Professional Documents

Culture Documents

ASSIGNMENT 4 Working Capital Management

Uploaded by

Raven RoxasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ASSIGNMENT 4 Working Capital Management

Uploaded by

Raven RoxasCopyright:

Available Formats

ASSIGNMENT 4

WORKING CAPITAL MANAGEMENT

Answer the following questions.

1. Based on what you observe in your household daily, how do you think your parents maintain the revolving fund in

order to support the family’s daily needs? (5 PTS)

- Since there are five of us in this household, my mother is usually the one who handles financial matters. My

mom would always put needs and necessities first on the list before everything. She do groceries on payday,

pay monthly tuition of my sister, pay electric and water bills and making sure every needs are secured before

putting expenses on wants. We find it challenging to save a lot of money because my older sister is in college

and she’s currently living in a dorm, I’m about to graduate and enter college too, and my younger sister is still

in elementary school, but my mother has always made sure that there is always room for our wants on the list.

She would always save every receipt she got from a purchase, even from a gas station, since she would

compute them all up and know where every penny went instead of just spending it all.

2. How can you help your parents about handling the funds of your family? (5 PTS)

- I've always enjoyed helping my parents limit their expenditures because I'm the middle kid. I was never the "buy

me that, buy me this" kind of kid. I was the child, though, who my parents would encourage to ask for what I

wanted. I believe I brought that up until this point, as a young adult. I would use my own allowance, which I had

saved from the leftover funds, to make purchases when I wanted to. I'm also very giving when it comes to gifts,

but anytime I buy something for myself, I make myself feel bad and tell myself I don't deserve it and I should

simply save up for it the next time, which is why I sometimes think I help my parents to save.

3. How do you relate or apply the concept of working capital even to micro businesses like sari-sari store, a barbecue

stand or a small online shop? Explain your answer. (10 PTS)

- Working capital, which is the difference between a business’s current assets and current liabilities or debts, is

used by a business in its everyday operations. A measure of a business’s operating effectiveness and short-

term financial stability is its working capital. This idea can be applied to tiny enterprises like sari-sari stores. The

money that their consumers give is also the money that they use to purchase additional things to sell, with the

exception that the profit they make is the stuff they'd keep. The same is applicable for barbecue stands; the

money that customers pay is also the money that the vendors use to purchase additional barbecued porks,

blood, intestines, barbecue sauces, and other items that they will offer to customers the following day.

Therefore, it turns into a cycle, a cycle in the financial realm, with the only distinction being that these merchants

profit more as a result. They pay for the materials they would buy for another sale using the same money that

customers would spend. Not only that applies for small businesses like small online shops, barbecues, and

sari-sari stores but it applies to every business there is, entrepreneurs rotate the money in the business and

they gain more from it.

You might also like

- Finance 101 for Kids: Money Lessons Children Cannot Afford to MissFrom EverandFinance 101 for Kids: Money Lessons Children Cannot Afford to MissRating: 5 out of 5 stars5/5 (3)

- 365 Ways to Live Cheap: Your Everyday Guide to Saving MoneyFrom Everand365 Ways to Live Cheap: Your Everyday Guide to Saving MoneyRating: 4 out of 5 stars4/5 (7)

- Workshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Document33 pagesWorkshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Ilie Viorel60% (5)

- An Introduction To Buddhist PsychologyDocument14 pagesAn Introduction To Buddhist PsychologyPemarathanaHapathgamuwa100% (4)

- SQL Queries Interview Questions and Answers - Query ExamplesDocument25 pagesSQL Queries Interview Questions and Answers - Query Examplesiveraj67% (9)

- Extreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingFrom EverandExtreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingRating: 5 out of 5 stars5/5 (1)

- Bad Money Habits: Turn Your Bad Money Habits Into Millionaire Money Habits by Not Spending Money Impulsively, Using Passive Income Strategies, and Investing with a Millionaire MindsetFrom EverandBad Money Habits: Turn Your Bad Money Habits Into Millionaire Money Habits by Not Spending Money Impulsively, Using Passive Income Strategies, and Investing with a Millionaire MindsetRating: 4 out of 5 stars4/5 (1)

- How to Save Money on Groceries Without Coupons: 35 Money-Saving Ideas to Eat Better for LessFrom EverandHow to Save Money on Groceries Without Coupons: 35 Money-Saving Ideas to Eat Better for LessRating: 5 out of 5 stars5/5 (1)

- Saving Money: The 40 Tip Cheat Sheet for Peace of Mind, Effective Budgeting and Financial SuccessFrom EverandSaving Money: The 40 Tip Cheat Sheet for Peace of Mind, Effective Budgeting and Financial SuccessRating: 3.5 out of 5 stars3.5/5 (6)

- Couponing for the Rest of Us: The Not-So-Extreme Guide to Saving MoreFrom EverandCouponing for the Rest of Us: The Not-So-Extreme Guide to Saving MoreRating: 3.5 out of 5 stars3.5/5 (3)

- Spend Smart: Be Thrifty, Budget Better, and How to Spend Your Money When You Don’t Have Much - Without Compromising Your LifestyleFrom EverandSpend Smart: Be Thrifty, Budget Better, and How to Spend Your Money When You Don’t Have Much - Without Compromising Your LifestyleRating: 2 out of 5 stars2/5 (1)

- Reviewer in Per. FinanceDocument11 pagesReviewer in Per. FinanceAki ZamiraNo ratings yet

- Save Your Money, Save Your Family ™ Guide to Savvy Shopping Skills:: How to Reduce Your Weekly Grocery Bill to $85 Per Week--Or Less!From EverandSave Your Money, Save Your Family ™ Guide to Savvy Shopping Skills:: How to Reduce Your Weekly Grocery Bill to $85 Per Week--Or Less!No ratings yet

- Money-Smart Kids: Teach Your Children Financial Confidence and ControlFrom EverandMoney-Smart Kids: Teach Your Children Financial Confidence and ControlRating: 4 out of 5 stars4/5 (5)

- How To Extreme Coupon: Your Step-By-Step Guide To Extreming CouponFrom EverandHow To Extreme Coupon: Your Step-By-Step Guide To Extreming CouponRating: 2 out of 5 stars2/5 (2)

- TSD 202WaysToSaveMoneyNowDocument64 pagesTSD 202WaysToSaveMoneyNowAnthonyNo ratings yet

- How To Save MoneyDocument10 pagesHow To Save Moneymichellouise17No ratings yet

- Because Money Matters: The 8 Principles to Build Your Wealth: Because Money Matters, #1From EverandBecause Money Matters: The 8 Principles to Build Your Wealth: Because Money Matters, #1No ratings yet

- IELTS Part 3 Discussion Questions About Saving MoneyDocument3 pagesIELTS Part 3 Discussion Questions About Saving MoneyXuan TrangNo ratings yet

- CHAPTER 2 - Lovely ResearchDocument19 pagesCHAPTER 2 - Lovely ResearchLovely Joy SalcepuedesNo ratings yet

- Money Matters For All AgesDocument42 pagesMoney Matters For All AgesBenjamin WilliamsNo ratings yet

- Cashcapades - Essay Writing - MissyDocument2 pagesCashcapades - Essay Writing - Missykinahnaquita17No ratings yet

- Piggybanking: Preparing Your Financial Life for Kids and Your Kids for a Financial LifeFrom EverandPiggybanking: Preparing Your Financial Life for Kids and Your Kids for a Financial LifeNo ratings yet

- The Everything Couponing Book: Clip your way to incredible savings!From EverandThe Everything Couponing Book: Clip your way to incredible savings!Rating: 3 out of 5 stars3/5 (2)

- "A Matter of Perspective - Do Money Worries Make You Crazy?" SUZE ORMANDocument7 pages"A Matter of Perspective - Do Money Worries Make You Crazy?" SUZE ORMANGeovanna DelgadoNo ratings yet

- Topic 1 - Money SkillsDocument12 pagesTopic 1 - Money SkillsNjeri TimothysNo ratings yet

- UntitledDocument2 pagesUntitledDrei FaballaNo ratings yet

- The Essential Habits of Conscious Consumers: A Guide to Wise and Sustainable ConsumptionFrom EverandThe Essential Habits of Conscious Consumers: A Guide to Wise and Sustainable ConsumptionNo ratings yet

- Living Big on a Small Budget: Mastering the Art of Successful Personal FinancingFrom EverandLiving Big on a Small Budget: Mastering the Art of Successful Personal FinancingNo ratings yet

- Ielts Speaking - MoneyDocument6 pagesIelts Speaking - MoneyTrần Phương LinhNo ratings yet

- The Retirement Secret: A Simple Approach to Financial Peace-of-MindFrom EverandThe Retirement Secret: A Simple Approach to Financial Peace-of-MindRating: 3 out of 5 stars3/5 (1)

- Help! I Can't Pay My Bills: Surviving a Financial CrisisFrom EverandHelp! I Can't Pay My Bills: Surviving a Financial CrisisNo ratings yet

- Data Analysis A. Reason For Selling That Product/putting Up That BusinessDocument11 pagesData Analysis A. Reason For Selling That Product/putting Up That BusinessErica Nicole MapiNo ratings yet

- SPFL Fa L L Newsl Etter: Who Are We?Document7 pagesSPFL Fa L L Newsl Etter: Who Are We?Maggie HenryNo ratings yet

- Daily Income EarnerDocument56 pagesDaily Income EarnerFidel EhikioyaNo ratings yet

- Shopaholism Intermediate-Upper IntermediateDocument11 pagesShopaholism Intermediate-Upper IntermediateMichelle CorreaNo ratings yet

- How to Make More Money 11 Ideas to Build Extra Income Plus 10 Ways to Make Money OnlineFrom EverandHow to Make More Money 11 Ideas to Build Extra Income Plus 10 Ways to Make Money OnlineRating: 3 out of 5 stars3/5 (1)

- 21st CLPW - Week 1Document61 pages21st CLPW - Week 1Raven RoxasNo ratings yet

- Ilocano and Bicolano Literature PPT 5Document46 pagesIlocano and Bicolano Literature PPT 5Raven RoxasNo ratings yet

- Mil ColgDocument1 pageMil ColgRaven RoxasNo ratings yet

- Panel Report 1Document3 pagesPanel Report 1Raven RoxasNo ratings yet

- Lorem IpsumDocument1 pageLorem IpsumRaven RoxasNo ratings yet

- 21st CLPW - WEEK 2Document32 pages21st CLPW - WEEK 2Raven RoxasNo ratings yet

- Assignment-2-Group 5Document4 pagesAssignment-2-Group 5Raven RoxasNo ratings yet

- Assignment 2Document3 pagesAssignment 2Raven RoxasNo ratings yet

- American and Japanese PeriodDocument4 pagesAmerican and Japanese PeriodRaven RoxasNo ratings yet

- 2Document2 pages2Raven RoxasNo ratings yet

- Nature of DanceDocument1 pageNature of DanceRaven RoxasNo ratings yet

- FDDocument3 pagesFDRaven RoxasNo ratings yet

- Who Are EntrepreneursDocument1 pageWho Are EntrepreneursRaven RoxasNo ratings yet

- Noli and El FiliDocument2 pagesNoli and El FiliGeramei Vallarta TejadaNo ratings yet

- Verilog HDL: Special ClassesDocument11 pagesVerilog HDL: Special ClassesUnique ProNo ratings yet

- HET Neoclassical School, MarshallDocument26 pagesHET Neoclassical School, MarshallDogusNo ratings yet

- BDU-BIT-Electromechanical Engineering Curriculum (Regular Program)Document187 pagesBDU-BIT-Electromechanical Engineering Curriculum (Regular Program)beselamu75% (4)

- TDS - 0121 - CapaCare Classic - 201912Document5 pagesTDS - 0121 - CapaCare Classic - 201912ayviwurbayviwurbNo ratings yet

- Advanced Concepts of GD&TDocument3 pagesAdvanced Concepts of GD&TPalani Trainer33% (3)

- Abrar AwolDocument153 pagesAbrar AwolErmias Assaminew AlmazNo ratings yet

- Time Value of MoneyDocument11 pagesTime Value of MoneyRajesh PatilNo ratings yet

- Math Achievement Gr11GenMathDocument3 pagesMath Achievement Gr11GenMathMsloudy VilloNo ratings yet

- Assignment (60%) : ECS312 Counselling in SchoolsDocument6 pagesAssignment (60%) : ECS312 Counselling in SchoolsJelebu Charity RunNo ratings yet

- Inter-Bank Fund Transfer: Case Study 6Document5 pagesInter-Bank Fund Transfer: Case Study 6Ravi RanjanNo ratings yet

- Statistics II Week 6 HomeworkDocument3 pagesStatistics II Week 6 Homeworkteacher.theacestudNo ratings yet

- L807268EDocument1 pageL807268EsjsshipNo ratings yet

- Jewelry 7000 Years An International History and Illustrated Survey From The Collections of The - Hugh Tait - May 1991 - Abradale Books - 9780810981034 - Anna's ArchiveDocument264 pagesJewelry 7000 Years An International History and Illustrated Survey From The Collections of The - Hugh Tait - May 1991 - Abradale Books - 9780810981034 - Anna's Archiveeve100% (2)

- Children With Cochlear Implants The Communication JourneeyDocument22 pagesChildren With Cochlear Implants The Communication Journeeyismail39No ratings yet

- Economic GrowthDocument15 pagesEconomic GrowthANJULI AGARWALNo ratings yet

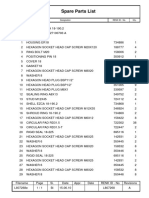

- Komatsu d65px 16 Parts BookDocument20 pagesKomatsu d65px 16 Parts Booklaura100% (54)

- Mathematics IDocument247 pagesMathematics IShreya PankajNo ratings yet

- Mahindra & Mahindra LogisticsDocument3 pagesMahindra & Mahindra LogisticspeednaskNo ratings yet

- Unidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFDocument24 pagesUnidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFpedropruebaNo ratings yet

- Rapid Prototyping and ToolingDocument2 pagesRapid Prototyping and ToolingelangandhiNo ratings yet

- Rod and Pump DataDocument11 pagesRod and Pump DataYoandri Stefania Guerrero CamargoNo ratings yet

- The Life of DadajiDocument87 pagesThe Life of DadajiMike Magee100% (1)

- Conscious Sedation PaediatricsDocument44 pagesConscious Sedation PaediatricsReeta TaxakNo ratings yet

- Monal - An Overview of Marketing Practices: Alishba IjazDocument6 pagesMonal - An Overview of Marketing Practices: Alishba IjazAmy KhanNo ratings yet

- PHP - Google Maps - How To Get GPS Coordinates For AddressDocument4 pagesPHP - Google Maps - How To Get GPS Coordinates For AddressAureliano DuarteNo ratings yet

- Grade 10 SAU 1, Term 4Document5 pagesGrade 10 SAU 1, Term 4Aizat SarsenovaNo ratings yet