Professional Documents

Culture Documents

DocScanner 23 Sep 2022 1 38 PM

DocScanner 23 Sep 2022 1 38 PM

Uploaded by

Ishita shah0 ratings0% found this document useful (0 votes)

13 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesDocScanner 23 Sep 2022 1 38 PM

DocScanner 23 Sep 2022 1 38 PM

Uploaded by

Ishita shahCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

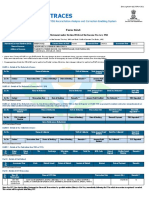

Tax Applicable (Tick one) =

NO./ ITNS 280 | (0021) INCOME-TAX (OTHER THAN COMPANIES)

CHALLAN | (0020) INCOME-TAX ON COMPANIES: (CORPORATION TAX)

py {tobe sent to the ZAQ)

“ToT | Assessment Year

4 2022-23

Permanent Account Number

Ren bEManc 0K.

|Full Name

AOPURA MAIN ROAD, VADODARA, GUJARAT

NUE, OPP USHA KIRAN BUILDING _

Total 170460 |

Total (in words):

GRORES | TAGS] THOUSANDS | HUNDREDS [TENS [UNITS

Zero | One | Seventy Four Sik Zero

Paid in Cash/Debit to A/o/Cheque No. z Dated sate

enamel |

‘Wane of tre Bank and Branch)

Date: 23/09/2022

Signature of the Person making payment

Taxpayers Counterfoil (To be filled up by tax payer)

PAN ‘AUFM2960K 7

Received from MERAJ DEVELOPERS

CastiDebit to A/c/Cheque No. =] For'Rs: [_ 470460

Rs, (in Words) [One Lac Seventy Thousand Four Hundred |

ii

Drawn on

(Name of the Bank and Branch)

On account of Companies/Other than Companies Tax

Type of Payment SelfAssessmentTax |

For the Assessment Year 2022-23

Phone No. [9925710344 Pin [390001

Type of Payment (Tick One) ae aia :

‘Advance Tax(100) [ ] Other Receipts(500)[ Suntax (102) [ ]

Self Assessment Tax (300) [v7] Tax on Distributed Profits of Domestic Companies (105) [J

|____Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107) ]

DETAILS OF PAYMENTS | FOR USE IN RECEIVING BANK

‘Amount (In Rs. Only) Debit to Alc/ Cheaue credited on

Income Tax To ayoseo) ||

Surcharge [= 0) | | a

Education Cess ' ee

Interest =a 0] | | SPACE FOR BANK SEAL

Penalty eapecmerennneeeo! | |

iar |

Others 0

Rs.

SPACE FOR BANK SEAL

MERAJ DEVELOPERS

SECOND FLOORANMOL AVENUE,

OPP. USHA KIRAN BUILDING,

RAOPURA MAIN ROAD,

VADODARA-390001

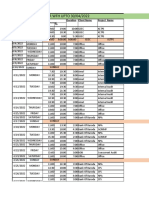

Group: Capital Account

Ledger: SHELIYA INFRASTRUCTURE PVT LTD-45%

404, PARUL APPARTMENT,

BIH- SEVEN SEAS MALL,

FATEHGUNJ

VADODARA

41-Apr-2021 to 31-Mar-2022

Veh Type ch No. Debit Credit

41,33,30,047.64

13 7,00,004

Date Particulars

1-4-2021 To Opening Balance

7-7-2021 By BANK OF INDIA Receipt

Ch No. TFR FROM — SHELIYA

INFRASTRUCUTURE PVT LTD

1-10-2021 To BANK OF INDIA Payment 41 7,00,000.00

Ch. No. :87559 PAID

Paymont 43 3,50,000.00

11-10-2021 To BANK OF INDIA

Ch. No. :87562 PAID

22-12-2021 To BANK OF INDIA Payment

Ch. No. :paid

31-12-2021 To Income Tax F.Y.2020-21

BEING INCOME TAX PAID FOR FIRM

TRANSFERED TO PARTNERS CAPITAL ACCOUNT

62 17,0,000.00

Journal 2 4,374.00

31-3-2022 By Profit & Loss Alc Journal

BEING NET PROFIT TRANSFER TO PARTNERS

CAPITAL ACCOUNT

461,34,42164 — 9,24.235 0

1,52,10.186 64

Closing Balance

be 7 4,61,34,421.64 1,64,34,421.64

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshita shahNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Mannual Rectification ApplicationDocument2 pagesMannual Rectification ApplicationIshita shahNo ratings yet

- COMPUTATIONDocument3 pagesCOMPUTATIONIshita shahNo ratings yet

- Rules For ArticleshipDocument1 pageRules For ArticleshipIshita shahNo ratings yet

- Unilink BSDocument10 pagesUnilink BSIshita shahNo ratings yet

- Name: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyDocument4 pagesName: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- Name Meshwa Shah: For The Month of April-2022Document2 pagesName Meshwa Shah: For The Month of April-2022Ishita shahNo ratings yet

- Aman Form 102Document3 pagesAman Form 102Ishita shahNo ratings yet

- Kushal Purohit WFH April, 2022Document2 pagesKushal Purohit WFH April, 2022Ishita shahNo ratings yet

- Work From Home Sheet For The Month of April 2022Document3 pagesWork From Home Sheet For The Month of April 2022Ishita shahNo ratings yet

- Name: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Document3 pagesName: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Ishita shahNo ratings yet

- Name Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscDocument3 pagesName Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscIshita shahNo ratings yet

- Mohammad Faizan ShekhDocument2 pagesMohammad Faizan ShekhIshita shahNo ratings yet

- Name Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayDocument3 pagesName Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayIshita shahNo ratings yet

- Name: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyDocument2 pagesName: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- Dhruti Bhatt WFH April, 2022Document3 pagesDhruti Bhatt WFH April, 2022Ishita shahNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishita shahNo ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet