Professional Documents

Culture Documents

Illustration

Uploaded by

Mahesh AgrawalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Uploaded by

Mahesh AgrawalCopyright:

Available Formats

19-07-2022

Quote No : qb8tlx1a01m66

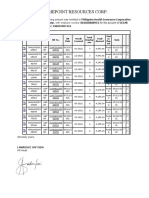

Benefit Illustration for HDFC Life Sanchay Fixed Maturity Plan(spl)

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Fixed Maturity Plan(spl)

DETAILS

Name of the Prospect/Policyholder: Rahul Agrawal Proposal No: NA

HDFC Life Sanchay Fixed Maturity

Age: 35 Name of Product:

Plan(spl)

A Non-Linked,Non-

Name of Life Assured 1: Rahul Agrawal Tag Line: Participating,Individual,Savings,Life

Insurance Plan

Age: 35 Unique Identification No: 101N142V01

Sex: M GST Rate: 4.5% for first year

Policy Term: 15 2.25% second year onwards

Premium Paying Term: 5

Amount of Instalment Premium

Rs.100000

(Without GST):

Mode of Payment of Premium: Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Policy Details

Policy Option Single Life

Death Benefit(at

Sum Assured on Maturity 1000000

981100 inception of the policy) Rs.

Rs.

Premium Summary

PP PP Total

Base Plan CI Rider IB Rider PP Rider (PAC) Rider Rider Instalment

(ADC) (CC) Premium

Instalment Premium without GST 1,00,000 0 0 0 0 0 1,00,000

Instalment Premium with First Year GST 1,04,500 0 0 0 0 0 1,04,500

Instalment Premium with GST 2nd Year Onwards 1,02,250 0 0 0 0 0 1,02,250

(Amount in Rupees)

Policy Year Single/ Guaranteed Non-Guaranteed

Annualized

Survival Benefits / Other benefits Maturity Benefit Death Benefit Min Special Surrender Value

Premium

Loyalty Additions (if any) Guaranteed

Surrender

Value

1 100000 0 0 0 1000000 0 0

2 100000 0 0 0 1000000 60000 60000

3 100000 0 0 0 1000000 105000 105000

4 100000 0 0 0 1000000 200000 296606

5 100000 0 0 0 1000000 250000 404998

6 0 0 0 0 1000000 250000 442476

7 0 0 0 0 1000000 250000 483486

8 0 0 0 0 1000000 280000 528126

9 0 0 0 0 1000000 305000 576985

10 0 0 0 0 1000000 335000 630357

11 0 0 0 0 1000000 365000 688732

12 0 0 0 0 1000000 395000 752406

13 0 0 0 0 1000000 420000 821966

14 0 0 0 0 1000000 450000 898001

15 0 0 0 981100 1000000 0 0

Notes:

1. Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax. Refer Sales

Literature for explanation of terms used in this illustration.

2. The maturity benefit is payable at the end of the policy year. Upon payment of the maturity benefit, the policy terminates and no further benefits become payable.

3. The death benefits shown above are at the end of the year. Upon payment, of death benefit the policy terminates and no further benefit is payable.

4. The surrender benefits shown above are at the end of the year. Upon payment of surrender benefit, the policy terminates and no further benefit becomes payable.

5. The Premium and the Sum Assured on Maturity stated above is based on the information provided. They may vary as a result of underwriting.

6. Any statutory levy or charges (such as Goods and Service tax) including any indirect tax may be charged to the Policyholder either now or in future by the company and such

amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to payment of premium.

I , have explained the premiums and benefits under the policy fully to the prospect / I Rahul Agrawal,having received the information with respect to the above, have

policyholder. understood the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- LVMH, Tiffany Merger AgreementDocument100 pagesLVMH, Tiffany Merger AgreementThe Fashion Law100% (1)

- Technical Advisory Committee On Claims Processing Texas 2010Document33 pagesTechnical Advisory Committee On Claims Processing Texas 2010Texas WatchdogNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- SMP 25 Years 1 LakhDocument3 pagesSMP 25 Years 1 LakhTamil Vanan NNo ratings yet

- SMP 20 Years 1 LAKHDocument3 pagesSMP 20 Years 1 LAKHTamil Vanan NNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- SMP 15 Year 1 LAKHDocument3 pagesSMP 15 Year 1 LAKHTamil Vanan NNo ratings yet

- Sanchay Fix 15-15Document3 pagesSanchay Fix 15-15Ravi KumarNo ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- IllustrationDocument3 pagesIllustrationsukh37949No ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- Hdfc-Illustration - 2022-09-09T113844.627Document3 pagesHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantagekesk32No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration - 2022-10-15T114040.772Document3 pagesIllustration - 2022-10-15T114040.772BLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- IllustrationDocument3 pagesIllustrationNiranjan LenkaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument3 pagesIllustrationpraharshafciNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- IllustrationDocument2 pagesIllustrationnikhilraoNo ratings yet

- Illustration - 2023-11-04T171018.610Document2 pagesIllustration - 2023-11-04T171018.610bakavoNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- Pending 1692863217 IllustrationDocument2 pagesPending 1692863217 IllustrationDishani MaityNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Insurance IllustrationDocument3 pagesInsurance Illustrationshikharjain101995No ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- CalculationDocument5 pagesCalculationSaurabh GoreNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument2 pagesIllustrationSakshi RaghuvanshiNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- RelianceDocument8 pagesRelianceMags VNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Renalyn Q. Tagubase: Financial AdvisorDocument21 pagesRenalyn Q. Tagubase: Financial AdvisorRENSKIENo ratings yet

- Acca f6 Taxation Vietnam 2011 Dec QuestionDocument14 pagesAcca f6 Taxation Vietnam 2011 Dec QuestionNguyễn GiangNo ratings yet

- Employee Share Ownership Plan: New Enrolment / Contribution Change FormDocument1 pageEmployee Share Ownership Plan: New Enrolment / Contribution Change FormMalvin ChuaNo ratings yet

- Top Brands of IndiaDocument14 pagesTop Brands of Indiauim KollamNo ratings yet

- Wealth-Insight - May 2021Document66 pagesWealth-Insight - May 2021vnmasterNo ratings yet

- Integrated Annual Report 2021 22Document388 pagesIntegrated Annual Report 2021 22Suhail DastanNo ratings yet

- 1.5 MasterTransaction M17 Q7Document10 pages1.5 MasterTransaction M17 Q7Marwan DababnehNo ratings yet

- IEM Form of Contract For Mechanical & Electrical Works - 2017Document80 pagesIEM Form of Contract For Mechanical & Electrical Works - 2017leonwun25100% (1)

- Final PPA of Kusum A Component - MiniDocument34 pagesFinal PPA of Kusum A Component - MiniintangiblegiftsofficialNo ratings yet

- Socket Realty Acts As An Agent in Buying Selling RentingDocument1 pageSocket Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNo ratings yet

- BIR Ruling 007-2007Document5 pagesBIR Ruling 007-2007Atty Rester John NonatoNo ratings yet

- IMC UNIT 1 Mock 1 KitDocument9 pagesIMC UNIT 1 Mock 1 KitSabinaNo ratings yet

- Acctg 202 - Module 1 - Strategic Cost ManagementDocument47 pagesAcctg 202 - Module 1 - Strategic Cost ManagementMaureen Kaye PaloNo ratings yet

- Problem 1 - Bobby Pacquio, A Lawyer Opened His Office On September 12, 2020. The Following Transactions Were Completed During The MonthDocument3 pagesProblem 1 - Bobby Pacquio, A Lawyer Opened His Office On September 12, 2020. The Following Transactions Were Completed During The MonthMark Angelo GarciaNo ratings yet

- Travel InsuranceDocument5 pagesTravel InsuranceTanima BiswasNo ratings yet

- Ic s01 Motor InsuranceDocument57 pagesIc s01 Motor InsuranceRanjithNo ratings yet

- Bruktbilkontrakt enDocument10 pagesBruktbilkontrakt enElizabeta DanescuNo ratings yet

- SYBCOMDocument79 pagesSYBCOMKiran TakaleNo ratings yet

- Bos 54380 CP 1Document53 pagesBos 54380 CP 1Deepak AsokanNo ratings yet

- Banking Awareness October Set 2Document7 pagesBanking Awareness October Set 2Madhav MishraNo ratings yet

- Comparative Analysis Between Unilever LTD and Procter and GambleDocument9 pagesComparative Analysis Between Unilever LTD and Procter and GambleTazrin RashidNo ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- Certificate of Contribution-PhilhealthDocument1 pageCertificate of Contribution-PhilhealthTrabaho PilipinasNo ratings yet

- Revised CSP Services Agreement 17.08.2020Document17 pagesRevised CSP Services Agreement 17.08.2020satya durga prasad kalaganti100% (1)

- MC08201710198 Click 2 Protect Health - Apollo Munich - Retail - Brochure PDFDocument37 pagesMC08201710198 Click 2 Protect Health - Apollo Munich - Retail - Brochure PDFbharaniNo ratings yet

- Week 1Document49 pagesWeek 1marianaNo ratings yet