Professional Documents

Culture Documents

John LTD CH

Uploaded by

Sagitarius SagitariaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

John LTD CH

Uploaded by

Sagitarius SagitariaCopyright:

Available Formats

A. 1.

Acquisition analysis

Net fair value of identifiable assets

Share capital 80000

Reserve 30000

RE 40000

(less) Goodwill 0

Total $150,000.00

Net consideration transferrd

Consideration 153000

(Less) Dividend 0

Net consideration transferred

153000

Goodwill $ 3,000.00

(Less) Record 0

Unrecorded G$ 3,000.00

Consolidation Worksheet Entries on 1 January 2019

1 July 2019 Goodwill 3000

Business Combination Val 3000

1 July 2019 Share capital 80000

Reserve 30000

RE 40000

BCVR 3000

Share in Robert Ltd 153000

1 July 2020 Goodwill 3000

Business Combination Val 3000

1 July 2020 Share capital 80000

Reserve 30000

RE 40000

BCVR 3000

Share in Robert Ltd 153000

B. 1. Acquisition analysis

Net fair value of identifiable assets

Share capital 80000

Reserve 30000

RE 40000

(less) Goodwill 0

Total $150,000.00

Net consideration transferrd

Consideration 148000

(Less) Dividend 0

Net consideration transferred

148000

Goodwill $ (2,000.00)

(Less) Record 0

Unrecorded G $ (2,000.00)

Gain on bargain purchase

$ 2,000.00

Worksheet entries at 1 July 2019

1 July 2019 Share capital 80000

Reserve 30000

RE 40000

Gain on bargain purchase 2000

Share in Robert Ltd 148000

Worksheet entries at 1 July 2020

1 July 2020 Share capital 80000

Reserve 30000

RE (40000-200 38000

Share in Robert Ltd 148000

RE balance - Gain on bargain purchae

C. 1. Acquisition analysis

Net fair value of identifiable assets

Share capital 80000

Reserve 30000

RE 40000

(less) Goodwill -4000

Total $146,000.00

Net consideration transferrd

Consideration 145000

(Less) Dividend 0

Net consideration transferred

145000

Goodwill $ (1,000.00)

(Less) Record 0

Unrecorded G $ (1,000.00)

Gain on bargain purchase

$ 1,000.00

You might also like

- 02 Introduction To Statistics JDocument12 pages02 Introduction To Statistics JSagitarius SagitariaNo ratings yet

- Sampling Distribution 3Document3 pagesSampling Distribution 3Sagitarius SagitariaNo ratings yet

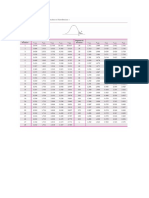

- T Distribution TableDocument1 pageT Distribution TableSagitarius SagitariaNo ratings yet

- Sustainability 12 06136Document13 pagesSustainability 12 06136Sagitarius SagitariaNo ratings yet

- How To Submit An Electronic AssignmentDocument4 pagesHow To Submit An Electronic AssignmentSagitarius SagitariaNo ratings yet

- Noun-Noun Phrase-Noun ClauseDocument14 pagesNoun-Noun Phrase-Noun ClauseSagitarius SagitariaNo ratings yet

- IA Ch. 9 - JohannaDocument35 pagesIA Ch. 9 - JohannaSagitarius SagitariaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IBE Chapter 5Document19 pagesIBE Chapter 5veenaNo ratings yet

- FRANSABANKDocument7 pagesFRANSABANKJn90No ratings yet

- Paper7 by KKDocument6 pagesPaper7 by KKKKNo ratings yet

- Robotic Process Automation Mini ProjectDocument34 pagesRobotic Process Automation Mini ProjectSipu100% (1)

- APA Result Announcement 2014Document5 pagesAPA Result Announcement 2014Mame SomaNo ratings yet

- Chapter 6 MC Employee Fraud and The Audit of CashDocument7 pagesChapter 6 MC Employee Fraud and The Audit of CashJames HNo ratings yet

- Introducing The Competitive Dimension To Corporate ForesightDocument10 pagesIntroducing The Competitive Dimension To Corporate ForesightAladdin PrinceNo ratings yet

- Paymentwintersemester LLMDocument1 pagePaymentwintersemester LLMRavindra RathoreNo ratings yet

- PFIP21220001666 - 1152021 - PT. Megahlestari Printing PackindoDocument7 pagesPFIP21220001666 - 1152021 - PT. Megahlestari Printing PackindoJumairyNo ratings yet

- PJT 1Document45 pagesPJT 1Adwale oluwatobi festusNo ratings yet

- NAPS PresentationDocument7 pagesNAPS PresentationDiwakar DwivediNo ratings yet

- Coca Cola Training ModuleDocument21 pagesCoca Cola Training ModulerameelNo ratings yet

- 3 Ordinary and Preference SharesDocument4 pages3 Ordinary and Preference SharesVP RaoNo ratings yet

- Timekeeping Procedures: Home To Work TravelDocument2 pagesTimekeeping Procedures: Home To Work TravelEric EhlersNo ratings yet

- Askari BankDocument62 pagesAskari Banksana_mariaahsa0% (1)

- Chapter-2 Conceptual Framework of GrievancesDocument40 pagesChapter-2 Conceptual Framework of GrievancesSoumyaranjan BeheraNo ratings yet

- New Syllabus: Open Book ExaminationDocument7 pagesNew Syllabus: Open Book Examinationsheena2saNo ratings yet

- Resolution NoDocument2 pagesResolution NoPearl Angelu O. AguilaNo ratings yet

- Quiz 1Document2 pagesQuiz 1Catherine VenturaNo ratings yet

- Order in Respect of Bhavesh Kothari, Partner Money Magnet Securities in The Matter of Synchronized Trading by Connected Persons.Document9 pagesOrder in Respect of Bhavesh Kothari, Partner Money Magnet Securities in The Matter of Synchronized Trading by Connected Persons.Shyam SunderNo ratings yet

- LTOM Final Book 1Document72 pagesLTOM Final Book 1Antonette Contreras DomalantaNo ratings yet

- Loan Pay CalculatorDocument6 pagesLoan Pay CalculatorHRITHIK CHOUKSENo ratings yet

- Consolidation Intercompany Sale of Fixed AssetsDocument4 pagesConsolidation Intercompany Sale of Fixed AssetsEdma Glory MacadaagNo ratings yet

- Applied Auditing Report (Audit of Receivables)Document7 pagesApplied Auditing Report (Audit of Receivables)mary louise magana100% (1)

- Invoice SD2593 JUNE 2020Document2 pagesInvoice SD2593 JUNE 2020Bharat SinghNo ratings yet

- Rob Parson at Morgan StanleyDocument15 pagesRob Parson at Morgan StanleyAnupam Kumar Majhi100% (1)

- Activity 2:: Date Account Titles and Explanation P.R. Debit CreditDocument2 pagesActivity 2:: Date Account Titles and Explanation P.R. Debit Creditemem resuentoNo ratings yet

- Answer KeyDocument52 pagesAnswer KeyDevonNo ratings yet

- Behind The Beautiful Forevers EssayDocument6 pagesBehind The Beautiful Forevers EssayKaliyah MartinNo ratings yet

- Af313 Tutorial Collection 4 - Economic Order QuantityDocument2 pagesAf313 Tutorial Collection 4 - Economic Order QuantityArti SinghNo ratings yet