Professional Documents

Culture Documents

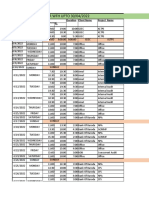

(0021) Non Company Deductees BRDK01948C: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2023-24 BRDK01948C

Uploaded by

Ishita shahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(0021) Non Company Deductees BRDK01948C: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2023-24 BRDK01948C

Uploaded by

Ishita shahCopyright:

Available Formats

T.D.S./T.C.S.

TAX CHALLAN Single(Copy to be sent the ZAO)

Tax Applicable(Tick One)* Assessment

CHALLAN NO./ TAX DEDUCTED/COLLECTED AT SOURCE FROM Year

ITNS 281 (0020) COMPANY DEDUCTEES (0021) NON COMPANY DEDUCTEES 2023-24

Tax Deduction Account No. TAN

BRDK01948C BRDK01948C

Full Name

KAMPF MACHINERY INDIA PRIVATE LIMITED

Complete Address With City and State

413,ATLANTIS HEIGHTS,GENDA CIRCLE,VADODARA,GUJARAT

Tel. No. Pin 390007

Type of Payment Code* 92B FOR USE IN RECEIVING BANK

TDS/TCS Payable by TaxPayer(200) debit to A/c /Cheque Credit on

TDS/TCS Regular Assessment(Raised by IT Deptt)(400)

DD MM YY

DETAILS OF PAYMENTS Amount(in Rs.only)

Income Tax 575170

Fee under sec. 234E 0

Surcharge 0

Education Cess 0

Interest 0

Penalty 0

Others 0

Total 575170

Total(in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

FIVE SEVENTY FIVE ONE SEVEN ZERO

Paid in Cash/Debit to Ac/Cheque No Cash Dated

Drawn on

(Name of Bank and Branch)

Date 27/05/2022 Signature of person making Payment Rs.

Taxpayers Counterfoil(To be Filed up by the tax payer ) SPACE FOR BANK SEAL

TAN BRDK01948C

Received From KAMPF MACHINERY INDIA PRIVATE LIMITED

Cash/Debit to Ac/Cheque No Cash For Rs. 575170

FIVE LAKH SEVENTY FIVE THOUSAND ONE HUNDRED

Rs in Words SEVENTY Only

Drawn on

(Name of the Bank and Branch)

Non Company Deductee

On account of Tax Deducted at Source (TDS)/ Tax Collected at source (TCS)

92B

from

for the Assessment Year 2023-24 Code KMI Rs.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Technipfmc Company Presentation: April 2020Document38 pagesTechnipfmc Company Presentation: April 2020Fedi M'hallaNo ratings yet

- Mannual Rectification ApplicationDocument2 pagesMannual Rectification ApplicationIshita shahNo ratings yet

- COMPUTATIONDocument3 pagesCOMPUTATIONIshita shahNo ratings yet

- Rules For ArticleshipDocument1 pageRules For ArticleshipIshita shahNo ratings yet

- Name Meshwa Shah: For The Month of April-2022Document2 pagesName Meshwa Shah: For The Month of April-2022Ishita shahNo ratings yet

- Unilink BSDocument10 pagesUnilink BSIshita shahNo ratings yet

- Name: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyDocument4 pagesName: NIHIR THAKKAR WFH UPTO 30/04/2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- Kushal Purohit WFH April, 2022Document2 pagesKushal Purohit WFH April, 2022Ishita shahNo ratings yet

- Work From Home Sheet For The Month of April 2022Document3 pagesWork From Home Sheet For The Month of April 2022Ishita shahNo ratings yet

- Neha Chauhan WFH Sheet For The Month of April, 2022Document4 pagesNeha Chauhan WFH Sheet For The Month of April, 2022Ishita shahNo ratings yet

- JINAL SHAH WFH April 2022Document2 pagesJINAL SHAH WFH April 2022Ishita shahNo ratings yet

- Name: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Document3 pagesName: Krishna Manishkumar Shukal: Work From Home Sheet (WFH Sheet) For The Month of April, 2022Ishita shahNo ratings yet

- Name Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscDocument3 pagesName Designation Division Date of Appointment Contact Number E-Mail ID Account Number Name of Bank Branch IfscIshita shahNo ratings yet

- Name: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyDocument2 pagesName: JANVI BRAHMBHATT WFH Upto 30-04-2022: Date DD/MM/ YyyyIshita shahNo ratings yet

- Name Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayDocument3 pagesName Dhruvi Shah WFH SHEET For The Month of April, 2022: SundayIshita shahNo ratings yet

- Mohammad Faizan ShekhDocument2 pagesMohammad Faizan ShekhIshita shahNo ratings yet

- Dhruti Bhatt WFH April, 2022Document3 pagesDhruti Bhatt WFH April, 2022Ishita shahNo ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishita shahNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshita shahNo ratings yet

- URI Protocol Scheme For MatrixDocument6 pagesURI Protocol Scheme For MatrixDhanNo ratings yet

- OHAS Midterm Quiz 1 - Attempt ReviewDocument7 pagesOHAS Midterm Quiz 1 - Attempt ReviewNot Racist By The WayNo ratings yet

- Jeetin Kumar - Swot and and Value Chain Analysis of Reliance FreshDocument21 pagesJeetin Kumar - Swot and and Value Chain Analysis of Reliance FreshJeetin KumarNo ratings yet

- Week 1 QuizDocument20 pagesWeek 1 QuizEduardo GomezNo ratings yet

- Sample Independent Contractor AgreementDocument5 pagesSample Independent Contractor AgreementRodolfo moo DzulNo ratings yet

- Internship Report TopicsDocument1 pageInternship Report TopicsMidul Khan100% (7)

- IMCDocument45 pagesIMCAsaf RajputNo ratings yet

- Chapter 4 v8.0Document102 pagesChapter 4 v8.0montaha dohanNo ratings yet

- Hyundai Led4 InstruccionesDocument5 pagesHyundai Led4 InstruccionesEncep ZaenalNo ratings yet

- New York Life Ins. Co. v. Edwards, 271 U.S. 109 (1926)Document6 pagesNew York Life Ins. Co. v. Edwards, 271 U.S. 109 (1926)Scribd Government DocsNo ratings yet

- Print Server Scalability and Sizing Technical Overview WhiteDocument14 pagesPrint Server Scalability and Sizing Technical Overview Whiteapi-3734769No ratings yet

- Prosperity Game and TreatmentDocument5 pagesProsperity Game and TreatmentБојан ЈаковљевићNo ratings yet

- 2 DX - 2 DN 1 DX - 1 DN Leaflet EN Lille 2935 0566 11Document20 pages2 DX - 2 DN 1 DX - 1 DN Leaflet EN Lille 2935 0566 11cliverNo ratings yet

- Road Construction EstimateDocument306 pagesRoad Construction EstimateRJ SisonNo ratings yet

- Research and Consideratio Ns For: Conor Timmons Juan Garelli Iris LichnovskáDocument23 pagesResearch and Consideratio Ns For: Conor Timmons Juan Garelli Iris LichnovskáAmal HameedNo ratings yet

- Scheduling BODS Jobs Sequentially and ConditionDocument10 pagesScheduling BODS Jobs Sequentially and ConditionwicvalNo ratings yet

- LM78S40 Switching Voltage Regulator Applications: National Semiconductor Application Note 711 March 2000Document17 pagesLM78S40 Switching Voltage Regulator Applications: National Semiconductor Application Note 711 March 2000Pravin MevadaNo ratings yet

- Case Study ExercisesDocument26 pagesCase Study ExercisesScribdTranslationsNo ratings yet

- Opinion of Advocate GeneralDocument13 pagesOpinion of Advocate GeneralpaulaNo ratings yet

- Chandigarh BillsDocument35 pagesChandigarh BillsDarshit VyasNo ratings yet

- Quality Control Reqmts For Using CRMBDocument6 pagesQuality Control Reqmts For Using CRMBAbhinay KumarNo ratings yet

- Job Order CostingDocument8 pagesJob Order CostingAndrea Nicole MASANGKAYNo ratings yet

- World SeriesDocument106 pagesWorld SeriesanonymousNo ratings yet

- H2H Connectivity Guide V7.3Document78 pagesH2H Connectivity Guide V7.3Roshan MadusankaNo ratings yet

- Dat 001 215 002 - enDocument2 pagesDat 001 215 002 - enNashriq ZahariNo ratings yet

- Machinery Safety OSHADocument14 pagesMachinery Safety OSHAYarenNo ratings yet

- Reverse LogisticsDocument21 pagesReverse LogisticsParth V. PurohitNo ratings yet

- The Inside Careers Guide To Patent Attorneys 201617Document79 pagesThe Inside Careers Guide To Patent Attorneys 201617thaiNo ratings yet

- Rural Marketing - Project ShaktiDocument12 pagesRural Marketing - Project ShaktiMonisha HenryNo ratings yet