Professional Documents

Culture Documents

Receivables Management

Receivables Management

Uploaded by

Nizana p sOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables Management

Receivables Management

Uploaded by

Nizana p sCopyright:

Available Formats

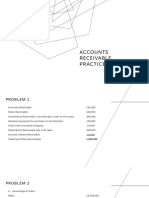

RECEIVABLES MANAGEMENT

PROBLEMS AND SOLUTIONS

1. A company plans to extend credit facilities to the following categories of customers:

A. Customers with a 10% risk of non-payment and

B. Customers with a 30% risk of non-payment.

The incremental sales expected in the case of category A are Rs.40000 while in the

case of category B is Rs.50000.

The cost of production and selling costs are 60% of sales while collection costs

amount to 5% of sales in the case of category (A) and 10% of sales in the case of

category (B).

You are required to advise the firm about extending credit facilities to each of the

above categories of customers.

Solution

1. Extending credit facilities to Category A Customers (10% risk of non-payment)

Rs.

Incremental Sales 40000

Less: 10% risk of non-payment 4000

Net Sales Revenue 36000

Less: Production and Selling costs (60% of sales) 24000

12000

Less: Collection costs (5% of Sales) 2000

Incremental Profit 10000

Result: If there is 10% risk of non-payment, the firm will earn a profit of

Rs.10000.

2. Extending credit facilities to Category B Customers (30% risk of non-payment)

Rs.

Sales 50000

Less: 30% risk of non-payment 15000

Net Sales Revenue 35000

Less: Production and Selling costs (60% of sales) 30000

5000

Less: Collection costs (10% of sales) 5000

Incremental Profit 0

Result: If there is 30% risk of non-payment, the firm will not get any profit or

loss.

Comment: The firm can extend credit facilities to category A customers with 10%

risk group because it gives an additional profit of Rs.10000.On the other hand,

the firm neither gain or lose on account of extending credit to customers with

30% risk group. Hence the firm should not extend credit to category B.

Problem 2

Sun Star Ltd. proposes to liberalize its credit facilities and also to increase its

sales. The liberalized credit policy will bring additional sales of Rs.300000.The

variable cost will be 60% of sales and there will be 10% risk for non-payment and

5% collection costs. Will the company benefit from the new credit policy?

Or Not?

Solution

Evaluation of New Credit Policy: Rs.

Additional Sales Revenue 300000

Less: 10% risk of non-payment 30000

Net Sales Revenue 270000

Less: Variable cost (60% of sales) 180000

90000

Less: Collection cost (5% of sales) 15000

Increase in profit 75000

Comment: The Company will be benefited from the new credit policy because

the profit of the company will increase by Rs.75000.

Problem 3

From the following information, calculate

(a)Debtors Turnover Ratio (b) Average collection period.

Rs.

Total Sales during the year 420000

Cash sales during the year 150000

Returns inward 20000

Debtors in the beginning 55000

Debtors at the end 45000

Provision for bad debts 5000.

You might also like

- The Manager's Handbook: Five Simple Steps to Build a Team, Stay Focused, Make Better Decisions, and Crush Your CompetitionFrom EverandThe Manager's Handbook: Five Simple Steps to Build a Team, Stay Focused, Make Better Decisions, and Crush Your CompetitionNo ratings yet

- CVP Analysis Review Problem SolutionDocument3 pagesCVP Analysis Review Problem SolutionSUNNY BHUSHANNo ratings yet

- Belldihide Corporation: Aulastine / D21200030Document12 pagesBelldihide Corporation: Aulastine / D21200030elliceNo ratings yet

- Cost Volume Profit AnalysisDocument15 pagesCost Volume Profit AnalysisPrateek Arora100% (1)

- MA2Document68 pagesMA2Isabella Gimao100% (2)

- HW 6-19Document9 pagesHW 6-19tgawri100% (2)

- Economics Practice ExamDocument33 pagesEconomics Practice ExamMelissa Douglas100% (1)

- Alpen Case Group 3Document13 pagesAlpen Case Group 3Ruchika100% (1)

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Case 29 SolutionDocument7 pagesCase 29 Solutiongators333100% (6)

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- CBK Power Co LTD Vs CIRDocument2 pagesCBK Power Co LTD Vs CIRIshNo ratings yet

- The 60 Second Sale: The Ultimate System for Building Lifelong Client Relationships in the Blink of an EyeFrom EverandThe 60 Second Sale: The Ultimate System for Building Lifelong Client Relationships in the Blink of an EyeNo ratings yet

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Percentage (Type-9,10)Document10 pagesPercentage (Type-9,10)devasishpal125No ratings yet

- Fashion Suitings PVTDocument42 pagesFashion Suitings PVTrijuhazarika100% (2)

- Accounting For ManagementDocument4 pagesAccounting For ManagementShabana ShabzzNo ratings yet

- FNF Final ExamDocument5 pagesFNF Final ExamThandar Swe ZinNo ratings yet

- Solution: P450,000: Answer: The Float Is P450,000Document1 pageSolution: P450,000: Answer: The Float Is P450,000Unknowingly AnonymousNo ratings yet

- ExerciseDocument7 pagesExercisekarthikNo ratings yet

- MARGINAL COSTIN1 Auto SavedDocument6 pagesMARGINAL COSTIN1 Auto SavedVedant RaneNo ratings yet

- Acctg 314 LQ CVPDocument2 pagesAcctg 314 LQ CVPYukimi Sugita0% (1)

- Student Exercise 3Document8 pagesStudent Exercise 3rishabh jainNo ratings yet

- Case 5 - 32Document5 pagesCase 5 - 32ashu140350% (2)

- Institute of Management Technology, Ghaziabad End Term Exam (Term - V) Take Home Exam (Time Duration: 04 HRS) Batch 2019 - 21 Answer-SheetDocument8 pagesInstitute of Management Technology, Ghaziabad End Term Exam (Term - V) Take Home Exam (Time Duration: 04 HRS) Batch 2019 - 21 Answer-SheetSakshi ShahNo ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- AR Prac Probs SolManDocument14 pagesAR Prac Probs SolManco230154No ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- CVP AnalysisDocument4 pagesCVP AnalysisLalit SapkaleNo ratings yet

- SyPhone Student Data (CLV)Document9 pagesSyPhone Student Data (CLV)leni th0% (2)

- Case 5-32&33Document4 pagesCase 5-32&33Majde Qasem100% (1)

- MA Assignment 3Document3 pagesMA Assignment 3SumreeenNo ratings yet

- Company Internal Deck PresentationDocument13 pagesCompany Internal Deck PresentationAct SujanpurNo ratings yet

- Going Rate PricingDocument3 pagesGoing Rate PricingHarshitha RNo ratings yet

- March Bonanza 30thmarchDocument1 pageMarch Bonanza 30thmarchRAHUL BISHWASNo ratings yet

- Uts Aml 2017 PpakDocument2 pagesUts Aml 2017 Ppakainun nisaNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- 13 Chapter 6.2 - LeverageDocument12 pages13 Chapter 6.2 - Leverageatishayjjj123No ratings yet

- A22Document4 pagesA22Tariq MehmoodNo ratings yet

- Problems On Breakeven AnalysisDocument2 pagesProblems On Breakeven AnalysisManoj NepalNo ratings yet

- Pittman Company Budgeted Income Statement For The Year Ended December 31Document4 pagesPittman Company Budgeted Income Statement For The Year Ended December 31Caca LokaNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- AA367Document12 pagesAA367Meena DasNo ratings yet

- Questions & Problems 2Document9 pagesQuestions & Problems 2Suman MahmoodNo ratings yet

- CVP Analysis Practice Numericals Sensitivity AnalysisDocument2 pagesCVP Analysis Practice Numericals Sensitivity AnalysisAll in ONENo ratings yet

- 23 Debtor's ManagementDocument6 pages23 Debtor's ManagementSakshi Baiwal100% (1)

- Debtors / Receivables ManagementDocument28 pagesDebtors / Receivables ManagementTuki DasNo ratings yet

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Receivables QuizDocument7 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Receivables QuizMarilou Arcillas PanisalesNo ratings yet

- COST VOLUME PROFIT ANALYSIS ExercisesDocument5 pagesCOST VOLUME PROFIT ANALYSIS ExercisesjenieNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Application of Marginal Costing TechniqueDocument7 pagesApplication of Marginal Costing TechniqueKumardeep SinghaNo ratings yet

- LiabilitiesDocument34 pagesLiabilitiesErin LumogdangNo ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahiNo ratings yet

- Marginal Costing Problems OnlyDocument6 pagesMarginal Costing Problems OnlyBharat ThackerNo ratings yet

- Accounting For Managerial DecisionsDocument6 pagesAccounting For Managerial DecisionsKrutika ManeNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- March Bonanza - 29thmarchDocument1 pageMarch Bonanza - 29thmarchjehem84155No ratings yet

- Mas Quizzer - Anaylysis 2021 Part 2Document9 pagesMas Quizzer - Anaylysis 2021 Part 2Ma Teresa B. CerezoNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsSugandhaShaikh0% (1)

- 20211016231949-A4362 - 201093M 2Document4 pages20211016231949-A4362 - 201093M 2bucin yaNo ratings yet

- From Bots to Billions: Unlocking Explosive Growth with AI AutomationFrom EverandFrom Bots to Billions: Unlocking Explosive Growth with AI AutomationNo ratings yet

- Simple Interest and Compound InterestDocument5 pagesSimple Interest and Compound InterestNizana p sNo ratings yet

- Smoothing Techniques - Moving AverageDocument6 pagesSmoothing Techniques - Moving AverageNizana p sNo ratings yet

- Tools and Techniques of Inventory ManagementDocument4 pagesTools and Techniques of Inventory ManagementNizana p s0% (1)

- Estimation of Required Working CapitalDocument4 pagesEstimation of Required Working CapitalNizana p sNo ratings yet

- Nizana P S Internship Report - WIPRO LTDDocument77 pagesNizana P S Internship Report - WIPRO LTDNizana p sNo ratings yet

- Entrepreneurial ProcessDocument15 pagesEntrepreneurial ProcessNizana p sNo ratings yet

- Revised January 1992 Daily Wage PayrollDocument4 pagesRevised January 1992 Daily Wage PayrollJhem Martinez100% (1)

- Fishing Sustainable Livelihood - A Discussion Paper On The Livelihood of Coastal Fisherwomen in IndiaDocument95 pagesFishing Sustainable Livelihood - A Discussion Paper On The Livelihood of Coastal Fisherwomen in IndiaHansen Thambi Prem100% (1)

- Sales Management Final-UnileverDocument34 pagesSales Management Final-UnileverMichelle Fernandes50% (2)

- KSSL Annual Report2016Document50 pagesKSSL Annual Report2016naseem ashrafNo ratings yet

- Pertemuan 9BDocument36 pagesPertemuan 9Bleny aisyahNo ratings yet

- Homework A-2Document7 pagesHomework A-2Daniel GabrielNo ratings yet

- Glosarium AkuntansiDocument6 pagesGlosarium AkuntansiYulinda SaledaNo ratings yet

- Detailed Project Report For: Bus - OfficeDocument16 pagesDetailed Project Report For: Bus - OfficeRohit ManeNo ratings yet

- A Study On Comparison of Profitability of Financial Ratio in Food Industry-1Document21 pagesA Study On Comparison of Profitability of Financial Ratio in Food Industry-1deborahkong9900No ratings yet

- NFJPIA Online Preboard Exam Tax UnformattedDocument22 pagesNFJPIA Online Preboard Exam Tax UnformattedYietNo ratings yet

- Financial Management and PolicyDocument7 pagesFinancial Management and PolicySåntøsh YådåvNo ratings yet

- SBMADocument82 pagesSBMARhenz ReyesNo ratings yet

- FM-Sessions 17-20 Capital Budgeting-Investment Decision CompleteDocument61 pagesFM-Sessions 17-20 Capital Budgeting-Investment Decision CompleteSaadat ShaikhNo ratings yet

- NBP KhurramDocument80 pagesNBP KhurramMRasul SalafiNo ratings yet

- 12 - Chapter 4 PDFDocument29 pages12 - Chapter 4 PDFNANDANA CHANDRANNo ratings yet

- Air India Case StudyDocument9 pagesAir India Case StudyShubham KothariNo ratings yet

- Chapter 3Document24 pagesChapter 3Irene Mae BeldaNo ratings yet

- Management Consultant CEO in Syracuse NY Resume William PeckDocument1 pageManagement Consultant CEO in Syracuse NY Resume William PeckWilliamPeck1No ratings yet

- Courtesy: CFA InstituteDocument46 pagesCourtesy: CFA InstituteSaurabh SinghNo ratings yet

- Business Development Plan - editedREVDocument18 pagesBusiness Development Plan - editedREVWilliamArugaNo ratings yet

- Formulating Long-Term Objectives and Grand StrategiesDocument33 pagesFormulating Long-Term Objectives and Grand StrategiesAnn MaryNo ratings yet

- Analysis of Audit ReportsDocument5 pagesAnalysis of Audit ReportsPhilip WellsNo ratings yet

- Fatima ReyesDocument26 pagesFatima ReyesNadia Che SafriNo ratings yet

- Ampeloquio AC3 AFAR SemiFinalsDocument11 pagesAmpeloquio AC3 AFAR SemiFinalsAmpeloquio Macky B.No ratings yet

- Microsoft v. IRSDocument15 pagesMicrosoft v. IRSIDG News ServiceNo ratings yet

- BEO6600 Group Ass1Document16 pagesBEO6600 Group Ass1vamsikrishnabNo ratings yet