Professional Documents

Culture Documents

Terms and Conditions of Japanese ODA Loans (Effective From April 1, 2022)

Uploaded by

Nino NinosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terms and Conditions of Japanese ODA Loans (Effective From April 1, 2022)

Uploaded by

Nino NinosCopyright:

Available Formats

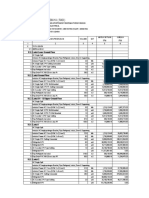

"Terms and Conditions of Japanese ODA Loans

(Effective from April 1, 2022)"

GNI Per Repayment

Grace Period Conditions for

Category Capita Terms Fixed/Floating Standard/Option Interest Rate (%) Period

(years) Procurement

(2020) (years)

Low-Income Least Developed

Countries1 0.01 40 10 Untied

(- US$ 1,045)

Standard 0.25 30 10

Preferential Terms for High Option1 0.20 25 7

Fixed

Specification (2,same as below) Option2 0.15 20 6

Option3 0.10 15 5

Longer option TORF+40bp 40 10

(4, same as Standard TORF+30bp 30 10

Floating

below) Option1 TORF+25bp 25 7

Option2 TORF+20bp 20 6

(3, same as below)

Least Developed Countries Preferential Terms Option3 TORF+15bp 15 5

Standard 0.65 30 10

or Option1 0.50 25 7

Fixed Untied

Option2 0.40 20 6

Low-Income-Countries Option3 0.25 15 5

(- US$ 1,045) Longer option TORF+50bp 40 10

Standard TORF+40bp 30 10

Floating Option1 TORF+35bp 25 7

Option2 TORF+30bp 20 6

General Terms Option3 TORF+25bp 15 5

Standard 0.75 30 10

Option1 0.60 25 7

Fixed

Option2 0.50 20 6

Option3 0.35 15 5

Standard 0.50 30 10

Preferential Terms for High Option1 0.45 25 7

Fixed

Specification Option2 0.40 20 6

Option3 0.35 15 5

Longer option TORF+90bp 40 10

Standard TORF+70bp 30 10

Floating Option1 TORF+60bp 25 7

Option2 TORF+50bp 20 6

Preferential Terms Option3 TORF+40bp 15 5

Standard 1.05 30 10

Lower-Middle-

US$ 1,046 - Option1 0.90 25 7

Income Fixed Untied

US$ 4,095 Option2 0.70 20 6

Countries

Option3 0.50 15 5

Longer option TORF+110bp 40 10

Standard TORF+90bp 30 10

Floating Option1 TORF+80bp 25 7

Option2 TORF+70bp 20 6

General Terms Option3 TORF+60bp 15 5

Standard 1.25 30 10

Option1 1.10 25 7

Fixed

Option2 0.90 20 6

Option3 0.70 15 5

Standard 0.70 30 10

Preferential Terms for High Option1 0.65 25 7

Fixed

Specification Option2 0.60 20 6

Option3 0.55 15 5

Longer option TORF+110bp 40 10

Standard TORF+90bp 30 10

Floating Option1 TORF+80bp 25 7

Option2 TORF+70bp 20 6

Upper-Middle- Preferential Terms Option3 TORF+60bp 15 5

Income Standard 1.25 30 10

Countries and Option1 1.10 25 7

US$ 4,096- Fixed Untied

Uppermost- Option2 0.90 20 6

Middle-Income Option3 0.70 15 5

Countries Longer option TORF+130bp 40 10

Standard TORF+110bp 30 10

Floating Option1 TORF+100bp 25 7

Option2 TORF+90bp 20 6

General Terms Option3 TORF+80bp 15 5

Standard 1.45 30 10

Option1 1.30 25 7

Fixed

Option2 1.10 20 6

Option3 0.90 15 5

STEP5 Fixed Standard 0.10 40 10 Tied

For consulting services, the interest rate will be minimal (0.01%) and the repayment, grace periods and conditions

Consulting Services

for procurement will be the same as those for main components.

In case of co-financing, it is possible to apply the same repayment terms as co-financer's lending while maintaining

Options for Program Type Japanese ODA Loans

the concessionality of Yen loans.

1

For Low-Income LDCs, three-year transition period will be granted to recipient countries that will move from the category of Low-Income LDCs, and, during the

period, the terms and conditions for Low-Income LDCs will be applied to the projects of the countries.

2

Preferential Terms for High Specification will be applicable to projects promoting quality infrastructure.The applicability of the terms will be decided on a case-by-case

basis.

3

Preferential Terms are applied to the following sectors and fields to all countries (except Low-Income LDCs) :

(i) Issues on Global Environmental and Climate Change

(ii) Health and Medical Care and Services

(iii) Disaster Prevention, and Reduction

(iv) Human Resource Development

4

The base rate of floating rate is the value of the 6-month TORF, and the fixed spread remains constant over the life of the loan. If the base rate plus fixed spread is

lower than 0.1%, the interest shall be 0.1%.

5

Special Terms for Economic Partnership (STEP) is extended to the projects for which Japanese technologies and know-how are substantially utilized, based on the

recipient countries' request to utilize and transfer excellent technologies of Japan. Countries (except LDCs), which are eligible for tied aid under Arrangement on

Officially Supported Export Credits issued by OECD, are eligible for STEP terms.

6

Irrespective of the income category, the term and condition of 0.01% interest rate and 40-year repayment period including 10-year grace period are applied to projects

assisting recoveries from disasters, including Stand-by Emergency Credit for Urgent Recovery (SECURE). For Stand-by Emergency Credit for Urgent Recovery

(SECURE), the term and condition of 20-year repayment period including 6-year grace period, or 15-year repayment period including 5-year grace period are also

available, in order to apply Currency Conversion Option.

7

For Contingent Credit Enhancement Facility for PPP Infrastructure Development (CCEF-PPP), only floating rate will be applied irrespective of income category. The

terms on conditions are individually set within the following range of interest rate as well as repayment period (In the case of short term financial support, however, the

repayment period is 10 years).

-Interest rate: TORF + 35 ~55bp

-Repayment period: maximum 40-year(maximum 30-year drawdown period plus 10 year)

Notes

・Under the EPSA (Enhanced Private Sector Assistance for Africa) initiative, the loan for projects co-financed with the AfDB are extended using "Preferential Terms,"

determined for each income category; in the case for Low-Income LDCs, the term and condition of 0.01% interest rate and 40-year repayment period including 10-year

grace period are applied.

・ For countries complying with ongoing IMF-supported programs or receiving grants from IDA, it is possible to modify the terms and conditions of the ODA Loans so

as to meet the IMF's concessionality criteria.

・ For General terms and Preferential terms, fixed rate for all countries (except Low-Income LDCs) will be revised on a regular basis so that its concessionality will be

equal to that of floating rate.

・ For Upper-Middle-Income Countries and Uppermost-Middle-Income Countries, floating rate will be applied in principle, although fixed rate could be applied.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EN Issue 39Document102 pagesEN Issue 39Igor19OgNo ratings yet

- Introduction To The Study of GlobalizationDocument19 pagesIntroduction To The Study of GlobalizationCheddy C. VillenaNo ratings yet

- Grade 5 Filipino LASDocument118 pagesGrade 5 Filipino LASbaby jane pairat80% (5)

- Kyc Individual FormDocument21 pagesKyc Individual FormNino NinosNo ratings yet

- Bangladesh Computer Samity: Election To Elect Members of The Executive Committee For The Term 2016-2017 Final Voter ListDocument38 pagesBangladesh Computer Samity: Election To Elect Members of The Executive Committee For The Term 2016-2017 Final Voter ListAbu Eleas LinkonNo ratings yet

- Rencana Anggaran Biaya (Rab) : Harga Satuan Jumlah (RP) (RP) Vii. Tata Suara NO Uraian Pekerjaan SATDocument3 pagesRencana Anggaran Biaya (Rab) : Harga Satuan Jumlah (RP) (RP) Vii. Tata Suara NO Uraian Pekerjaan SATNino NinosNo ratings yet

- Vigilar V Aquino DigestDocument2 pagesVigilar V Aquino DigestErika PotianNo ratings yet

- Confidential: Application Guideline For The JICA Knowledge Co-Creation Program Young LeadersDocument14 pagesConfidential: Application Guideline For The JICA Knowledge Co-Creation Program Young LeadersNino NinosNo ratings yet

- Advance 202104Document14 pagesAdvance 202104Nino NinosNo ratings yet

- Unclaimed WarrantDocument113 pagesUnclaimed WarrantNino NinosNo ratings yet

- Account 202104Document12 pagesAccount 202104Nino NinosNo ratings yet

- Bgfu - D.O.ADocument25 pagesBgfu - D.O.ANino NinosNo ratings yet

- Company Profile: CNBM Group CorporationDocument3 pagesCompany Profile: CNBM Group CorporationNino NinosNo ratings yet

- Rencana Anggaran Biaya (Rab) : V.I.I. Lantai Lower Ground FloorDocument3 pagesRencana Anggaran Biaya (Rab) : V.I.I. Lantai Lower Ground FloorNino NinosNo ratings yet

- Corporate Entry : Documentation EnclosedDocument25 pagesCorporate Entry : Documentation EnclosedNino NinosNo ratings yet

- Loan Term Sheet-David Lending ServicesDocument3 pagesLoan Term Sheet-David Lending ServicesNino NinosNo ratings yet

- A Work of ArtificeDocument6 pagesA Work of Artificeriddhimashetty28No ratings yet

- Sexual TextualDocument7 pagesSexual Textualcol890% (1)

- Act 564 Telemedicine Act 1997 PDFDocument11 pagesAct 564 Telemedicine Act 1997 PDFAdam Haida & CoNo ratings yet

- Analysis - Arakan Army - A Powerful New Threat To The TatmadawDocument11 pagesAnalysis - Arakan Army - A Powerful New Threat To The TatmadawIndobhasa MogNo ratings yet

- Problem of Elderly in IndiaDocument6 pagesProblem of Elderly in IndiaGaurav Devadiga100% (2)

- UNGA-SOCHUM Study GuideDocument14 pagesUNGA-SOCHUM Study GuideRaghav SamaniNo ratings yet

- Made, Not Born - Why Some Soldiers Are Better Than OthersDocument216 pagesMade, Not Born - Why Some Soldiers Are Better Than OthersHaning Tyas Cahya PratamaNo ratings yet

- Art 17,18 Consti IIDocument3 pagesArt 17,18 Consti IIAnupam VermaNo ratings yet

- The Negative Effects of Free Trade Agreements On EmploymentDocument11 pagesThe Negative Effects of Free Trade Agreements On EmploymentRaymina CNo ratings yet

- Bluebook Citation GuideDocument3 pagesBluebook Citation GuideBerenice Joanna Dela CruzNo ratings yet

- Vjeran Kursar, "Ambiguous Subjects and Uneasy Neighbors: Bosnian Franciscans' Attitudes Toward The Ottoman State, Turks,' and Vlachs"Document45 pagesVjeran Kursar, "Ambiguous Subjects and Uneasy Neighbors: Bosnian Franciscans' Attitudes Toward The Ottoman State, Turks,' and Vlachs"vjeran_kNo ratings yet

- Sexual Harassment 1Document9 pagesSexual Harassment 1api-679532352No ratings yet

- European Security Defence Policy PDFDocument2 pagesEuropean Security Defence Policy PDFCharleneNo ratings yet

- Trade Unions in The Changing Scenario of Industrial RelationsDocument11 pagesTrade Unions in The Changing Scenario of Industrial RelationsJagannath Shashank VadrevuNo ratings yet

- NathusinghDocument20 pagesNathusinghjkraj462364100% (1)

- Foundations of Modern Social ThoughtDocument288 pagesFoundations of Modern Social Thoughtnini345100% (1)

- NSTP Project Proposal - Feeding ProgramDocument16 pagesNSTP Project Proposal - Feeding ProgramZyrill MachaNo ratings yet

- TalcottParsons - On The Concept of Power PDFDocument32 pagesTalcottParsons - On The Concept of Power PDFAna Cecilia MedinaNo ratings yet

- Case SummaryDocument2 pagesCase SummaryAditya D TanwarNo ratings yet

- Political Science-II 1 PDFDocument24 pagesPolitical Science-II 1 PDFKhushi SinghNo ratings yet

- ADEGORE R. PLUMPTRE vs. ATTY. SOCRATES R. RIVERADocument1 pageADEGORE R. PLUMPTRE vs. ATTY. SOCRATES R. RIVERAdulnuan jerusalemNo ratings yet

- West Java Establish Operator BUMD For Kertajati Airport - 22 April 2013 - IndIIDocument2 pagesWest Java Establish Operator BUMD For Kertajati Airport - 22 April 2013 - IndIITeddy HarmonoNo ratings yet

- 1resolution 003Document3 pages1resolution 003JoebellNo ratings yet

- Plan de Marketing Dise o Implementaci N y Control 65 To 85 PDFDocument21 pagesPlan de Marketing Dise o Implementaci N y Control 65 To 85 PDFPaulina Elizabeth JimnzNo ratings yet

- Preliminary InvestigationDocument4 pagesPreliminary InvestigationAimee HernandezNo ratings yet