Professional Documents

Culture Documents

Safekeeping of Documents

Uploaded by

Mary Therese Anne DequiadoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Safekeeping of Documents

Uploaded by

Mary Therese Anne DequiadoCopyright:

Available Formats

REVENUE REGULATIONS NO.

5-2014

The salient portions of the RR are as follows:

1. Taxpayers are required to preserve their books of accounts for a period of ten (10) years, which shall

be reckoned from the day following the deadline in filing the return, or if filed after deadline, from the

date of filing of the return, for the taxable year when the last entry was made in the books of accounts.

Within the first five (5) years thereof, taxpayers are required to retain hardcopies. Thereafter,

taxpayers may retain only an electronic copy thereof provided that the same is stored via an Electronic

Storage System (“ESS”).

2. The independent CPA who audited the records and certified the financial statements of the taxpayer is

also required to maintain and preserve electronic copies of the audited and certified financial

statements and their audit working papers for 10 years from due date of filing of the annual income

tax return or the actual date of filing thereof, whichever comes later.

3. Taxpayers and independent CPAs who use an ESS must completely transfer images of the hardcopies of

above documents. They should have reasonable controls to ensure the integrity, accuracy, and

reliability of their ESS.

What type of accounting records need to be preserved?

As a basic rule, all accounting-related records relevant to each transaction performed by filipino businesses

must be preserved. The BIR requires that records be maintained “intact, unaltered and unmutilated.” Revenue

Regulation 17-2013 specifically provides that the following documents must be retained by businesses:

a. Books of Accounts – these are the books where business transactions are recorded and maintained. General

ledgers and general journals are primary records within the books of accounts. Check out our article on books

of accounts in the Philippines for more information

b. Subsidiary books – these are books of accounts where similar transactions are recorded in chronological

order. Examples of these are cash receipts journal, cash disbursement journal, sales journal and purchases

journal

c. Other accounting records – “other accounting records” include invoices, receipts, vouchers, returns and

other source documents that support entries into the books of accounts

d. Registers – these are accounting records that illustrate the transactions for each account together with the

running balance

e. Vouchers – this is an accounting document used to prepare payments to creditors

You might also like

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Revenue Regulation 5-2014Document4 pagesRevenue Regulation 5-2014Clarissa Mae SawaliNo ratings yet

- Income Taxation: Electronic Record Keeping RequirementsDocument4 pagesIncome Taxation: Electronic Record Keeping RequirementsMarc Darrell Masangcay OrozcoNo ratings yet

- RR 21-02Document2 pagesRR 21-02Butch AmbataliNo ratings yet

- Accounts of CompaniesDocument43 pagesAccounts of CompaniesSaurabh KumarNo ratings yet

- Tips in Tax FilingDocument30 pagesTips in Tax FilingNIcey NiceyNo ratings yet

- Professional Ethics Notes ACCOUNTANCY FOR LAWYERSDocument21 pagesProfessional Ethics Notes ACCOUNTANCY FOR LAWYERSPratima100% (4)

- Registers and RecordsDocument90 pagesRegisters and RecordsVikram DasNo ratings yet

- Toaz - Info Professional Ethics Notes Accountancy For Lawyers PRDocument21 pagesToaz - Info Professional Ethics Notes Accountancy For Lawyers PRsa7054No ratings yet

- Difference Between Accounting and AuditDocument5 pagesDifference Between Accounting and AuditsrpvickyNo ratings yet

- Company Accounts and Audit 2Document17 pagesCompany Accounts and Audit 2Nickson MaingiNo ratings yet

- Accountancy For LawyersDocument5 pagesAccountancy For Lawyerssiddarth kumar80% (5)

- Accounting Law - 2002Document8 pagesAccounting Law - 2002jargalbsNo ratings yet

- Audit of Sole ProprietorDocument9 pagesAudit of Sole ProprietorPrincess Bhavika100% (1)

- Trial Balance and FSDocument58 pagesTrial Balance and FSMubarrach MatabalaoNo ratings yet

- Financial & Accounting Policies & ProceduresDocument34 pagesFinancial & Accounting Policies & ProceduresAnnabel Strange100% (5)

- Fge - Chapter 1Document49 pagesFge - Chapter 1bereket nigussieNo ratings yet

- Audit ContractDocument5 pagesAudit Contractmary louise magana100% (4)

- Non Gov ReviewerDocument426 pagesNon Gov ReviewerMA. CHRISTINA BUSAINGNo ratings yet

- Government Accounting SystemDocument46 pagesGovernment Accounting SystemMeshack NyekelelaNo ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- Accounting LawDocument45 pagesAccounting LawMẫn Chi Nguyễn PhạmNo ratings yet

- Accounting System Short Notes Du Bcom Hons Chapter 1Document7 pagesAccounting System Short Notes Du Bcom Hons Chapter 1ishubhy111No ratings yet

- Accounting in China (PDF Library)Document4 pagesAccounting in China (PDF Library)Dimitriu OtiliaNo ratings yet

- Company Final AccountsDocument38 pagesCompany Final AccountsNeeti Chopra50% (2)

- Audit 2Document2 pagesAudit 2Cecilia AngelineNo ratings yet

- Theory Base of Accounting Class 11 Notes Accountancy Chapter 2Document6 pagesTheory Base of Accounting Class 11 Notes Accountancy Chapter 2SSDLHO sevenseasNo ratings yet

- TAX-1402 (Compliance Requirements)Document2 pagesTAX-1402 (Compliance Requirements)Hilo MethodNo ratings yet

- Unit 1Document24 pagesUnit 1KirosTeklehaimanotNo ratings yet

- Basic Phases of AccountingDocument6 pagesBasic Phases of AccountingAnamika Rai PandeyNo ratings yet

- FGE Chapterr 1 PPTXDocument53 pagesFGE Chapterr 1 PPTXDEREJENo ratings yet

- Accounts Theory (Examination)Document12 pagesAccounts Theory (Examination)kaashvi dubeyNo ratings yet

- Unit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementDocument24 pagesUnit One Introduction To Federal Government of Ethiopia Accounting and Financial ManagementTIZITAW MASRESHANo ratings yet

- Accounts and Book Keeping in Primary Level Cooperatives10920Document40 pagesAccounts and Book Keeping in Primary Level Cooperatives10920Palek Koang DiawNo ratings yet

- Chapter One .EGADocument13 pagesChapter One .EGAAdugnaNo ratings yet

- LM1-07 Accounting Controls in PlaceDocument3 pagesLM1-07 Accounting Controls in Placendayidaba emmanuelNo ratings yet

- Assginment On Audit Report: Advance AuditingDocument9 pagesAssginment On Audit Report: Advance AuditingFaizan ChNo ratings yet

- IAandFAR ReviewerDocument6 pagesIAandFAR ReviewerKairo ZeviusNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementEunice SorianoNo ratings yet

- Company Final AccountsDocument36 pagesCompany Final Accountsalfin gonsalvesNo ratings yet

- PpapDocument7 pagesPpapTimKillerStewNo ratings yet

- Government Accounting Lesson 1Document36 pagesGovernment Accounting Lesson 1Danica GeanNo ratings yet

- OhadaDocument24 pagesOhadaDesmond NsohNo ratings yet

- Final Accounts: Prof. P. KumaresanDocument21 pagesFinal Accounts: Prof. P. KumaresanalexanderNo ratings yet

- Illustrative Bank Branch Audit FormatDocument3 pagesIllustrative Bank Branch Audit FormatAjay UpadhyayNo ratings yet

- Chapter 6 A4Document122 pagesChapter 6 A4Dhiraj JaiswalNo ratings yet

- Assignnent Audit and ControlDocument6 pagesAssignnent Audit and ControlJherico Renz MolanoNo ratings yet

- Accounting For Local Government Unit I. Basic Fatures and PoliciesDocument10 pagesAccounting For Local Government Unit I. Basic Fatures and PoliciesChin-Chin Alvarez SabinianoNo ratings yet

- Provisions of Audit Under Service Tax LawDocument3 pagesProvisions of Audit Under Service Tax Lawanon_922292293No ratings yet

- Chapter 3 Accounting Practice in Government OrganizationDocument26 pagesChapter 3 Accounting Practice in Government Organizationalemayehu tarikuNo ratings yet

- New FGE Chapter I and IIDocument18 pagesNew FGE Chapter I and IImubarek kemalNo ratings yet

- Depositories Act 1996: Depository SystemDocument5 pagesDepositories Act 1996: Depository SystemMukul Kr Singh ChauhanNo ratings yet

- Sample UGC NET CommerceDocument8 pagesSample UGC NET Commercefaltuid1430No ratings yet

- New Government Accounting System (NGAS) in The PhilippinesDocument24 pagesNew Government Accounting System (NGAS) in The PhilippinesJingRellin100% (1)

- Anglais s1Document9 pagesAnglais s1JassNo ratings yet

- Ngas Module Government AccountingDocument11 pagesNgas Module Government AccountingAnn Kristine Trinidad50% (2)

- What Is Financial AccountingDocument1 pageWhat Is Financial AccountingalejandroleaharneeNo ratings yet

- Pre-1. Introduction To Government AccountingDocument24 pagesPre-1. Introduction To Government AccountingPaupauNo ratings yet

- Legal Documents EquipmentDocument2 pagesLegal Documents EquipmentMary Therese Anne DequiadoNo ratings yet

- Payroll HR or FinanceDocument2 pagesPayroll HR or FinanceMary Therese Anne DequiadoNo ratings yet

- Billing and CollectionDocument3 pagesBilling and CollectionMary Therese Anne DequiadoNo ratings yet

- FA Vs MADocument1 pageFA Vs MAMary Therese Anne DequiadoNo ratings yet

- VAT and EWT BasisDocument2 pagesVAT and EWT BasisMary Therese Anne DequiadoNo ratings yet

- Documentary Stamp TaxDocument2 pagesDocumentary Stamp TaxMary Therese Anne DequiadoNo ratings yet

- PROCEMAC PT Spare Parts ManualDocument27 pagesPROCEMAC PT Spare Parts ManualMauricio CruzNo ratings yet

- The Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Document8 pagesThe Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Stephen James - Independent Investigative Journalism & PhotographyNo ratings yet

- Drafting Foundation PlanDocument24 pagesDrafting Foundation Planerol bancoroNo ratings yet

- Final Lpd1Document6 pagesFinal Lpd1MONIC STRAISAND DIPARINENo ratings yet

- How To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasDocument10 pagesHow To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasNowellyn IncisoNo ratings yet

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Document52 pages03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreNo ratings yet

- Mohamed Nagy Elsayed: Supply Chain ManagerDocument6 pagesMohamed Nagy Elsayed: Supply Chain Managerfasiha thathiNo ratings yet

- Questionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewDocument2 pagesQuestionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewAbhinav SahaniNo ratings yet

- 20091216-153551-APC Smart-UPS 1500VA USB SUA1500IDocument4 pages20091216-153551-APC Smart-UPS 1500VA USB SUA1500Ifietola1No ratings yet

- CIMICDocument228 pagesCIMICKehinde Olaoluwa100% (1)

- PlayAGS, Inc.Document309 pagesPlayAGS, Inc.vicr100No ratings yet

- Virtual Vacancy Round 2 Mbbs - Bds Ug Counselling 20Document90 pagesVirtual Vacancy Round 2 Mbbs - Bds Ug Counselling 20Jaydev DegloorkarNo ratings yet

- Amt in A Nutshell - ExplainedDocument2 pagesAmt in A Nutshell - ExplainedMis El100% (2)

- NYPE93Document0 pagesNYPE93gvsprajuNo ratings yet

- Legal DraftingDocument28 pagesLegal Draftingwadzievj100% (1)

- Law Clinic and Mooting DR DapaahDocument19 pagesLaw Clinic and Mooting DR DapaahGlennNo ratings yet

- Rfa TB Test2Document7 pagesRfa TB Test2Сиана МихайловаNo ratings yet

- Partial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesDocument55 pagesPartial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesElsan BalucanNo ratings yet

- Geometric Driver Components Serial Copy: Topsolid'WoodDocument22 pagesGeometric Driver Components Serial Copy: Topsolid'Wooddrine100% (1)

- Accredited Architecture QualificationsDocument3 pagesAccredited Architecture QualificationsAnamika BhandariNo ratings yet

- Windows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Document5 pagesWindows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Sheen QuintoNo ratings yet

- Market Research and AnalysisDocument5 pagesMarket Research and AnalysisAbdul KarimNo ratings yet

- Netflix OriginalDocument3 pagesNetflix Originalyumiko2809No ratings yet

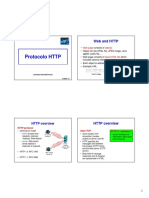

- HTTP ProtocolDocument16 pagesHTTP ProtocolHao NguyenNo ratings yet

- SYKES - Telework Work Area AgreementDocument2 pagesSYKES - Telework Work Area AgreementFritz PrejeanNo ratings yet

- Name - Hiral Baid Class - 12 C Subject - Commerce Project 1 - Swot Analysis and Consumer ProtectionDocument21 pagesName - Hiral Baid Class - 12 C Subject - Commerce Project 1 - Swot Analysis and Consumer Protectionhiral baidNo ratings yet

- Assignment3 (Clarito, Glezeri BSIT-3A)Document9 pagesAssignment3 (Clarito, Glezeri BSIT-3A)Jermyn G EvangelistaNo ratings yet

- Leyson vs. OmbudsmanDocument12 pagesLeyson vs. OmbudsmanDNAANo ratings yet

- Standards For Pipes and FittingsDocument11 pagesStandards For Pipes and FittingsMohammed sabatinNo ratings yet

- LETTEROFGUARANTEEDocument1 pageLETTEROFGUARANTEELim DongseopNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet