Professional Documents

Culture Documents

Rev Annex A - Invitation Letter

Rev Annex A - Invitation Letter

Uploaded by

MJ Pa-MaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rev Annex A - Invitation Letter

Rev Annex A - Invitation Letter

Uploaded by

MJ Pa-MaCopyright:

Available Formats

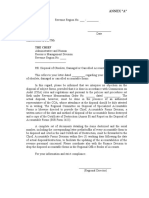

Annex “A”

__________________

(Date)

_____________________

_____________________

_____________________

Sir/Madam:

Greetings!

One of the sources of revenue envisioned by this Office to achieve its annual collection

goal is the collection of taxes from real property transactions such as capital gains, documentary

stamp, estate, donors and withholding taxes. The basis of such computation of taxes is the

approved zonal valuation of the Bureau of Internal Revenue (BIR) under Section 6(E) of the

National Internal Revenue Code of 1997, as amended.

After more than ______ years of using the ___ revision of zonal values of real properties

within the city/municipality/province of ______________which took effect on ___________, it

is deemed necessary for the BIR to update it.

As member of the Sub-Technical Committee on Real Property Valuation (STCRPV)

pursuant to Department Order No. _____ dated _______________, you are hereby requested to

attend a meeting on _____________ at _____________________ relative to the

revision/updating of the zonal values of real properties within your locality.

Failure to attend the said meeting and submit your recommended values within ten (10)

calendar days after the concluding STCRPV meeting will mean your concurrence to the final

values that will be recommended by the other members of the Committee or the BIR, as the case

may be.

Hoping for your active participation in this endeavor.

Revenue District Officer

Chairman, STCRPV

Conforme:

_______________________

(Signature of Addressee)

___________________________

(Name in Print)

___________________________

(Date Received)

You might also like

- Hacking for Beginners: Comprehensive Guide on Hacking Websites, Smartphones, Wireless Networks, Conducting Social Engineering, Performing a Penetration Test, and Securing Your Network (2022)From EverandHacking for Beginners: Comprehensive Guide on Hacking Websites, Smartphones, Wireless Networks, Conducting Social Engineering, Performing a Penetration Test, and Securing Your Network (2022)No ratings yet

- Annex K - Final Completion Inspection ReportDocument1 pageAnnex K - Final Completion Inspection ReportRo Ma SantaNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderLeomar ContilloNo ratings yet

- Authority To Debit - Credit Account ANNEX GDocument1 pageAuthority To Debit - Credit Account ANNEX GJeannifer MV100% (2)

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- Objective QuestionsDocument11 pagesObjective Questionsshekarj50% (2)

- Annex ADocument1 pageAnnex AZen Catolico Erum100% (2)

- Taxpayer Information Sheet: BIR Form No. April 2006Document1 pageTaxpayer Information Sheet: BIR Form No. April 2006Judith50% (2)

- Tax Exemption LetterDocument1 pageTax Exemption Letterprem_k_sNo ratings yet

- Annex "A": Memorandum To: The ChiefDocument1 pageAnnex "A": Memorandum To: The ChiefMrs Pokemon MasterNo ratings yet

- COA M2004-014 AnnexB PDFDocument1 pageCOA M2004-014 AnnexB PDFJoel Mangubat AmanteNo ratings yet

- Letter To Police - Barangay (RMO 15-2018)Document1 pageLetter To Police - Barangay (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Application Form MPSSIRS 2014Document5 pagesApplication Form MPSSIRS 2014Ar Raj YamgarNo ratings yet

- Circular For I.tax Statement For Fy2022-2023-NbagrDocument9 pagesCircular For I.tax Statement For Fy2022-2023-NbagrS S PradheepanNo ratings yet

- Termination of Contract Ra 9184 GPPB No 03-2019 SampleDocument3 pagesTermination of Contract Ra 9184 GPPB No 03-2019 SampleVALERIE JOY CATUDIONo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- Final GPF SettlementDocument2 pagesFinal GPF SettlementKhalid Hashmi100% (2)

- DAR+ +LUC+FORM+J+ +Assessment+of+Performance+Bond+ (As+of+13aug2019)Document1 pageDAR+ +LUC+FORM+J+ +Assessment+of+Performance+Bond+ (As+of+13aug2019)Blessy BaldeoNo ratings yet

- Affidavit: SUBSCRIBED AND SWORN To Before Me This - Day of - atDocument2 pagesAffidavit: SUBSCRIBED AND SWORN To Before Me This - Day of - atMark RelucioNo ratings yet

- TABLESDocument6 pagesTABLESLouise jedNo ratings yet

- Mission Order (Rmo 15-2018)Document1 pageMission Order (Rmo 15-2018)Christian Albert HerreraNo ratings yet

- Taxi Receipt 17Document1 pageTaxi Receipt 17sanketkumar.golaNo ratings yet

- Local Assistance Procedures Manual Exhibit 7-B Field Review FormDocument4 pagesLocal Assistance Procedures Manual Exhibit 7-B Field Review FormRupesh RajguruNo ratings yet

- GP Fund Form ADocument2 pagesGP Fund Form Aihsan ul haqNo ratings yet

- GP Fund Form CDocument2 pagesGP Fund Form CIrfan ArifNo ratings yet

- Rer NewDocument1 pageRer NewJulhan GubatNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderReymund S BumanglagNo ratings yet

- Orderly and ConveyanceDocument3 pagesOrderly and ConveyanceIra MinochaNo ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42)Document1 pageCertificate of Collection or Deduction of Tax: (See Rule 42)Ali ButtNo ratings yet

- Reimbursement Expense Receipt: Entity Name: Fund Cluster: Regular Agency Fund Date: RER No.Document1 pageReimbursement Expense Receipt: Entity Name: Fund Cluster: Regular Agency Fund Date: RER No.Vennice Gumban FontanillaNo ratings yet

- ProceduresDocument89 pagesProceduresmayur_jadav54No ratings yet

- Rera-Form-2-Engineer's CertificateDocument3 pagesRera-Form-2-Engineer's CertificateCA Amit RajaNo ratings yet

- Order of Payment The Collecting Officer: Department of Budget and ManagementDocument1 pageOrder of Payment The Collecting Officer: Department of Budget and ManagementMarielle MenorNo ratings yet

- ST Catherine Municipal Corporation Building Application Form 2021Document6 pagesST Catherine Municipal Corporation Building Application Form 2021Stre HncNo ratings yet

- Annex CDocument1 pageAnnex CMrs Pokemon MasterNo ratings yet

- Appendix 46 - RERDocument28 pagesAppendix 46 - REREspiritu Light LopezNo ratings yet

- VIII (A) Agreement With VDZ + A Consulting Re Skatepark Study $73,789Document15 pagesVIII (A) Agreement With VDZ + A Consulting Re Skatepark Study $73,789Dan LehrNo ratings yet

- Annexur1 Clu ImportantDocument2 pagesAnnexur1 Clu Importantbaljinder singhNo ratings yet

- Artifact 5 - Employee Pension Scheme Form 10 CDocument4 pagesArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryNo ratings yet

- Audited Utilisation CertificateDocument1 pageAudited Utilisation CertificateRitunesh KumarNo ratings yet

- HQP-HLF-007 Notice of Approval-Circular No. 300Document1 pageHQP-HLF-007 Notice of Approval-Circular No. 300maxx villaNo ratings yet

- FORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyDocument6 pagesFORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyHem Ch DeuriNo ratings yet

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- COA Cir No. 75-006a-Clarification On Use of Govt VehiclesDocument3 pagesCOA Cir No. 75-006a-Clarification On Use of Govt Vehiclescrizalde m. de diosNo ratings yet

- Form 121Document3 pagesForm 121aks.heerani.akNo ratings yet

- CBIM 2021 Form B-09 - Final Inspection Report For Flood ControlDocument2 pagesCBIM 2021 Form B-09 - Final Inspection Report For Flood ControlMessy Rose Rafales-CamachoNo ratings yet

- Quartlerly Statement of Bingo Operations (BC-7Q)Document2 pagesQuartlerly Statement of Bingo Operations (BC-7Q)Jacob GiffenNo ratings yet

- Performance ContractDocument3 pagesPerformance Contractcasinoking0316No ratings yet

- Services Export Promotion Council, New Delhi: Application Form FOR Registration-Cum-Membership Certificate (RCMC)Document5 pagesServices Export Promotion Council, New Delhi: Application Form FOR Registration-Cum-Membership Certificate (RCMC)pratikNo ratings yet

- 2 Check Memo 2023-25Document5 pages2 Check Memo 2023-25varma typingNo ratings yet

- Notice To TP (RMO 15-2018)Document3 pagesNotice To TP (RMO 15-2018)Christian Albert HerreraNo ratings yet

- RMC No. 10-2020 Annex A - Sworn DeclarationDocument2 pagesRMC No. 10-2020 Annex A - Sworn DeclarationAudrey De GuzmanNo ratings yet

- Confirmation LetterDocument1 pageConfirmation LetterGrace PerezNo ratings yet

- Monthly Congregation Accounts Report: All ReceiptsDocument2 pagesMonthly Congregation Accounts Report: All ReceiptsBaby RedNo ratings yet

- AGIF Car Loan Application Form PDFDocument12 pagesAGIF Car Loan Application Form PDFMansi0% (1)

- NoneDocument2 pagesNoneBejie BalazoNo ratings yet

- Endorsing Section 4.5 of Annex "D" of The Implementing Rules and Regulations of Republic Act No. 9184 For Approval of The President of The Republic of The PhilippinesDocument2 pagesEndorsing Section 4.5 of Annex "D" of The Implementing Rules and Regulations of Republic Act No. 9184 For Approval of The President of The Republic of The PhilippinesJill IsaiahNo ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- BFE Local Taxi ExepensesDocument15 pagesBFE Local Taxi ExepensesNantukina TeshomeNo ratings yet