Professional Documents

Culture Documents

DOA Monetized

DOA Monetized

Uploaded by

Harry MdnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DOA Monetized

DOA Monetized

Uploaded by

Harry MdnCopyright:

Available Formats

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

This Investment Agreement regarding investment and financial co-operation with the volume of

investments of $ XXXXXXX, is entered into this XXXX, 2022 by and between the below

Parties.

The transaction code is: xxx/xxxx

PARTY A / INVESTOR: xxxxxxx. (The company duly incorporated under the laws of USA,

having its registered

REPRESENTED BY: xxxxxxxxx

PASSPORT NUMBER: XXXXXX

CORP REGISTRATION xxxxxxxx

ISSUING BANK NAME Issue xxxxxx

BANK ADDRESS:

SWIFT CODE xxxxxxxx

ACCOUNT No:

BANK OFFICER: TBA

BANK OFFICER PHONE: TBA

BANK OFFICER EMAIL: TBA

and

PARTY B / ORGANISER: xxxxxxx

REPRESENTED BY: XXXXXX

PASSPORT NUMBER: XXXXXX

COMPANY NAME: XXXXXXX

RECEIVING BANK

ADDRESS TBD

SWIFT CODE: TBD

ACCOUNT NAME: TBD

ACCOUNT No (USD): TBD

BANKOFFICER: TBD

PHONE TBD

TBD

EMAIL TTTTTTTTBD

TBD

Together and individually hereinafter referred to as the "PARTIES"; the terms herein altogether

shall hereinafter be referred to as the "Agreement".

Initial PARTY A Page 1 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

THE INSTRUMENT

INSTRUMENT: First BCL , see procedure below.

Follow by BG or SBLC

AMOUNT $ xxxxxxx(US Dollar xxxxxxxx)

PROFITS TO PAY-OUT AFTER 20 BANKING DAYS max 90% OF THE FACE VALUE.

PARTY A/ INVESTOR

After sending Swift MT799 and Swift MT760 via Swift.com network.

PAY-OUT 80% COMPANY NAME XXXXXXXX

BANK COORDINATE REGISTRATION

BANK NAME XXXXXXXXX

BANK ADDRESS: XXXXXXXXX

SWIFT CODE xxxxxxxxx

ACCOUNT No: xxxxxxxxx

BANK OFFICER: XXXXXXX

BANK OFFICER PHONE XXXXXXXXX

PAY-OUT xx% PARTY A assignment account after 90% pay-out

BANK COORDINATE

WHEREAS:

Whereas the Parties hereto are desirous of entering into this Agreement for developing their

own investment projects contemplated herein for their mutual benefit only and not for other

purposes whatsoever. Whereas both Parties hereto warrant that the funds to be transacted, for

making the investments, are all good, clean and cleared funds of non- criminal origin, without

any traces of illegality or unlawfulness whatsoever.

Whereas each Party hereto declares that it is legally empowered, fully authorised to execute and

accept this agreement, as well as agrees to be bound by its terms and conditions.

1. SUBJECT OF AGREEMENT, PERFORMANCE TERMS, PROCEDURES

1.1. The subject of this Agreement is a joint investment activity of the Parties.

1.2. The Contracting "Parties", to strengthen bilateral friendly international relations, are

intended to cooperate in the following make own projects at the expense of own funds

and financial opportunities as well as attracting involving partners.

1.3. PARTY A/INVESTOR agrees to contribute material investments represented as “THE

INSTRUMENT” as described above and referenced by the above named

TRANSACTION CODE.

Initial PARTY A Page 2 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

Initial PARTY A Page 3 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

2. PROCEDURES

2.1. Party A / The Investor will provide CIS include the Passport.

2.2 The bank must issue a Bank Confirmation Letter signed by 2 bank officers indicating

that the bank is RWA to issue the SBLC/BG Other documents may be requested on an

as-need basis.

2.3 The parties will sign this Agreement

3. JOINT ACTIVITIES OF THE PARTIES AND DEFAULT

3.1. The undersigned Parties hereby with full legal and corporate responsibility, confirm that

PARTY A/INVESTOR is Ready, Willing, and Able to cause the Instrument to be issued

and that PARTY B/ORGANISER is ready to receive the Instrument and make payment as

per the agreed terms and conditions contained in this Agreement.

4. BLANK

5. CONFIDENTIAL INFORMATION AND SECURITY

5.1. The Parties understand and agree that any confidential information disclosed pursuant to

this Agreement is secret, proprietary and of great value to each Party which value may be

impaired if the secrecy of such information is not maintained.

5.2. The Parties further agree that they will take reasonable security measures to preserve and

protect the secrecy of such “confidential information” and will hold such information in

trust and not to disclose such information, either directly or indirectly to any person or

entity during the term of this Agreement or any time following the expiration or

termination of this Agreement for a period of five (5) years. The Parties may disclose the

confidential information to an assistant, agent or employee who has agreed in writing to

keep such information confidential and to whom disclosure is necessary for the providing

of services under this Agreement.

5.3. Separate introductions made through different intermediary chains may result in other

transactions between the Parties will not constitute a breach of confidential information,

provided such new chains were not created for purposes of circumvention of the first

introducing chain.

6. COMMUNICATION

6.1 Neither Party may contact the bank of the other Party without the written permission of

the Party whose bank is to be contacted. Any unauthorised contact by either Party will be

considered a breach of this Agreement and shall cause the immediate cancellation of the

Agreement and the transaction will become null and void.

6.2 Communication with banks will be limited to communication between authorised bank

officers/representatives including principals of PARTY A / INVESTOR and the principals

Initial PARTY A Page 4 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

of PARTY B/ORGANISER during commencement of this transaction. No

communication by any other party is permitted without prior written consent of the named

account holders.

6.3 Any notice to be given hereunder from either Party to the other shall be in writing and

shall be delivered by email to the email address of the respective party as provided herein.

The Parties agree that acknowledged e-mail are treated as legally binding original

documents. Email copies scanned and sent of this Agreement and exchange of

correspondence duly signed and/or executed shall be deemed to be original and shall be

binding and are regarded as original and good for any legal purpose.

6.4 A notice which is sent by email must request a read receipt and the recipient must

forward that receipt at the time the email is opened.

6.5 Until such time as requested by either Party, electronic copies of this Agreement shall be

deemed and acknowledged as original.

7. CODES OF IDENTIFICATION

The Parties agree that all documents related to the transactions bear the codes listed on the pages

of this Agreement and that the said codes remain unchangeable within this Agreement duration,

including all rollovers, extensions and additions.

8. FORCE MAJEURE

8.1. Neither Party shall be held liable for failure to perform any or all the provisions set out in

this Agreement where such failure, or delay, is caused by Force Majeure being any event,

that may occur by circumstance beyond the reasonable control of either Party, including,

without prejudice to generality of the forgoing failure or delay caused by or resulting from

Acts of God, strikes, fire, floods, wars (whether declared or undeclared, riots, destruction

of embargoes, accidents, pandemics, restrictions on quotas by any Government authority

(including allocation, requisitions, and price controls).

8.2 Each Party hereto shall be obliged to immediately inform the other Party about the

beginning, probable duration and cessation of any Force Majeure circumstances. The

disclosure of non-information relating to Force Majeure circumstances shall cancel the

right of either party hereto to make reference to it.

8.3 The fulfilment term of the contractual obligations of the Parties shall accordingly be

postponed for the period during which such Force Majeure circumstances apply.

9. VALIDITY

Once this Agreement is signed by both Parties the purposed schedule shall begin within Three

(3) banking days or sooner, excluding Saturdays and Sunday and any bank holidays.

10. FULL UNDERSTANDING

10.1. This Agreement comprises the entire Agreement between the Parties in relation to its

subject matter and no earlier agreement, understanding or representation, whether oral or

Initial PARTY A Page 5 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

in writing, in relation to any matter dealt within this Agreement will have any effect from

the date of this Agreement.

10.2. Part or all of any section of this Agreement that is illegal or unenforceable will be severed

from this Agreement and will not affect the continued operation of the remaining

provisions of this Agreement.

11. ASSIGNMENT

Neither Party to this Agreement may assign this Agreement either in part or in full to any other

party without the express written permission of the other Party under the terms of this

Agreement.

12. LAW AND ARBITRATION

All disputes arising out of or in connection with the present contract shall be finally settled under

the Rules of Arbitration of the International Chamber of Commerce by one or more arbitrators

appointed in accordance with the said Rules.

13. EDT- ELECTRONIC DOCUMENT TRANSMITTAL & COUNTERPARTS

This Agreement may be executed in multiple copies at different times and places, each being

considered an original and binding. All facsimile /electronic transmittal/communications,

including electronic signature relating to this Agreement and which are mutually accepted by the

Parties, shall be deemed legally binding and enforceable documents for the duration of the

transaction.

SIGNATURES OF THE PARTIES

Executed as an Agreement on the dates named below.

SIGNED for and on behalf of Party A/INVESTOR

xxxxxxxxx

REPRESENTED BY: xxxxxxxxx

……………………………………

Signature

On this xxxxx 2022

SIGNED for and on behalf by Party B/ORGANISER

xxxxxxxx

..........................................................

On this xxxxxx 2022 Signature

PARTY A/INVESTOR – PASSPORT COPY

Initial PARTY A Page 6 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

Initial PARTY A Page 7 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

PARTY-B/ORGANISER PASSPORT COPY

Initial PARTY A Page 8 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

EXHIBIT C BCL VERBIAGE

ADVANCE PAYMENT GUARANTEE

.

Issuing Date: /////////

.

Guarantee No.: GCXXXXXXXXXXX

.

The Guarantor: Bank xxxxxx,xxxxxxx, xxxxxxx, xxxxxxx

.

Name of Contract/Contract No.: xxxxxxxxx Project, the Contract No. xxxx

.

The Beneficiary (the ''Employer''): xxxxxxxxxxx

.

We have been informed that xxxxxxxxx (hereinafter called the ''Applicant'') is your Contractor un-

der such Contract and wishes to receive an advance payment, for which the Contract requires

him/her to obtain a guarantee.

.

At the request of the Applicant, we Bankxxxxx xxxxxx ,xxxxxxxx hereby irrevocably undertake

to pay you, the Beneficiary/Employer, any sum or sums not exceeding in total the amount of US-

Dxxxxxxxx (Say xxxxxxx Million only) (the ''Guaranteed Amount'') upon receipt by us of your de-

mand in writing and your written statement that:

a) a) the Applicant has failed to repay the advance payment in accordance with the Condi-

tions of Contract, and

b) b) the amount of the advance payment which the Applicant has failed to repay.

.

THIS LETTER OF GUARANTEE SHALL BECOME EFFECTIVE FROM THE TIME OF THE

ACTUAL RECEIPT OF THE ADVANCE PAYMENT OF US xxxxxxx BY THE Applicant

FROM YOU ON HIS ACCOUNT NO. xxxxxxxxxcHELD WITH BANK xxxxxxx, xxxxxxxxx

.

The Guaranteed Amount shall be reduced by the amounts of the advance payment repaid to you,

as evidenced by presentation to us of the copy of 1)Applicant's Progress Report(s) issued to the

Employer under the Contract showing a) the refund amount of the advance payment and b) the in-

terim payment amount to be paid by the Employer, accompanied by the copy of receipt voucher

issued by the Applicant's bank showing such interim payment made by the Employer, the Contract

number OR this guarantee number, or 2) notice of interim payment issued by the employer, and

we shall promptly notify you of the revised Guaranteed Amount accordingly.

Any demand for payment must contain your signature(s) which must be authenticated by your bankers by

authenticated SWIFT or by a notary public.

.

The authenticated demand and statement must be received by us at the following xxxxxx on or

before the closing business hours of xxxxxx or the date of presentation of Taking-Over-Certific-

ate under the Contract or the date of the total value of the Security reduced to zero, whichever is

earliest (the ''Expiry Date''), when this guarantee shall expire.

.

The party liable for the payment of any charges: xxxxxxxxxxx

Initial PARTY A Page 9 of 10 Initial PARTY B

Investment Agreement

xxxx/xxxxc/xxxM/xxxxx

.

This guarantee shall be governed by the laws of xxxxxxx and shall be subject to the Uniform Rules for

Demand Guarantees (URDG) 2010 Revision, ICC Publication No. 758.

Initial PARTY A Page 10 of 10 Initial PARTY B

You might also like

- Swift MessageDocument2 pagesSwift Messageheinrich.ehrhardt69100% (1)

- Partnership Agreement Draft IpipDocument17 pagesPartnership Agreement Draft Ipipsaber rahbar sadatNo ratings yet

- Issue LC mt700 20221203090439Document5 pagesIssue LC mt700 20221203090439Centro turistico Los rosalesNo ratings yet

- Fishpond Lease Contract 11.05.2020Document4 pagesFishpond Lease Contract 11.05.2020Aaron ValdezNo ratings yet

- Agreement IBBA-HCIM - V20211026 SignedDocument16 pagesAgreement IBBA-HCIM - V20211026 SignedНизами КеримовNo ratings yet

- Ciemsa Cta BCV 2B 221205Document12 pagesCiemsa Cta BCV 2B 221205Alberto Sarabia100% (1)

- Snyder Contracts Fall 2009Document58 pagesSnyder Contracts Fall 2009fvillarroel6No ratings yet

- ESCROW SWAP SPA - USDT 22k BTC - SH 1019Document15 pagesESCROW SWAP SPA - USDT 22k BTC - SH 1019Firas KhalafNo ratings yet

- Final ArgumentDocument7 pagesFinal ArgumentFaris YoungNo ratings yet

- Swift MT734Document1 pageSwift MT734Muhammad Ashifur RahmanNo ratings yet

- DTC Master Agreement Blank - MDocument14 pagesDTC Master Agreement Blank - MДенис Копотиенко100% (1)

- 103FTP2022-01027 4Document10 pages103FTP2022-01027 4Desart Bano100% (1)

- Retail Crypto Purchase AgreementDocument3 pagesRetail Crypto Purchase AgreementalexmillerNo ratings yet

- 35 T PGLDocument14 pages35 T PGLemmanuelnwankwoNo ratings yet

- Education Loan Proposal FormDocument4 pagesEducation Loan Proposal FormRoshan SinghNo ratings yet

- International Chamber of CommerceDocument15 pagesInternational Chamber of Commerce2km presentNo ratings yet

- Provider DLC - 199 - 700 and Fiduciary 199 Reply VerbiageDocument6 pagesProvider DLC - 199 - 700 and Fiduciary 199 Reply VerbiageAmit DasNo ratings yet

- Swift MT799Document1 pageSwift MT799Muhammad Ashifur RahmanNo ratings yet

- MT799 Cash Transfer Notice MT799Document2 pagesMT799 Cash Transfer Notice MT799hford5734_638722150No ratings yet

- MT 17112913 21486Document1 pageMT 17112913 21486Juan David Moncada GarciaNo ratings yet

- Normal 5d5ef095313ffDocument24 pagesNormal 5d5ef095313ffZafer Galip özberkNo ratings yet

- KK - Displaying The Vendor Transaction Figures in Transaction FK10NDocument4 pagesKK - Displaying The Vendor Transaction Figures in Transaction FK10NSmith F. JohnNo ratings yet

- Offline Transaction 2023Document5 pagesOffline Transaction 2023ChristianMNo ratings yet

- Se 19040047928444Document3 pagesSe 19040047928444yuanda syahfitraNo ratings yet

- Special NotesDocument1 pageSpecial NotesНизами КеримовNo ratings yet

- No. 58482) in The Mukim of Batu, District Kuala Lumpur and State of WilayahDocument4 pagesNo. 58482) in The Mukim of Batu, District Kuala Lumpur and State of WilayahNazirah ZainudinNo ratings yet

- Surat Perjanjian Kerjasama Investasi GBK Yudistira-Signed 1xDocument9 pagesSurat Perjanjian Kerjasama Investasi GBK Yudistira-Signed 1xbram pratamaNo ratings yet

- International Bank Draft ProceduresDocument1 pageInternational Bank Draft ProceduresBank GuaranteeNo ratings yet

- Business Insight of SeagenDocument6 pagesBusiness Insight of SeagenDr. Mohd AriffuddinNo ratings yet

- Doa TradeDocument17 pagesDoa TradeEduardo WitonoNo ratings yet

- Projekt Provider S Initial - Inverstor S InitialDocument5 pagesProjekt Provider S Initial - Inverstor S Initialmohammad chandra ferdiansyahNo ratings yet

- Irrevocable Documentary Credit - Appl (EN) v1.1Document2 pagesIrrevocable Documentary Credit - Appl (EN) v1.1Firaol BelayNo ratings yet

- PunjabPolice DS PDFDocument1 pagePunjabPolice DS PDFHamza SheikhNo ratings yet

- MT760 Blocked Funds Confirmation Draft WordingDocument1 pageMT760 Blocked Funds Confirmation Draft WordingWasis WidjajadiNo ratings yet

- MT799 Blocked Funds VerbiageDocument2 pagesMT799 Blocked Funds VerbiageFonan KONENo ratings yet

- SBLC Locating Procedure Full Detail-1Document1 pageSBLC Locating Procedure Full Detail-1Dzenan MufticNo ratings yet

- Format Description Mt103 RCM v1 0 RCCDocument10 pagesFormat Description Mt103 RCM v1 0 RCCharirk1986No ratings yet

- Green Derivatives Trading Desk Limited Certificate Philip GreenDocument1 pageGreen Derivatives Trading Desk Limited Certificate Philip GreenPhilip GreenNo ratings yet

- MT 103Document9 pagesMT 103HukleberipenNo ratings yet

- Final Example-Long MessageDocument2 pagesFinal Example-Long MessageJanette LabbaoNo ratings yet

- Get Ready For: Universal Payment ConfirmationsDocument4 pagesGet Ready For: Universal Payment Confirmationsswift adminNo ratings yet

- Swift Standards Category 1 VersionDocument440 pagesSwift Standards Category 1 VersionMephistopheles1No ratings yet

- Relay 760 Fortress IssuedDocument2 pagesRelay 760 Fortress Issuedcodeblack100% (3)

- Abdulaziz Yousef Al-Rashed Client Information Sheet HSBC CIS 10272022Document4 pagesAbdulaziz Yousef Al-Rashed Client Information Sheet HSBC CIS 10272022rasool mehrjooNo ratings yet

- USD Agency L2L Transaction Procedures 20-15Document3 pagesUSD Agency L2L Transaction Procedures 20-15alehillarNo ratings yet

- XXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX: 77C:NarrativeDocument1 pageXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX: 77C:NarrativeUlrich Maria Baltzer0% (1)

- 1 PDFDocument3 pages1 PDFSugiThanikaNo ratings yet

- DeedDocument8 pagesDeedabmmasukNo ratings yet

- Text of The Bank Guarantee: AnnexureDocument1 pageText of The Bank Guarantee: AnnexurekarthicfinconNo ratings yet

- KRA Tax Compliance CertificateDocument1 pageKRA Tax Compliance Certificateyasmin contractingcoltdNo ratings yet

- Nostro Account Details Wire TransferDocument1 pageNostro Account Details Wire TransferRAHUL SINHANo ratings yet

- MT103 375 Rev-11092018 FinalDocument18 pagesMT103 375 Rev-11092018 FinalHakan ErgünNo ratings yet

- LC Issue (Swift) 3Document4 pagesLC Issue (Swift) 3gohoji4169No ratings yet

- 760 Drafts 200 UbsDocument2 pages760 Drafts 200 UbsAlberto SarabiaNo ratings yet

- Euroclear - Legalization - 2023-Olena SafonovaDocument8 pagesEuroclear - Legalization - 2023-Olena Safonovadanil.zarubin.192No ratings yet

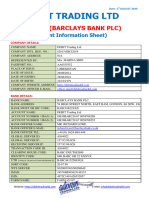

- 0090 Cis Debit Trading LTD Marina Shin Ipip Ipid s2s 2020 8288 8255 Barclays 1Document4 pages0090 Cis Debit Trading LTD Marina Shin Ipip Ipid s2s 2020 8288 8255 Barclays 1rasool mehrjooNo ratings yet

- Payment in Voice Met LifeDocument1 pagePayment in Voice Met LifeSonam ShahNo ratings yet

- LC ApplicationDocument2 pagesLC ApplicationShruti BudhirajaNo ratings yet

- Block Fund ProcedureDocument2 pagesBlock Fund ProcedureSARAH VICTORIENNo ratings yet

- Partnership - Agreement - On - In. 1 2 (Sepa)Document16 pagesPartnership - Agreement - On - In. 1 2 (Sepa)Hamad Falah100% (1)

- MT 199 Maribel Gonzalez 27 06 22Document2 pagesMT 199 Maribel Gonzalez 27 06 22ULRICH VOLLERNo ratings yet

- CLAUSULADocument19 pagesCLAUSULARicardo LeblondNo ratings yet

- Al Amal Ravi KumarDocument10 pagesAl Amal Ravi KumarJaswani SAPNo ratings yet

- OT CobobliDocument77 pagesOT CobobliJohn Jet TanNo ratings yet

- Equity Trusts I Revision NotesDocument27 pagesEquity Trusts I Revision NotesS MathangkiNo ratings yet

- Benuetzungsvertrag - EN - SHEHU Erion Ab 01.06. Bis 31.08.2023 - Signed PDFDocument4 pagesBenuetzungsvertrag - EN - SHEHU Erion Ab 01.06. Bis 31.08.2023 - Signed PDFMsc. Erion ShehuNo ratings yet

- 6 Step Advice Process: Best Practice Advice ChecklistDocument2 pages6 Step Advice Process: Best Practice Advice Checklistdenny suci kurniaNo ratings yet

- 21 Gaite v. FonacierDocument2 pages21 Gaite v. FonacierLuis MacababbadNo ratings yet

- AOF78275Document240 pagesAOF78275GogyNo ratings yet

- Draft Agreement On Supply and Installation of Solar Materials For Office and Twin FlatsDocument6 pagesDraft Agreement On Supply and Installation of Solar Materials For Office and Twin FlatsBuluz TawalNo ratings yet

- Salvage & Towage-1Document21 pagesSalvage & Towage-1GunasundaryChandramohanNo ratings yet

- Osmena de Valencia Vs Rodriguez PDFDocument4 pagesOsmena de Valencia Vs Rodriguez PDFShiara SalazarNo ratings yet

- Tabacalera Insurance Co., vs. North Front Shipping Services, IncDocument2 pagesTabacalera Insurance Co., vs. North Front Shipping Services, IncNash LedesmaNo ratings yet

- CFAs Code of Ethics and Standards of Professional ConductDocument2 pagesCFAs Code of Ethics and Standards of Professional ConductHeidi DaoNo ratings yet

- Law of ContractDocument4 pagesLaw of ContractChristina ChristianNo ratings yet

- OJT FormsDocument9 pagesOJT FormsJohn ValenciaNo ratings yet

- Allianz POL PrivateCar MalaysiaDocument24 pagesAllianz POL PrivateCar Malaysiachertt77No ratings yet

- 1-Draft EIA 2020 PDFDocument1 page1-Draft EIA 2020 PDFSuraj HakkeNo ratings yet

- Contemporary Issues in Alternative Dispute ResolutionDocument6 pagesContemporary Issues in Alternative Dispute ResolutionINSTITUTE OF LEGAL EDUCATIONNo ratings yet

- Detroit Lakes - MnDOT State Airport Fund Grant AgreementDocument6 pagesDetroit Lakes - MnDOT State Airport Fund Grant AgreementMichael AchterlingNo ratings yet

- BL2 SeatworkDocument2 pagesBL2 SeatworkJanna Mari FriasNo ratings yet

- Conflict of Laws Syllabus: Prepared For The Exclusive Use of USPF School of LawDocument6 pagesConflict of Laws Syllabus: Prepared For The Exclusive Use of USPF School of LawRalph RCNo ratings yet

- Cat 214-09Document3 pagesCat 214-09mokamokamokaNo ratings yet

- 211859-2018-United Coconut Planters Bank v. Spouses Uy20210424-12-Kn4gqfDocument11 pages211859-2018-United Coconut Planters Bank v. Spouses Uy20210424-12-Kn4gqfAnonymous RabbitNo ratings yet

- PDF Aqa Gcse Physics Student Book Jim Breithaupt Ebook Full ChapterDocument46 pagesPDF Aqa Gcse Physics Student Book Jim Breithaupt Ebook Full Chaptertimothy.anderson235100% (3)

- Construction Arbitration: Industry Insights Issue 1Document29 pagesConstruction Arbitration: Industry Insights Issue 1Emi EmikoNo ratings yet

- Purpose of This Agreement Is For Atty. Kirstie Dawn F. Barrion To Provide ClientDocument8 pagesPurpose of This Agreement Is For Atty. Kirstie Dawn F. Barrion To Provide ClientJenny ButacanNo ratings yet

- Chapter Vi - Ra 6713Document5 pagesChapter Vi - Ra 6713Gabriel Sta MariaNo ratings yet

- Property Tax in Himachal PradeshDocument3 pagesProperty Tax in Himachal PradeshShimon OberoiNo ratings yet

- Standard Contract of English 3Document7 pagesStandard Contract of English 3Sang KatakNo ratings yet