Professional Documents

Culture Documents

EC-Final Make Up 2020

EC-Final Make Up 2020

Uploaded by

Tamara al bittar0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

EC-Final_make_up_2020

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesEC-Final Make Up 2020

EC-Final Make Up 2020

Uploaded by

Tamara al bittarCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

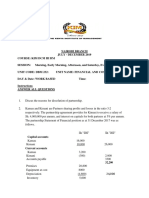

LEBANESE Dept.

: Civil engineering

UNIVERSITY Semester : 5

ENGINEERING Date : 7 September 2020

FACULTY Prof. : Dr T. Al-Bittar

BRANCH I

Documents Forbidden Duration : 1:15 hours

Make-up Exam

ENGINEERING ECONOMICS

Problem 1: (25 Points)

You need to know whether the building of a new warehouse is justified under the following

conditions:

The proposal is for a warehouse costing $200,000. The warehouse has an expected useful life

of 35 years and a net salvage value of $35,000. Annual receipts of $37,000 are expected,

annual maintenance and administrative costs will be $8,000/year, and annual income taxes

are $5,000.

Given the foregoing data, which of the following statements are correct?

(a) The proposal is justified for a MARR of 9%.

(b) The proposal has a net present worth of $152,512 when 6% is used as the interest rate.

(c) The proposal is acceptable, as long as MARR is

(d) All of the preceding are correct.

Problem 2: (25 Points)

A consumer product company is considering introducing a new shaving system called

DELTA-4 in the market. The company plans to manufacture 75 million units of DELTA-4 a

year. The investment at time 0 that is required for building the manufacturing plant is

estimated as $500 million, and the economic life of the project is assumed to be 10 years. The

annual total operating expenses, including manufacturing costs and overheads, are estimated

as $175 million. The salvage value that can be realized from the project is estimated as $120

million. If the company’s MARR is 25%, determine the minimum price that the company

should charge for a DELTA-4 shaving system

Problem 3: (25 Points)

Consider four investments with the following sequences of cash flows:

(a) Classify the following projects as simple or nonsimple investments

(b) Which project has no rate of return? Explain

(c) For the rest of the projects, calculate the internal rate of return.

Problem 4: (25 Points)

Consider the following two investment alternatives:

The firm’s MARR is known to be 15%.

(a) Compute the IRR of project B.

(b) Compute the PW of project A.

(c) Suppose that projects A and B are mutually exclusive. Using the IRR, which project

would you select?

Effective Interest Rate per Payment Period

Discrete compounding i = [(1 + r/(CK)]C - 1

Continuous compounding i = er/K - 1

where i =effective interest rate per payment period

r = nominal interest rate or APR

C = number of interest periods per payment period

K = number of payment periods per year

Market Interest Rate i =i' + f + i'f

where i = market interest rate

i’= inflation-free interest rate

f = general inflation rate

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Answer Foreclosure Defense New JerseyDocument15 pagesSample Answer Foreclosure Defense New Jerseyjorg100% (2)

- Critical Analysis of Organisation: PGDM BATCH: 2017-19Document29 pagesCritical Analysis of Organisation: PGDM BATCH: 2017-19NIKKI KUMARI0% (1)

- EC-midterm 2022Document3 pagesEC-midterm 2022Tamara al bittarNo ratings yet

- Midterm MDS2 2020 2021Document2 pagesMidterm MDS2 2020 2021Tamara al bittarNo ratings yet

- A) What Is The Effective Interest Rate Per Payment Period (I B) Compute The Monthly PaymentDocument2 pagesA) What Is The Effective Interest Rate Per Payment Period (I B) Compute The Monthly PaymentTamara al bittarNo ratings yet

- Problem 1: (20 Points)Document3 pagesProblem 1: (20 Points)Tamara al bittarNo ratings yet

- Problem 1: (25 Points)Document2 pagesProblem 1: (25 Points)Tamara al bittarNo ratings yet

- ARO Drilling For WebsiteDocument18 pagesARO Drilling For WebsiteDheeraj KapoorNo ratings yet

- Sample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorDocument15 pagesSample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorLaskar PejuangNo ratings yet

- DBM 232-1Document2 pagesDBM 232-1Newton otirnNo ratings yet

- Act 6 of 1965 PDFDocument451 pagesAct 6 of 1965 PDFgopireddyveerareddyNo ratings yet

- Explanation': Certlflcatelnco-Operativehousingmanagement: ToDocument4 pagesExplanation': Certlflcatelnco-Operativehousingmanagement: ToShahnawaz ShaikhNo ratings yet

- Clubbing of IncomeDocument8 pagesClubbing of IncomeVineet Gupta100% (1)

- ProblemDocument8 pagesProblemCORES LYRICSNo ratings yet

- Portfolio Recovery Associates Comments To The FTC Debt Collection Roundtable 2007Document4 pagesPortfolio Recovery Associates Comments To The FTC Debt Collection Roundtable 2007Jillian Sheridan100% (1)

- The Investment Function in BankingDocument20 pagesThe Investment Function in BankingJahidul IslamNo ratings yet

- Credit Limit Process For On Boarding ClientDocument2 pagesCredit Limit Process For On Boarding ClientUsman CreditNo ratings yet

- DBB1103-Unit 02-Economic EnvironmentDocument22 pagesDBB1103-Unit 02-Economic EnvironmentaishuNo ratings yet

- Aschauer, D. 1989 PDFDocument18 pagesAschauer, D. 1989 PDFAliJesusNavarroNo ratings yet

- ALLIANCE RESOURCE PARTNERS LP 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Document4 pagesALLIANCE RESOURCE PARTNERS LP 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNo ratings yet

- New Version of This Material Will Coming Soon: Sap Fi/Co Integration of FI With MMDocument10 pagesNew Version of This Material Will Coming Soon: Sap Fi/Co Integration of FI With MMSai ParekhNo ratings yet

- Concern Detail Database Tables Finyear Field Name Field Type SizeDocument10 pagesConcern Detail Database Tables Finyear Field Name Field Type SizeanadhanNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Gift Deed Sample FormatDocument3 pagesGift Deed Sample FormatSameerNo ratings yet

- FAR.2830 Financial Liabilities Summary DIY.Document7 pagesFAR.2830 Financial Liabilities Summary DIY.Lynssej BarbonNo ratings yet

- Clean Development Mechanism PDFDocument14 pagesClean Development Mechanism PDFtanzu4uNo ratings yet

- Perbandingan Hukum Negara Indonesia Dengan Hukum Negara Belanda Dalam Penyelesaian Perkara Sisa Hutang Debitor PailitDocument14 pagesPerbandingan Hukum Negara Indonesia Dengan Hukum Negara Belanda Dalam Penyelesaian Perkara Sisa Hutang Debitor PailitMuhammad ApriansyahNo ratings yet

- Negotiable Instruments Law Reviewer MagzDocument15 pagesNegotiable Instruments Law Reviewer MagzCorneliaAmarraBruhildaOlea-VolterraNo ratings yet

- Thailand Technology Internet - GS Research - 20180706Document50 pagesThailand Technology Internet - GS Research - 20180706AyushNo ratings yet

- Activity BFDocument2 pagesActivity BFJan Maurile AguaNo ratings yet

- Bop PPT - V3Document19 pagesBop PPT - V3abhaysharmadarocks7505No ratings yet

- University of Veterinary and Animal Sciences Lahore 4th Merit List On (24 Nov, 2023) For DVM (Morning)Document2 pagesUniversity of Veterinary and Animal Sciences Lahore 4th Merit List On (24 Nov, 2023) For DVM (Morning)hammad17678No ratings yet

- CFO-Forum MCEV Principles and Guidance April 2016Document31 pagesCFO-Forum MCEV Principles and Guidance April 2016apluNo ratings yet

- Old Liberalism Vs New LiberalismDocument8 pagesOld Liberalism Vs New LiberalismfdsennevilleNo ratings yet

- Brief IntroductionDocument25 pagesBrief IntroductionRahul BasnetNo ratings yet