Professional Documents

Culture Documents

Unit - IV Banking and Insurance Law Study Notes

Uploaded by

Sekar M KPRCAS-CommerceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit - IV Banking and Insurance Law Study Notes

Uploaded by

Sekar M KPRCAS-CommerceCopyright:

Available Formats

1

Unit – IV

Topic : Insurance : Meaning

The Insurance Act, 1938

This Act was passed in 1938 and was brought into force from 1st July, 1939. This act applies

to the GIC and the four subsidiaries. The act was amended several times in the years 1950,

1968, 1988, 1999. This Act specifies the restrictions and limitations applicable as specified

by the Central Government under powers conferred by section 35 of the General Insurance

Business (Nationalization) Act. The important provisions of the Act relate to:

Registration: Every insurer is required to obtain a Certificate of Registration from the

Controller of Insurance, by making the payment of requisite fees. Registration should be

renewed annually.

Accounts and audit: An insurer is required to maintain separate accounts of the receipts and

payments in each class of insurance viz. Fire, Marine and Miscellaneous Insurance. Apart

from the regular financial statements, the companies are required to maintain the following

documents in respect of each class of insurance:

Record of Cover notes specifying the details of the risk covered

Record of policies

Record of premiums

Record of endorsements

Record of Bank guarantees

Record of claims

Register of agency force and business procured by each with details of

commission

Register of employees

Cash Books

Reinsurance details

Claims register

Investments: Investments of insurance company are usually made in approved investments

under the provisions of the Act. The guidelines and limitations are issued by the Central

Government from time to time.

Limitation on management expenses: The Act prescribes the maximum limits of expenses

of management including commission that may be incurred by an insurer. The percentages

are prescribed in relation to the total gross direct business written by the insurer in India.

Prohibition of Rebates: The Act prohibits any person from offering any rebate of commission

or a rebate of premium to any person to take insurance. Any person found guilty would be

punished with a fine up to five hundred rupees.

Powers of Investigation: The Central Government may at any time direct the Controller or

any other person by order, to investigate the affairs of any insurer and report to the central

government.

Other Provisions: Other provisions of the Act deal with the licensing of agents, surveyors,

advance payment of premium and Tariff Advisory Committee (TAC).

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

2

Prohibition of rebates

Powers of investigation

Licensing of agents

Advance payments of premiums

Tariff Advisory Committee

GENERAL INSURANCE BUSINESS NATIONALIZATION ACT, 1972

This Act came into force on 1st January, 1973. This Act gave effect to clause (c) of Article 39

of the constitution of India. Article 39 (c) read as follows:

The State shall direct its policy towards securing that the operation of the economic system

does not result in concentration of wealth and means of production so as to prove harmful to

the common interest of the community‖.

Under this Act, there were no longer private insurers in the country. As a result general

insurance business became the domain of the State. The General Insurance Corporation of

India (GIC) became the holding company with four subsidiaries, namely United India

Insurance Company with Head Office in Madras, Oriental Insurance Company with Head

Office in New Delhi, National Insurance Company with Head Office in Calcutta and New

India Assurance Company with Head Office in Bombay. The ownership of all shares of both

the Indian insurance companies and the foreign insurers from then on vested in the Central

Government with effect from 1.1.1973. The services of all the personnel in the private sector

were also transferred to the holding company and subsidiaries based on factors such as

qualification, seniority, position and location.

Objectives of the Act

The object of the Act was primarily,

To provide for the acquisition of the shares of the existing general insurance

companies

To serve the needs of the economy by development of general insurance business

To establish the GIC by the central government under the provisions of the

Companies

Act of 1956, with an initial authorized share capital of seventy – five crores.

To aid, assist, and advise the companies in the matter of setting up of standards in the

conduct of general insurance business.

To encourage healthy competition amongst the companies as far as possible

To ensure that the operation of the economic system does not result in the

concentration

of wealth to the common detriment.

To ensure that no person shall take insurance in respect of any property in India with

an

insurer whose principal registered office is outside India

To carry on of any part of the general insurance business if it thinks it desirable to do

so.

The Mission of GIC

To provide need-based and low cost general insurance covers to rural population

To administer a crop insurance scheme for the benefit of the farmers

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

3

To develop and introduce covers with social security benefits

To develop a marketing network throughout the country including areas with low

premium potential Promote balanced regional development irrespective of cost

considerations

To make benefits of insurance available to the masses.

INSURANCE REGULATORY AND DEVELOPEMNT AUTHORITY (IRDA):-

The Committee on reforms of the insurance sector under the chairmanship of Shri R N

Malhotra, ex-governor of Reserve Bank of India, recommended for the creation of a more

efficient and competitive financial system in tune with global trends. It recommended

amendments to regulate the insurance sector to adjust with the economic policies of

privatization. The government in pursuance of the recommendation of the committee,

decided to establish a Provisional Insurance Regulatory and Development Authority in 1996,

to replace the erstwhile authority called the Controller of Insurance constituted under the

Insurance Act, 1938, which initially worked under the Ministry of Commerce and later

transferred to the Ministry of Finance.

Finally, the decision to establish the Insurance Regulatory and Development Authority was

implemented by the passing of the Insurance Regulatory and Development Authority Act,

1999. In India, presently after the opening up of the insurance sector, the regulator for the

monitoring of the operations of the insurance companies is the IRDA, having its head office

in Hyderabad.

The regulatory framework mainly aims to focus on three areas, viz.,

The protection of the interest of the consumers

To ensure the financial soundness of the insurance industry

To pave the way to help a healthy growth of the insurance market where both the

government and the private players play simultaneously.

The Consumer Protection Act, 1986:-

This Act was enacted to provide for the protection of the interest of the consumers and to

make provision for the establishment of the consumer councils and other authorities for the

settlement of consumer disputes.

Consumer Protection Act, 1986 is an act of Parliament of India enacted in 1986 to protect

interests of consumers in India. It makes provision for the establishment of consumer

councils and other authorities for the settlement of consumers' disputes and for matters

connected therewith.

A consumer dispute means a dispute where the person against whom a complaint has been

made denies and disputes the allegations contained in the complaint. For the purpose of the

Act, Consumer Disputes Redressed Agencies are established in each district and state and at

the national level.

Consumer Forum Orders :-

The Redressed Forums after detailed evaluation of the cases filed can issue direction to the

opposite party to do one of the following things namely:

To remove the defect from the goods in question.

To replace the goods which shall be free from any defect.

To return to the complainant the price or charges paid by him/her.

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

4

To pay compensation for any loss or injury suffered by the consumer due to the

negligence of the opposite party.

To remove the defects/ deficiencies in the services in question.

To disallow the continuation of any unfair trade practice or the restrictive trade

practice.

Not to offer any hazardous goods for sale.

To withdraw hazardous goods from being offered for sale.

To provide for adequate costs to parties.

Insurance as a “service‟

The business of insurance is defined as ‗service‘ under the provisions of this act. Most of the

consumer disputes relating to insurance fall in the following categories:

Delay in settlement of claims

Non- settlement of claims

Repudiation of claims

Quantum of loss

Policy terms and conditions.

Note: The Consumer Protection Act also takes into consideration cases pertaining to Products

Liability insurances and Professional Indemnities. The cases may pertain to injuries, etc.

caused by defective products or negligence of professionals like doctors, lawyers and

accountants. In a study conducted on 114 consumer cases adjudicated by the National

Commission during the period 1991 to 1994, 65 cases were decided against insurers and 49

cases in their favor. Can also mention about Insurance Ombudsman, though it is not through

legislation but only through a govt. notification. It is like an arbitrator facilitating redressed of

customer grievances.

Central Consumer Protection Council: -

It is established by the Central Government which consists of the following members:

The Minister of Consumer Affairs, – Chairman, and

Such number of other official or non-official members representing such interests as

may be prescribed.

State Consumer Protection Council: -

It is established by the State Government which consists of the following members:

The Minister in charge of consumer affairs in the State Government – Chairman.

Such number of other official or non-official members representing such interests as

may be

prescribed by the State Government.

Such number of other official or non-official members, not exceeding ten, as may be

nominated by the Central Government.

The State Council is required to meet as and when necessary but not less than two meetings

every year.

Subject: Banking and Insurance Law Course Incharge: Dr.M.Sekar

Programme : III B.Com CA

You might also like

- Deed of Absolute Sale With Assumption of MortgageDocument5 pagesDeed of Absolute Sale With Assumption of MortgageCarolinaDonsol100% (5)

- PRINCIPLES & PRACTICE OF GENERAL INSURANCEDocument190 pagesPRINCIPLES & PRACTICE OF GENERAL INSURANCEsrivenraman475475% (4)

- Personal Property Security ActDocument4 pagesPersonal Property Security ActREENA ALEKSSANDRA ACOPNo ratings yet

- Consumer Protection ActDocument59 pagesConsumer Protection Actramit77No ratings yet

- Insurance dispute over hijacked goods deliveryDocument2 pagesInsurance dispute over hijacked goods deliveryIan Luigie100% (2)

- Bonded Labour in India: Origin To AbolitionDocument13 pagesBonded Labour in India: Origin To AbolitionvidhiNo ratings yet

- Provision of Investigation in The Companies Act, 1956: A Project ReportDocument17 pagesProvision of Investigation in The Companies Act, 1956: A Project Reportajit yadavNo ratings yet

- Unit II Banking and Insurance Law Study NotesDocument12 pagesUnit II Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Symbiosis Law School, Pune: Symbiosis International (Deemed University)Document84 pagesSymbiosis Law School, Pune: Symbiosis International (Deemed University)Ishita AgarwalNo ratings yet

- Legal Writing ProjectDocument17 pagesLegal Writing ProjectJahnavi GopaluniNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganNo ratings yet

- Insurance Regulatory Authority Act ExplainedDocument6 pagesInsurance Regulatory Authority Act ExplainedTitus ClementNo ratings yet

- M S. Afcons Infra. Ltd. & Anr Vs M S Cherian Varkey Constn ... On 26 July, 2010Document19 pagesM S. Afcons Infra. Ltd. & Anr Vs M S Cherian Varkey Constn ... On 26 July, 2010Vinayak SNo ratings yet

- PDC RegisterDocument35 pagesPDC RegisterDaniyal SirajNo ratings yet

- Performance of Contracts Under The Sale of Goods ActDocument7 pagesPerformance of Contracts Under The Sale of Goods ActThomas JosephNo ratings yet

- Case Record - NLIU - Justice Tankha MootDocument35 pagesCase Record - NLIU - Justice Tankha MootAmritya SinghNo ratings yet

- Hindustan Zinc Ltd. v. Rajasthan Electricity Regulatory CommissionDocument9 pagesHindustan Zinc Ltd. v. Rajasthan Electricity Regulatory CommissionDrishti TiwariNo ratings yet

- Case analysis of MR Engineers Constructions Pvt. Ltd v SomDatt BuildersDocument9 pagesCase analysis of MR Engineers Constructions Pvt. Ltd v SomDatt BuildersNEHA VASHISTNo ratings yet

- Assigment No 1 Topic 1.1 Drafting of Legal NoticeDocument12 pagesAssigment No 1 Topic 1.1 Drafting of Legal NoticegovindNo ratings yet

- Agreement To SellDocument5 pagesAgreement To Sellabhinandan khanduriNo ratings yet

- SECTION 37 APPEALSDocument10 pagesSECTION 37 APPEALSsakshi mehtaNo ratings yet

- E ContractDocument31 pagesE ContractKaramjeet Singh BajwaNo ratings yet

- LLB 1sem PDFDocument9 pagesLLB 1sem PDFAshutosh DwivediNo ratings yet

- Drafting, Pleading and Conveyance-Assignment XXDocument8 pagesDrafting, Pleading and Conveyance-Assignment XXAryan KatalNo ratings yet

- 8th Manipal Rank International Moot Memorial RespondentDocument25 pages8th Manipal Rank International Moot Memorial Respondentkavita bohraNo ratings yet

- Law of Torts ContentDocument9 pagesLaw of Torts ContentViren GandhiNo ratings yet

- Harshil Vijayvargiya CV - GeneralDocument3 pagesHarshil Vijayvargiya CV - GeneralChayank LohchabNo ratings yet

- The Specific Relief ActDocument14 pagesThe Specific Relief Act410 Lovepreet KaurNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Tata Cellular V Union of India 1996Document58 pagesTata Cellular V Union of India 1996Manisha SinghNo ratings yet

- Sale Deed FormatDocument8 pagesSale Deed Formatsangeetha ramNo ratings yet

- GCC (Arbitration Clauses) Jan19Document77 pagesGCC (Arbitration Clauses) Jan19Himanshu MeneNo ratings yet

- Practical Problams - LawDocument12 pagesPractical Problams - LawApurva JhaNo ratings yet

- "Horizontal Agreements": Research Paper ONDocument15 pages"Horizontal Agreements": Research Paper ONRuhee MaknooNo ratings yet

- Trademarks Act, 1999: Different Forms of Trade Mark Objective History and EvolutionDocument25 pagesTrademarks Act, 1999: Different Forms of Trade Mark Objective History and EvolutionKarina ManafNo ratings yet

- The Payment of Bonus Act-ChecklistDocument1 pageThe Payment of Bonus Act-ChecklistRohini G ShettyNo ratings yet

- Contractual Liability of The Government: Tusharika Singh Roll Number-411Document32 pagesContractual Liability of The Government: Tusharika Singh Roll Number-411Ar SoniNo ratings yet

- PIL Format For Supreme Court Under Article 32 of The Constitution of India. Writ Petition Public Interest LitigationDocument6 pagesPIL Format For Supreme Court Under Article 32 of The Constitution of India. Writ Petition Public Interest LitigationPalak ChawlaNo ratings yet

- 1863 - Duties, Powers and Functions of IRDADocument2 pages1863 - Duties, Powers and Functions of IRDARakshaNo ratings yet

- The Provincial Small Cause Court Act NotesDocument4 pagesThe Provincial Small Cause Court Act NotesAnand BhushanNo ratings yet

- Constitutional Provisions for Environmental ProtectionDocument20 pagesConstitutional Provisions for Environmental ProtectionPrabhat Sharma100% (1)

- INRR 155 - RespondentDocument20 pagesINRR 155 - RespondentDavid Johnson100% (1)

- Trade Union Autonomy and Closed Shop ArrangementsDocument94 pagesTrade Union Autonomy and Closed Shop ArrangementsARYAN RAKESHNo ratings yet

- Aibe XviDocument12 pagesAibe XviLawbuzz CornerNo ratings yet

- Draft Sale DeedDocument10 pagesDraft Sale DeedaNo ratings yet

- 7th Legislative Drafting Competition 2018 RULESDocument6 pages7th Legislative Drafting Competition 2018 RULESMohd ArifNo ratings yet

- Section 106Document11 pagesSection 106aakash chakole100% (1)

- Collective Investment SchemeDocument8 pagesCollective Investment SchemeHarmanSinghNo ratings yet

- What Is TrademarkDocument5 pagesWhat Is TrademarkAnany UpadhyayNo ratings yet

- Internship Report 2021Document20 pagesInternship Report 2021sanjana sethNo ratings yet

- Supreme Court modifies sentence in 26-year-old bus accident caseDocument6 pagesSupreme Court modifies sentence in 26-year-old bus accident caseAmogha Gadkar100% (1)

- Notes The Representation of The People Act, 1951 (An Analysis)Document11 pagesNotes The Representation of The People Act, 1951 (An Analysis)Sreekanth Reddy100% (1)

- The Representation of The People Act: Part IIDocument6 pagesThe Representation of The People Act: Part IIVishal yadavNo ratings yet

- Recent Amendments On Karnataka Rent Control Act.Document3 pagesRecent Amendments On Karnataka Rent Control Act.Guidance ValueNo ratings yet

- Memorandum of DepositDocument3 pagesMemorandum of DepositdwadmohanNo ratings yet

- Before The Hon'ble Real Estate Regulatory Authority at Cambala at Satya PradeshDocument12 pagesBefore The Hon'ble Real Estate Regulatory Authority at Cambala at Satya Pradeshsanchit singlaNo ratings yet

- Filing of Written Statement and PlaintDocument13 pagesFiling of Written Statement and PlaintAnubhav NiranjanNo ratings yet

- Your Vodafone Bill: Amount DueDocument4 pagesYour Vodafone Bill: Amount DueHasan ChandulNo ratings yet

- Rights to collect resources from land classified as immovable propertyDocument2 pagesRights to collect resources from land classified as immovable propertyLively Roamer100% (1)

- Class 2 MBL: Private Limited CompaniesDocument19 pagesClass 2 MBL: Private Limited CompaniesNeha JayaramanNo ratings yet

- Vanishing CompaniesDocument7 pagesVanishing CompaniesVinay Artwani100% (1)

- T35 Petitioners Issue 3 and 4Document24 pagesT35 Petitioners Issue 3 and 4diwakarNo ratings yet

- Prem Singh Vs BirbalDocument10 pagesPrem Singh Vs Birbalajay narwalNo ratings yet

- PARTNERSHIP DEED - SenthinathanDocument5 pagesPARTNERSHIP DEED - SenthinathanRaguraam ChandrasekharanNo ratings yet

- Human Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsFrom EverandHuman Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsNo ratings yet

- Liberalisation of Insurance Services RefinedDocument22 pagesLiberalisation of Insurance Services RefinedJojin JoseNo ratings yet

- Banking and Insurance Unit III Study NotesDocument13 pagesBanking and Insurance Unit III Study NotesSekar M KPRCAS-CommerceNo ratings yet

- BANKING AND INSURANCE LAW HISTORYDocument12 pagesBANKING AND INSURANCE LAW HISTORYSekar M KPRCAS-CommerceNo ratings yet

- Unit - V Banking and Insurance Law Study NotesDocument4 pagesUnit - V Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

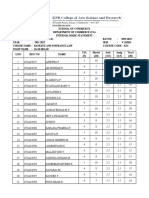

- BANKING AND INSURANCE LAW MARK STATEMENTDocument2 pagesBANKING AND INSURANCE LAW MARK STATEMENTSekar M KPRCAS-CommerceNo ratings yet

- KPR College Marketing Management CourseDocument127 pagesKPR College Marketing Management CourseSekar M KPRCAS-CommerceNo ratings yet

- BAC 202 Group 1 Obligation With A Period or A TermDocument17 pagesBAC 202 Group 1 Obligation With A Period or A TermJulie Catadman ArnosaNo ratings yet

- Comparison Regarding Personal Financing Between Ambank and Islamic Bank BahrainDocument3 pagesComparison Regarding Personal Financing Between Ambank and Islamic Bank BahrainPutri NickenNo ratings yet

- Purchase Agreement Template: Seller Name of BuyerDocument3 pagesPurchase Agreement Template: Seller Name of BuyerSyed MustafaNo ratings yet

- Indian Companies Act TypesDocument25 pagesIndian Companies Act Typesdinesh53No ratings yet

- Ansell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Document19 pagesAnsell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Teri BuhlNo ratings yet

- FIDIC IntroDocument18 pagesFIDIC IntroMohammed ShafiNo ratings yet

- Format of Minutes of First Board Meeting As Per Companies ActDocument4 pagesFormat of Minutes of First Board Meeting As Per Companies Actsailaja yelavarthi100% (1)

- 12 Cardinal Mistakes of Commodity TradingDocument9 pages12 Cardinal Mistakes of Commodity Tradingamna tabbasumNo ratings yet

- Partnership DissolutionDocument19 pagesPartnership DissolutionBYRON DESEMBRANANo ratings yet

- Financial Derivatives ExplainedDocument8 pagesFinancial Derivatives ExplainedAmit babarNo ratings yet

- Legal Environment of Business A Managerial Approach Theory To Practice 3rd Edition Melvin Test BankDocument13 pagesLegal Environment of Business A Managerial Approach Theory To Practice 3rd Edition Melvin Test Bankdilatermesmerics1gm8100% (13)

- Addendum Containing Notice of ObligationDocument1 pageAddendum Containing Notice of ObligationLdiazNo ratings yet

- InstructionsDocument8 pagesInstructionsEmilio JamettNo ratings yet

- Consideration: Barrister Tanvir SarwarDocument18 pagesConsideration: Barrister Tanvir SarwarFahim Tajual Ahmed TusharNo ratings yet

- Insurance RegulatorsDocument6 pagesInsurance Regulatorsmoses machiraNo ratings yet

- Carrascoso, Jr. v. Court of Appeals, SupraDocument2 pagesCarrascoso, Jr. v. Court of Appeals, SupraRoi RedNo ratings yet

- IA2 Chapter 7 ActivitiesDocument5 pagesIA2 Chapter 7 ActivitiesShaina TorraineNo ratings yet

- Currency Swaps: 180 Days Per PeriodDocument6 pagesCurrency Swaps: 180 Days Per PeriodAngelica MaeNo ratings yet

- F & F PETY BILL PL Makwana 8.22Document9 pagesF & F PETY BILL PL Makwana 8.22Prakash MakwanaNo ratings yet

- Guidelines on COVID-19 loan moratoriaDocument8 pagesGuidelines on COVID-19 loan moratoriaForNo ratings yet

- For Whose Benefit Is The Period Constituted?: General RuleDocument11 pagesFor Whose Benefit Is The Period Constituted?: General RuleIts meh SushiNo ratings yet

- OfferletterDocument3 pagesOfferletterAjay Pandey75% (4)

- Corporation For Final - Docx 2Document3 pagesCorporation For Final - Docx 2Marygrace MalilayNo ratings yet

- Regulation of Stock ExchangesDocument12 pagesRegulation of Stock ExchangesShibashish GiriNo ratings yet

- Negotiating Group On The Multilateral Agreement On Investment (MAI)Document5 pagesNegotiating Group On The Multilateral Agreement On Investment (MAI)Tube KuliNo ratings yet