Professional Documents

Culture Documents

MSME Rating

Uploaded by

saorabh130 ratings0% found this document useful (0 votes)

7 views3 pagesmsme sd

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmsme sd

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesMSME Rating

Uploaded by

saorabh13msme sd

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

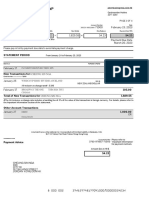

CENTRAL BANK OF INDIA

MANUAL RATING SHEET FOR MSME LOANS UPTO RS.200 LAKH

SATSANG

NAME OF ACCOUNT- M/S BS ENTERPRISES Branch NAGAR ,DEOGHA

R

RATING BASED ON ABS

S.N. Parameters Maximum Marks Marks Scored

A Business Risk 20

1 Proximity to Buyers

Company has wide distribution network to have access to most of buyers 3 3

Company has adequate distribution network to have access to buyers 2

Some of the buyers are located far away from place of operations of firm 1

Most of the buyers are located far away from place of operations of firm 0

2 Dependence on limited Customers

Very large no of customers/Retail customers 3 3

Large no of customers 2.

Small no of customers 1

Very few customers 0

3 Availability of Skilled Manpower

Skilled Manpower locally available/tied up 2 2

Skilled Manpower not locally available but source identified 1

Skilled Manpower not locally available nor identified 0

4 Availability of key raw material

Raw Materials locally available/tied up 3 3

Raw materials not locally available but source identified 2

Raw materials not locally available nor identified 0

5 Availability of power and other utilities

Power and other utilities locally available/tied up 3 3

Power and other utilities not locally available but source identified 2

Power and other utilities not locally available nor identified 0

6 Litigation

No litigiation history/pending 1 1

Litigation cases pending 0

7 Statutory Compliance

All statutory compliance duly obtained and kept on record 1 1

All statutory compliaces not obtained 0

8 Ownership of business premises

Business premises owned by borrower 2 2

Business premises take on lease/rented 1

9 Type of Technology

Latest/Updated Technology 2 2

Old Technology 0 0

B Financial Risk 60

1 Current Ratio*

Current Ratio 1.33 and above 10 10

Current Ratio between 1.20 and 1.32 8

Current Ratio between 1.10 and 1.19 6

Current Ratio between 1.00 and 1.09 4

Current Ratio Less than 1 2

2 Credit Summations

Credit Summations to total sales ratio for latest financial year greater than 90% 5

Credit Summations to total sales ratio for latest financial year between 80% and

4

90%

Credit Summations to total sales ratio for latest financial year between70% and 80% 3

Credit Summations to total sales ratio for latest financial year between 60% and

2

70%

Credit Summations to total sales ratio for latest financial year less than 60% 1

MANUAL RATING SHEET UP TO 2 CR 1

CENTRAL BANK OF INDIA

MANUAL RATING SHEET FOR MSME LOANS UPTO RS.200 LAKH

SATSANG

NAME OF ACCOUNT- M/S BS ENTERPRISES Branch NAGAR ,DEOGHA

R

RATING BASED ON ABS

S.N. Parameters Maximum Marks Marks Scored

3 Payment track record with Bankers/lenders

If Interest/Installment is serviced within 1 month after its application 10 10

If Interest/Installment is serviced within 2 months after its application 8

If Interest/Installment is serviced within 3 months after its application 4

If Interest/Installment is serviced after 3 months after its application 0

4 Debt Equity Ratio (DER)*@

DER (avg of last 2 years) upto 1 10

DER (avg of last 2 years) above 1 and upto 2 8 8

DER (avg of last 2 years) above 2 and upto 3 6

DER (avg of last 2 years) above 3 and upto 4 4

DER (avg of last 2 years)above 4 2

5 Total Outside Liabilities/ Total Networth*@

TOL/TNW(avg for last 3 years) positive and upto 3 10 10

TOL/TNW(avg for last 3 years) above 3 and upto 4 8

TOL/TNW(avg for last 3 years) above 4 and upto 5 6

TOL/TNW(avg for last 3 years) above 5 and upto 6 4

TOL/TNW(avg for last 3 years) above 6 or negative 2

6 Growth in sales*@

Net Sales Growth Rate over 20% for past 3 years 5 0

Net Sales Growth Rate over 15% upto 20% for past 3 years 4 4

Net Sales Growth Rate over 10% upto 15% for past 3 years 2

Net Sales Growth Rate positive for past 3 years 1

Net Sales Growth Rate negative during past year 0

7 PAT/Net sales ratio*

PAT/Net sales of over 15% 5

PAT/Net sales of over 10% upto 15% 4

PAT/Net sales of over 5% upto 10% 2 2

PAT/Net sales of upto 5% 1

PAT/Net sales negative 0

8 Interest Coverage Ratio*

Interest Coverage Ratio 2 and above 5 5

Interest Coverage Ratio between 1.75 and 2 4

Interest Coverage Ratio between 1.5 and 1.75 3

Interest Coverage Ratio between 1.25 and 1.5 2

Interest Coverage Ratio Less than 1.25 1

C Management Risk 20

1 Collateral/Guarantee coverage

Collateral/Gurantees available over 100% of bank loan 10 10

Collateral/Gurantees available over 50% and upto 100% of bank loan or covered

8

under CGTSME scheme

Collateral/Gurantees available upto 50% 5

Collateral/Gurantees below 50% 3

No Collateral/Gurantees 0

2 Credentials, background and experience of management

Management is highly experienced and qualified 5

Management is fairly experienced but lacks expertise 3 3

Management is no experience or very few years of experience in the industry 1

3 Years in existence

>10 years of existence 5 0

between 5 to 10 years of existence 4

MANUAL RATING SHEET UP TO 2 CR 2

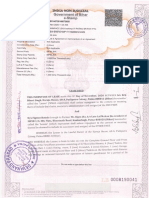

CENTRAL BANK OF INDIA

MANUAL RATING SHEET FOR MSME LOANS UPTO RS.200 LAKH

SATSANG

NAME OF ACCOUNT- M/S BS ENTERPRISES Branch NAGAR ,DEOGHA

R

RATING BASED ON ABS

S.N. Parameters Maximum Marks Marks Scored

Between 3 to 5 years of existence 3

Between 1 to 3 years of existence 2 0

less than 1 year of existence 1 1

Total Marks Scored

Business Risk 20 20

Financial Risk 60 49

Management Risk 20 14

Total Marks 100 83

*For new units, financial ratios to be computed on projected financials;

# If any parameter is not applicable, then weightage to be obtained as under: (Marks obtained * 100)/Total maximum marks

assigned to applicable parameters

@ In cases where required number of years data is not available, average of available data can be taken

The mapping of marks obtained to rating grades will be as follows:

% OF MARKS FOR THIS ACCOUNT 83%

RATING OF THE ACCOUNT BASED ON ABS - 31.03.2023 CBI-3

Percentage of marks obtained Rating Grade

Those who are above 90% CBI-1

Those who are >85% and <=90% CBI-2

Those who are >80% and <=85% CBI-3

Those who are >70% and <=80% CBI-4

Those who are >60% and <=70% CBI-5

Those who are >=51% and <=60% CBI-6

Those who are >45% and <51% CBI-7

Those who are >40% and <=45% CBI-8

Those who are >35% and <=40% CBI-9

Those who are <=35% CBI-10

MANUAL RATING SHEET UP TO 2 CR 3

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Platinum Card®: Page 1 of 4Document4 pagesThe Platinum Card®: Page 1 of 4Emma ChanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AMI Trustee Letter To JPMorganDocument13 pagesAMI Trustee Letter To JPMorganForeclosure FraudNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BA II Plus Calculator - User GuideDocument17 pagesBA II Plus Calculator - User GuidekithuciNo ratings yet

- Negotiable Instruments Law Reviewer QuestionsDocument11 pagesNegotiable Instruments Law Reviewer QuestionsMelgen100% (1)

- 07 Heinz Private EquityDocument27 pages07 Heinz Private EquityfwfsdNo ratings yet

- Partnership DeedDocument4 pagesPartnership DeedAnshumanTripathiNo ratings yet

- Partnership DeedDocument4 pagesPartnership DeedAnshumanTripathiNo ratings yet

- REPUBLIC ACT 3765 "Truth in Lending Act" PurposeDocument1 pageREPUBLIC ACT 3765 "Truth in Lending Act" PurposeKarl Luzung100% (2)

- FINC 536 Case Study 2Document9 pagesFINC 536 Case Study 2karimNo ratings yet

- FinMan Module 2 Financial Markets & InstitutionsDocument13 pagesFinMan Module 2 Financial Markets & Institutionserickson hernanNo ratings yet

- Cash Treasury Management GuideDocument19 pagesCash Treasury Management GuideShashank ShashuNo ratings yet

- Figtree 68A Lease DeedDocument6 pagesFigtree 68A Lease Deedsaorabh13No ratings yet

- Cma DataDocument28 pagesCma Datasaorabh13No ratings yet

- Glass Connector CostingDocument1 pageGlass Connector Costingsaorabh13No ratings yet

- About Firm-2022Document7 pagesAbout Firm-2022saorabh13No ratings yet

- ASSUMTIONDocument1 pageASSUMTIONsaorabh13No ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of Indiasaorabh13No ratings yet

- Final Process NoteDocument24 pagesFinal Process Notesaorabh13No ratings yet

- TO MVR-81/2016-5271ft-q-1 - 06.10.2016: TifikftDocument3 pagesTO MVR-81/2016-5271ft-q-1 - 06.10.2016: Tifikftsaorabh13No ratings yet

- Khalsa: On Readymade Garment Manufacturing UnitDocument15 pagesKhalsa: On Readymade Garment Manufacturing Unitsaorabh13No ratings yet

- KapoorDocument2 pagesKapoorsaorabh13No ratings yet

- Form For AryabhatthaDocument3 pagesForm For Aryabhatthasaorabh13No ratings yet

- Cash Flow ModelDocument6 pagesCash Flow ModelniroNo ratings yet

- M/S ABC CO PROJECT REPORT ANALYSISDocument10 pagesM/S ABC CO PROJECT REPORT ANALYSISRajesh BogulNo ratings yet

- Financial StatementDocument15 pagesFinancial Statementuday kumarNo ratings yet

- RahulDocument12 pagesRahulsaorabh13No ratings yet

- KapoorDocument2 pagesKapoorsaorabh13No ratings yet

- CMA - ASP Flour Bhog MillDocument55 pagesCMA - ASP Flour Bhog Millsaorabh13No ratings yet

- Consent LetterDocument1 pageConsent Lettersaorabh13No ratings yet

- LPC (Land Possession Certificate)Document1 pageLPC (Land Possession Certificate)saorabh13100% (1)

- ProfileDocument25 pagesProfilesaorabh13No ratings yet

- Financial Statements VikrDocument51 pagesFinancial Statements Vikrsaorabh13No ratings yet

- Financial Statement Main File ArunDocument12 pagesFinancial Statement Main File Arunsaorabh13No ratings yet

- Excel Loan Calculation SheetDocument1 pageExcel Loan Calculation Sheetsaorabh13No ratings yet

- CheckistDocument3 pagesCheckistsaorabh13No ratings yet

- Financial Statement (Ashok Kumar)Document24 pagesFinancial Statement (Ashok Kumar)saorabh13No ratings yet

- Agrasen Ayurved Bhawan Pvt. Ltd. JanuaryDocument5 pagesAgrasen Ayurved Bhawan Pvt. Ltd. Januarysaorabh13No ratings yet

- Checklist of Documents Name Loan SL - No Particulars Current Status Comments Client NameDocument2 pagesChecklist of Documents Name Loan SL - No Particulars Current Status Comments Client Namesaorabh13No ratings yet

- Statement of AccountDocument2 pagesStatement of AccountReshma ModhiaNo ratings yet

- Exercise 1 and 1B Version 2Document10 pagesExercise 1 and 1B Version 2Salman Sajid0% (1)

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementSh Mati ElahiNo ratings yet

- Bank 1Document14 pagesBank 1Anand CorreiaNo ratings yet

- Ch2-Budget Constraints N ChoicesDocument76 pagesCh2-Budget Constraints N ChoicesthutrangleNo ratings yet

- Capital StructureDocument28 pagesCapital Structureyaatin dawarNo ratings yet

- Trần Tấn Phát S3878775 (G13) Assignment 1Document4 pagesTrần Tấn Phát S3878775 (G13) Assignment 1s3878775No ratings yet

- Ms May 20 p1rDocument17 pagesMs May 20 p1rTahmid MahabubNo ratings yet

- Staff Per Loan OdDocument7 pagesStaff Per Loan OdAlpha Motors CompanyNo ratings yet

- Jurnal Roa LDR Cir Nim Car NPLDocument7 pagesJurnal Roa LDR Cir Nim Car NPLwahyu setyoNo ratings yet

- How Mental Blind Spots Can Lead Smart Investors Astray and How to Think Clearly About MoneyDocument7 pagesHow Mental Blind Spots Can Lead Smart Investors Astray and How to Think Clearly About MoneyElroi FelixNo ratings yet

- Accounting Standard 16Document7 pagesAccounting Standard 16Gaurav JadhavNo ratings yet

- Financial Institutions and Markets Exam Q&ADocument24 pagesFinancial Institutions and Markets Exam Q&AAnonymous jTY4ExMNo ratings yet

- International Finance A SR Jwhe3pDocument11 pagesInternational Finance A SR Jwhe3pRajni KumariNo ratings yet

- Mutual Fund Unit 2Document30 pagesMutual Fund Unit 2Aman Chauhan100% (1)

- Contrato BNBDocument2 pagesContrato BNBAnonimous BossNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Assets Finance CompanyDocument18 pagesAssets Finance CompanyEntersliceNo ratings yet

- Intership Report of PPCBLDocument104 pagesIntership Report of PPCBLSehar IrfanNo ratings yet

- International Finance Question & AnswersDocument22 pagesInternational Finance Question & Answerspranjalipolekar100% (1)