Professional Documents

Culture Documents

Marcos Company 3

Marcos Company 3

Uploaded by

Asuna Yuuki0 ratings0% found this document useful (0 votes)

12 views3 pagesJob #13 was completed and transferred. The balance in Work in Process Inventory at the end of the period is $170,720 if overhead is applied at the end of the period. The total costs of Jobs 6 and 9 were $82,750 and $87,970 respectively, for a total of $170,720. This matches option D.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJob #13 was completed and transferred. The balance in Work in Process Inventory at the end of the period is $170,720 if overhead is applied at the end of the period. The total costs of Jobs 6 and 9 were $82,750 and $87,970 respectively, for a total of $170,720. This matches option D.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesMarcos Company 3

Marcos Company 3

Uploaded by

Asuna YuukiJob #13 was completed and transferred. The balance in Work in Process Inventory at the end of the period is $170,720 if overhead is applied at the end of the period. The total costs of Jobs 6 and 9 were $82,750 and $87,970 respectively, for a total of $170,720. This matches option D.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

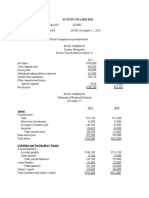

Refer to Marcos Company.

If Job #13 is completed and transferred, what is the balance in Work in Process Inventory at

the end of the period if overhead is applied at the end of the period?

a. $ 96,700

b. $ 99,020

c. $139,540

d. $170,720

ANS: D

Step 1: Determine Total Cost of Job 13

DM: $120,000 * .25 $ 30,000

DL: 4,200 * 8.50 35,700

FOH: 35,700 * 120% 42,840 108,540

Step 2: Compute Total Cost of Job 6

DM: $120,000 * .30 $ 36,000

DL: 2,500 * 8.50 21,250

FOH: 21,250 * 120% 25,500 82,750

Step 2: Compute Total Cost of Job 9

DM: $120,000 * .25 $ 30,000

DL: 3,100 * 8.50 26,350

FOH: 26,350 * 120% 31,620

87,970

Total Costs of Jobs 6 and 9 170,720

DIF: Difficult OBJ: 4-4

Refer to Marcos Company. Assume the balance in Work in Process Inventory was $18,500 on June 1 and

$25,297 on June 30. The balance on June 30 represents one job that contains direct material of $11,250. How many direct

labor hours have been worked on this job (rounded to the nearest hour)?

a. 751

b. 1,324

c. 1,653

d. 2,976

ANS: A

Step 1: Determine DL and FOH

WIP at June 30: $ 25,297

Less DM in WIP 11,250 14,047

Step 2: Separate DL and FOH Let

x = DL; 1.2x = FOH

x + 1.2x = 14,047 2.2x = 14,047

x = $6,385

Step 3: Compute DL Hours

$6,385 ÷ 8.50 751 hours

DIF: Moderate OBJ: 4-4

d. $144,000

ANS: B

Direct Labor Hours 6 2500

9 3100

13 4200 9,800

Direct Labor Rate $ 8.50

Overhead Application Rate 120%

Total Overhead Applied $ 99,960

DIF: Moderate OBJ: 4-4

DIF: Moderate OBJ: 4-4

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Hilton Chap 17 SolutionsDocument9 pagesHilton Chap 17 Solutionstarcher1987No ratings yet

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Cost Accounting Chapter 7 PDFDocument8 pagesCost Accounting Chapter 7 PDFCaren GerebitNo ratings yet

- Afar SolutionsDocument4 pagesAfar SolutionsSheena BaylosisNo ratings yet

- P5 8Document4 pagesP5 8laurentinus fikaNo ratings yet

- Ch.2 - Job CostingDocument26 pagesCh.2 - Job Costingahmedgalalabdalbaath2003No ratings yet

- Solutions Manual For Introduction To Management Accounting 16Th Edition Horngren Sundem Schatzberg Burgstahler 0133058786 9780133058789 Full Chapter PDFDocument36 pagesSolutions Manual For Introduction To Management Accounting 16Th Edition Horngren Sundem Schatzberg Burgstahler 0133058786 9780133058789 Full Chapter PDFdavid.rex111100% (12)

- 2023 Answer CHAPTER 7 PDFDocument19 pages2023 Answer CHAPTER 7 PDFRianne NavidadNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DSarah GoNo ratings yet

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Coverage of Learning ObjectivesDocument55 pagesCoverage of Learning ObjectivesRaam Tha BossNo ratings yet

- Coverage of Learning ObjectivesDocument55 pagesCoverage of Learning ObjectivesReyansh SharmaNo ratings yet

- Cost Accounting Chapter 8 CompressDocument7 pagesCost Accounting Chapter 8 Compressandreyaanne06No ratings yet

- Full Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full Chapterhomelingcomposedvqve100% (20)

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- College Accounting 14th Edition Price Haddock Farina ISBN Solution ManualDocument22 pagesCollege Accounting 14th Edition Price Haddock Farina ISBN Solution Manualdonald100% (23)

- Solutions To Sample Variable Absorption and Job Order CostingDocument7 pagesSolutions To Sample Variable Absorption and Job Order CostingWinter's ClandestineNo ratings yet

- College Accounting A Contemporary Approach 3rd Edition Haddock Price Farina ISBN Solution ManualDocument22 pagesCollege Accounting A Contemporary Approach 3rd Edition Haddock Price Farina ISBN Solution Manualdonald100% (25)

- Chapter 11 Practice SolutionsDocument3 pagesChapter 11 Practice Solutionslemanhan240103No ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostgabrielleNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- College Accounting 14th Edition Price Solutions ManualDocument36 pagesCollege Accounting 14th Edition Price Solutions Manualoosporebeauxite.jw91h100% (51)

- Activity Cost Allocation Cost Per UnitDocument4 pagesActivity Cost Allocation Cost Per UnitJOLLYBEL ROBLESNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Gitman CH 8 Zutter CH 12 Solutions To Selected End of Chapter ProblemsDocument11 pagesGitman CH 8 Zutter CH 12 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- 4 6048443301533583445Document3 pages4 6048443301533583445Beka AsraNo ratings yet

- Cost Accounting 2014Document94 pagesCost Accounting 2014Juliet Leron MediloNo ratings yet

- Chapter 5 - Teacher's Manual - Far Part 1aDocument9 pagesChapter 5 - Teacher's Manual - Far Part 1aMark Anthony TibuleNo ratings yet

- Problem 5Document3 pagesProblem 5Rudy LugasNo ratings yet

- Cost Accounting Solman de Leon 2014 1Document181 pagesCost Accounting Solman de Leon 2014 1Mark Anthony Siva94% (16)

- IEDA 2010 Assignment 2 - SolutionDocument5 pagesIEDA 2010 Assignment 2 - SolutionNorris wongNo ratings yet

- Reviewer 2Document11 pagesReviewer 2Kindred WolfeNo ratings yet

- Cost Acct Answer KeyDocument95 pagesCost Acct Answer KeyCarlaNo ratings yet

- Ass. Cost Chapter 8Document4 pagesAss. Cost Chapter 8Jea Ann CariñozaNo ratings yet

- BA4202 Capital Budgeting Solved ProblemsDocument9 pagesBA4202 Capital Budgeting Solved ProblemsVasugi KumarNo ratings yet

- F2 - Chương 4Document3 pagesF2 - Chương 4Thị Thanh Viên CaoNo ratings yet

- To Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Document12 pagesTo Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Alizah BucotNo ratings yet

- Jose Fabian Jara Lara Workshop CostsDocument10 pagesJose Fabian Jara Lara Workshop CostsScribdTranslationsNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- Effective Project Cost & SchedulingDocument82 pagesEffective Project Cost & Schedulingakdass100% (4)

- Name: Grade and Section:: S A L G L O S R E VDocument5 pagesName: Grade and Section:: S A L G L O S R E VPaul Robert DonacaoNo ratings yet

- Cost Accounting and Control by de Leon 2019Document182 pagesCost Accounting and Control by de Leon 2019Sly BlueNo ratings yet

- FIA MA2 Mock Exam - SolutionsDocument12 pagesFIA MA2 Mock Exam - SolutionsTrizah KaranjaNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- FIM PL IV Solution Dec 2019Document8 pagesFIM PL IV Solution Dec 2019Hanif Khan SrkNo ratings yet

- Leverages: Solutions To Assignment ProblemsDocument7 pagesLeverages: Solutions To Assignment ProblemsPalash BairagiNo ratings yet

- Tally Paper 1Document1 pageTally Paper 1mohammad rafeeque QureshiNo ratings yet

- Study Questions For IE305 Miderm IDocument4 pagesStudy Questions For IE305 Miderm IArif Berk GARİPNo ratings yet

- Quiz2 - Nguyễn Bình MinhDocument5 pagesQuiz2 - Nguyễn Bình MinhMinh NguyễnNo ratings yet

- FBGGBDocument5 pagesFBGGBPaul Robert DonacaoNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Rise of the Project Workforce: Managing People and Projects in a Flat WorldFrom EverandThe Rise of the Project Workforce: Managing People and Projects in a Flat WorldRating: 4 out of 5 stars4/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mathematics Answer Key Part 3Document1 pageMathematics Answer Key Part 3Asuna YuukiNo ratings yet

- Symbolism in Michael Cunningham's White AngelDocument1 pageSymbolism in Michael Cunningham's White AngelAsuna YuukiNo ratings yet

- Innocence in Irene Hunt's Across Five AprilsDocument1 pageInnocence in Irene Hunt's Across Five AprilsAsuna YuukiNo ratings yet

- Answer: B SolutionDocument4 pagesAnswer: B SolutionAsuna YuukiNo ratings yet

- Renewable Energy Resources Advantages DisadvantagesDocument2 pagesRenewable Energy Resources Advantages DisadvantagesAsuna YuukiNo ratings yet

- Theft in The Kite RunnerDocument1 pageTheft in The Kite RunnerAsuna YuukiNo ratings yet

- Amir Should Not Be Forgiven in The Kite RunnerDocument1 pageAmir Should Not Be Forgiven in The Kite RunnerAsuna YuukiNo ratings yet

- The Kite Runner Rape Scene AnalysisDocument1 pageThe Kite Runner Rape Scene AnalysisAsuna YuukiNo ratings yet

- Marcus Dupree Thesis: Show More ContentDocument1 pageMarcus Dupree Thesis: Show More ContentAsuna YuukiNo ratings yet

- Logistics and Channel ManagementDocument21 pagesLogistics and Channel ManagementMary Grace PanganibanNo ratings yet

- Final Exam 2016 MBA 603: Operations ManagementDocument12 pagesFinal Exam 2016 MBA 603: Operations ManagementAbel AberaNo ratings yet

- Inventory Estimation Problems With SolutionsDocument36 pagesInventory Estimation Problems With SolutionsPRINCESS JUDETTE SERINA PAYOT100% (2)

- Incoterms Made EasyDocument35 pagesIncoterms Made EasyjssainisNo ratings yet

- The Production ProcessDocument84 pagesThe Production ProcessGoutam Reddy100% (9)

- Chapter 3Document10 pagesChapter 3Julia CanoNo ratings yet

- Nguyễn Đức Anh-chap-12-TOMDocument3 pagesNguyễn Đức Anh-chap-12-TOMĐức Anh LeoNo ratings yet

- EMBA OM Mid Term 1 Examination Fall 2021Document13 pagesEMBA OM Mid Term 1 Examination Fall 2021Ruel OrvilNo ratings yet

- Supply Chain Management Mba (MM) Iii SemDocument43 pagesSupply Chain Management Mba (MM) Iii SemAbhijeet SinghNo ratings yet

- FreeGoods and FreeGifts - Rev.01Document23 pagesFreeGoods and FreeGifts - Rev.01dwi utomoNo ratings yet

- Logistic Supply and Chain Management Multiple Choice QuestionsDocument37 pagesLogistic Supply and Chain Management Multiple Choice QuestionsAbhishek A. Nadgire100% (1)

- Logistics Management CHP 1Document26 pagesLogistics Management CHP 1naaim aliasNo ratings yet

- MSE - UNIT - 3.pptmDocument26 pagesMSE - UNIT - 3.pptm3111hruthvikNo ratings yet

- ECT 250: Survey of E-Commerce TechnologyDocument21 pagesECT 250: Survey of E-Commerce TechnologyKN Tituss NKNo ratings yet

- Overview of SCMDocument56 pagesOverview of SCMvitrahulNo ratings yet

- Request Consolidated Inventory ReportsDocument6 pagesRequest Consolidated Inventory ReportsOweNo ratings yet

- Chapter 7. Supplier EvaluationDocument52 pagesChapter 7. Supplier EvaluationIsis La ganadoraNo ratings yet

- A Lateral Transshipment Model For Perishable Inventory ManagementDocument15 pagesA Lateral Transshipment Model For Perishable Inventory Managementandres0515No ratings yet

- CV Supply Chain - NayyarDocument3 pagesCV Supply Chain - NayyarNayyar MuhammadNo ratings yet

- Forecasting:: 1. Planning ProcessesDocument6 pagesForecasting:: 1. Planning ProcessesVarnika DevanNo ratings yet

- VACS - Presentation Week 2Document29 pagesVACS - Presentation Week 2anandNo ratings yet

- Dropship - Vendor Panel - MEDocument20 pagesDropship - Vendor Panel - MENeeraj SharmaNo ratings yet

- Australia: Origin (Country) State/City Philippine Freight Forwarder Foreign Agent/CounterpartDocument25 pagesAustralia: Origin (Country) State/City Philippine Freight Forwarder Foreign Agent/CounterpartMabs BalatbatNo ratings yet

- Merrimack Tractors and Mowers, Inc 1Document12 pagesMerrimack Tractors and Mowers, Inc 1KshitishNo ratings yet

- BP Op Entpr S4hanax Usv1 Prerequisites Matrix en UsDocument20 pagesBP Op Entpr S4hanax Usv1 Prerequisites Matrix en UsChinh Lê ĐìnhNo ratings yet

- Bullwhip Effect: What Is It Real World Example Effect On CompaniesDocument11 pagesBullwhip Effect: What Is It Real World Example Effect On CompaniesUdayanidhi RNo ratings yet

- Warehouse Management SystemDocument12 pagesWarehouse Management SystemOpeyemi Oyewole0% (1)

- Chapter 16 - Managing Retailing, Wholesaling and Logistics Prepared By: Sujay Soni - Roll No. 25 R. K. Singh - Roll No. 32Document50 pagesChapter 16 - Managing Retailing, Wholesaling and Logistics Prepared By: Sujay Soni - Roll No. 25 R. K. Singh - Roll No. 32Sheetal Soni100% (1)

- Chapter 7 - Expenditure CycleDocument52 pagesChapter 7 - Expenditure CyclePhan Thị Trúc VyNo ratings yet

- CV Deva DharmapuspaDocument3 pagesCV Deva Dharmapuspadevie.iklanNo ratings yet