Professional Documents

Culture Documents

Ajay15 G

Uploaded by

surendra singh kachhavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ajay15 G

Uploaded by

surendra singh kachhavaCopyright:

Available Formats

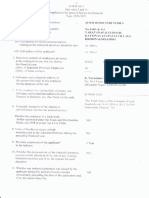

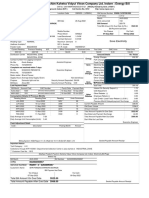

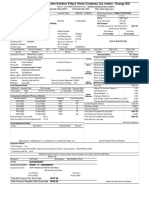

1FORM NO.

15G

[See section 197A(1),197 A(1A) and rule 29C]

Declaration uncler section l97A(l) and section I97A(1A) to be made by an

individual or a persoll (not being a company or firrn) claiming certain

incomes without deduction of tax

PART I

1. Nan-rc of Assessee (Declaraiil) X r": v 4. r nJt- H 2. PAN of the Asscss NAe PS "r' I L{4 &

3. Status2 4. Preirious year(P.Y.)3 5. Residcntial Statusl

2-l -1--'s

(for lvlrich ieclaration is being macle; 20

Ttvlorwsu*t-

6. FIat/Doori Biock No. / \anlrt a)l rl'L-mtse's 8. Road/Street,/Lanc 9. Area./Locality $6 PP1 A6

1 0. Tori n / City / Districl }$itlot 311. State H P 12. PIN 4 y35-S-, 13. Ernail

14. Telephone No. (u,ith STD 15 (n) Wl-rether assessc.d to tax under tlie Yes No

Code) and N'Iobile No. Income-tar Act, 1961s:

+tq7-r7 3 Ls 7

(b) If ves, latest assessnlent vear lcr u'lrich assessed

16. Estimated incorne for lvhich Lhis declaration 17. Estirnated tol:ri income of the P.Y' in rvhicl'r

is rrade incc-rrt-tc meitlioned itr ccilumn 16 1.o be inclLrdccls

18. Detaiis of Form No. 15G other lhan this lorm liled during the previous J'ear, if anvT

Total No. of Form No. 15G filed Aggregate a[tounl of incomc for u'hich Forrl No'15G filed

*:.,

19. Details of incorte for u,hicli lhe declaration is filed

AI Idenlification number of reievant Naturrc oi irtcome Section under r'r,hich tax Anrount of urcomc

No. investntent,/ztccouni, etc.s is deductible

lo I 66 s-S*as* 6Lo PF -vtinaycL{..r.J 11z- n 3q"TT

t e Dec'f.arctnte

D e c lara tio n / Ve ri f i c a tio ttlo

-I/We....fi,5hy-....5nt-v..(rr.1r...."........",......... .mv/r:ur"knou'l-

clo herebl declare that to the best of

.I/We declare that

cdgc anci belief rvhat is stated abovc is corr"ect, cornplcte and is truly statcd.

in the total incorxe of anY othcr pcrsclrl

thclincomcs refcrrecl to in this form are not incluclible -I/We *on

Llnder sections 60 tr: 64 r:t the Income-tax Act, 1961. further dcclar:e that ttrc tax

*incomcfincomes refcrred to in colurnil 16 *ancl

my/our estimatccl tr-rt;rl incc.lrnc incluc[ing

*income/incomes rcferrcd to in column 18 computed in accordancc

aggrcgatc arrrolmt of

t["provisionsof the h'rcome-taxAct, lg6l,fortheprevious]'earerldingon.3l..f.nnr.rA.r.o.a

*mY/our l

"Iit

reler,antto thc assessment -vcar ..2v1'2::.AB.r-J rvill be nil..IlWe also declare that

.incomc/incomes referred io in column 16 .and tlre aggregate arxount r.;f .income/incomes

referred to in colurnn 18 for the previous .vear ending on ............. relevant to the

zrssessment vear ......... rviiinot exceed the maxilnum amount rvhich is not r:hargc-

zrblc to income-tax.

Signati,tre at' the l)eclarante

l. Substitutecl by IT (Four"teenth Amdt') Ruk's 29l-i, 1ii.e.['. 1-10-2015" Eadier^ Form No. 15G rvas

inserted b,v the IT (Fifth Anrdt.) Rules, 1982, rv.e.f .21-6-1982 and later on atnended bv the

IT (F'ifth nmdt.) Ruies, 1989, w.r.e.f. 1-4-1988, lT (For-u-teenth Amdt.) Rules, 1990, w"e.f.

20-11-1990 arrd IT (Trveif th Amdt.) Rules, 2002, w.e.f. 2l-b-2}02 and substituted bv the IT

(Eighth Amcit.)Rules, 2003, rv.c.f.9-6-2003 and iT (Sccond Amdt.) Ruies, 20i 3, lv.e.|.19-2-2AB

You might also like

- Ajay 15 GDocument1 pageAjay 15 Gsurendra singh kachhavaNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- Form No. 15GDocument1 pageForm No. 15GkardinyenduNo ratings yet

- Andhra Pradesh Small Scale Industries Restriction On Sales Tax Holiday Act 1995Document7 pagesAndhra Pradesh Small Scale Industries Restriction On Sales Tax Holiday Act 1995Latest Laws TeamNo ratings yet

- Tamil Nadu Cultivating Tenants (Special Provisions) Amendment Act, 1985Document4 pagesTamil Nadu Cultivating Tenants (Special Provisions) Amendment Act, 1985Anonymous Pz6EolsTC3No ratings yet

- R, Arbqrql (, Sail (: 3Fltf, (Document1 pageR, Arbqrql (, Sail (: 3Fltf, (Nitesh ChaudharyNo ratings yet

- Larry R Hicks Financial Disclosure Report For 2009Document9 pagesLarry R Hicks Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Adobe Scan 20 Jun 2022Document5 pagesAdobe Scan 20 Jun 2022rekha safarirNo ratings yet

- Tax Ordinance No. 2021-22Document3 pagesTax Ordinance No. 2021-22Evangeline PalitayanNo ratings yet

- RMC No 24 2015 QA Scanned Copies of Forms 2307 and 2316 PDFDocument4 pagesRMC No 24 2015 QA Scanned Copies of Forms 2307 and 2316 PDFRalph ZelaNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- Mariana R Pfaelzer Financial Disclosure Report For 2009Document12 pagesMariana R Pfaelzer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Pushpa Form15gDocument2 pagesPushpa Form15gimmanuel alfredNo ratings yet

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- Tamil Nadu Taxation Laws (Inapplicability of Limitation) Act, 1985Document3 pagesTamil Nadu Taxation Laws (Inapplicability of Limitation) Act, 1985Latest Laws TeamNo ratings yet

- Tamil Nadu Taxation Laws (Inapplicability of Limitation) Act, 1985 PDFDocument3 pagesTamil Nadu Taxation Laws (Inapplicability of Limitation) Act, 1985 PDFLatest Laws TeamNo ratings yet

- 911 Taxpayer AssistanceDocument1 page911 Taxpayer Assistanceapi-3826089No ratings yet

- United DC-6/7 Combined Flight ManualDocument578 pagesUnited DC-6/7 Combined Flight Manualsimonduder85No ratings yet

- House.: Disclosure Summary Page AsDocument6 pagesHouse.: Disclosure Summary Page AsZach EdwardsNo ratings yet

- Adobe Scan 9 Feb 2024Document2 pagesAdobe Scan 9 Feb 2024anusha.veldandiNo ratings yet

- RR No. 20-2020 PDFDocument2 pagesRR No. 20-2020 PDFBobby Olavides SebastianNo ratings yet

- RMC No 62-16 Tax Treatment of Passed-On GRT PDFDocument3 pagesRMC No 62-16 Tax Treatment of Passed-On GRT PDFGil PinoNo ratings yet

- MahaRERA RADocument21 pagesMahaRERA RAharshNo ratings yet

- International Prisoner Transfer DataDocument4 pagesInternational Prisoner Transfer DataJustin PichéNo ratings yet

- Fully Vouched Contingent BillDocument2 pagesFully Vouched Contingent BillVirendra MahalaNo ratings yet

- SI 2018-205 - Amendments To Finance Act & Income Tax ActDocument4 pagesSI 2018-205 - Amendments To Finance Act & Income Tax ActMelody Tendayi SaunyamaNo ratings yet

- Itemized Campaign Finance DisclosureDocument30 pagesItemized Campaign Finance DisclosureThe Valley IndyNo ratings yet

- Suburban Express FilingDocument9 pagesSuburban Express FilingNewsTeam20No ratings yet

- FR', e /s /": Ea PP - NGDocument2 pagesFR', e /s /": Ea PP - NGZach EdwardsNo ratings yet

- Obaidul Quader's Income Tax CertificateDocument9 pagesObaidul Quader's Income Tax CertificateNetra NewsNo ratings yet

- F T I '"". U .: DisclosureDocument4 pagesF T I '"". U .: DisclosureZach EdwardsNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024anusha.veldandiNo ratings yet

- RR No. 6-2018Document2 pagesRR No. 6-2018Andrew Benedict PardilloNo ratings yet

- Mona Chirag DarjiDocument3 pagesMona Chirag Darjikirit patelNo ratings yet

- Turbine PDFDocument22 pagesTurbine PDFare fiqah77No ratings yet

- 5502newDocument2 pages5502newDeepak PhogatNo ratings yet

- Richard E Dorr Financial Disclosure Report For 2009Document17 pagesRichard E Dorr Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- India Sudar TaxFile 2005-06Document7 pagesIndia Sudar TaxFile 2005-06India Sudar Educational and Charitable Trust100% (1)

- 2018-10-31 - T1 - Transitional Policy For Ongoing Prop (CIRCULAR NO.33 of 2018-19)Document4 pages2018-10-31 - T1 - Transitional Policy For Ongoing Prop (CIRCULAR NO.33 of 2018-19)Mandeep SinghNo ratings yet

- '$#F, ?+ L, T I' Eu Oi "TFF HFDocument1 page'$#F, ?+ L, T I' Eu Oi "TFF HFZach EdwardsNo ratings yet

- Ry-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), RilnrqDocument4 pagesRy-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), Rilnrqcalmincometax36No ratings yet

- De Boef Betty - 1237 - ScannedDocument4 pagesDe Boef Betty - 1237 - ScannedZach EdwardsNo ratings yet

- Tariff 2019-20 Wef 1 June 19Document6 pagesTariff 2019-20 Wef 1 June 19khuranapalak96No ratings yet

- RMC No. 135-2019Document4 pagesRMC No. 135-2019Jeffrey Dela Rosa BautistaNo ratings yet

- Ylrr: :",F R:: Na Ts and Repo, TS",R, Ffii T"T" 20t I Jan T 2 'TRDocument4 pagesYlrr: :",F R:: Na Ts and Repo, TS",R, Ffii T"T" 20t I Jan T 2 'TRZach EdwardsNo ratings yet

- Income Tax Exemption 21Document7 pagesIncome Tax Exemption 21samNo ratings yet

- F, A& %-,ffi'lk) : Lli'//'l'lDocument3 pagesF, A& %-,ffi'lk) : Lli'//'l'lMobile LegendsNo ratings yet

- NCR No.-6Document7 pagesNCR No.-6Galsingh ChouhanNo ratings yet

- IT Circular For FY 2020-21Document1 pageIT Circular For FY 2020-21Praveen Kumar ArjalaNo ratings yet

- Notification For Inclusion of Mephedrone Under Psychotropic SubstancesDocument6 pagesNotification For Inclusion of Mephedrone Under Psychotropic SubstancespzohmingthangaNo ratings yet

- Otto R Skopil Financial Disclosure Report For 2009Document6 pagesOtto R Skopil Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Premises: Situation Premises: I' Lnd1Tstlltts 4iiiDocument2 pagesPremises: Situation Premises: I' Lnd1Tstlltts 4iiiAssistant Inspector of Labour KrishnagiriNo ratings yet

- R - : I'ende4Kl/E Fo Ffi'upp1y/workof ', ' ,',: ' (ShortDocument1 pageR - : I'ende4Kl/E Fo Ffi'upp1y/workof ', ' ,',: ' (ShortMundakayam Substation KSEBNo ratings yet

- Laq Instructions and Check ListDocument26 pagesLaq Instructions and Check ListSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Document4 pagesDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaNo ratings yet

- Voucher and VRET Format For Payment 12.06.19Document2 pagesVoucher and VRET Format For Payment 12.06.19RahulNo ratings yet

- Raymond C Clevenger III Financial Disclosure Report For 2009Document12 pagesRaymond C Clevenger III Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Airtravel Om26102016 PDFDocument2 pagesAirtravel Om26102016 PDFshankerahulNo ratings yet

- Cdac 09-09-2023Document4 pagesCdac 09-09-2023surendra singh kachhavaNo ratings yet

- Acknowledgement Slip - Online Demographics UpdateDocument1 pageAcknowledgement Slip - Online Demographics UpdateLev AnangNo ratings yet

- Save Electricity: N3249012818 DHS11 - 71 - 3249012818Document1 pageSave Electricity: N3249012818 DHS11 - 71 - 3249012818surendra singh kachhavaNo ratings yet

- N3283006557 Aug-2022Document1 pageN3283006557 Aug-2022surendra singh kachhavaNo ratings yet

- N3283006557 Sep-2022Document1 pageN3283006557 Sep-2022surendra singh kachhavaNo ratings yet

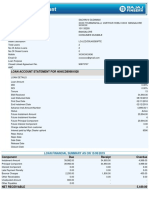

- Statement of Axis Account No:920010001115480 For The Period (From: 10-10-2022 To: 12-10-2022)Document2 pagesStatement of Axis Account No:920010001115480 For The Period (From: 10-10-2022 To: 12-10-2022)surendra singh kachhavaNo ratings yet

- IBPS Clerk Interview QuestionsDocument4 pagesIBPS Clerk Interview QuestionsSai KaneNo ratings yet

- Nero's Pasta Case Study Analysis - Group 9Document9 pagesNero's Pasta Case Study Analysis - Group 9ajaxorNo ratings yet

- Payables 11i Test ScenariosDocument58 pagesPayables 11i Test ScenariosyasserlionNo ratings yet

- Book ListDocument10 pagesBook Listdj1284No ratings yet

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- Kochi Issues With Initial of Haider AliDocument4 pagesKochi Issues With Initial of Haider AliJee Francis TherattilNo ratings yet

- MS-4 Dec 2012 PDFDocument4 pagesMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNo ratings yet

- Legal and Regulatory Aspects of Money Laundering: Presented byDocument80 pagesLegal and Regulatory Aspects of Money Laundering: Presented byHema MehtaNo ratings yet

- PDFDocument7 pagesPDFClaytonNo ratings yet

- InsuranceDocument188 pagesInsurancetura kedirNo ratings yet

- Lenders+Deck+Mar'23 IFSDocument18 pagesLenders+Deck+Mar'23 IFSGautam MehtaNo ratings yet

- BAC 2020 Annual ReportDocument207 pagesBAC 2020 Annual ReportLituyopNo ratings yet

- Capital Market V/s Money MarketDocument23 pagesCapital Market V/s Money Marketsaurabh kumarNo ratings yet

- Appendix 32 DVDocument1 pageAppendix 32 DVJohn-Rey ManzanoNo ratings yet

- Credit Rating Report On Pinaki Garments LimitedDocument1 pageCredit Rating Report On Pinaki Garments LimitedNishita AkterNo ratings yet

- The Yoruba Ile-Ori and Its Cowries A Complex Example of A Complex World View of MoneyDocument16 pagesThe Yoruba Ile-Ori and Its Cowries A Complex Example of A Complex World View of Moneyatomlinson_teague67% (3)

- International Financial Reporting and Analysis 7th Edition Alexander Solutions ManualDocument13 pagesInternational Financial Reporting and Analysis 7th Edition Alexander Solutions Manualcrastzfeiej100% (15)

- Digital EnvironmentDocument13 pagesDigital EnvironmentPrathameshNo ratings yet

- Jun2023Document15 pagesJun2023Piyush NagarNo ratings yet

- Request For Academic Transcript Form V2-18 - 04 - 12Document1 pageRequest For Academic Transcript Form V2-18 - 04 - 12summerskiesNo ratings yet

- Sample Credit Card BillDocument2 pagesSample Credit Card BillCeresjudicata100% (1)

- 4040 CD 89981928Document3 pages4040 CD 89981928Sachin N GudimaniNo ratings yet

- Project On Banking System: Chapter - 1 Introduction To BankDocument62 pagesProject On Banking System: Chapter - 1 Introduction To Bankmanwanimuki12No ratings yet

- S.Samanta & Co.: (Chartered Accountants)Document2 pagesS.Samanta & Co.: (Chartered Accountants)Samrat MajumderNo ratings yet

- Img 20221210 0001-1Document1 pageImg 20221210 0001-1Sandy MNo ratings yet

- 2018 - Mock AnswerDocument3 pages2018 - Mock AnswerNghiem Nguyen VinhNo ratings yet

- Ch10 PPTDocument62 pagesCh10 PPTmuhammad Adeel0% (1)

- Ajanta PharmaDocument18 pagesAjanta Pharmaumesh.raoNo ratings yet

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiNo ratings yet

- Final FMDocument17 pagesFinal FMNikita MaskaraNo ratings yet