Professional Documents

Culture Documents

Notes in Taxation

Uploaded by

JULLIE CARMELLE H. CHATTOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes in Taxation

Uploaded by

JULLIE CARMELLE H. CHATTOCopyright:

Available Formats

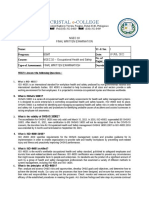

TAXATION EL

Taxation is:

1. A STATE POWER – an inherent power of the State to enforce a proportional contribution from its subjects for

public purposes.

2. A LEGISLATIVE PROCESS – a process of levying taxes by the legislature of the State to enforce proportional

contribution from its subjects for public purposes.

3. A MODE OF GOVERNMENT COST OF CONTRIBUTION – the Sate allocates its costs or burden to its subject

who are benefited by its spending.

The theory of taxation is the government’s necessity for funding.

The basis of taxation is the mutuality of support between the people and the government. The government offers public

services while the people pay taxes.

THEORIES OF ALLOCATION

1. Benefit received theory – the amount of benefit one receives form the government is proportional to the amount

he should be taxed.

2. Ability to pay theory – the capacity to pay is proportional to the amount he should be taxed.

a. Vertical Theory – proposes that the extent of one’s ability to pay is directly proportional to the level of

his tax base. (Gross Concept)

b. Horizontal Theory – proposes that the extent of one’s ability to pay is indirectly proportional to the level

of his tax base, considering particular circumstances. (Net Concept)

INHERENT POWERS OF THE STATE – powers can be exercise without the need of any law.

1. Taxation Power – power of the state to raise revenue for public purposes.

a. As to the coverage, taxation is the strongest because it covers anything.

b. As tot eh exercise of power, taxation is the weakest because it is subject to inherent and constitutional

limitation.

2. Police Power – the general power of the State to enact laws to protect the well-being of the people.

3. Eminent Domain – power of the State to take private property for public use after paying just compensation.

LIMITATIONS OF THE TAXATION POWER

A. Inherent Limitation

i. Territoriality of taxation – taxes are be imposed only within the territories of the State.

Resident citizens and domestic corps are taxable on income derived within/outside the country.

ii. International comity – mutual courtesy or reciprocity between states.

iii. Public purpose – intended for the common good.

iv. Exemption of the government – the gov’t can exercise the power upon anything excluding itself

v. Non-delegation of taxing power

B. Constitutional Limitation

i. Due process of law

ii. Equal protection of the law

iii. Uniformity rule in taxation

iv. Progressive system of taxation

v. Non-imprisonment for non-payment of debt or poll tax

vi. Non-impairment of obligation and contract

vii. Free worship rule

viii. Exemption of religious or charitable entities, non-profit cemeteries, churches and mosque from property

tax

ix. Non-appropriation of public funds or property for the benefit of any church, sect or system of religion

x. Exemption form taxes of the revenues and assets of non-profit, non-stock educational institution

xi. Concurrence of a majority of all members of Congress for the passage of a law granting tax exemption

xii. Non-diversification of tax collections

xiii. Non-delegation of the power of taxation

xiv. Non-impairment of the jurisdiction of the Supreme Court to review tax cases

xv. The requirement that appropriations, revenue, or tariff bills shall originate exclusively in the House of

Representatives

xvi. The delegation of taxing power to local government units

TAXATION EL

STAGES OF THE EXERCISE OF TAXATION POWER

1. Levy or Imposition -

2. Assessment and collection

You might also like

- IRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Document1 pageIRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Jennipher Lin100% (4)

- Public Debt ManagementDocument24 pagesPublic Debt ManagementGenelyn Cabudsan MancolNo ratings yet

- Income Taxation Banggawan - Chapter 1Document5 pagesIncome Taxation Banggawan - Chapter 1Frances Garrovillas100% (13)

- Introduction To Tax (Summary)Document2 pagesIntroduction To Tax (Summary)Loise MorenoNo ratings yet

- Principles of Taxation-ReviewerDocument36 pagesPrinciples of Taxation-ReviewerNikki Coleen SantinNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- Chapter 1 Income TaxationDocument11 pagesChapter 1 Income Taxationviceduard teclingNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesMa. Valerie LabareñoNo ratings yet

- Taxation May Be Defined As A State Power, A Legislative Process, and A Mode ofDocument18 pagesTaxation May Be Defined As A State Power, A Legislative Process, and A Mode ofIsabelita PavettNo ratings yet

- IAS 12 Income TaxesDocument4 pagesIAS 12 Income Taxeshae1234No ratings yet

- Taxation (Lecture 1)Document10 pagesTaxation (Lecture 1)Criselda TeanoNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationJames GuiruelaNo ratings yet

- Income Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)Document40 pagesIncome Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)JessaNo ratings yet

- SGV Co. Briefing EOPT ActDocument23 pagesSGV Co. Briefing EOPT ActFlores Renato Jr. S.100% (1)

- Chapter 5Document5 pagesChapter 5JULLIE CARMELLE H. CHATTONo ratings yet

- Taxation 1Document63 pagesTaxation 1Ella Joy MataNo ratings yet

- Estate Tax Return ComputationDocument2 pagesEstate Tax Return Computationjarlen cosasNo ratings yet

- Chapter 1 Income TaxationDocument7 pagesChapter 1 Income TaxationAihla Michelle Berido100% (1)

- Income Tax 01 General Principles of TaxationDocument11 pagesIncome Tax 01 General Principles of TaxationJade Ivy GarciaNo ratings yet

- MITERM Reviewer (Chap 1-4)Document17 pagesMITERM Reviewer (Chap 1-4)Necy Adeline GenogalingNo ratings yet

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- 21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.Document1 page21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.loschudentNo ratings yet

- Reviewer in TaxationDocument19 pagesReviewer in TaxationMarco ComboyaNo ratings yet

- Chapter 1: Introduction To Income TaxationDocument12 pagesChapter 1: Introduction To Income TaxationBeggie BucagNo ratings yet

- Basic Concepts of Taxation1Document6 pagesBasic Concepts of Taxation1Angela CanayaNo ratings yet

- Chapter 1 - Introduction To Taxation: Page 1 of 15Document15 pagesChapter 1 - Introduction To Taxation: Page 1 of 15Kristine dela CruzNo ratings yet

- Chapter 1 Introduction To Taxation Supplementary MaterialsDocument4 pagesChapter 1 Introduction To Taxation Supplementary MaterialsAngel PaltincaNo ratings yet

- Module 1 - TaxationDocument9 pagesModule 1 - TaxationYan DelfinNo ratings yet

- Taxation - ch1Document5 pagesTaxation - ch1Jannah CayabyabNo ratings yet

- Introduction of TaxationDocument3 pagesIntroduction of TaxationKristine LuarcaNo ratings yet

- Chapter 1 IntaxDocument7 pagesChapter 1 IntaxrarerawrolesNo ratings yet

- Inc Tax - 1Document18 pagesInc Tax - 1Rosalie Colarte LangbayNo ratings yet

- Bukidnon State University Alubijid Satellite CampusDocument16 pagesBukidnon State University Alubijid Satellite CampusJames Bryle GalagnaraNo ratings yet

- TaxationDocument12 pagesTaxationZia Angelica Jatap-Kurosawa Bocter-BarinasNo ratings yet

- NotesDocument11 pagesNotesjezbonquin1006No ratings yet

- Income Tax Part 1Document16 pagesIncome Tax Part 1mary jhoyNo ratings yet

- Accounting ModuleDocument104 pagesAccounting ModuleMa Fe PunzalanNo ratings yet

- BACC105-1 Introduction To TaxationDocument29 pagesBACC105-1 Introduction To TaxationJunel MamarilNo ratings yet

- Shabu Batak TaxationDocument41 pagesShabu Batak TaxationJOSHUA M. ESCOTONo ratings yet

- As A State Power: What Is Taxation?Document13 pagesAs A State Power: What Is Taxation?Less BalesoroNo ratings yet

- Tax 1Document18 pagesTax 1Billie Jan Louie JardinNo ratings yet

- Chapter 1Document4 pagesChapter 1Christian LadesmaNo ratings yet

- Taxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDocument2 pagesTaxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDeyNo ratings yet

- Income-Taxation-Notes - 01 06 24Document6 pagesIncome-Taxation-Notes - 01 06 24Gregzilla YoloMcswaginsNo ratings yet

- TaxationDocument7 pagesTaxationlenllera09No ratings yet

- Tax ReviewerDocument12 pagesTax Reviewerashleykate.hapeNo ratings yet

- TAXATION-General Principles: 3. Based Ability To PayDocument11 pagesTAXATION-General Principles: 3. Based Ability To PayJudy Ann Matos DiaganNo ratings yet

- Chapter 1 TaxationDocument16 pagesChapter 1 Taxationshirileon08No ratings yet

- Tax 1Document8 pagesTax 1Romeo ViernesNo ratings yet

- Taxation: General PrinciplesDocument34 pagesTaxation: General PrinciplesKeziah A GicainNo ratings yet

- PrinciplesDocument13 pagesPrinciplesRosalie PenedaNo ratings yet

- St. Paul University SystemDocument9 pagesSt. Paul University SystemKeziah AliwanagNo ratings yet

- Table of Contents IntroductionDocument25 pagesTable of Contents IntroductionRowena EspirituNo ratings yet

- DISCUSSION QUESTIONS - Income Taxation Chap 1Document2 pagesDISCUSSION QUESTIONS - Income Taxation Chap 1Vivienne Rozenn LaytoNo ratings yet

- Lecture 1 - General PrinciplesDocument5 pagesLecture 1 - General PrinciplesLovenia Magpatoc100% (1)

- Prelim Handouts What Is Taxation?Document18 pagesPrelim Handouts What Is Taxation?emielyn lafortezaNo ratings yet

- Taxation - Chapter 1Document12 pagesTaxation - Chapter 1CIARA MAE ORTIZNo ratings yet

- Introduction To Taxation: Don Honorio Ventura State UniversityDocument18 pagesIntroduction To Taxation: Don Honorio Ventura State UniversityJaypee ManiegoNo ratings yet

- Income Taxation ReviewerDocument7 pagesIncome Taxation ReviewerJudyann CadampogNo ratings yet

- Introduction To Taxation What Is Taxation?Document65 pagesIntroduction To Taxation What Is Taxation?Mae Justine Joy TajoneraNo ratings yet

- Principles of Income TaxationDocument29 pagesPrinciples of Income TaxationAriane Grace Hiteroza MargajayNo ratings yet

- Week 2 4Document50 pagesWeek 2 4Richelle BarongNo ratings yet

- General Principles of TaxationDocument10 pagesGeneral Principles of TaxationCamille LibradillaNo ratings yet

- Chapter 1Document16 pagesChapter 1Erika Joy EscobarNo ratings yet

- Fundamental Principles of Taxation: ObjectivesDocument12 pagesFundamental Principles of Taxation: ObjectivesChristelle JosonNo ratings yet

- Tax 1Document4 pagesTax 1Nicole Anne M. ManansalaNo ratings yet

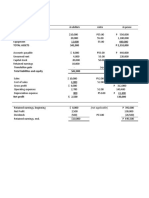

- FC ProblemDocument1 pageFC ProblemJULLIE CARMELLE H. CHATTONo ratings yet

- Ans - Midterm - Prob. 2Document1 pageAns - Midterm - Prob. 2JULLIE CARMELLE H. CHATTONo ratings yet

- Computer Audit Ethics Page 2Document6 pagesComputer Audit Ethics Page 2JULLIE CARMELLE H. CHATTONo ratings yet

- Computer Audit EthicsDocument3 pagesComputer Audit EthicsJULLIE CARMELLE H. CHATTONo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Form 4Document18 pagesForm 4JULLIE CARMELLE H. CHATTONo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- FCDocument1 pageFCJULLIE CARMELLE H. CHATTONo ratings yet

- Answer TranslationDocument1 pageAnswer TranslationJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 6 Applied Performance Practices NotesDocument4 pagesChapter 6 Applied Performance Practices NotesJULLIE CARMELLE H. CHATTONo ratings yet

- Balaba Fwe Ngec 10 2122 S - DDocument8 pagesBalaba Fwe Ngec 10 2122 S - DJULLIE CARMELLE H. CHATTONo ratings yet

- Case 3 From Reo To Nuclear To Nucor (Key Points)Document4 pagesCase 3 From Reo To Nuclear To Nucor (Key Points)JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 7 Decision Making and CreativityDocument3 pagesChapter 7 Decision Making and CreativityJULLIE CARMELLE H. CHATTONo ratings yet

- Death Penalty DebateDocument1 pageDeath Penalty DebateJULLIE CARMELLE H. CHATTONo ratings yet

- Fernan DebateDocument2 pagesFernan DebateJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 7Document5 pagesChapter 7JULLIE CARMELLE H. CHATTONo ratings yet

- CHATTO Discipline EssayDocument1 pageCHATTO Discipline EssayJULLIE CARMELLE H. CHATTONo ratings yet

- Chapters 11 15Document8 pagesChapters 11 15JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 6Document1 pageChapter 6JULLIE CARMELLE H. CHATTONo ratings yet

- From Reo To Nuclear To Nucor Case Study AnalysisDocument7 pagesFrom Reo To Nuclear To Nucor Case Study AnalysisJULLIE CARMELLE H. CHATTONo ratings yet

- Legal Service Company Cover Page 1Document1 pageLegal Service Company Cover Page 1JULLIE CARMELLE H. CHATTONo ratings yet

- Chap 2 Interpretation and ComputationDocument15 pagesChap 2 Interpretation and ComputationJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 9Document1 pageChapter 9JULLIE CARMELLE H. CHATTONo ratings yet

- Long Term Construction 1Document1 pageLong Term Construction 1JULLIE CARMELLE H. CHATTONo ratings yet

- Orca Share Media1670374193894 7006057162954118241Document4 pagesOrca Share Media1670374193894 7006057162954118241JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 8Document3 pagesChapter 8JULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 10Document2 pagesChapter 10JULLIE CARMELLE H. CHATTONo ratings yet

- Installment SalesDocument2 pagesInstallment SalesJULLIE CARMELLE H. CHATTONo ratings yet

- Barton Inc Completed Its First Year of Operations On DecemberDocument1 pageBarton Inc Completed Its First Year of Operations On Decemberhassan taimourNo ratings yet

- Book Profit: How To Calculate Book Profit From Cash Profit?Document3 pagesBook Profit: How To Calculate Book Profit From Cash Profit?zaheerbdsNo ratings yet

- Submitted Status:: Tax Period KNTN Name Submission Date Normal AmendedDocument2 pagesSubmitted Status:: Tax Period KNTN Name Submission Date Normal AmendedEntertaining VideosNo ratings yet

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument5 pagesFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesGoutham Kumar'sNo ratings yet

- Union Budget 2023Document5 pagesUnion Budget 2023Datta CreationsNo ratings yet

- Dheeraj 1Document1 pageDheeraj 1MOHD ASRAF ANSARINo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

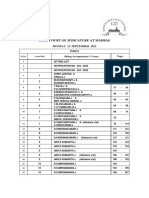

- Cause - List HCDocument615 pagesCause - List HCPradheesh MalhotraNo ratings yet

- ARVINDDocument1 pageARVINDSourabh YadavNo ratings yet

- Bts 44445Document1 pageBts 44445msNo ratings yet

- Flexi Pay - 2 The Following Terms Shall Have The Interpretations As BelowDocument2 pagesFlexi Pay - 2 The Following Terms Shall Have The Interpretations As BelowanuNo ratings yet

- Suspension of Audit - RMC 76-2022Document1 pageSuspension of Audit - RMC 76-2022ECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

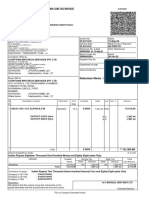

- Challan Cum Tax InvoiceDocument1 pageChallan Cum Tax InvoiceSahil KadamNo ratings yet

- Sales Tax FormDocument4 pagesSales Tax FormzilchhourNo ratings yet

- Cpa Reading ListDocument6 pagesCpa Reading ListIddy MohamedNo ratings yet

- 2-НДФЛ Перевод На АнглийскийDocument1 page2-НДФЛ Перевод На Английский13KARATNo ratings yet

- Business Mathematics - Module 12 - Gross and Net EarningsDocument4 pagesBusiness Mathematics - Module 12 - Gross and Net EarningsLovely Joy Hatamosa Verdon-DielNo ratings yet

- UTG Training Flyer Dampha FannehDocument1 pageUTG Training Flyer Dampha FannehMr DamphaNo ratings yet

- Repayment of The First-Time Homebuyer CreditDocument1 pageRepayment of The First-Time Homebuyer CreditKate SchwartzNo ratings yet

- SYBAF SEM IV TAXATION Unit IDocument5 pagesSYBAF SEM IV TAXATION Unit ISam RockerNo ratings yet

- CTP BooksDocument3 pagesCTP BooksuzernaamNo ratings yet

- 27 Key Changes Introduced in New ITR Forms Applicable For AY 2023-24Document11 pages27 Key Changes Introduced in New ITR Forms Applicable For AY 2023-24Nanu9711 JaiswalNo ratings yet

- The Federal BudgetDocument15 pagesThe Federal Budgetapi-426413696No ratings yet

- In 30302854036156Document2 pagesIn 30302854036156mallikaNo ratings yet