Professional Documents

Culture Documents

Mannual Rectification Application

Uploaded by

Ishita shahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mannual Rectification Application

Uploaded by

Ishita shahCopyright:

Available Formats

22/02/2024

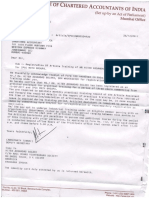

To,

The Income Tax Officer,

Ward 4(1)(7)

Income tax office,

Vadodara.

Respected Sir/Madam,

Sub : Process rectification application u/s 154 of AY 2018-19, delete the demand and issue

the refund

Reference:

Name : Dhanesh Komalchand Singhai

PAN No : ACRPS0616D

Assessment year : 2018-19

Financial year : 2017-18

Mobile No : 9662546992

With reference to above, I submit before your good self as under:

1. I had filed my income tax return for the AY 2018-19 electronically vide

acknowledgment no. 860774270220718 dated 22/07/2018.The acknowledgment/

ITR V of income tax return for AY 2018-19 is enclosed for your reference.

2. After filing income tax return, I came to know that self-assessment tax was

missed to pay. So immediately after filing income tax return on same day, I had

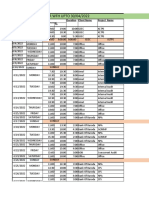

paid self-assessment tax of Rs.64,780/- vide challan no.21644, BSR code 0510308

dated 22/07/2018. Copy of challan is enclosed.

3. I had also filed rectification application on 19/01/2022 vide acknowledgment no.

946094200190122. Copy of acknowledgment of rectification application is

enclosed.

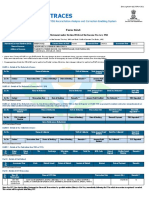

4. I had submitted online response to outstanding demand on 09/05/2022 vide

transaction ID FOS001039920311. Response details of which is also enclosed for

your reference.

5. I had submitted E-Proceeding response of DIN & Letter No.

ITBA/COM/F/17/2022-23/1049969925(1) dated 21/02/2023 on 23/02/2023 vide

acknowledgment no. 964564161230223. E-Proceeding Response

acknowledgment is also enclosed for your reference.

6. I had submitted E-Proceeding response of DIN & Letter No.

ITBA/COM/F/17/2022-23/1050494978(1) dated 07/03/2023 on 25/03/2023 vide

acknowledgment no. 993612411250323. E-Proceeding Response

acknowledgment is also enclosed for your reference.

7. You are requested to delete the demand of AY 2018-19 Rs. 64775 + accrued

interest Rs.22645 and issue refund of Rs.37,155/- which has been wrongly

adjusted against refund of AY 2021-22. Intimation u/s 143(1) of AY 2021-22

showing refund adjusted is enclosed for your reference.

Also delete the outstanding demand of Rs.27,625/- and Accrued interest of

Rs.22645 showing at portal. Screenshot of outstanding demand appearing at

portal is enclosed for your reference.

The above details are summarised as under:

AY 2018-19 AY 2018-19

Demand accrued interest

Total demand 64775 22645

Less: adjusted against 37155 -

refund of AY 2021-22

Existing demand at 27625 22645

portal

8. You are requested to delete the demand of AY 2018-19 Rs. 64775 + accrued

interest Rs.22645 and issue refund of AY 2021-22. An early action in the matter

will be greatly appreciated.

Thanking you, sir/madam.

Yours sincerely,

For Dhanesh Komalchand Singhai

Sd/-

CA Ishita Parikh

CA & AR

Enclosed: As Above

You might also like

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- IC38 Janamghutti v1 10052019 PDFDocument67 pagesIC38 Janamghutti v1 10052019 PDFMahesh S Gour75% (4)

- LT Bill 46001160003 201512Document2 pagesLT Bill 46001160003 201512Santanu DasNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Equity Markets in Transition PDFDocument612 pagesEquity Markets in Transition PDFkshitij kumar100% (1)

- Banking AwarenessDocument130 pagesBanking AwarenessDAX LABORATORY100% (2)

- Manpowergroup Services India PVT LTD Vs Commissioner of Income TaxDocument6 pagesManpowergroup Services India PVT LTD Vs Commissioner of Income Taxtry testNo ratings yet

- Calcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)Document6 pagesCalcutta Discount Co. Ltd. v. ITO: (1961) 41 ITR 191 (SC) (1967) 63 ITR 219 (SC)rigiyanNo ratings yet

- VILGST - SGST - High Court Cases - 2022-VIL-124-GUJDocument17 pagesVILGST - SGST - High Court Cases - 2022-VIL-124-GUJJAYKISHAN VIDHWANINo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700No ratings yet

- 'CL 2021 22 (1) 3Document24 pages'CL 2021 22 (1) 3aakash jainNo ratings yet

- PRADIPDocument7 pagesPRADIPGovindNo ratings yet

- Pol 129298Document2 pagesPol 129298summu paulNo ratings yet

- LettersDocument1 pageLettersMirza Arbaz SamastipurNo ratings yet

- Atr 14541220Document2 pagesAtr 14541220camurthykarumuriNo ratings yet

- The GSTODocument1 pageThe GSTOabhishekNo ratings yet

- Transaction Review RKPL, Draft ReportDocument13 pagesTransaction Review RKPL, Draft ReportJoni alauddinNo ratings yet

- Advanced Tax Laws Question Paper 2021-2022Document4 pagesAdvanced Tax Laws Question Paper 2021-2022sorien panditNo ratings yet

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- 2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsDocument5 pages2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsvinodNo ratings yet

- Information Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Document3 pagesInformation Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Mangesh JoshiNo ratings yet

- IT Refund Letter Manoram MahulkarDocument1 pageIT Refund Letter Manoram MahulkarMohit JainNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- Circular On Chaneg of Address in Rice CardsDocument2 pagesCircular On Chaneg of Address in Rice Cardsvali814No ratings yet

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- Atr 3472126Document1 pageAtr 3472126Vijay Kumar ThakurNo ratings yet

- Chapter 3 MCQs On Disallowance of PGBPDocument11 pagesChapter 3 MCQs On Disallowance of PGBPDevesh NagilaNo ratings yet

- ALPHA 91KP Solutions Brief Facts of The CaseDocument2 pagesALPHA 91KP Solutions Brief Facts of The CaseAdv Shyam KGNo ratings yet

- Reply-Gst G SDocument2 pagesReply-Gst G SZaheer MalikNo ratings yet

- 68 00lDocument3 pages68 00lCulture CommissionNo ratings yet

- Detailed Statement of ClarificationDocument1 pageDetailed Statement of ClarificationDivyanshu TejwaniNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Order 122Document9 pagesOrder 122Zaid NaveedNo ratings yet

- Personal ApplicationDocument2 pagesPersonal ApplicationMD YUSUFNo ratings yet

- Internal Audit ReportDocument4 pagesInternal Audit ReportJoni alauddinNo ratings yet

- 15/08/1975 Pao Hyderabad (HQR) Telangana Jyothi Chilakamarthi GA/66336 Emp Id:2573711Document3 pages15/08/1975 Pao Hyderabad (HQR) Telangana Jyothi Chilakamarthi GA/66336 Emp Id:2573711jyothiNo ratings yet

- Skyline Pipes para WiseDocument4 pagesSkyline Pipes para WiseAjay SinghNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Voltas LimitedDocument16 pagesVoltas LimitedvedaNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- GST 7th Edition With CorrectionsDocument512 pagesGST 7th Edition With CorrectionsMemeswale BhaiyaaaNo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- Security Zahir Rehman AM&RDocument1 pageSecurity Zahir Rehman AM&RNouman AkhtarNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument26 pagesRepublic of The Philippines Court of Tax Appeals Quezon Citylantern san juanNo ratings yet

- View CertificateDocument1 pageView CertificateSatyanarayana NandulaNo ratings yet

- Tri Pre Engl LHeadNotice Danieli India 280221Document4 pagesTri Pre Engl LHeadNotice Danieli India 280221Sandeep Kumar GuptaNo ratings yet

- Reverse Charge Liability Under GST Not Paid in 2018-19Document3 pagesReverse Charge Liability Under GST Not Paid in 2018-19Finance KRIPPLNo ratings yet

- Reverse Charge Liability Under GST Not Paid in 2018-19 - Taxguru - inDocument3 pagesReverse Charge Liability Under GST Not Paid in 2018-19 - Taxguru - inFinance KRIPPLNo ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- Print FileDocument6 pagesPrint FileShahid AminNo ratings yet

- United Intl Pictures AB Vs CIRDocument5 pagesUnited Intl Pictures AB Vs CIRMitch Arcones-GabineteNo ratings yet

- Ramesh GPF Old StatementDocument2 pagesRamesh GPF Old StatementSHARANUNo ratings yet

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocument10 pagesRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNo ratings yet

- Judgment: Ms. Henna George and Ms. Purti Gupta, AdvocatesDocument14 pagesJudgment: Ms. Henna George and Ms. Purti Gupta, AdvocatesvlgsaaaNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- Reply To Communication For Payment Before Issue of SCNDocument2 pagesReply To Communication For Payment Before Issue of SCNCAAniketGangwalNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- MEENA KOTECHA 271 (1) (C) LetterDocument20 pagesMEENA KOTECHA 271 (1) (C) LetterAnonymous pOGrNqNo ratings yet

- Pim Application FormatDocument6 pagesPim Application Formatseshadrimn seshadrimnNo ratings yet

- Interest Certificate - 36185174 - 1054440Document1 pageInterest Certificate - 36185174 - 1054440ganeshbanger73No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Name: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyDocument4 pagesName: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- COMPUTATIONDocument3 pagesCOMPUTATIONIshita shahNo ratings yet

- Rules For ArticleshipDocument1 pageRules For ArticleshipIshita shahNo ratings yet

- Hiten Golani-JeevanlalDocument1 pageHiten Golani-JeevanlalIshita shahNo ratings yet

- Neha Chauhan WFH Sheet For The Month of April, 2022Document4 pagesNeha Chauhan WFH Sheet For The Month of April, 2022Ishita shahNo ratings yet

- Unilink BSDocument10 pagesUnilink BSIshita shahNo ratings yet

- Name Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscDocument3 pagesName Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscIshita shahNo ratings yet

- Name: Mitali Virvani: Work From Home (WFH) SheetDocument2 pagesName: Mitali Virvani: Work From Home (WFH) SheetIshita shahNo ratings yet

- Name Meshwa Shah: For The Month of April-2022Document2 pagesName Meshwa Shah: For The Month of April-2022Ishita shahNo ratings yet

- JINAL SHAH WFH April 2022Document2 pagesJINAL SHAH WFH April 2022Ishita shahNo ratings yet

- Kushal Purohit WFH April, 2022Document2 pagesKushal Purohit WFH April, 2022Ishita shahNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishita shahNo ratings yet

- Work From Home Sheet For The Month of April 2022Document3 pagesWork From Home Sheet For The Month of April 2022Ishita shahNo ratings yet

- Name: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Document3 pagesName: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Ishita shahNo ratings yet

- (0021) Non Company Deductees BRDK01948C: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2023-24 BRDK01948CDocument1 page(0021) Non Company Deductees BRDK01948C: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2023-24 BRDK01948CIshita shahNo ratings yet

- HusenDocument1 pageHusenIshita shahNo ratings yet

- Name: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyDocument2 pagesName: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- Name Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayDocument3 pagesName Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayIshita shahNo ratings yet

- Dhruti Bhatt WFH April, 2022Document3 pagesDhruti Bhatt WFH April, 2022Ishita shahNo ratings yet

- Mohammad Faizan ShekhDocument2 pagesMohammad Faizan ShekhIshita shahNo ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Details RequiredDocument1 pageDetails RequiredIshita shahNo ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet

- Details RequiredDocument1 pageDetails RequiredIshita shahNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshita shahNo ratings yet

- Mutual Funds - IntroductionDocument9 pagesMutual Funds - IntroductionMd Zainuddin IbrahimNo ratings yet

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDocument6 pagesPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNo ratings yet

- Goa University International Economics Sem V SyllabusDocument3 pagesGoa University International Economics Sem V SyllabusMyron VazNo ratings yet

- VPS Form SampleDocument7 pagesVPS Form SampleMuhammad ShariqNo ratings yet

- W.C PPT by MeDocument70 pagesW.C PPT by Meramr9000No ratings yet

- LESSON PLAN 7 - Saving and InvestingDocument19 pagesLESSON PLAN 7 - Saving and InvestingNikita MundadaNo ratings yet

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDocument2 pagesRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNo ratings yet

- Governance, Business Ethics, Risk Management and Internal Control ReportingDocument5 pagesGovernance, Business Ethics, Risk Management and Internal Control ReportingApril Joy ObedozaNo ratings yet

- Warm Fuzz Cards CaseDocument2 pagesWarm Fuzz Cards CaseVeeranjaneyulu KacherlaNo ratings yet

- 1910dsycp 11600Document2 pages1910dsycp 11600brandiwinde41No ratings yet

- READS S Worksheet 1Document3 pagesREADS S Worksheet 1Auguste Anthony SisperezNo ratings yet

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- Ali UblDocument135 pagesAli UblMuhammad SajidNo ratings yet

- Far: Property, Plant, and Equipment: I. Definition and NatureDocument13 pagesFar: Property, Plant, and Equipment: I. Definition and NatureAl ChuaNo ratings yet

- Cement LuckyDocument13 pagesCement LuckyAnonymous BoaSnZQvpS100% (1)

- Module 5 - Interests Formula and RatesDocument14 pagesModule 5 - Interests Formula and RatesHazel NantesNo ratings yet

- Department of Commerce: Sri Dev Suman Uttarakhand University Tehri GarhwalDocument29 pagesDepartment of Commerce: Sri Dev Suman Uttarakhand University Tehri Garhwalpsychopath peopleNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Chapter 18Document27 pagesChapter 18jimmy_chou1314100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTed Mosby100% (1)

- History of Investment BankingDocument40 pagesHistory of Investment BankingMaritoGuzmanNo ratings yet

- Power of AttorneyDocument3 pagesPower of Attorneyjames brownNo ratings yet

- Malaysian Airline System Berhad Annual Report 04/05 (10601-W)Document87 pagesMalaysian Airline System Berhad Annual Report 04/05 (10601-W)Nur AfiqahNo ratings yet

- NM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERDocument9 pagesNM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERrecovaNo ratings yet

- FM AssignmentDocument9 pagesFM AssignmentNikesh Shrestha100% (1)

- Chapter 3 - Value and Logistics CostsDocument19 pagesChapter 3 - Value and Logistics CostsTran Ngoc Tram AnhNo ratings yet

- 01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Document146 pages01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Yash SharmaNo ratings yet