Professional Documents

Culture Documents

Aarti 3R Aug11 - 2022

Uploaded by

Arka MitraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aarti 3R Aug11 - 2022

Uploaded by

Arka MitraCopyright:

Available Formats

Stock Update

Aarti Industries Ltd

Strong Q1; long-term growth guidance intact

Powered by the Sharekhan 3R Research Philosophy Specaility Chem Sharekhan code: AARTIIND

3R MATRIX + = -

Reco/View: Buy CMP: Rs. 815 Price Target: Rs. 1,000

Result Update

Right Sector (RS) ü á Upgrade Maintain â Downgrade

Right Quality (RQ) ü Summary

Q1FY23 operating profit/adjusted PAT of Rs. 369 crore/Rs. 219 crore, up 18%/24% y-o-y beat our estimate led

Right Valuation (RV) ü by a strong volume growth of 15-20% y-o-y, resilient absolute margins on price hikes and a lower tax rate. We

have adjusted reported PAT of Rs. 189 crore for negative forex impact of Rs. 30 crore.

+ Positive = Neutral – Negative Specialty chemical/pharma segments’ revenues grew strongly by 44%/48% y-o-y to Rs. 1,766 crore/Rs. 407

crore led by volume growth and price hikes on pass of RM/logistic cost. Although OPM of 18.7% (largely in-line)

declined by 510 bps/59 bps y-o-y/q-o-q, but the company was able to maintain absolute delta margins.

What has changed in 3R MATRIX

High single-digit EBITDA growth for FY23 is maintained as management sees slowdown in domestic textile and

Old New FMCG sector. It reiterated revenue/PAT growth guidance of 1.7-2x by FY24 versus FY21 as fixed cost for new

projects to be absorbed in FY23. Guided for 70%+ utilization for first/second long-term contract by FY24-end.

RS We maintain a Buy on Aarti Industries with an unchanged PT of Rs. 1,000. We believe it would be a key

beneficiary of the China plus One strategy and a massive capex would drive strong earnings growth. Pharma

business demerger could unlock value and is a key near-term catalyst.

RQ

Aarti Industries Limited’s performance was good in Q1FY23 with stronger-than-expected revenue growth of

RV 49.8% y-o-y and 12.3% q-o-q to Rs. 1,972 crore (5.6% above our estimate) led by 15-20% y-o-y volume growth and

a 25-30% y-o-y rise in realisation on price hikes to pass on higher raw material/logistics costs. Specialty chemical

segment’s revenues increased by 44% y-o-y to Rs. 1,766 crore supported by a higher volume trajectory, ramp-

up of first/second long term contracts and price hikes however; shortage of nitric acid continue to affect growth.

ESG Disclosure Score NEW Revenue from pharmaceutical segment grew by 48% y-o-y to Rs. 407 crore led by higher demand trajectory

for key products from generic pharma/Xanthine businesses and healthy realisations. Although OPM of 18.7%

(largely in-line) declined by 510 bps/59 bps y-o-y/q-o-q, the company was able to maintain absolute delta margin

ESG RISK RATING

Updated July 08, 2022

35.34 (i.e. per kg margin) and thus operating profit grew strongly by 17.7% y-o-y and 8.9% q-o-q to Rs. 369 crore, 4%

above our estimate of Rs. 355 crore. Specialty chemical/pharma EBIT increased by 7.7%/45.7% y-o-y to Rs. 250

crore/Rs. 76 crore. PAT (adjusted for negative forex impact of Rs. 30 crore) at Rs. 219 crore (up 24.3% y-o-y; up

High Risk 12.7% q-o-q), was 12% above our estimate of Rs. 196 crore reflecting beat in operating profit and lower-than-

expected tax rate of 19% (versus assumption of 20%).

NEGL LOW MED HIGH SEVERE

Key positives

0-10 10-20 20-30 30-40 40+

Stronger-than-expected revenue growth of 50% y-o-y led by volume growth and price hikes.

Source: Morningstar Robust pharma EBIT margin of 18.7%, up 153 bps q-o-q.

Key negatives

Company details

Gross margin declined sharply by 935 bps/318 bps y-o-y/q-o-q to 44.3%.

Market cap: Rs. 29,537 cr Management Commentary

52-week high/low: Rs. 1,168/669 Management maintained high single-digit EBITDA growth for FY23 as it is seeing demand slowdown (especially

from textile and FMCG sector in domestic market) and would look to revise guidance post Q2FY23. FY24 would

witness strong EBITDA growth as fixed cost for new projects is expected to be absorbed in FY23.

NSE volume:

7.8 lakh Company maintained medium-term growth guidance of revenue/EBITDA/PAT of 1.7x-2x for FY24 over FY21 and

(No of shares) long-term growth guidance for revenue at 2.5x-3.5x, while EBITDA/PAT growth at 3x-4x by FY27 over FY21.

First/second long-term contract started and has witnessed ramp-up in Q1FY23; management guided to further

BSE code: 524208 ramp-up in utilisation to over 70%+ by FY24-end. It commenced commercial production at USFDA approved API

facility at Tarapur in early Q2FY22.

NSE code: AARTIIND Capex for third long-term contract, NCB capacity expansion, and other projects are on track, and expected to be

commissioned in a phases starting in the latter part of FY23. Capex guidance of Rs. 4,500-5,000 crore (including

Free float: Rs. 1,500 crore for existing products and Rs. 3,000-3,500 crore for new products) over FY23E-24E.

20.2 cr

(No of shares) NCLT hearing for pharma demerger concluded on August 01, 2022 and it expects the order to be issued soon. The

company would take necessary actions to make demerger effective immediately.

Shareholding (%) Revision in estimates – We maintain our FY2023-FY2024 earnings estimate.

Our Call

Promoters 44

Valuation – Maintain Buy on Aarti Industries with an unchanged PT of Rs. 1,000: Robust growth guidance of

2x/4x increase in earnings by FY2024E/FY2027E over FY2021 reinforces confidence in terms of sustained long-term,

FII 12 high-growth potential for Aarti Industries. Thus, we expect a strong revenue/EBITDA/PAT CAGR of 22%/25%/26%

over FY2022-FY2024E, led by high capex intensity over the next couple of years. We believe that Aarti Industries

DII 15 would benefit immensely from a strong growth outlook for the Indian specialty chemical sector supported by the

China Plus One strategy of global companies, import substitution in domestic markets (identified opportunities of ~$1

Others 29 billion), and rising domestic demand for specialty chemicals. Moreover, favourable dynamics for the Indian specialty

chemicals sector are likely to support premium valuation. Hence, we maintain a Buy rating on the stock with an

Price chart unchanged price target (PT) of Rs. 1,000. At the CMP, the stock trades at 38x its FY2023E EPS and 26.7x its FY2024E

EPS.

1,200

Key Risks

1,050 Slowdown in demand and delay in commissioning of facilities for multi-year contracts can affect revenue growth

momentum.

900 Adverse commodity price and currency movement might affect margins.

750 Valuation (Consolidated) Rs cr

600 Particulars FY21 FY22 FY23E FY24E

Dec-21

Apr-22

Aug-21

Aug-22

Revenue 4,506 6,369 7,256 9,512

OPM (%) 21.8 20.7 20.2 21.9

Adjusted PAT 523 697 777 1,105

Price performance y-o-y growth (%) (2.4) 33.2 11.5 42.1

(%) 1m 3m 6m 12m Adjusted EPS (Rs.) 14.4 19.2 21.4 30.5

P/E (x) 56.4 42.4 38.0 26.7

Absolute 11.8 10.0 -17.5 -12.1 P/BV (x) 8.4 5.0 4.5 4.0

Relative to EV/EBITDA (x) 32.2 23.9 21.9 16.1

1.7 -2.1 -19.5 -20.2

Sensex RoCE (%) 12.4 13.7 12.3 15.2

Sharekhan Research, Bloomberg RoE (%) 16.3 14.8 12.4 15.7

Source: Company; Sharekhan estimates

August 11, 2022 1

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Strong growth sustained in Q1 led by volume growth and resilient margin despite high cost

Q1FY23 performance was good with stronger-than-expected revenue growth of 49.8% y-o-y and 12.3% q-o-q

to Rs. 1972 crore (5.6% above our estimate) led by 15-20% y-o-y volume growth and a 25-30% y-o-y rise

in realisation on price hikes to pass on higher raw material/logistics costs. Specialty chemical segment’s

revenues increased by 44% y-o-y to Rs. 1,766 crore supported by a higher volume trajectory, ramp-up of

first/second long term contracts and price hikes however; shortage of nitric acid continues to affect growth.

Revenue from pharmaceutical segment grew by 48% y-o-y to Rs. 407 crore led by higher demand trajectory

for key products from generic pharma/Xanthine businesses and healthy realisations. Although OPM of 18.7%

(largely in-line) declined by 510 bps/59 bps y-o-y/q-o-q, the company was able to maintain absolute delta

margin (i.e. per kg margin) and thus operating profit grew strongly by 17.7% y-o-y and 8.9% q-o-q to Rs. 369

crore, 4% above our estimate of Rs. 355 crore. Specialty chemical/pharma EBIT increased by 7.7%/45.7%

y-o-y to Rs. 250 crore/Rs. 76 crore. PAT (adjusted for negative forex impact of Rs. 30 crore) at Rs. 219 crore (up

24.3% y-o-y; up 12.7% q-o-q), was 12% above our estimate of Rs. 196 crore reflecting beat in operating profit

and lower-than-expected tax rate of 19% (versus assumption of 20%).

Q1FY2023 key conference call highlights

Inflationary headwinds affect demand from certain sectors: Inflationary environment is posing some

challenges for the company and they are witnessing a softness in demand from domestic textile and

FMCG companies; yet the company has posted strong revenue growth led by high volumes due to new

capacities and ramp-up in production and also due to firm selling prices. Company has managed to pass

on input costs but with a time lag, which has led to drop in the gross margins during the quarter.

Growth guidance unchanged: The management reiterated its guidance for high single digit growth in

EBITDA for FY23. Management has maintained its revenue/EBITDA/PAT growth guidance of 1.7-2x for

FY24 and maintained long-term growth guidance of 2.5-3.5x in turnover and 3-4x growth in EBITDA/PAT

for FY27 over FY21.

Backward integration for Nitric Acid: Planned capex of Rs. 150-200 crore for its key raw material nitric

acid with a capacity of 225-250 TPD (expected by Q4FY24). Management expressed some concerns over

the availability of nitric acid in H2FY23 but expects supply to normalise in FY24.

Update on long-term contracts: The project related to the first and second long-term contract has started

seeing volume ramp up and utilisation levels are expected to increase to ~70%+ by FY24-end. Third long-

term contract will be commissioned in Q2FY23.

Tarapur API facility commencement and Pharma demerger update: Commenced commercial production

at the new block of the USFDA approved API facility at Tarapur in early Q2, which would further strengthen

the company’s niche offerings in Pharma and lead to positive contribution in subsequent quarters. NCLT

hearing for pharma demerger concluded on August 01, 2022 and expect the order to be issued soon. The

company would take necessary actions to make demerger effective immediately.

USFDA observations on Dombivali facility: In June 2022, company received two USFDA observations

for its Dombivli facility under regulation 483. Company is confident of addressing the same and obtaining

the EIR. With that, the Dombivali facility will be the company’s third USFDA site.

Capex: Capex stood at Rs. 200 crore in Q1FY23 and the management guided for a capex of Rs. 1,500

crore in FY23. FY23-24, company will have a capex plan of about Rs. 2500-3000 crore for chemicals and

Rs. 350-500 crore for pharmaceuticals, which will drive the growth from FY25 and beyond.

August 11, 2022 2

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Production updates: Production of nitro-chlorobenzene stood at 20,515 MT versus 19,551 MT in Q4FY22.

Production of hydrogenated products stood at 3,295 MT/month versus 3,029 MT /month in Q4FY22. Nitro-

toluene production stood at 5,252 MT versus 5,155 MT in Q4FY2022. Production of PDA was at 370 MT/

month. In Q1FY23, Capacity utilization rates were at 100% for nitro-chlorobenzene and 70% for Nitro-

toluene.

Others: Finance cost increased by Rs. 30 crore led by significant rupee depreciation during the quarter.

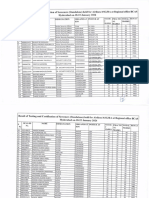

Results (Consolidated) Rs cr

Particulars Q1FY23 Q1FY22 YoY (%) Q4FY22 QoQ (%)

Revenue 1,972 1,317 49.8 1,756 12.3

Total expenditure 1,603 1,003 59.8 1,417 13.1

Operating profit 369 314 17.7 339 8.9

Other Income 0.4 0.1 660.0 0.2 123.5

Depreciation 87 69 26.1 77 12.0

Interest 50 38 30.1 31 62.7

PBT 233 207 12.8 231 0.8

Tax 44 42 5.7 38 17.6

Reported PAT 189 165 14.7 194 (2.4)

Adjusted PAT 219 176 24.3 195 12.7

Reported EPS (Rs. ) 5.2 4.5 14.7 5.3 (2.4)

Adjusted EPS (Rs. ) 6.0 4.9 24.3 5.4 12.7

Margin (%) BPS BPS

OPM 18.7 23.8 (510) 19.3 (59)

NPM 9.6 12.5 (293) 11.0 (145)

Tax Rate 19.0 20 (126) 16 270

Source: Company; Sharekhan Research

Segmental performance Rs cr

Particulars Q1FY23 Q1FY22 YoY (%) Q4FY22 QoQ (%)

Revenue

Speciality Chemicals 1,766 1,228 43.8 1,629 8.4

Pharmaceuticals 407 276 47.8 388 4.8

Less: GST 201 187 7.7 262 (23.4)

Total Revenue 1,972 1,317 49.8 1,756 12.3

EBIT

Speciality Chemicals 250 232 7.7 246 2.0

Pharmaceuticals 76 52 45.7 67 14.2

Total EBIT 327 285 14.7 312 4.6

EBIT margin bps bps

Speciality Chemicals 14.2 18.9 (475) 15.1 (89)

Pharmaceuticals 18.7 19.0 (27) 17.2 153

Overall EBIT margin 16.6 21.6 (506) 17.8 (123)

Source: Company; Sharekhan Research

August 11, 2022 3

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector View – Structural growth drivers to drive sustained growth for specialty chemicals in medium to

long term

We remain bullish on the medium to long-term growth prospects of the specialty chemicals sector, given a

massive revenue opportunity from import substitution (India’s total specialty chemical imports are estimated

at $56 billion), potential increase in exports given China plus One strategy by global customers and

favourable government policies (such as tax incentive and production-linked incentive scheme similar to

the pharmaceutical sector). In our view, conducive government policies, product innovation, massive export

opportunity, and low input costs would help the sector witness sustained high double-digit earnings growth

for the next 2-3 years.

n Company Outlook – Long-term growth intact supported by capex in the right space

The company is investing in the right areas to build capabilities and enhance client engagements. Growth is

expected to be largely driven by - i) Growth in global markets, ii) Import substitution, and iii) customer de-risking.

Issues arising out of China such as - 1) Stringent regulatory environment and 2) the COVID-19 pandemic (outbreak

of COVID-19 in China and its spread to other regions) have provided opportunities for Indian players to scale

up their business as global players are looking for long-term relationships with suppliers who can offer quality

products on a sustainable basis.

n Valuation – Maintain Buy on Aarti Industries with an unchanged PT of Rs. 1,000

Robust growth guidance of 2x/4x increase in earnings by FY2024E/FY2027E over FY2021 reinforces confidence

in terms of sustained long-term, high-growth potential for Aarti Industries. Thus, we expect a strong revenue/

EBITDA/PAT CAGR of 22%/25%/26% over FY2022-FY2024E, led by high capex intensity over the next couple

of years. We believe that Aarti Industries would benefit immensely from a strong growth outlook for the Indian

specialty chemical sector supported by the China Plus One strategy of global companies, import substitution in

domestic markets (identified opportunities of ~$1 billion), and rising domestic demand for specialty chemicals.

Moreover, favourable dynamics for the Indian specialty chemicals sector are likely to support premium valuation.

Hence, we maintain a Buy rating on the stock with an unchanged price target (PT) of Rs. 1,000. At the CMP, the

stock trades at 38x its FY2023E EPS and 26.7x its FY2024E EPS.

One-year forward P/E (x) band

60.0

50.0

40.0

P/E (x)

30.0

20.0

10.0

0.0

Dec-11

Dec-13

Dec-15

Dec-17

Dec-19

Dec-21

Apr-11

Apr-13

Apr-15

Apr-17

Apr-19

Apr-21

Aug-12

Aug-14

Aug-16

Aug-18

Aug-20

Aug-22

Source: Sharekhan Research

August 11, 2022 4

Stock Update

Powered by the Sharekhan

3R Research Philosophy

About company

Aarti Industries is a leading specialty chemicals company in benzene-based derivatives with a global

footprint having integrated operations and high level of cost optimisation. The company has been setup by

first-generation technocrats in 1984 and its pharmaceutical business spans across APIs, intermediates, and

Xanthene derivatives. The company has strong R&D capabilities, with three R&D facilities and a dedicated

pool of over 170 engineers and scientists. The company has 11 plants located in western India with proximity

to ports; specialty chemicals are manufactured in all plants; and four of the plants are approved as pharma-

grade (2 USFDA and 2 WHO/GMP). The company is also coming up with two project sites at Dahej SEZ and

the fourth R&D centre at Navi Mumbai.

Investment theme

Aarti Industries is investing in the right areas for building capabilities and richer client engagements, which

would create a long-term moat in a booming industry. Expanding capacity for Nitro chlorobenzene (NCB) by

33,000 MTPA at a capex of Rs. 150 crore in two phases is expected to be operational by FY2021 and FY2022.

Multi-year growth levers are getting stronger; the company has signed the third multi-year contracts worth

$125 million with global players for 10 years, though small in size but they bring in new capabilities for long-

term growth (the second multi-year contract is with the global player in the specialty chemical space for Rs.

10,000 crore for 15 years). The company expects significant growth prospects in sight, led by expansion and

diversification plans and concerns over supplies from China.

Key Risks

Slowdown in demand offtake and delay in commissioning of facilities for multi-year contracts can affect

revenue growth momentum.

Adverse commodity prices and currency movements might affect margins.

Additional Data

Key management personnel

Rajendra Vallabhaji Gogri Chairman cum Managing Director

Rashesh Chandrakant Gogri Vice Chairman cum Managing Director

Renil Rajendra Gogri, Kirit Ratilal Mehta, Parimal Hasmukhlal Desai, Executive Director

Manoj Mulji Chheda, Hetal Gogri Gala

Chetan B Gandhi Chief Finance Officer (CFO)

Raj Sarraf Company Secretary & Compliance Officer

Source: Company Website

Top shareholders

Sr. No. Holder Name Holding (%)

1 Life Insurance Corp of India 4.3

2 HDFC Asset Management Co. Ltd 2.9

3 Baron Capital Inc. 2.8

4 Aditya Birla Sun Life Trustee Co. Pvt. Ltd 1.8

5 Vanguard Group Inc. 1.8

6 Aditya Birla Sun Life Asset Management Co. Ltd 1.8

7 HDFC Life Insurance Co. Ltd 1.2

8 BlackRock Inc. 0.8

9 Norges Bank 0.7

Source: Bloomberg (old data)

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

August 11, 2022 5

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Priya Sonavane; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai – 400 028,

Maharashtra, INDIA, Tel: 022 - 67502000/ Fax: 022 - 24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH /

F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- Zapanta v. COMELECDocument3 pagesZapanta v. COMELECnrpostreNo ratings yet

- In For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Document31 pagesIn For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Doshi VaibhavNo ratings yet

- CDCS Self-Study Guide 2011Document21 pagesCDCS Self-Study Guide 2011armamut100% (2)

- Online Illuminati Brotherhood Registration Call On +27632807647 How To Join IlluminatiDocument5 pagesOnline Illuminati Brotherhood Registration Call On +27632807647 How To Join IlluminatinaseefNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Adding Print PDF To Custom ModuleDocument3 pagesAdding Print PDF To Custom ModuleNguyễn Vương AnhNo ratings yet

- Aarti Industries 10-08-2021 KhanDocument8 pagesAarti Industries 10-08-2021 KhanAkchikaNo ratings yet

- Aarti Ind. SharekhanDocument8 pagesAarti Ind. SharekhanAniket DhanukaNo ratings yet

- MarutiSuzuki 3R Oct27 - 2023Document7 pagesMarutiSuzuki 3R Oct27 - 2023ajoy14091981No ratings yet

- Jyothy - Lab Sharekhan PDFDocument7 pagesJyothy - Lab Sharekhan PDFAniket DhanukaNo ratings yet

- Pidilite 3R Aug11 2022Document8 pagesPidilite 3R Aug11 2022Arka MitraNo ratings yet

- Insecticides Q1 Result UpdateDocument7 pagesInsecticides Q1 Result UpdateAryan SharmaNo ratings yet

- Coromandel Q1 Result UpdateDocument8 pagesCoromandel Q1 Result UpdateshrikantbodkeNo ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Atul LTD: ESG Disclosure ScoreDocument7 pagesAtul LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- Asian Paints 26-07-2023 KhanDocument7 pagesAsian Paints 26-07-2023 Khangaurav24021990No ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- Federal Bank 08-05-2023 KhanDocument7 pagesFederal Bank 08-05-2023 KhansendtokrishmunNo ratings yet

- SupremeInd 3R Apr29 2022Document7 pagesSupremeInd 3R Apr29 2022bdacNo ratings yet

- Investoreye (6) - 6Document61 pagesInvestoreye (6) - 6Harry AndersonNo ratings yet

- Agri Inputs: Sector Valuations Price in A Good SeasonDocument12 pagesAgri Inputs: Sector Valuations Price in A Good SeasonPrahladNo ratings yet

- Stock Update: Jyothy LaboratoriesDocument4 pagesStock Update: Jyothy LaboratoriesjeetchauhanNo ratings yet

- TVS Motor Company LTD: ESG Disclosure ScoreDocument7 pagesTVS Motor Company LTD: ESG Disclosure ScorePiyush ParagNo ratings yet

- HDFC Life Insurance Company: ESG Disclosure ScoreDocument6 pagesHDFC Life Insurance Company: ESG Disclosure ScorebdacNo ratings yet

- Healthcare Global - Initiating Coverage - Axis Sec - 291121Document18 pagesHealthcare Global - Initiating Coverage - Axis Sec - 291121Ravi KumarNo ratings yet

- Aarti Industries LTDDocument5 pagesAarti Industries LTDViju K GNo ratings yet

- Sunp 28 5 23 PLDocument8 pagesSunp 28 5 23 PLraj patilNo ratings yet

- Grasim 3R Feb14 - 2023Document7 pagesGrasim 3R Feb14 - 2023Rajavel GanesanNo ratings yet

- L&T Finance Holdings LTD: ESG Disclosure ScoreDocument6 pagesL&T Finance Holdings LTD: ESG Disclosure ScoreAshwet JadhavNo ratings yet

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- TataMotors SharekhanDocument9 pagesTataMotors SharekhanAniket DhanukaNo ratings yet

- Axis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LineDocument9 pagesAxis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LinemisfitmedicoNo ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- SRF Khan 17122021Document8 pagesSRF Khan 17122021MiwcoNo ratings yet

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDocument8 pagesNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqNo ratings yet

- Elgi Equipments (ELEQ IN) 2Q24 - HaitongDocument14 pagesElgi Equipments (ELEQ IN) 2Q24 - Haitonglong-shortNo ratings yet

- Sun Pharma: CMP: INR574 TP: INR675 (+18%)Document10 pagesSun Pharma: CMP: INR574 TP: INR675 (+18%)rishab agarwalNo ratings yet

- Affle Stock PricingDocument8 pagesAffle Stock PricingSandyNo ratings yet

- Kirloskar 3R Feb10 2023Document7 pagesKirloskar 3R Feb10 2023sushant panditaNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- HSIE Results Daily: Result ReviewsDocument13 pagesHSIE Results Daily: Result ReviewsKiran KudtarkarNo ratings yet

- National Medical Care Co - Al Jazira Capital PDFDocument2 pagesNational Medical Care Co - Al Jazira Capital PDFikhan809No ratings yet

- Power Grid-Feb09 2024Document7 pagesPower Grid-Feb09 2024shashankNo ratings yet

- 2020-08, Ambit Insights - Laurus LabsDocument19 pages2020-08, Ambit Insights - Laurus LabsKarthikNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- Torrent Pharma-3R-Oct25 2022Document7 pagesTorrent Pharma-3R-Oct25 2022Aa BaNo ratings yet

- Subros 3R Jan31 - 2024Document8 pagesSubros 3R Jan31 - 2024h40280890No ratings yet

- ITC 3R Oct20 - 2022Document7 pagesITC 3R Oct20 - 2022Sri DPNo ratings yet

- VaTech Q1 Result UpdateDocument7 pagesVaTech Q1 Result UpdateAryan SharmaNo ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- Investoreye (10) - 4Document43 pagesInvestoreye (10) - 4Harry AndersonNo ratings yet

- TCI Express SharekhanDocument7 pagesTCI Express SharekhanAniket DhanukaNo ratings yet

- Jubilant Life Sciences: CMP: INR809 Across-The-Board Traction Strengthening Growth StoryDocument10 pagesJubilant Life Sciences: CMP: INR809 Across-The-Board Traction Strengthening Growth StorymilandeepNo ratings yet

- AsianPaints 3R May11 - 2023Document8 pagesAsianPaints 3R May11 - 2023Nitin KumarNo ratings yet

- To, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentDocument24 pagesTo, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentrohitnagrajNo ratings yet

- 20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enDocument2 pages20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enPost PictureNo ratings yet

- Upll 2 8 20 PL PDFDocument9 pagesUpll 2 8 20 PL PDFwhitenagarNo ratings yet

- ABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementDocument4 pagesABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementShanti RanganNo ratings yet

- Ajanta PharmaDocument9 pagesAjanta Pharmamahima patelNo ratings yet

- ITC - Q1FY24 - Result Update - 16082023 - 16-08-2023 - 08Document8 pagesITC - Q1FY24 - Result Update - 16082023 - 16-08-2023 - 08Sanjeedeep Mishra , 315No ratings yet

- Sobha 3R Aug11 - 2022Document7 pagesSobha 3R Aug11 - 2022Arka MitraNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- Metropolis 3R Aug11 2022Document8 pagesMetropolis 3R Aug11 2022Arka MitraNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- Central Nervous SystemDocument16 pagesCentral Nervous SystemArka MitraNo ratings yet

- Most Market Outlook: Morning UpdateDocument9 pagesMost Market Outlook: Morning UpdateArka MitraNo ratings yet

- General Surgery Questions: Chandra RayidiDocument42 pagesGeneral Surgery Questions: Chandra RayidiArka MitraNo ratings yet

- General Surgery Questions: Chandra RayidiDocument42 pagesGeneral Surgery Questions: Chandra RayidiArka MitraNo ratings yet

- Atmanirbhar Bharat Package 3.0: 12 November 2020 Ministry of FinanceDocument26 pagesAtmanirbhar Bharat Package 3.0: 12 November 2020 Ministry of FinanceArka MitraNo ratings yet

- Commodities-Daily Technical ReportDocument7 pagesCommodities-Daily Technical ReportArka MitraNo ratings yet

- Usdinr: Technical OutlookDocument5 pagesUsdinr: Technical OutlookArka MitraNo ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- Usdinr: Technical OutlookDocument5 pagesUsdinr: Technical OutlookArka MitraNo ratings yet

- MazagonDockShipbuilder IPONote 25092020 PDFDocument14 pagesMazagonDockShipbuilder IPONote 25092020 PDFRomelu MartialNo ratings yet

- 5 6147838164842054055Document5 pages5 6147838164842054055Arka MitraNo ratings yet

- University of Nottingham Department of Architecture and Built EnvironmentDocument43 pagesUniversity of Nottingham Department of Architecture and Built EnvironmentDaniahNo ratings yet

- Nxivm: 2nd Superseding IndictmentDocument32 pagesNxivm: 2nd Superseding IndictmentTony Ortega100% (2)

- Sage 200 Evolution Training JourneyDocument5 pagesSage 200 Evolution Training JourneysibaNo ratings yet

- Nepal CountryReport PDFDocument64 pagesNepal CountryReport PDFnickdash09No ratings yet

- Upload 1 Document To Download: Ergen DedaDocument3 pagesUpload 1 Document To Download: Ergen DedakNo ratings yet

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDocument14 pagesEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNo ratings yet

- QT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDocument3 pagesQT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDoan Ngoc DucNo ratings yet

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- 2 Players The One With Steam BaronsDocument1 page2 Players The One With Steam BaronsBrad RoseNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMatinChris KisomboNo ratings yet

- MODULE 5 - WeirDocument11 pagesMODULE 5 - WeirGrace MagbooNo ratings yet

- Farmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesDocument13 pagesFarmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Advanced Excel Training ManualDocument6 pagesAdvanced Excel Training ManualAnkush RedhuNo ratings yet

- 2023-2024 Draft Benzie County Budget BookDocument91 pages2023-2024 Draft Benzie County Budget BookColin MerryNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- RS485 ManualDocument7 pagesRS485 Manualndtruc100% (2)

- Reterta V MoresDocument13 pagesReterta V MoresRam Migue SaintNo ratings yet

- Maverick Research: World Order 2.0: The Birth of Virtual NationsDocument9 pagesMaverick Research: World Order 2.0: The Birth of Virtual NationsСергей КолосовNo ratings yet

- Techgig Open Round CompetitionDocument6 pagesTechgig Open Round CompetitionAnil Kumar GodishalaNo ratings yet

- VKC Group of Companies Industry ProfileDocument5 pagesVKC Group of Companies Industry ProfilePavithraPramodNo ratings yet

- IMS DB Interview Questions: Beginner LevelDocument19 pagesIMS DB Interview Questions: Beginner LevelsudhakarcheedaraNo ratings yet

- (1895) Indianapolis Police ManualDocument122 pages(1895) Indianapolis Police ManualHerbert Hillary Booker 2ndNo ratings yet

- Factors Affecting The Rate of Chemical Reactions Notes Key 1Document3 pagesFactors Affecting The Rate of Chemical Reactions Notes Key 1api-292000448No ratings yet

- HyderabadDocument3 pagesHyderabadChristoNo ratings yet

- San Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintDocument25 pagesSan Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintFindLawNo ratings yet