Professional Documents

Culture Documents

July

July

Uploaded by

Rmillionsque FinserveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

July

July

Uploaded by

Rmillionsque FinserveCopyright:

Available Formats

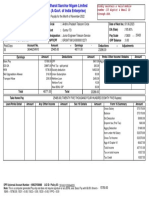

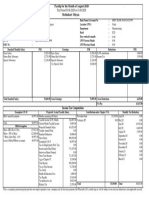

Salary Payslip for the Month Of July-2022

Pay Period 01.07.2022- 31.07.2022 EIH Limited

Bhupender Kumar Sharma

Employee ID : 10004688 Bank Account No & Name : 100401509309 & ICICI BANK LTD,

Department : Housekeeping

Designation : Housekeeping Supervisor

DOJ / Gender : 02.01.2006/Male Grade : Staff-Permanent RL8

PAN NO : APVPB0836M Days Worked In Month : 31.00

PF / Pension No : DL/1509/1281 Notice Pay : 0.00

UAN No : 100113167680 LOP + Unsched Previous Months: 0.00

ESI No : Gratuity/Leave Encashment : 0.00/0.00

Rate Of Salary INR Earnings INR Deductions INR

Basic Pay 20,638.00 Basic Salary 20,638.00 Ee PF contribution 2,477.00

House Rent Allowance 39,471.00 House Rent Allowance 39,471.00 Ee VPF contribution 4,540.00

Cafeteria Deduction 250.00

Total Standard Salary 60,109.00 Gross Earnings 60,109.00

Gross Deductions 7,267.00

Net Pay 52,842.00

Income Tax Computation

Monthly Tax Deductions Exemption U/S 10 Deductions Under Chapter VI-A Form 16 Summary INR

August 22 2,847.00 HRA Annual Exemption 74,834.40 Agg of Chapter VI 150,000.00 Exemption U/S 10 74,834.40

Gross Salary 721,308.00

Balance 646,474.00

Std Deduction 50,000.00

Aggrg Deduction 50,000.00

Incm under Hd Salary 596,474.00

Gross Tot Income 596,474.00

Agg of Chapter VI 150,000.00

Total Income 446,474.00

Tax on total Income 9,823.70

Tax Credit 9,823.70

*This is a computer generated payslip and doesn't require signature or any company seal. The above payslip is generated after considering the payroll inputs till

24th of this month. All one time payments like taxable LTA, variable pay etc. will be subject to one time tax deduction at your applicable tax slab. All the

payments and deductions are subject to change on the basis of the actuals supporting documents submitted. The calculation of income tax is only provisional

You might also like

- Payu Fin NocDocument1 pagePayu Fin NocRmillionsque Finserve50% (2)

- Noc Home CreditDocument1 pageNoc Home CreditRmillionsque Finserve100% (1)

- NDXPDocument2 pagesNDXPRmillionsque FinserveNo ratings yet

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- PCL Chap 4 en CaDocument70 pagesPCL Chap 4 en CaRenso Ramirez100% (1)

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- CREATE Law InfographicDocument20 pagesCREATE Law InfographicVennice Castaneda100% (3)

- (Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021Document47 pages(Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021apprenant amitNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- RR 16-08Document5 pagesRR 16-08matinikkiNo ratings yet

- Partnership Tax NotesDocument35 pagesPartnership Tax NotesAleksandr Kharshan100% (1)

- Tax ProblemsDocument15 pagesTax Problemsjaine0305No ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Sal Slip Feb 2019Document1 pageSal Slip Feb 2019pankajNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- MAR - 2024 - PaySlip (1) - UnlockedDocument1 pageMAR - 2024 - PaySlip (1) - Unlockednaveen.rawat.10420No ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Form 1Document1 pageForm 1mdarsalankhan.hseNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- Rajiv Verma - Income Tax Computation StatementDocument2 pagesRajiv Verma - Income Tax Computation StatementRajiv VermaNo ratings yet

- UnknownDocument1 pageUnknownFiroz ShaikhNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipmishra.prashant8948No ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Paystub - 202111 2Document1 pagePaystub - 202111 2katya surapurajuNo ratings yet

- Paystub 202401Document1 pagePaystub 202401asafintax.consultingNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- JAN Payslip India-UnlockedDocument2 pagesJAN Payslip India-Unlockedbskapoor68No ratings yet

- Documents To Print PDFDocument44 pagesDocuments To Print PDFrajeevtyagiNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- 1 PDFDocument1 page1 PDFpahalNo ratings yet

- Ifive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityDocument1 pageIfive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityReymar BanaagNo ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- UnknownDocument1 pageUnknownBSNL BBOVERWIFINo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- April 2023 - UnlockedDocument2 pagesApril 2023 - Unlockedajinkya jagtapNo ratings yet

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Document1 pageDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- PDFDocument2 pagesPDFkumar Ranjan 22No ratings yet

- Salary Slip FebDocument1 pageSalary Slip FebDee JeyNo ratings yet

- Anant Pay Slip Dec 23Document1 pageAnant Pay Slip Dec 23Tarun BiswalNo ratings yet

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocument1 pagePayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- L & T Finance: Customer Details Product DetailsDocument1 pageL & T Finance: Customer Details Product DetailsRmillionsque FinserveNo ratings yet

- Scan 0001Document16 pagesScan 0001Rmillionsque FinserveNo ratings yet

- S G Encon Private Limited Phase-8, Mohali, Chandigarh Salary Slip For The Month of Apr/2023Document1 pageS G Encon Private Limited Phase-8, Mohali, Chandigarh Salary Slip For The Month of Apr/2023Rmillionsque FinserveNo ratings yet

- SR LetterDocument1 pageSR LetterRmillionsque FinserveNo ratings yet

- FWFWD 47464Document5 pagesFWFWD 47464Rmillionsque FinserveNo ratings yet

- Account Statement From 6 Apr 2023 To 19 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 6 Apr 2023 To 19 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRmillionsque FinserveNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Preferred Time SlotRmillionsque FinserveNo ratings yet

- Tax - FBT and de MinimisDocument19 pagesTax - FBT and de Minimisryan rosalesNo ratings yet

- Chargeability and Section 56 PDFDocument6 pagesChargeability and Section 56 PDFArpit GoyalNo ratings yet

- Public Ruling No. 3-2013 Benefits in Kind PDFDocument34 pagesPublic Ruling No. 3-2013 Benefits in Kind PDFKen ChiaNo ratings yet

- F6 Midterm Test QuestionDocument11 pagesF6 Midterm Test QuestionChippu AnhNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutDocument29 pagesCPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutMark LapidNo ratings yet

- Requirement AgraDocument46 pagesRequirement AgraPaul Christopher PinedaNo ratings yet

- MVIN02698Document20 pagesMVIN02698anuj.nigamNo ratings yet

- 2017-An Ordinance Enacting The Revised Pasig Revenue CodeDocument194 pages2017-An Ordinance Enacting The Revised Pasig Revenue CodeRandy PaderesNo ratings yet

- MCQ Test BankDocument97 pagesMCQ Test BankMilanNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- Benefit ChangeDocument2 pagesBenefit Changemike reasonNo ratings yet

- Executive Excess 2012 CEO Hands in Uncle Sams PocketDocument50 pagesExecutive Excess 2012 CEO Hands in Uncle Sams PocketPaul GoldsteinNo ratings yet

- Income TaxationDocument10 pagesIncome Taxationjay arr s. mirandaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Class - 1 Clubbing of IncomeDocument41 pagesClass - 1 Clubbing of IncomeTomy MathewNo ratings yet

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Document10 pagesPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorNo ratings yet

- Ias 12Document10 pagesIas 12ImrahNo ratings yet

- Estate Tax AmnestyDocument41 pagesEstate Tax AmnestyCourt Nanquil100% (1)

- Income Tax Software 2022-23 (AP) C Ramanjaneyulu (24-01-2023)Document23 pagesIncome Tax Software 2022-23 (AP) C Ramanjaneyulu (24-01-2023)teja chavaNo ratings yet

- CIR v. Central Luzon Drug CorpDocument2 pagesCIR v. Central Luzon Drug CorpSophia SyNo ratings yet

- Itr3 2018 PR1Document148 pagesItr3 2018 PR1Harish Kumar MahavarNo ratings yet

- Revenue Memorandum Order No. 53-98Document25 pagesRevenue Memorandum Order No. 53-98johnnayel50% (2)

- S1 2020 Reading Guide BTF3931Document13 pagesS1 2020 Reading Guide BTF3931Yu WeiNo ratings yet

- A Quick Guide To Taxation in GhanaDocument55 pagesA Quick Guide To Taxation in GhanaEnoch DaviesNo ratings yet