Professional Documents

Culture Documents

Acc 101 Project 1 Sample Format

Uploaded by

Ma'am Kathy LabaoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 101 Project 1 Sample Format

Uploaded by

Ma'am Kathy LabaoCopyright:

Available Formats

This is a sample file of how to format the journal entries,

general ledger accounts, worksheet, and the financial

statements. The numbers in these schedules do not tie

together and not meant to tie together. It is just to show the

proper formatting and what your project should look like

when you turn it in for grading.

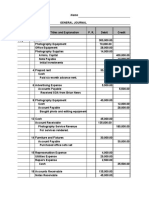

Journal Entries Page 1

Post

Date Account Ref Debit Credit

1-Jun Laptop 130 1,000.00

Cash 101 1,000.00

Purchased Laptop with cash

2-Jun Cash 101 1,500.00

Sales 401 1,500.00

Cash sales

3-Jun Photography Equipment 140 600.00

Accounts Payable 201 600.00

purchase equipment on account

4-Jun Travel Expense 540 275.00

Cash 101 275.00

paid for travel expenses

5-Jun Accounts Receivable 110 500.00

Sales 401 500.00

billed customers on account

Adjusting Journal Entries Page 2

Post

Date Account Ref Debit Credit

30-Jun Depreciation Ex- Photo Equipment 570 1,500.00

Accumulated Depr Photo Equipment 141 1,500.00

Record montly depreciation

30-Jun Supplies Expense 510 3,000.00

Supplies 120 3,000.00

Adjust Supplies to correct ending balance

Closing Journal Entries Page 3

Post

Date Account Ref Debit 8,200.00

30-Jun Sales 401 35,000.00

Income Summary 901 35,000.00

Close Sales Account

30-Jun Income Summary 901 19,300.00

Supplies Expense 510 3,000.00

Advertising Expense 520 4,000.00

Insurance Expense 530 100.00

Travel Expense 540 100.00

Cell Phone Expense 550 600.00

Equipment Repairs Expense 560 10,000.00

Depreciation Expense - Equip. 570 1,500.00

Close Expense Accounts

30-Jun Income Summary 901 15,700.00

Molly - Capital 302 15,700.00

Close Income Summary to Molly Capital

30-Jun Molly - Capital 301 10,000.00

Molly - Drawing 302 10,000.00

Closing Drawing account

-

Happy Smiles

General Ledger

ASSETS

Cash Acct # 101

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance JE P 1 5,500.00

2-Jun Purchased Laptop with cash JE P 1 1,000.00 4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

4,500.00

Accounts Receivable Acct # 110

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance JE P 1 750.00

2-Jun Billed customers on account JE P 1 500.00 1,250.00

1,250.00

1,250.00

Supplies Acct # 120

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance 100.00

30-Jun Adjust Supplies to correct ending balance

AJE P2 50.00 50.00

Laptop Acct # 130

Date Description Post Ref Debit Credit Balance

1-Jun Purchased Laptop with cash JE P1 1,000.00 1,000.00

Photography Equipment Acct # 140

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance 2,000.00

2,000.00

Accumulated Depreciation - Photography Equipment Acct # 141

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance 100.00

30-Jun Record montly depreciation AJE P2 100.00 200.00

100

LIABILITIES

3000

Accounts Payable Acct# 201

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance 1,000.00

3-Jun purchase equipment on account JE P 1 600.00 1,600.00

1,600.00

EQUITY

Molly - Capital Acct# 301

Date Description Post Ref Debit Credit Balance

1-Jun Beginning Balance 7,250.00

30-Jun Close Income Summary to Molly Capital

CJE P 3 15,700.00 22,950.00

30-Jun Close Drawing account CJE P 3 10,000.00 12,950.00

Molly - Drawing Acct# 302

Date Description Debit Credit Balance

1-Jun Beginning Balance 15,000.00

30-Jun Close Drawing account 1000 10,000.00 5,000.00

3000

REVENUE

SALES Acct# 401

Date Description 0 Debit Credit Balance

1-Jun Sales on account JE P 1 1,500.00 1,500.00

3-Jun Cash Sales JE P 1 500.00 2,000.00

2,000.00

2,000.00

EXPENSES

Supplies Expense Acct# 510

Date Description Post Ref Debit Credit Balance

30-Jun Adjust Supplies to correct ending balance

AJE P2 3,000.00 3,000.00

30-Jun Close Expense Accounts CJE P 3 3,000.00 -

Advertising Expense Acct# 520

Date Description Post Ref Debit Credit Balance

Insurance Expense Acct# 530

Date Description Post Ref Debit Credit Balance

Income Summary Acct# 901

Date Description Post Ref Debit Credit Balance

30-Jun Close Sales Account CJE P 3 35,000.00 35,000.00

30-Jun Close Expense Accounts CJE P 3 19,300.00 15,700.00

30-Jun Close Income Summary CJE P 3 15,700.00 -

HAPPY SMILES WORKSHEET FOR JUNE 20XX

Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Acct# Account Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

101 Cash 6,000.00 6,000.00 6,000.00

110 Accounts Receivable 3,000.00 3,000.00 3,000.00

120 Supplies 10,000.00 3,000.00 7,000.00 7,000.00

130 Laptop 1,000.00 1,000.00 1,000.00

140 Photography Equipment 2,000.00 2,000.00 2,000.00

141 Accumulated Depr. Photo-Equip 100.00 1,500.00 1,600.00 1,600.00

201 Accounts Payable 1,600.00 1,600.00 1,600.00

301 Molly - Capital 12,000.00 12,000.00 12,000.00

302 Molly - Drawing 14,000.00 14,000.00 14,000.00

401 Sales 26,000.00 26,000.00 26,000.00

510 Supplies Expense 1,000.00 3,000.00 4,000.00 4,000.00

520 Advertising Expense 1,100.00 1,100.00 1,100.00

530 Insurance Expense 400.00 400.00 400.00

540 Travel Expense 500.00 500.00 500.00

550 Cell Phone Expense 600.00 600.00 600.00

560 Equipment Repairs Expense 100.00 100.00 100.00

570 Depreciation Expense - Equip. 1,500.00 1,500.00 1,500.00

Totals 39,700.00 39,700.00 4,500.00 4,500.00 41,200.00 41,200.00 8,200.00 26,000.00 33,000.00 15,200.00

Net Income 17,800.00 17,800.00

Totals 26,000.00 26,000.00 33,000.00 33,000.00

Note for the heading of all financial statements, it follows a pattern:

LINE 1 Is the name of the company

LINE 2 Is the name of the statement

LINE 3 is for the period (Income statement and Statement of Owner's equity) or the Date

(Balance Sheet and Trial Balance)

Second, their are not debit and credit columns except in a trial balance.

The column on the left is for detail calculations, the column on the right is for summary

information.

Third, look at the use of the dollar sign and the underlines.

Happy Smiles

Income Statement

For the Month Ended June 30, 20XX

Revenues

Sales $ 5,000.00

Expenses

Supplies Expense $ 100.00

Advertising Expense 200.00

Insurance Expense 200.00

Travel Expense 200.00

Cell Phone Expense 200.00

Equipment Repairs Expense 200.00

Depreciation Expense - Equip. 200.00

Total Expenses 1,300.00

Net Income $ 3,700.00

Happy Smiles

Statement of Owner's Equity

For the Month Ended June 30, 20XX

Molly - Capital May 31, 20XX $ 8,000.00

Add Net Income $ 3,700.00

Less Molly - Drawig 300.00

Net Increase 3,400.00

Molly Capital June 30, 20XX $ 11,400.00

Happy Smiles

Balance Sheet

June 30, 20XX

ASSETS

Cash $ 15,000.00

Accounts Receivable 2,000.00

Supplies 100.00

Laptop 1,000.00

Photography Equipment $ 3,000.00

Accumulated Depr. Photo-Equip 1,500.00 1,500.00

Total Assets $ 19,600.00

LIABILITIES

Accounts Payable $ 8,200.00

OWNER'S EQUITY

Molly - Capital 11,400.00

Total Liabilities and Equity $ 19,600.00

Happy Smiles

Post Closing Trial Balance

June 30, 20XX

Acct # Account Debit Credit

101 Cash $ 15,000.00

110 Accounts Receivable 2,000.00

120 Supplies 100.00

130 Laptop 1,000.00

140 Photography Equipment 3,000.00

141 Accumulated Depr. Photo-Equip $ 1,500.00

201 Accounts Payable 8,200.00

301 Molly - Capital 11,400.00

302 Molly - Drawing

401 Sales

510 Supplies Expense

520 Advertising Expense

530 Insurance Expense

540 Travel Expense

550 Cell Phone Expense

560 Equipment Repairs Expense

570 Depreciation Expense - Equip.

Totals $ 21,100.00 $ 21,100.00

You might also like

- Jurisdiction of Civil CourtsDocument12 pagesJurisdiction of Civil CourtsSkk IrisNo ratings yet

- The Role of Accounting in BusinessDocument18 pagesThe Role of Accounting in BusinessJawad AzizNo ratings yet

- Fabm 2 Practice SetDocument33 pagesFabm 2 Practice SetJen Trixie Gallardo57% (7)

- Acc 101 Project 1 Template and Start File - Marso, Christine JoyDocument21 pagesAcc 101 Project 1 Template and Start File - Marso, Christine JoyChristine Joy Rapi Marso0% (1)

- ACTG123 (DR Nickmarasigan)Document24 pagesACTG123 (DR Nickmarasigan)Regine BungcalonNo ratings yet

- Javier v. Reyes, G.R No. L-39451, February 20, 1989Document2 pagesJavier v. Reyes, G.R No. L-39451, February 20, 1989Carie LawyerrNo ratings yet

- Rosales vs. RosalesDocument2 pagesRosales vs. RosalesEunice Valeriano Guadalope100% (1)

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerNo ratings yet

- Poe Llamanzares Vs Comelec Case DigestDocument4 pagesPoe Llamanzares Vs Comelec Case DigestCess Lamsin100% (3)

- Fabm 2 Practice SetDocument31 pagesFabm 2 Practice SetDanise PorrasNo ratings yet

- Article by Niall Meehan: Distorting Irish History Two, The Road From Dunmanway.Document23 pagesArticle by Niall Meehan: Distorting Irish History Two, The Road From Dunmanway.lucy_brown_15No ratings yet

- NameDocument17 pagesNameMARY GRACE VARGAS100% (1)

- Marasigan TransactionDocument20 pagesMarasigan TransactionE.D.J100% (2)

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocument9 pagesProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- MODULE-5 Ac 5 inDocument14 pagesMODULE-5 Ac 5 inBlesh Macusi75% (4)

- Heidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were CompletedDocument6 pagesHeidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were Completedlaale dijaan100% (1)

- Acco1050 1.2Document6 pagesAcco1050 1.2KMDOSNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Hosting Script First BirthdayDocument1 pageHosting Script First BirthdayMaria Carla Aganan88% (8)

- Accounting CycleDocument18 pagesAccounting CycleIris Joy JobliNo ratings yet

- WTB IT ToolsDocument12 pagesWTB IT ToolsJustine FloresNo ratings yet

- Faith 113016Document21 pagesFaith 113016Clay MaaliwNo ratings yet

- Accounting Practice Set Forms ANIMEDocument20 pagesAccounting Practice Set Forms ANIMETrishia Camille SatuitoNo ratings yet

- Assignment - 1 (Revised)Document8 pagesAssignment - 1 (Revised)RaffyNo ratings yet

- Barbeyto DistributorsDocument17 pagesBarbeyto DistributorsMark Lyndon YmataNo ratings yet

- Rose Trial BalanceDocument29 pagesRose Trial BalanceWenna BaeNo ratings yet

- Acc 201 - Final Project Workbook-DeSKTOP-5TE6TIFDocument34 pagesAcc 201 - Final Project Workbook-DeSKTOP-5TE6TIFTera McKnight95% (19)

- Periodic Method-Joseph MerchandiseDocument8 pagesPeriodic Method-Joseph MerchandiseRACHEL DAMALERIONo ratings yet

- Assignment EditDocument10 pagesAssignment EditMasresha TasewNo ratings yet

- BookkeepingDocument14 pagesBookkeepingCristel TannaganNo ratings yet

- BINI General Merchandise Answer Key 2Document19 pagesBINI General Merchandise Answer Key 2workwithericajaneNo ratings yet

- Pivot The GreatDocument16 pagesPivot The GreatAngeline AcebucheNo ratings yet

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Dates Transactions Balance Sheet, July 2014. AssetsDocument12 pagesDates Transactions Balance Sheet, July 2014. AssetsMille DcnyNo ratings yet

- Bini General Merchandise 1st PageDocument1 pageBini General Merchandise 1st PageworkwithericajaneNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS7 DRAFTDocument15 pagesFundamentals of ABM1 - Q4 - LAS7 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- Tugas III Irensyah PayungbuaDocument4 pagesTugas III Irensyah PayungbuaWilliam MangumbanNo ratings yet

- Jurnal 1Document8 pagesJurnal 1William MangumbanNo ratings yet

- Basic Accounting Semestral Exam 2022Document6 pagesBasic Accounting Semestral Exam 2022Angie M. DelgadoNo ratings yet

- P2 Page 118 Budget Driving JeDocument17 pagesP2 Page 118 Budget Driving JeSophia VistanNo ratings yet

- Milestone 1Document22 pagesMilestone 1Luis MelendezSilvaNo ratings yet

- Simulation 9 - Nikita SaxenaDocument9 pagesSimulation 9 - Nikita Saxenaapi-663766273No ratings yet

- Buenaventura Problems1 4 Pages 410 413Document9 pagesBuenaventura Problems1 4 Pages 410 413AnonnNo ratings yet

- Chapter 5Document11 pagesChapter 5Your NameNo ratings yet

- Anala Rahsya Shafar - Morgan Company - 1EB09Document6 pagesAnala Rahsya Shafar - Morgan Company - 1EB09rully.movizarNo ratings yet

- Answer 2Document29 pagesAnswer 2Meshack MateNo ratings yet

- Accounting Cycle Prob 14Document24 pagesAccounting Cycle Prob 14Mc Clent CervantesNo ratings yet

- Lor, Lady Lyn B. - INDIVIDUAL ACTIVITY NO. 3 - PETTY CASHDocument2 pagesLor, Lady Lyn B. - INDIVIDUAL ACTIVITY NO. 3 - PETTY CASHLady Lyn LorNo ratings yet

- Accounting Clerk Exam - Answer KeyDocument5 pagesAccounting Clerk Exam - Answer KeyErwin Dave M. DahaoNo ratings yet

- PeriodicDocument19 pagesPeriodicAlyssa Mae MarceloNo ratings yet

- Worksheet To FSDocument29 pagesWorksheet To FSChelsea TengcoNo ratings yet

- Books of Accounts TemplatesDocument18 pagesBooks of Accounts TemplatesMc Clent CervantesNo ratings yet

- Activity No. 1 - Cash & Cash Equivalents (Salvador)Document9 pagesActivity No. 1 - Cash & Cash Equivalents (Salvador)Princess Aleia SalvadorNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Trust Accounts - Example Q and ADocument7 pagesTrust Accounts - Example Q and AChamela MahiepalaNo ratings yet

- Problem No.1 - Ch6 Cost Flow AssumptionDocument3 pagesProblem No.1 - Ch6 Cost Flow AssumptionFoong Chan PingNo ratings yet

- General Ledger LK11jam13.15Document12 pagesGeneral Ledger LK11jam13.15Ferris126GTNo ratings yet

- Week2 Acitivty Financial REportsDocument4 pagesWeek2 Acitivty Financial REportsAngelie PajaresNo ratings yet

- MANUEL KATHLLEN TABASA (UP FC1 BSA1 10) ACC102 WorksheetDocument17 pagesMANUEL KATHLLEN TABASA (UP FC1 BSA1 10) ACC102 WorksheetKathleen Tabasa ManuelNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Written Work 1Document35 pagesWritten Work 1ABM ST.MATTHEW Misa john carlo100% (1)

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Book I PDFDocument293 pagesBook I PDFUday DokrasNo ratings yet

- Class Program For Blended LearningDocument2 pagesClass Program For Blended LearningTin TinNo ratings yet

- Good and Evil Dichotomy EssayDocument5 pagesGood and Evil Dichotomy EssayBenjamin BurtonNo ratings yet

- The Dutch Oven 2Q13Document25 pagesThe Dutch Oven 2Q13lsdostrusteeNo ratings yet

- Raad M. Hassan 305347Document4 pagesRaad M. Hassan 305347Texas WatchdogNo ratings yet

- BAJAJ HEALTHCARE LTD. - PurveeshaDocument44 pagesBAJAJ HEALTHCARE LTD. - PurveeshaShree KhandelwalNo ratings yet

- Racism in Health-Care System Pushed Into Spotlight Once More - Winnipeg Free PressDocument4 pagesRacism in Health-Care System Pushed Into Spotlight Once More - Winnipeg Free Presslmaohearts100% (1)

- Kahromika Appln CompltdDocument2 pagesKahromika Appln CompltdAsaf Khader AliNo ratings yet

- Brittania & Innovation-Apoorva R OulkarDocument5 pagesBrittania & Innovation-Apoorva R OulkarAR OulkarNo ratings yet

- Pakistan Studies - Affairs - Most Important MCQs (Set III) For CSS, PMS, PCS, NTSDocument9 pagesPakistan Studies - Affairs - Most Important MCQs (Set III) For CSS, PMS, PCS, NTSJatoi AkhtarNo ratings yet

- Definisi Sukses : Sukses Sangat Berkaitan Erat DenganDocument40 pagesDefinisi Sukses : Sukses Sangat Berkaitan Erat DenganphyoulifyNo ratings yet

- Nicholson v. Shreve ORDERDocument2 pagesNicholson v. Shreve ORDERNetNewsLedger.comNo ratings yet

- Food - Oil EIA, KebedeDocument74 pagesFood - Oil EIA, Kebedesileshi AngerasaNo ratings yet

- Why Do Youth Join Gangs?Document9 pagesWhy Do Youth Join Gangs?Alexandra KeresztesNo ratings yet

- Fuzzy Sketch Business PlanDocument10 pagesFuzzy Sketch Business Planjohysonta5109No ratings yet

- Artificial Intelligence Human Flourishing and The Rule of LawDocument6 pagesArtificial Intelligence Human Flourishing and The Rule of LawAinaa KhaleesyaNo ratings yet

- Angels Hadith - Full PaperDocument25 pagesAngels Hadith - Full PaperSouad El MouqtassirNo ratings yet

- Sandia Remote Sensing E-MagazineDocument7 pagesSandia Remote Sensing E-Magazinesandia_docsNo ratings yet

- Tod South Delhi PDFDocument50 pagesTod South Delhi PDFNovianiNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Official #PapalVisitPH 2015 Liturgical BookletDocument132 pagesOfficial #PapalVisitPH 2015 Liturgical BookletTonyo Cruz100% (2)

- Bristol, Virginia ResolutionDocument2 pagesBristol, Virginia ResolutionNews 5 WCYBNo ratings yet

- Practice Problems For UnemploymentDocument2 pagesPractice Problems For UnemploymentSteveNo ratings yet