Professional Documents

Culture Documents

Method of Genetic Algorithms For The Optimal Investment Portfolio

Uploaded by

1. b3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Method of Genetic Algorithms For The Optimal Investment Portfolio

Uploaded by

1. b3Copyright:

Available Formats

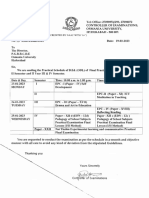

2018 5th International Conference on Control, Decision Thessaloniki, Greece

and Information Technologies (CoDIT’18) April 10-13, 2018

Method of Genetic Algorithms for the

Optimal Investment Portfolio

O. Kuzmych, O. Mekush, K. Solich and A. Telmoudi, Member, IEEE

Abstract— this paper is devoted to the problem of optimal most famous optimization methods for one-period portfolios is

investment portfolio design on the base of mathematical modeling the model of the mid-dispersion constraint, proposed by

tools and method of genetic algorithms. The purpose relates to Markowitz [15,16], where the problem is solved by quadratic

investing the funds into financial assets such that certain requirements programming and related type of the models are discussed. In

regarding the expected profits and possible losses would be reached. these works the connection between the problem of long-term

The main result is developing a state-space dynamical model of

portfolio management and control engineering is explained. In

portfolio management and applying a genetic algorithm in order to

obtain the optimal solution. the same time a discussion why stochastic optimal control is the

appropriate framework for solving the problem of multi-period

portfolio optimization is given. In context of this problem

I. INTRODUCTION Markowitz proposes the most famous and most popular model

The optimization problem of an investment portfolio is one that is the mean-variance framework. This model defines the

of the main problem in financial management and engineering expected returns and the risk as the variance of a portfolio. The

so it represents both scientific and practical interest. The problem can be efficiently solved by a quadratic programming.

effectiveness of investments essentially depends on chosen A lot of interesting results relating of the models of single-

portfolio management strategies. The development and research period portfolio are: the mean deviation approach of Konno

of such strategies requires the use of modern mathematical and Yamazaki [17], the regret optimization approach of Dembo

methods, models, computing technologies. This is a well- and King [18], the min-max approach described in [19], as well

known problem with many different solution's ideas and as the conditional value-at-risk approach of Rockafellar and

methods [1,2,3]. In the work [4] authors propose one of the Uryasev [20]. They mostly differ in the methods of modeling of

approaches for a rational choice of an investment portfolio return distributions and risk measures.

based on the criterion of mean and standard deviation. Article In this article we search an effective management strategies

[5, 6] are devoted to the investment portfolio problems of the of investment portfolio. We consider portfolios of financial

industrial enterprise, calculation of profitability and risk. The assets such as stocks, bonds, indices of various markets, and

question of optimizing the investment portfolio on the basis of cash. A portfolio is described by two main characteristics:

mathematical modeling is also presented in [7-10]. The semi- return (expected profit) and risk (possible losses). Very often,

Mark's control processes for investigating the multi-component the risk aversion defines in which assets investors tend to

model of the theory of inventory management was considered invest, portfolios with high expected returns are in general more

in [11]. The task of making investment decisions under risky. But the risk return pattern is not the only variable that

uncertainty is presented in [12], and in [13] an approach to defines a portfolio. Other important variables are the

model the asset prices is proposed, which allows obtaining high investment horizon (duration of the investments), the asset

simulation and forecast properties of the returns of these assets. classes, or the markets (domestic or international). In this paper

The work [14] investigates multi-stage stochastic portfolio we develop the dynamical model of portfolio management for

optimization problems with the use of risk measures. Since the long-term investment. The basic idea is to use method of

stock market serves as an effective mechanism of investments dynamical analogies [21-23] in order to construct the state-

attraction, the effectiveness of investments crucially depends on space model. Description of the dynamical processes is based

the chosen strategies of investment portfolio management. on a system of differential equations. Using this model we solve

In this paper a one-period problem of portfolio management the multi-criteria investment portfolio optimization problem

is considered, which is related to the problem of optimal using cluster genetic algorithm based on the method presented

investment decisions without any possibility of changing a in [24]. The results were tested on developed an appropriate

portfolio composition during the investment period. One of the software.

In the Introduction Section we discuss the base problems of

the investment portfolio investigation, we analyze the existing

O. Kuzmych (corresponding author), O.Mekush, K.Solich are with Lesya approaches to model it and review the related economic

Ukrainka Eastern European National University, 43000, Ukraine, Lutsk, Voli problems; The Section II is devoted to development of the

st., 13; e-mail: kuzmych79@gmail.com, mekush77@gmail.com, model of forecasting the price of risk-free assets, the

solichkatya@gmail.com ).

A. Telmoudi is with LARATSI-Lab, ENIM, University of Monastir, Tunisia appropriate theoretical base of the dynamic modeling is

and Higher Institute of Applied Sciences and Technology of Sousse, University presented. Based on the obtained model we develop an

of Sousse, Tunisia (email: telmoudi@ieee.org ).

978-1-5386-5065-3/18/$31.00 ©2018 IEEE -683-

optimization algorithm in order to maximize a profit of the capital, reserve capital, capital formed by the bank's long-term

investor in the Section III. In the Section IV the software is loan.

presented for finding the optimal investment portfolio on the 2) The principle of the independent action of economic

base on the proposed algorithm. forces relating to change prices [23] is hold. At the same time,

the rate of prices changing under the influence of forces is

II. MODEL OF FORECASTING THE PRICE OF RISK-

equivalent to the total effect of all "applied" economic forces.

FREE ASSETS

All economic forces operating on this process are in

In this section we explain the dynamical effects occur in the equilibrium.

process of investment portfolio management. Consider the 3) The following law is used: the rate of increase (decrease)

problem of dynamic portfolio management of risk-free assets of the price of asset is proportional to the resulting sum of all

and the optimal market of capital. operating economic forces. Each economic force has the

The basis of the model construction is the method of physical dimension of the rate of growth, that is, the rate of

dynamic analogies, which has been widely used since the time price changing per unit time.

of Walras [21]. This method which applies the laws of In accordance with assumption 2 (the principle of independence

dynamics in economic problems is described in [22-23]. We of the actions of economic forces), the total effect of forces that

use an analogy with the laws of dynamics regarding the influence to the dynamics of the process, is expressed by the

specially chosen measure of motion to some extent. As such following sum of functions:

property we define a quantitative measure of the price dynamic F t Fi t

n

(5),

i 1

of assets of the investment portfolio x (t ) . As the speed of

where n – is amount of applied economic forces.

prices changing we enter the value x (t ) and define it as the Therefore, we use x (t ) - the rate of price change. Then we

price change rate. construct the state-space mathematical model for the price

The result of modeling is presented in a form of a system of dynamic in the form of a ordinary differential equations. Thus,

ordinary differential equations, which describes the change of the problem is defined as the price forecast of risk-free assets,

the prices of the assets depending of time and satisfies a namely as the dynamic of capital market.

number of assumptions - hypotheses concerning the economic First, we define the dynamic equations of risk-free assets:

relations between the parts of the system. , (8)

Suppose we have the functions of prices of assets are where – state vector of the system, that describes

determined by available measurable values x1 ( t ), x 2 ( t ),..., x n ( t ) the price dynamic of -th asset, – rate of return, –

at the certain time t . Based on the considerations similar to sum of economic forces that influence to the risk-free asset

[22] when constructing a model, we make the following prices.

assumptions. Suppose an investor has the opportunity to form a portfolio

1) The dynamics of prices are defined by economic forces of N risk-free assets at the initial time . Although the

that affect them and change. According to the planning process assumption of risk-free condition restricts the applicability of

of investment activity, we describe the nature and character of the model, note that these arguments are valid in some cases.

these active forces that are generated by the subjects of the For example, the price of forward contracts are usually

process. These forces are divided into two groups that they calculated as the risk-free asset prices.

affect on the prices by contributing to growth and decline, Forward contract is a standard document certifying individual

respectively. They are due to the need to spend or to receive obligation to purchase (sell) an underlying asset at a certain

revenues. Based on the laws of dynamics in relation to a time under certain conditions in the future, with fixed selling

specially chosen measure of motion (changing), we define these prices when concluding the contract.

economic forces as follows: Functions of risk-free assets yield the dynamic equation

Fi t C i t Pi t , i 1,..., n (4) . (9)

The economic forces C i t are the forces that influence the Identification of the parameter in this equation is possible

by assumption that the value of this function is known in the

process in the direction of decreasing the price of assets (the

specified period of up to time . This assumption is

results of operating, investment, financial activities: taxes, fees,

based on the fact that although the real market system has a

production costs of sales, sales costs, production management

complete or partial uncertainty of external influences, but the

costs, costs for technology improvement and organization

information about yields can be obtained, by knowing the price

process of production).

of forward contracts of related assets maturing at some time t in

Pi t includes forces that reflect the impact on the dynamics the future.

of asset prices in the direction of their growth, for example: F r t is a sum of economic forces affecting the dynamics of

financial receipts, contributions of founders into working return. The economic forces F t та F r t depends of the

CoDIT'18 / Thessaloniki, Greece - April 10-13, 2018 -684-

instability of exchange rate; the refinancing rate of the central Namely: to determine a composition of securities such that a

bank; state support of certain enterprises in the form of loans profit on their sales at certain time t would be maximal. In order

and benefits. They affect to the dynamics of their risk-free to solve this problem we use a cluster genetic algorithm. The

assets and rate of return. algorithm was tested on developed software environment.

The developed model of the optimal investment portfolio is One of the variants of this optimization problem’s solution is

based also on the approaches given in the paper [15], which based on the modification of the classical genetic algorithm

presents a model for dynamics of investment asset prices using (GA) in the cluster GA [24]. Genetic algorithms - is adaptive

of stochastic differential equations. Basis of this model is the search, which recently used to solve optimization problems.

description of the dynamics of asset prices, which depend on They are used as an analogue mechanisms of genetic

changes in economic and financial factors that describe the inheritance and an analogue of natural selection. Cluster

state of the economy. At the same time, the expected modification of genetic algorithm partially imitates principles

profitability of asset price dynamics is the function of these of diversity in the population and the process of genetic

factors. Using also considerations and the principle given in selection. Namely, the partition of search space into sections

[30], we find an optimal investment portfolio taking into depending on the value of the objective function.

account the dynamics of yield and rates of returns. In this case, Define the basic specifications of this problem.

the available funds U can be used to acquire n kinds of In terms of GA, the number of securities of one company is a

securities in amounts U 1 ,...U n . The initial value i of one unit gene (chromosome), and a certain set of genes - is one of the

realization of an investment portfolio. To determine the

of type i is known, as well as its estimated value i at time t. optimality of the chromosome, a fitness function was defined

It is assumed that i i ( i 1,..., n ) . The declared problem that takes into account the specifics of the solvable problem:

obtaining the maximum return of the investment portfolio, the

is to determine the composition of securities and assets such investor's desire to invest the whole amount of fund in the

that the profits on their sales at time t would be maximum. portfolio or obtain some balance for the formation of the

Therefore we propose an modification of this mathematical portfolio, as well as strict control of the amount of allocated

model, in order to make it more flexible for the potential user funds. As a result, the target fitness function of adaptability has

of investment portfolio. For this optimization we enter - the form:

amounts of each of the assets as variables in the mathematical

n i xi . (11)

model. In addition to improve "practical potential" of tasks we f max i n

i 1

associate an assessment of return with each asset (9) calculated x

i 1 i i

on the basis of stock market securities, instead of projected The basic terms of the declared problem are following.

income (8). Chromosome - a binary string consisting of zeros and units

Thus, taking into account of (8)-(9), the resulting model of obtained as a result of the binary coding of the data set

forecasting of total price of risk-free assets would be: corresponding to the variant of the investment portfolio.

Population - a set of chromosomes, i.e. a set of implemented

variants of the investment portfolio.

Adaptability - is defining a function to be optimized.

Crossover is an exchange of chromosomes by its parts to create

(10) a new population, i.e. the exchange of parts of the binary code

sets to generate a new portfolio's variant.

Mutation is a random change of one or more positions of gens

where - expected return of i-th asset, in the chromosome.

- the rate of the price of i-th asset, - Fitness function defined in (11) is constructed to determine the

optimal chromosome. It takes into account the specificity of

lower and upper limit of the amount of securities of type i, its the problem: getting the maximum profit on the investment

specification is given in the Section III. portfolio, a desire of investors to invest full amount of money

into a portfolio or take some balance to create a portfolio, as

III. OPTIMIZATION ALGORITHM FOR THE well as strong or not strong control of allocated funds. The

INVESTMENT PORTFOLIO latter implies the possibility of increasing the size of the initial

investment to purchase an additional number of shares in

A. Basic concepts perspective in terms of return on assets and/or securities.

Below the optimization algorithm is described.

In this section we develop an algorithm in order to maximize

a profit of investor which has the financial means of amount ,

used to purchase types of securities in the amount U 1 ,...U n .

CoDIT'18 / Thessaloniki, Greece - April 10-13, 2018 -685-

B. Optimization algorithm mutation (probability of random changes of the ammount of

1) Generation of initial sets of investment portfolios. securities of i-the company where i=1…n, n - number of

Generating of initial population with N chromosomes. Reading companies in the portfolio.)

input data of investment companies, parameters of the genetic Crossover produses two parental individuals, four

algorithm. Recoding of investment portfolio data into binary subsidiaries are formed. Parental individuals - two randomly

code. For example, each variant of an investment portfolio is selected portfolios. We use multi-point crossbreeding namely

encoded by a separate chromosome expressed by a binary code. in-gene. Number of shares of i-th securities (i=1..n, n-number

2) Checking of portfolios under optimality and their selection. of companies) in the "child's" portfolio with a probability of

1 step. Calculation the value of the adaptability function for 50% may be inherited from so-called "father" portfolio, or with

a given set of chromosomes (variants of realization of an the same probability from "mother". It is important that when

investment portfolio), i.e. obtaining sets of solutions of the creating a new population, the centroids of clusters that are the

optimization problem. "best" portfolios in each of the groups of similar portfolios, can

2 step. The portfolios are selected in accordance with the not be interrupted, mutated or deleted. So the clusters are

threshold value of the function of adaptability. The goal of copied from the previous population to the next one. The new

optimization - to get the maximum of investments income, i.e. population consists of both parents and daughters.

achieving the maximum of the adaptability function . During Selection process after reaching a predetermined

3) Clustering (Grouping of Similar Investment Portfolios). number of generations, a subpopulation of clusters contains

Grouping the sets of solutions for the optimization that are various solutions with different optimality. The group of the

encoded by chromosomes with similar phenotypes. The degree solutions defining the global extremum (at certain level of the

of proximity is the binary metric (Hamming). solution of the problem) are centroids - the best portfolios

4) Crossover. Generation of the new sets of investment of the last cluster’s subpopulation.

portfolios, i.e. the selection the chromosomes and the creation a When Mutation is executed, it should be noted that the

new set of subsidiary chromosomes. The result is a new set of choice of values for a control parameter such as a cluster radius

investment portfolios, they are compared with the obtained can only be carried out experimentally, taking into account the

already. following recommendations: clusters should cover the whole

5) Mutation. Random change of genes in the chromosome for search area; the value of the cluster radius should be sufficient

preventing falling into a local extreme and avoiding premature to generate the clusters that cover all the optimal solutions; an

convergence. intensive mutation should be realized with a large number of

6) Run steps (3-5) to generate a new generation of N generations.

chromosome population, that is, new variants of the investment The obtained result includes data sets of the number of

portfolio. securities of each company, which are the solutions of the

7) Run steps (2-5) until the end condition of the algorithm (for multi-extremity optimization problem of investment portfolio;

example, a certain number of iterations) is reached. amount of funds invested into the securities, i.e. the total price

of the portfolio; the objective fitness function's value for each

of these solutions, i.e. predictable profit. One of the program

IV. MODEL REALIZATION realization is presented in Table I in order to obtain for the

optimal plan. The first stage is data preparation and

The OptPortfolio software was developed for finding the preprocessing, the real data of prices and profitability of

optimal investment portfolio is based on the proposed securities of several Ukrainian companies engaged in various

algorithm. It was developed on the base of the crossplatform fields were taken from the information portal of investment and

software development framework Qt 5.4 under the GNU LGPL finance.

license. Program product was realized with programming

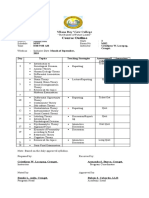

language C++. The software implements genetic operators of TABLE I. INPUT DATA

crossover, mutation, selection, parental selection, and clustering Number Min Max Asset’s Returns

module. of the amount of amount of price

In general this algorithmic tool needs the following input company assets assets

data: number and names of the companies; data of the 1 10 20 266 4,3

securities of which an investor wants to buy; limitations on the 2 100 500 0,15 0,04

number of securities (Minimum and maximum number); yield 3 200 700 0,8 0,01

of securities of each company; cluster radius (size of the 4 20 200 22 10

portfolios); number of iterations (populations) - the number of 5 50 300 8 4

choices of portfolios; number of individuals in the population

(number of variants in a single portfolio); probability of

CoDIT'18 / Thessaloniki, Greece - April 10-13, 2018 -686-

The following parameters of the genetic algorithm were [9] Rzayev D.O., Rzayeva S.L. “Simulation of portfolio optimization”,

Modeling and information systems in economy. - 2012. - No 86. - P. 188-195.

entered: the radius of the cluster 10; number of iterations 5000;

[10] Getman O.M., Vakarov V.M., Sember S.V. “Optimization of modeling of

probability of mutations 0.2; number of individuals in the investment portfolio management”, Scientific Bulletin of Uzhgorod

population 50, initial capital 5000. University: Series: Economics. Uzhhorod: Publishing House "Goverla", 2012.

- No. 2 (36). - P. 147-153.

TABLE II. OPTIMAL PLAN [11] Knopov P.S., Pepelyaeva T.V., Demchenko I.Yu. “On one semi-Markov

model of inventory management”, Cybernetics and system analysis .- 2016.-

1 2 3 4 5Portfolio’s Return Fitness Vol. 52.- No. 5.- P. 81-88.

price function [12] Levkin V.M., Dubrovin V.I. “The investment decisions under

uncertainty”, Information Processing Systems .- 2012.- Issue 2 (100) .- P.264-

12 136 202 55 52 5000 817 5,49 270.

The resulting optimal plan is given on the Table II. [13] Nazarenko O. M., Karpusha M.V. “Modeling of forecasted yields and

their use in problems of estimating the efficiency of investment portfolios”,

V. CONCLUSION Economy Development. - 2012. - No. 1. - P. 98 - 102.

[14] Galkina O.A. “Investigation of multi-stage stochastic portfolio

In this paper, a dynamic state-space model of investment optimization tasks “, Cybernetics and system analysis.-2016.-volume 52, No.

portfolio is developed. The basis of the constructed model is 6.-p.30-39.

[15]Markowitz H. M. “Portfolio Selection”, Journal of Finance.-1952.-№7.-

the method of dynamic analogies, which consists of applying

pp. 77–91.

the laws of dynamics to the chosen measure of motion. On the [16] Markowitz H. M. “Portfolio Selection: Efficient Diversification of

base of systems of ordinary differential equations, we propose Investments” . — New York : John Wiley & Sons, Inc. — 1959. — 344 p.

a model for forecasting risk-free assets and an optimal capital [17] Konno H., Yamazaki H. “Mean absolute deviation portfolio optimization

and its application to Tokyo Stock Market”, Management Science. -1991.-

market, which is used to solve the problem of investment

№37.-pp. 519–531.

distribution. The optimization algorithm for finding the [18] Dembo R. S., King, A. J. “Tracking models and the optimal regret

maximum return on investment through the achievement of the distribution in asset allocation”, Applied Stochastic Models and Data

maximum of the target function of adaptability is presented. Analysis.-1992.- №8.- pp.151–157.

The developed models have been tested on real data, and the [19] Young M. R. “A minmax portfolio selection rule with linear programming

solution”, Management Science .-1998.-№44(5).-pp. 673–683.

problem of maximizing the investor's income is solved. In [20] Rockafellar R., Uryasev S. P. “Optimization of Conditional Value-at-

further research, the model for forecasting risk-free assets and Risk”, Journal of Risk.-2000.-№ 2(3).-pp. 21–41.

optimal capital market will expand, risk assets will be [21] Walras L. “Elements of pure economics or the theory of social”, (1954).

considered, it is expedient to consider the task of identifying the Translated by W.Jaffe: Orion Editions.- 1984. 620p.

[22] Kalitin B.S. “Mathematical models of first order for a competitive market:

parameters with the help of real statistical data. Also, the manual”, - Minsk: BSU, 2011. - 131 p.

software will be improved, its capabilities will be [23] Kalitin B.S. “Dynamic model of the market, of type "effective

complemented by a solution to the problem of minimizing risk. competition", Bulletin of the Belarusian University, Issue1, Phys.-Math. Inf.

1997, No. 1, p. 68-70.

[24] Kazakov P.V. “Cluster Genetic Algorithm for the Synthesis of Optimal

REFERENCES Investment Portfolio”, Information Technologies: Scientific-Technical and

Scientific -Production Journal. - 2010. - No. 12. - P. 38-42.

[1] Reilly F.K., Brown K.C. “Investment Analysis and Portfolio Management”

// Harcourt.-1999.- 1082 p .

[2] Sharpe W.F., Alexander G.J., Bailey J.V. Investments . — New Jersey :

Prentice Hall. — 1998. – 962 p.

[3] Luenberger D. G. “Investment Science”.-Oxford University Press.-1998.-

594 p.

[4] Gamalij V.F, Vishnevskaya V.A. “The problem of selection an investment

portfolio with risk taking” // Scientific papers of the Kirovohrad National

Technical University. Economic sciences -2013.- No 24.-pp. 67-72.

[5] Maslennikov Y.I., Danilov R.I. “ Economy: realities of time”. Scientific

Journal. - 2015. - No. 5 (21). - P. 83-88.

[6] Borimsky Yu.S., Ryabushenko A.V, Maslyanko P.P., Lyubashenko N.D.

“The method of forming an investment portfolio of financial management and

investment management system”, Scientific News of NTUU "KPI" .- 2010.-

№5.-С.31-40.

[7] Bozhemska I.O., Garmatiy N.M. “Economic-mathematical modeling of the

investment portfolio of commercial bank (PJSC KB "Privatbank") on the

model of Quasi-Sharpe”. - Economy modeling: problems, tendencies,

experience: VII International scientific-methodical conference "Forum of

young economists-cybernetics", October 21-22, 2016 р.-Ternopil: "Type" .-

2016.-pp.14-16.

[8] Vsklenko A.V., Lisovenko M.M “Optimization modeling of the securities

portfolio of a participant in the stock market”, Economic Bulletin of National

University of Ukraine .- 2006.- № 2.-pp.111-117.

CoDIT'18 / Thessaloniki, Greece - April 10-13, 2018 -687-

You might also like

- A Hybrid Combinatorial Approach To A Two-Stage Stochastic Portfolio Optimization Model With Uncertain Asset PricesDocument17 pagesA Hybrid Combinatorial Approach To A Two-Stage Stochastic Portfolio Optimization Model With Uncertain Asset PricesPFE FSJESTeNo ratings yet

- (BAO, 2014) A Simulation-Based Portfolio Optimization Approach With Least Squares LearningDocument6 pages(BAO, 2014) A Simulation-Based Portfolio Optimization Approach With Least Squares LearningarnaudNo ratings yet

- A Mean-VaR Based Deep Reinforcement Learning Framework For Practical Algorithmic TradingDocument14 pagesA Mean-VaR Based Deep Reinforcement Learning Framework For Practical Algorithmic TradingYang FeiNo ratings yet

- A General Framework For Portfolio Theory-Part I THDocument43 pagesA General Framework For Portfolio Theory-Part I THishikakeswani4No ratings yet

- chiminglinAMS5 8 2007Document10 pageschiminglinAMS5 8 2007Heades JulechristNo ratings yet

- The Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Document12 pagesThe Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Gu GraceNo ratings yet

- Optimisation of Complex Financial Models Using Nature-Inspired TechniquesDocument11 pagesOptimisation of Complex Financial Models Using Nature-Inspired TechniquesfpttmmNo ratings yet

- Equity Portfolio Construction and Selection Using Multiobjective Mathematical ProgrammingDocument25 pagesEquity Portfolio Construction and Selection Using Multiobjective Mathematical ProgrammingHeni AgustianiNo ratings yet

- Dynamic Portfolio Selection With Market Impact CostsDocument8 pagesDynamic Portfolio Selection With Market Impact CostsHassan AlJishiNo ratings yet

- TradeDocument6 pagesTradekyleleefakeNo ratings yet

- ALM ReviewDocument16 pagesALM ReviewMd. Jasim UddinNo ratings yet

- Me and YouDocument8 pagesMe and YouLaffin Ebi LaffinNo ratings yet

- Operations Research Techniques Applied To The FinancialMarketsDocument10 pagesOperations Research Techniques Applied To The FinancialMarketsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 16144-Article Text-19638-1-2-20210518Document8 pages16144-Article Text-19638-1-2-20210518Sebastian StapfNo ratings yet

- The Investment Portfolio Selection Using Fuzzy Logic and PDFDocument6 pagesThe Investment Portfolio Selection Using Fuzzy Logic and PDFtatioliveira01No ratings yet

- Trans Rebalancing An Investment Portfolio in The Presence of Convex Transaction Costs and Market Impact CostsMarketimpact RescaleDocument24 pagesTrans Rebalancing An Investment Portfolio in The Presence of Convex Transaction Costs and Market Impact CostsMarketimpact Rescalek_ij9658No ratings yet

- A Multicriteria Methodology For Bank Asset Liability ManagementDocument26 pagesA Multicriteria Methodology For Bank Asset Liability ManagementHoàng Trần HữuNo ratings yet

- A Literature Study On The Capital Asset Pricing MoDocument5 pagesA Literature Study On The Capital Asset Pricing Momarcel XNo ratings yet

- A Mathematical Approach To A Stocks Portfolio Sele PDFDocument15 pagesA Mathematical Approach To A Stocks Portfolio Sele PDFvasanthanilNo ratings yet

- Tsoukalas Giesecke Wang 19Document26 pagesTsoukalas Giesecke Wang 19Tom HardyNo ratings yet

- Doubly Regularized Portfolio With Risk Minimization - AAAI - 14Document7 pagesDoubly Regularized Portfolio With Risk Minimization - AAAI - 14Chua Yong Sheng DarrenNo ratings yet

- Zopounidis2018 Article PrefaceAnalyticalModelsForFinaDocument4 pagesZopounidis2018 Article PrefaceAnalyticalModelsForFinaMahedre ZenebeNo ratings yet

- An Adaptive Metaheuristic Approach For Risk-Budgeted Portfolio OptimizationDocument10 pagesAn Adaptive Metaheuristic Approach For Risk-Budgeted Portfolio OptimizationIAES IJAINo ratings yet

- Applied To Financial Market: Key-WordsDocument13 pagesApplied To Financial Market: Key-WordsFrancisco SalinasNo ratings yet

- 2021.10 - Liquidity Stress Testing in Asset Management-Part Three - enDocument98 pages2021.10 - Liquidity Stress Testing in Asset Management-Part Three - enDavid CartellaNo ratings yet

- Econ 213Document116 pagesEcon 213Victor KiruiNo ratings yet

- SSRN Id593584Document28 pagesSSRN Id593584Loulou DePanamNo ratings yet

- Integrated Long-Term Stock Selection Models Based On Feature Selection and Machine Learning Algorithms For China Stock MarketDocument14 pagesIntegrated Long-Term Stock Selection Models Based On Feature Selection and Machine Learning Algorithms For China Stock MarketdeepaboobalakrishnanNo ratings yet

- Opt Portfolio DEADocument21 pagesOpt Portfolio DEAsladjanapaunovic11No ratings yet

- Portfolio Theory in Solving The Problem Structural Choice: Risk and Financial ManagementDocument20 pagesPortfolio Theory in Solving The Problem Structural Choice: Risk and Financial ManagementPaula MoldovanNo ratings yet

- Maths Case Study 2Document6 pagesMaths Case Study 2nishitasolanki588No ratings yet

- Modelo Colas PDFDocument36 pagesModelo Colas PDFRafael BarriosNo ratings yet

- Translete UtsDocument14 pagesTranslete UtsfirdausNo ratings yet

- Non Parametric For FinanceDocument78 pagesNon Parametric For Financeblinking02No ratings yet

- AHigher Order Hidden Markov Chain Modulated Modelfor Asset AllocationDocument27 pagesAHigher Order Hidden Markov Chain Modulated Modelfor Asset AllocationParlog IoanaNo ratings yet

- Regime-Switching Factor Investing With Hidden Markov ModelsDocument15 pagesRegime-Switching Factor Investing With Hidden Markov ModelsHao OuYangNo ratings yet

- MonteCarloSimulation in RiskDocument20 pagesMonteCarloSimulation in RiskVictor Hugo Fernandez ArrayaNo ratings yet

- Sensitivity Assessment Modelling in European Funded Projects Proposed by Romanian Companies Droj Laurentiu, Droj GabrielaDocument11 pagesSensitivity Assessment Modelling in European Funded Projects Proposed by Romanian Companies Droj Laurentiu, Droj GabrielaMohammed AlmusawiNo ratings yet

- 08 Dziwok Asset Allocation Strategy... 02Document11 pages08 Dziwok Asset Allocation Strategy... 02Viviana CVNo ratings yet

- 2018 Book NewMethodsInFixedIncomeModelinDocument298 pages2018 Book NewMethodsInFixedIncomeModelinEgyptian67% (3)

- Statistics PDFFDocument2 pagesStatistics PDFFDaniel ChihomaNo ratings yet

- Sensitivity AnalysisDocument5 pagesSensitivity AnalysisMohsin QayyumNo ratings yet

- Multi-Asset Scenario Building For Trend-Following Trading StrategiesDocument34 pagesMulti-Asset Scenario Building For Trend-Following Trading StrategiespanazeliaNo ratings yet

- Modern Portfolio Theory DissertationDocument7 pagesModern Portfolio Theory DissertationHelpWritingPapersForCollegeSalem100% (1)

- Artificial Agents and Speculative BubblesDocument10 pagesArtificial Agents and Speculative BubblesSergiu Marius TalinNo ratings yet

- Postdoctoral Resercher, Institute of National Economy, Romanian Academy, Bucharest, RomaniaDocument4 pagesPostdoctoral Resercher, Institute of National Economy, Romanian Academy, Bucharest, RomaniaHà ThùyNo ratings yet

- Complexity EconomicsDocument9 pagesComplexity EconomicsCHINGZU212No ratings yet

- Model Validation: Theory, Practice and PerspectivesDocument13 pagesModel Validation: Theory, Practice and PerspectivesDJ VirusNo ratings yet

- Financial Mathematics: Main ArticleDocument1 pageFinancial Mathematics: Main ArticleMaika J. PudaderaNo ratings yet

- Portfolio Op Tim IzationDocument18 pagesPortfolio Op Tim IzationMihir JaipuriaNo ratings yet

- Bielecki 2005Document32 pagesBielecki 2005JUANNo ratings yet

- Ainassaari Kallio RanneDocument17 pagesAinassaari Kallio RanneŠejla HadžićNo ratings yet

- 9033 PDFDocument12 pages9033 PDFKrishna JoshiNo ratings yet

- CVaR Vs CDaRDocument25 pagesCVaR Vs CDaRcuenta 2No ratings yet

- Critical Appraisal of Financial Models in Investment Decisions & Security TradingDocument7 pagesCritical Appraisal of Financial Models in Investment Decisions & Security TradingAnonymous CwJeBCAXpNo ratings yet

- Evolutionary Theory in Financial DecisionDocument17 pagesEvolutionary Theory in Financial DecisionJanice YangNo ratings yet

- A Comprehensive Review On Capital Structure TheoriesDocument24 pagesA Comprehensive Review On Capital Structure TheoriesCristian Buffalo SlobodeaniucNo ratings yet

- Pattern Matching Trading System Based On The Dynamic Time Warping AlgorithmDocument18 pagesPattern Matching Trading System Based On The Dynamic Time Warping AlgorithmognjanovicNo ratings yet

- Kimiagari2010 Genetic Algorithms For Fuzzy Multi-Objective Approach To Portfolio SelectionDocument8 pagesKimiagari2010 Genetic Algorithms For Fuzzy Multi-Objective Approach To Portfolio SelectionfatimaNo ratings yet

- A Comparative Study of Mixed-Integer Linear Programming and Genetic Algorithms For Solving Binary ProblemsDocument5 pagesA Comparative Study of Mixed-Integer Linear Programming and Genetic Algorithms For Solving Binary Problems1. b3No ratings yet

- Scheduling Job Seekers Using Genetic Algorithms: Hussain M. AlfadhliDocument5 pagesScheduling Job Seekers Using Genetic Algorithms: Hussain M. Alfadhli1. b3No ratings yet

- Use of Genetic Algorithms For Classification of Datasets: Ashwinkumarum@reva - Edu.inDocument5 pagesUse of Genetic Algorithms For Classification of Datasets: Ashwinkumarum@reva - Edu.in1. b3No ratings yet

- Multi-Label Modality Classification For Figures in Biomedical LiteratureDocument6 pagesMulti-Label Modality Classification For Figures in Biomedical Literature1. b3No ratings yet

- 978-1-5090-1172-8/17/$31.00 ©2017 Ieee 667Document4 pages978-1-5090-1172-8/17/$31.00 ©2017 Ieee 6671. b3No ratings yet

- Scheduling Services For Manets Using Genetic Algorithms: Marcelo Petri Janine Kniess Rafael Stubs ParpinelliDocument8 pagesScheduling Services For Manets Using Genetic Algorithms: Marcelo Petri Janine Kniess Rafael Stubs Parpinelli1. b3No ratings yet

- Vehicle Layout Optimization Using Multi-Objective Genetic AlgorithmsDocument10 pagesVehicle Layout Optimization Using Multi-Objective Genetic Algorithms1. b3No ratings yet

- Stock Price Prediction Using Genetic Algorithms and Evolution StrategiesDocument5 pagesStock Price Prediction Using Genetic Algorithms and Evolution Strategies1. b3No ratings yet

- Building Social Networks and Strategies For SuccessDocument32 pagesBuilding Social Networks and Strategies For SuccessGita CindyNo ratings yet

- Physical Science NOV. 20-22, 2019 DLPDocument2 pagesPhysical Science NOV. 20-22, 2019 DLPJedidiah Jara QuidetNo ratings yet

- Algonquin College International Business Management: International Marketing Professor-Clarecia ChristieDocument3 pagesAlgonquin College International Business Management: International Marketing Professor-Clarecia ChristieMudit GoelNo ratings yet

- Dani Extreme V3 Manual PDFDocument14 pagesDani Extreme V3 Manual PDFHumbertoJaimeNo ratings yet

- Doctrine of Double EffectDocument3 pagesDoctrine of Double EffectRael VillanuevaNo ratings yet

- Aliquat-336 As A Novel Collector For Quartz FlotationDocument8 pagesAliquat-336 As A Novel Collector For Quartz FlotationMaicol PérezNo ratings yet

- Critical Study of Richard Dawkins, The God DelusionDocument10 pagesCritical Study of Richard Dawkins, The God DelusionJuan Pablo Pardo BarreraNo ratings yet

- Saroj Dulal - Pest Management Practices by Commercial Farmers in Kakani Rural MuncipalityDocument123 pagesSaroj Dulal - Pest Management Practices by Commercial Farmers in Kakani Rural MuncipalitySaroj DulalNo ratings yet

- Community Health Nursing BookDocument96 pagesCommunity Health Nursing BookSamantha Renei SanchezNo ratings yet

- Course Outline: Yllana Bay View CollegeDocument10 pagesCourse Outline: Yllana Bay View CollegeCriseljosa LacapagNo ratings yet

- PSE PG Structure ModifedDocument61 pagesPSE PG Structure ModifedAnkit YadavNo ratings yet

- Chapter 9Document22 pagesChapter 9Marjorie Anne VilledoNo ratings yet

- Essay My Favourite FoodDocument6 pagesEssay My Favourite Foodafabfasaf100% (2)

- Cantilever Retaining Wall ExampleDocument8 pagesCantilever Retaining Wall ExampleRahul Sinha100% (1)

- Vellore CaseDocument17 pagesVellore Casesai kiran gudisevaNo ratings yet

- Wiring DM 1wDocument20 pagesWiring DM 1wAnan NasutionNo ratings yet

- Hookes Law Practice Problems PDFDocument3 pagesHookes Law Practice Problems PDFSyed JaffreeNo ratings yet

- UniAmericas PASSIVATION - SOLUTION MSDSDocument3 pagesUniAmericas PASSIVATION - SOLUTION MSDSVivian FrancisNo ratings yet

- TRANS Finals NSTPDocument6 pagesTRANS Finals NSTPStephanieNo ratings yet

- Independent University, BangladeshDocument8 pagesIndependent University, BangladeshMD. Akif RahmanNo ratings yet

- DST-JSPS Call For Proposals 2020Document3 pagesDST-JSPS Call For Proposals 2020Dr-Bharath Vedashantha MurthyNo ratings yet

- PSSR Pre-Commissioning SafetyDocument6 pagesPSSR Pre-Commissioning SafetymanuNo ratings yet

- Development and Assessment of A Hand Assist DeviceDocument15 pagesDevelopment and Assessment of A Hand Assist DeviceAugusto Rodas VelezNo ratings yet

- Quantitative Techniques NcatDocument191 pagesQuantitative Techniques NcatJeremiah AkonyeNo ratings yet

- Science and Technology and Nation BuildingDocument16 pagesScience and Technology and Nation BuildingJm BalessNo ratings yet

- 111196688bed Odl TimetabaleDocument1 page111196688bed Odl TimetabaleVIVEK MURDHANINo ratings yet

- Directorate General of Drug Administration: SL Name of The Pharmaceutical Address Location Licence No. Present StatusDocument2 pagesDirectorate General of Drug Administration: SL Name of The Pharmaceutical Address Location Licence No. Present StatusAnamika SahaNo ratings yet

- 7055 - Case Study - UK Power Station FINAL For WEBDocument2 pages7055 - Case Study - UK Power Station FINAL For WEBNyx RubyNo ratings yet

- Short CV RJCDocument3 pagesShort CV RJCShivani KhannaNo ratings yet

- Models of Cultural Heritage Management: Transformations in Business and Economics January 2014Document23 pagesModels of Cultural Heritage Management: Transformations in Business and Economics January 2014aaziNo ratings yet