Professional Documents

Culture Documents

Form No. 15G

Uploaded by

kardinyendu0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

FORM NO. 15G

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageForm No. 15G

Uploaded by

kardinyenduCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

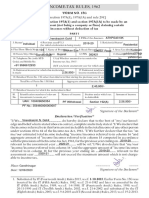

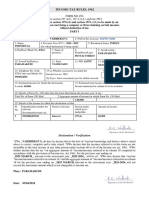

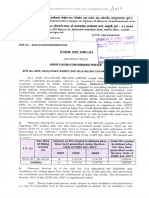

INCOME-TAX RULES, 1962

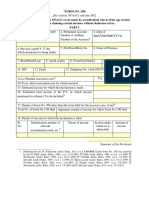

FORM NO. I5G

[See sectlon 197A(1), 197A(1A) and rule 29C]

Declaration under sectlon 197A(1) and sectlon 197A(1A) to be made by an

Indivldual or a person (not being a company or firm) clalmlng

Ing certaln

Incomes wlthout deductton of tux

PARTI

1. Nane of Asesnce (Declarana) Fatup KUMAR PRAD 2. PAN d the Asesee T1Pp3OrA L

3.Stotus

NDIVISOAL

4 Previous

9023-244

drsbih lolaratlon is te ntale)

5. Residential Stus

6.Flat/or/Bloxk Ne. 7 Nameof Pre:nists 9, Ara. LaNaley

Jerkoa

10 Towy CIy Drit 11.State Hest Benga12. PIN 412401.

14 Telenhe (with sTD I5 (ui Whether asesd ta tax under the

Codel ud Mobile Na Incom-tan Act, 161:

|4434444432 (h LF ves, latest asyument year tor wltich asessed

I6. Eatimated incone for which this declaration 17, Estimated tutal inicoe l the PY nwhkh

inome Tenoncd in culln l lo neODA

I3. Detuils f Fam No. I5G other than tis torn led during the pivs yea, if any

Tocal Nu.uf Fomu Nu, 15G iled Aguregate arnoant ot came fu swtich Fotn Nool5G liet

NP NA

19. Details uf iincue lorwhich the declariton is Filed

Naturef incote Stction udet whels tis Anount o incume

kentitication nunher ofrelevant

inestment/accoa, etc. is deuctible

PF|o1064 q2304 PF HITHDRAMAL 192A

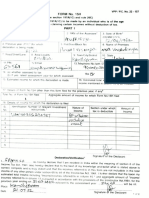

Signauire of the Declaran

Declaration/Verification'

"UWe.ANyp KuMA.QRADMAN. do hereby declare that to thestated,

best of'1/Wedeclarethat

"my our knot

cdgeand belicf what isstatedaboveiscorrect,complete and istrulv

the incomes referred to in this form are not includible in the total income of any otherperson

under scetions 60 to 64 of the Income-tax At, 1961l. "T/We urnher delare that the tax 'on

l6 and

my/our estimated total icome including income/incones relerred to in column

aggregate amount ol "income/incomes relered to in colun vear 18 co1puted in accordattce

withtheprovisions of the Income-taxAet, 1961,fortheprevious endingon.20.4

relevant to the assess1ment year.225..2.4.... will be mil. T/We also declare that 'mvour

"income/incomes referred to in column l6'and the aggregate anmount of icome/ihcomes

referred to in column 18 lor the previous ycar endimg ou 32.4. relevant to the

asscssmcnt vear.202.3..2... will not exceed the maximum amount which is not charge

able to income-tax.

Place: ERAMnBn4.

Signatt1re of the Declarant"

Date: .....

Farlier Form No. 15G w

2015,

1. Substituted bv IT (Fourteenth Aridt.) K u S l1-10-2015.

ew.cf. 8 aud later on anended by the

inserted by the lT (Fifth Amdt) Res e Eurteenth Amdt) Rules, T9,

IT (Filh Amdt.) Rules, S , 2-6-2002 and substituled by the

20)-11-1990 and n awen A n u S d Adt.) Rules, 2013, W..193.

Eighth Amdt.) Rules. 2003, w.ef.9

You might also like

- Stamps Duties ActDocument62 pagesStamps Duties Actreine_jongNo ratings yet

- MBA - 20 Part-3 Unit3Document10 pagesMBA - 20 Part-3 Unit3priya srmNo ratings yet

- Redundancy and the Law: A Short Guide to the Law on Dismissal with and Without Notice, and Rights Under the Redundancy Payments Act, 1965From EverandRedundancy and the Law: A Short Guide to the Law on Dismissal with and Without Notice, and Rights Under the Redundancy Payments Act, 1965Rating: 4 out of 5 stars4/5 (1)

- UK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPFrom EverandUK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPNo ratings yet

- Fee Protection Agreement - sampLEDocument3 pagesFee Protection Agreement - sampLEmario100% (4)

- Mumbai Data CFODocument288 pagesMumbai Data CFOPreet Tiwari100% (1)

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- Lecture 11 PPT - PPT Business ModelDocument30 pagesLecture 11 PPT - PPT Business Modelmohammadaliae71100% (1)

- Project Management..Book Scanned-1Document194 pagesProject Management..Book Scanned-1Norwellah Macmod100% (3)

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- Ajay15 GDocument1 pageAjay15 Gsurendra singh kachhavaNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDocument4 pagesAKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDebarshi SenguptaNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Ajay 15 GDocument1 pageAjay 15 Gsurendra singh kachhavaNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Income Tax Act1989 - 42Document47 pagesIncome Tax Act1989 - 42BrooksNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- SanskritDocument2 pagesSanskritSAMPATH RAMESHNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- Adobe Scan 20 Jun 2022Document5 pagesAdobe Scan 20 Jun 2022rekha safarirNo ratings yet

- Form 15G PDFDocument2 pagesForm 15G PDFLegend RickNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- 323 To 325 - Da - BS Ii21022024192715Document6 pages323 To 325 - Da - BS Ii21022024192715Legal DepartmentNo ratings yet

- CREATE IRR Amendment (Rule 18, Sec. 5)Document2 pagesCREATE IRR Amendment (Rule 18, Sec. 5)Basille QuintoNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Parul SinglaNo ratings yet

- Form 15HDocument2 pagesForm 15HNithya SathyaprasathNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- RR No. 25-2020Document2 pagesRR No. 25-2020Kram Ynothna BulahanNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- Richard E Dorr Financial Disclosure Report For 2009Document17 pagesRichard E Dorr Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Skills Development Levies Act - 9of1999Document13 pagesSkills Development Levies Act - 9of1999jadesterNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)royprithvi37No ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Form 15 H - 2020-21Document2 pagesForm 15 H - 2020-21Lavesh DixitNo ratings yet

- Universal Self: Be A Respectable Taxpayer Submit Return in Due Time Avoid PenaltyDocument20 pagesUniversal Self: Be A Respectable Taxpayer Submit Return in Due Time Avoid PenaltyShuvro PaulNo ratings yet

- NIC161Document4 pagesNIC161coffeepathNo ratings yet

- Ry-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), RilnrqDocument4 pagesRy-Ff, Tlil:: +R+FRQ, Iir6r (RRLST), Rilnrqcalmincometax36No ratings yet

- DHS, FEMA and Dept. of State: Failure of Hurricane Relief Efforts: 08-20-1998 Order Number 40-YA-BC-803055Document2 pagesDHS, FEMA and Dept. of State: Failure of Hurricane Relief Efforts: 08-20-1998 Order Number 40-YA-BC-803055CREWNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- Larry R Hicks Financial Disclosure Report For 2009Document9 pagesLarry R Hicks Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Adobe Scan 27-Jan-2024Document3 pagesAdobe Scan 27-Jan-2024kardinyendu100% (1)

- SBI PassbookDocument1 pageSBI PassbookkardinyenduNo ratings yet

- Adobe Scan 27-Jan-2024Document1 pageAdobe Scan 27-Jan-2024kardinyenduNo ratings yet

- Adobe Scan 08-Jan-2024Document15 pagesAdobe Scan 08-Jan-2024kardinyenduNo ratings yet

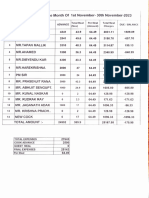

- February 2024 Month Mess Calculation...Document1 pageFebruary 2024 Month Mess Calculation...kardinyenduNo ratings yet

- ACC Ind PVT Ltd. Dibyendu Appointment LaterDocument3 pagesACC Ind PVT Ltd. Dibyendu Appointment LaterkardinyenduNo ratings yet

- Adobe Scan 06-Nov-2023Document16 pagesAdobe Scan 06-Nov-2023kardinyenduNo ratings yet

- Adobe Scan 06-Nov-2023Document1 pageAdobe Scan 06-Nov-2023kardinyenduNo ratings yet

- Adobe Scan 06 Jan 2024Document15 pagesAdobe Scan 06 Jan 2024kardinyenduNo ratings yet

- Adobe Scan 04-Mar-2024Document3 pagesAdobe Scan 04-Mar-2024kardinyenduNo ratings yet

- Adobe Scan 06-Nov-2023Document1 pageAdobe Scan 06-Nov-2023kardinyenduNo ratings yet

- Aconsumer's Willingness To Substitute One Good For Another Will Depend On The Commodities in Question. ForDocument3 pagesAconsumer's Willingness To Substitute One Good For Another Will Depend On The Commodities in Question. ForFebrian AlexsanderNo ratings yet

- Advance Logistics Management Course - Senior MGMTDocument2 pagesAdvance Logistics Management Course - Senior MGMTzulkarnainahmad_conanNo ratings yet

- Monthly Alphalist of Payees (MAP) For Supplier of Goods & Services For MARCH 2019Document16 pagesMonthly Alphalist of Payees (MAP) For Supplier of Goods & Services For MARCH 2019Andrea BuenoNo ratings yet

- Global Management: Managing Across Borders: By: Estephany GeronaDocument18 pagesGlobal Management: Managing Across Borders: By: Estephany GeronaJamesAnthonyNo ratings yet

- Pre-Week (Llamado)Document25 pagesPre-Week (Llamado)Mischievous MaeNo ratings yet

- Chapter 1 Economics and It's NatureDocument31 pagesChapter 1 Economics and It's NatureAlthea Faye RabanalNo ratings yet

- Bharat Engineering Works LTDDocument13 pagesBharat Engineering Works LTDKuldeep jajraNo ratings yet

- 04-08-2021 Incident ReportDocument2 pages04-08-2021 Incident ReportnoahojitoNo ratings yet

- Chapter 26 Saving, Investment, and The Financial SystemDocument32 pagesChapter 26 Saving, Investment, and The Financial SystemNusaiba Binte MamunNo ratings yet

- Lean Six Sigma Green BeltDocument2 pagesLean Six Sigma Green BeltManjula RNo ratings yet

- PTW General Work - 2020, FilledDocument4 pagesPTW General Work - 2020, FilledPalaniappan SolaiyanNo ratings yet

- Fund Formation Attracting Global Investors PDFDocument87 pagesFund Formation Attracting Global Investors PDFSushimNo ratings yet

- Line of BalanceDocument14 pagesLine of BalanceBrijbhushan SinghNo ratings yet

- Tadano All Terrain Crane Ar 5500m 1 Gd5015 Operation Manual 2018 enDocument22 pagesTadano All Terrain Crane Ar 5500m 1 Gd5015 Operation Manual 2018 enchasewashington200487noi100% (119)

- IPA Seminar in Indonesia - Sponsorship OpportunitiesDocument3 pagesIPA Seminar in Indonesia - Sponsorship Opportunitiesrizkysatria PREMIUMNo ratings yet

- Assidi, S. (2020)Document13 pagesAssidi, S. (2020)Aby HuzaiNo ratings yet

- Token Economics: What Is Braintrust?Document2 pagesToken Economics: What Is Braintrust?CaxonNo ratings yet

- University of Science and Technology of Southern PhilippinesDocument3 pagesUniversity of Science and Technology of Southern PhilippinesLayla Miya100% (1)

- Cad-Cam Manual PDFDocument34 pagesCad-Cam Manual PDFM.Saravana Kumar..M.E100% (2)

- Sunrise CSP India NDADocument8 pagesSunrise CSP India NDAraghav joshiNo ratings yet

- BB050523125230716Document1 pageBB050523125230716chidambari SahooNo ratings yet

- A Project On Retail Marketing Mix and Store Layout of Ramraj Cotton, Thiruvanmiyur Retail OutletDocument20 pagesA Project On Retail Marketing Mix and Store Layout of Ramraj Cotton, Thiruvanmiyur Retail Outletroshini rajendran100% (1)

- Huc Acc201-Revision Questions May Intake, 2022Document4 pagesHuc Acc201-Revision Questions May Intake, 2022Sritel Boutique HotelNo ratings yet

- Ipr Unit 4Document57 pagesIpr Unit 4Tanay SHAHNo ratings yet

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet