Professional Documents

Culture Documents

S2021 Financial Accounting and Reporting UK GAAP

Uploaded by

Choo LeeCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentS2021 Financial Accounting and Reporting UK GAAP

Uploaded by

Choo LeeImportant Information:

1. Please read the instructions carefully before

you begin your exam.

Starting and ending the exam

2. Click on the right arrow in the header to

begin the exam. The exam timer will begin to

PROFESSIONAL count down.

LEVEL 3. A warning is given five minutes before the

exam ends. When the exam timer reaches

zero, the exam will end. To end the exam

MONDAY 6 SEPTEMBER 2021 earlier, navigate to the last question and click

the right arrow button. Click the Submit

3 HOURS button to close the exam.

Encountering issues during the exam

FINANCIAL 4. If you encounter any issues during the

delivery of the exam you should alert the

ACCOUNTING AND invigilator (or online chat support if you are

sitting remotely). Neither the invigilator nor

REPORTING – UK the online chat support can advise you on

how to use the software.

GAAP Preparing your answers

This exam consists of four questions (100 5. Respond directly to the exam question

marks). requirements. Do not include any content of

a personal nature, this includes your name or

Marks breakdown any other identifying content.

Question 1 32 marks 6. You may use a pen and paper for draft

Question 2 32 marks workings. Any information you write on paper

Question 3 12 marks will not be read or marked.

Question 4 24 marks

7. The examiner will take account of the way in

which your answers are structured. You must

make sure your answers and workings are

Unless otherwise stated, make all

clearly visible in the word processing area

calculations to the nearest month and the

when you submit your exam. Only your

nearest £.

answer in the word processing area will be

marked. You must copy over any data

All references to UK GAAP are to FRS 102,

from the spreadsheet area to the word

The Financial Reporting Standard applicable

processing area for marking. The

in the UK and Republic of Ireland and the

examiner will not be able to expand rows or

Companies Act 2006 unless stated

columns where content is not visible.

otherwise.

After the exam

The UK Accounting Standards and

Company Law book is available as a 8. If you are sitting in an exam centre and

resource in each question. believe that your performance has been

affected by any issues which occurred during

the exam, you must inform your invigilator at

Copyright © ICAEW 2021. All rights reserved. Page 1 of 10

the time of the occurrence and follow up with

ICAEW directly after your exam. You will

then need to submit a special consideration

application to ICAEW if you wish us to

consider such issues, as per our published

policy. If you are sitting remotely please

submit your special consideration application

referring to anything of note which occurred

and will have been recorded, for use as

evidence to support your case.

8. A student survey is provided post-exam for

feedback purposes.

Copyright © ICAEW 2021. All rights reserved. Page 2 of 10

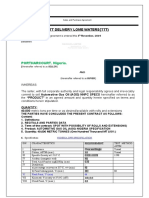

Question 1

Guelder Ltd is currently preparing its financial statements for the year ended 31 December

2020. The following balances have been extracted from the company’s nominal ledger at

31 December 2020.

Note £

Sales 1,320,000

Administrative expenses 404,300

Purchases 698,000

Stock at 31 December 2019 23,600

Trade debtors (1) 76,300

Trade creditors 81,250

Research and development costs (2) 160,000

Land and buildings (5)

Cost (land £240,000) 690,000

Accumulated depreciation at 31 December 2019 185,000

Plant and equipment (3), (4), (5)

Cost 375,150

Accumulated depreciation at 31 December 2019 196,875

Profit and loss account reserve at 31 December 2019 147,825

Called up share capital (£1 shares) 500,000

Cash at bank (debit balance) 3,600

Notes:

(1) A review of the trade debtors balance was made in January 2021 and it was discovered

that a number of customer balances were over six months overdue. All outstanding balances

were investigated and it was concluded that £3,800 of trade debtors were unlikely to be

recovered.

(2) Between 1 May 2020 and 31 December 2020 £160,000 was spent on research and

development of two new products, Alpha and Beta, using new artificial intelligence (AI)

techniques. The full £160,000 has been recognised as an intangible asset (and credited to

cash). No other accounting entries have been made. The breakdown of expenditure for the

year ended 31 December 2020 was as follows:

£ £

Initial research into use of AI 34,000

Product Alpha (costs incurred to 31 August 2020)

Product development costs 48,800

Product development assistant 25,500

– employed on 1 July 2020

Sales staff training 6,300

Initial product testing 7,200

87,800

Product Beta (costs incurred to 31 December 2020)

Product development costs 38,200

160,000

Copyright © ICAEW 2021. All rights reserved. Page 3 of 10

Product development costs were incurred from 1 May 2020 for both products. On 1 July 2020

Alpha was considered to be commercially viable. 25% of the product development costs for

both products were incurred up to 30 June 2020. A review at the end of the reporting period

showed that Beta was not considered commercially viable due to advancements in biometric

technology.

Alpha was launched on 1 September 2020 and is estimated to have a useful life of three

years.

(3) On 1 January 2020 Guelder Ltd entered into a four-year finance lease for a 3-D printer.

The printer is estimated to have a useful life of four years. The present value of the minimum

lease payments at the commencement of the lease was £11,140, which was equivalent to

fair value.

A payment of £3,215 is due on 31 December each year, commencing on 31 December 2020.

The first payment was duly made on 31 December 2020, debiting plant and equipment and

crediting cash. No other accounting entries have been made in relation to the lease. The

implicit interest rate of the lease is 6%.

(4) On 31 December 2020, the directors decided they no longer needed a machine which

originally cost Guelder Ltd £25,000 on 1 January 2016. No adjustments have been made to

reflect this decision. The machine is expected to sell for £5,000 with estimated selling costs

of £200 and has a value in use of £1,000.

(5) No adjustments have been made for depreciation for the year ended 31 December 2020.

Guelder Ltd uses the straight-line basis for depreciation. Unless indicated otherwise,

buildings are depreciated over 40 years and plant and equipment at 15% pa.

All costs associated with tangible fixed assets are recognised in cost of sales.

(6) Stock at 31 December 2020 was correctly valued at £37,800.

(7) Guelder Ltd’s tax liability for the year ended 31 December 2020 has been estimated at

£9,800. An additional amount of £3,000 is due following an HMRC investigation. No amounts

have been reflected in the nominal ledger for tax.

Requirements

1. Prepare for Guelder Ltd a profit and loss account for the year ended 31 December 2020

and a balance sheet as at that date, in a form suitable for publication. (23 marks)

2. Explain, with supporting calculations, how the asset in Note (4) above would be treated

in Guelder Ltd’s financial statements for the year ended 31 December 2020 if Guelder

Ltd followed IFRS. (4 marks)

3. FRS 102, Section 102 Concepts and Pervasive Principles identifies comparability,

verifiability, timeliness and understandability as qualitative characteristics. Explain how

these characteristics help ensure that financial statements are useful to users. (5

marks)

Total: 32 marks

Copyright © ICAEW 2021. All rights reserved. Page 4 of 10

Question 2

Willow Firth is an ICAEW Chartered Accountant and has been recently appointed as financial

controller to Wayfaring Ltd, an engineering company based in the UK. Willow reports directly

to Balsa Carob, the finance director, who is also an ICAEW Chartered Accountant. Willow is

finalising the draft consolidated financial statements for Wayfaring Ltd and has received the

following email from Balsa.

I have to present the consolidated financial statements to the board next week.

You may be unaware but Wayfaring are looking for new investment and we have some

financial institutions that are interested. We need to publish a good set of results. In

particular, it is important to have a debt/equity ratio below 1; anything higher will be

considered too highly geared.

The directors are all entitled to profit-related bonuses which have already been

estimated based on the draft figures prepared by your predecessor, so hopefully you

won’t disappoint! Usually, the directors give all employees a bonus if they receive theirs,

so you’ll be everyone’s friend!

I’m sure you’ll want to make a good impression as you have only just joined the

company.

The following information has been passed to Willow to allow her to complete the

consolidated financial statements for the year ended 31 December 2020.

Draft figures for the Wayfaring Ltd group:

Profit for the financial year £315,000

Creditors: amounts falling due after more than one year £650,000

Capital and reserves (equity) £1,163,000

Debt/Equity ratio 0.56

(based on Creditors: amounts falling due after more than one year/Capital and reserves)

Additional information:

(1) On 1 January 2020 Wayfaring Ltd acquired new equipment that will be used in its latest

laser cutting technology. The equipment cost £50,000 and is estimated to have a

ten-year useful life. The equipment uses integrated lasers that need replacing every two

years at a cost of £6,000.

The total cost of the new equipment was debited to tangible fixed assets and depreciation for

the year ended 31 December 2020 was recognised based on the ten-year useful life.

(2) On 1 January 2020 Wayfaring Ltd issued 300,000 5% £1 redeemable preference shares

at par, debiting cash and crediting capital and reserves. These shares will be redeemed on

31 December 2024 at a premium. The effective interest rate is 6.75%. The preference share

dividend was paid on 31 December 2020 and was recognised directly in reserves.

Copyright © ICAEW 2021. All rights reserved. Page 5 of 10

(3) On 1 April 2020 Wayfaring Ltd received a government grant of £150,000 for setting up a

new training scheme for 12 young adults. A condition of the grant is that the on-the-job

training must run for two years at the end of which at least 25% of trainees must be retained

by Wayfaring Ltd as full-time employees. The training scheme commenced on 1 April 2020.

Wayfaring Ltd’s accounting policy is to recognise government grants using the accrual model.

As Wayfaring Ltd plans to retain at least 50% of the trainees at the end of the training period

it credited the grant to ‘other income’ on receipt.

(4) On 1 July 2020 Wayfaring Ltd and Aspen Ltd, an unrelated company, each subscribed at

par for half of Sitka Ltd’s 80,000 £1 ordinary shares on its incorporation. Wayfaring Ltd and

Aspen Ltd have entered into a contractual arrangement whereby each will receive equal

profit shares and unanimous consent is required for all key operating decisions.

Sitka Ltd made a profit for the six months to 31 December 2020 of £32,600. During

December 2020 Wayfaring Ltd made sales of £6,000 to Sitka Ltd at a mark-up of 25%. Sitka

Ltd still held these goods in stock at 31 December 2020.

Wayfaring Ltd recognised the investment in Sitka Ltd at its cost of £40,000 within fixed assets

and recognised £6,000 in turnover from the sale of goods. No further accounting entries were

made in respect of Sitka Ltd.

Requirements

1. Explain the required UK GAAP financial reporting treatment of (1) to (4) above in

Wayfaring Ltd’s consolidated financial statements for the year ended 31 December

2020, preparing all relevant calculations. (21 marks)

2. Calculate the following revised figures for the year ended 31 December 2020 for the

Wayfaring Ltd group:

• Profit for the financial year

• Creditors: amounts falling due after more than one year

• Capital and reserves (equity)

• Debt/equity ratio

(4 marks)

3. Explain how the redeemable preference shares in Note (2) above would be accounted

for if the financial statements were prepared in accordance with FRS 105, The Financial

Reporting Standard Applicable to the Micro-entities Regime and calculate redeemable

preference shares at 31 December 2020. (2 marks)

4. Discuss the ethical issues arising from the scenario for Willow and set out any actions

she should take. (5 marks)

Total: 32 marks

Copyright © ICAEW 2021. All rights reserved. Page 6 of 10

Question 3

The following information is relevant to Larch Ltd for the year ended 31 December 2020.

Balance sheet as at 31 December 2020 (extract)

2020 2019

£ £

Fixed assets

Tangible assets 822,800 795,200

Capital and reserves

Equity attributable to the owners of Larch Ltd

Called up share capital (£1 shares) 410,000 300,000

Share premium account 15,000 30,000

Profit and loss account 290,000 200,600

(1) Since 31 December 2015 Larch Ltd has used the revaluation model for land and

buildings. The following data is relevant:

Land Buildings

£ £

Net book value at 31 December 2015 200,000 315,000

Valuation at 31 December 2015 320,000 400,000

Valuation at 31 December 2020 340,000 335,000

The estimated useful life of the buildings at 31 December 2015 was 40 years and this has

never changed. Larch Ltd does not make annual transfers between reserves. The valuation

at 31 December 2020 is correctly included in the closing figure for tangible fixed assets

shown above.

(2) Depreciation of £23,000 was correctly calculated and recognised for the year ended

31 December 2020 in relation to tangible fixed assets. Equipment with a net book value of

£17,500 was disposed of during the year and a loss of £2,500 was made on the disposal.

New equipment was acquired for cash during the year. Other than the revaluation there were

no other movements on tangible fixed assets during the year.

(3) Larch Ltd made two share issues during the year:

• On 1 April 2020 a bonus issue of shares, utilising the share premium account as far as

possible.

• On 1 October 2020 a further issue of 60,000 shares at a premium.

(4) Draft profit for the year was £235,400. An interim dividend was paid in July 2020.

Requirements

1. Calculate the balance on Larch Ltd’s revaluation reserve at 31 December 2020. (3

marks)

Copyright © ICAEW 2021. All rights reserved. Page 7 of 10

2. Prepare an extract from Larch Ltd’s statement of cash flows for the year ended

31 December 2020, showing:

• cash flows from investing activities; and

• cash flows from financing activities.

(7 marks)

3. Calculate the earnings per share at 31 December 2020. (2 marks)

Total: 12 marks

Copyright © ICAEW 2021. All rights reserved. Page 8 of 10

Question 4

At 1 January 2020 Hemlock Ltd had a number of investments including two subsidiaries,

Elder Ltd and Aspen Ltd. Hemlock Ltd acquired its 85% investment in Aspen Ltd on

1 January 2020.

On 1 August 2020 Hemlock Ltd sold its 75% holding in Elder Ltd’s 200,000 £1 ordinary

shares, for cash consideration of £530,000.

The draft summarised balance sheets for Hemlock Ltd and Aspen Ltd, at 31 December 2020

are shown below.

Hemlock Aspen

Ltd Ltd

£ £

Fixed assets

Tangible assets 485,000 316,000

Investments 543,000 –

1,028,000 316,000

Current assets

Stock 70,800 46,000

Trade and other debtors 84,600 18,600

Cash at bank and in hand 12,500 3,700

167,900 68,300

Creditors: amounts falling due within one year

Trade and other creditors (78,400) (24,600)

Taxation (68,000) (12,300)

(146,400) (36,900)

Net current assets 21,500 31,400

Net assets 1,049,500 347,400

Capital and reserves

Called up share capital (£1 shares) 350,000 225,000

Share premium account 175,000 –

Profit and loss account 524,500 122,400

1,049,500 347,400

Additional information

(1) Hemlock Ltd amortises all goodwill over 10 years.

(2) The consideration for the acquisition of Elder Ltd was £385,000 when the profit and loss

account reserve of Elder Ltd was £176,000.

The fair values of Elder Ltd’s assets, liabilities and contingent liabilities at the date of

acquisition were equal to their carrying amounts.

At 31 December 2019 Elder Ltd’s profit and loss account reserve was £283,500 and its profit

for the financial year to 31 December 2020 was £146,400. Profits accrued evenly over the

year.

Copyright © ICAEW 2021. All rights reserved. Page 9 of 10

Cumulative amortisation of goodwill at the date of disposal in respect of Elder Ltd was

£38,625.

The only accounting entries made by Hemlock Ltd on the disposal of its shares in Elder Ltd

were to credit the sale proceeds of £530,000 to income and debit them to cash.

(3) The consideration for the acquisition of Aspen Ltd was £326,400.

Cash of £150,000 was paid on 1 January 2020, the date of acquisition, and was recognised

as a fixed asset investment. The remaining £176,400 is payable on 1 January 2022, for

which no accounting entries were made. An appropriate discount rate is 5% pa.

The fair values of Aspen Ltd’s assets, liabilities and contingent liabilities at 1 January 2020

were equal to their carrying amounts. A reassessment of Aspen Ltd’s assets, liabilities and

contingent liabilities and consideration transferred took place following acquisition and no

adjustments were necessary.

Aspen Ltd has developed a number of artificial intelligence-based systems which use

predictive analytics. This technology has not been recognised in Aspen Ltd’s financial

statements as it was internally developed. However, it is a separable asset and had a fair

value of £120,000 at 1 January 2020. The technology is estimated to have a useful life of four

years from 1 January 2020.

The profit and loss account reserve of Aspen Ltd was £75,000 at 1 January 2020.

(4) Aspen Ltd pays an annual management fee to Hemlock Ltd of £24,000, which is invoiced

in 12 equal monthly instalments. The December 2020 invoice was paid by Aspen Ltd on

31 December 2020 although the cash was not received by Hemlock Ltd until 2 January 2021

due to a delay in the banking system.

(5) In December 2020 Aspen Ltd sold goods to Hemlock Ltd for £12,000 earning a 20%

gross margin. At 31 December 2020 all the goods were still held by Hemlock Ltd and the

invoice remained unpaid.

Requirements

1. Briefly explain how the profit or loss for the year from discontinued operations should be

calculated in accordance with UK GAAP and calculate the figure in respect of the

disposal of Elder Ltd. (6 marks)

2. Prepare the consolidated balance sheet of Hemlock Ltd as at 31 December 2020.

(18 marks)

Note:

You should assume that the disposal of Elder Ltd constitutes a discontinued activity in

accordance with FRS 102 Section 5, Statement of Comprehensive income and Income

Statement.

Total: 24 marks

Copyright © ICAEW 2021. All rights reserved. Page 10 of 10

You might also like

- Unit 6 Managing A Successful Computing Project 2021Document62 pagesUnit 6 Managing A Successful Computing Project 2021ishan maduahanka0% (2)

- F8 AA QB September 2020-June 2021 As at 11 May 2020 FINALDocument424 pagesF8 AA QB September 2020-June 2021 As at 11 May 2020 FINALBacho Tsverikmazashvili100% (1)

- September 2022 Audit and Assurance Paper ICAEWDocument10 pagesSeptember 2022 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- Social Media Marketing Impact On Delivery CompaniesDocument12 pagesSocial Media Marketing Impact On Delivery CompaniesSaima AsadNo ratings yet

- TT T Delivery Lome Waters (TT T) : PORTHARCOURT. NigeriaDocument6 pagesTT T Delivery Lome Waters (TT T) : PORTHARCOURT. NigeriaABUBAKARNo ratings yet

- December 2021 Financial Acocunting and Reporting UK GAAPDocument11 pagesDecember 2021 Financial Acocunting and Reporting UK GAAPChoo LeeNo ratings yet

- December 2022 Audit and Assurance Paper ICAEWDocument11 pagesDecember 2022 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- 2021 December QPDocument11 pages2021 December QPMarchella LukitoNo ratings yet

- S2021 Financial Management PDFDocument10 pagesS2021 Financial Management PDFscottNo ratings yet

- Financial Management Exam Sept 2022Document10 pagesFinancial Management Exam Sept 2022scottNo ratings yet

- Financial Acocunting and Reporting IFRS Sept 2022Document10 pagesFinancial Acocunting and Reporting IFRS Sept 2022karnanNo ratings yet

- June 2023 Audit and Assurance Paper ICAEWDocument10 pagesJune 2023 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- Unexpected Changes in Gross Profit MarginsDocument22 pagesUnexpected Changes in Gross Profit MarginsMaher Samar Amin LurkaNo ratings yet

- PL J22 Financial ManagementDocument10 pagesPL J22 Financial ManagementscottNo ratings yet

- Financial Management Exam Dec 2022Document10 pagesFinancial Management Exam Dec 2022scottNo ratings yet

- Financial Accounting and Reporting IFRS March 2023 ExamDocument9 pagesFinancial Accounting and Reporting IFRS March 2023 Examrwinchella2803No ratings yet

- PL M22 FM PDFDocument11 pagesPL M22 FM PDFscott100% (1)

- March 2021 Financial Accounting and Reporting UK GAAPDocument10 pagesMarch 2021 Financial Accounting and Reporting UK GAAPChoo LeeNo ratings yet

- Financial Accounting and Reporting Ifrs December 2023 ExamDocument11 pagesFinancial Accounting and Reporting Ifrs December 2023 ExamkarnanNo ratings yet

- March 2023 Audit and Assurance Paper ICAEWDocument9 pagesMarch 2023 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- Audit and Assurance September 2023 ExamDocument11 pagesAudit and Assurance September 2023 ExamkarnanNo ratings yet

- Business Planning Taxation March 2023 ExamDocument10 pagesBusiness Planning Taxation March 2023 Examrwinchella2803No ratings yet

- Assessment 1 Booklet DISD Semester 2 2302Document9 pagesAssessment 1 Booklet DISD Semester 2 2302laurabrown120No ratings yet

- Tax Compliance March 2023 ExamDocument10 pagesTax Compliance March 2023 Examrwinchella2803No ratings yet

- July 23 QPDocument19 pagesJuly 23 QPMaahi KarimNo ratings yet

- ICAEW Audit and Assurance Study Guide 2016Document24 pagesICAEW Audit and Assurance Study Guide 2016Kim Hussain100% (1)

- Exam Day BookletDocument36 pagesExam Day BookletMartin MilenovNo ratings yet

- Business Planning Taxation June 2023 ExamDocument9 pagesBusiness Planning Taxation June 2023 Examrwinchella2803No ratings yet

- Unit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016Document32 pagesUnit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016vantrang0310No ratings yet

- Wentworth Institute of Higher Education Final Examination Mp223 Tax Law and PracticeDocument8 pagesWentworth Institute of Higher Education Final Examination Mp223 Tax Law and PracticeSamriddhi KarmcharyaNo ratings yet

- Fac2601 Eqp October 2022Document11 pagesFac2601 Eqp October 2022precious matjaneNo ratings yet

- ACC101 T222 FinalExam MarkingGuideDocument18 pagesACC101 T222 FinalExam MarkingGuideTan IrisNo ratings yet

- LCR4803_June 2023Document7 pagesLCR4803_June 2023Mpho MolokoaneNo ratings yet

- Tutorial Letter 001/3/2021Document14 pagesTutorial Letter 001/3/2021Hendrick T HlungwaniNo ratings yet

- Company Accounting Acc2115 s1 2018 Web TwmbaDocument4 pagesCompany Accounting Acc2115 s1 2018 Web TwmbaAamir SaeedNo ratings yet

- Aui3701 Exam 2020Document6 pagesAui3701 Exam 2020tinyikodiscussNo ratings yet

- AUI3703 Exam May 2023 230525 075327Document14 pagesAUI3703 Exam May 2023 230525 075327Terrence MokoenaNo ratings yet

- BSBTEC101 Student Assessment Tasks 21-05-21Document17 pagesBSBTEC101 Student Assessment Tasks 21-05-21Naysha Blas TrujilloNo ratings yet

- Op Aud Quizzes 9 Files MergedDocument166 pagesOp Aud Quizzes 9 Files MergedAlliahDataNo ratings yet

- Financial Management Exam March 2023Document9 pagesFinancial Management Exam March 2023lavanya vsNo ratings yet

- Edb 2022Document36 pagesEdb 2022Marta MT0% (1)

- July 23 QP-SBMDocument20 pagesJuly 23 QP-SBMMaahi KarimNo ratings yet

- ACCT 1116 - Syllabus Sec A05 Rupani (W2020)Document7 pagesACCT 1116 - Syllabus Sec A05 Rupani (W2020)mikewithers41No ratings yet

- MM234Document96 pagesMM234thiwankaamila75No ratings yet

- BTEC Student Handbook: Pearson BTEC Level 3 National Extended Diploma in Engineering (NQF)Document12 pagesBTEC Student Handbook: Pearson BTEC Level 3 National Extended Diploma in Engineering (NQF)Brill brianNo ratings yet

- 2021 Tulip Mock QuestionsDocument17 pages2021 Tulip Mock QuestionsSophie ChopraNo ratings yet

- Acf8 (RN) Mar19 LR PDFDocument84 pagesAcf8 (RN) Mar19 LR PDFDiana IlievaNo ratings yet

- FINA 3710 SyllabusDocument4 pagesFINA 3710 SyllabusroBinNo ratings yet

- (Version Controlled) BSBINM601 Student Assessment TasksDocument20 pages(Version Controlled) BSBINM601 Student Assessment Taskspeempp0% (1)

- LEV3701 Oct2022 PDFDocument8 pagesLEV3701 Oct2022 PDFThabang MojajeNo ratings yet

- Financial Accounting and Analysis AssignmentDocument3 pagesFinancial Accounting and Analysis AssignmentaarhaNo ratings yet

- Financial Accounting and Analysis - Assignment Dec 2021 - Set 1 GvzfOVqGMUDocument3 pagesFinancial Accounting and Analysis - Assignment Dec 2021 - Set 1 GvzfOVqGMUTanmay KothariNo ratings yet

- Assurance ICAEW CFAB Question Bank 2021Document178 pagesAssurance ICAEW CFAB Question Bank 2021Huyền TrangNo ratings yet

- AUI3703 Assignm02 Solution S2 2022 FinalDocument12 pagesAUI3703 Assignm02 Solution S2 2022 FinalTerrence MokoenaNo ratings yet

- 2324 BM Formative Assignment Brief FinalDocument10 pages2324 BM Formative Assignment Brief Finalprplayz55No ratings yet

- Faculty of Business and Law 7000ACC Financial Analysis and Decision MakingDocument7 pagesFaculty of Business and Law 7000ACC Financial Analysis and Decision MakingSalai SivagnanamNo ratings yet

- AF7 2022-23 Practice Test 1 (October 2019 EG) PDFDocument25 pagesAF7 2022-23 Practice Test 1 (October 2019 EG) PDFAnan Guidel AnanNo ratings yet

- Internal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDocument37 pagesInternal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDINU100% (1)

- 1447-1628760497056-Unit 6 MSCP - 2021 and 22 RWDocument98 pages1447-1628760497056-Unit 6 MSCP - 2021 and 22 RWHimsara vihanNo ratings yet

- CFS2101-2324 Assignment Brief 23-241Document7 pagesCFS2101-2324 Assignment Brief 23-241liua01804No ratings yet

- Unit Guide: Vcalint001 Vcal - Victorian Certificate of Applied Learning (Intermediate)Document4 pagesUnit Guide: Vcalint001 Vcal - Victorian Certificate of Applied Learning (Intermediate)Nancy HaddadNo ratings yet

- AhmadK PDFDocument365 pagesAhmadK PDFCha ChaNo ratings yet

- P6mys 2016 Jun A HybridDocument14 pagesP6mys 2016 Jun A HybridChoo LeeNo ratings yet

- Tax Treatment of Capital Projects and Expenditure for Serene Garment Sdn BhdDocument16 pagesTax Treatment of Capital Projects and Expenditure for Serene Garment Sdn BhdChoo LeeNo ratings yet

- P6 Taxation Answers - Pioneer Status vs ITA for Malaysian ManufacturingDocument13 pagesP6 Taxation Answers - Pioneer Status vs ITA for Malaysian ManufacturingChoo LeeNo ratings yet

- P6mys 2017 Sept Dec ADocument14 pagesP6mys 2017 Sept Dec AChoo LeeNo ratings yet

- F6mys 2013 Dec ADocument8 pagesF6mys 2013 Dec AĐàm TrangNo ratings yet

- f6MYS 2019 Sep ADocument9 pagesf6MYS 2019 Sep AChoo LeeNo ratings yet

- F6MYS 2013 Dec QuestionDocument14 pagesF6MYS 2013 Dec QuestionChoo LeeNo ratings yet

- September 2021 FAR UK GAAP Student Mark Plan v2Document13 pagesSeptember 2021 FAR UK GAAP Student Mark Plan v2Choo LeeNo ratings yet

- March 2021 Financial Accounting and Reporting UK GAAPDocument10 pagesMarch 2021 Financial Accounting and Reporting UK GAAPChoo LeeNo ratings yet

- D2021 Financial Accounting and Reporting UKGAAP Student Mark PlanDocument13 pagesD2021 Financial Accounting and Reporting UKGAAP Student Mark PlanChoo LeeNo ratings yet

- f6MYS 2019 DecDocument11 pagesf6MYS 2019 DecChoo LeeNo ratings yet

- Acca Tx-Mys 2019 JuneDocument14 pagesAcca Tx-Mys 2019 JuneChoo LeeNo ratings yet

- Taxation (Malaysia) : September/December 2016 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : September/December 2016 - Sample QuestionsGary Danny Galiyang100% (1)

- Taxation (Malaysia) : March/June 2018 - Sample QuestionsDocument13 pagesTaxation (Malaysia) : March/June 2018 - Sample QuestionsTeneswari RadhaNo ratings yet

- Acca Tx-Mys 2019 SeptemberDocument13 pagesAcca Tx-Mys 2019 SeptemberChoo LeeNo ratings yet

- Financial Accounting CH 2Document12 pagesFinancial Accounting CH 2Karim KhaledNo ratings yet

- T1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7Document11 pagesT1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7mavisNo ratings yet

- 2020-07-23 St. Mary's County TimesDocument32 pages2020-07-23 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- CostingDocument56 pagesCostingaiko0% (2)

- End of Term 1 Higher TestDocument3 pagesEnd of Term 1 Higher TestbussybeeNo ratings yet

- Corporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFDocument35 pagesCorporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFvernon.amundson153100% (10)

- FIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureDocument31 pagesFIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureMd Al Alif Hossain 2121155630No ratings yet

- The Learners Independently Prepare and Cook Vegetable DishesDocument4 pagesThe Learners Independently Prepare and Cook Vegetable DishesJunelyn SabrosoNo ratings yet

- The Human Side of Digital Transformation in Sales Review Future PathsDocument5 pagesThe Human Side of Digital Transformation in Sales Review Future PathsPELO ENLONo ratings yet

- HRM CROSSWORD (Team 16) - Crossword LabsDocument2 pagesHRM CROSSWORD (Team 16) - Crossword LabsAastha PawarNo ratings yet

- Financial Performance Analysis of SIFCODocument8 pagesFinancial Performance Analysis of SIFCONamuna JoshiNo ratings yet

- Implementing Guidelines for Loan Document SafekeepingDocument3 pagesImplementing Guidelines for Loan Document SafekeepingJan Paolo CruzNo ratings yet

- GST Suvidha Kendra Service List 2019Document26 pagesGST Suvidha Kendra Service List 2019Jayant Kumar SwainNo ratings yet

- BMW Brand AwarenessDocument2 pagesBMW Brand AwarenessrakeshNo ratings yet

- OligopolyDocument2 pagesOligopolyOptimistic RiditNo ratings yet

- Dipannita Dey Address: Career ObjectiveDocument4 pagesDipannita Dey Address: Career Objectivevipin HNo ratings yet

- Economics of Strategy (Rješenja)Document227 pagesEconomics of Strategy (Rješenja)Antonio Hrvoje ŽupićNo ratings yet

- Cold Email TemplateDocument15 pagesCold Email TemplateJordyNo ratings yet

- Make MONEY Now - Website Copywriting - SEO Copywriting - FreelanceDocument18 pagesMake MONEY Now - Website Copywriting - SEO Copywriting - FreelanceMansoor Ul Hassan SiddiquiNo ratings yet

- Bux - Multi-Wallet OverviewDocument29 pagesBux - Multi-Wallet OverviewEllen BrillantesNo ratings yet

- Module 1 PDFDocument9 pagesModule 1 PDFUday GowdaNo ratings yet

- Udemy Business Executive SummaryDocument8 pagesUdemy Business Executive SummaryAshish RanjanNo ratings yet

- Nit For Facility Management & Maintenance Contract For 11 Nos. Avc Based Ettm Tolling Systems & Toll Plazas Installed On Highways Including Operations Center at Nha HQ, IslamabadDocument3 pagesNit For Facility Management & Maintenance Contract For 11 Nos. Avc Based Ettm Tolling Systems & Toll Plazas Installed On Highways Including Operations Center at Nha HQ, IslamabadAbn e MaqsoodNo ratings yet

- Com502 Getubig-1te4Document2 pagesCom502 Getubig-1te4EastNo ratings yet

- Basava Weekly ReportDocument5 pagesBasava Weekly Reportbasava prasadNo ratings yet

- Daily Routine in CompanyDocument1 pageDaily Routine in CompanyDesakuNo ratings yet

- Simple 9/30 Moving Average Trading StrategyDocument3 pagesSimple 9/30 Moving Average Trading StrategybhushanNo ratings yet

- Cash Receipts Journal EntriesDocument7 pagesCash Receipts Journal EntriesMeliana WandaNo ratings yet