Professional Documents

Culture Documents

Kirloskar 3R Feb10 2023

Uploaded by

sushant panditaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kirloskar 3R Feb10 2023

Uploaded by

sushant panditaCopyright:

Available Formats

Viewpoint

Kirloskar Oil Engines Ltd

Strong Q3; core growth levers intact

Powered by the Sharekhan 3R Research Philosophy Capital Goods Sharekhan code: KIRLOSENG

3R MATRIX + = -

Reco/View: Positive CMP: Rs. 315 Upside potential: 16-18%

Result Update

Right Sector (RS) ü á Upgrade Maintain â Downgrade

Right Quality (RQ) ü Summary

We stay positive on KOEL and expect a 16-18% upside, given reasonable valuations and strong growth

Right Valuation (RV) ü prospects aided by favourable macro environment.

+ Positive = Neutral – Negative Standalone results were strong but fell marginally short of estimates on profitability front. Revenue

growth was driven by power-gen, industrial and after-market segments. OPM rose by ~483 bps y-o-y to

10.9%, net profit was at Rs. 68 crore (+169.8%).

Demand outlook continues to be promising in domestic business across its key segments. Exports is

seeing some softness although there is no major red flag at this juncture.

What has changed in 3R MATRIX Implementation of CPCB-IV plus norms, exports ramp-up, growth in after sales services and margin

expansion are the key growth enablers for achieving 2x revenue by FY26.

Old New

Kirloskar Oil Engines Limited’s (KOEL’s) standalone results lagged expectations particularly on

RS profitability front. Revenue grew by 19.5% y-o-y to Rs 1,000 crore. Its B2B sales grew by 21% y-o-y to Rs

867 crore, while B2C sales grew at a moderate pace of 9% y-o-y to Rs 122 crore. Strong growth was seen

RQ in the power generation, industrial, after-market & distribution. International markets also grew by 35%

y-o-y to Rs 120 crore. GPM improved by 329 bps y-o-y to 32.3%, however it declined sequentially by 100

RV bps. Operating profit increased by 114.8% y-o-y to Rs 109 crore (vs our estimate of Rs 118 crore). OPM

improved to 10.9% vs 6.1% in Q3FY22 but was lower by 53 bps on q-o-q basis. Net profit grew by 169.8%

y-o-y to Rs 68 crore (vs our estimate of Rs. 75 crore) led by strong operating performance.

Key positives

Company details Power generation, industrial, after-market & distribution grew by 23%/15%/13%, respectively.

Exports sales have registered 35% y-o-y growth.

Market cap: Rs. 4,555 cr OPM has improved y-o-y on account of decline in raw-material cost and other expenses.

Its subsidiary La-Gajjar Machineries (P) Ltd (LGM) turned EBITDA positive this quarter.

52-week high/low: Rs. 372/124

Key negatives

NSE volume: LGM registered flat sales of Rs. 251 crore.

7.3 lakh

(No of shares) The performance has been below expectations q-o-q owing to product mix and rise in employee cost and

other expenses.

BSE code: 533293

Management Commentary

NSE code: KIRLOSENG Powergen segment grew by ~23% y-o-y backed by robust demand. The gas gensets launched in Q2 are

generating good response. There is also a good traction in the telecom segment.

Free float:

5.9 cr Exports rose by ~35% y-o-y and the company launched two new firefighting models for international

(No of shares) markets.

The q-o-q decline in OPM is a result of product mix and higher employee cost.

Export demand has softened in some international markets, but the management does not see a sharp

decline in the near to medium term.

35-40% of company’s total product portfolio in power generation would be impacted due to implementation

Shareholding (%) of CPCB- IV plus norms from July 2023 onwards.

Promoters 59.4 The company expects to see pre-buying in Q4FY23 before implementation of CPCB-IV plus norms which

would lead to substantial increase in prices of gensets.

FII 3.6 Revision in estimates – We have broadly maintained our FY2023-FY2025E estimates.

DII 14.7 Our Call

Valuation – Maintain Positive view; expect 16-18% upside: KOEL has been consistently performing well

Others 22.3 since the last two-three quarters driven by robust demand. Further, changes at the top management and

the company’s focus on pursuing various growth opportunities have been yielding satisfactory results.

We maintain our Positive view on KOEL as we expect the growth momentum to continue, given sustained

demand across business verticals and expansion of product range. The company’s strategy to grow 2x

revenue in three years would be driven by demand generation from CPCB-IV plus norms, export growth, and

Price chart scalability of its customer support business. In addition, the company is well poised to benefit from sector

400 tailwinds such as PLI schemes, infrastructure spending by the government, and power deficit. Hence, strong

growth levers in the core business as well as subsidiaries give us confidence about its long-term prospects.

325 Hence, we maintain our Positive view on KOEL and expect 16-18% upside valuing it on SOTP basis.

250 Key Risks

Slowdown in the domestic and overseas macro-environment can negatively affect business outlook and

175 earnings growth.

100

Valuation (Standalone) Rs cr

Oct-22

Jun-22

Feb-22

Feb-23

Particulars FY22 FY23E FY24E FY25E

Revenue 3,300 3,722 4,156 4,653

OPM (%) 8.2 9.8 10.2 10.8

Adjusted PAT 156 220 260 314

Price performance % YoY growth -12.2 41.5 18.0 20.7

(%) 1m 3m 6m 12m Adjusted EPS (Rs.) 10.8 15.2 18.0 21.7

P/E (x) 29.2 20.7 17.5 14.1

Absolute 5.4 15.1 103.3 100.2 P/B (x) 2.5 2.4 2.2 2.1

Relative to EV/EBITDA (x) 15.8 11.7 10.1 8.4

5.3 15.5 100.0 96.2

Sensex RoNW (%) 8.6 11.6 12.6 14.5

Sharekhan Research, Bloomberg RoCE (%) 11.9 15.6 16.7 19.0

Source: Company; Sharekhan estimates

February 10, 2023 1

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Another strong quarter barring marginal miss on OPM and net profit fronts

Kirloskar Oil Engines Limited’s (KOEL’s) standalone results lagged expectations particularly on profitability

front. Revenue grew by 19.5% y-o-y to Rs 1,000 crore. Its B2B sales grew by 21% y-o-y to Rs 867 crore,

while B2C sales grew at a moderate pace of 9% y-o-y to Rs 122 crore. Strong growth was seen in the power

generation, industrial, after-market & distribution. International markets also grew by 35% y-o-y to Rs 120

crore. GPM improved by 329 bps y-o-y to 32.3%, however it declined sequentially by 100 bps. Operating

profit increased by 114.8% y-o-y to Rs 109 crore (vs our estimate of Rs 118 crore). OPM improved to 10.9% vs

6.1% in Q3FY22 but was lower by 53 bps on q-o-q basis. Net profit grew by 169.8% y-o-y to Rs 68 crore (vs our

estimate of Rs. 75 crore) led by strong operating performance.

Bright outlook remains intact

The company has been pursuing growth and market share gains opportunities in all its segments to achieve

its goal of growing 2x in three years, with sales of Rs. 6,500 crore and double-digit OPM. The company has

re-aligned its focus on export markets and expects its revenue share to increase to 15-18% in the next 2-3

years. The company has launched gas gensets, which have been received well in the domestic market. It

has also launched two new firefighting models for international markets. Its subsidiaries have also turned

profitable and its witnessing traction in exports from LGM. Hence, we believe the company is on a sustained

long-term growth trajectory.

Investor Update and Conference Call Highlights

Change in product mix led to OPM decline on q-o-q basis: In Q3FY23, different product mix has led to

marginal decline in OPM on a q-o-q basis. Further, increase in employee and other cost has also led to

decline in OPM. However, the company has not taken any price reduction.

Focus on data centres – The company is looking to pursue opportunities in the data centres in 500 KVA

and upwards.

Order book strong in B2B business: The company has a good order book in B2B business driven by

demand from construction, healthcare and hospitals.

Working capital cycle and cash balance: The company has a working capital cycle of 90 days and net

cash position is Rs 200 crore.

Capacity utilisation: Currently, the capacity utilization is at 60%. The company would not require any

substantial capex to achieve its target of 2x top line by FY26. The capex target is Rs. 60-80 crore for the

next couple of years as the company would largely spend on technological improvement in its products.

Investment in Arka Financial Holdings: The company has only Rs 36 crore remaining to be invested out

of Rs 1000 crore that it planned to invest in Arka Financial Holdings.

CPCB IV plus update: KOEL is geared for CPCB-IV plus emission norms. The company has in-house R&D

and is focused on product development. Most of the components are localized. Changing of these norms

is an opportunity for large companies to grow their business. The company expects 25-40% cost increase

due to change in emission norms. Pre-buy demand is expected in Q4FY23 as prices would go up post the

implementation.

Farm mechanisation: Farm mechanisation sales grew by 16% y-o-y to Rs 79 crore. The company carried

out successful trials of innovative harvester product in paddy and its channel expansion activities are

gaining momentum.

February 10, 2023 2

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

LGM update: For LGM, Q3 was a good quarter in terms of profitability, while the revenues remained flat at

Rs 251 crore. Margins have improved to 5% from -1.3% due to higher price realization, wider reach and cost

control. There has also been traction in exports. The company expects further improvement in margins

going forward.

Exports update: The company has witnessed a slowdown in some of the global markets. Currently,

proportion of exports in total business is ~13%. The product portfolio which will be compliant with new

emission norms in India would help the company market its products internationally as well. Thus, the

company expects growth momentum to sustain in the export markets in the long-term.

Results (Standalone) Rs cr

Particulars Q3FY23 Q3FY22 YoY (%) Q2FY23 QoQ (%)

Net Sales 1,000.1 836.9 19.5 1,010.4 -1.0

Operating Profit 108.9 50.7 114.8 115.3 -5.6

Depreciation 21.2 19.0 12.0 21.3 -0.4

Interest 1.9 2.2 -14.0 1.0 84.5

Other Income 6.0 4.8 24.9 4.8 26.0

PBT 91.7 34.3 167.4 97.8 -6.1

Total Tax 23.6 9.0 160.5 25.2 -6.4

Reported PAT 68.2 25.3 169.8 72.6 -6.1

Adj. PAT 68.2 25.3 169.8 72.6 -6.1

EPS (Rs.) 4.7 1.7 169.8 5.0 -6.1

Margin (%) BPS BPS

OPM 10.9 6.1 483 11.4 -53

NPM 6.8 3.0 380 7.2 -37

Tax Rate 25.7 26.3 -68 25.7 -7

Source: Company; Sharekhan Research

February 10, 2023 3

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector View – Continued government focus on infrastructure spending to provide growth opportunities

It is estimated that India would need to spend $4.5 trillion on infrastructure by 2030 to make itself $5 trillion economy

by FY2025 and to continue growing at an escalated trajectory until 2030. To achieve the desired goal, the government

has drawn up National Infrastructure Pipeline (NIP) through a bottom-up approach, wherein all projects costing

more than Rs. 100 crore per project under construction, proposed greenfield and brownfield projects, and those at

conceptualisation stage were captured. Consequently, total capital expenditure in the infrastructure sector in India

during FY2020-FY2025 is projected at ~Rs. 111 lakh crore. During the same period, sectors such as energy (24%),

roads (18%), urban (17%), and railways (12%) amount to ~71% of the projected infrastructure investments in India. The

huge outlay towards the infrastructure sector is expected to provide healthy growth opportunities for infrastructure

companies.

n Company Outlook – Domestic market expected to perform well

For KOEL, the power generation segment and growth in sectors such as roads and real estate (residential and commercial)

will drive demand for high and mid-horsepower diesel gensets. Further, with the availability of electricity in rural areas,

demand for electric pumps is expected to improve. KOEL, being one of the leading players, is in a sweet spot to leverage on

demand pick-up. Further, the industrial segment’s sales will be driven by demand from Railways, Metro Projects, Roads (off-

highway equipment), and bottoming-out of diesel generator demand for water well rigs. Improvement in core business and

increased outsourcing of maintenance services by clients will also boost the distribution business. The company expects

healthy growth from the commercial realty segment as demand for office spaces and commercial establishments continues

to increase. However, the expanding portfolio of domestic players as well as manufacturing footprint of international

players continues to increase competitive activity.

n Valuation – Maintain Positive view; Expect 16-18% upside

KOEL has been consistently performing well since the last two-three quarters driven by robust demand. Further, changes

at the top management and the company’s focus on pursuing various growth opportunities have been yielding satisfactory

results. We maintain our Positive view on KOEL as we expect the growth momentum to continue, given sustained demand

across business verticals and expansion of product range. The company’s strategy to grow 2x revenue in three years would

be driven by demand generation from CPCB-IV plus norms, export growth, and scalability of its customer support business.

In addition, the company is well poised to benefit from sector tailwinds such as PLI schemes, infrastructure spending by the

government, and power deficit. Hence, strong growth levers in the core business as well as subsidiaries give us confidence

about its long-term prospects. Hence, we maintain our Positive view on KOEL and expect 16-18% upside valuing it on SOTP

basis.

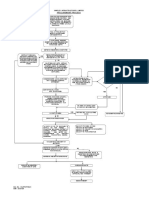

One-year forward P/E (x) band

52.0

42.0

32.0

22.0

12.0

2.0

Feb-15

Feb-16

Feb-17

Feb-18

Feb-19

Feb-20

Feb-21

Feb-22

Feb-23

Aug-15

Aug-16

Aug-17

Aug-18

Aug-19

Aug-20

Aug-21

Aug-22

1yr Fwd PE(x) Avg 1yr fwd PE Peak Trough

Source: Sharekhan Research

February 10, 2023 4

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

About company

KOEL is the flagship company of the Kirloskar Group, one of India’s largest engineering conglomerates. The

company is one of the world’s largest generating set manufacturers, specialising in manufacturing of both air-

cooled and water-cooled engines (2.5HP to 740HP), and diesel generating sets across a wide range of power

output from 5kVA to 3,000kVA. The company has four manufacturing plants – at Kagal, Pune, Nashik, and

Rajkot. KOEL has a sizable presence in international markets, with offices in Dubai, South Africa, and Kenya, and

representatives in Indonesia and Nigeria. KOEL also has a strong distribution network throughout the Middle

East and Africa. KOEL caters to power generation, agriculture, and industrial and machinery sectors. Of late, the

company has diversified into the NBFC business through its subsidiary, Arka Financial Holdings (P.) Ltd.

Investment theme

KOEL is one of the leading genset players in India with lead market share in medium and large gensets. The

company has a strong technology/innovation track record. The company’s diversified business presence

across power generation, industrial BU, exports, and distribution contributes to reasonable long-term growth

prospects with healthy return/cash flow profile. While the recent drop in demand, both domestic and exports

market, has posed near-term challenges, demand has gradually improved with improvements seen across

key segments such as powergen, wherein industrial consumption of power demand has gone up (relatively

slow earlier) and infra-related demand (airports, agri processing, and consumer space industry) is moving

very well and bodes well for KOEL. Further, the company is well geared up to handle the transition to CPCB4

plus norms. We believe the stock offers favourable risk-reward for long-term investors, given vast product

offerings, management’s focus on efficiency/cost, and a healthy potential scale from domestic infra and

global market pick-up.

Key Risks

Slowdown in domestic macro-environment can result in slower-than-expected growth for the company.

Global market demand weakness poses key downside risk to exports.

Additional Data

Key management personnel

Mr. Atul C. Kirloskar Executive Director-Chairperson

Ms. Gauri Kirloskar Managing Director

Mr. Aseem Srivastav Chief Executive Officer

Source: Company Website

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Franklin Resources Ltd 7.41

2 Mahindra Manulife Investment Management Pvt Ltd 1.76

3 L&T Mutual Fund Trustee 1.46

4 General Insurance Corporation Of India 1.38

5 Nippon Life India Asset Management 0.81

6 Dimensional Fund Advisors LP 0.75

7 BlackRock Inc 0.15

8 Investment Trust Of India 0.10

9 LIC Mutual Fund Asset Management Co Ltd 0.09

10 Achyut & Neeta Holdings & Finance Holdings Ltd 0.09

Source: Bloomberg (Old data)

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

February 10, 2023 5

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive

this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved) and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he or his

relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in

the securities of the company at the end of the month immediately preceding the date of publication of the research report nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in

this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Binkle Oza; Tel: 022-61150000; email id: complianceofficer@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com.

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai – 400 028,

Maharashtra, INDIA, Tel: 022 - 67502000/ Fax: 022 - 24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH / F&O/

CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- Strong Q1 Results for Pidilite; Valuation Limits UpsideDocument8 pagesStrong Q1 Results for Pidilite; Valuation Limits UpsideArka MitraNo ratings yet

- ISGEC 3R Nov17 - 2021Document7 pagesISGEC 3R Nov17 - 2021Aayushman GuptaNo ratings yet

- Tata Motors Company 1QFY23 Under Review 28 July 2022Document9 pagesTata Motors Company 1QFY23 Under Review 28 July 2022Rojalin SwainNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- Supreme Industries reports Q4 results, maintains 15% volume growth outlookDocument7 pagesSupreme Industries reports Q4 results, maintains 15% volume growth outlookbdacNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- Reliance Communication Ltd.Document2 pagesReliance Communication Ltd.ratika_bvpNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- MarutiSuzuki 3R Oct27 - 2023Document7 pagesMarutiSuzuki 3R Oct27 - 2023ajoy14091981No ratings yet

- JPM Reliance Industries 2022-07-20 4150945Document8 pagesJPM Reliance Industries 2022-07-20 4150945Abhishek SaxenaNo ratings yet

- Mahindra Logistics earnings decline on weak auto sectorDocument6 pagesMahindra Logistics earnings decline on weak auto sectordarshanmadeNo ratings yet

- Crompton Greaves LTD.: Investment RationaleDocument0 pagesCrompton Greaves LTD.: Investment Rationalespatel1972No ratings yet

- Investoreye (7) - 5Document47 pagesInvestoreye (7) - 5Harry AndersonNo ratings yet

- TVS Motor Company LTD: ESG Disclosure ScoreDocument7 pagesTVS Motor Company LTD: ESG Disclosure ScorePiyush ParagNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- 20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enDocument2 pages20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enPost PictureNo ratings yet

- Bharat Forge Geojit Research May 17Document5 pagesBharat Forge Geojit Research May 17veguruprasadNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- Praj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11Document8 pagesPraj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11samraatjadhavNo ratings yet

- Mahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsDocument6 pagesMahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsdarshanmadeNo ratings yet

- Reliance Industries (RIL IN) : Q1FY21 Result UpdateDocument7 pagesReliance Industries (RIL IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Sobha 3R Aug11 - 2022Document7 pagesSobha 3R Aug11 - 2022Arka MitraNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- Glenmark Pharmaceuticals PDFDocument23 pagesGlenmark Pharmaceuticals PDFsandyNo ratings yet

- Insecticides Q1 Result UpdateDocument7 pagesInsecticides Q1 Result UpdateAryan SharmaNo ratings yet

- Rel in HDFC SecuritiesDocument9 pagesRel in HDFC Securitiesopemperor06No ratings yet

- Subros 3R Jan31 - 2024Document8 pagesSubros 3R Jan31 - 2024h40280890No ratings yet

- Voltamp Transformers LTD: Invest ResearchDocument8 pagesVoltamp Transformers LTD: Invest ResearchDarwish MammiNo ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- GNA Axles Q1 Result UpdateDocument8 pagesGNA Axles Q1 Result UpdateshrikantbodkeNo ratings yet

- Trader's Daily DigestDocument12 pagesTrader's Daily DigestSudheera IndrajithNo ratings yet

- HSIE Results Daily: Result ReviewsDocument13 pagesHSIE Results Daily: Result ReviewsKiran KudtarkarNo ratings yet

- Press Release Q3fy19Document6 pagesPress Release Q3fy19movies hubNo ratings yet

- Sunp 28 5 23 PLDocument8 pagesSunp 28 5 23 PLraj patilNo ratings yet

- Gateway Distriparks LTD: Long Road To RecoveryDocument6 pagesGateway Distriparks LTD: Long Road To RecoveryPratik ChandakNo ratings yet

- Axis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LineDocument9 pagesAxis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LinemisfitmedicoNo ratings yet

- Motilal Oswal Sees 8% UPSIDE in Exide Lower Revenue Growth DentsDocument10 pagesMotilal Oswal Sees 8% UPSIDE in Exide Lower Revenue Growth DentsDhaval MailNo ratings yet

- Asian Paints 26-07-2023 KhanDocument7 pagesAsian Paints 26-07-2023 Khangaurav24021990No ratings yet

- Tata Elxsi 4qfy19 Result Update19Document6 pagesTata Elxsi 4qfy19 Result Update19Ashutosh GuptaNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- GNA Axles: To Continue Outpacing IndustryDocument5 pagesGNA Axles: To Continue Outpacing IndustrydarshanmadeNo ratings yet

- Stock Update: Atul Ltd downgraded to Hold on valuation concernsDocument7 pagesStock Update: Atul Ltd downgraded to Hold on valuation concernsGrim ReaperNo ratings yet

- PrabhudasDocument8 pagesPrabhudasSaketh DahagamNo ratings yet

- Vaibhav Global Research ReportDocument4 pagesVaibhav Global Research ReportVikrant SadanaNo ratings yet

- Aarti Ind. SharekhanDocument8 pagesAarti Ind. SharekhanAniket DhanukaNo ratings yet

- Minda Corp 1QFY20 Result Update - 190813 - Antique ResearchDocument4 pagesMinda Corp 1QFY20 Result Update - 190813 - Antique ResearchdarshanmadeNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- Avenue Supermarts Sell: Result UpdateDocument6 pagesAvenue Supermarts Sell: Result UpdateAshokNo ratings yet

- Stock Update: Greaves CottonDocument3 pagesStock Update: Greaves CottonanjugaduNo ratings yet

- Reliance Capital (RELCAP) : Businesses Growing, Return Ratios ImprovingDocument15 pagesReliance Capital (RELCAP) : Businesses Growing, Return Ratios Improvingratan203No ratings yet

- RelianceJan2024Document56 pagesRelianceJan2024jaikumar608jainNo ratings yet

- MNCL-La - Opala - November 2023 - Update - 012630 - 13882Document9 pagesMNCL-La - Opala - November 2023 - Update - 012630 - 13882Sriram RanganathanNo ratings yet

- Placement Consent Letter123Document1 pagePlacement Consent Letter123sushant panditaNo ratings yet

- Placement Consent Letter123Document1 pagePlacement Consent Letter123sushant panditaNo ratings yet

- Impact of Celebrity Endorsements On BrandDocument16 pagesImpact of Celebrity Endorsements On Brandsushant panditaNo ratings yet

- Business Perspectivesand ResearcheditorialDocument3 pagesBusiness Perspectivesand Researcheditorialsushant panditaNo ratings yet

- Co2Creativity and Business IdeaDocument31 pagesCo2Creativity and Business Ideasushant panditaNo ratings yet

- Sushant PanditaDocument22 pagesSushant Panditasushant panditaNo ratings yet

- APEDA Exporter Directory in RajasthanDocument21 pagesAPEDA Exporter Directory in RajasthanSandeep BhandariNo ratings yet

- Accounting Chapter 25Document3 pagesAccounting Chapter 25Eugene Dexter NonesNo ratings yet

- Pricing Decisions: Global MarketingDocument19 pagesPricing Decisions: Global MarketingAsif_Jamal_9320No ratings yet

- Libta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingDocument21 pagesLibta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingAlexandru BogdanNo ratings yet

- OM Chap 1Document17 pagesOM Chap 1Kumkum SultanaNo ratings yet

- Financial Management of A Marketing Firm (Second Edition) by David C. BakerDocument309 pagesFinancial Management of A Marketing Firm (Second Edition) by David C. BakerGabriel De LunaNo ratings yet

- Identify Functional RequirementsDocument3 pagesIdentify Functional RequirementsEugene LingNo ratings yet

- 611 F (Y) PDFDocument4 pages611 F (Y) PDFSusanket DuttaNo ratings yet

- INTRO TO INTERNATIONAL TRADEDocument17 pagesINTRO TO INTERNATIONAL TRADEAndy SugiantoNo ratings yet

- Iqra Marble Industry - EA ReportDocument49 pagesIqra Marble Industry - EA ReportAzeemuddinNo ratings yet

- Sustainability AssessmentDocument9 pagesSustainability AssessmentEbrahim AminiNo ratings yet

- POSDCORB (Gulick)Document2 pagesPOSDCORB (Gulick)Stephen Ebenezer Kulandai Yesu67% (3)

- Current Asset Management Chapter SummaryDocument14 pagesCurrent Asset Management Chapter SummaryLokamNo ratings yet

- Unclaimed Balances Act OutlineDocument5 pagesUnclaimed Balances Act OutlineJannah Mae NeneNo ratings yet

- 27 Flow Chart For Procurement Process Rev1Document1 page27 Flow Chart For Procurement Process Rev1Prasanta ParidaNo ratings yet

- Basic Econometrics Gujarati 2008Document946 pagesBasic Econometrics Gujarati 2008api-239303870100% (11)

- Maruti Suzuki 1 - 5Document78 pagesMaruti Suzuki 1 - 5sedhubbaNo ratings yet

- Final Assignment: Mct1074 Business Intelligence and AnalyticsDocument28 pagesFinal Assignment: Mct1074 Business Intelligence and AnalyticsAhmad Shahir NohNo ratings yet

- Cincinnati Dividing Head ChartDocument26 pagesCincinnati Dividing Head ChartNewton LoNo ratings yet

- Cafc - QCP General Civil WorksDocument26 pagesCafc - QCP General Civil WorksAimar SmartNo ratings yet

- G 4.1 2019 Steel Bridge Fabrication QC - Qa GuidelinesDocument48 pagesG 4.1 2019 Steel Bridge Fabrication QC - Qa Guidelinesniinee100% (1)

- Corporate Personality SlidesDocument36 pagesCorporate Personality SlidesshanhaolihaiNo ratings yet

- CA3 Pankaj ACC215Document10 pagesCA3 Pankaj ACC215Pankaj MahantaNo ratings yet

- Cs403 Short NotesDocument5 pagesCs403 Short NotesChanda KhanNo ratings yet

- FS Final OutputDocument62 pagesFS Final OutputMariael PinasoNo ratings yet

- MakeAnimated PowerPoint Slide by PowerPoint SchoolDocument9 pagesMakeAnimated PowerPoint Slide by PowerPoint SchoolMUHAMMAD HAMZA JAVEDNo ratings yet

- Strategic Management GuideDocument168 pagesStrategic Management GuideShriram DawkharNo ratings yet

- E-poslovanje i elektronska trgovinaDocument5 pagesE-poslovanje i elektronska trgovinasamhagartNo ratings yet

- China GroupDocument28 pagesChina GroupAndrew OrbetaNo ratings yet

- Unit 7 - Review QuestionsDocument3 pagesUnit 7 - Review Questionslinhnhp.workNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Extreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingFrom EverandExtreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingRating: 5 out of 5 stars5/5 (1)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- 109 Personal Finance Tips: Things you Should Have Learned in High SchoolFrom Everand109 Personal Finance Tips: Things you Should Have Learned in High SchoolNo ratings yet

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet