0% found this document useful (0 votes)

318 views16 pagesAccounting Problems

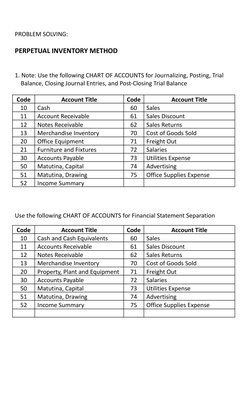

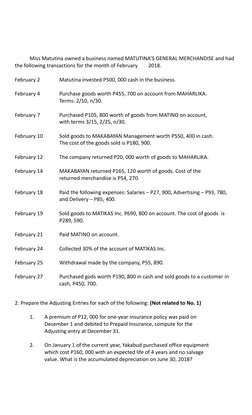

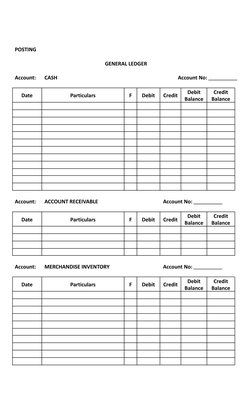

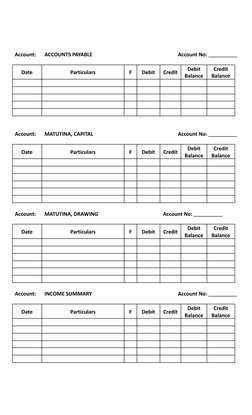

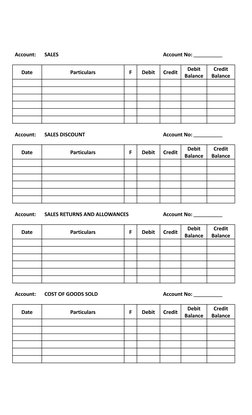

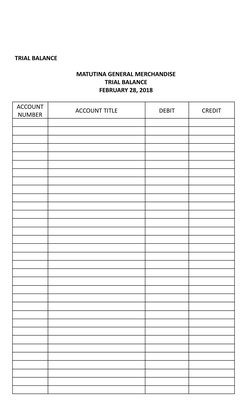

The document provides information about the perpetual inventory method and includes a chart of accounts. It then details transactions in February 2018 for Matutina's General Merchandise business. Key events include investing cash, purchases and sales on account, expenses paid, and withdrawal. The problem involves journalizing, posting, preparing trial balances and financial statements for this business through February 2018.

Uploaded by

Khira Xandria AldabaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

318 views16 pagesAccounting Problems

The document provides information about the perpetual inventory method and includes a chart of accounts. It then details transactions in February 2018 for Matutina's General Merchandise business. Key events include investing cash, purchases and sales on account, expenses paid, and withdrawal. The problem involves journalizing, posting, preparing trial balances and financial statements for this business through February 2018.

Uploaded by

Khira Xandria AldabaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Problem Solving: Perpetual Inventory Method

- Journalization

- Posting

- Financial Statements

- Part II: Adjusting Entries