Professional Documents

Culture Documents

Long Term Construction 1

Uploaded by

JULLIE CARMELLE H. CHATTO0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

long-term-construction-1 (2)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageLong Term Construction 1

Uploaded by

JULLIE CARMELLE H. CHATTOCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

ACCOUNTING REFRESHER COURSE 1

ADVANCE FINANCIAL ACCOUNTING AND REPORTING

LONG TERM CONSTRUCTION CONTRACT

1. The records of Federer Construction in 2022 showed the following:

Project A Project B

Contract price 588,000 420,000

Cost incurred in 2022 336,000 392,000

Estimated costs to complete 168,000 56,000

Under the percentage-of-completion method how much gross profit should the company report in 2022?

a. P 588,000 b. P476,000 c. P258,000 d. P28,000

2. In 2021 Nadal Builders started work on a P6,750,000 fixed price construction contract. The company uses the

percentage-of-completion method of accounting for this type of contract. The records of the Co. showed the ff:

Cumulative Contract Cost Est. Total Cost at completion

2021 2,925,000 5,850,000

2022 4,725,000 6,075,000

How much income should be reported on December 31, 2022?

a. P75,000 b. P225,000 c. P450,000 d. P525,000

3. On January 1, 2021, Djokovic Construction Co. which uses the percentage-of-completion method

began work on a P9,000,000 construction contract. The following data relate to the progress of the contract:

Income recognized at Dec. 31, 2021 P 900,000

Cost incurred Jan. 1, 2017 - Dec. 31, 2022 5,400,000

Estimated cost to complete at Dec. 31, 2022 1,800,000

On Dec. 31, 2022, how much income should be recognized by Djokovic Company?

a. P787,500 b. P450,000 c. P1,350,000 d. P900,000

4. Murray Company uses the percentage-of-completion method of recognizing income from construction

contracts. In 2021, the company entered into a contract for the construction of a mall for P 100,000,000.

Dec. 31, 2021 Dec. 31, 2022

Estimated total cost at completion P75,000,000 P 80,000,000

Income recognized (cumulative) 5,000,000 12,000,000

Percentage of completion 20% 60%

How much is the total contract cost in 2022?

a. P32,000,000 b. P35,000,000 c. P33,000,000 d. P48,000,000

5. Cilic Construction Company uses the percentage of completion method of accounting. The company

started work on two job sites during the current year. Data relating to the two jobs are given below:

Contract Price Actual Cost Est. Cost to

Dec. 31, 2021 Complete

Contract 1 P 600,000 150,000 P 150,000

Contract 2 450,000 87,500 162,500

In 2022, Contract 3 was started for a contract price of P 900,000. As of Dec. 31, 2022, the ff. data are given:

Actual Cost Est. cost to

1/1/21-12/31/22 complete

Contract 1 P 280,000 P 70,000

Contract 2 180,000 120,000

Contract 3 180,000 320,000

How much income should be reported for the year 2022?

a. P90,000 b. P214,000 c. P144,000 d. P434,000

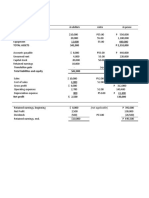

6. On January 2, 2022 YY Construction Co. entered into a contract to construct two projects.

Project 1 Project 2

Contract price P 945,000 P 675,000

Costs incurred during 2022 540,000 630,000

Estimated cost to complete 270,000 157,500

Billings to customers 337,500 607,500

What amount of gross profit should YY Const. Co. report in his 2022 income statement under the ff. method?

(a) (b) ('c) (d)

Percentage of Completion P -0- P(112,500) P(22,500) P(22,500)

Zero Profit Method P(90,000) P(22,500) P -0- P(112,500)

You might also like

- Form 4Document18 pagesForm 4JULLIE CARMELLE H. CHATTONo ratings yet

- FCDocument1 pageFCJULLIE CARMELLE H. CHATTONo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Computer Audit Ethics Page 2Document6 pagesComputer Audit Ethics Page 2JULLIE CARMELLE H. CHATTONo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- FC ProblemDocument1 pageFC ProblemJULLIE CARMELLE H. CHATTONo ratings yet

- Ans - Midterm - Prob. 2Document1 pageAns - Midterm - Prob. 2JULLIE CARMELLE H. CHATTONo ratings yet

- Fernan DebateDocument2 pagesFernan DebateJULLIE CARMELLE H. CHATTONo ratings yet

- Computer Audit EthicsDocument3 pagesComputer Audit EthicsJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 6 Applied Performance Practices NotesDocument4 pagesChapter 6 Applied Performance Practices NotesJULLIE CARMELLE H. CHATTONo ratings yet

- Death Penalty DebateDocument1 pageDeath Penalty DebateJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 7 Decision Making and CreativityDocument3 pagesChapter 7 Decision Making and CreativityJULLIE CARMELLE H. CHATTONo ratings yet

- Balaba Fwe Ngec 10 2122 S - DDocument8 pagesBalaba Fwe Ngec 10 2122 S - DJULLIE CARMELLE H. CHATTONo ratings yet

- Answer TranslationDocument1 pageAnswer TranslationJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 7Document5 pagesChapter 7JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 6Document1 pageChapter 6JULLIE CARMELLE H. CHATTONo ratings yet

- Legal Service Company Cover Page 1Document1 pageLegal Service Company Cover Page 1JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 5Document5 pagesChapter 5JULLIE CARMELLE H. CHATTONo ratings yet

- CHATTO Discipline EssayDocument1 pageCHATTO Discipline EssayJULLIE CARMELLE H. CHATTONo ratings yet

- Case 3 From Reo To Nuclear To Nucor (Key Points)Document4 pagesCase 3 From Reo To Nuclear To Nucor (Key Points)JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 8Document3 pagesChapter 8JULLIE CARMELLE H. CHATTONo ratings yet

- From Reo To Nuclear To Nucor Case Study AnalysisDocument7 pagesFrom Reo To Nuclear To Nucor Case Study AnalysisJULLIE CARMELLE H. CHATTONo ratings yet

- Installment SalesDocument2 pagesInstallment SalesJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 10Document2 pagesChapter 10JULLIE CARMELLE H. CHATTONo ratings yet

- Chapters 11 15Document8 pagesChapters 11 15JULLIE CARMELLE H. CHATTONo ratings yet

- Orca Share Media1670374193894 7006057162954118241Document4 pagesOrca Share Media1670374193894 7006057162954118241JULLIE CARMELLE H. CHATTONo ratings yet

- Notes in TaxationDocument2 pagesNotes in TaxationJULLIE CARMELLE H. CHATTONo ratings yet

- Chap 2 Interpretation and ComputationDocument15 pagesChap 2 Interpretation and ComputationJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 9Document1 pageChapter 9JULLIE CARMELLE H. CHATTONo ratings yet

- Powerpoint - SimulationDocument20 pagesPowerpoint - SimulationJULLIE CARMELLE H. CHATTONo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Send Me An AngelDocument3 pagesSend Me An AngeldeezersamNo ratings yet

- Budget ProposalDocument1 pageBudget ProposalXean miNo ratings yet

- Green Biocomposites For Structural ApplicationsDocument27 pagesGreen Biocomposites For Structural ApplicationsLamia Nour Ben abdelrahmenNo ratings yet

- 12-Zoomlion 70t Crawler Crane Specs - v2.4Document2 pages12-Zoomlion 70t Crawler Crane Specs - v2.4Athul BabuNo ratings yet

- Harper 2001Document6 pagesHarper 2001Elena GologanNo ratings yet

- Baixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFDocument5 pagesBaixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFCarlos Mendoza25% (4)

- Complete Cocker Spaniel Guide 009 PDFDocument119 pagesComplete Cocker Spaniel Guide 009 PDFElmo RNo ratings yet

- Governance Whitepaper 3Document29 pagesGovernance Whitepaper 3Geraldo Geraldo Jr.No ratings yet

- HP MSM775 ZL Controller Installation GuideDocument21 pagesHP MSM775 ZL Controller Installation GuidezarandijaNo ratings yet

- AFI 90-901 Operational Risk ManagementDocument7 pagesAFI 90-901 Operational Risk ManagementJohan Lai100% (1)

- The Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Document3 pagesThe Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Astry Iswara Kelana CitraNo ratings yet

- Laws and Policies of Fertilizers SectorDocument12 pagesLaws and Policies of Fertilizers Sectorqry01327No ratings yet

- Tutorial Class 4: Finders As Bailee Right of A Bailee General LienDocument26 pagesTutorial Class 4: Finders As Bailee Right of A Bailee General Lienchirag jainNo ratings yet

- Julian BanzonDocument10 pagesJulian BanzonEhra Madriaga100% (1)

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocument80 pagesGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNo ratings yet

- HitchjikersGuide v1Document126 pagesHitchjikersGuide v1ArushiNo ratings yet

- Odisha Block Summary - NUAGAONDocument8 pagesOdisha Block Summary - NUAGAONRohith B.NNo ratings yet

- A Brief History of LinuxDocument4 pagesA Brief History of LinuxAhmedNo ratings yet

- EEN 203 Slide Notes Year 2018: PART I - Numbers and CodesDocument78 pagesEEN 203 Slide Notes Year 2018: PART I - Numbers and CodesSHIVAM CHOPRANo ratings yet

- Soul Winners' SecretsDocument98 pagesSoul Winners' Secretsmichael olajideNo ratings yet

- PEDIA OPD RubricsDocument11 pagesPEDIA OPD RubricsKylle AlimosaNo ratings yet

- Komatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop ManualDocument20 pagesKomatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop Manualmallory100% (47)

- Sauna Studies As An Academic Field: A New Agenda For International ResearchDocument42 pagesSauna Studies As An Academic Field: A New Agenda For International ResearchsedgehammerNo ratings yet

- Civil Engineering Interview QuestionsDocument19 pagesCivil Engineering Interview QuestionsSrivardhanSrbNo ratings yet

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNo ratings yet

- Propht William Marrion Branham Vist IndiaDocument68 pagesPropht William Marrion Branham Vist IndiaJoshuva Daniel86% (7)

- Robot 190 & 1110 Op - ManualsDocument112 pagesRobot 190 & 1110 Op - ManualsSergeyNo ratings yet

- BUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Document55 pagesBUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Nguyễn Thị Thanh ThúyNo ratings yet

- University of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveDocument4 pagesUniversity of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveSupriyo BiswasNo ratings yet

- DLL Week 7 MathDocument7 pagesDLL Week 7 MathMitchz TrinosNo ratings yet