Professional Documents

Culture Documents

Incotax Ho2021-11

Uploaded by

Jiaan HolgadoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Incotax Ho2021-11

Uploaded by

Jiaan HolgadoCopyright:

Available Formats

DE LA SALLE LIPA

College of Business, Economics, Accountancy, and Management

Accountancy and Accounting Information Systems Area

PHILIPPINE INCOME TAXATION

Income Taxation for Corporations, Partnerships, and Joint Ventures (Part 4)

Special Corporations

DOMESTIC CORPORATIONS

Proprietary Non-profit Educational Institutions and Hospitals

The rules applicable to ordinary corporations will also apply to proprietary educational institutions and

hospitals which are nonprofit except the following:

1. In computing basic income tax, the rate is 1%. However, if income not related to its primary

purpose or function is more than 50% of its total gross income, the rate applicable is 25%/20%.

Unrelated trade, business, or other activity – is an activity which is not substantially related to the

exercise or performance of the school or hospital’s primary purpose or function such as but not

limited to rental income from available school spaces or facilities

Examples of related income (RMC 4-2013)

• Income from tuition fees and miscellaneous school fees

• Income from hospital where medical graduates are trained for residency

• Income from canteen situated within the school campus

• Income from bookstore situated within the school campus

Proprietary educational institution – is any private school maintained and administered by private

individuals or groups with an issued permit to operate from the Department of Education (DepEd),

or the Commission on Higher Education (CHED), or the Technical Education and Skills

Development Authority (TESDA), as the case may be, in accordance with existing law and

regulations.

2. It is not subject to MCIT

3. Expenditures for expansion of school facilities may not be capitalized but instead claimed as

outright expense. This rule shall not apply, however, to a non-profit hospital.

Applicable Income Tax of Educational Institutions in the Philippines

Educational Institution Ordinary Income Passive Income* Capital Gains**

Proprietary Educational Generally 1% of net income FWT CGT****

Institutions (PEIs)*** 25%/20% if unrelated income >

Ex. UB, LPU, FEU related income

Non-stock non-profit • Philippine Constitution, Art.XIV, FWT CGT****

educational institutions Sec. 4(3): ALL REVENUES and

(NSEIs) ASSETS of non-stock, non-profit

Ex. DLSL, OLCA, STC, educational institutions used

Canossa actually, directly, and exclusively

for educational purposes shall be

exempt from taxes and duties; and

• Exempt under Sec. 30, NIRC; The

following shall not be taxed in

respect to income received by

them as such:

(H) A non-stock non-profit

educational institution

Government • Exempt under Sec. 30, NIRC; The FWT CGT****

Educational Institutions following shall not be taxed in

(GEIs) respect to income received by

Ex. BatStateU, KLL them as such:

(I) Government educational

institution & as provided for in the

law or charter creating the GEI

* On certain passive income derived from Philippine sources.

**On sale of shares of stock of a non-listed domestic corporation and real properties located in the

Philippines classified as capital assets.

***Only PEIs are classified as special corporations unless its Unrelated Income is higher than Related

Income. Hence, the discussions regarding PEIs in the preceding pages shall not be applied to NSEIs

and GEIs (ex. Income from leasing of spaces > tuition fee revenue)

****Sec. 234 of the Local Government Code – the following are exempted from payment of the real

property tax: (b) Charitable institutions, churches, parsonages or covenants appurtenant thereto,

mosques, nonprofit or religious cemeteries and all lands, buildings, and improvements actually, directly,

and exclusively used for religious, charitable, or educational purposes.

Applicable Income Tax of Hospitals in the Philippines

Educational Institution Ordinary Income Passive Income* Capital Gains**

For Profit Hospital Higher of 25%/20% RCIT, 1% MCIT FWT CGT

Ex. Mary Mediatrix

Medical Center

Non-stock non-profit 1% of net income (RA11534), FWT CGT****

hospitals (Special however, 25%/20% if unrelated

Corp.)*** income > related income

Ex. St. Luke’s Medical

Center May also be exempt if all the

requirements for exemptions under

the law are complied as illustrated

* On certain passive income derived from Philippine sources.

**On sale of shares of stock of a non-listed domestic corporation and real properties located in the

Philippines classified as capital assets.

***Generally, non-stock non-profit hospitals are classified as special corporations. Therefore, generally

taxable at 1% unless its Unrelated Income is higher than Related Income.

****Sec. 234 of the Local Government Code – the following are exempted from payment of the real

property tax: (b) Charitable institutions, churches, parsonages or covenants appurtenant thereto,

mosques, nonprofit or religious cemeteries and all lands, buildings, and improvements actually, directly,

and exclusively used for religious, charitable, or educational purposes.

RESIDENT FOREIGN CORPORATIONS:

International Carriers

Gross Philippine Billings PXXX

Rate x2.5%**

Income Tax PXXX

INCOTAX/INC-TAX #2021-11 | JAC

**International carriers may avail of a lower tax rate (preferential rate) or exemption under RA 10378 on

the basis of:

a. Tax Treaty

b. International agreement

c. Reciprocity – an international carrier, whose home country grants income tax exemption to

Philippine carriers, shall likewise be exempt from income tax.

Gross Philippine Billings (GPB):

a. International Air Carrier – refers to the amount of gross revenue derived from carriage of persons,

excess baggage, cargo, and mail:

- Originating from the Philippines;

- In a continuous and uninterrupted flight;

- Irrespective of the place of sale or issue and the place of payment of the ticket or passage of

document/

NOTE:

1. Tickets revalidated, exchanged and/or indorsed to another international airline form part of the

GPB if a passenger boards a plane in a port or point in the Philippines.

2. Flight which originates from the Philippines, but transshipment of passenger takes place at

any port outside the Philippines on another airline, only the aliquot portion of the cost of the

ticket corresponding to the leg flown from the Philippines to the point of transshipment shall

form part of the GPB.

b. International Shipping – means gross revenue whether for passenger, cargo, or mail originating

from the Philippines up to final destination, regardless of the place of sale or payments of the

passage or freight documents.

Regional Operating Headquarters (ROHQs)

The rules applicable to ordinary corporations will also apply to Regional Operating Headquarters except

the following:

1. In computing basic income tax, the rate is 10% but effective January 1, 2022, it will be at 25%

2. It is not subject to MCIT.

NON-RESIDENT FOREIGN CORPORATION

TYPE TAX BASE RATE

Non-resident Cinematographic Film Owner, Lessor, or Gross Income 25%

Distributor

Non-resident Owner or Lessor of Vessels Chartered Gross Rentals, lease, or charter fees 4.5%

by Philippine Nationals

Non-resident Owner or Lessor of Aircraft, Gross rentals, charters, or other fees 7.5%

Machineries, and Other Equipment

Offshore Banking Units (OBU)

An OBU is a branch, subsidiary, or affiliate or a foreign banking corporation located in a/n

Offshore Financial Center (OFC) which is duly authorized by the Bangko Sentral ng Pilipinas (BSP) to

transact offshore banking business in the Philippines (PD 1034; BSP Circular No. 1389). OBUs are

allowed to provide all traditional banking services to non-residents in any currency other than Philippine

national currency. Offshore banking units are forbidden to make any transactions in Philippine Peso.

Banking transactions to residents are limited and restricted. Income derived by offshore banking units

(OBUs) from foreign currency transactions shall be taxed as follows:

INCOTAX/INC-TAX #2021-11 | JAC

COUNTERPARTY RATE

Nonresidents Exempt

Other OBUs Exempt

Local Commercial Banks Exempt

Branches of foreign banks Exempt

Other residents 10%

If an OBU earn income other than from foreign currency transactions, it will be subject to basic

income tax (RCIT vs. MCIT, whichever is higher). Hence, OBUs are not classified as special

corporations. Any income derived by nonresidents (individuals or corporations) from transactions with

OBUs shall not be subject to income tax.

Regional or Area Headquarters (RHQs)

RHQs shall not be subject to income tax. RHQs are not included in the definition of corporation for

income tax purposes. Hence, RHQs are not special corporations.

BRANCH PROFIT REMITTANCE TAX (BPRT) OF RFCs

Formula

Profit remittance PXXXX

Rate 15%

BPRT PXXX

PROFIT REMITTANCE

PROFIT REMITTED APPLICABLE TAX

Connected with the conduct of its trade or business in the Philippines Subject to 15% BPRT

Others (i.e. passive income) Not subject to BPRT

EXEMPT ENTITIES

Activities registered with the following shall be exempt from BPRT:

1. Philippine Economic Zone Authority (PEZA)

2. Subic Bay Metropolitan Authority (SBMA)

3. Clark Development Authority (CDA)

FILING REQUIREMENTS

Filing of Tax Returns may be made through:

• Manual filing

• Electronic Filing and Payment System (eFPS)

• eBIR Forms

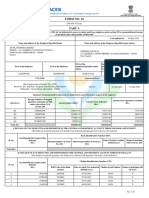

Form 1702Q (Quarterly Income Tax Return for Corporations, Partnerships and Other Non-

Individual Taxpayers)

- Description

This return is filed quarterly by every corporation, partnership, joint stock companies, joint

accounts, associations (except foreign corporation not engaged in trade or business in the

Philippines and joint venture or consortium formed for the purpose of undertaking construction

projects or engaging in petroleum, coal, geothermal and other energy operations),

government-owned or controlled corporations, agencies and instrumentalities.

- Filing Date

INCOTAX/INC-TAX #2021-11 | JAC

The corporate quarterly income tax return shall be filed with or without payment within sixty

(60) days following the close of each of the first three (3) quarters of the taxable year whether

calendar or fiscal year.

Form 1702-EX (Annual Income Tax Return For Corporation, Partnership and Other Non-Individual

Taxpayers EXEMPT Under the Tax Code, as Amended, {Sec. 30 and those exempted in Sec.

27(C)} and Other Special Laws, with NO Other Taxable Income)

- Description

This return shall be filed by a Corporation, Partnership and Other Non-Individual Taxpayer

EXEMPT under the Tax Code, as amended [Sec. 30 and those exempted in Sec. 27(C)] and

other Special Laws WITH NO OTHER TAXABLE INCOME such as but not limited to

foundations, cooperatives, charitable institutions, non-stock and non-profit educational

institutions, General Professional Partnership (GPP) etc.

- Filing Date

This return is filed on or before the 15th day of the 4th month following the close of the

taxpayer's taxable year.

Form 1702-MX (Annual Income Tax Return for Corporation, Partnership and Other Non-Individual

with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to

SPECIAL/PREFERENTIAL RATE)

- Description

This return shall be filed by every Corporation, Partnership and Other Non-Individual

Taxpayer with MIXED Income subject to MULTIPLE INCOME TAX RATES or with income

subject to SPECIAL/PREFERENTIAL RATE.

- Filing Date

This return is filed, with or without payment, on or before the 15th day of the 4th month

following the close of the taxpayer's taxable year.

Form 1702-RT (Annual Income Tax Return for Corporation, Partnership and Other Non-Individual

Taxpayer Subject Only to REGULAR Income Tax Rate)

- Description

This return shall be filed by Corporation, Partnership and other Non-Individual Taxpayer

Subject Only to REGULAR Income Tax Rate of 30%. Every corporation, partnership no

matter how created or organized, joint stock companies, joint accounts, associations (except

foreign corporation not engaged in trade or business in the Philippines and joint venture or

consortium formed for the purpose of undertaking construction projects or engaging in

petroleum, coal, geothermal and other energy operations), government-owned or controlled

corporations, agencies and instrumentalities shall render a true and accurate income tax

return in accordance with the provisions of the Tax Code.

- Filing Date

This return is filed, with or without payment, on or before the 15th day of the 4th month

following close of the taxpayer's taxable year.

-END-

INCOTAX/INC-TAX #2021-11 | JAC

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- TAX - Corporations With Special RatesDocument16 pagesTAX - Corporations With Special RatesZaaavnn Vannnnn100% (1)

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- Cbtax01 Chapter4Document11 pagesCbtax01 Chapter4Christelle JosonNo ratings yet

- Lecture-Corporate-Income-Tax 2Document5 pagesLecture-Corporate-Income-Tax 2Ragelli Mae NatalarayNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Tax On Corporations Oct 2019 PDFDocument70 pagesTax On Corporations Oct 2019 PDFKharen ValdezNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSDocument9 pagesMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47No ratings yet

- Income Tax On Special Corporations: Proprietary Educational Institutions and HospitalsDocument6 pagesIncome Tax On Special Corporations: Proprietary Educational Institutions and HospitalsachiNo ratings yet

- Lesson 5: Taxation of CorporationsDocument14 pagesLesson 5: Taxation of CorporationsGio yowyowNo ratings yet

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Taxation of CorporationsDocument26 pagesTaxation of CorporationsjolinaNo ratings yet

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorNo ratings yet

- Income Tax Reviewer Edward ArribaDocument26 pagesIncome Tax Reviewer Edward ArribaOdarbil BasogNo ratings yet

- Income Taxation Finals - CompressDocument9 pagesIncome Taxation Finals - CompressElaiza RegaladoNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Chapter 15 PDFDocument14 pagesChapter 15 PDFAvox EverdeenNo ratings yet

- MCL - TAX.106 - Income Taxation of Individuals CorporationsDocument58 pagesMCL - TAX.106 - Income Taxation of Individuals CorporationsKim TividadNo ratings yet

- Tax On Corporation - NotesDocument9 pagesTax On Corporation - NotesMervidelleNo ratings yet

- Finals (Taxation)Document30 pagesFinals (Taxation)Ruffa Mae SanchezNo ratings yet

- Corporation TaxationDocument12 pagesCorporation TaxationKaiNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- Lebanon TaxationDocument5 pagesLebanon TaxationShashank VarmaNo ratings yet

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- Chapter 15 Regular Income Taxation CorporationsDocument9 pagesChapter 15 Regular Income Taxation CorporationsMary Jane PabroaNo ratings yet

- TAXATIONDocument31 pagesTAXATIONRocel DomingoNo ratings yet

- Income Tax On CorporationDocument4 pagesIncome Tax On CorporationNikolai DanielovichNo ratings yet

- Corporation TaxationDocument7 pagesCorporation TaxationslncrochetNo ratings yet

- Lecture 2 - Income Taxation (Individual)Document8 pagesLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Income From Foreign Currency TransactionsDocument2 pagesIncome From Foreign Currency TransactionsMeghan Kaye LiwenNo ratings yet

- Income Tax On CorporationDocument54 pagesIncome Tax On CorporationJamielene Tan100% (1)

- TAX Reviewer 2Document9 pagesTAX Reviewer 2Krystal MaciasNo ratings yet

- Taxation Law Review Notes Corporation)Document9 pagesTaxation Law Review Notes Corporation)joycellemalabNo ratings yet

- 1 Corporate Income Taxation - IntroductionDocument7 pages1 Corporate Income Taxation - IntroductionIvy ObligadoNo ratings yet

- Income Tax On CorporationDocument53 pagesIncome Tax On CorporationLyka Mae Palarca IrangNo ratings yet

- Sir Lectures Final TaxDocument12 pagesSir Lectures Final TaxCrystal KateNo ratings yet

- Create Act: Corporate Recovery & Tax Incentives For EnterprisesDocument6 pagesCreate Act: Corporate Recovery & Tax Incentives For EnterprisesDanica RamosNo ratings yet

- Tax CorporateDocument5 pagesTax CorporateJorenz ObiedoNo ratings yet

- Module No. 1 - Introduction To Corporate Income Tax and Exempt Domestic CorporationsDocument6 pagesModule No. 1 - Introduction To Corporate Income Tax and Exempt Domestic CorporationsashleyNo ratings yet

- Income Tax PresentationDocument22 pagesIncome Tax PresentationItchigo KorusakiNo ratings yet

- Create LawDocument14 pagesCreate Lawmariaerica.toledoNo ratings yet

- 4 CorporationDocument15 pages4 CorporationrhieelaaNo ratings yet

- Corporate Income TaxDocument22 pagesCorporate Income TaxElson TalotaloNo ratings yet

- Corporate Income TaxationDocument20 pagesCorporate Income TaxationCris Margot LuyabenNo ratings yet

- Tax Lecture - CorporationsDocument7 pagesTax Lecture - CorporationsMagic ShopNo ratings yet

- Sec. 2 of The Corporation Code of The Philippines. Batas Blg. 68Document6 pagesSec. 2 of The Corporation Code of The Philippines. Batas Blg. 68jetotheloNo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Domestic Corporations Not Subject To MCITDocument3 pagesDomestic Corporations Not Subject To MCITMeghan Kaye LiwenNo ratings yet

- Faqs - Create LawDocument13 pagesFaqs - Create LawMichy De GuzmanNo ratings yet

- Philippines TaxDocument3 pagesPhilippines TaxerickjaoNo ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- Philippine Corporate TaxDocument3 pagesPhilippine Corporate TaxRaymond FaeldoñaNo ratings yet

- Preferential TaxationDocument9 pagesPreferential TaxationAnna Mae Sanchez100% (3)

- AE29 Corporate Income TaxDocument35 pagesAE29 Corporate Income TaxJames AguilarNo ratings yet

- Non - Resident Foreign Corporations Subject To Special Tax RatesDocument3 pagesNon - Resident Foreign Corporations Subject To Special Tax RatesMeghan Kaye LiwenNo ratings yet

- Preferential TaxationDocument8 pagesPreferential TaxationMary Jane PabroaNo ratings yet

- Reaction Paper Sales EffectivenessDocument2 pagesReaction Paper Sales EffectivenessJiaan HolgadoNo ratings yet

- GT1Document4 pagesGT1Jiaan HolgadoNo ratings yet

- Oblicon ReviewerDocument62 pagesOblicon ReviewerJiaan HolgadoNo ratings yet

- BMEC4 NotesDocument13 pagesBMEC4 NotesJiaan HolgadoNo ratings yet

- SOlution - IAS 28 3 PDFDocument4 pagesSOlution - IAS 28 3 PDFEISEN BELWIGANNo ratings yet

- DINAGTUAN Rhonalyn Installment LiquidationDocument20 pagesDINAGTUAN Rhonalyn Installment LiquidationRhad EstoqueNo ratings yet

- Q Feb21 PDFDocument9 pagesQ Feb21 PDFuser mrmysteryNo ratings yet

- Assignment No.5 AccountingDocument6 pagesAssignment No.5 Accountingibrar ghaniNo ratings yet

- U.S. Return of Partnership Income: Employer Identification NoDocument16 pagesU.S. Return of Partnership Income: Employer Identification Nosherr jones100% (1)

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- More Outputs With The Same InputsDocument34 pagesMore Outputs With The Same InputsDrama SubsNo ratings yet

- Audit-Assurance-December 2013-Exam-Paper (1) - 0Document9 pagesAudit-Assurance-December 2013-Exam-Paper (1) - 0Iddy MohamedNo ratings yet

- Working Capital ManagementDocument72 pagesWorking Capital ManagementKING KARTHIKNo ratings yet

- DR Bawumia Presentation at Kumasi Townhall MeetingDocument77 pagesDR Bawumia Presentation at Kumasi Townhall Meetingmyjoyonline.comNo ratings yet

- Module 1 Lesson 2 - Programming ExercisesDocument3 pagesModule 1 Lesson 2 - Programming ExercisesChrissie Jean E. TorresNo ratings yet

- KO Income Statement: Total RevenueDocument4 pagesKO Income Statement: Total RevenueSadiya Basheer Sadiya BasheerNo ratings yet

- Full Accounting Questions and AnswersDocument7 pagesFull Accounting Questions and Answersdiane dildine100% (2)

- SPECIAL ECONOMIC ZONE ACT OF 1995 As AmendedDocument10 pagesSPECIAL ECONOMIC ZONE ACT OF 1995 As AmendedRonil ArbisNo ratings yet

- Unit 3: Indian Accounting Standard 113: Fair Value MeasurementDocument35 pagesUnit 3: Indian Accounting Standard 113: Fair Value MeasurementvijaykumartaxNo ratings yet

- FABM 1 - Contextualized LAS - Week 4Document7 pagesFABM 1 - Contextualized LAS - Week 4Sheila Marie Ann Magcalas-GaluraNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Meghmani Organics 2018Document219 pagesMeghmani Organics 2018Puneet367No ratings yet

- Auditing Reviewer and AnswersDocument15 pagesAuditing Reviewer and AnswersElaine Joyce GarciaNo ratings yet

- InventoriesDocument15 pagesInventoriesAshelNo ratings yet

- Chapter 3 Mid SlybusDocument15 pagesChapter 3 Mid SlybusImtiaz SultanNo ratings yet

- Some Important Abbreviation For ITP ExamDocument3 pagesSome Important Abbreviation For ITP ExamMuhammed Abul Kalam AcmaNo ratings yet

- NCIII ReviewerDocument3 pagesNCIII ReviewerEmellaine Arazo de Guzman90% (30)

- HERBERT HERNANDEZ 2019 Tax Return PDFDocument31 pagesHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- Benjo Lopez CoDocument2 pagesBenjo Lopez Conovy0% (1)

- Mars Case-Siqi LIDocument4 pagesMars Case-Siqi LISiqi LINo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- FM Assignment 1Document8 pagesFM Assignment 1SAKSHAM ARJANINo ratings yet

- Translation ActivityDocument1 pageTranslation ActivityJon Dumagil Inocentes, CPANo ratings yet

- Reference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Document26 pagesReference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Aira PartiNo ratings yet