Professional Documents

Culture Documents

(Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course Hero

Uploaded by

JdkrkejOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Solved) Respond To The Following Question in Your Textbook C - 2-26 - Carl... - Course Hero

Uploaded by

JdkrkejCopyright:

Available Formats

Question Find study &

Answer resources

Explanation Related Questions Related Courses 숿

Question 숤 Answered step-by-step

Respond to the following question in your textbook C:2-26: Carl...

Respond to the following question in your textbook C:2-26: Carl contributes equipment with a $50,000 adjusted basis and an $80,000

FMV to Cook Corporation for 50 of its 100 shares of stock. His son, Carl Jr., contributes $20,000 cash for the remaining 50 Cook shares.

What tax issues regarding the exchange should Carl and his son consider?

Law Social Science Tax law ACC 668 섈 쉋

Answer & Explanation Solved by verified expert 숨

Carl and Carl Jr. should consider the following tax issues:

1.Gain or loss on the asset exchange

2.Period of holding

3.Basis of the SOS of Cook Corporation

Step-by-step explanation

Note:

The Basis here mentioned as Th.B.

Adjusted Basis mentioned as AB.

SOS mentioned as SOS.

At the point of exchange of equipment, Carl can face the following issues:

1. Gain or loss at the course of exchange of property:

Gain on exchange is applicable only to Carl because Carl Jr. made a contribution in names of cash.

Equipment's AB and the FMV difference is the gain/loss on the transfer( equipment).

2.Period of holding:

Period of holding is considered at the time of sale of such shares of stock and it is taken from the date on which the equipment is

held by Carl.

But for Carl Jr., it should be the date on which he acquired the SOS in the corporation.

3.Basis of the Share:

While exchanging the equipment to get the share of the stock of Cook Corporation, Carl has to find out what is Th.B. of such stock.

For the calculation of the Stock Basis, we have to find the AB, and then we have to add any amount such as dividend further. It is

decreased by the contribution made in the cash for the stock is received and if at the time of transfer the taxpayer incurred any loss,

it should also be deducted.

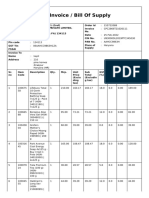

Calculations for Th.B. of the Stock are as follows:

Image transcription text

섘 A B 1 Calculation of the Th.B.of the share of stock 2

Particular Amount(in S) 3 AB of the equipment $50.000.00 4

Add: Gain incurred on the date of transfer $30.... Show more

Formula Snip:

Question

Find study &

Answer resources

Explanation Related Questions Related Courses 숿

Image transcription text

섘 A B Calculation of the Th.B.of the share of stock 2 Particular

Amount(in $) 3 AB of the equipment $50.000.00 4 Add: Gain

incurred on the date of transfer $30.000.00 5 L... Show more

* Gain on transfer is the difference between FMV and the AB of the property.

Further, Carl contributes equipment of $80,000 which has an AB of $50,000 for 50% of the stock of Cool Corporation. So, for Carl,

Th.B. of the stock is as it is determined for the corporation which is $60,000.

For exchange of the equipment, Carl gets an SOS and for that, Th.B. of such stock is $60,000.

But when the cash contribution is made by any taxpayer in the Corporation, Th.B. of the stock is calculated on Th.B. of cash

contribution made by them.

Therefore, for Carl Jr., Th.B. for the stock is $20,000 as he contributed such an amount by cash in the corporation.

References:

Basis at the time of exchange:

https://www.irs.gov/publications/p542#en_US_201809_publink1000257764

Basis of Stock:

https://www.irs.gov/publications/p542#en_US_201809_publink1000257768

Is this answer helpful? Helpful 싙 Unhelpful 싗

Report this answer

Add to library

Grand Canyon University

/ ACC

/ ACC 668

/ Respond to the following question in your

Related Answered Questions

숵 Q: Lucia, a single taxpayer, operates a florist business. She is considering either continuing the business as a sole propr

숵 Q: Six years ago, Donna purchased land as an investment. The land cost 150,000 and is now worth 480,000. Donna plans to tra

숵 Q: Allina, a single taxpayer, operates a mini mart. she is considering either continuing the business as a sole proprietors

숵 Q: sec 351 boot property received Sara transfers land a capital asset having a 30,000 adjusted basis to temple corp in a se

숵 Q: For the past five years, Peter Jones has owned all 100 shares of Trenton Corporation stock. This year, Mary Smith contri

See more 쇵

Can't find your question?

Question Find study &

Answer resources

Explanation Ask a new question

Related Questions Related Courses 숿

Related Course Resources

ACC 650 ACC 502

Grand Canyon University Grand Canyon University G

섵 1616 Documents 섵 1551 Documents 섵

❓ 755 Question & Answers ❓ 196 Question & Answers ❓

솩 솩 솩 솩 솩 솩 솩 솩 솩 솩 솩 솩

Company Get Course Hero Careers

About Us iOS Leadership

Scholarships Android Careers

Sitemap Chrome Extension Campus Rep Program

Q&A Archive Educators

Standardized Tests Tutors

Education Summit

Help Legal Connect with Us

Contact Us Copyright Policy College Life

FAQ Academic Integrity Facebook

Feedback Our Honor Code Twitter

Privacy Policy LinkedIn

Terms of Use YouTube

Attributions Instagram

Copyright © 2022. Course Hero, Inc.

Course Hero is not sponsored or endorsed by any college or university.

You might also like

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- Solved Blair and Rosen, Inc B&R Is A Brokerage Firm That SpecializesDocument3 pagesSolved Blair and Rosen, Inc B&R Is A Brokerage Firm That SpecializesMesso FrancisNo ratings yet

- Provide Income Statements in Both Variable Costing and Absorption..Document3 pagesProvide Income Statements in Both Variable Costing and Absorption..Anutaj NagpalNo ratings yet

- Solved Determine The Characteristics of The Assets Given Below .... Course HeroDocument6 pagesSolved Determine The Characteristics of The Assets Given Below .... Course HerojomarvaldezconabacaniNo ratings yet

- Atlantic Drydock Is Considering Replacing An Existing Hoist..Document5 pagesAtlantic Drydock Is Considering Replacing An Existing Hoist..maudiNo ratings yet

- Solved XY Inc. Franchisor Entered Into Franchise Agreement With AB Inc.... - Course HeroDocument3 pagesSolved XY Inc. Franchisor Entered Into Franchise Agreement With AB Inc.... - Course HerothatparticulardreamerNo ratings yet

- Step-By-Step ExplanationDocument3 pagesStep-By-Step ExplanationFrista Khaulanabila Adina PutriNo ratings yet

- Explain Multiproduct Breakeven Analysis. What Is The Assumption On..Document3 pagesExplain Multiproduct Breakeven Analysis. What Is The Assumption On..Anutaj NagpalNo ratings yet

- (Solved) A. Prepare The Journal Entries On Peanut's Books For The... - Course HeroDocument3 pages(Solved) A. Prepare The Journal Entries On Peanut's Books For The... - Course HeroIT'S SIMPLENo ratings yet

- Find Study Resourc : JOINT AND BY3PRODUCT Maroon LTD Is A Company That Produces..Document5 pagesFind Study Resourc : JOINT AND BY3PRODUCT Maroon LTD Is A Company That Produces..AShley NIcoleNo ratings yet

- Problem 1 X, Y, An Z Agreed To Form A Joint Operation. Pro T Or..Document6 pagesProblem 1 X, Y, An Z Agreed To Form A Joint Operation. Pro T Or..Trixie CapisosNo ratings yet

- (Solved) Holz Disc Golf Course Was Opened On March 1 by Brothers Holz. The..Document4 pages(Solved) Holz Disc Golf Course Was Opened On March 1 by Brothers Holz. The..CycuNo ratings yet

- HBR-investing in A Retirement Plan. Assignment Questions 1. What..Document4 pagesHBR-investing in A Retirement Plan. Assignment Questions 1. What..Sannithi YamsawatNo ratings yet

- (Solved) Clap Off Manufacturing Uses 1,150 Switch Assemblies Per Week And... - Course HeroDocument3 pages(Solved) Clap Off Manufacturing Uses 1,150 Switch Assemblies Per Week And... - Course Heromisonim.eNo ratings yet

- (Solved) Lombard Company Is Contemplating The PurDocument5 pages(Solved) Lombard Company Is Contemplating The PurFahmi Ilham Akbar0% (1)

- (Solved) Let V Be A Finite-Dimensional Vector Space, and Let W 1 and W 2 Be..Document3 pages(Solved) Let V Be A Finite-Dimensional Vector Space, and Let W 1 and W 2 Be..CycuNo ratings yet

- (Solved) What Were Some of The Largest Mergers and Acquisitions Over The... - Course HeroDocument3 pages(Solved) What Were Some of The Largest Mergers and Acquisitions Over The... - Course HeroJdkrkejNo ratings yet

- Here Is A Tip:: Find Study ResourcesDocument2 pagesHere Is A Tip:: Find Study Resourcesmuhammad aliNo ratings yet

- (Solved) Dahlia Colby, CFO of Charming Florist LTD., Has Created The Firm's... - Course HeroDocument3 pages(Solved) Dahlia Colby, CFO of Charming Florist LTD., Has Created The Firm's... - Course Heromisonim.eNo ratings yet

- (Solved) 1. Discuss How Digital Technology Change Society in The Area of A.... Course HeroDocument1 page(Solved) 1. Discuss How Digital Technology Change Society in The Area of A.... Course HeroYlla Ciesla Millanes AutenticoNo ratings yet

- Solved What Is Your Assessment of Starbucks Financial Performance During... - Course HeroDocument5 pagesSolved What Is Your Assessment of Starbucks Financial Performance During... - Course HeroAhihiNo ratings yet

- Cost of Capital Coleman Technologies Is Considering A Major..Document7 pagesCost of Capital Coleman Technologies Is Considering A Major..Legend WritersNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument3 pagesFind Study Resources: Answered Step-By-StepJohn KingNo ratings yet

- (Solved) Basic Earnings Per Share Monona Company Reported Net Income Of... - Course HeroDocument5 pages(Solved) Basic Earnings Per Share Monona Company Reported Net Income Of... - Course HerovevalyneoyooNo ratings yet

- Division A of Harkin Company Has The Capacity For Making 3000 Motors Per Month Course HeroDocument1 pageDivision A of Harkin Company Has The Capacity For Making 3000 Motors Per Month Course Heroshairel-joy marayagNo ratings yet

- File: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple ChoiceDocument53 pagesFile: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple ChoiceJessa Mae DuhaylongsodNo ratings yet

- File: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple ChoiceDocument58 pagesFile: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple Choicejana ayoubNo ratings yet

- It's Ready! Rate The Answer: Find Study ResourcesDocument2 pagesIt's Ready! Rate The Answer: Find Study ResourcesAnwar HabibiNo ratings yet

- TB03Document131 pagesTB03LiaNo ratings yet

- (Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - ADocument2 pages(Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AAli Hussain Al SalmawiNo ratings yet

- 3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsDocument32 pages3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsGaith1 AldaajahNo ratings yet

- 310A A1 Practice PaperDocument6 pages310A A1 Practice PaperRifat MahmudNo ratings yet

- Course 4Document4 pagesCourse 4Jason MalikNo ratings yet

- Full Download Advanced Accounting Hoyle 12th Edition Test Bank PDF Full ChapterDocument36 pagesFull Download Advanced Accounting Hoyle 12th Edition Test Bank PDF Full Chapterbeatencadiemha94100% (11)

- (Solved) Please See An Attachment For Details - Course HeroDocument4 pages(Solved) Please See An Attachment For Details - Course HeroJdkrkejNo ratings yet

- Chapter 19 - Introduction To Company AccountingDocument56 pagesChapter 19 - Introduction To Company AccountingK60 Triệu Thùy LinhNo ratings yet

- (Solved) What Types of Groups-Teams Are Used at Amazon? How Are Roles... - CliffsNotesDocument9 pages(Solved) What Types of Groups-Teams Are Used at Amazon? How Are Roles... - CliffsNoteslunganilamla1410No ratings yet

- M 198Document4 pagesM 198Rafael Capunpon VallejosNo ratings yet

- C B E M: WWW - Isap.edu - PH Adminoffice@isap - Edu.phDocument5 pagesC B E M: WWW - Isap.edu - PH Adminoffice@isap - Edu.phJohn Mark PalapuzNo ratings yet

- Aqa Additional Science CourseworkDocument8 pagesAqa Additional Science Courseworkafiwfrvtf100% (2)

- Fundamentals of Corporate Finance 3rd Edition Berk Test BankDocument28 pagesFundamentals of Corporate Finance 3rd Edition Berk Test Bankadamburtonbsdqicoewy100% (31)

- Module 2 - Case: Stock and Bond ValuationDocument3 pagesModule 2 - Case: Stock and Bond ValuationEUGENE AICHANo ratings yet

- Step-By-Step Explanation: Find Study ResourcesDocument3 pagesStep-By-Step Explanation: Find Study ResourcesVic smithNo ratings yet

- Advanced Accounting Hoyle 12th Edition Test BankDocument8 pagesAdvanced Accounting Hoyle 12th Edition Test Bankjasonbarberkeiogymztd100% (45)

- (Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course HeroDocument6 pages(Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course Heroadulusman501No ratings yet

- Advanced Accounting Hoyle 12th Edition Test BankDocument8 pagesAdvanced Accounting Hoyle 12th Edition Test Banklilyduxjrj54No ratings yet

- 3.0 Revised Accounting and FinanceDocument13 pages3.0 Revised Accounting and Financekevin kipkemoi100% (1)

- Ocr History Coursework GuidanceDocument5 pagesOcr History Coursework Guidanceafjwdryfaveezn100% (2)

- Solved - Chapter 4, Problem P4-30 - Advanced Financial Accounting (12th Edition)Document3 pagesSolved - Chapter 4, Problem P4-30 - Advanced Financial Accounting (12th Edition)CycuNo ratings yet

- Advanced Accounting Hoyle 12th Edition Test BankDocument8 pagesAdvanced Accounting Hoyle 12th Edition Test BankNicholas Becerra100% (33)

- Solved SIMPLE ACTIVITY in Class Discuss How The Following Multimodal... Course HeroDocument12 pagesSolved SIMPLE ACTIVITY in Class Discuss How The Following Multimodal... Course Hero23-09665No ratings yet

- 숤 Answered step-by-step: Answer & ExplanationDocument3 pages숤 Answered step-by-step: Answer & ExplanationJdkrkejNo ratings yet

- MBA404 T1 2020 Assessment 03 v03 Consumer Behaviour and Marketing Psycho...Document5 pagesMBA404 T1 2020 Assessment 03 v03 Consumer Behaviour and Marketing Psycho...Pooja Nikunj AgarwalNo ratings yet

- (Solved) Data Were Collected From A Random Sample of 220 Home Sales From A... - Course HeroDocument5 pages(Solved) Data Were Collected From A Random Sample of 220 Home Sales From A... - Course HeroReevesNo ratings yet

- ADVANCED ACCOUNTING Topic - Business Combination Co... PDFDocument2 pagesADVANCED ACCOUNTING Topic - Business Combination Co... PDFChillyNo ratings yet

- Ocr Salters Chemistry Coursework TitrationDocument6 pagesOcr Salters Chemistry Coursework Titrationpudotakinyd2100% (2)

- Science Coursework B Titles 2014Document7 pagesScience Coursework B Titles 2014afjzdonobiowee100% (2)

- Study Resources: Earn Free AccessDocument17 pagesStudy Resources: Earn Free AccessTsegaye BojagoNo ratings yet

- LML6004 TASK 2 S1 2023 FinalDocument3 pagesLML6004 TASK 2 S1 2023 FinalchuhongchokNo ratings yet

- Solved Hi Kinini, I Hope You Are Doing Well I Want Help in The FollowingDocument3 pagesSolved Hi Kinini, I Hope You Are Doing Well I Want Help in The FollowingMesso FrancisNo ratings yet

- Ans 22Document2 pagesAns 22JdkrkejNo ratings yet

- 숤 Answered step-by-step: Answer & Explanation Related QuestionsDocument3 pages숤 Answered step-by-step: Answer & Explanation Related QuestionsJdkrkej100% (1)

- Chegg by NinjaDocument3 pagesChegg by NinjaJdkrkejNo ratings yet

- 8 1 Project FinalDocument10 pages8 1 Project FinalJdkrkejNo ratings yet

- (Solved) LEARNING TASK 1 - Directions - Choose The Letter That Corresponds To... - Course HeroDocument5 pages(Solved) LEARNING TASK 1 - Directions - Choose The Letter That Corresponds To... - Course HeroJdkrkejNo ratings yet

- 숤 Answered step-by-step: Answer & ExplanationDocument3 pages숤 Answered step-by-step: Answer & ExplanationJdkrkejNo ratings yet

- 숤 Answered step-by-step: Answer & Explanation Related Questions Related CoursesDocument3 pages숤 Answered step-by-step: Answer & Explanation Related Questions Related CoursesJdkrkejNo ratings yet

- Solved For The Overhanging Beam Determine The Magnitude and S CheggDocument1 pageSolved For The Overhanging Beam Determine The Magnitude and S CheggJdkrkejNo ratings yet

- (Solved) Ola College of Education (OCE) Is One of The Colleges of Education... - Course HeroDocument3 pages(Solved) Ola College of Education (OCE) Is One of The Colleges of Education... - Course HeroJdkrkejNo ratings yet

- (Solved) Please See An Attachment For Details - Course HeroDocument4 pages(Solved) Please See An Attachment For Details - Course HeroJdkrkejNo ratings yet

- (Solved) Please See An Attachment For Details - Course HeroDocument3 pages(Solved) Please See An Attachment For Details - Course HeroJdkrkejNo ratings yet

- (Solved) What Were Some of The Largest Mergers and Acquisitions Over The... - Course HeroDocument3 pages(Solved) What Were Some of The Largest Mergers and Acquisitions Over The... - Course HeroJdkrkejNo ratings yet

- (Solved) Assume That There Is Uncertainty About The Value of Pollution... - Course HeroDocument4 pages(Solved) Assume That There Is Uncertainty About The Value of Pollution... - Course HeroJdkrkejNo ratings yet

- Dess9e Chapter08 TB AnswerkeyDocument47 pagesDess9e Chapter08 TB AnswerkeyJdkrkejNo ratings yet

- From 95.2 % To Reach 41.7 Million Filipinos Employed. The Total Employed. Understand and Gave All The Information NeededDocument3 pagesFrom 95.2 % To Reach 41.7 Million Filipinos Employed. The Total Employed. Understand and Gave All The Information NeededJdkrkejNo ratings yet

- Schools Division of Parañaque City Tvl-Electrical Installation and Maintenance 11 Third Quarter Week 5 & Week 6 Install Wire Ways and Cable TraysDocument5 pagesSchools Division of Parañaque City Tvl-Electrical Installation and Maintenance 11 Third Quarter Week 5 & Week 6 Install Wire Ways and Cable TraysJdkrkejNo ratings yet

- Step 1 Formation of table.: Let mass of A, C, D be, m m m dis tan ce l. θDocument3 pagesStep 1 Formation of table.: Let mass of A, C, D be, m m m dis tan ce l. θJdkrkejNo ratings yet

- Importance of Heat Transfer For Chemical ProcessingDocument2 pagesImportance of Heat Transfer For Chemical ProcessingJdkrkejNo ratings yet

- Practice - Fabm1 q3 Mod3 Accountingequation Final 1 PDFDocument23 pagesPractice - Fabm1 q3 Mod3 Accountingequation Final 1 PDFJdkrkejNo ratings yet

- Accounting Equation: LessonDocument14 pagesAccounting Equation: LessonJdkrkejNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Group Assignment - April 23Document16 pagesGroup Assignment - April 23DIVA RTHININo ratings yet

- 201743-2016-InG Bank N.V. v. Commissioner of InternalDocument11 pages201743-2016-InG Bank N.V. v. Commissioner of Internalaspiringlawyer1234No ratings yet

- BIR Ruling 244-12 PDFDocument3 pagesBIR Ruling 244-12 PDFJudy RoblesNo ratings yet

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyKapil SinglaNo ratings yet

- Consolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Document8 pagesConsolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Renjie XuNo ratings yet

- Auditing Arens Chapter 20Document30 pagesAuditing Arens Chapter 20MARLINNo ratings yet

- Start Ups and Legal Compliance in IndiaDocument43 pagesStart Ups and Legal Compliance in Indianishetha HemaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Maveeran Arun RajNo ratings yet

- Chapter 14 IllustrationsDocument8 pagesChapter 14 IllustrationsE.D.JNo ratings yet

- Types of SelfDocument8 pagesTypes of SelfcoolmdNo ratings yet

- Nepal Taxation Guide 2018 - 20180801041445 - 20181126030832Document25 pagesNepal Taxation Guide 2018 - 20180801041445 - 20181126030832its4krishna3776No ratings yet

- Zimbabwe Tax SystemDocument396 pagesZimbabwe Tax SystemEugenie KupembonaNo ratings yet

- September AthenaDocument1 pageSeptember AthenaSathyavathi PyNo ratings yet

- SafariDocument1 pageSafarijayNo ratings yet

- Temporal Goods NotesDocument21 pagesTemporal Goods NotesAdriano Tinashe Tsikano80% (5)

- Globalization PLRDDocument34 pagesGlobalization PLRDnicolas_vejar5583No ratings yet

- Notice of Cash Allocation PDFDocument17 pagesNotice of Cash Allocation PDFNah HamzaNo ratings yet

- List of Importables ExcelDocument4 pagesList of Importables ExcelRACNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ayush ThakkarNo ratings yet

- Standard Balance Sheet - YUNITA WIDHY ASTUTIDocument1 pageStandard Balance Sheet - YUNITA WIDHY ASTUTIDian Novia PurwandariNo ratings yet

- Lecturer 1 Sole ProprietorshipDocument11 pagesLecturer 1 Sole ProprietorshipGoitse LithekoNo ratings yet

- IHRMDocument15 pagesIHRMShipra ShrivastavaNo ratings yet

- Sop Torrens UpdatedDocument13 pagesSop Torrens Updatedahmed saeedNo ratings yet

- DRC 03Document2 pagesDRC 03Sonu JainNo ratings yet

- Ahluwalia - Economic Reforms in India Since 1991Document34 pagesAhluwalia - Economic Reforms in India Since 1991sambit pradhanNo ratings yet

- Arevalo Cabel ReyesDocument124 pagesArevalo Cabel ReyesDiannarose MarinNo ratings yet

- RA 8553 RA 8553: Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument5 pagesRA 8553 RA 8553: Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledPau JoyosaNo ratings yet

- Airtel Black Bill 5Document9 pagesAirtel Black Bill 5Akshay KharolaNo ratings yet

- HT2329I005080200Document4 pagesHT2329I005080200Aakash VyshnavNo ratings yet