Professional Documents

Culture Documents

Calculate Indian Income Tax Liability

Uploaded by

mostak0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document outlines the tax liability calculation for two different levels of total income: Rs. 50,00,000 and Rs. 15,00,000. It shows how the total income is reduced by tax exemptions and taxed in slabs, with the applicable tax rates provided. For a total income of Rs. 50,00,000, the total tax liability is Rs. 10,60,000 and for a total income of Rs. 15,00,000 the total tax liability is Rs. 1,85,000.

Original Description:

tax liability calculation

Original Title

Tax Liability Calculation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the tax liability calculation for two different levels of total income: Rs. 50,00,000 and Rs. 15,00,000. It shows how the total income is reduced by tax exemptions and taxed in slabs, with the applicable tax rates provided. For a total income of Rs. 50,00,000, the total tax liability is Rs. 10,60,000 and for a total income of Rs. 15,00,000 the total tax liability is Rs. 1,85,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesCalculate Indian Income Tax Liability

Uploaded by

mostakThe document outlines the tax liability calculation for two different levels of total income: Rs. 50,00,000 and Rs. 15,00,000. It shows how the total income is reduced by tax exemptions and taxed in slabs, with the applicable tax rates provided. For a total income of Rs. 50,00,000, the total tax liability is Rs. 10,60,000 and for a total income of Rs. 15,00,000 the total tax liability is Rs. 1,85,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

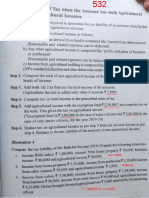

Tax Liability Calculation

Total Income 50,00,000 Tax Liability Calculation

50,00,000-2,50,000= 47,50,000 on first 2,50,000 =nil

47,50,000-4,00,000 =43,50,000 on next 4,00,000 @ 10% = 40,000

43,50,000-5,00,000 = 38,50,000 on next 5,00,000 @ 15% = 75,000

38,50,000-6,00,000 =32,50,000 on next 6,00,000 @ 20% = 1,20,000

32,50,000- 30,00,000 = 2,50,000 on next 30,00,000 @ 25% = 7,50,000

2,50,000-2,50,000=0 next balance 2,50,000@30% = 75,000

total tax liability =10,60,000

Tax Liability Calculation

Total Income 15,00,000 Tax Liability Calculation

15,00,000-2,50,000= 12,50,000 on first 3,00,000 =nil

12,50,000- 4,00,000= 8,50,000 on next 4,00,000 @ 10% =40,000

8,50,000- 5,00,000 = 3,50,000 on next 5,00,000 @ 15% = 75,000

3,50,000-3,50,000 =0 on next 6,00,000 @ 20%;

3,50,000 @ 20% =70,000

total tax liability 1,85,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- TAX LIABILITY PDF) OkDocument7 pagesTAX LIABILITY PDF) OksaeNo ratings yet

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- Areesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDocument2 pagesAreesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Presto ProductsDocument3 pagesPresto ProductsReign Imee NortezNo ratings yet

- Laiba Tufail Malik Fa18-Baf-005 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDocument2 pagesLaiba Tufail Malik Fa18-Baf-005 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNo ratings yet

- TaxationDocument11 pagesTaxationkhowcatherine2000No ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Income From Salary..adDocument7 pagesIncome From Salary..adduch mangNo ratings yet

- AFAR1 Operation SolutionDocument4 pagesAFAR1 Operation SolutionMiru YuNo ratings yet

- Reviewer Fabm2Document3 pagesReviewer Fabm2Mark LappayNo ratings yet

- Calculate expected loss for loan portfolioDocument6 pagesCalculate expected loss for loan portfoliodevilsnitchNo ratings yet

- PDF Actos y Condiciones Inseguras Soporte Cap CompressDocument16 pagesPDF Actos y Condiciones Inseguras Soporte Cap CompressDaniel SotoNo ratings yet

- Rates of Income Tax for AY 2017-18Document70 pagesRates of Income Tax for AY 2017-18dbp9050No ratings yet

- Important QNA PracticalDocument2 pagesImportant QNA PracticalDA FamilyNo ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Labaklan KorporasiDocument5 pagesLabaklan KorporasiNabilla Mutiara YurikaNo ratings yet

- Bsba2b INCOMETAXCOMP3 - 2 CABALLES, JERICALDocument30 pagesBsba2b INCOMETAXCOMP3 - 2 CABALLES, JERICALJerica CaballesNo ratings yet

- Inland Revenue Board of Malaysia: Eng MalDocument6 pagesInland Revenue Board of Malaysia: Eng Malathirah jamaludinNo ratings yet

- Treasury Management Assignment 1Document4 pagesTreasury Management Assignment 1jojie dadorNo ratings yet

- Tax Slabs: Ca. Dipayan DasDocument4 pagesTax Slabs: Ca. Dipayan DasNoob GamerNo ratings yet

- Agriculture Income - Income TaxDocument5 pagesAgriculture Income - Income TaxRainy GoodwillNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Arindam 2023Document1 pageArindam 2023Anupam DasNo ratings yet

- Year Cash Benefit Depreciation Income BT Tax at 50% Income AT Cashflow After Tax DF at 10%Document6 pagesYear Cash Benefit Depreciation Income BT Tax at 50% Income AT Cashflow After Tax DF at 10%Farhan Khan MarwatNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingFarhan Khan MarwatNo ratings yet

- 06 Task Performance 1 MRDocument5 pages06 Task Performance 1 MRclaudia smithNo ratings yet

- FM - Chapter 3 - QuizDocument8 pagesFM - Chapter 3 - QuizHausland Const. Corp.No ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Banjaran Pendapatan BercukaiDocument1 pageBanjaran Pendapatan BercukaiSiti NurafiqahNo ratings yet

- Yacapin Legal Services Adjusted Trial BalanceDocument3 pagesYacapin Legal Services Adjusted Trial BalanceCleah WaskinNo ratings yet

- Project AppraisalDocument34 pagesProject AppraisalWilly Mwangi KiarieNo ratings yet

- Tax TablesDocument1 pageTax TablesEmman NepacenaNo ratings yet

- Robinsons Bank Convert To Cash Processing FeesDocument1 pageRobinsons Bank Convert To Cash Processing FeesGen MacaleNo ratings yet

- Fiscal Reconciliation ExerciseDocument1 pageFiscal Reconciliation ExerciseMaria DevinaNo ratings yet

- Investment B Is Better Than Investment ADocument5 pagesInvestment B Is Better Than Investment AAsh JaneNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- Taxation 2 (Maika Notes)Document30 pagesTaxation 2 (Maika Notes)Maria Acepcion DelfinNo ratings yet

- Budget Template With ChartsDocument3 pagesBudget Template With ChartsAhmedNo ratings yet

- Project Evaluation Techniques Non-Discounted Cash FlowDocument3 pagesProject Evaluation Techniques Non-Discounted Cash FlowYameteKudasaiNo ratings yet

- Payroll AccoutingDocument7 pagesPayroll AccoutingGizaw BelayNo ratings yet

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- Car wash payback period calculationDocument2 pagesCar wash payback period calculationGray JavierNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Graduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Document3 pagesGraduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Jecah May R. RiegoNo ratings yet

- Paper20 Solution 1Document21 pagesPaper20 Solution 1lucasmathew15No ratings yet

- Financial Plan: Track BusDocument9 pagesFinancial Plan: Track BusbhaveshNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Income TaxDocument1 pageIncome TaxSelina TanNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Contoh Metode Cadangan Dan Penghapusan LangsungDocument3 pagesContoh Metode Cadangan Dan Penghapusan Langsungagung liandoNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Income Tax Slab CalculationDocument2 pagesIncome Tax Slab CalculationRaunak DaryananiNo ratings yet

- AMD AssignmentDocument4 pagesAMD Assignment234ss 567ppNo ratings yet

- Lecture 1 BD Economics AKDocument30 pagesLecture 1 BD Economics AKmostakNo ratings yet

- Lecture 2 - Bangladesh EconomicsDocument39 pagesLecture 2 - Bangladesh EconomicsmostakNo ratings yet

- Bangladesh Economics - Lecture 3Document30 pagesBangladesh Economics - Lecture 3mostakNo ratings yet

- Errors & FraudsDocument27 pagesErrors & FraudsmostakNo ratings yet

- Cse & EeeDocument48 pagesCse & EeemostakNo ratings yet