Professional Documents

Culture Documents

Correction IRA No. 3 (G)

Uploaded by

Prolen AcantoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Correction IRA No. 3 (G)

Uploaded by

Prolen AcantoCopyright:

Available Formats

Corrections for IRA No.

3, Problem (G)

Please see some corrections for IRA No. 3, Problem G (in red fonts).

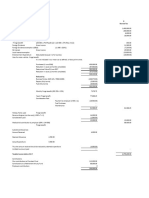

G.

No. 1:

Fringe Benefits Tax:

Monetary value received:

Motor vehicle P1,020,000

De minimis benefits:

Rice allowance (147,200-24,000) 123,200

Medical allowance (101,800 – 10,000) 91,800

Total 215,000

Less – Other benefit exclusion (90,000) 125,000

Taxable monetary value (or value of benefit) P1,145,000

/ 65%

Grossed-up monetary value 1,761,538.46

x 35%

Fringe benefit tax P 616,538.46

Notes:

The amount of P18,000 in the old solution provided was based on the OLD rice subsidy which

was still at P1,500 monthly.

Updated rice allowance is now at P2,000 per month de minimis ceiling amount.

No. 2:

Amount of deduction for employer:

Motor vehicle 1,020,000.00

Rice allowance 147,200.00

Medical allowance 101,800.00

Total fringe benefits expense (including de minimis) 1,269,000.00

Fringe benefits tax expense 616,538.46

Total deduction for employer 1,885,538.46

No. 3:

Non-taxable Monetary Value:

De minimis within ceiling:

Rice allowance 24,000

Medical allowance 10,000 34,000

Other benefits 90,000

Non-taxable monetary value 124,000

You may not under any circumstances, transmit, reproduce, distribute, display, or lend, in whole or part, any of the contents provided in this document. Access to

this material is used solely as an educational tool for distance and remote learning and for the personal use only of students enrolled in BA 127 FS 2022-2023.

You might also like

- IRA No. 3 Answer KeyDocument4 pagesIRA No. 3 Answer KeyProlen AcantoNo ratings yet

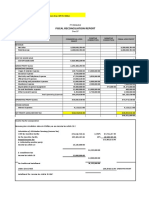

- Government Rank and File Employee Summary of Compensation and Benefits in 2020Document4 pagesGovernment Rank and File Employee Summary of Compensation and Benefits in 2020kate bautistaNo ratings yet

- IRA No. 4 Answer KeyDocument3 pagesIRA No. 4 Answer KeyProlen AcantoNo ratings yet

- For The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Document2 pagesFor The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Aleksa FelicianoNo ratings yet

- Part 4Document7 pagesPart 4Kushagra BurmanNo ratings yet

- Corporate Accounting - II (Solutions)Document107 pagesCorporate Accounting - II (Solutions)Leo JacobNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Tax 3702 Assignment 2Document3 pagesTax 3702 Assignment 2ngoloyintomboxoloNo ratings yet

- R2. TAX ML Solution CMA January 2022 ExaminationDocument6 pagesR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- BDC-PNL Wilmar Ref PLTG 2018Document18 pagesBDC-PNL Wilmar Ref PLTG 2018Biyan FarabiNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- CTC Offered For The Role IsDocument1 pageCTC Offered For The Role IsHimanshi PandeyNo ratings yet

- Insurance Company AccountsDocument12 pagesInsurance Company AccountsSarfaraz ShaikhNo ratings yet

- INCOME TAXATION - Fringe Benefit TaxDocument7 pagesINCOME TAXATION - Fringe Benefit TaxErlle AvllnsaNo ratings yet

- Chapter 10 ProblemsDocument4 pagesChapter 10 ProblemsOnaisah TalibNo ratings yet

- Valencia FBT Chapter 6 5th EditionDocument8 pagesValencia FBT Chapter 6 5th EditionJacob AcostaNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Question 1-Page 188: Chapter 25 - Income Tax in Bfis and Insurance CompaniesDocument2 pagesQuestion 1-Page 188: Chapter 25 - Income Tax in Bfis and Insurance CompaniesBashu GuragainNo ratings yet

- Revised Compensation ETDocument2 pagesRevised Compensation ETSantosh SonavaneNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Final Bomb (Before Main Body)Document7 pagesFinal Bomb (Before Main Body)Mohammad helal uddin ChowdhuryNo ratings yet

- Atien Rachman - CalcDocument2 pagesAtien Rachman - CalcQonita LuthfiaNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Torch and Shield Security Agency: Cost DistributionDocument1 pageTorch and Shield Security Agency: Cost DistributionJomar Del BarrioNo ratings yet

- Chapter 3 - LeveragesDocument9 pagesChapter 3 - LeveragesParth GargNo ratings yet

- Insurance Company Accounts: Solutions To Assignment ProblemsDocument13 pagesInsurance Company Accounts: Solutions To Assignment ProblemsBAZINGANo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- JackieLunaSamplePolicy PDFDocument1 pageJackieLunaSamplePolicy PDFDom De Ocampo DaigoNo ratings yet

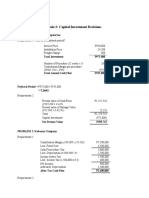

- MADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDocument2 pagesMADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDheine MaderazoNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Ca Ipcc Taxation Guideline Answer For May 2016 ExamDocument8 pagesCa Ipcc Taxation Guideline Answer For May 2016 Examileshrathod0No ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Document34 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Makoy BixenmanNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument7 pagesAnnex This Schedule To The Return of Income If You Have Income From Salariesshamim islam limonNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Darshan Payslip Oct'19 PDFDocument1 pageDarshan Payslip Oct'19 PDFDarshan SubramanyaNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Quiz Gross Income SolutionsDocument1 pageQuiz Gross Income SolutionsMa Jodelyn RosinNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Accenture - OfferletterDocument1 pageAccenture - OfferletternittingulatiNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- C3&4Document4 pagesC3&4Joana MarieNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Annual Budget CY 2022 - WT AjustmentDocument224 pagesAnnual Budget CY 2022 - WT AjustmentClarence GonzalesNo ratings yet

- Payslip SampleDocument1 pagePayslip SampleWayo PhodangNo ratings yet

- 06 Task PerformanceDocument2 pages06 Task PerformanceKatherine Borja67% (3)

- IRA No. 3 FBTXDocument3 pagesIRA No. 3 FBTXProlen AcantoNo ratings yet

- IRA No. 2 Answer KeyDocument2 pagesIRA No. 2 Answer KeyProlen AcantoNo ratings yet

- Correction IRA No. 2 DDocument1 pageCorrection IRA No. 2 DProlen AcantoNo ratings yet

- IRA No. 4 Estate Trust Co-OwnDocument2 pagesIRA No. 4 Estate Trust Co-OwnProlen AcantoNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- Kho Wah Wah Form BK-2Document4 pagesKho Wah Wah Form BK-2Steph SaavedraNo ratings yet

- Si - No. Invoice Date Invoice No. Cleint NameDocument8 pagesSi - No. Invoice Date Invoice No. Cleint NameKishnsNo ratings yet

- In The USA, Personal Income Tax IllegalDocument10 pagesIn The USA, Personal Income Tax IllegalArnulfo Yu LanibaNo ratings yet

- Prelim TaxDocument5 pagesPrelim TaxDonna Zandueta-TumalaNo ratings yet

- Organized PDFDocument9 pagesOrganized PDFAkshita yadavNo ratings yet

- W 8 BenDocument1 pageW 8 Bendavid_valentine_184% (19)

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- Received With Thanks ' 12,571.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 12,571.00 Through Payment Gateway Over The Internet FromGaurav ShyamaniNo ratings yet

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestDocument1 page13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- EMI Prepayment Calculator With Tax BenefitsDocument26 pagesEMI Prepayment Calculator With Tax BenefitsShubham NaikNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- INGETEAM Power Technology India Private LimitedDocument1 pageINGETEAM Power Technology India Private LimitedAmolGonganeNo ratings yet

- Note On House Rent AllowanceDocument5 pagesNote On House Rent AllowanceAbhisek SarkarNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- الانتقال من النتيجة المحاسبية إلى النتيجة الجبائية على ضوء الفروقات بين النظام المحاسبي المالي والنظام الجبائي الجزائري .Document16 pagesالانتقال من النتيجة المحاسبية إلى النتيجة الجبائية على ضوء الفروقات بين النظام المحاسبي المالي والنظام الجبائي الجزائري .hocine_kashi100% (2)

- June PayslipDocument3 pagesJune Paysliphennieswart62No ratings yet

- Epayment Print Common ActionDocument2 pagesEpayment Print Common ActionHema Agarwal0% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument4 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingColeen BiocalesNo ratings yet

- CIR vs. Japan Air Lines, Inc. and CTADocument1 pageCIR vs. Japan Air Lines, Inc. and CTARobinson MojicaNo ratings yet

- Ecorea 2 Invoice Copy 06-09-2023Document1 pageEcorea 2 Invoice Copy 06-09-2023Jai Narayan TemhurkarNo ratings yet

- Perfect Match PDFDocument1 pagePerfect Match PDFtutikaNo ratings yet

- DT DURATION SHEET - CMA INTER - SYL 2022 - AY 2023-24 (20th EDITION)Document2 pagesDT DURATION SHEET - CMA INTER - SYL 2022 - AY 2023-24 (20th EDITION)niteshNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Prem JaiswaraNo ratings yet

- Admissions Report: March April May June Total North East West South TotalDocument20 pagesAdmissions Report: March April May June Total North East West South TotalRoderick GatdulaNo ratings yet

- Format of Computation For Income Tax PayableDocument2 pagesFormat of Computation For Income Tax PayableMiera FrnhNo ratings yet

- U.S. Individual Income Tax Return: Cruz 605-92-4936 Luis EDocument21 pagesU.S. Individual Income Tax Return: Cruz 605-92-4936 Luis ELui67% (3)

- INVOICE: INV44692504 Customer #52693642Document1 pageINVOICE: INV44692504 Customer #52693642Sandy TessierNo ratings yet

- Flexible Price List - 01.09.2017Document1 pageFlexible Price List - 01.09.2017Rajat ChandelNo ratings yet