Professional Documents

Culture Documents

12 Month Cash Flow statement1AZX

Uploaded by

Umer FiazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month Cash Flow statement1AZX

Uploaded by

Umer FiazCopyright:

Available Formats

Twelve-month profit and loss projection Enter your Company Name here Fiscal Year Begins Jan-04

Notes on Preparation

LY

.%

4

4

4

4

04

4

4

4

4

B/A

04

y-0

g-0

AR

v-0

p-0

c-0

b-0

n-0

r-0

n-0

t-0

Note: You may want to print this information to use as reference later. To delete these

r-

IND

l-

%

%

%

Ma

Ma

Ap

No

Oc

Au

YE

De

Se

Fe

Ju

Ju

Ja

%

instructions, click the border of this text box and then press the DELETE key.

Revenue (Sales)

Category 1 - - You should change

- "category 1, category

- 2", etc. labels

- to the actual names

- of your sales

- - - - - - -

categories. Enter sales for each category for each month. The spreadsheet will add up total

Category 2 - - annual sales. In- the "%" columns,-the spreadsheet will

- show the % of -total sales contributed

- - - - - - -

Category 3 - - by each category.

- - - - - - - - - - -

Category 4 - - - -

Cost of Sales- or COGS): COGS- are those expenses - - - - - - -

COST OF GOODS SOLD (also called

Category 5 - - directly related to

- producing or buying

- your products- or services. For example,

- purchases - of - - - - - -

Category 6 - -

inventory or raw- materials, as well- as the wages (and -

payroll taxes) of- employees directly - - - - - - -

involved in producing your products/services, are included in COGS. These expenses usually

Category 7 - - go up and down- along with the volume

- of production- or sales. Study your

- records to - - - - - - -

Total Revenue (Sales) 0 0.0 0 0.0 determine 0 COGS

0.0 for each 0sales0.0

category. Control

0 of COGS is the

0.0 0 key

0.0 to profitability

0 for0.0most 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0

businesses, so approach this part of your forecast with great care. For each category of

Cost of Sales product/service, analyze the elements of COGS: how much for labor, for materials, for

packing, for shipping, for sales commissions, etc.? Compare the Cost of Goods Sold and

Category 1 - - -

Gross Profit of your various sales -categories. Which- are most profitable,- and which are least- - - - - - - -

Category 2 - - and why? Underestimating

- COGS- can lead to under- pricing, which can - destroy your ability

- to - - - - - -

earn a profit. Research carefully and be realistic. Enter the COGS for each category of sales

Category 3 - - for each month.- In the "%" columns,- the spreadsheet - will show the COGS- as a % of sales- - - - - - -

Category 4 - - dollars for that category.

- - - - - - - - - - -

Category 5 - - - - - - - - - - - - -

GROSS PROFIT: Gross Profit is Total Sales minus Total COGS. In the "%" columns, the

Category 6 - - spreadsheet will- show Gross Profit

- as a % of Total Sales.

- - - - - - - - -

Category 7 - - - - - - - - - - - - -

OPERATING EXPENSES (also called Overhead): These are necessary expenses which,

Total Cost of Sales 0 - 0 - however,0are not - directly related

0 to- making or0buying- your products/services.

0 - 0 utilities,

Rent, - 0 - 0 - 0 - 0 - 0 - 0 -

telephone, interest, and the salaries (and payroll taxes) of office and management employees

Gross Profit 0 - 0 - 0

are examples. -

Change the0names- of the Expense

0 -

categories to0suit your

- type of business

0 - and 0 - 0 - 0 - 0 - 0 - 0 -

your accounting system. You may need to combine some categories, however, to stay within

Expenses the 20 line limit of the spreadsheet. Most operating expenses remain reasonably fixed

regardless of changes in sales volume. Some, like sales commissions, may vary with sales.

Salary expenses - - - - - - - - - - - - -

Some, like utilities, may vary with the time of year. Your projections should reflect these

Payroll expenses - - fluctuations. The- only rule is that the

- projections should

- simulate your -financial reality as- - - - - - -

Outside services - - nearly as possible.

- In the "%" columns,

- the spreadsheet

- will show Operating

- Expenses as - a - - - - - -

% of Total Sales.

Supplies (office and

- - - - - - - - - - - - -

operating)

NET PROFIT: The spreadsheet will subtract Total Operating Expenses from Gross Profit to

Repairs and maintenance - - calculate Net Profit.

- In the "%" columns,

- it will show -Net Profit as a % of

- Total Sales. - - - - - - -

Advertising - - INDUSTRY AVERAGES:

- The first- column, labeled "IND.

- %" is for posting

- average cost factors

- - - - - - -

Car, delivery and travel - - for firms of your- size in your industry.

- Industry average

- data is commonly

- available from- - - - - - -

industry associations, major manufacturers who are suppliers to your industry, and local

Accounting and legal - - -

colleges, Chambers of Commerce, - and public libraries.

- One common -source is the book- - - - - - -

Rent - - Statement Studies- published annually - by Robert Morris

- Associates. It -can be found in major

- - - - - - -

libraries, and your banker almost surely has a copy. It is unlikely that your expenses will be

Telephone - - - industry averages,

exactly in line with - - helpful in areas -in which expenses- may

but they can be - - - - - -

Utilities - - be out of line. - - - - - - - - - - -

Insurance - - - - - - - - - - - - -

Taxes (real estate, etc.) - - - - - - - - - - - - -

Interest - - - - - - - - - - - - -

Depreciation - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Misc. (unspecified) - - - - - - - - - - - - -

Total Expenses 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

Net Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

You might also like

- Fill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredFrom EverandFill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredNo ratings yet

- 12 Month Cash Flow Statement1AZXDocument1 page12 Month Cash Flow Statement1AZXahmed HOSNYNo ratings yet

- 12 Month Cash Flow Statement1AZXDocument1 page12 Month Cash Flow Statement1AZXSayed Abo ElkhairNo ratings yet

- 12month P&L ProjectionDocument1 page12month P&L Projectionapi-3809857No ratings yet

- Twelve-Month Profit and Loss Projection: Notes On PreparationDocument1 pageTwelve-Month Profit and Loss Projection: Notes On PreparationVorn Ra VuthNo ratings yet

- PaciênciaDocument3 pagesPaciênciaandrels89No ratings yet

- AstronomiaDocument1 pageAstronomiaHazel Anne LopezNo ratings yet

- Left Alone TabsDocument8 pagesLeft Alone TabsbruheNo ratings yet

- Concertino A Minor in Russian Style OpDocument3 pagesConcertino A Minor in Russian Style Op8pn4xjm8n5No ratings yet

- GPeixe Mirim PartesDocument6 pagesGPeixe Mirim PartesMarlon MolinaNo ratings yet

- Libertango Classic Guitar Scores - Stas Karpenko ArrangementDocument2 pagesLibertango Classic Guitar Scores - Stas Karpenko ArrangementGonzalo Perren0% (1)

- IMSLP458907 PMLP73098 Kayser - Opus 20 PDFDocument60 pagesIMSLP458907 PMLP73098 Kayser - Opus 20 PDFAntonio CicconeNo ratings yet

- Yesterday Once MoreDocument3 pagesYesterday Once MoreMai Xuân HiệpNo ratings yet

- 12A - Up on the Housetop 在屋頂上&C練習曲Document1 page12A - Up on the Housetop 在屋頂上&C練習曲ChakNeng SouNo ratings yet

- V G.F. Hndel Sonata in F Major HWV 370 AllegroDocument1 pageV G.F. Hndel Sonata in F Major HWV 370 AllegroCanal InformalNo ratings yet

- RADWIMPS - Is There Still Anything That Love Can Do?Document4 pagesRADWIMPS - Is There Still Anything That Love Can Do?Vincent CheungNo ratings yet

- Francisco Tárrega - Capricho Árabe Serenata PDFDocument4 pagesFrancisco Tárrega - Capricho Árabe Serenata PDFFernanda Torres Aguirre33% (3)

- Bottom Euro Type Tray: Assembly Drg. NoDocument2 pagesBottom Euro Type Tray: Assembly Drg. NoJohn AlexanderNo ratings yet

- Jesus - Christ - Superstar - Complete - Then We Are DecidedDocument5 pagesJesus - Christ - Superstar - Complete - Then We Are Decidedchilaquiles123No ratings yet

- Etude 4Document1 pageEtude 4Александра ЖуковаNo ratings yet

- 04 - Vals Venezolano No.1 (A.lauro)Document2 pages04 - Vals Venezolano No.1 (A.lauro)Paulo100% (1)

- Be - Computer Engineering - Semester 6 - 2023 - May - Internet of Thingsrev 2019 C SchemeDocument1 pageBe - Computer Engineering - Semester 6 - 2023 - May - Internet of Thingsrev 2019 C SchemevaishaliNo ratings yet

- Rastros - para Piano e Live ElectronicsDocument5 pagesRastros - para Piano e Live ElectronicsLucas Quínamo Furtado de MendonçaNo ratings yet

- Be Chemical Engineering Semester 7 2022 December Chemical Engineering Equipment Design Rev 2019 C SchemeDocument3 pagesBe Chemical Engineering Semester 7 2022 December Chemical Engineering Equipment Design Rev 2019 C SchemeMitesh ThakurNo ratings yet

- دائره ثلاث محركات تبديل بتايمر واحدDocument1 pageدائره ثلاث محركات تبديل بتايمر واحدBrahim CherguiNo ratings yet

- 6shflàfdwlrqiru Fruurvlrquhvlvwlqjvwhho Pxvkurrpkhdghg Vorwwhggulyherowv Vwuhqjwkfodvv03DDocument12 pages6shflàfdwlrqiru Fruurvlrquhvlvwlqjvwhho Pxvkurrpkhdghg Vorwwhggulyherowv Vwuhqjwkfodvv03Dson gokuNo ratings yet

- La Catedral BarriosDocument10 pagesLa Catedral Barrios8dgvdfmcd2No ratings yet

- 03 - Sons de Carrilhões (J.Pernambuco)Document2 pages03 - Sons de Carrilhões (J.Pernambuco)Paulo0% (1)

- PDF To WordDocument2 pagesPDF To WordRamdas NagareNo ratings yet

- AI Paper 1Document1 pageAI Paper 1harshalbhamare987No ratings yet

- Yanni, BlueDocument8 pagesYanni, BlueSarmad Ke100% (10)

- EL CAMINO DE LA VIDA - UkuleleDocument3 pagesEL CAMINO DE LA VIDA - UkulelePENSANDO EN ANIMACIONNo ratings yet

- El Sitio de Mi Recreo Antonio VegaDocument5 pagesEl Sitio de Mi Recreo Antonio Vegajose antonio100% (1)

- Junction P1, T26 and T15Document1 pageJunction P1, T26 and T15Amiry Halifa HidaNo ratings yet

- Cad-Cam QBDocument2 pagesCad-Cam QBSamkNo ratings yet

- (BAT) (BAT) (BAT) : Air ConditioningDocument26 pages(BAT) (BAT) (BAT) : Air ConditioningToàn LêNo ratings yet

- Grande Valsa BrilhanteDocument12 pagesGrande Valsa BrilhanteAndréNo ratings yet

- Hiace Turn Signal and Hazard Warning Light-01-01Document1 pageHiace Turn Signal and Hazard Warning Light-01-01Kudakwashe KurangwaNo ratings yet

- Easy Guitar Riffs (Standard Tuning)Document9 pagesEasy Guitar Riffs (Standard Tuning)shorovskyNo ratings yet

- Apna Bana Le Fingerstyle Tabs by Soumavo MaitraDocument2 pagesApna Bana Le Fingerstyle Tabs by Soumavo MaitraRAFAN zNo ratings yet

- Drawing Cooler UnitDocument3 pagesDrawing Cooler UnitSepti36 Diary-Ride-R15VVA-BandungNo ratings yet

- Prelude PDFDocument6 pagesPrelude PDFMete ÇarıkçıNo ratings yet

- BaseDocument1 pageBasemaxNo ratings yet

- Mariage Damour PDFDocument7 pagesMariage Damour PDFAntigoni Basdeki100% (3)

- Norsok S-001-2008Document72 pagesNorsok S-001-2008matrix69No ratings yet

- TAS-1942 - Subinsert - Chill Vent CS - 1006 - Sheet - 1Document1 pageTAS-1942 - Subinsert - Chill Vent CS - 1006 - Sheet - 1Agustin Jaime GalvanNo ratings yet

- RapsodiaDocument1 pageRapsodiaBert LietaertNo ratings yet

- Kayser Etude 1 Op.20Document1 pageKayser Etude 1 Op.20Neo ComposerNo ratings yet

- Concerto em Si Menor, Op. 35Document19 pagesConcerto em Si Menor, Op. 35Tity ArrobaNo ratings yet

- Mafua Ze MenezesDocument3 pagesMafua Ze MenezesleoliveiraguitarNo ratings yet

- AIDS Question Paper - RemovedDocument8 pagesAIDS Question Paper - RemovedPriyadarshini ChavanNo ratings yet

- Barney Kessel - Corcovado (Full Score)Document6 pagesBarney Kessel - Corcovado (Full Score)RodrigoDonosoNo ratings yet

- First Floor Plan: Hema.K 113718251023 Iv-A SCALE - 1:300 Site-Alandur Zone - 4Document1 pageFirst Floor Plan: Hema.K 113718251023 Iv-A SCALE - 1:300 Site-Alandur Zone - 4hema paakNo ratings yet

- Tarrega Franciso Isabel PDFDocument2 pagesTarrega Franciso Isabel PDFmateoNo ratings yet

- Francisco Tárrega: IsabelDocument2 pagesFrancisco Tárrega: IsabelHerberth Botero100% (1)

- (Free Scores - Com) - Tarrega Francisco Isabel 20271 PDFDocument2 pages(Free Scores - Com) - Tarrega Francisco Isabel 20271 PDFAldo MedinaNo ratings yet

- Maria Luisa, SagrerasDocument2 pagesMaria Luisa, SagrerasAldo Medina100% (2)

- Instalaciones Sanitarias AP PlanoDocument1 pageInstalaciones Sanitarias AP PlanoIgnacio AcuñaNo ratings yet

- ZBHH 2Document1 pageZBHH 2FF XNo ratings yet

- 12 Month Cash Flow statement1AZXDocument17 pages12 Month Cash Flow statement1AZXUmer FiazNo ratings yet

- Balance-Sheet US GAAPDocument1 pageBalance-Sheet US GAAPvishnuNo ratings yet

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementiPakistan100% (2)

- 12 Month Cash Flow Statement1AZXDocument6 pages12 Month Cash Flow Statement1AZXMukhlish AkhatarNo ratings yet

- 8 Signs of A Toxic LeaderDocument11 pages8 Signs of A Toxic Leaderdragonxyz70No ratings yet

- Some of The Most Important Theories of Business CyDocument24 pagesSome of The Most Important Theories of Business CyAqib ArshadNo ratings yet

- Profile Scalo InvestmentsDocument18 pagesProfile Scalo InvestmentsDlamini SiceloNo ratings yet

- 5 Stakeholders in A BusinessDocument2 pages5 Stakeholders in A BusinessLIN LUONo ratings yet

- Payslip 795119 CIN Sep 2019 PDFDocument1 pagePayslip 795119 CIN Sep 2019 PDFRaju UllengalaNo ratings yet

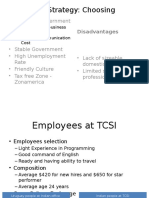

- Locational Strategy: Choosing Uruguay: - Access To GovernmentDocument3 pagesLocational Strategy: Choosing Uruguay: - Access To GovernmentVasu GandhiNo ratings yet

- Job & Batch Costing-IllustrationsDocument14 pagesJob & Batch Costing-IllustrationskeyurNo ratings yet

- LM A1.1Document17 pagesLM A1.1Dat HoangNo ratings yet

- How To Write A CVDocument10 pagesHow To Write A CVRainy DayNo ratings yet

- DeepStar Business and Operating PlanDocument22 pagesDeepStar Business and Operating PlanmikeseqNo ratings yet

- Contract Management AgreementDocument4 pagesContract Management Agreementabdul_salahiNo ratings yet

- Pondicherry Tourism ProposalDocument29 pagesPondicherry Tourism ProposalBabu GeorgeNo ratings yet

- Wang Anshi Economic ReformsDocument16 pagesWang Anshi Economic Reformspanos stebNo ratings yet

- Well-Being and Organizational Performance: An Organizational-Level Test of The Happy-Productive Worker HypothesisDocument18 pagesWell-Being and Organizational Performance: An Organizational-Level Test of The Happy-Productive Worker HypothesisLejandra MNo ratings yet

- Recruitment and Selection of The Sales ForceDocument53 pagesRecruitment and Selection of The Sales ForceThomas Varghese67% (3)

- The Trade Unions Act, 1926Document37 pagesThe Trade Unions Act, 1926Huzaifa SalimNo ratings yet

- Company Car PolicyDocument9 pagesCompany Car PolicyHasa Samudrala100% (1)

- CHAP19 Advance in Business Cycle TheoryDocument23 pagesCHAP19 Advance in Business Cycle TheoryFitriyani SalamuddinNo ratings yet

- DDUGKY - DARPG - Goa - Anil SubramaniamDocument24 pagesDDUGKY - DARPG - Goa - Anil SubramaniamRS ShekhawatNo ratings yet

- Class Xii Compiled by Sudhir Sinha Business StudiesDocument7 pagesClass Xii Compiled by Sudhir Sinha Business StudiesSudhir SinhaNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument6 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDianaNo ratings yet

- Hba Interest CalculationDocument3 pagesHba Interest CalculationparirNo ratings yet

- 202 HRMDocument2 pages202 HRMThakur GautamNo ratings yet

- 03 ENTERPRISE B2 NEW Quiz 01CDocument3 pages03 ENTERPRISE B2 NEW Quiz 01CdariaNo ratings yet

- Prevention of Occupational Hazards: Management of International Financial ServicesDocument8 pagesPrevention of Occupational Hazards: Management of International Financial ServicesMorvinNo ratings yet

- Labor Case Digests (Doctrines) - Rhapsody P. JoseDocument8 pagesLabor Case Digests (Doctrines) - Rhapsody P. JoseRhapsody JoseNo ratings yet

- Neeyamo Placement Product Specalist 2024 PuneDocument14 pagesNeeyamo Placement Product Specalist 2024 Punevismayramesh129No ratings yet

- Canadian Federation of Students (CFS) - Public Education For The Public Good - A National Vision For Canada's Post-Secondary Education System - October 2012Document30 pagesCanadian Federation of Students (CFS) - Public Education For The Public Good - A National Vision For Canada's Post-Secondary Education System - October 2012climbrandonNo ratings yet

- Thesis Statement For Raising Minimum WageDocument5 pagesThesis Statement For Raising Minimum Wageqpftgehig100% (2)

- Career AbstractsDocument10 pagesCareer AbstractsMichiel van den AnkerNo ratings yet