Professional Documents

Culture Documents

Annual Report of IOCL 179

Uploaded by

Nikunj ParmarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of IOCL 179

Uploaded by

Nikunj ParmarCopyright:

Available Formats

Indian Oil Corporation Limited 3rd Integrated Annual Report 61st Annual Report 2019-20

About the Report

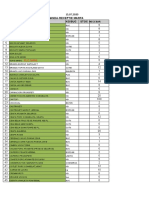

NOTES TO FINANCIAL STATEMENTS NOTES TO FINANCIAL STATEMENTS

Note - 22 : TRADE PAYABLES Note - 24 : OTHER INCOME

(₹ in Crore) (₹ in Crore)

Particulars March 31, 2020 March 31, 2019 Particulars 2019-2020 2018-2019

Chairman’s Desk

Dues to Micro and Small Enterprises 233.03 236.82 Interest on: A

From the

Dues to Related Parties 777.62 1,276.93 Financial items:

Dues to Others 26,592.89 39,680.37 Deposits with Banks 75.83 44.47

TOTAL 27,603.54 41,194.12 Customers Outstandings 348.56 433.26

Oil Companies GOI SPL Bonds/ Other Investments 825.50 907.41

About IndianOil

Note - 23 : REVENUE FROM OPERATIONS Other Financial Items 643.11 261.79

(₹ in Crore)

Total interest on Financial items 1,893.00 1,646.93

Particulars 2019-2020 2018-2019

Non-Financial items 119.86 99.34

Sales (Net of Discounts) 5,70,001.67 6,07,524.57

2,012.86 1,746.27

Sale of Services 135.53 115.86

Description of Capitals

Dividend B 709.96 863.30

Other Operating Revenues (Note “23.1”) 4,893.68 5,040.14

Fair value Gain on Investments/ Provision Written Back (Net) - 1.60

5,75,030.88 6,12,680.57

Gain on Derivatives - 0.32

Net Claim/(Surrender) of SSC 100.20 310.66

Fair value Gain on Financial instruments classified as FVTPL - 13.87

Subsidy From Central/State Governments 161.68 150.00

Other Non Operating Income 67.47 88.92

Grant from Government of India 1,296.17 4,110.18

Board of Directors, etc.

TOTAL 2,790.29 2,714.28

TOTAL 5,76,588.93 6,17,251.41

A 1. Includes Tax Deducted at Source 8.43 24.62

Particulars relating to Revenue Grants are given in Note - 43.

A 2. Includes interest received under section 244A of the Income Tax Act. 45.75 90.14

Note - 23.1 : OTHER OPERATING REVENUES A 3. Include interest on:

(₹ in Crore) Current Investments 516.93 657.36

Particulars 2019-2020 2018-2019 Non-Current Investments 308.57 250.05

Directors’ Report

Sale of Power and Water 338.15 430.66 A 4. Total interest income (calculated using the effective interest method) for financial

assets:

Revenue from Construction Contracts 8.11 6.50

In relation to Financial assets classified at amortised cost 1,067.50 739.52

Unclaimed / Unspent liabilities written back 158.90 317.27

In relation to Financial assets classified at FVOCI 825.50 907.41

Provision for Doubtful Debts, Advances, Claims, and Stores written back 633.63 58.93

Discussion & Analysis

B Dividend Income consists of Dividend on:

Provision for Contingencies written back 1,353.49 1,492.97

Management’s

Current Investments 5.65 17.44

Recoveries from Employees 16.53 13.37

Non-Current Investments 704.31 845.86

Retail Outlet License Fees 1,117.06 1,187.82

Income from Non Fuel Business 173.23 247.39

Note - 25 : COST OF MATERIAL CONSUMED

Commission and Discount Received 1.25 2.95

(₹ in Crore)

Responsibility Report

Sale of Scrap 225.27 246.16 Particulars 2019-2020 2018-2019

Business

Income from Finance Leases 5.03 2.48 Opening Stock 30,528.08 28,342.80

Amortization of Capital Grants 134.77 99.99 Add: Purchases 2,76,368.21 3,08,657.50

Revenue Grants 46.76 224.31 3,06,896.29 3,37,000.30

Commodity Hedging Gain (Net) - 27.58

Corporate Governance

Less: Closing Stock 20,099.02 30,528.08

Terminalling Charges 56.84 83.11 Less: Transfer to Exceptional Items 5,717.14 -

Report on

Other Miscellaneous Income 624.66 598.65 TOTAL 2,81,080.13 3,06,472.22

TOTAL 4,893.68 5,040.14

Particulars relating to Revenue Grants adjusted in purchases are given in Note - 43.

Financial Statements

Consolidated

352 Financial Statements Financial Statements 353

You might also like

- Annual Report of IOCL 172Document1 pageAnnual Report of IOCL 172Nikunj ParmarNo ratings yet

- Employment News This Week 1st To 7th October 2022Document7 pagesEmployment News This Week 1st To 7th October 2022Rupam BurmanNo ratings yet

- Groundwater Resources of Tumkur District, KarnatakaDocument32 pagesGroundwater Resources of Tumkur District, KarnatakamaheshanischithaNo ratings yet

- Economic Survey 2020-21 Eng Final RDocument765 pagesEconomic Survey 2020-21 Eng Final RNischith GowdaNo ratings yet

- Endorsement HDFC Format MotorDocument3 pagesEndorsement HDFC Format MotorvasuNo ratings yet

- Redbus Ticket - Tr4G41802839Document4 pagesRedbus Ticket - Tr4G41802839christyNo ratings yet

- INVT - AC Servo-DB100 - Manual - V3.0Document171 pagesINVT - AC Servo-DB100 - Manual - V3.0Raison AutomationNo ratings yet

- All India CW Pricelist Wef 01.08.2022Document6 pagesAll India CW Pricelist Wef 01.08.2022Bharath Raj SNo ratings yet

- P16MBA4Document2 pagesP16MBA4Gamers N2No ratings yet

- Prelims Problem Solving SolutionsDocument2 pagesPrelims Problem Solving SolutionsEmer Jacob FadriNo ratings yet

- PSPLDocument13 pagesPSPLAswin KurupNo ratings yet

- Detailed StatementDocument6 pagesDetailed Statementronak palgotaNo ratings yet

- Mentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticeDocument2 pagesMentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticePonugoti Pavan kumarNo ratings yet

- Tabel Comanda-Receptie Marfa NR Denumire Produs Kg/Buc Stoc: Plic MareDocument3 pagesTabel Comanda-Receptie Marfa NR Denumire Produs Kg/Buc Stoc: Plic MarePorumbacean RemusNo ratings yet

- Factories and Works RegulationsDocument12 pagesFactories and Works Regulationschrissy zee1100% (1)

- JBL Basspro Car Active Subwoofer Rev.0Document18 pagesJBL Basspro Car Active Subwoofer Rev.0Edgar MamaniNo ratings yet

- 2021 July Trading Post (Ver 1.1)Document3 pages2021 July Trading Post (Ver 1.1)Woods100% (1)

- MERKLE Tig - 254 - AcdcDocument41 pagesMERKLE Tig - 254 - AcdcJosé Carlos de Alencar DiasNo ratings yet

- AccountingDocument15 pagesAccountingRahul agarwalNo ratings yet

- Mobile Services Bill BreakdownDocument6 pagesMobile Services Bill BreakdownSahil SharmaNo ratings yet

- Kids Club Halloween Activity BookDocument9 pagesKids Club Halloween Activity BookKris KirstNo ratings yet

- B.tech Ordinance 2020Document340 pagesB.tech Ordinance 2020KSHITIJ KANOJIANo ratings yet

- Gds Ce Rule 2021Document42 pagesGds Ce Rule 2021Vishnu MuralidharanNo ratings yet

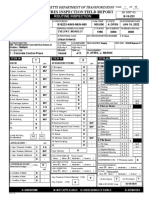

- Seaport Light Falls Massdot Inspection Report 1-22Document70 pagesSeaport Light Falls Massdot Inspection Report 1-22Boston 25 DeskNo ratings yet

- Bosch LTDDocument50 pagesBosch LTDmanishsngh24No ratings yet

- Weatherby Firearms 2013Document22 pagesWeatherby Firearms 2013belgranostore0% (1)

- CCL Products LTD.: Initiating Coverage Stock UpdateDocument8 pagesCCL Products LTD.: Initiating Coverage Stock Updateuma sankar vetsaNo ratings yet

- Shakespeare, Much Ado About Nothing, 1564-1616Document30 pagesShakespeare, Much Ado About Nothing, 1564-1616Giordano BrunoNo ratings yet

- CIS Controls v8 Internet of Things Companion Guide 2022 11Document69 pagesCIS Controls v8 Internet of Things Companion Guide 2022 11jemima mendesNo ratings yet

- 1 - Lenovo-Y510 - VIQY1 - NM - A032-2013-03-19 Rev1.0-compalnma032r10schematics.-OK!OK! - Podxodit K-Y500 PDFDocument70 pages1 - Lenovo-Y510 - VIQY1 - NM - A032-2013-03-19 Rev1.0-compalnma032r10schematics.-OK!OK! - Podxodit K-Y500 PDFGAMMA GERNo ratings yet

- 2023 Sebs 0004Document16 pages2023 Sebs 0004WDIV/ClickOnDetroitNo ratings yet

- C2021.23 Supply Install & Commissioning of 09nos Containerised Plant (EBid)Document105 pagesC2021.23 Supply Install & Commissioning of 09nos Containerised Plant (EBid)LEED Sales & Marketing-1No ratings yet

- Digilocker InsurancePolicy TwoWheeler1673027695353Document2 pagesDigilocker InsurancePolicy TwoWheeler1673027695353Darshan DravidNo ratings yet

- MTDP III Vol. 2Document128 pagesMTDP III Vol. 2aj ogayonNo ratings yet

- E-Newsletter VDMA Bangalore July - Sep-2020Document18 pagesE-Newsletter VDMA Bangalore July - Sep-2020Raj VitkarNo ratings yet

- Bylaws of CooperativesDocument9 pagesBylaws of CooperativesMaeil BamNo ratings yet

- Garhmukteshwar EPC UP 344.77 CR NHAIDocument2 pagesGarhmukteshwar EPC UP 344.77 CR NHAIMohit SrivastavaNo ratings yet

- 1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Document1 page1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Vikram MaanNo ratings yet

- Name To Be Added To Le Roy War Memorial: Lamb Farms IncDocument8 pagesName To Be Added To Le Roy War Memorial: Lamb Farms IncWatertown Daily TimesNo ratings yet

- ACCT 1160 Term ProjectDocument12 pagesACCT 1160 Term ProjectRICHARD CHOMBANo ratings yet

- CROSSOVER FUND DECEMBER 2018Document2 pagesCROSSOVER FUND DECEMBER 2018Ashish Agrawal100% (1)

- Pitchbook - Trading Business: BSE LTDDocument34 pagesPitchbook - Trading Business: BSE LTDVenu MadhavNo ratings yet

- nextLI/Newsday + Hofstra SurveyDocument42 pagesnextLI/Newsday + Hofstra SurveynextLINo ratings yet

- Zesa Load Shedding Schedule 2021Document4 pagesZesa Load Shedding Schedule 2021Venancio KwiriraiNo ratings yet

- The Hindu Review September 2022 by Ambitious BabaDocument59 pagesThe Hindu Review September 2022 by Ambitious BabaRaja SNo ratings yet

- Fdocuments - in - Hero-Motocorp-Ltd-55844bb02b8ee (Repaired)Document66 pagesFdocuments - in - Hero-Motocorp-Ltd-55844bb02b8ee (Repaired)HIMANSHU KUMAR TIWARINo ratings yet

- HTML Basics - Div Tag: HintsDocument38 pagesHTML Basics - Div Tag: HintsnagendraNo ratings yet

- Richland 2Document158 pagesRichland 2Nevin SmithNo ratings yet

- Haryana Solar Water Piump PolicyDocument375 pagesHaryana Solar Water Piump PolicySunil Parikh0% (1)

- Mid Session Reforecast 02182022Document4 pagesMid Session Reforecast 02182022Fauquier NowNo ratings yet

- SIES College Sales Management Exam Case Study on Benefits of Offline StoresDocument4 pagesSIES College Sales Management Exam Case Study on Benefits of Offline StoresSayali PatilNo ratings yet

- Rules (Amendment) On The Income Tax Act of The Kingdom of Bhutan 2001 - Fifth EditionDocument198 pagesRules (Amendment) On The Income Tax Act of The Kingdom of Bhutan 2001 - Fifth EditionKuenga GeltshenNo ratings yet

- Mayor Eric Adams' Office Warns NYC Lawmakers of Title 42 Migrant SurgDocument1 pageMayor Eric Adams' Office Warns NYC Lawmakers of Title 42 Migrant Surgedwinbramosmac.comNo ratings yet

- Building blocks tool listDocument2 pagesBuilding blocks tool listBoopathiNo ratings yet

- GMR Infrastructure LimitedDocument35 pagesGMR Infrastructure LimitedAmrut BhattNo ratings yet

- Bahan Presentasi Ke MSCDocument15 pagesBahan Presentasi Ke MSCYusuf MalikNo ratings yet

- Intensely Charming: Colournext Decor Directions BookDocument5 pagesIntensely Charming: Colournext Decor Directions BookGampa Vamshi KrishnaNo ratings yet

- Afghan Church A Heritage Site in South BombayDocument33 pagesAfghan Church A Heritage Site in South BombayIntrovertkind100% (1)

- Account Statement For Account:2962000100457772: Branch DetailsDocument2 pagesAccount Statement For Account:2962000100457772: Branch DetailsBest Auto TechNo ratings yet

- Annual Report of IOCL 107Document1 pageAnnual Report of IOCL 107Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- Boks For Romamcre 1Document1 pageBoks For Romamcre 1Nikunj ParmarNo ratings yet

- McKinsey On Finance No.45Document40 pagesMcKinsey On Finance No.45User OneNo ratings yet

- Agriculture Industrial SurveyDocument52 pagesAgriculture Industrial SurveyanburishiNo ratings yet

- W5. Rate of Return Analysis Part 1Document28 pagesW5. Rate of Return Analysis Part 1ChrisThunder555No ratings yet

- Repo Rate and Its Effect On GDP: An Empirical Indian ExperienceDocument11 pagesRepo Rate and Its Effect On GDP: An Empirical Indian ExperienceAnonymous CwJeBCAXpNo ratings yet

- Bank Reconciliation Statements: MBA ExecutiveDocument37 pagesBank Reconciliation Statements: MBA ExecutiveAreeb IqbalNo ratings yet

- Economic Growth: Cameroon'SDocument53 pagesEconomic Growth: Cameroon'SFabrice EwoloNo ratings yet

- Estmt - 2023 02 17Document6 pagesEstmt - 2023 02 17allan tu50% (2)

- What Is The Definition of Investment?: StocksDocument3 pagesWhat Is The Definition of Investment?: StocksJhesnil SabundoNo ratings yet

- Sterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Document2 pagesSterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Sterling Bank PLCNo ratings yet

- Replacement AnalysisDocument22 pagesReplacement Analysismercedesferrer100% (1)

- Quiz 1 Midterm InventoriesDocument6 pagesQuiz 1 Midterm InventoriesSophia TenorioNo ratings yet

- CMBS 101 Slides (All Sessions)Document41 pagesCMBS 101 Slides (All Sessions)Karan MalhotraNo ratings yet

- Intermediate Accounting Millan Solution Manual PDFDocument3 pagesIntermediate Accounting Millan Solution Manual PDFRoldan Hiano Manganip13% (8)

- IAS 33: Earnings Per ShareDocument15 pagesIAS 33: Earnings Per SharecolleenyuNo ratings yet

- CHAPTER 7 Preparing, Analyzing, and Forecasting Financial StatementDocument10 pagesCHAPTER 7 Preparing, Analyzing, and Forecasting Financial StatementJoban Las PinyasNo ratings yet

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFDocument23 pagesAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DNo ratings yet

- Mary Buffett, David Clark - Buffettology 51 PDFDocument1 pageMary Buffett, David Clark - Buffettology 51 PDFAsok KumarNo ratings yet

- EI Fund Transfer Intnl TT Form V3.0Document1 pageEI Fund Transfer Intnl TT Form V3.0Tosin SimeonNo ratings yet

- Ciq Financials MethodologyDocument25 pagesCiq Financials Methodologysanti_hago50% (2)

- AttachmentDocument95 pagesAttachmentSyed InamNo ratings yet

- F6mys Jun 2011 QuDocument10 pagesF6mys Jun 2011 Qutoushiga100% (1)

- 1 The Nature, Purpose and Scope of AuditingDocument12 pages1 The Nature, Purpose and Scope of Auditingyebegashet100% (1)

- Cash Handling FEDocument109 pagesCash Handling FEAsfar KhanNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- DisclaimerDocument13 pagesDisclaimerAK CREATIONSNo ratings yet

- Individual Performance Commitment and Review FormTITLE Individual Performance Commitment and Review FormDocument17 pagesIndividual Performance Commitment and Review FormTITLE Individual Performance Commitment and Review FormCabittaogan Nhs69% (13)

- 16 Important Kinds of Insurance PoliciesDocument7 pages16 Important Kinds of Insurance PoliciesFaheemNo ratings yet

- Mancon Quiz 4Document32 pagesMancon Quiz 4Quendrick SurbanNo ratings yet

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabNo ratings yet

- Muhammad Aqeel Alvi: Work Experience SkillsDocument1 pageMuhammad Aqeel Alvi: Work Experience SkillsaqeelNo ratings yet