Professional Documents

Culture Documents

Tax Sa1

Uploaded by

Lhulaan Ordanozo0 ratings0% found this document useful (0 votes)

34 views2 pagesThis document contains 50 true/false questions testing knowledge of taxation principles under Philippine law. Key points covered include:

- Taxation is a power inherent in sovereignty and necessary for the existence of the state.

- The scope of taxation is comprehensive, plenary, unlimited and supreme.

- Taxation must be based on the necessity of the state and promote the general welfare.

- Taxpayers under the same circumstances should be taxed equally.

Original Description:

Original Title

TAX_SA1 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 50 true/false questions testing knowledge of taxation principles under Philippine law. Key points covered include:

- Taxation is a power inherent in sovereignty and necessary for the existence of the state.

- The scope of taxation is comprehensive, plenary, unlimited and supreme.

- Taxation must be based on the necessity of the state and promote the general welfare.

- Taxpayers under the same circumstances should be taxed equally.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views2 pagesTax Sa1

Uploaded by

Lhulaan OrdanozoThis document contains 50 true/false questions testing knowledge of taxation principles under Philippine law. Key points covered include:

- Taxation is a power inherent in sovereignty and necessary for the existence of the state.

- The scope of taxation is comprehensive, plenary, unlimited and supreme.

- Taxation must be based on the necessity of the state and promote the general welfare.

- Taxpayers under the same circumstances should be taxed equally.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

B-BACD002 [SUMMATIVE 1 – PART 1]

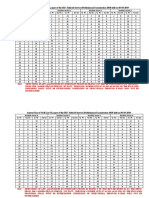

1. International comity connotes courtesy between nations. TRUE

2. The benefit received theory presupposes that some taxpayers within the territorial jurisdiction of the Philippines will

be exempted from paying tax so long as they do not receive benefits from the government. FALSE

3. Taxation is an enforced contribution on the following subjects, except: BEHAVIOR

4. Taxation is separable with the State, hence, it is considered inherent. FALSE

5. Taxation is a rule; exemption is the exception. TRUE

6. The scope of taxation is regarded as comprehensive, plenary, unlimited and supreme. TRUE

7. The three fundamental powers of the state may be exercise only by the government. FALSE

8. Taxation is a process or means by which the sovereign, through its law making body raises income to defray the

expenses of the government. TRUE

9. Forward tax shifting basically has the effect of price reduction in relation to tax. FALSE

10. The agreement among nations to lessen tax burden of their respective subjects is called territoriality. FALSE

11. Taxation is important because it is based on: THE NECESSITY OF THE STATE TO EXIST

12. Ad valorem tax includes income tax. FALSE

13. The president is vested with the authority to sign a bill that has been passed by the legislative body. TRUE

14. Tax avoidance as a means of escaping taxation results in a loss of revenue to the government. TRUE

15. Taxation has retroactive application. FALSE

16. In selection of the objects of taxation, the courts have no power to inquire into wisdom, objectivity, motive,

expediency, or necessity of a tax law. TRUE

17. The lifeblood doctrine requires the government to override its obligations and contracts when necessary. FALSE

18. One characteristic of tax is that; taxes can be subject to assignment. FALSE

19. Taxation is subject to inherent and constitutional limitations. TRUE

20. All inherent powers presuppose an equivalent form of compensation. TRUE

21. The doctrine of escape from taxation where prices of goods are reduced so that the amount of taxes paid is added as

part of the selling price without distorting the original price is called: TAX CAPITALIZATION

22. Taxes collected are based on the willingness of the taxpayer to pay. FALSE

23. The power of the state to promote the general welfare of individuals through proper regulations of rights is called:

POLICE POWER

24. Tax laws are civil and penal in nature because there are penalties provided in the case of violation. FALSE

25. A person may refuse to pay on the ground that he will not receive a benefit from tax. FALSE

26. The government should tax itself. FALSE

27. FMV is the value as declared in the Real Property Tax Declaration Form while zonal value is determined by the

Commissioner pursuant to his authority to prescribe real property values. TRUE

28. The situs or place of taxation is influenced by the following factors, excepts: AMOUNT OF INCOME EARNED

BY THE TAXPAYER

29. Tax assessment is a process of taxation that involves the passage of tax laws. FALSE

30. Collection of taxes in the absence of a law is violation of the constitutional requirement for due process. TRUE

31. The agreement among nations to lessen tax burden of their respective subjects is called international comity. TRUE

32. Every government unit must exercise the power of taxation, since taxation is very important for the existence of the

State. FALSE

33. Thirteenth month pay and other benefits received by officials and employees of public and private entities are exempt

provided, however, that the total exclusions shall not exceed P82,000. TRUE

34. Taxpayers under the same circumstances should be taxed differently. FALSE

35. The power of taxation is considered inseparable from the existence of a State; hence, taxation is absolute and

complete. FALSE

36. The following are the aspects of taxation except: FILLING OF CHARGES IN THE APPROPRIATE COURT

37. Estate tax is an example of ad valorem taxes. TRUE

38. The statement “the government and the taxpayers are not creditors and debtors of each other” support the principle the

principle that tax is not subject to compensation or set-off. FALSE

39. No one shall be imprisoned for non-payment of tax. FALSE

40. The concept that payment of taxes shall be more or less the same underlined by the principle of uniformity and equity

in taxation. FALSE

41. The constitutional exemption of religious or charitable institutions refers only to real property tax. TRUE

42. Which of the following concepts of taxation embraces the idea that tax affects the area as a community rather than as

an individual? PUBLIC PURPOSE

43. The basic principle of a sound taxation system that advocates that revenues collected are sufficient to absorb the

expenses of the government is called: FISCAL ADEQUANCY

44. Taxation is the strongest among the three inherent powers of the State TRUE

45. Under the equal protection clause of the constitution, all persons subject to legislation shall be treated alike under

circumstances and conditions, both in the privileges conferred and liabilities imposed. FALSE

46. The taxes collected by the government are given back to taxpayers in the form of services. TRUE

47. Taxation power can be used to destroy as an implement of police power. TRUE

48. CHED regulations is one source that becomes part of tax laws. FALSE

49. The two kinds of double taxation are tax shifting and tax capitalization. FALSE

50. Taxation is inherent in sovereignty. TRUE

You might also like

- Taxation Legit 1Document17 pagesTaxation Legit 1Lhulaan OrdanozoNo ratings yet

- Taxation EADocument14 pagesTaxation EALhulaan OrdanozoNo ratings yet

- Answer: Enabling Assessment No. 01Document21 pagesAnswer: Enabling Assessment No. 01cherry blossomNo ratings yet

- CHAPTER 1 - Fundamental Principles of TaxationDocument7 pagesCHAPTER 1 - Fundamental Principles of Taxationcurlybambi100% (2)

- Tax 1 QuizDocument6 pagesTax 1 QuizJasmine CandidoNo ratings yet

- W1 Principles of TaxationDocument9 pagesW1 Principles of TaxationChristine Joy MondaNo ratings yet

- Taxation 2015 UP Pre-WeekDocument216 pagesTaxation 2015 UP Pre-WeekIriz Beleno100% (3)

- Chapter 1 Exercises-Income TaxationDocument14 pagesChapter 1 Exercises-Income TaxationFaith Pumihic0% (1)

- Bam 031 Additional NotesDocument3 pagesBam 031 Additional NotesShane QuintoNo ratings yet

- Taxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyDocument18 pagesTaxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyReynaldo YuNo ratings yet

- Week 1 Principles of Taxation True or FalseDocument4 pagesWeek 1 Principles of Taxation True or FalsekemeeNo ratings yet

- TaxationDocument26 pagesTaxationJabeth IbarraNo ratings yet

- Tax 1 - TereDocument57 pagesTax 1 - Terecmv mendoza100% (1)

- TaxationDocument18 pagesTaxationMatthew MadriagaNo ratings yet

- Gen. Principles and Income TaxDocument46 pagesGen. Principles and Income TaxLeidi Kyohei NakaharaNo ratings yet

- Taxation Summative Assessment 1 Part 1 MC TFDocument4 pagesTaxation Summative Assessment 1 Part 1 MC TFBlythe teckNo ratings yet

- Chapter 1 To 6 Tax Answers AutosavedDocument33 pagesChapter 1 To 6 Tax Answers AutosavedBisag AsaNo ratings yet

- Bar NIEL Final TAX PrintDocument48 pagesBar NIEL Final TAX PrintNiel S. DefensorNo ratings yet

- Taxation Notes I. Taxation 1. Definition of Taxation Taxation As A PowerDocument17 pagesTaxation Notes I. Taxation 1. Definition of Taxation Taxation As A PowerReynaldo YuNo ratings yet

- Part I - General Principles On TaxationDocument28 pagesPart I - General Principles On TaxationMarco Rvs100% (1)

- Taxation ReviewerDocument14 pagesTaxation Reviewerralfgerwin inesaNo ratings yet

- Tax NotesDocument8 pagesTax NotesChristian Paul PinoteNo ratings yet

- FundamentalDocument11 pagesFundamentalWilfredo VillaflorNo ratings yet

- Tax1 General Principles of TaxationDocument81 pagesTax1 General Principles of TaxationLee Suarez100% (1)

- Gashdklajsdja LDocument15 pagesGashdklajsdja LDe Lima RJNo ratings yet

- Taxation ActivityDocument7 pagesTaxation ActivityJohn Cedric Ybañez ParkNo ratings yet

- Argumentative Essay On TaxationDocument3 pagesArgumentative Essay On TaxationJonnifer Quiros100% (3)

- Quicknotes-Tax-MCQS - Book 1 and 2Document42 pagesQuicknotes-Tax-MCQS - Book 1 and 2Dianna MontefalcoNo ratings yet

- Chap 1 Gen PrinciplesDocument4 pagesChap 1 Gen PrinciplesJourd Magbanua100% (3)

- LIFEBLOOD THEORY - Taxing The People and Their Property Is NECESSITY THEORY - The Power To TaxDocument12 pagesLIFEBLOOD THEORY - Taxing The People and Their Property Is NECESSITY THEORY - The Power To TaxStephen SalemNo ratings yet

- Hello Tax Income Taxation True or FalseDocument51 pagesHello Tax Income Taxation True or FalseAinsley Jane YuNo ratings yet

- Finals Reviewer in Taxation Law 1 January 2023Document11 pagesFinals Reviewer in Taxation Law 1 January 2023Alena Icao-Anotado100% (1)

- Tax NotesDocument20 pagesTax NotesLaurice Pocais100% (1)

- General Principles: Power of TaxationDocument21 pagesGeneral Principles: Power of TaxationCarl MurphyNo ratings yet

- Classification of TaxesDocument16 pagesClassification of TaxesJo-Al Gealon100% (1)

- Nature and Scope of The Power of TaxationDocument4 pagesNature and Scope of The Power of Taxationwiggie2782% (17)

- Prelim Handouts What Is Taxation?Document18 pagesPrelim Handouts What Is Taxation?emielyn lafortezaNo ratings yet

- Income Taxation ReviewerDocument84 pagesIncome Taxation ReviewerCharmaine Mejia100% (1)

- Tax Reviewer - CallantaDocument52 pagesTax Reviewer - CallantaAnonymous 8SUSyvGc3dNo ratings yet

- Neral Principles of Taxation PDFDocument10 pagesNeral Principles of Taxation PDFKaren Joy MagsayoNo ratings yet

- Week 8 Scope and Taxation Reforms of The PhilippinesDocument4 pagesWeek 8 Scope and Taxation Reforms of The PhilippinesAngie Olpos Boreros BaritugoNo ratings yet

- Taxation - Aban BookDocument99 pagesTaxation - Aban BookClarisse Ann Miranda100% (4)

- Answer in TaxationDocument11 pagesAnswer in TaxationMarella GemperoNo ratings yet

- Chapter 2 Tax Laws EtcDocument56 pagesChapter 2 Tax Laws EtcKlare CadornaNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- Yes, Because Goccs Are Essentially Commercial in NatureDocument19 pagesYes, Because Goccs Are Essentially Commercial in NatureAdah Micah PlarisanNo ratings yet

- Chapter 1 5 Income Tax MCDocument14 pagesChapter 1 5 Income Tax MCEysyel ZeyNo ratings yet

- Aggregate Expenditure: Fundamentals of Taxation (Nature and Purpose)Document6 pagesAggregate Expenditure: Fundamentals of Taxation (Nature and Purpose)Riche ArdaNo ratings yet

- General Principles of TaxationDocument12 pagesGeneral Principles of TaxationMatt Marqueses PanganibanNo ratings yet

- Definition of TaxationDocument41 pagesDefinition of TaxationAnna AntonioNo ratings yet

- SA2 TAXATION Part 1Document7 pagesSA2 TAXATION Part 1Blythe teckNo ratings yet

- Taxation Review: General PrinciplesDocument175 pagesTaxation Review: General Principlessha marananNo ratings yet

- Week 2 4Document50 pagesWeek 2 4Richelle BarongNo ratings yet

- Table of Contents IntroductionDocument25 pagesTable of Contents IntroductionRowena EspirituNo ratings yet

- Tax Reviewer Vitug AcostaDocument5 pagesTax Reviewer Vitug AcostaNievesAlarcon100% (1)

- General Principles and Concepts of TaxationDocument8 pagesGeneral Principles and Concepts of TaxationHERNANDO REYESNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- Evidence End SemDocument20 pagesEvidence End SemGUNJAN CHOUDHARYNo ratings yet

- 4-Ordoñez vs. Director of Prisons, 235 SCRA 152Document6 pages4-Ordoñez vs. Director of Prisons, 235 SCRA 152Chuck GalvadoresNo ratings yet

- TENTH (10) Division: Court of AppealsDocument14 pagesTENTH (10) Division: Court of AppealsBrian del Mundo0% (1)

- PPTDocument31 pagesPPTAshwina NamtaNo ratings yet

- Memorial AppellantDocument25 pagesMemorial AppellantBrij BhushanNo ratings yet

- Durkheim (Sociology of Law)Document8 pagesDurkheim (Sociology of Law)samriddhiNo ratings yet

- CRIMINAL JURISPRUDENCE Set 1Document19 pagesCRIMINAL JURISPRUDENCE Set 1Jana Marie CorpuzNo ratings yet

- People vs. Reafor JurisprudenceDocument7 pagesPeople vs. Reafor JurisprudenceFernand Castro100% (1)

- DC Bar Complaint Jeffrey Clark Sept 12th ReportDocument19 pagesDC Bar Complaint Jeffrey Clark Sept 12th ReportFile 411No ratings yet

- Documents (89) : About Lexisnexis Privacy Policy Terms & ConditionsDocument731 pagesDocuments (89) : About Lexisnexis Privacy Policy Terms & ConditionswghiNo ratings yet

- F. Sps Jesus and Elizabeth Fernando v. Northwest AirlinesDocument21 pagesF. Sps Jesus and Elizabeth Fernando v. Northwest AirlinesKaloi GarciaNo ratings yet

- 25 Geluz vs. Court of AppealsDocument3 pages25 Geluz vs. Court of AppealsSimeon TutaanNo ratings yet

- Successional Rights of The Adopted ChildDocument22 pagesSuccessional Rights of The Adopted Childarcinasanthonyjuve100% (8)

- 04 Atienza v. Board of MedicineDocument3 pages04 Atienza v. Board of MedicinePatricia SulitNo ratings yet

- Discriminalization of SodomyDocument7 pagesDiscriminalization of SodomyYining Zhou (Susie)No ratings yet

- WE4 Group 2 Appellants BriefDocument10 pagesWE4 Group 2 Appellants BriefJerahmeel CuevasNo ratings yet

- Bentham - Rationale of Judicial EvidenceDocument823 pagesBentham - Rationale of Judicial EvidenceBoelckeNo ratings yet

- Swagman Hotels and Travel, Inc., vs. CADocument1 pageSwagman Hotels and Travel, Inc., vs. CAPhilip SuplicoNo ratings yet

- 2019 - 3 - HPJS Objections Key & Format-2018Document4 pages2019 - 3 - HPJS Objections Key & Format-2018ApnaNo ratings yet

- In The Matter of JAMES JOSEPH HAMM Case DigestDocument7 pagesIn The Matter of JAMES JOSEPH HAMM Case DigestJuan AntonioNo ratings yet

- Private Private Complainant Complainant in Ina A Slander Slander by by Deed DEED Case CaseDocument7 pagesPrivate Private Complainant Complainant in Ina A Slander Slander by by Deed DEED Case CaseEFGNo ratings yet

- Drs. Jarcia & Bastan Vs People - CASE DIGESTDocument2 pagesDrs. Jarcia & Bastan Vs People - CASE DIGESTRaiza Sarte100% (1)

- ENGLEZA, Adina RadulescuDocument128 pagesENGLEZA, Adina RadulescuMirela02100% (1)

- Cdi Organize Crime Investagation Reviewer by MaglucotDocument11 pagesCdi Organize Crime Investagation Reviewer by Maglucotban diazNo ratings yet

- Constitution of Criminal Courts and OfficesDocument21 pagesConstitution of Criminal Courts and OfficesTanvi RamdasNo ratings yet

- Information Technology Act, 2000Document17 pagesInformation Technology Act, 2000Shraddha TiwariNo ratings yet

- Aetcsa: Atty. Josabeth V. Alonso and Shalimar P. Lazatin, Complainants, vs. Atty. Ibaro B. Relamida, JR., RespondentDocument45 pagesAetcsa: Atty. Josabeth V. Alonso and Shalimar P. Lazatin, Complainants, vs. Atty. Ibaro B. Relamida, JR., RespondentAira Rowena TalactacNo ratings yet

- Cases For CrammingDocument22 pagesCases For CrammingMary Ann TanNo ratings yet

- RE - LETTER OF TONY Q. V ALENCIANO A.M. No. 10-4-19-SCDocument12 pagesRE - LETTER OF TONY Q. V ALENCIANO A.M. No. 10-4-19-SCKathleen Ebilane PulangcoNo ratings yet

- In The High Court of Delhi: Usha Mehra, JDocument14 pagesIn The High Court of Delhi: Usha Mehra, JjhonnyNo ratings yet