Professional Documents

Culture Documents

DARIA Assig2 Tren Corp

Uploaded by

Nina Paula0 ratings0% found this document useful (0 votes)

42 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views2 pagesDARIA Assig2 Tren Corp

Uploaded by

Nina PaulaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

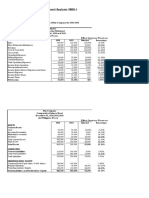

TREN Corp

Comparative Statement of Financial Position

December 31, 2015

In Thousand pesos

ASSETS 2015 2014 AMOUNT PERCENT

CURRENT ASSETS

Cash & Cash Equivalent 24, 890 2,120 22,770 10740.06%

Trading Securities 10,000 - 10,000

Trade & Other Receivable 16,000 6,000 10,000 166.67%

Inventory 8,960 10,600 -1,640 15.47%

Total Current Assets 59, 850 18, 720 41,130 219.71%

NON-CURRENT ASSETS

PPE 150,000 161,280 -11,280 6.99%

Investment in Equity Securities 16,000 20,000 -4,000 -20%

Total Non-Current

166, 000 181, 280

Assets -15,280 8.43%

TOTAL ASSETS 225,850 200,000 25,850 12.93%

LIABILITIES

CURRENT LIABILITIES

Trade & Other Payables 8,400 3,350 5,050 150.75%

Unearned Revenues 10,600 11,650 -1,050 -9.01%

Notes Payable - Current 900 600 300 50%

Total Current Liabilities 19,900 15,600 4,300 27.56%

NON-CURRENT LIABILITIES

Notes Payable - Non-current 73,550 100,000 -26,450 -26.45%

TOTAL LIABILITIES 934,500 115,600 818,900 708.39%

SHAREHOLDER'S EQUITY

Ordinary Shares, P1 par 80,000 60,000 20,000 33.33%

Premium on Ordinary Shares 16,000 10,000 6,000 60%

Total paid-in-capital 96,000 70,000 26,000 37.14%

RETAINED EARNINGS 36,400 14,400 22,000 152.78%

TOTAL SHAREHOLDERS' EQUITY 132,400 84,400 48,000 56.87%

TOTAL LIBILITIES & SHAREHOLDERS' EQUITY 225,850 200,000 25,850 12.93%

TREN Corporation

Comparative Income Statement

December 3133, 2015 & 2014

2015 2014 AMOUNT Percent

Sales 480,000 400,000 80,000 20%

Less: Cost of goods sold 364,000 280,000 84,000 30%

Gross Income 116,000 120,000 -4,000 3.33%

Add: Other Income 15,000 9,600 5,400 56.25%

Total income 131,000 129,600 1,400 1.08%

Less: Other expenses 12,400 - 12,400

Finance Cost (Interest) 14,400 19,000 -4,600 24.21%

Total Expenses 26,800 19,000 7,800 41.05%

Net Income before taxes 104,200 110,600 -6,400 -5.79%

Less: Income Tax 32,334 35,392 -3,058 -8.64%

Net Income after taxes 71,866 75,208 -3,342 -4.44%

You might also like

- Fm-Answer-Key 2Document5 pagesFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- Chap - Test - CH4 - Financial Ratio Analysis and Their Implications To ManagementDocument10 pagesChap - Test - CH4 - Financial Ratio Analysis and Their Implications To Managementroyette ladicaNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisRoel AsduloNo ratings yet

- CLN Company financial position comparison 2014-2015Document4 pagesCLN Company financial position comparison 2014-2015Vince Lloyd RaborNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Analysis and Interpretation of FS-Part 1Document2 pagesAnalysis and Interpretation of FS-Part 1Rhea RamirezNo ratings yet

- Quiz - Horizontal AnalysisDocument2 pagesQuiz - Horizontal AnalysisQuenie De la CruzNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- (Financial Analysis) MANALO, Frances M. LM2-1Document3 pages(Financial Analysis) MANALO, Frances M. LM2-11900118No ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Financial Ratio Analysis GuideDocument24 pagesFinancial Ratio Analysis GuideMariel NatullaNo ratings yet

- Revised Verti On SFP 2019Document2 pagesRevised Verti On SFP 2019cheesekuhNo ratings yet

- W2020 ACC100 Financial Statement AnalysisDocument5 pagesW2020 ACC100 Financial Statement AnalysisMahmoud ZizoNo ratings yet

- Latihan Analisis Horizontal VertikalDocument4 pagesLatihan Analisis Horizontal Vertikaltheresia paulintiaNo ratings yet

- Answer Key For Module 4 To 10 1Document8 pagesAnswer Key For Module 4 To 10 1mae annNo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Tri-Star Company Financial Statement AnalysisDocument10 pagesTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Ratio and Trend Analysis (FC)Document26 pagesRatio and Trend Analysis (FC)Cindelyn LibodlibodNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisMaxine Lois PagaraganNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Lopez, Ella Marie - Quiz 2 FinanarepDocument4 pagesLopez, Ella Marie - Quiz 2 FinanarepElla Marie Lopez0% (1)

- Act 2 Answer KeyDocument8 pagesAct 2 Answer KeyDianne PañoNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocument3 pagesBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNo ratings yet

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocument3 pagesBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNo ratings yet

- Keith Corporation Generates Significant Positive Cash FlowsDocument24 pagesKeith Corporation Generates Significant Positive Cash FlowsMaiko KopadzeNo ratings yet

- ABC Corporation's 2019 Financial Statement AnalysisDocument15 pagesABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoNo ratings yet

- Financial Statement Analysis-MathDocument35 pagesFinancial Statement Analysis-MathAamir Hamza MehediNo ratings yet

- Latihan Soal Financial RatiosDocument6 pagesLatihan Soal Financial RatiosInanda ErvitaNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document2 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Laurenz R. Patawe - Activity 1PART2 PDFDocument2 pagesLaurenz R. Patawe - Activity 1PART2 PDFJonellNo ratings yet

- Local Media2551384955216348707Document4 pagesLocal Media2551384955216348707alinashane obleaNo ratings yet

- Financial Statement Analysis-2Document12 pagesFinancial Statement Analysis-2Glaidel Rodenas PeñaNo ratings yet

- Assgnmnt 2 FIN658Document5 pagesAssgnmnt 2 FIN658markNo ratings yet

- Emperador Inc. and Subsidiaries 2016 and 2015 Financial StatementsDocument25 pagesEmperador Inc. and Subsidiaries 2016 and 2015 Financial StatementschenlyNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Income Statement and Balance Sheet for FY2019 with Financial MetricsDocument2 pagesIncome Statement and Balance Sheet for FY2019 with Financial MetricsJayash KaushalNo ratings yet

- Initial Resources and Projections for Fashion StartupDocument8 pagesInitial Resources and Projections for Fashion StartupRizwan GhafoorNo ratings yet

- Comparative Financial Statements TREN CorpDocument3 pagesComparative Financial Statements TREN CorpKliennt TorrejosNo ratings yet

- Elite, S.A. de C.V.: Balance GeneralDocument6 pagesElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNo ratings yet

- Tran Thi Thu Nguyet-PA3-HWCHAPTER18Document3 pagesTran Thi Thu Nguyet-PA3-HWCHAPTER18Nguyet Tran Thi ThuNo ratings yet

- Sotalbo, Norhie Anne O. 3BSA-2Document11 pagesSotalbo, Norhie Anne O. 3BSA-2Acads PurpsNo ratings yet

- Entity A's 20x1 Financial StatementsDocument8 pagesEntity A's 20x1 Financial Statementsann abegail perezNo ratings yet

- Analysis and Interpretation - BalladaDocument4 pagesAnalysis and Interpretation - BalladaClaire Evann Villena EboraNo ratings yet

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BDocument10 pagesHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoNo ratings yet

- Apple Inc: ISIN: US0378331005 WKN: 037833100 Asset Class: StockDocument2 pagesApple Inc: ISIN: US0378331005 WKN: 037833100 Asset Class: StockrimNo ratings yet

- Reckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018Document19 pagesReckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018EryllNo ratings yet

- HorizontalDocument7 pagesHorizontalMarquez, Lynn Andrea L.No ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- Võ Thành Thắng - 31211024016 - NFGDocument28 pagesVõ Thành Thắng - 31211024016 - NFGtungphan.31211023431No ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- Month Pay TS Incr. DA HRA CCA Total CPS Tsgli GIS PT Ewf SWF I.T Net Total Sl. No. AHR ADocument3 pagesMonth Pay TS Incr. DA HRA CCA Total CPS Tsgli GIS PT Ewf SWF I.T Net Total Sl. No. AHR AMahendar ErramNo ratings yet

- Roster Artisti Musical Events Solutions (Alin Voica)Document5 pagesRoster Artisti Musical Events Solutions (Alin Voica)AlexandruConstantinescuNo ratings yet

- CFR ProblemsDocument28 pagesCFR ProblemsMadhu kumarNo ratings yet

- John Keells Holdings PLC AR 2021 22 CSEDocument332 pagesJohn Keells Holdings PLC AR 2021 22 CSEDINESH INDURUWAGENo ratings yet

- Partnership and Corporation Accounting ReviewerDocument9 pagesPartnership and Corporation Accounting ReviewerMarielle ViolandaNo ratings yet

- Lesson 1.3 Review: Production Possibilities CurvesDocument4 pagesLesson 1.3 Review: Production Possibilities CurvesMartha StewartNo ratings yet

- The correct answer is B. During a recession, consumer incomes fall which means that the demand for normal goods like new cars will decrease and the demand curve will shift leftDocument15 pagesThe correct answer is B. During a recession, consumer incomes fall which means that the demand for normal goods like new cars will decrease and the demand curve will shift leftDaisy Ann Cariaga SaccuanNo ratings yet

- Account Statement For Account:0114002101107545: Branch DetailsDocument4 pagesAccount Statement For Account:0114002101107545: Branch DetailsHappy JainNo ratings yet

- Vellikallu Culvert Revised Working EstimateDocument33 pagesVellikallu Culvert Revised Working EstimateRA1511001010329 229510No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceJALARAM TRADINGNo ratings yet

- Aicte - Swanath Scholarship Scheme - 2021 - 2022Document2 pagesAicte - Swanath Scholarship Scheme - 2021 - 2022Harsha SamagaraNo ratings yet

- Competitive Industrial Performance Index - 2020Document2 pagesCompetitive Industrial Performance Index - 2020Hamit OzmanNo ratings yet

- FM Jack Tar Case StudyDocument2 pagesFM Jack Tar Case StudyjanelleNo ratings yet

- Knox Local Food SurveyDocument3 pagesKnox Local Food SurveyMadhu BalaNo ratings yet

- 2009 Warren Buffet Black-Scholes and Long Dated OptionsDocument13 pages2009 Warren Buffet Black-Scholes and Long Dated OptionsTerry MaNo ratings yet

- Foreign Trade Multiplier: Meaning, Effects and CriticismsDocument6 pagesForeign Trade Multiplier: Meaning, Effects and CriticismsDONALD DHASNo ratings yet

- PDM YumbeDocument18 pagesPDM YumbeAkimu sijaliNo ratings yet

- NNK Chè UaeDocument5 pagesNNK Chè UaenatalieNo ratings yet

- EFM Hotel Investment Model 3-1Document10 pagesEFM Hotel Investment Model 3-1NgọcThủyNo ratings yet

- Crypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDocument10 pagesCrypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDinuka ChathurangaNo ratings yet

- Important Weekly Current Affairs PDF 7 To 13 JuneDocument20 pagesImportant Weekly Current Affairs PDF 7 To 13 Junerajeshraj0112No ratings yet

- Foundations of Engineering EconomyDocument45 pagesFoundations of Engineering EconomySaid SaayfanNo ratings yet

- 11th Commerce 3 Marks Study Material English MediumDocument21 pages11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNo ratings yet

- TNPSC Mental Ability and Aptitude Test Question and Answers 2013 PDFDocument23 pagesTNPSC Mental Ability and Aptitude Test Question and Answers 2013 PDFlakshmananNo ratings yet

- A Short Story of Philippine EconomyDocument28 pagesA Short Story of Philippine EconomyCandie TancianoNo ratings yet

- ALIF 2021-2022 Annual PDFDocument79 pagesALIF 2021-2022 Annual PDFCAL ResearchNo ratings yet

- Dhaka Stock ExchangeDocument39 pagesDhaka Stock ExchangeProtap Roy50% (2)

- Managerial Economics and Micro EconomicsDocument2 pagesManagerial Economics and Micro EconomicsVarun KalseNo ratings yet

- Micro-Finance Study in JalandharDocument53 pagesMicro-Finance Study in Jalandharkaran_tiff100% (1)

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet