binti Syed Abd HamidNo ratings yet

- VSR 411 QB AnaesthesiaDocument7 pagesVSR 411 QB Anaesthesiavishnu dathNo ratings yet

- Sample UploadDocument14 pagesSample Uploadparsley_ly100% (6)

- BMC Brochure WebDocument4 pagesBMC Brochure WebVikram Pratap SinghNo ratings yet

- All Vaccinees Are Requested To Bring Certificate of Dose-II From COWIN Portal Alongwith Registered Mobile Number Before Proceeding For VaccinationDocument7 pagesAll Vaccinees Are Requested To Bring Certificate of Dose-II From COWIN Portal Alongwith Registered Mobile Number Before Proceeding For VaccinationRakesh KumarNo ratings yet

- 936-Article Text-2359-1-10-20211003Document6 pages936-Article Text-2359-1-10-20211003Geka KusumoNo ratings yet

- Hedayati2014 Article BirdStrikeAnalysisOnATypicalHeDocument12 pagesHedayati2014 Article BirdStrikeAnalysisOnATypicalHeSharan KharthikNo ratings yet

- Radiesthesia and The Major ArcanaDocument72 pagesRadiesthesia and The Major ArcanaStere Stere67% (3)

- Performance Management and Strategic Planning:: Organization's Strategic PlanDocument7 pagesPerformance Management and Strategic Planning:: Organization's Strategic PlanSara AbidNo ratings yet

- MDB Specs PDFDocument9 pagesMDB Specs PDFAbdElrahman AhmedNo ratings yet

- February 2023 PROGRAM OF THE MPLEDocument8 pagesFebruary 2023 PROGRAM OF THE MPLEDale Iverson LacastreNo ratings yet

- DefibrillatorDocument2 pagesDefibrillatorVasanth VasanthNo ratings yet

- 01 Mono Channel BurnerDocument1 page01 Mono Channel BurnerSelwyn MunatsiNo ratings yet

- CO2 & SelexolDocument18 pagesCO2 & Selexolmihaileditoiu2010No ratings yet

- Interactive and Comprehensive Database For Environmental Effect Data For PharmaceuticalsDocument5 pagesInteractive and Comprehensive Database For Environmental Effect Data For PharmaceuticalsRaluca RatiuNo ratings yet

- Surgery CssDocument13 pagesSurgery CssNaren ShanNo ratings yet

- LR-360KAS-BROCHURE-LNG Sampling SystemsDocument4 pagesLR-360KAS-BROCHURE-LNG Sampling SystemsIdehen KelvinNo ratings yet

- EMC Design GuideDocument42 pagesEMC Design GuideDe Raghu Veer KNo ratings yet

- Biomedical EngineeringDocument5 pagesBiomedical EngineeringFranch Maverick Arellano Lorilla100% (1)

- Learners ' Health and Safety Practices and Their Academic PerformanceDocument10 pagesLearners ' Health and Safety Practices and Their Academic PerformanceHira SaddozaiNo ratings yet

- Evolution Practice Test 2 With AnswersDocument10 pagesEvolution Practice Test 2 With AnswersSuhani SinhaNo ratings yet

- API Filter Press - Test ProcedureDocument8 pagesAPI Filter Press - Test ProcedureLONG LASTNo ratings yet

- 08 163 4 JPL ScheickDocument50 pages08 163 4 JPL ScheickSaqib Ali KhanNo ratings yet

- AudiometerDocument3 pagesAudiometerVasanth VasanthNo ratings yet

- School: Sta. Maria Integrated School Group No. Names: Energy Forms & Changes Virtual LabDocument3 pagesSchool: Sta. Maria Integrated School Group No. Names: Energy Forms & Changes Virtual LabNanette Morado0% (1)

- GEC PE 3 ModuleDocument72 pagesGEC PE 3 ModuleMercy Anne EcatNo ratings yet