Professional Documents

Culture Documents

Goods and Services Tax (GST) in India - An Overview and Impact

Uploaded by

samar sagarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goods and Services Tax (GST) in India - An Overview and Impact

Uploaded by

samar sagarCopyright:

Available Formats

Advances In Management Vol.

12 (1) March (2019)

Goods and Services Tax (GST) in India –

An Overview and impact

Songara Manoj

Department of Commerce, Govt. Krishnajirao Pawar PG College, Dewas, INDIA

Abstract ST in India

GST also known as the Goods and Services tax is GST was introduced as the constitution (one hundred and

defined as the giant indirect tax structure designed to first amendment) act 2017 following the passage of

support and enhance the economic growth of a country. constitution 122nd amendment Bill. Dr. R. Vasanthagopal

The aim of this research paper is regarding impact of studied, “GST in India: A Big Leap in the Indirect Taxation

System” and concluded that switching to GST from current

GST and its impact on various sectors. With the

indirect tax system in India will be a positive step to boost

introduction of GST, there is chaos and confusion the Indian economy.10 GST while replacing the VAT (Value

among common man. GST bill will be a form for Added Tax) solved all the complexities present in the current

economic integration of India. indirect tax system.3 This tax structure provided the Indian

economy with a strong tax system which was much needed

The main trait of the GST is to transform India into a for economic development of the country. Thus, Goods and

unified market by dismantling the present fiscal barrier Services Tax had a positive impact on the Indian economy.

among states and can expect improved tax compliance.

There would be only one tax, that too at the national Definition of Goods and Service Tax: New Article

level, monitored by the central government. GST is also 366(12A) of the Indian Constitution defines Goods and

different in the way it is levied — at the final point of Services Tax (GST) as any tax on supply of goods or

services or both except taxes on the supply of the alcoholic

consumption and not at the manufacturing stage.

liquor for human consumption.

Keywords: Goods and service tax, Economic growth,

Impact. Research methodology

The study attempts at descriptive analysis based on the

secondary data sourced from journals articles and media

Introduction

reports. Available secondary data was extensively used for

The major source of revenue for any nation is the tax, so for

the study.

economic development of the nation, it is compulsory to

have good taxation system. India started its journey towards

tax system in the year 1980. GST would be a major move Results and Discussion

towards Indian economy as since independence India has Impact of GST on the Indian Economy: GST will impact

faced some of the issues because of complex indirect tax the overall taxation system of the Indian economy.11 It will

system, this complexity is assumed to be resolved by present improvise the country's GDP ratio and also will control

GST structure replacing all state and central indirect taxes in inflation to a certain extent. However, the reform will mainly

to one simple unique tax.1 GST is a comprehensive indirect be advantageous to the manufacturing industry but will make

tax on manufacture, sale and consumption of goods and some things challenging for the service sector industry.

services at national level. One of the biggest taxation reforms There has been a fall in the cost of production in the domestic

in India is the (GST) all set to integrate state economies and market after the introduction of GST, which is a positive

boost overall growth. influence to increase the competitiveness towards the

international market. GST is expected to raise the GDP

Currently, companies and businesses pay lot of indirect taxes growth from 1% to 2%, but these figures can only be

such as VAT, Service tax, sales tax, entertainment tax, octroi analysed after successful implementation. GST is also

and luxury tax. There would be only one tax, that too at the different in the way it is levied at the final point of

national level, monitored by the central government.6,8 consumption and not at the manufacturing stage.

Under this system, the consumer pays the final tax but an

efficient input tax credit system ensures that there is no At present, separate tax rates are applied to goods and

cascading of taxes. services. Some countries have faced a mixed response in

growth like New Zealand saw a higher GDP as compared to

The concept behind this tax was invented by a French tax countries like China, Thailand, Australia and Canada.12 The

official in the 1950s. France is the first country in the world GST rate is implemented in various slabs like 5%, 12%, 18%

which has implemented GST in 1954. Today, more than 160 and 28%, which will automatically provide great tax

nations, including the European union and Asian countries increments to the government and the manufacturing sector

such as Srilanka, Singapore and China practice this form of will face immense growth with reduction in tax rate. There

taxation.13 is definitely something good for everyone.9 Various

unorganized sectors which enjoy the cost advantage equal to

World Business ‘n Economy Congress 2019 59

Advances In Management Vol. 12 (1) March (2019)

tax rate will be brought under GST. This will make various particularly for this sector. The industry of automobiles is

sectors like Hardware, Paint and Electronics etc. under the tremendously big which tackles the manufacturing of a very

tax slab. large chunk of cars and bikes every year. Overall it is defined

that the GST impact on the automobile industry is less than

GST requires everything to be planned meticulously for the previous tax scheme due to the lowered tax scenario. As

organized rate of taxation. There are still lots of sectors the automobile industry has already gone through some

which are to be discussed under GST and this requires proper tough situations like demonetization and after which

planning. For the common man and different companies, the emissions norms rule hit the grounds of automobiles sector,

collection of Central and State taxes will be done at point of now the industry will get benefits out of GST with

time when sales originate, both components will be charged minimum hassle-free procedures and rate fixation across the

on manufacturing costs and price of the product will nation.

downgrade and consumption will thereby increase.5 There

will be more transparency in the system as the customers will (vi) Cement industry: The implementation of GST in the

know exactly how much taxes they are being charged and on country will somehow create a menace in the cement

what bases. industry. GST council has decided heavy tax rates over

cement industry of 28 percent which seems to overburden

Impact of GST on various Sectors: Goods and Services the sector with already prevailing tax entities and under

Tax will unite the Indian economy into one common market developing area in the urbanization. Indian cement industry

under a single umbrella of taxation rates7 leading to easiness is aimed to grow at a CAGR of 11.14% in volume terms

of starting and doing businesses, leading to increase in during FY 2011-FY 2017 and is expected to reach 407

savings and cost reduction among various sectors.4 Some million tons by March 2017.

industries will be empowered by GST because of reduction

in tax rates while some will lose because of higher rate of Prominent cement manufacturers such as Ultratech, JK

GST interests. Cement and Shree Cement are expected to get some setback

from this decision over new tax reform in India. The reports

(i) Real Estate: The effective GST rate on under- suggest that the introduction of 28% Goods and Services

construction real estate projects will be 12 per cent only and Tax on Cement industry will certainly make hard expansion

not 18 per cent as there will be abatement for land cost choice in the Indian cement industry and will affect their

according to a report by PTI quoting tax consultant EY. profitability as well. GST India is likely to have a negative

impact on the cement industry and will also take the concrete

(ii) Effect on transportation: Under GST, cab and taxi rides admixtures manufacturing sector towards downfall.

are taxed lower, from 6% to 5%. For those who travel by air,

GST is favourable as the tax rate is lowered to 5% for the Conclusion

economy class and 12% for business class. Train fare, The implementation of GST would pave way for a simple

meanwhile, is mostly unaffected as the change is minimal and understandable tax structure and would also help in

from 4.5% to 5%. Those who travel by sleeper are not avoiding any evasion taking place at any level. Thus, lot

affected by the tax rate change but those who travel first class being said and done, an appropriate implementation would

are charged more.2 lead to actually understand whether “GST is a boon or curse.

All sectors in India - manufacturing, service, telecom,

(iii) Construction Materials: Under revised order from the automobile etc. will bear the impact of GST. While

government, GST on under construction flats and comparing challenges with its advantages, it is clearly

properties will be taxed at 18% which includes 9% SGST visible that its advantages are more compared to challenges;

plus 9% CGST. The government has also allowed deduction GST will give Indian economy a strong and smart tax system

of land value equivalent to one-third of the total amount for economic development. But for gaining those benefits,

charged by a developer, thus, making the effective tax rate country will need to build strong mechanism.

as 12%. The 12% slab offered for the real estate sector will

not affect at the price of the flat but it will be on building References

materials. 1. Abda S., Effects of goods and services tax on indian economy,

International Education and Research Journal, 3(5), 584-585

(iv) FMCG GOODS: Fast moving consumer goods sector (2015)

will benefit from the GST due to the present of big

unorganised market. GST rate for products like hair oil, 2. Baliyan M. and Rathi P., Impact Of GST On Different Sectors

soaps and toothpaste has been lowered by 500-600 bps from Of Indian Economy, International Journal of Innovative Research

the previous rates. Companies such as Colgate-Palmolive, and Advanced Studies (IJIRAS), 5(3), 241-243 (2018)

HUL, Britanina, Heritage food etc. will benefit from the

3. Chochan V., Shakdwipee P. and Khan S., Measuring Awareness

move. about implementation of GST: A Survey of Small Business

(v) Automobile sector: The automobile Industry is coping Owners of rajasthan, Pacific Business Review International, 9(8),

up with the GST regime as the government is very cautious 116-125 (2017)

World Business ‘n Economy Congress 2019 60

Advances In Management Vol. 12 (1) March (2019)

4. Dani S., A research paper on an impact of Goods and Service 9. Ramya N. and Sivasakthi D., GST and its impact on various

Tax (GST) on indian Economy, Business and Economics Journal, sectors, Journal of Management and Science, 1, 65-69 (2017)

7(4), 1-2 (2016)

10. Kapila Pallavi, GST: Impact on Indian Economy, Int. Journal

5. Garg Y. and Gupta J., An Exploratory study on evolution and of Engineering Research and Application, 8(1), 1-3 (2018)

implementation of GST in india, International Journal of Science

Technology and Management, 6(1), 721-725 (2017) 11. Kawle Pooja S. and Aher Yogesh L., GST: An economic

overview: Challenges and Impact ahead, International Research

6. Konnur M.N. and Singh M.B., Trade & Industry Development Journal of Engineering and Technology, 4(4), 2760-2763 (2017)

Through GST, In Paramashivaiah P., Sudarsanareddy G. and

Shekhar B., Introducing GST and its impact on indian Economy, 12. Shokeen S., Banwari V. and Singh P., Impact of goods and

Bengluru, Niruta Publications, 210 (2016) services tax bill on the Indian economy, Journal of Finance, 11(7),

65-78 (2017)

7. Kumar K.A., A Journey of Goods and services tax (GST) and

Structural Impact of GST on the Growth of GDP in India, 13. Shah I. and Tariq A., Impact of GST on Jammu and kashmir

Advances in Sciencesand Humanities, 3(5), 50-53 (2017) Economy, Journal of advanced Management Research, 5(5), 418-

426 (2017).

8. Kumar P., GST (Challenges and implication in Indian context),

International Research Journal of Management Sociology & (Received 22nd December 2018, accepted 25th January 2019)

Humanities, 4(1), 1571-1576 (2013)

World Business ‘n Economy Congress 2019 61

You might also like

- PO TY: 1. Centre-State RelationsDocument25 pagesPO TY: 1. Centre-State RelationsNamita JoshiNo ratings yet

- Dove - RespondentDocument25 pagesDove - RespondentTanilNo ratings yet

- Tushar Dhananjay Mandlekar Vs MR Abhaykumar Singh, Ceo Sbi Cards ... On 10 April, 2012Document9 pagesTushar Dhananjay Mandlekar Vs MR Abhaykumar Singh, Ceo Sbi Cards ... On 10 April, 2012Badrinath ChavanNo ratings yet

- 27 Supreme Court DecisionsDocument600 pages27 Supreme Court Decisionsfuck pakNo ratings yet

- N The Matter ofDocument35 pagesN The Matter ofTulika GuptaNo ratings yet

- The Indian Law Reports: (Cuttack Series, Monthly)Document174 pagesThe Indian Law Reports: (Cuttack Series, Monthly)Karthik Sarangan100% (1)

- Petitioner Memo Teamcode-LDocument36 pagesPetitioner Memo Teamcode-LdiwakarNo ratings yet

- Chapter-Vi: Role of Legislature and Legal Services Authorities Towards Lok-AdalatDocument26 pagesChapter-Vi: Role of Legislature and Legal Services Authorities Towards Lok-AdalatmelveenNo ratings yet

- Compat Order Vs NSE For MCXDocument95 pagesCompat Order Vs NSE For MCXlegallyindiaNo ratings yet

- Taxation - Updated MaterialDocument125 pagesTaxation - Updated Materialtrishul poovaiahNo ratings yet

- I. C. Golaknath & Ors Vs State of Punjab & Anrs. (With ... On 27 February, 1967Document128 pagesI. C. Golaknath & Ors Vs State of Punjab & Anrs. (With ... On 27 February, 1967Piyush KulshreshthaNo ratings yet

- SSB RulesDocument110 pagesSSB RulesmalaynsamaniNo ratings yet

- Khatri and Others Vs State of Bihar & Ors On 19 December, 1980Document8 pagesKhatri and Others Vs State of Bihar & Ors On 19 December, 1980NaveedNo ratings yet

- 2020 2021 Important JudgementsDocument6 pages2020 2021 Important JudgementsRidam Saini100% (1)

- Drafting, Pleading and ConveyancingDocument7 pagesDrafting, Pleading and ConveyancingpriyanandanNo ratings yet

- Changes to Hindu Family Law in IndiaDocument5 pagesChanges to Hindu Family Law in IndiaIshikaNo ratings yet

- Supreme Court Upholds SEBI Decision in Technip CaseDocument4 pagesSupreme Court Upholds SEBI Decision in Technip CaseMahak ChhabraNo ratings yet

- Legal Writing ProjectDocument17 pagesLegal Writing ProjectJahnavi GopaluniNo ratings yet

- CEE Moot Bundle 2009 With LogosDocument255 pagesCEE Moot Bundle 2009 With Logosly miNo ratings yet

- Legal Desire Quarterly Journal Issue 2Document103 pagesLegal Desire Quarterly Journal Issue 2Anuj KumarNo ratings yet

- CRPC End TermsDocument17 pagesCRPC End TermsSomya YadavNo ratings yet

- NCLT Moot Court Exam on Resolution Plans for Polycab LtdDocument19 pagesNCLT Moot Court Exam on Resolution Plans for Polycab LtdKartikey VarshneyNo ratings yet

- Industrial Relations and Contract Labour in IndiaDocument20 pagesIndustrial Relations and Contract Labour in IndiaRaj KamalNo ratings yet

- Kesavananda Bharati Vs State of Kerala - Landmark Judgement of Supreme Court PDFDocument4 pagesKesavananda Bharati Vs State of Kerala - Landmark Judgement of Supreme Court PDFkarunakaran09100% (1)

- Classification of Prisoners PDFDocument4 pagesClassification of Prisoners PDFraghavendratagare0% (1)

- APCR Vs UOIDocument58 pagesAPCR Vs UOIAnaghNo ratings yet

- Topic Law of Defamation As A Weapon AgaiDocument66 pagesTopic Law of Defamation As A Weapon AgaiPratishtha ShreeNo ratings yet

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthNo ratings yet

- Tripple E of DemonetisationDocument19 pagesTripple E of DemonetisationAmeen Uddin Ansari100% (1)

- PDF DocumentDocument50 pagesPDF DocumentGOKUL NATHNo ratings yet

- Calcutta University B.com project report on the role of capital marketsDocument12 pagesCalcutta University B.com project report on the role of capital marketsSanoj Kumar YadavNo ratings yet

- India's Electoral System ExplainedDocument24 pagesIndia's Electoral System ExplainedVicky DNo ratings yet

- Committee Report on Electoral ReformsDocument93 pagesCommittee Report on Electoral ReformsUKNo ratings yet

- ICFAI LAW SCHOOL MOOT PROBLEM ON DATA PRIVACYDocument4 pagesICFAI LAW SCHOOL MOOT PROBLEM ON DATA PRIVACYHena KhanNo ratings yet

- Respondent Memo BRDocument36 pagesRespondent Memo BRvidiyaNo ratings yet

- Tax Law IIDocument14 pagesTax Law IIshreya ahujaNo ratings yet

- Rahul Case Hearing in S C From 21st July, 2023Document15 pagesRahul Case Hearing in S C From 21st July, 2023H Janardan PrabhuNo ratings yet

- Case Name: - : Assignment - IDocument4 pagesCase Name: - : Assignment - IktkiNo ratings yet

- 1 MBL Ka Dec11Document18 pages1 MBL Ka Dec11Neha JayaramanNo ratings yet

- Principles of Taxation Law: Notes OnDocument62 pagesPrinciples of Taxation Law: Notes OnRaoof bin MohammedNo ratings yet

- IN THE HIGH COURT OF DELHI AT New Delhi2Document14 pagesIN THE HIGH COURT OF DELHI AT New Delhi2Suryanshi GuptaNo ratings yet

- Law of Torts ContentDocument9 pagesLaw of Torts ContentViren GandhiNo ratings yet

- Roll No-29 Plaintiff MemoDocument23 pagesRoll No-29 Plaintiff MemoatipriyaNo ratings yet

- National Law Institute University, BhopalDocument12 pagesNational Law Institute University, BhopalRohit Vijaya ChandraNo ratings yet

- 310 Case AnalysisDocument12 pages310 Case AnalysisvibhuNo ratings yet

- Competition Issues in The Infrastructure Sector - With Special Reference To The Indian Electricity SectorDocument48 pagesCompetition Issues in The Infrastructure Sector - With Special Reference To The Indian Electricity Sectorgeeths207No ratings yet

- SC dismisses appeal against HC order vacating injunction on encashing letter of creditDocument9 pagesSC dismisses appeal against HC order vacating injunction on encashing letter of creditMayank MishraNo ratings yet

- High Court of Bombay hears batch of petitions challenging provisions of Real Estate ActDocument330 pagesHigh Court of Bombay hears batch of petitions challenging provisions of Real Estate ActM S SHANKARNo ratings yet

- Rajasthan HC On Prison ManualDocument4 pagesRajasthan HC On Prison ManualThe WireNo ratings yet

- 8th Manipal Rank International Moot Memorial RespondentDocument25 pages8th Manipal Rank International Moot Memorial Respondentkavita bohraNo ratings yet

- Form Tm-A: The Trade Marks Act, 1999 Application For Registration of A TrademarkDocument4 pagesForm Tm-A: The Trade Marks Act, 1999 Application For Registration of A TrademarkAurko HaldiNo ratings yet

- Upon Submission To The Hon'Ble Justice of The High CourtDocument21 pagesUpon Submission To The Hon'Ble Justice of The High CourtSheela AravindNo ratings yet

- Agricultural Loans - Stamp Duty ExemptionDocument2 pagesAgricultural Loans - Stamp Duty ExemptionRojy ChandranNo ratings yet

- Rajasthan High Court Judgment DT August 10, 2015, Declared The Jain Practice of SantharaDocument46 pagesRajasthan High Court Judgment DT August 10, 2015, Declared The Jain Practice of SantharaLatest Laws TeamNo ratings yet

- Sem 1 - Torts Case Briefs Modules 5-9Document27 pagesSem 1 - Torts Case Briefs Modules 5-9Parthiv100% (1)

- Employment Standing Orders Act overviewDocument13 pagesEmployment Standing Orders Act overviewDevesh UniyalNo ratings yet

- Judgements FinalDocument24 pagesJudgements FinalSahil TomarNo ratings yet

- Impact of GST On Manufacturers, Distributors and RetailersDocument6 pagesImpact of GST On Manufacturers, Distributors and Retailershemant rajNo ratings yet

- 88 1 407 2 10 20170909 PDFDocument13 pages88 1 407 2 10 20170909 PDFJazz JuniorNo ratings yet

- Steag State Power v. CIRDocument2 pagesSteag State Power v. CIRSab Amantillo BorromeoNo ratings yet

- Tolley® Exam Training: Adit Paper 1 Memory JoggersDocument58 pagesTolley® Exam Training: Adit Paper 1 Memory JoggersMohamed HusseinNo ratings yet

- CombinepdfDocument3 pagesCombinepdfChelsea RegodonNo ratings yet

- 03 CIR v. AgrinurtureDocument2 pages03 CIR v. AgrinurtureBasil Maguigad100% (1)

- Business Law and Taxation with Laws affecting MSMEs Quiz 01Document5 pagesBusiness Law and Taxation with Laws affecting MSMEs Quiz 01John Mar GaminoNo ratings yet

- Mayoral Ball "Under The Big Top"Document4 pagesMayoral Ball "Under The Big Top"R L Gipson100% (1)

- Solution Manual For Mcgraw Hills Taxation of Individuals 2020 Edition 11th by SpilkerDocument22 pagesSolution Manual For Mcgraw Hills Taxation of Individuals 2020 Edition 11th by SpilkerKatherine Daniels100% (35)

- Affidavit of GROSS SALESDocument1 pageAffidavit of GROSS SALESJane Tan Yap-EvangelistaNo ratings yet

- 2010 Barangay Legal Opinions Reference GuideDocument1 page2010 Barangay Legal Opinions Reference Guideruss8dikoNo ratings yet

- Course Title: Advanced Taxation Course Code: Acfn 522 Credit Hour: 2 Prerequisite: NoneDocument3 pagesCourse Title: Advanced Taxation Course Code: Acfn 522 Credit Hour: 2 Prerequisite: NoneSeifu BekeleNo ratings yet

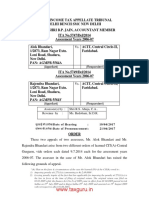

- Alok Bhandari Anr. vs. ACIT ITAT DelhiDocument7 pagesAlok Bhandari Anr. vs. ACIT ITAT DelhivedaNo ratings yet

- CREATE Bill Impact on Philippine Company TaxesDocument8 pagesCREATE Bill Impact on Philippine Company TaxesHanee Ruth BlueNo ratings yet

- Linklaters Case Study Taxation LawDocument18 pagesLinklaters Case Study Taxation LawAnugya JhaNo ratings yet

- Tungo Sa Bayang Magiliw - 3: Ating Karapatan Sa Batas at Pananagutang PanlipunanDocument25 pagesTungo Sa Bayang Magiliw - 3: Ating Karapatan Sa Batas at Pananagutang PanlipunanAxel GalaNo ratings yet

- Taxing Powers (Imposition of Taxes)Document18 pagesTaxing Powers (Imposition of Taxes)Nichelle De RamaNo ratings yet

- 181-13-2022-GST Clarification On Refund Related IssuesDocument2 pages181-13-2022-GST Clarification On Refund Related IssuesHr legaladviserNo ratings yet

- BIR Form 1601E Schedule I March 2018 WithholdingDocument10 pagesBIR Form 1601E Schedule I March 2018 WithholdingMaricrisNo ratings yet

- W-8BEN: ColombiaDocument1 pageW-8BEN: ColombiaJhonNo ratings yet

- 05 Victorias Milling Vs Municipality of VictorialDocument2 pages05 Victorias Milling Vs Municipality of VictorialJeanne CalalinNo ratings yet

- Q6 Donors TaxDocument7 pagesQ6 Donors TaxGreta DuqueNo ratings yet

- Invoice 1708 Narendra Goud Narendra GoudDocument1 pageInvoice 1708 Narendra Goud Narendra GoudNarendra GoudNo ratings yet

- Act 5Document1 pageAct 5Unknowingly AnonymousNo ratings yet

- Sukhamrit Singh 8031 Sec-A Tax LawDocument12 pagesSukhamrit Singh 8031 Sec-A Tax LawSukhamrit Singh ALS, NoidaNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Oil and Gas Revenue Sharing in Iraq: María Lasa ArestiDocument24 pagesOil and Gas Revenue Sharing in Iraq: María Lasa ArestiAdam AldulaimiNo ratings yet

- BBA-508 - Economic Planning and PoliciesDocument11 pagesBBA-508 - Economic Planning and PoliciesSimanta KalitaNo ratings yet

- TDS Tax Deduction at Source: Prepared By: Visharad ShuklaDocument25 pagesTDS Tax Deduction at Source: Prepared By: Visharad ShuklaPriyanshi GandhiNo ratings yet

- Assignment 1Document4 pagesAssignment 111dylan97No ratings yet

- Estate Tax and Donor's Tax ComputationDocument8 pagesEstate Tax and Donor's Tax ComputationHeidi KaterineNo ratings yet

- Chapter 2-Meaning and Scope of Public FinanceDocument21 pagesChapter 2-Meaning and Scope of Public FinanceyebegashetNo ratings yet