Professional Documents

Culture Documents

Home Loan Application

Uploaded by

rajesh rajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Loan Application

Uploaded by

rajesh rajCopyright:

Available Formats

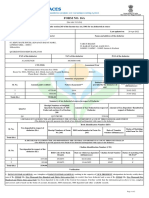

UCO Bank

To

The Manager Passport size Passport size

UCO Bank Photograph Photograph

……………………. Branch Applicant Co-Applicant

Sir / Madam,

Sub: - Application for Term Loan under UCO Home Loan Scheme

I / We apply for sanction of a term loan limit of Rs ………………. in favour of me/ us under UCO Home

Loan Scheme and furnish below the necessary information & relevant particulars: -

Applicant Co-Applicant

First Name Middle Name Surname First Name Middle Name Surname

Name

(In Block letter)

Father’s Name

Husband’s

Name

Date of Birth Age Date of Birth Age

(dd/mm/yyyy) (years) (dd/mm/yyyy) (years)

Gender (√) Male/Female/Third-gender Male/Female/Third-gender

Marital Status Married/ Bachelor/Widow/Widower/ Divorced Married/ Bachelor/Widow/Widower/ Divorced

(√)

Category (√) Gen/SC/ST/OBC Gen/SC/ST/OBC

CURRENT ADDRESS

Applicant Co-Applicant

Address

(Holding/

Premises no.

Flat/floor no.

Street

Ward no. etc.)

Municipality Village/Town Municipality Village

/Corporation / /Corporation /Town

Panchayat / Panchayat

City Post- Office City Post-

Office

District State District State

Pin Code E mail Pin Code E mail

Phone Mobile Phone Mobile

No. of years in

Current Address

Application form - UCO Home Loan Scheme 1

UCO Bank

PERMANENT ADDRESS

Applicant Co-Applicant

Address

(Holding/

Premises no.

Flat/floor no.

Street

Ward no. etc.)

Municipality Village/Town Municipality Village

/Corporation / /Corporation /Town

Panchayat / Panchayat

City Post- Office City Post-

Office

District State District State

Pin Code Phone Pin Code Phone

RELATIONSHIP WITH ANY MEMBER OF UCO BANK STAFF

Applicant Co-Applicant

Relationship with If yes, Relationship If yes,

any Member of UCO Yes / No Nature of with any Yes / No Nature

Bank Staff (√) relationship Member of of

UCO Bank Staff relations

(√) hip

Name of the UCO PFM No. Name of the PFM No.

Bank Staff UCO Bank Staff

Category of the Present Category of Present

UCO Bank Staff Officer/Clerk Place of the UCO Bank Officer/Clerk Place of

(√) / Sub-staff Posting Staff (√) /Sub-staff Posting

EDUCATIONAL QUALIFICATION

Applicant Co-Applicant

Academic Professional Academic Professional

Qualification Qualification Qualification Qualification

FAMILY MEMBERS

Applicant Co-Applicant

Minors (No.) Adults (No.) Minors (No.) Adults (No.)

No. of No. of No. of No. of

Family Dependents Family Dependents

Members Members

OTHER INFORMATION

Applicant Co-Applicant

Pan Card/ GIR Ration Card Pan Card/ Ration Card

no. no. GIR no. no.

Voter Id Card Passport no. Voter Id Passport no.

no. Card no.

Driving License Office Driving Office

no. Identity License no. Identity

Card no Card no

Relationship

between the

Applicant &

Co-applicant

Application form - UCO Home Loan Scheme 2

UCO Bank

OTHER INFORMATION Applicant Co-Applicant

Age of Banking Relationship with New Customer / …………(Months) New Customer / …………(Months)

UCO Bank

/ …………. (Years) / …………. (Years)

Whether you are guarantor of

someone else? ( √ ) Yes / No Yes / No

SB/Current a/c no. with UCO BANK

(CBS Branch)

OCCUPATION PARTICULARS: -

Applicant Co-Applicant

Occupation Service/Business/Professional/Self- Service/Business/Professional/Self-

(√) employed/Agriculture/Retired/House employed/Agriculture/Retired/House

wife/Student/Others wife/Student/Others

Designation Department Designation Department

No. of years in Emp / PF No. No. of years Emp / PF

Present in Present No.

Occupation Occupation

Date of Retirement Date of Retirement

Retirement Age Retirement Age

(As per Employer’s (As per Emp.

certificate) certificate)

Name of the

Employer /

Business

Organization

Address of the

Employer /

Business

Organization

Village/Town/ Post- Village/Town/ Post-

City Office City Office

District State District State

Pin Phone Pin Phone

Fax E mail Fax E mail

Nature of

Employment (√) Transferable / Non- Transferable Transferable / Non- Transferable

No. of years in

the present

occupation

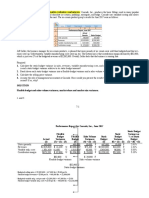

INCOME PARTICULARS: -

Applicant Co-Applicant

Monthly Income from

Occupation (A) Rs……………. Rs……………. (A)

Other Regular Income per Source Other Regular Source

month (B) Rs…………… Income per Rs……….

month (B)

Total Monthly Income

(C=A+B) Rs……………. Rs……………. (C=A+B)

Monthly Deductions /

Expenses (D) Rs……………. Rs……………. (D)

Net Income (E=C-D)

Rs……………. Rs……………. (E=C-D)

Monthly Repayment (EMI)

of any outstanding loan/s Rs……………. Rs…………….

`

Application form - UCO Home Loan Scheme 3

UCO Bank

LOAN PARTICULARS

PURPOSE OF LOAN

1. Independent house/ready built flat for residential purpose.

2. Old house/flat not more than 30 yrs old, & free from tenancy

a. Purchase (√)

3. Flat from Regd. Co-op Society

4. Flat from builders

5. Purchase of Land from Urban Development Authorities/Govt. Bodies

b. Construction (√) Yes/ No

c. Extension /Repair/ Renovation (√) Yes/ No

d. Takeover (√) Yes/ No

e. Furnishing (√) Yes/ No

f. Shelter in Old Age Home (√) Yes/ No

g. Shelter against liquid Securities

(√) Yes/ No

h. Second Shelter Loan for Extension

/Repair/ Renovation (√) Yes/ No

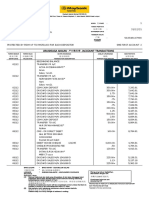

REQUIREMENT & SOURCE OF FUND

Estimate of Funds Requirement Amount in Rupees Estimate of Source to Amount in Rupees

Meet Requirement of

Funds

1. Proposed Purchase price of Land a)

from Urban Development NSC/KVP/FDRS

Authorities/Govt. Bodies only.

2. Total Purchase Price of House/Flat b) SB Deposits

3. c) Surrender Value of LICI

Construction Cost of House

Certificate

4. Cost of d) Other Source … (specify)

Repair/Extension/Renovation

5. e) Loan Applied from UCO

Cost of Registration

Bank

6. Repayment of Housing Loan as

takeover from other Bank/FIs

7. Cost of Furnishing

8. Shelter for Old Age Home

9. Shelter against Liquid Securities

10. Insurance Charges (one time)

11. Amount already spent

A. Total (1 To 10) - (11) B. Total (1 TO 5)

OTHER INFORMATION

1. Proposed Repayment Period (Months)

2. Proposed Moratorium Period within the above

Repayment Period (Months) Rs…………….

3. Rate of Interest opted (√) Fixed / Floating

4. Rate of Interest opted (√) Fixed / Float

5. Proposed Equated Monthly Instalment (EMI) for Term

Loan Rs…………….

6. Proposed Mode of Repayment for Term Loan Deduction from monthly salary/ Post dated Cheques

7. Amount of Instalment the borrower / co-applicant can

pay Rs. ……………………. per month

Application form - UCO Home Loan Scheme 4

UCO Bank

PARTICULARS OF THE IMMOVABLE PROPERTY OFFERED AS SECURITY

Name of the present owner/s of the

property

Description of the property

Location of the property (√) Metro/Urban/Semi-Urban/Rural

Marketability (√) Very Good/ Good/ Fair/ Poor

Area of the Land

Built up area of the Building, if any Age of the Building ……….. years

(sq. Ft.)

POSTAL ADDRESS OF THE

PROPERTY

(Holding/ Premises no./Flat/

floor no. Street, Ward no. etc.)

Village/Town City

Municipality /Corporation / Post- Office

Panchayat

Police Station District

State Pin Code

Property Schedule

Title Deed No Book no

Volume No Page No

Year of Registration/ Registry Office

Purchase

Purchase Price Rs. ……………… Survey/Circle/Mouza

J L No Khaitan no

Dag/plot no Class of Land

OTHER INFORMATION (For the Immovable Property Offered as Security)

1. Monthly Maintenance Cost of the Properties (Monthly

fixed costs like Maintenance Costs, Property

Insurance (pro-rata), property taxes etc) Rs…………….

2. Name of the vendor/ builder/ developer

3. Do you propose to rent the dwelling unit? ( √ )

Yes/ No

If so., amount of rent expected per month Rs…………….

4. Are you sole owner of the dwelling unit? ( √ ) Yes/ No

5. Is the legal title to the dwelling unit clear? ( √ ) Yes/ No

6. Whether bank is able to obtain 1st mortgage of

Yes/ No

dwelling unit? ( √ )

7. Whether you want to avail housing loan- With Life Risk

Yes/ No/ (Yes both 7 & 8)

/ Accident Benefit (√)

8. Whether you want to avail housing loan- With

Accident Benefit / House Risk (√) Yes/ No/ (Yes both 7 & 8)

Application form - UCO Home Loan Scheme 5

UCO Bank

PARTICULARS OF COLLATERAL SECURITIES OFFERED

A. Personal guarantee offered, if any

Name of the Guarantor Nature of Relationship with the applicant/s, if any

B. Collateral Securities offered, if any

Description of Collateral Securities offered Present value of Collateral Securities

1

Rs…………….

2

Rs…………….

3

Rs…………….

DECLARATION

I/We declare that all particulars and information given in the application form are true, correct and

complete and that they shall form the basis of loan under UCO Home Loan Scheme to be availed

from UCO Bank.

I/We confirm that we have had no insolvency proceedings against me/us nor have I/we ever been

adjudicated /insolvent.

I/we also agree to UCO Bank making enquiries in respect of the loan application made by me/us.

I/We further agree that my/our loan if sanctioned shall be governed by the rules of UCO Bank which

may be in force from time to time.

(Applicant’s Signature) (Co-Applicant’s Signature)

Date: - Date: -

Place: - Place: -

List of Enclosure: - As per Annexure

Application form - UCO Home Loan Scheme 6

UCO Bank

Annexure

LIST OF DOCUMENTS TO BE SUBMITTED BY THE APPLICANT

{A} Statement of means of Applicant/s (format enclosed)

{B} Two passport size photographs of Applicant/s

{C} Proof of Identity/Age

1. Ration Card

2. Voter’s Identity Card

3. PAN Card

4. Pass Port

5. Driving Licence

(Any one document of the above documents (1-5) is compulsory)

6. Office Identity Card

7. Birth Certificate

8. School Leaving Certificate

(Any one document of the above documents (6-8) is compulsory)

9. Bank’s Pass Book/ Statement of accounts for last six month

** Submission of Bank’s Pass Book / Statement of accounts (of both for Applicant/s and Guarantor/s) for last six

month is COMPULSORY.

{D} Proof of Employment/Income

1. Employment Verification Certificate (Format enclosed)

2. Salary Slip for the last three months

3. Form 16 issued by the office

4. Income Tax Return/Assessment Order.

{E} Proof of undertaking the business (For Non-Salaried Class people)

a) Trade license

b) The statement of accounts (CA/CC)

c) Financial statements

{F} Documents for Take Over Loans

1. Statement of Loan account with other bank/institution.

2. Copy of the sanction advice issued by the bank/institution

{G} Additional documents, if any, as per the terms & conditions of UCO Home loan scheme as well as

norms & guidelines of the Bank.

DOCUMENTS TO BE SUBMITTED BY THE APPLICANT AFTER RECEIVING ‘IN PRINCIPLE SANCTION’ LETTER.

(i) FOR PURCHASE/ REPAIR/EXTENSION

1. Agreement for Sale/Allotment Letter

2. Mother title deed/Link Deed of the property

3. Sanction Plan issued by Corporation/Municipality/Panchayat authority

4. Receipt of Initial Payment made to the seller for executing the agreement for sale.

5. Certificate from the Bank’s empanelled Chartered Engineer regarding the age

of the house/ flat and its residual life in case of repurchase.

(ii) FOR CONSTRUCTION

1. Title Deed of the land

2. Mutation Certificate

3. In case the land has been inherited, Gift Deed/Partition Deed

4. Sanction Plan valid for implementation

5. Estimate for Construction by Civil Engineer or approved Valuer of Corporation / Municipality

6. Statement of Expenditure incurred for construction so far

Application form - UCO Home Loan Scheme 7

UCO Bank

(iii) FOR TAKE OVER (copies to be submitted)

1. Title deed of the land in case house constructed.

2. Mutation Certificate

3. Deed of conveyance in case of purchase of flat/house.

4. Sanction Plan.

5. Municipal Tax Receipt.

6. Parcha

7. Any other document submitted to the bank for creation of Mortgage.

(iv) COMMON DOCUMENT

1. Mutation in the Name of present owner (Municipal/BLRO)

2. Mortgage Permission from the Housing Board/ Co-operative Society

3. Parcha, Municipal Tax Receipt

(vi) DOCUMENTS TO BE OBTAINED BY THE BRANCH BEFORE FINAL SANCTION

In addition to the above documents (mentioned under Part A & B) above the branch should also obtain the

following:

1. Legal opinion / Search Certificate / Certificate on the marketability of the property to be financed.

2. Certificate from the Bank’s Empanelled Chartered Engineer / Valuer regarding the age of the house / Flat and

its residual life in case of repurchase.

3. Estimate of the cost of construction / repair / extension from the Bank’s Empanelled Valuer / Chartered

Engineer where the amount of loan is above Rs.10 lac.

Application form - UCO Home Loan Scheme 8

You might also like

- SLF066 CalamityLoanApplicationForm V04Document2 pagesSLF066 CalamityLoanApplicationForm V04marta100% (4)

- 2021 1098-Mort Mortgage 0223 WellsfargoDocument2 pages2021 1098-Mort Mortgage 0223 WellsfargokhoaqphanNo ratings yet

- AUTO-OWNERS INSURANCE COMPANY v. COLORADO INTERSTATE GAS Et Al DocketDocument2 pagesAUTO-OWNERS INSURANCE COMPANY v. COLORADO INTERSTATE GAS Et Al DocketACELitigationWatchNo ratings yet

- MorningStar ES0143416115Document4 pagesMorningStar ES0143416115José J. Ruiz SorianoNo ratings yet

- Nationstar q1 2013Document22 pagesNationstar q1 2013Jay KabNo ratings yet

- Loan Number: Borrower Co-BorrowerDocument5 pagesLoan Number: Borrower Co-BorrowerJeff BettsNo ratings yet

- Twenty4ever, September 2011 NewsletterDocument2 pagesTwenty4ever, September 2011 NewsletterAlliant Credit UnionNo ratings yet

- Foreclosure 19-17-26Document3 pagesForeclosure 19-17-26adityaNo ratings yet

- Statement of Account - 14!47!49Document2 pagesStatement of Account - 14!47!49lalithaNo ratings yet

- 411DPFHZ539384 Foreclosure LetterDocument3 pages411DPFHZ539384 Foreclosure LetterSaikiran VeepuriNo ratings yet

- ALDOT Cooper BriefDocument51 pagesALDOT Cooper BriefErica ThomasNo ratings yet

- Akash Shinde: Loan Account Statement For 402Cdd92213452Document2 pagesAkash Shinde: Loan Account Statement For 402Cdd92213452Akash ShindeNo ratings yet

- Action Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELDocument5 pagesAction Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELJulu EmimaryNo ratings yet

- Foreclosure Letter 23-41-25Document3 pagesForeclosure Letter 23-41-25आम्हीं मालवणीNo ratings yet

- Service Request Affidavit - CANADA - 12 - 21 - 17 - RogersDocument2 pagesService Request Affidavit - CANADA - 12 - 21 - 17 - RogersSangeetha BajanthriNo ratings yet

- Medical Insurance 2020Document4 pagesMedical Insurance 2020Victor WongNo ratings yet

- Todd Rhodes Police ReportsDocument106 pagesTodd Rhodes Police Reportssavannahnow.comNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V05Document3 pagesSLF065 MultiPurposeLoanApplicationForm V05JOSPEH ONTORIANo ratings yet

- Cash Plus Personal Loan PdsDocument2 pagesCash Plus Personal Loan PdsVaishnavi KrishnanNo ratings yet

- Statement - Nov 2019 2Document13 pagesStatement - Nov 2019 2Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- Loan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)mulaparthi RaviNo ratings yet

- Signed ApplicationDocument4 pagesSigned ApplicationDaBaddest ManagementNo ratings yet

- Caliber Lone Star LSF9 IPO Investment Prospectus S 1 ADocument2,569 pagesCaliber Lone Star LSF9 IPO Investment Prospectus S 1 ANye LavalleNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Todaleep sharmaNo ratings yet

- Monthly Services: Included at No Extra CostDocument1 pageMonthly Services: Included at No Extra CostRajnish VermaNo ratings yet

- Loan Account Statement For 454pstfu477657Document3 pagesLoan Account Statement For 454pstfu477657Gurpreet SinghNo ratings yet

- Payment Schedule - 20190430 - 073337 PDFDocument2 pagesPayment Schedule - 20190430 - 073337 PDFKylyn JynNo ratings yet

- 3 A. Tesla Inc. Board Packet PG 1 19Document19 pages3 A. Tesla Inc. Board Packet PG 1 19Casey HarrisonNo ratings yet

- Tax Information Account 943420759Document12 pagesTax Information Account 943420759DavidNo ratings yet

- Application Summary: Wells Fargo Home Mortgage Rate Reduction ProgramDocument3 pagesApplication Summary: Wells Fargo Home Mortgage Rate Reduction Programpiehay7577No ratings yet

- Chillicothe Police Reports For 1-20-17Document40 pagesChillicothe Police Reports For 1-20-17Andy BurgoonNo ratings yet

- Ebill Nov2022 1.95384351Document8 pagesEbill Nov2022 1.95384351Bushee ComelNo ratings yet

- Brick Township v. Congregation Kehilos YisroelDocument3 pagesBrick Township v. Congregation Kehilos YisroelRise Up Ocean CountyNo ratings yet

- My Zone Card Statement: Payment SummaryDocument2 pagesMy Zone Card Statement: Payment SummaryKunal DasNo ratings yet

- Chillicothe Police Reports For May 8th 2014Document79 pagesChillicothe Police Reports For May 8th 2014Andrew AB BurgoonNo ratings yet

- 1099 G 2018documentdownloadDocument1 page1099 G 2018documentdownloadKristine McVeighNo ratings yet

- WellsFargoDocument5 pagesWellsFargoUsm amNo ratings yet

- Firefighter Recruiting InformationDocument5 pagesFirefighter Recruiting InformationWVLT NewsNo ratings yet

- Get PDF DocumentDocument2 pagesGet PDF DocumentkarthiktoyouNo ratings yet

- MBBcurrent 564548147990 2021-12-31 PDFDocument5 pagesMBBcurrent 564548147990 2021-12-31 PDFAdeela fazlinNo ratings yet

- SOP 3.7 r9 - Accidental Aircraft and Component Damage Reporting - Procedures Dated 04-24-2023Document5 pagesSOP 3.7 r9 - Accidental Aircraft and Component Damage Reporting - Procedures Dated 04-24-2023Darby MorganNo ratings yet

- Dcoument7 AMEXStatement Mar 2015Document11 pagesDcoument7 AMEXStatement Mar 2015Daniel TaylorNo ratings yet

- Statement 2022Document1 pageStatement 2022Alexander Barno AlexNo ratings yet

- Employee Details For RazorpayX PayrollDocument8 pagesEmployee Details For RazorpayX PayrollDeepak kumar M RNo ratings yet

- Manikandan S Sosekark 3 452 4 15 A Nattuvakkudi Mugandhanur Po Kudavasal TK TiruvarurDocument3 pagesManikandan S Sosekark 3 452 4 15 A Nattuvakkudi Mugandhanur Po Kudavasal TK TiruvarurManikandan MkNo ratings yet

- Somerset Homes For Sale 200-250kDocument24 pagesSomerset Homes For Sale 200-250kSuzanne SandsNo ratings yet

- Hardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Document4 pagesHardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Blake BrewerNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummaryMohammad MAAZNo ratings yet

- Dow Elite 5401G TDSDocument3 pagesDow Elite 5401G TDSAli RazuNo ratings yet

- Oct-22 421102Document4 pagesOct-22 421102Harish LawandNo ratings yet

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorNo ratings yet

- UKjanuaryDocument1 pageUKjanuaryЕгор100% (1)

- PayslipDocument2 pagesPaysliporrinlloyd750No ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- Expert Witness Report of Zachary Allen Bumpus Filed As Ex. 28 MRS V JPM-D.E. 363Document22 pagesExpert Witness Report of Zachary Allen Bumpus Filed As Ex. 28 MRS V JPM-D.E. 363larry-612445No ratings yet

- Car Insurance Go Digit SkodaDocument3 pagesCar Insurance Go Digit SkodaAbhiroop AwasthiNo ratings yet

- Shortsale Foreclosure - Resources 1 2013Document6 pagesShortsale Foreclosure - Resources 1 2013Imani BalivajaNo ratings yet

- Bill 1Document1 pageBill 1ajeet sainNo ratings yet

- Guarantors Statement FormDocument5 pagesGuarantors Statement FormVeerababu AdapaNo ratings yet

- Mambulao Lumber V PNB (22 SCRA 359)Document4 pagesMambulao Lumber V PNB (22 SCRA 359)Jose RolandNo ratings yet

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- Econ30001 - S1 201Document15 pagesEcon30001 - S1 201vanessa8pangestuNo ratings yet

- E TicketDocument1 pageE TicketKamal Raj MohanNo ratings yet

- Annual Report BDP 2016Document130 pagesAnnual Report BDP 2016Zahra Putri PratamaNo ratings yet

- Mice PDFDocument284 pagesMice PDFAsillia RatnaNo ratings yet

- Bandhan Statement SandipDocument4 pagesBandhan Statement SandipIndranilGhosh0% (1)

- Assignment 1: Daniella AlemaniaDocument4 pagesAssignment 1: Daniella AlemaniaDaniella AlemaniaNo ratings yet

- Rajasthan Housing Board, Circle - Iii, JaipurDocument1 pageRajasthan Housing Board, Circle - Iii, JaipurAshish AshishNo ratings yet

- MKTG446 Case 11-2Document2 pagesMKTG446 Case 11-2kanyaNo ratings yet

- Counterfeit Chronicles by Lubogo and Etal 2023Document256 pagesCounterfeit Chronicles by Lubogo and Etal 2023lubogoNo ratings yet

- Caretaker AgreementDocument2 pagesCaretaker AgreementWenceslao MagallanesNo ratings yet

- Tade Barrier Cigarettes Case Study - Global OperationsDocument23 pagesTade Barrier Cigarettes Case Study - Global OperationsDIKY RAHMANNo ratings yet

- Pad381 - Am1104b - Group 1 ReportDocument19 pagesPad381 - Am1104b - Group 1 ReportNOR EZALIA HASBINo ratings yet

- Chapter 5 Pad104Document6 pagesChapter 5 Pad1042022460928No ratings yet

- Principles of Taxation: The Chartered Institute of Taxation of Nigeria April 2021 Pathfinder For Foundation LevelDocument60 pagesPrinciples of Taxation: The Chartered Institute of Taxation of Nigeria April 2021 Pathfinder For Foundation Levelashaolu ayanfeoluwaNo ratings yet

- BBYB - Annual Report - 2018Document271 pagesBBYB - Annual Report - 2018sofyanNo ratings yet

- 1 - UNIT-1-2-globalization-international-businessDocument20 pages1 - UNIT-1-2-globalization-international-businessTejaswiniNo ratings yet

- Hyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesHyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)aurang zaibNo ratings yet

- UGC Care List 1 & 2 - Management Journals - Updated 2022Document4 pagesUGC Care List 1 & 2 - Management Journals - Updated 2022Naina SobtiNo ratings yet

- C 4 C 00 D 37Document12 pagesC 4 C 00 D 37alyaa rabbaniNo ratings yet

- Singapore IncDocument2 pagesSingapore IncBastiaan van de Loo100% (1)

- Cs-Supertrends 22 Eng RGBDocument47 pagesCs-Supertrends 22 Eng RGBWildan AriefNo ratings yet

- What To Include in Financial AnalysisDocument12 pagesWhat To Include in Financial Analysisayushi kapoorNo ratings yet

- CVP AnalysisDocument33 pagesCVP AnalysisnamuNo ratings yet

- Do You Think Globalization Leads To Cultural ImperialismDocument2 pagesDo You Think Globalization Leads To Cultural Imperialismjezreel alog83% (6)

- Freelance Marketer Sales DeckDocument14 pagesFreelance Marketer Sales DeckyanalkassiNo ratings yet

- Chapter 2 Partnership Operations and Financial ReportingDocument28 pagesChapter 2 Partnership Operations and Financial Reportingpia guiret0% (2)

- Modeling Business DecisionDocument3 pagesModeling Business Decision7xdbbnnhqmNo ratings yet

- International Trade PoliciesDocument12 pagesInternational Trade Policieskateangel ellesoNo ratings yet