Professional Documents

Culture Documents

Unit - V Banking and Insurance Law Study Notes

Uploaded by

Sekar M KPRCAS-Commerce0 ratings0% found this document useful (0 votes)

34 views4 pagesStudy Material

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStudy Material

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views4 pagesUnit - V Banking and Insurance Law Study Notes

Uploaded by

Sekar M KPRCAS-CommerceStudy Material

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 4

Unit – V

REGULATION OF INSURANCE BUSINESS IN INDIA

This Act was passed by Parliament in Dec.1999 & it received presidential assent in Jan.2000.

The aim of the Authority is “to protect the interest of holders of Insurance policies to

regulate, promote and ensure orderly growth of Insurance industry & for matters connected

therewith or incidental thereto.” Under this Act, an authority called IRDA is established

which replaces Controller of Insurance under Insurance Act 1938.

The IRDA was incorporated as a statutory body in April, 2000. The key objectives of the

IRDA include promotion of competition so as to enhance customer satisfaction through

increased consumer choice and lower premiums, while ensuring the financial security of the

insurance market. The IRDA opened up the market in August 2000 with the invitation for

application for registrations. Foreign companies were allowed ownership of up to 26%. The

Authority has the power to frame regulations under Section 114A of the Insurance Act, 1938

and has from 2000 onwards framed.

Beside IRDA Act and Insurance Act, 1938, there are some common Act/Regulation to the

General and Life Insurance Business in India and some Acts have been made for specific

requirement of Life Insurance/General Insurance Acts/Regulations common to General and

Life Insurance Business in India The following Acts regulate the Insurance Business in India.

• Insurance Act,1938

• IRDA Act,1999

• Insurance Amendment Act,2002

• Exchange Control Regulations(FEMA)

• Insurance Co-opSociety

• Indian Stamp Act,1899

•Consumer Protection Act,1986

• Insurance Ombudsman

Features of Authority

Corporate body by the aforesaid name which means it will act as group of persons, called

members, who will work jointly not as an individual person like Controller of Insurance.

Having perpetual succession which means any member may resign or die but the

Authority will work.

A common seal with power to enter into a contract by affixing a stamp on the documents.

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

Sue or be sued means the Authority can file a case against any person or organization and

vice versa.

Composition of Authority

The Authority shall consist of nine persons as per details given below:.

Chairperson.

Not more than 5 whole time members.

Not more than 4 part time members.

These persons shall be appointed by the Central Govt. from amongst persons of ability,

integrity & standing who have knowledge or experience in life Insurance, general Insurance,

actuarial science, finance, economics, law accountancy, administration or other discipline

which would in the opinion of the Central Govt. be useful to the Authority. (Section 4)

CONSTITUTION OF INSURANCE REGULATORY AND DEVELOPMENT

AUTHORITY

The IRD Act has established the Insurance Regulatory and Development Authority (“IRDA”

or “Authority”) as a statutory regulator to regulate and promote the insurance industry in

India and to protect the interests of holders of insurance policies. The IRDA Act also carried

out a series of amendments to the Act of1938 and conferred the powers of the Controller of

Insurance on the IRDA. The members of the IRDA are appointed by the Central Government

from amongst persons of ability, integrity and standing who have knowledge or experience in

life insurance, general insurance, actuarial science, finance, economics, law, accountancy,

administration etc. The Authority consists of a chairperson, not more than five whole-time

members and not more than four part-time members. Every Chairperson and member of

IRDA appointed shall hold office for a term of five years. However, Chairperson shall not

hold office once he or she attains 65 years while whole time members shall not hold office

beyond 62 years. Central Government may remove any member from office if he or she is

adjudged insolvent or is physically or mentally incapacitated or has been convicted of an

offence involving moral turpitude or has acquired financial or other interests or has abused

his position. Chairperson and the whole time members shall not for a period of two years

from the date of cessation of office in IRDA, hold office as an employee with Central

Government or any State Government or with any company in the insurance sector.

POWERS /FUNCTIONS OF IRDA Under Section 14 of the IRDA Act, IRDA has the

following powers:

(a) Issue of Certificate of Registration to insurance companies, renew, modify, withdraw,

suspend or cancel the certificate of registration

(b) Protection of interests of policyholders in matters concerning assignment of policies,

nomination, insurable interest, claim settlement, surrender value and other terms and

conditions of insurance contract

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

(c) Specification of requisite qualifications, practical training and code of conduct for

insurance agents and intermediaries

(d) Specification of code of conduct for surveyors and loss assessors

(e) Promoting efficiency in the conduct of insurance business

(f) Promoting and regulating professional organizations connected with insurance and

reinsurance business

(g) Levying fees and other charges for carrying out the purposes of the Act

(h) Calling for information from or undertaking inspection of insurance companies,

intermediaries and other oganisations connected with insurance business

(i) Control and regulation of rates, advantages, terms and conditions that may be offered by

general insurance companies

(j) Specifying the form and manner in which books of account shall be maintained by

insurance companies and intermediaries

(k) Regulation of investments of funds by insurance companies

(l) Regulation of maintenance of margin of solvency

(m) Adjudication of disputes between insurers and insurance intermediaries

(n) Supervising the functioning of Tariff Advisory Committee

(o) Specifying the percentage of premium income of the insurer to finance schemes for

promoting and regulating professional organizations.

Powers of IRDA with reference to control of management of insurance companies, takeover

of management, mergers, acquisitions and winding up Section 52A empowers IRDA to make

a report to Central Government if the affairs of a Life insurance Company are carried on in

any manner prejudicial to the interests of policyholders.

Based on the Report, the Central Government is empowered to appoint an Administrator to

manage the affairs of the life insurance company.

A report shall be filed by such Administrator to the Central Government giving his

recommendations on the way forward, including the options of transfer of business to an

existing insurer or winding up, as he deems fit.

Central Government is empowered to take such action as it deems fit based on the Report of

the Administrator.

Section 52H empowers Central Government to acquire the undertaking of any insurer based

on a report from IRDA on failure to comply with directions or if the insurance company is

being managed in a manner detrimental to the public interest or in the interests of public or

policyholders it is appropriate to do so.

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

Powers of IRDA for imposition of penalties for default in complying with the Act (Section

102) Section 102 empowers IRDA to impose a penalty not exceeding Rupees five lakhs for

each of the following failures by an insurance company:

(a) Failure to furnish any document, statement, account, return or report to IRDA

(b) Failure to comply with the directions (Section 34 empowers IRDA to issue directions if it

is satisfied to do so in the interests of public or for prevention of affairs being conducted

detrimental to policyholders or to secure proper management of any insurer)

(c) Failure to maintain the required solvency margin

(d) Failure to comply with the directions on the insurance treaties Further Section 105B

empowers IRDA to impose a penalty not exceeding Rupees Five lakhs for failure to comply

with Section 32B, while Section 105C empowers IRDA to impose a penalty not exceeding

Rupees Twenty five lakhs for failure to comply with Section 32C, with cancellation of

certificate of registration for continuing failure.

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- FIN 2101 Module Book - UpdatedDocument123 pagesFIN 2101 Module Book - UpdatedRay LowNo ratings yet

- The Insurance Act 1938Document26 pagesThe Insurance Act 1938Rahul Kumar80% (5)

- Blackstone and The Sale of Citigroup's Loan PortfolioDocument10 pagesBlackstone and The Sale of Citigroup's Loan PortfolioRonak Jain0% (1)

- This Study Resource Was: Biological Assets Question 21-1 Multiple Choice (PAS 41)Document6 pagesThis Study Resource Was: Biological Assets Question 21-1 Multiple Choice (PAS 41)Alexandra Nicole IsaacNo ratings yet

- Unit II Banking and Insurance Law Study NotesDocument12 pagesUnit II Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Bank of The Philippine Islands-CisDocument9 pagesBank of The Philippine Islands-CisKershey SalacNo ratings yet

- ANTLMONEY LAUNDERING INNDIADocument12 pagesANTLMONEY LAUNDERING INNDIAanila rathodaNo ratings yet

- Constitution of Insurance Regulatory and Development AuthorityDocument27 pagesConstitution of Insurance Regulatory and Development Authoritymaha27No ratings yet

- 6 IRDADocument23 pages6 IRDASudha AgarwalNo ratings yet

- IRDADocument21 pagesIRDAJyoti SukhijaNo ratings yet

- Presented by Yashasvini Tharani Rashmi Vandana Devi PriyaDocument30 pagesPresented by Yashasvini Tharani Rashmi Vandana Devi PriyaRASHUNo ratings yet

- IRDA Regulation Relating To General InsuranceDocument14 pagesIRDA Regulation Relating To General InsurancerahulhaldankarNo ratings yet

- Irda (Insurance Regulatory & Development Authority)Document20 pagesIrda (Insurance Regulatory & Development Authority)harishkoppalNo ratings yet

- IRDAI Regulates India's Insurance SectorDocument7 pagesIRDAI Regulates India's Insurance SectorFaisal AhmadNo ratings yet

- Insurance Regulatory and Development Authority (Irda) : A Law of Insurance Project OnDocument5 pagesInsurance Regulatory and Development Authority (Irda) : A Law of Insurance Project OnAnju PanickerNo ratings yet

- IRDA Act SummaryDocument67 pagesIRDA Act SummaryVirendra JhaNo ratings yet

- Insurance Regulatory & Development Authority of India (IRDAI)Document10 pagesInsurance Regulatory & Development Authority of India (IRDAI)Deeptangshu KarNo ratings yet

- IRDADocument2 pagesIRDAJIYA DOSHINo ratings yet

- IRDA Act, 1999: Presentation OnDocument58 pagesIRDA Act, 1999: Presentation Ondeepakarora201188No ratings yet

- Mulund College of CommerceDocument11 pagesMulund College of CommerceashwitaNo ratings yet

- Calss PresentationDocument6 pagesCalss PresentationKasiNo ratings yet

- Unit 3 InsuranceDocument5 pagesUnit 3 InsuranceAkash SharmaNo ratings yet

- The Irda ActDocument3 pagesThe Irda ActAdeel RahmanNo ratings yet

- INSURANCE & IRDA REGULATIONSDocument33 pagesINSURANCE & IRDA REGULATIONSrajisumaNo ratings yet

- Malhotra Committee recommendations led to IRDA formationDocument4 pagesMalhotra Committee recommendations led to IRDA formationKanishq BawejaNo ratings yet

- Insurance Regulatory and Development AuthorityDocument12 pagesInsurance Regulatory and Development AuthorityVipin JacobNo ratings yet

- IntroductionDocument14 pagesIntroductionVedant NavalkarNo ratings yet

- IRDA PresentationDocument22 pagesIRDA PresentationSamhitha KandlakuntaNo ratings yet

- IRDAI's Role and FunctionsDocument5 pagesIRDAI's Role and FunctionsKirti ChotwaniNo ratings yet

- Presented By-Akhilesh (IMB2010008) : Insurance Regulatory and Development AuthorityDocument22 pagesPresented By-Akhilesh (IMB2010008) : Insurance Regulatory and Development Authoritybhuwanesh-man-rajbhandari-5259No ratings yet

- Insurance Law Notes RnDocument84 pagesInsurance Law Notes RnRudraksh NagarNo ratings yet

- The Relevance of Insurance Regulatory Authority of India in The Indian Insurance Sector IDocument12 pagesThe Relevance of Insurance Regulatory Authority of India in The Indian Insurance Sector IVaijayanti SharmaNo ratings yet

- Private Entry Insurance Sector GrowthDocument21 pagesPrivate Entry Insurance Sector GrowthSaurabh HampiNo ratings yet

- IrdaDocument15 pagesIrdaNitesh SudanNo ratings yet

- Unit - IV Banking and Insurance Law Study NotesDocument4 pagesUnit - IV Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Insurance Regulatory and Development AuthorityDocument3 pagesInsurance Regulatory and Development AuthorityDeepak SharmaNo ratings yet

- Irda (Insurance Regulatory & Development Authority)Document22 pagesIrda (Insurance Regulatory & Development Authority)guru_shettiNo ratings yet

- Development Authority Act, 1999 and Duly Passed by The Government of IndiaDocument2 pagesDevelopment Authority Act, 1999 and Duly Passed by The Government of IndiaNancygirdherNo ratings yet

- Insurance Regulatory and Development Authority (IRDA)Document4 pagesInsurance Regulatory and Development Authority (IRDA)Chandini KambapuNo ratings yet

- Insurance - Unit 3&4Document20 pagesInsurance - Unit 3&4Dhruv GandhiNo ratings yet

- Development Authority (IRDA) Is A National Agency of The: Government of India HyderabadDocument5 pagesDevelopment Authority (IRDA) Is A National Agency of The: Government of India HyderabadSwarna RajpootNo ratings yet

- A Project Report OnDocument22 pagesA Project Report Onangel_ekta20079048No ratings yet

- IRDA Project - Akanksha - LLMDocument9 pagesIRDA Project - Akanksha - LLMPULKIT KHANDELWALNo ratings yet

- IRDA ActDocument11 pagesIRDA ActShaifali ChauhanNo ratings yet

- IrdaDocument10 pagesIrdafundoo16No ratings yet

- Insurance Regulatory and Development Authority of IndiaDocument6 pagesInsurance Regulatory and Development Authority of IndiaAkanksha PandeyNo ratings yet

- 09 Chapter 3Document32 pages09 Chapter 3palak2407No ratings yet

- Channi InsuranceDocument16 pagesChanni InsuranceSanjeev KashyapNo ratings yet

- Role of Final)Document37 pagesRole of Final)mamta_sawant25No ratings yet

- Role and Functions of India's Insurance Regulator IRDADocument3 pagesRole and Functions of India's Insurance Regulator IRDARaghav DhillonNo ratings yet

- IRDA by The DudesDocument13 pagesIRDA by The DudesAbhimanyu MaheshwariNo ratings yet

- Expectations: Duties, Powers and Functions of IRDADocument3 pagesExpectations: Duties, Powers and Functions of IRDAAlnoor PujaniNo ratings yet

- IRDADocument11 pagesIRDAkhrn_himanshuNo ratings yet

- Presented By: Sai Reddy Sravana Karthik V.B.RaoDocument29 pagesPresented By: Sai Reddy Sravana Karthik V.B.RaoSravana KarthikNo ratings yet

- IRDADocument12 pagesIRDAShreya PavithranNo ratings yet

- IRDADocument17 pagesIRDAHemant DeshmukhNo ratings yet

- Insurance Regulatory Framework: Main Reasons For Insurance Regulation IrdaiDocument12 pagesInsurance Regulatory Framework: Main Reasons For Insurance Regulation IrdaiIndeevar SarkarNo ratings yet

- Irda - IiiDocument15 pagesIrda - IiiB.Com (BI) CommerceNo ratings yet

- Unit - 6Document15 pagesUnit - 6Yaggendra GargNo ratings yet

- Authority of India (IRDA of India) After The Formal Declaration of Insurance Laws (Amendment)Document3 pagesAuthority of India (IRDA of India) After The Formal Declaration of Insurance Laws (Amendment)hima binduNo ratings yet

- Irda 1999Document15 pagesIrda 1999Charu LataNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementDocument2 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Should Insurer Compensate Loss from RiotsDocument33 pagesShould Insurer Compensate Loss from RiotsKanchan GuptaNo ratings yet

- Optimizing Sales and Distribution of MilkDocument70 pagesOptimizing Sales and Distribution of MilkRavi Shankar SharmaNo ratings yet

- Unit - IV Banking and Insurance Law Study NotesDocument4 pagesUnit - IV Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Banking and Insurance Unit III Study NotesDocument13 pagesBanking and Insurance Unit III Study NotesSekar M KPRCAS-CommerceNo ratings yet

- BANKING AND INSURANCE LAW HISTORYDocument12 pagesBANKING AND INSURANCE LAW HISTORYSekar M KPRCAS-CommerceNo ratings yet

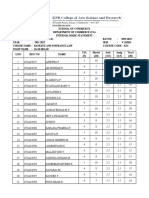

- BANKING AND INSURANCE LAW MARK STATEMENTDocument2 pagesBANKING AND INSURANCE LAW MARK STATEMENTSekar M KPRCAS-CommerceNo ratings yet

- KPR College Marketing Management CourseDocument127 pagesKPR College Marketing Management CourseSekar M KPRCAS-CommerceNo ratings yet

- Canara BankDocument21 pagesCanara BankVinayNo ratings yet

- Financial ModuleDocument7 pagesFinancial ModuleVarad VinherkarNo ratings yet

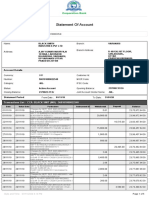

- Statement of AccountDocument5 pagesStatement of AccountAjay MauryaNo ratings yet

- IntangiblesworksheetDocument2 pagesIntangiblesworksheetammad uddinNo ratings yet

- Transaction HeaderDocument3 pagesTransaction HeaderطارقمجدىNo ratings yet

- Internship Report On Fsibl On Ratio AnalysisDocument32 pagesInternship Report On Fsibl On Ratio AnalysisAlamesu50% (2)

- A Study On Various Deposit Schemes, Retail Banking and Internet Banking With Reference To Syndicate BankDocument67 pagesA Study On Various Deposit Schemes, Retail Banking and Internet Banking With Reference To Syndicate BanklalsinghNo ratings yet

- Beams10e Ch07 Intercompany Profit Transactions BondsDocument25 pagesBeams10e Ch07 Intercompany Profit Transactions BondsIrma RismayantiNo ratings yet

- UPI: Understanding India's Unified Payments InterfaceDocument23 pagesUPI: Understanding India's Unified Payments InterfaceRITIK YADAVNo ratings yet

- IMPLEMENTING INDONESIA'S NEW HOUSING POLICY:THE WAY FORWARD. DraftDocument77 pagesIMPLEMENTING INDONESIA'S NEW HOUSING POLICY:THE WAY FORWARD. DraftOswar MungkasaNo ratings yet

- Valuation of Inventories.a Cost Basis ApproachDocument36 pagesValuation of Inventories.a Cost Basis ApproachMarvin Agustin De CastroNo ratings yet

- Loan Application ProcessDocument17 pagesLoan Application Processsamm yuuNo ratings yet

- Chapter 8 - Part ADocument22 pagesChapter 8 - Part AKwan Kwok AsNo ratings yet

- Project Report On Risk MGT in Life InsuranceDocument77 pagesProject Report On Risk MGT in Life InsuranceAlpatron shit'sNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- Askari Bank Personal Loan CBD Excel SheetDocument4 pagesAskari Bank Personal Loan CBD Excel Sheetsumbul imranNo ratings yet

- Group 3 Financial MarketsDocument17 pagesGroup 3 Financial MarketsLady Lou Ignacio LepasanaNo ratings yet

- Merchant Banking Research PaperDocument3 pagesMerchant Banking Research PaperSajid ShaikhNo ratings yet

- HIG 2012 - Model Test PromptDocument2 pagesHIG 2012 - Model Test PromptLoïc HalleuxNo ratings yet

- Calculate LTV ratio and monthly amortizationDocument4 pagesCalculate LTV ratio and monthly amortizationMichelle GozonNo ratings yet

- Cash and Cash Equivalents PDFDocument7 pagesCash and Cash Equivalents PDFFritzey Faye RomeronaNo ratings yet

- Nike Financial Analysis - EditedDocument12 pagesNike Financial Analysis - EditedmosesNo ratings yet

- Corporate Governance RatingsDocument3 pagesCorporate Governance RatingsSOHEL ALAM 17BBLB050No ratings yet

- Bpi Endorsement LetterDocument1 pageBpi Endorsement Letterthesamgyup31No ratings yet