Professional Documents

Culture Documents

Indonesia Daily: Update

Uploaded by

yolandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indonesia Daily: Update

Uploaded by

yolandaCopyright:

Available Formats

I n d o n e s i a D a i l y Tuesday, 05 October 2021

PLEASE CLICK ON THE PAGE NUMBER TO MOVE TO THE RELEVANT PAGE. REGIONAL MARKET

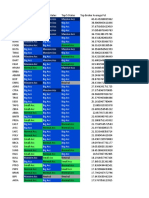

Market Close +/- Chg (%)

KEY HIGHLIGHTS MSCI Indonesia 6,418.7 171.7 2.7

MSCI Asia-Ex Japan 788.6 (6.5) (0.8)

KLCI 1,522.5 (2.0) (0.1)

Update FSSTI 3,089.7 38.5 1.2

SET 1,614.5 9.3 0.6

Erajaya Swasembada (ERAA IJ/BUY/Rp585/Target: Rp780) Page 2 Hang Seng 24,036.4 (539.3) (2.2)

Mobile handset sales volume to recover in 4Q21. Nikkei 28,444.9 (326.2) (1.1)

Shanghai Comp 3,568.2 - -

Dow Jones 34,002.9 (323.5) (1.0)

TRADERS’ CORNER Page 5

Source: Bloomberg

Unilever Indonesia (UNVR IJ): Technical BUY

INDONESIA STOCK EXCHANGE

Ace Hardware Indonesia (ACES IJ): Technical BUY Level +/- Chg (%)

Index 6,342.7 113.8 1.8

LQ-45 911.0 25.0 2.8

Value (US$m) 1,191.8 (1,005.6) (45.8)

FOREIGN TRADE IN IDX

Net (US$m) Buy Sell Total (%)

139.7 348.6 208.9 23.4

TOP VOLUME

Company Price Chg Volume

(Rp) (%) ('000)

Smartfren Telecom 105 (1.9) 1,334,381

Perusahaan Gas Negara 1,405 9.8 442,993

Metro Healthcare 440 1.9 390,007

Bank Rakyat Indonesia 3,970 1.8 335,763

Adaro Energy 1,860 4.5 235,059

TOP GAINERS

Company Price Chg Volume

(Rp) (%) ('000)

Indo Tambangraya 24,575 16.1 14,177

Merdeka Copper 2,810 14.2 107,870

Summarecon Agung 920 11.5 144,580

Bumi Serpong Damai 1,110 10.4 115,977

Perusahaan Gas Negara 1,405 9.8 442,993

TOP LOSERS

Company Price Chg Volume

(Rp) (%) ('000)

Multistrada 5,625 (6.6) 61

Harum Energy 8,325 (4.6) 11,692

Elang Mahkota 1,625 (3.8) 70,350

Bank Jago 14,500 (3.8) 13,945

Bank Ina Perdana 3,470 (3.3) 1,414

COMMODITY TREND

4 Oct 21 Chg (%)

Closing 1-day 1-mth

Forex (Rp/US$) 14,267 (0.3) 0.0

Crude Oil NYMEX (US$/bbl) 77.62 2.3 12.0

Coal Fut Newc (US$/tonne) 240.00 5.3 n.a.

Nickel 3M LME 17,924 (0.3) (9.4)

Tin 3M LME 34,450 1.8 4.2

Gold SPOT (US$/oz) 1,749 (0.7) (4.3)

CPO Fut Msia (MYR/tonne) 4,838 1.8 6.3

Source: Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 1

I n d o n e s i a D a i l y Tuesday, 05 October 2021

COMPANY UPDATE BUY

Erajaya Swasembada (ERAA IJ) (Maintained)

Mobile Handset Sales Volume To Recover In 4Q21 Share Price Rp585

Target Price Rp780

With the relaxation of the semi-lockdown and the government recently allowing children

under 12 to enter shopping malls, we expect ERAA to record better sales volume in Upside +33.3%

4Q21. The number of smartphone users in Indonesia is expected to grow 8.4% yoy in

2021. We do not expect the rumoured acquisition of ERAA by Bli-Bli to happen in the

near term. Maintain BUY with a target price of Rp780 as ERAA is trading below the COMPANY DESCRIPTION

historical 5-year average PE. Erajaya Swasembada mainly distributes and

retails cell-phones, is licensed to distribute

WHAT’S NEW international brands and operates a chain of

retail shops in Indonesia.

Mobile handset volume to recover in 4Q21. We expect Erajaya Swasembada’s (ERAA)

mobile handset sales volume to recover in 4Q21. During the semi-lockdown in Jul 21, STOCK DATA

ERAA was able to maintain its revenue at 80% of the normal levels, which was better than GICS sector Information Technology

the 59% registered during the first semi-lockdown in Apr 20. Since mid-Aug 21, the Bloomberg ticker: ERAA IJ

government has relaxed the semi-lockdown policies, allowing malls to be reopened.

Shares issued (m): 15,950.0

Starting from the fourth week of Sep 21, children under 12 will be allowed to enter malls,

Market cap (Rpb): 9,330.8

which should support mall traffic. According to the Google Mobility Index, as of 25 Sep 21,

the retail and recreation index was at -2.4 (the average of 1-25 Sep 21) and is better than Market cap (US$m): 654.0

before the semi-lockdown index of -4.1 (the average from 1-30 Jun 21). 3-mth avg daily t'over (US$m): 3.9

Statista expects the number of smartphone users in Indonesia to grow 8.4% yoy in

Price Performance (%)

2021 to 199.2m. On the other hand, smartphone penetration in Indonesia is also 52-week high/low Rp720/Rp306

expected to grow by 7.3% yoy in 2021 to 72.1%. We still expect ERAA’s mobile handset

1mth 3mth 6mth 1yr YTD

volume to grow by 9.2% yoy for 2021 to 11.16m units due to the low-base effect in 2020,

(0.8) (10.7) 15.8 97.6 33.0

and 5.7% yoy for 2022 to 11.8m units.

Major Shareholders %

Rumours of Bli-bli acquiring ERAA… Bli-Bli (an e-commerce company in Indonesia Eralink International 54.5

with the fifth-highest traffic, backed by Djarum Group) is rumoured to be acquiring ERAA,

FY21 NAV/Share (Rp) 386

with ERAA’s ultimate shareholder (which owns 54.5% of shares outstanding) supposedly

FY21 Net Debt/Share (Rp) 111

asking for a 14x PE valuation, which translates into Rp850/share using our 2021 earnings

forecast or market capitalisation of Rp13.5t (~US$948m). Previously, Bli-Bli announced

the acquisition plan of 51% of outstanding shares of Ranch Market (RANC IJ), a premium PRICE CHART

supermarket chain. (lcy)

ER AJA YA SWA SEMB AD A TB K PT

(%)

ER AJA YA SWA SEMB AD A TB K PT/JCI IN DEX

800

…should not come true in the near term. If the acquisition happens, this could benefit 250

investors as it could unlock value for ERAA’s shareholders. However, there could be 700

220

limited expansion of ERAA’s online sales as Bli-Bli is only ranked fifth in Indonesia in 600

190

terms of e-commerce traffic. On the other hand, ERAA is not aware of the acquisition, and 500 160

the acquisition cost to acquire 54.5% of ERAA’s outstanding share (assumed at 14x PE 400 130

based on the rumour) would be at >3.5x of RANC’s acquisition cost, and this might force

300

Djarum to inject more capital into Bli-Bli. Overall, we see a low chance of the acquisition 100

happening in the near term. 200

1000

70

Volume (m)

KEY FINANCIALS 500

Year to 31 Dec (Rpb) 2019 2020 2021F 2022F 2023F

0

Net turnover 32,945 34,113 43,031 49,480 58,528 Oct 20 Dec 20 Feb 21 Apr 21 Jun 21 Aug 21 Oct 21

EBITDA 903 1,219 1,812 2,198 2,626

Operating profit 777 1,103 1,666 2,021 2,411 Source: Bloomberg

Net profit (rep./act.) 295 612 974 1,241 1,539

Net profit (adj.) 295 612 974 1,241 1,539 ANALYST(S)

EPS (Rp) 18.5 38.4 61.1 77.8 96.5

Benyamin Mikael

PE (x) 31.6 15.2 9.6 7.5 6.1

P/B (x) 1.9 1.7 1.5 1.3 1.1 +6221 2993 3917

EV/EBITDA (x) 12.7 9.4 6.3 5.2 4.4 benyaminmikael@uobkayhian.com

Dividend yield (%) 1.7 0.0 2.4 3.1 4.0

Net margin (%) 0.9 1.8 2.3 2.5 2.6

Net debt/(cash) to equity (%) 44.2 (2.3) 28.6 (3.8) 25.6

Interest cover (x) 2.8 6.6 7.0 8.6 9.1

ROE (%) 6.2 12.0 16.8 18.7 20.0

Consensus net profit - - 1,042 1,204 1,349

UOBKH/Consensus (x) - - 0.94 1.03 1.14

Source: Erajaya Swasembada, Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 2

I n d o n e s i a D a i l y Tuesday, 05 October 2021

ESSENTIALS TOP 6 SMARTPHONE VENDOR MARKET SHARE (%)

JUL 20 – JUL 21

Launch of iPhone 13 might become a short-term catalyst. The iPhone 13 was officially

released on 24 Sep 21, with a line-up of: iPhone 13 mini (US$699+), the iPhone 13

(US$799+), the iPhone 13 Pro (US$999+) and the iPhone 13 Pro Max (US$1,099+). The

iPhone 12 was available for purchase in Indonesia in mid-Dec 20. We expect the iPhone

13 to be released in Indonesia at a similar time to last year.

GOOGLE MOBILITY INDEX RETAIL

Source: Statcounter

MOBILE HANDSET VOLUME GROWTH IN 1H21

Source: Google, UOB Kay Hian

NUMBER OF SMARTPHONE USERS IN INDONESIA

Source: ERAA, UOB Kay Hian

MOBILE HANDSET ASP GROWTH IN 1H21 (RP)

Source: Statista, UOB Kay Hian

SMARTPHONE USER PENETRATION IN INDONESIA

Source: ERAA, UOB Kay Hian

CASH CONVERSION CYCLE

Mar 20 Mar 21 Jun'20 Jun'21

Inventory Day 48 39 48 38

Receivable day 11 8 12 7

Payable Day 17 18 22 16

CCC 42 29 37 30

Source: ERAA, UOB Kay Hian

3-YEAR PE VALUATION (BEST 12-MONTH

Source: Statista, UOB Kay Hian FORWARD)

EARNINGS REVISION/RISK

None.

Risks. Lower-than-expected demand, longer cash conversion cycle days, margin

pressure, increase in the number of COVID-19 cases which will force stores to close.

VALUATION/ RECOMMENDATION

Maintain BUY with a target price of Rp780, based our 12.8x of 2021F PE or +1SD of its

three-year mean PE. We are comfortable with assigning +1SD in valuing ERAA because

Source: Bloomberg, UOB Kay Hian

of its high earnings growth potential.

Refer to last page for important disclosures. 3

I n d o n e s i a D a i l y Tuesday, 05 October 2021

PROFIT & LOSS BALANCE SHEET

Year to 31 Dec (Rpb) 2020 2021F 2022F 2023F Year to 31 Dec (Rpb) 2020 2021F 2022F 2023F

Net turnover 34,113 43,031 49,480 58,528 Fixed assets 716 841 984 1,138

EBITDA 1,219 1,812 2,198 2,626 Other LT assets 2,948 3,719 4,276 5,058

Deprec. & amort. 116 146 178 215 Cash/ST investment 2,002 814 2,802 763

EBIT 1,103 1,666 2,021 2,411 Other current assets 5,545 7,634 7,290 10,018

Total other non-operating income (0.5) 5.0 10 10 Total assets 11,211 13,008 15,352 16,976

Net interest income/(expense) (185) (258) (254) (290) ST debt 1,879 2,579 2,529 2,879

Pre-tax profit 917 1,413 1,776 2,131 Other current liabilities 3,264 3,433 4,754 4,686

Tax (246) (379) (477) (533) LT debt 0.0 0.0 0.0 0.0

Minorities (59) (59) (59) (59) Other LT liabilities 380 480 552 653

Net profit 612 974 1,241 1,539 Shareholders' equity 5,409 6,164 7,112 8,279

Net profit (adj.) 612 974 1,241 1,539 Minority interest 279 352 405 479

Total liabilities & equity 11,211 13,008 15,352 16,976

CASH FLOW KEY METRICS

Year to 31 Dec (Rpb) 2020 2021F 2022F 2023F Year to 31 Dec (%) 2020 2021F 2022F 2023F

Operating 3,111 (700) 3,155 (941) Profitability

Pre-tax profit 917 1,413 1,776 2,131 EBITDA margin 3.6 4.2 4.4 4.5

Tax (246) (379) (477) (533) Pre-tax margin 2.7 3.3 3.6 3.6

Deprec. & amort. 116 146 178 215 Net margin 1.8 2.3 2.5 2.6

Working capital changes 1,118 (1,588) 1,912 (2,654) ROA 5.8 8.0 8.7 9.5

Other operating cashflows 1,206 (292) (234) (101) ROE 12.0 16.8 18.7 20.0

Investing (973) (1,042) (878) (1,150)

Capex (growth) (214) (271) (320) (368) Growth

Others (759) (771) (557) (782) Turnover 3.5 26.1 15.0 18.3

Financing (707) 554 (290) 52 EBITDA 35.0 48.7 21.3 19.4

Dividend payments 0.0 (219) (292) (372) Pre-tax profit 94.1 54.0 25.8 20.0

Issue of shares 0.0 0.0 0.0 0.0 Net profit 107.4 59.2 27.3 24.1

Proceeds from borrowings (824) 700 (50) 350 Net profit (adj.) 107.4 59.2 27.3 24.1

Others/interest paid 118 73 53 74 EPS 107.4 59.2 27.3 24.1

Net cash inflow (outflow) 1,431 (1,188) 1,988 (2,039)

Beginning cash & cash equivalent 571 2,002 814 2,802 Leverage

Changes due to forex impact n.a. n.a. n.a. n.a. Debt to total capital 24.8 28.4 25.2 24.7

Ending cash & cash equivalent 2,002 814 2,802 763 Debt to equity 34.7 41.8 35.6 34.8

Net debt/(cash) to equity (2.3) 28.6 (3.8) 25.6

Interest cover (x) 6.6 7.0 8.6 9.1

Refer to last page for important disclosures. 4

I n d o n e s i a D a i l y Tuesday, 05 October 2021

TRADERS’ CORNER

UNVR.JK - Daily 10/4/2021 Open 3880, Hi 4020, Lo 3870, Close 3980 (3.1%) MA1(Close,20) = 3,989.50, MA2(Close,50) = 4,153.80, BBTop(Close,50,2) = 4,567.66, BBBot(Close,50,2) = 3,739.94

Unilever Indonesia (UNVR IJ)

7,000

Technical BUY with 8% potential return

6,500 Resistance: Rp4,080, Rp4,300

6,000

Support: Rp3,830, Rp3,800

Stop-loss: Rp3,870

5,500

Share price closed with positive notes and formed

5,000 a bullish candlestick. Momentum is getting better;

hence, we expect more upside pressure and

4,567.66

4,500

challenge the resistance at Rp4,080 and

4,153.8

3,989.5 Rp4,300. Technical indicator RSI is sloping

3,980

4,000

3,739.94

upwards but remains under its centre line while

the MACD has just formed a bullish crossover

May Jun Jul Aug Sep Oct

UNVR.JK - RSI(13) = 47.47 47.4677 signal. Buy at Rp3,960 and take profit at

30

Rp4,300.

UNVR.JK - MACD(12,26) = -82.39, Signal(12,26,9) = -94.48

-82.3864

0 Approximate time frame: 2-4 weeks.

-100

-94.4819

-200

UNVR.JK - Volume = 42,279,800.00, MA(Volume,5) = 29,404,720.00

60M

Our institutional research has a fundamental BUY

42,279,800

40M

29,404,720

20M

and target price of Rp5,900.

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

Source: Amibroker

ACES.JK - Daily 10/4/2021 Open 1260, Hi 1330, Lo 1260, Close 1305 (3.6%) MA1(Close,20) = 1,330.25, MA2(Close,50) = 1,366.80, BBTop(Close,50,2) = 1,500.21, BBBot(Close,50,2) = 1,233.39 1,700

Ace Hardware Indonesia

1,650

(ACES IJ)

1,600

Technical BUY with 6% potential return

1,550

Resistance: Rp1,340, Rp1,370

1,500.21

1,500

Support: Rp1,280, Rp1,250

1,450

Stop-loss: Rp1.265

1,400

Share price rebounded strongly and formed a

long-body bullish candlestick. The price breached

1,366.8

1,350

its Rp1,280 resistance level; hence, we see

1,330.25

1,305

1,300

potential for more upside continuation and

1,250

1,233.39

challenge the resistance at Rp1,340 and

May Jun Jul Aug Sep Oct

Rp1,370. Technical indicator RSI is rebounding

ACES.JK - RSI(13) = 44.69 70

from its oversold zone, while the MACD has

44.6885

30

potential to form a bullish crossover signal. Buy at

ACES.JK - MACD(12,26) = -33.77, Signal(12,26,9) = -30.59 Rp1,290 and take profit at Rp1,370.

-30.59450

Approximate time frame: 2-4 weeks.

-33.7725

-50

ACES.JK - Volume = 84,265,696.00, MA(Volume,5) = 34,379,180.00 84,265,696

50M

34,379,180

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

Source: Amibroker

ANALYST(S)

Maskun Ramli, CFTe

+6221 2993 3915

maskunramli@uobkayhian.com

Refer to last page for important disclosures. 5

I n d o n e s i a D a i l y Tuesday, 05 October 2021

Disclosures/Disclaimers

This report is prepared by PT UOB Kay Hian Sekuritas (“PT UOBKH”), a licensed broker dealer registered in the Republic of Indonesia

and a member of the Indonesia Stock Exchange (“IDX”)

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an

advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the

particular needs of any recipient hereof. Advice should be sought from a financial adviser regarding the suitability of the investment

product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this

report to any other person without the prior written consent of PT UOBKH. This report is not directed to or intended for distribution to or

use by any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as PT

UOBKH may determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to

applicable law or would subject PT UOBKH and its associates and its officers, employees and representatives to any registration, licensing

or other requirements within such jurisdiction.

The information or views in the report (“Information”) has been obtained or derived from sources believed by PT UOBKH to be reliable.

However, PT UOBKH makes no representation as to the accuracy or completeness of such sources or the Information and PT UOBKH

accepts no liability whatsoever for any loss or damage arising from the use of or reliance on the Information PT UOBKH and its associate

may have issued other reports expressing views different from the Information and all views expressed in all reports of PT UOBKH and its

connected persons are subject to change without notice. PT UOBKH reserves the right to act upon or use the Information at any time,

including before its publication herein.

Except as otherwise indicated below, (1) PT UOBKH, its associates and its officers, employees and representatives may, to the extent

permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit business

from, the subject corporation(s) referred to in this report; (2) PT UOBKH, its associate and its officers, employees and representatives may

also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business from, other persons in

respect of dealings in the securities referred to in this report or other investments related thereto; (3) the officers, employees and

representatives of PT UOBKH may also serve on the board of directors or in trustee positions with the subject corporation(s) referred to in

this report. (All of the foregoing is hereafter referred to as the “Subject Business”); and (4) PT UOBKH may otherwise have an interest

(including a proprietary interest) in the subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in

the securities of the corporation(s) which are referred to in the content they respectively author or are otherwise responsible for.

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report is prepared by PT UOBKH, a company authorized, as noted above, to engage in securities activities in Indonesia. PT

UOBKH is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of

research reports and the independence of research analysts. This research report is provided for distribution by PT UOBKH (whether

directly or through its US registered broker dealer affiliate named below) to “major U.S. institutional investors” in reliance on the exemption

from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All US persons

that receive this document by way of distribution from or which they regard as being from PT UOBKH by their acceptance thereof

represent and agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on

the information provided in this research report should do so only through UOB Kay Hian (U.S.) Inc (“UOBKHUS”), a registered broker-

dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell

securities or related financial instruments through PT UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is

delivered to and intended to be received by a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry

Regulatory Authority (“FINRA”) and may not be an associated person of UOBKHUS and, therefore, may not be subject to applicable

restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Refer to last page for important disclosures. 6

I n d o n e s i a D a i l y Tuesday, 05 October 2021

Analyst Certification/Regulation AC

Each research analyst of PT UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect

his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by

him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of PT UOBKH or any other person, any of the Subject

Business involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not

receive any compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any

sales, trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the

compensation received by each such research analyst is based upon various factors, including PT UOBKH total revenues, a portion of

which are generated from PT UOBKH business of dealing in securities.

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the

following table.

General This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or

located in any country or jurisdiction where the distribution, publication or use of this report would be contrary to

applicable law or regulation.

Hong Kong This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the

Securities and Futures Commission of Hong Kong. Neither the analyst(s) preparing this report nor his associate, has

trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the listed

corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under

Para. 16.5 of Code of Conduct with the listed corporation covered in this report. Where the report is distributed in Hong

Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong

Kong in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong

who is not a professional investor, or institutional investor, UOBKHHK accepts legal responsibility for the contents of the

analyses or reports only to the extent required by law.

Indonesia This report is distributed in Indonesia by PT UOB Kay Hian Sekuritas, which is regulated by Financial Services Authority

of Indonesia (“OJK”). Where the report is distributed in Indonesia and contains research analyses or reports from a

foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the relevant

foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the

recipients of the analyses or reports are to contact UOBKHM (and not the relevant foreign research house) in Malaysia,

at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as UOBKHM is the

registered person under CMSA to distribute any research analyses in Malaysia.

Singapore This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital

markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore. Where the

report is distributed in Singapore and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore

in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore

who is not an accredited investor, expert investor or institutional investor, UOBKH accepts legal responsibility for the

contents of the analyses or reports only to the extent required by law.

Thailand This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated

by the Securities and Exchange Commission of Thailand.

United This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning

Kingdom of the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in

the UK is intended only for institutional clients.

United This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S.

States of laws and regulations. It is being distributed in the U.S. by UOB Kay Hian (US) Inc, which accepts responsibility for its

America contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to in

(‘U.S.’) the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2021, PT UOB Kay Hian Sekuritas. All rights reserved.

http://research.uobkayhian.com

Refer to last page for important disclosures. 7

You might also like

- Indonesia Daily - Tuesday, May 30, 2023Document7 pagesIndonesia Daily - Tuesday, May 30, 2023Saham IhsgNo ratings yet

- AKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)Document7 pagesAKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)FREE FOR FREEDOMNo ratings yet

- Indonesia Daily - Thursday, October 15, 2015Document5 pagesIndonesia Daily - Thursday, October 15, 2015Rendy SentosaNo ratings yet

- Reliance Relative ValuationDocument15 pagesReliance Relative ValuationHEM BANSALNo ratings yet

- Summary portfolio of investments continued for CREF Growth AccountDocument1 pageSummary portfolio of investments continued for CREF Growth AccountLjubiNo ratings yet

- Bca VistaDocument18 pagesBca VistaSaputra SaputraNo ratings yet

- Value Hunt - 07 May 2009Document3 pagesValue Hunt - 07 May 2009dhanan12No ratings yet

- AC Penetration Accross CountriesDocument21 pagesAC Penetration Accross Countrieshh.deepakNo ratings yet

- Revenues & Earnings: All Figures in US$ MillionDocument4 pagesRevenues & Earnings: All Figures in US$ MillionenzoNo ratings yet

- Sun Microsystems Financials and ValuationDocument6 pagesSun Microsystems Financials and ValuationJasdeep SinghNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- Markets Stay Steady: BSE Auto Index - Motor Still RunningDocument28 pagesMarkets Stay Steady: BSE Auto Index - Motor Still RunningshanmugammaithiliNo ratings yet

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance Highlightscbz786skNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Jordan Telecom 04jan11 PDFDocument26 pagesJordan Telecom 04jan11 PDFAlex CurtoisNo ratings yet

- Market Sentiments: Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG YtdDocument11 pagesMarket Sentiments: Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG Ytdvikalp123123No ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Morning Pack 20230306Document9 pagesMorning Pack 20230306jovalNo ratings yet

- APM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Document7 pagesAPM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Rhb InvestNo ratings yet

- Simulated Portfolio Model AnswerDocument5 pagesSimulated Portfolio Model AnswerHarsh ChoumalNo ratings yet

- 2021-12-17-PH-D Telecom Sector - 100% Foreign Ownership in TelcosDocument4 pages2021-12-17-PH-D Telecom Sector - 100% Foreign Ownership in TelcosIsaac SamsonNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet

- LS India Cements Q1FY11Document2 pagesLS India Cements Q1FY11prateepnigam355No ratings yet

- Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG YtdDocument10 pagesIndian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG Ytdvikalp123123No ratings yet

- Sun Microsystems Case PDFDocument30 pagesSun Microsystems Case PDFJasdeep SinghNo ratings yet

- Company Comparable Analysis My Apple Inc Quick CompDocument34 pagesCompany Comparable Analysis My Apple Inc Quick Comp/jncjdncjdnNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Portfolio - Home 15 OctoberDocument3 pagesPortfolio - Home 15 OctobermukeshinsaaNo ratings yet

- Spark Research 18 June 2018 PDFDocument37 pagesSpark Research 18 June 2018 PDFAdroit WaterNo ratings yet

- Capital Goods - Chennai-Delhi-Pune Visit - Sector Update - Dec 13 BKDocument13 pagesCapital Goods - Chennai-Delhi-Pune Visit - Sector Update - Dec 13 BKSn SubramanyaNo ratings yet

- Other News:: THU 01 FEB 2018Document4 pagesOther News:: THU 01 FEB 2018JM CrNo ratings yet

- Net losses and declines drag Indian indices lowerDocument3 pagesNet losses and declines drag Indian indices lowerPalak MayaramkaNo ratings yet

- PSE drops below 6,000 as investors take profitsDocument8 pagesPSE drops below 6,000 as investors take profitsJajahinaNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument27 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialPrasad VeesamshettyNo ratings yet

- Supermax Corp (SUCB MK) : Regional Morning NotesDocument5 pagesSupermax Corp (SUCB MK) : Regional Morning NotesIqbal YusufNo ratings yet

- Top Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingDocument3 pagesTop Stories:: Ceb: Ceb Increases Flights To Boracay and Bohol Rrhi: Growsari Raises Us$30Mil in FundingJajahinaNo ratings yet

- Ev-Ebitda Oil CompaniesDocument2 pagesEv-Ebitda Oil CompaniesArie Yetti NuramiNo ratings yet

- Top Stories:: THU 19 AUG 2021Document7 pagesTop Stories:: THU 19 AUG 2021Elcano MirandaNo ratings yet

- We LL Co MeDocument24 pagesWe LL Co MeShibly Qureshi TamimNo ratings yet

- Dialog Group Berhad: Secured E&C Contract Worth SG$21.3mDocument3 pagesDialog Group Berhad: Secured E&C Contract Worth SG$21.3mRhb InvestNo ratings yet

- PSEi Ends Slightly Lower on Profit-Taking; TA Subsidiary to Develop 40MW Wind ProjectDocument4 pagesPSEi Ends Slightly Lower on Profit-Taking; TA Subsidiary to Develop 40MW Wind Project一 克No ratings yet

- Ayushi Nautiyal - 502104195 - RelativeValuationDocument4 pagesAyushi Nautiyal - 502104195 - RelativeValuationAYUSHI NAUTIYALNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Document5 pagesAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestNo ratings yet

- Top Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21Document9 pagesTop Story:: Consumer Sector: Consumer Companies Deliver Mixed Results in 1Q21JajahinaNo ratings yet

- TechnoFunda Excel AnalysisDocument27 pagesTechnoFunda Excel AnalysisPrasad VeesamshettyNo ratings yet

- IJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Document3 pagesIJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Rhb InvestNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- VA Tech Wabag-KotakDocument9 pagesVA Tech Wabag-KotakADNo ratings yet

- 2 - BK City Union Bank - 3QFY20Document8 pages2 - BK City Union Bank - 3QFY20Girish Raj SankunnyNo ratings yet

- DCF Valuation ModelDocument25 pagesDCF Valuation Modelgwheinen100% (2)

- Anand Ratpital Goods Q2FY22 Result PreviewDocument13 pagesAnand Ratpital Goods Q2FY22 Result PreviewRaktim BiswasNo ratings yet

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikNo ratings yet

- SCC 9M21 net income exceed estimatesDocument10 pagesSCC 9M21 net income exceed estimatesJajahinaNo ratings yet

- Indian Markets Gain on Positive Global CuesDocument11 pagesIndian Markets Gain on Positive Global CuesDelhidevil2021No ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Sucor Sunrise: Jakarta Composite Index UpdateDocument6 pagesSucor Sunrise: Jakarta Composite Index UpdateyolandaNo ratings yet

- 5 6089418062631535689Document74 pages5 6089418062631535689yolandaNo ratings yet

- Elang Mahkota Teknologi: Flash NoteDocument4 pagesElang Mahkota Teknologi: Flash Noteroy95121No ratings yet

- IHS Markit Indonesia Manufacturing PMI™Document2 pagesIHS Markit Indonesia Manufacturing PMI™yolandaNo ratings yet

- Wijaya Karya: IndonesiaDocument7 pagesWijaya Karya: IndonesiayolandaNo ratings yet

- Pembelian Ke-Harga Jumlah Lot Total Beli: Bbri 100,000,000Document6 pagesPembelian Ke-Harga Jumlah Lot Total Beli: Bbri 100,000,000yolandaNo ratings yet

- Equity Research: Company UpdateDocument6 pagesEquity Research: Company UpdateyolandaNo ratings yet

- Equity Research: Sectoral ReportDocument5 pagesEquity Research: Sectoral ReportyolandaNo ratings yet

- IR Presentation: Mitsubishi UFJ Financial Group, IncDocument90 pagesIR Presentation: Mitsubishi UFJ Financial Group, IncyolandaNo ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- Equity Research: Company FocusDocument13 pagesEquity Research: Company FocusyolandaNo ratings yet

- IPCM Expands Client Base and Awaits Benefits from New PortDocument4 pagesIPCM Expands Client Base and Awaits Benefits from New PortyolandaNo ratings yet

- 5 6336574399516246815Document8 pages5 6336574399516246815yolandaNo ratings yet

- Technical Analysis: Dr. Pankaj K AgarwalDocument58 pagesTechnical Analysis: Dr. Pankaj K AgarwalAnshul GuptaNo ratings yet

- MACD - Trading The MACD DivergenceDocument7 pagesMACD - Trading The MACD DivergenceAaron DrakeNo ratings yet

- TomT Stock Market Model October 30 2011Document20 pagesTomT Stock Market Model October 30 2011Tom TiedemanNo ratings yet

- The Macd Indicator Revisited by John F. EhlersDocument11 pagesThe Macd Indicator Revisited by John F. Ehlersmuhkito100% (3)

- Make Money With This Forex Trading SystemDocument14 pagesMake Money With This Forex Trading SystemLideresEmpredimientoLiderazgoTransformacionalNo ratings yet

- Free MACD Divergence Chart Pattern Training VideosDocument3 pagesFree MACD Divergence Chart Pattern Training VideosMohamed Abdel FattahNo ratings yet

- Swing Trading Strategy-Trading Divergence Patterns and Making 100-400 Pips Per Trade!Document5 pagesSwing Trading Strategy-Trading Divergence Patterns and Making 100-400 Pips Per Trade!Ahmad HassamNo ratings yet

- Final Report - Rahul Jain - 17BSP2109Document81 pagesFinal Report - Rahul Jain - 17BSP2109Rohan PatilNo ratings yet

- Mastering the MACDDocument4 pagesMastering the MACDsaran21No ratings yet

- 99982d1270108051-Elite-Indicators-The Schaff Trend CycleDocument6 pages99982d1270108051-Elite-Indicators-The Schaff Trend Cyclejim blackNo ratings yet

- Stocks & Commodities Traders Tips Archives - Page 2 of 2 - AIQ TradingExpert ProDocument11 pagesStocks & Commodities Traders Tips Archives - Page 2 of 2 - AIQ TradingExpert ProTony BertoniNo ratings yet

- 2 MACD Effortless Forex Swing Trading SystemDocument34 pages2 MACD Effortless Forex Swing Trading Systemgiotto99No ratings yet

- Moving Averages 101 - Incredible Signals That Will Make You Money in The Stock Market (PDFDrive)Document78 pagesMoving Averages 101 - Incredible Signals That Will Make You Money in The Stock Market (PDFDrive)raj gupta100% (2)

- 5 Most Accurate Intraday Trading Indicators - LittleMeshDocument12 pages5 Most Accurate Intraday Trading Indicators - LittleMeshKarthick AnnamalaiNo ratings yet

- Technical Analysis PDFDocument11 pagesTechnical Analysis PDFlightbarqNo ratings yet

- ANT v1.0.0.0 User GuideDocument106 pagesANT v1.0.0.0 User GuideMinal PatilNo ratings yet

- Adventage and Disadvantages OscilliatorDocument3 pagesAdventage and Disadvantages OscilliatorHustle GangNo ratings yet

- Catalogue V 16Document11 pagesCatalogue V 16percysearchNo ratings yet

- Catalogue V 17Document11 pagesCatalogue V 17percysearchNo ratings yet

- Guide To Technical Analysis Sjc963Document18 pagesGuide To Technical Analysis Sjc963Frank DiazNo ratings yet

- Toppers Trading Institute Course SyllabusDocument4 pagesToppers Trading Institute Course SyllabusArpita BhansaliNo ratings yet

- Technical Analysis Tools for Stock PredictionDocument82 pagesTechnical Analysis Tools for Stock PredictionwqewqdefeNo ratings yet

- Advanced Technical Analysis en PDFDocument23 pagesAdvanced Technical Analysis en PDFTarkeshwar Mahato75% (4)

- EMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Document5 pagesEMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Sonarat MoulnengNo ratings yet

- John Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsDocument6 pagesJohn Murphy's Ten Laws of Technical Trading - All Star Charts - All Star ChartsjohnrollNo ratings yet

- How to trade the rising wedge patternDocument3 pagesHow to trade the rising wedge patternMOHD TARMIZI100% (2)

- Trading Survival 101Document44 pagesTrading Survival 101Ñîwrê ÑwrNo ratings yet

- Momentum Picks New RecommendationsDocument25 pagesMomentum Picks New RecommendationstanmaygoonNo ratings yet

- 3-Predicting Stock Prices Using Deep Learning - by Yacoub Ahmed - Towards Data Science PDFDocument15 pages3-Predicting Stock Prices Using Deep Learning - by Yacoub Ahmed - Towards Data Science PDFAkash GuptaNo ratings yet

- Professor Trading JournalDocument68 pagesProfessor Trading JournalAman AgrawalNo ratings yet