Professional Documents

Culture Documents

Employee Share Ownership Plan: New Enrolment / Contribution Change Form

Uploaded by

Malvin ChuaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Share Ownership Plan: New Enrolment / Contribution Change Form

Uploaded by

Malvin ChuaCopyright:

Available Formats

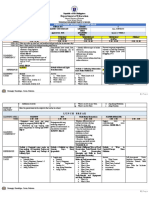

Employee Share Ownership Plan

New Enrolment / Contribution Change Form

Colleague Information

Last name, First name (please print) Colleague ID# Division Social Insurance Number

| |

Eligibility & Contributions

Eligibility to participate in the Employee Share Ownership Plan (“ESOP” or the “Plan”) is subject to completion of six (6) months’ continuous service with

the Company. Contributions to the ESOP must be made through regular payroll deductions and cannot be made in a lump-sum. Your contributions to the

Plan will attract a matching Company contribution equal to 25% of your contributions on a per pay basis. The Company’s contribution represents a taxable

benefit to you.

Computershare Trust Company of Canada, the administrative agent of the ESOP, purchases common shares of Loblaw Companies Limited (“Shares”) on

your behalf upon receipt of contributions from the Payroll Administrator. The number of Shares purchased will depend both on total contributions (your

contributions and the Company matching contributions) and on the market price of the Shares during the purchasing period.

For additional information about the Plan, please refer to the ESOP Summary posted on Loblaw Inside. If you don’t have access to Loblaw Inside, contact

the Colleague Info Centre (“CIC”) at 1-877-303-3013 to request that a copy of the Summary be emailed or mailed to you.

Payroll Deduction Authorization

I authorize deductions from my pay as indicated (X) below. I understand that my ESOP enrolment date, payroll deductions or change to payroll deductions,

as applicable, will commence on the first available pay period following receipt of this form by the Regional CIC (or Executive Payroll Department, as

applicable).

❑ New Enrolment ❑ 1% ❑ 2% ❑ 3% ❑ 4% ❑ 5%

❑ Change or Reinstate Payroll Deductions ❑ 1% ❑ 2% ❑ 3% ❑ 4% ❑ 5%

❑ Stop Payroll Deductions

My signature on this Form grants consent for my social insurance number (SIN) to be used by Loblaw and Computershare for the purpose of

administration and compliance with all legal and tax requirements in connection with the ESOP.

I understand and agree that the personal information provided herein or collected in the future by Loblaw may be collected, used, or disclosed to

administer the group policy of which I am an eligible member. My personal information may be collected from and/or released to a third party. These third

parties may include other underwriters, institutions, government and regulatory authorities, and other third parties when required to administer benefits

under the ESOP.

I understand that my personal information will be kept confidential and secure. However, if my consent is withheld or revoked, my participation in the

ESOP may be denied. I understand why my personal information is needed and am aware of the risks of consenting or refusing to consent to its

disclosure.

Colleague Signature Date: (yyyy/mm/dd)

Submit your signed form by email, fax or inter-office mail

Atlantic, Ontario and West Region colleagues Quebec colleagues Loblaw Executives

Colleague Support Centre Colleague Support Centre

Executive Payroll Department

Loblaw Companies Limited Loblaw Companies Limited

George Weston Limited

1 President’s Choice Circle 400, avenue Ste-Croix

22 St. Clair Ave East, 8th Floor

Brampton, ON L6Y 5S5 Ville St. Laurent, Qc H4N 3L4

Toronto, ON M4T 2S7

email: cic@loblaw.ca email: cic@loblaw.ca

email: Pensions.Benefits@weston.ca

fax: 905-861-2353 / toll free 1-888-880-9166 fax: 905-861-2353 / toll free 1-888-880-9166

tel: 1-877-303-3013 tel: 1-877-303-3013 tel: 416-965-5555

CIC / Executive Payroll Use

Date Form Received (yyyy/mm/dd) Date Payroll Updated Date of Last Deduction Processed by: (Insert name of CIC or Executive Payroll Administrator)

(yyyy/mm/dd) (yyyy/mm/dd)

YOU MAKE LOBLAW GREAT!

February 2019

You might also like

- The Financial Death Spiral of the United States Postal Service ...Unless?From EverandThe Financial Death Spiral of the United States Postal Service ...Unless?No ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Member DetailsDocument2 pagesMember DetailsSmith LiriopeNo ratings yet

- Absa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFDocument3 pagesAbsa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFAlvin JantjiesNo ratings yet

- (To Upgrade To Margin or Option Trading) Tda2334Document10 pages(To Upgrade To Margin or Option Trading) Tda2334Sebastian PozoNo ratings yet

- BoA Estmt PDF PDF Financial Transaction Deposit AccountDocument1 pageBoA Estmt PDF PDF Financial Transaction Deposit AccountAnthony AndersonNo ratings yet

- Your Credit Report: Fill Out A Form Pick The Reports You WantDocument20 pagesYour Credit Report: Fill Out A Form Pick The Reports You Wantwhat is thisNo ratings yet

- HRMS & PayrollDocument27 pagesHRMS & PayrollDede KurniawanNo ratings yet

- 10X Umbrella Notification of Withdrawal Form PrintDocument5 pages10X Umbrella Notification of Withdrawal Form PrintsaadiqahNo ratings yet

- APRIL 1, 2011: Preferred Blue PPO Plan Blue Care Elect PPODocument19 pagesAPRIL 1, 2011: Preferred Blue PPO Plan Blue Care Elect PPOIan S. SandovalNo ratings yet

- October 2010 NewsletterDocument2 pagesOctober 2010 NewsletterKen BillburgNo ratings yet

- Member Application: Section A - Member IdentificationDocument3 pagesMember Application: Section A - Member IdentificationgordieNo ratings yet

- Su580 1404en FDocument5 pagesSu580 1404en FDaniel Camilo Granados FlórezNo ratings yet

- Separation Pay TaxabilityDocument3 pagesSeparation Pay TaxabilitybrownboomerangNo ratings yet

- WellnessDocument2 pagesWellnessNikhil AgarwalNo ratings yet

- How To Make Cash Flow Projections - 0Document6 pagesHow To Make Cash Flow Projections - 0Kyll MarcosNo ratings yet

- COBA Newsletter 0408 (GH-31)Document16 pagesCOBA Newsletter 0408 (GH-31)Albany Times UnionNo ratings yet

- Patty Kennedy 310.962.3513: Consumer Purpose Sub-Prime Owner OccupiedDocument4 pagesPatty Kennedy 310.962.3513: Consumer Purpose Sub-Prime Owner OccupiedElizabeth JacksonNo ratings yet

- UKBA FoI Release 21.8.09 SNR MGR BonusesDocument3 pagesUKBA FoI Release 21.8.09 SNR MGR Bonusestaylorp123No ratings yet

- Kids Savings Enrollment AgreementDocument2 pagesKids Savings Enrollment AgreementSSNo ratings yet

- DSNHP00200200000013109 NewDocument11 pagesDSNHP00200200000013109 Newtumpa mandalNo ratings yet

- Summer 2013Document8 pagesSummer 2013lesley_chisholm_1No ratings yet

- Salem-Keizer Public Schools 2012-13 Budget Message (Draft)Document23 pagesSalem-Keizer Public Schools 2012-13 Budget Message (Draft)Statesman JournalNo ratings yet

- L Huang Offer Letter CoOpTermJ-A20 - SignedDocument4 pagesL Huang Offer Letter CoOpTermJ-A20 - SignedplsplsplaNo ratings yet

- Survey365 Information 2020Document3 pagesSurvey365 Information 2020Themba Mhlanga MposekieNo ratings yet

- Knowledge Sharing On Provident FundDocument15 pagesKnowledge Sharing On Provident FundkeziaNo ratings yet

- Change of Option Form 2020Document3 pagesChange of Option Form 2020Charles MutetwaNo ratings yet

- State Bank of India Officers' Association Chandigarh CircleDocument3 pagesState Bank of India Officers' Association Chandigarh CircleKuldeep KushwahaNo ratings yet

- 5348 - 780673 Allied Fee Change FinalDocument1 page5348 - 780673 Allied Fee Change FinalJon KroonNo ratings yet

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- Muhlenkamp Fund Semi Annual 10Document31 pagesMuhlenkamp Fund Semi Annual 10eric695No ratings yet

- Teamsters Local 320 Summer NewsletterDocument8 pagesTeamsters Local 320 Summer NewsletterForward GallopNo ratings yet

- OnlineWL 8378 03 Apr 19 070849Document15 pagesOnlineWL 8378 03 Apr 19 070849velmurug_balaNo ratings yet

- Opportunity MeetingDocument33 pagesOpportunity Meetingapi-258221737100% (1)

- L&T Payroll ManualDocument25 pagesL&T Payroll ManualArun PriyaNo ratings yet

- Bank Statement - 2023-05-25Document4 pagesBank Statement - 2023-05-25ozmaedith633No ratings yet

- Form of Ownership Chosen and ReasoningDocument14 pagesForm of Ownership Chosen and ReasoningSheikh MarufNo ratings yet

- Veterans Agency National BranchDocument20 pagesVeterans Agency National Branchapi-26270907No ratings yet

- Globe broadband bill summaryDocument6 pagesGlobe broadband bill summaryJay ReposoNo ratings yet

- Contribution Remittance FormDocument1 pageContribution Remittance FormAsfand Yar BajwaNo ratings yet

- Pre-Authorized Debit Plan ("Pad") : 1. General InformationDocument2 pagesPre-Authorized Debit Plan ("Pad") : 1. General Informationnm_rangaNo ratings yet

- Global Business Continuation Program - Q&A: Worldw Ide Business SupportDocument5 pagesGlobal Business Continuation Program - Q&A: Worldw Ide Business SupportagustiNo ratings yet

- Letter of IntentDocument1 pageLetter of IntentVina Mae LacangNo ratings yet

- Management CompensationDocument29 pagesManagement CompensationFanambinana MamiarimanitraNo ratings yet

- Formula Ire Cand en FINAL RightsDocument12 pagesFormula Ire Cand en FINAL RightsVlad Marie SandulescuNo ratings yet

- Members Update Data FormDocument2 pagesMembers Update Data FormSittie Aimah DPundoma ModasirNo ratings yet

- Wells Fargo Simple Business Checking: Important Account InformationDocument15 pagesWells Fargo Simple Business Checking: Important Account Informationsenia HidalgoNo ratings yet

- OJIDocument4 pagesOJIRobert Dumbrys0% (2)

- Update On Tax Treatment of Services Australia Income Compliance Program RefundsDocument2 pagesUpdate On Tax Treatment of Services Australia Income Compliance Program Refundsalexotp88No ratings yet

- CU SpecEdit - Final5Document8 pagesCU SpecEdit - Final5Latisha WalkerNo ratings yet

- 401 (K) Enrollment BookDocument40 pages401 (K) Enrollment BookSwisskelly1No ratings yet

- Your June Statement: A Snapshot of Your Super AccountDocument12 pagesYour June Statement: A Snapshot of Your Super AccountjennijnewlingNo ratings yet

- Loan Proposal of New Loan ProductDocument2 pagesLoan Proposal of New Loan Productkem erlinaNo ratings yet

- This Agreement Is by and Between Shoebox Bookkeeping & Accounting &Document7 pagesThis Agreement Is by and Between Shoebox Bookkeeping & Accounting &NCB School of Herbalism & Holistic HealthNo ratings yet

- 40 Rewards Member Benefits GuideDocument2 pages40 Rewards Member Benefits GuideMarko JoosteNo ratings yet

- GNRTK00205010000000078 NewDocument12 pagesGNRTK00205010000000078 NewMithlesh YadavNo ratings yet

- PDFDocument4 pagesPDF24allamiNo ratings yet

- Amit Mahanti LOI UpdatedDocument3 pagesAmit Mahanti LOI UpdatedDebi Das SarkarNo ratings yet

- Sample Accountant CV - Great Sample ResumeDocument4 pagesSample Accountant CV - Great Sample ResumedrustagiNo ratings yet

- L 19073 TcaDocument4 pagesL 19073 TcabrocodebymindsNo ratings yet

- Summative Test 1Document3 pagesSummative Test 1Glenda AstodilloNo ratings yet

- Gabriel's Oboe String PartsDocument5 pagesGabriel's Oboe String Partshekerer50% (2)

- 11g SQL Fundamentals I Student Guide - Vol IIDocument283 pages11g SQL Fundamentals I Student Guide - Vol IIIjazKhanNo ratings yet

- pmwj93 May2020 Omar Fashina Fakunle Somaliland Construction IndustryDocument18 pagespmwj93 May2020 Omar Fashina Fakunle Somaliland Construction IndustryAdebayo FashinaNo ratings yet

- DR Horton Homeowners ManualDocument80 pagesDR Horton Homeowners ManualLynn RaisesNo ratings yet

- Lcasean PaperDocument6 pagesLcasean Paperkean ebeoNo ratings yet

- Lab Skill Workbook - Applied Physics - Seph0009 07-12-2023Document87 pagesLab Skill Workbook - Applied Physics - Seph0009 07-12-2023rahulsaitalasilaNo ratings yet

- Organizational Behavior: Eighteenth EditionDocument37 pagesOrganizational Behavior: Eighteenth EditionPrashant Kumar100% (1)

- The Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Document656 pagesThe Routledge Handbook of Translation and Culture by Sue-Ann Harding (Editor), Ovidi Carbonell Cortés (Editor)Rita PereiraNo ratings yet

- Lesson 19 - Preparation of Capital Statement and Balance SheetDocument6 pagesLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayNo ratings yet

- ITC Gardenia LavendreriaDocument6 pagesITC Gardenia LavendreriaMuskan AgarwalNo ratings yet

- GJ ScriptDocument83 pagesGJ ScriptKim LawrenceNo ratings yet

- Parallel Computing: # Registering Cores For Parallel ProcessDocument4 pagesParallel Computing: # Registering Cores For Parallel ProcessJohn SinghNo ratings yet

- Visa Vertical and Horizontal Analysis ExampleDocument9 pagesVisa Vertical and Horizontal Analysis Examplechad salcidoNo ratings yet

- Bible Walk Through - Old TestamentDocument211 pagesBible Walk Through - Old TestamentWei Wang100% (2)

- Nilai Murni PKN XII Mipa 3Document8 pagesNilai Murni PKN XII Mipa 3ilmi hamdinNo ratings yet

- Search For TruthDocument64 pagesSearch For TruthJay Cal100% (5)

- Remove Head IsmDocument67 pagesRemove Head IsmjeremyNo ratings yet

- 7vk61 Catalog Sip E6Document18 pages7vk61 Catalog Sip E6Ganesh KCNo ratings yet

- Democracy Against Domination PDFDocument257 pagesDemocracy Against Domination PDFvmcosNo ratings yet

- Pink Illustrative Weather Quiz Game PresentationDocument28 pagesPink Illustrative Weather Quiz Game PresentationMark Laurenze MangaNo ratings yet

- AUMUND Bucket Elevators 180801Document16 pagesAUMUND Bucket Elevators 180801Tino TorehNo ratings yet

- 100 transaction cycle in VisionPLUS banking systemDocument7 pages100 transaction cycle in VisionPLUS banking systemGoushik Balakrishnan100% (1)

- Barrett Preliminary Injunction in 'Heartbeat Bill' CaseDocument12 pagesBarrett Preliminary Injunction in 'Heartbeat Bill' CaseCincinnatiEnquirerNo ratings yet

- Theory of Machines Kinematics FundamentalsDocument31 pagesTheory of Machines Kinematics FundamentalsmungutiNo ratings yet

- Royalstone ReadmeDocument2 pagesRoyalstone ReadmeAdnan BrianNo ratings yet

- Inelastic Response SpectrumDocument10 pagesInelastic Response Spectrummathewsujith31No ratings yet

- Lenses and Optical Instruments: Major PointsDocument20 pagesLenses and Optical Instruments: Major Points陳慶銘No ratings yet

- Grade 6 Quarter 3 WHLP WEEK 4Document3 pagesGrade 6 Quarter 3 WHLP WEEK 4JaneDandanNo ratings yet

- Monitoring Mouse ActivityDocument4 pagesMonitoring Mouse ActivityrehnaNo ratings yet